The global decorative chrome plating market, driven by rising demand in automotive, aerospace, and consumer electronics industries, is projected to grow at a CAGR of 4.8% from 2023 to 2030, according to Grand View Research. With increasing consumer preference for enhanced surface aesthetics and corrosion resistance, dark chrome plating has emerged as a sought-after finish, particularly in luxury automotive trims, high-end fixtures, and custom industrial components. This growth is further supported by advancements in electroplating technologies and a shift toward durable, low-maintenance finishes across sectors. As demand intensifies, a select group of manufacturers have positioned themselves as leaders in quality, innovation, and production capacity. Based on market presence, technological capability, and industry reputation, the following list highlights the top 10 dark chrome plating manufacturers shaping this evolving landscape.

Top 10 Dark Chrome Plating Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Quality Plating Co., Inc.

Domain Est. 1999

Website: qualityplating.com

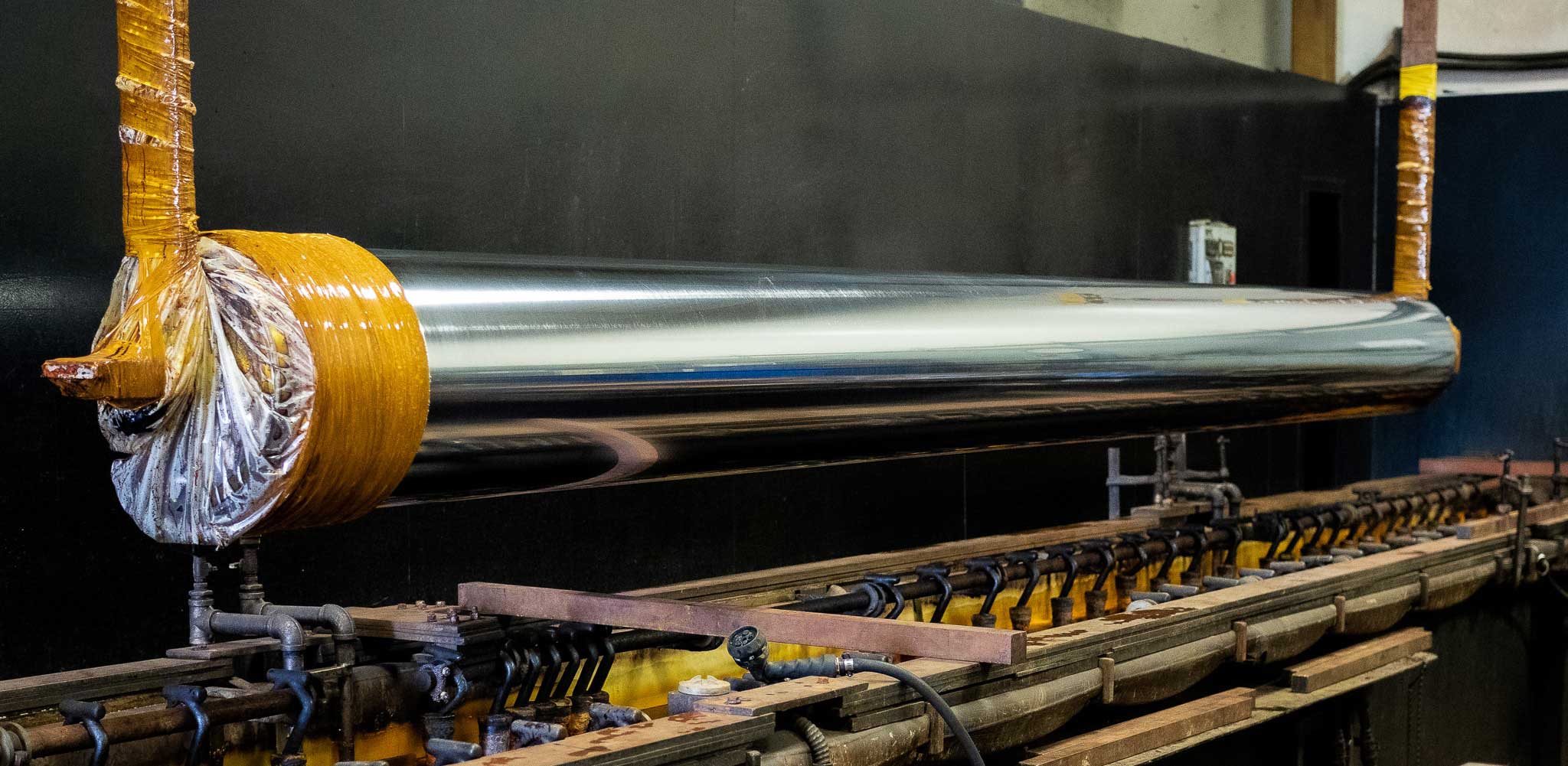

Key Highlights: Industrial or hard chrome plating is the electro-chemical process of depositing chrome directly on the base metal of the part. It is used primarily for wear ……

#2 Chromium Plating Company

Domain Est. 1996

Website: chromeusa.com

Key Highlights: Chromium Plating Company has been providing the highest-quality industrial hard chrome finishing solutions for the manufacturing industry for over 90 years….

#3 Advanced Plating

Domain Est. 1997

Website: advancedplating.com

Key Highlights: Restoration. Make it beautiful once again. Restoring your plated parts to like new condition is much more than just dipping the part into a chrome tank.Missing: dark manufacturer…

#4 The Armoloy Corporation

Domain Est. 1997

Website: armoloy.com

Key Highlights: Armoloy is a plating company with over 65 years of expertise in metal plating services and surface treatments for high-performance manufacturers worldwide….

#5 Hard Chrome Plating & Electroless Nickel Plating

Domain Est. 1999

Website: uschrome.com

Key Highlights: U.S. Chrome is the leader in hard chrome plating, electroless nickel plating, flash chrome, and other industrial use surface finishes….

#6 Dark Chrome Plating

Domain Est. 1998

Website: masterfinishco.com

Key Highlights: Master Finish Company provides dark chrome plating, or black chrome plating offering smooth finishes and rich, dark tints for your components….

#7 #1 In Black Chrome Plating

Domain Est. 1998

Website: calchrome.com

Key Highlights: Black Chrome plating results in a look that will set you apart from the crowd. We can Black Chrome parts, wheels and more! Black Chrome’s available in two ……

#8 Chrome Plating & Electroplating in Los Angeles

Domain Est. 1998

Website: stutzmanplating.com

Key Highlights: Chrome plating & electroplating in Los Angeles with high-quality, durable & corrosion-resistant finishes. Call today (323) 732-9147….

#9 Black Chrome Plating Suppliers

Domain Est. 1999

Website: arlingtonplating.com

Key Highlights: Black chrome plating can be done over bright nickel, satin nickel, or dull nickel. Each metal plating combinations produce a different ……

#10 Allied Finishing

Domain Est. 2000

Website: alliedfinishinginc.com

Key Highlights: Allied Finishing offers 40+ years of experience. As a top metal finishing company, we’re proud to serve the Midwest and Canada. Call today!…

Expert Sourcing Insights for Dark Chrome Plating

2026 Market Trends for Dark Chrome Plating

The dark chrome plating market is poised for notable evolution by 2026, driven by shifting consumer preferences, technological advancements, and sustainability imperatives. While maintaining its stronghold in automotive and luxury goods, the industry is adapting to new demands across multiple sectors.

Growing Demand in Automotive and Consumer Electronics

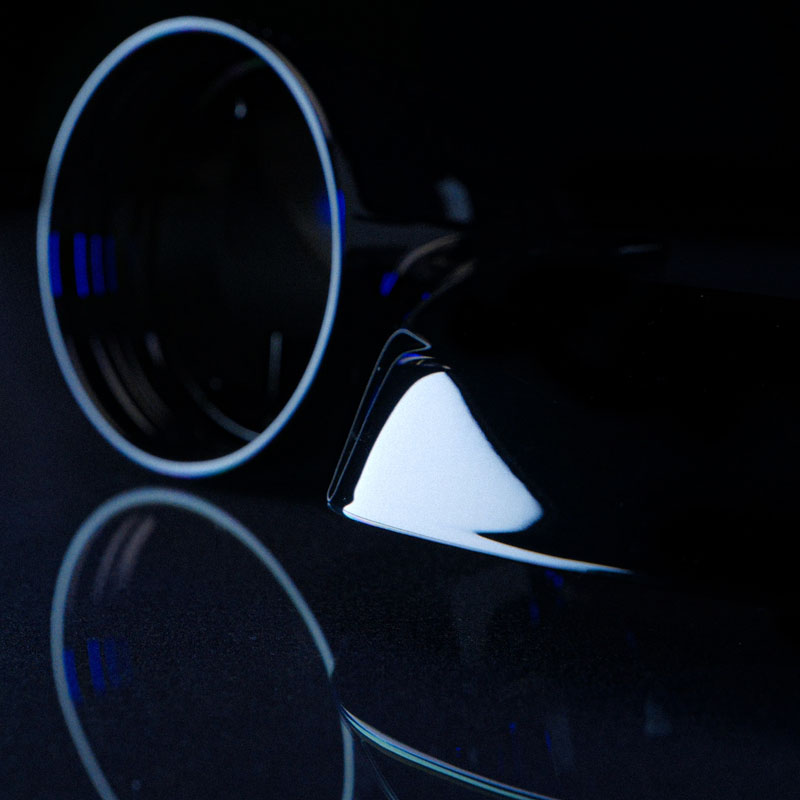

By 2026, the automotive sector will remain the dominant driver of dark chrome plating demand, particularly in high-end and performance vehicles. Consumers increasingly favor the sleek, sophisticated appearance of dark chrome for trim, grilles, wheels, and exhaust tips. This trend extends to electric vehicles (EVs), where manufacturers use dark finishes to emphasize a modern, minimalist aesthetic. Concurrently, consumer electronics—such as premium audio equipment, gaming peripherals, and smartphone accessories—are adopting dark chrome finishes to enhance perceived quality and differentiate products in a competitive market.

Advancements in PVD and Eco-Friendly Alternatives

Traditional hexavalent chromium plating faces increasing regulatory and environmental scrutiny. By 2026, Physical Vapor Deposition (PVD) and other vacuum coating technologies are expected to gain significant market share as sustainable alternatives. PVD offers superior durability, a consistent dark chrome finish, and reduced environmental impact. Innovations in trivalent chromium plating are also improving color depth and corrosion resistance, enabling wider adoption in applications where traditional dark chrome was previously unfeasible due to environmental concerns.

Expansion into Architectural and Industrial Design

The appeal of dark chrome extends beyond transportation and electronics. In architecture and interior design, dark chrome finishes are increasingly used for fixtures, lighting, and decorative elements, aligning with modern industrial and minimalist design trends. Similarly, industrial equipment manufacturers are incorporating dark chrome for both functional durability and aesthetic branding, especially in machinery where visual appeal complements robust performance.

Emphasis on Customization and Premiumization

As consumer markets become more experience-driven, customization is a key trend. By 2026, manufacturers offering tailored dark chrome finishes—ranging from matte black chrome to deep gunmetal tones—will capture niche markets in luxury goods, custom automotive builds, and designer products. This premiumization supports higher margins and strengthens brand identity, particularly in aftermarket and bespoke segments.

Regional Growth and Supply Chain Adaptations

Asia-Pacific, particularly China and India, is expected to witness the fastest growth due to rising disposable incomes and expanding automotive and electronics manufacturing. North America and Europe will focus on high-value applications and compliance with environmental regulations, accelerating the shift toward PVD and trivalent processes. Supply chains will adapt by investing in localized, compliant plating facilities and forming strategic partnerships with material science innovators to ensure quality and sustainability.

In conclusion, the dark chrome plating market in 2026 will be shaped by aesthetic innovation, environmental responsibility, and technological advancement. Companies that embrace sustainable methods, diversify applications, and cater to premium customization will be best positioned for success.

Common Pitfalls When Sourcing Dark Chrome Plating (Quality, IP)

Sourcing dark chrome plating can present several challenges related to both quality consistency and intellectual property (IP) protection. Being aware of these pitfalls helps ensure a successful supplier relationship and a reliable end product.

Inconsistent Finish Quality

One of the most frequent issues is variability in the final appearance of the dark chrome finish. Factors such as substrate material, pre-treatment processes, plating bath chemistry, and operator skill can lead to differences in color tone, gloss level, or surface uniformity across batches. Without strict process controls, even minor deviations can result in rejected parts or mismatched components in final assemblies.

Lack of Standardized Specifications

Dark chrome plating is not as universally standardized as conventional chrome. Suppliers may use proprietary methods or dyes, making it difficult to define and enforce consistent technical requirements. This ambiguity can lead to misunderstandings about acceptable color shades, durability, or coating thickness—especially when switching suppliers or scaling production.

Poor Adhesion and Durability

Low-quality plating may exhibit poor adhesion, leading to flaking, peeling, or blistering under thermal cycling or mechanical stress. Additionally, inadequate corrosion resistance can result in premature tarnishing or rust, especially in harsh environments. These failures compromise both aesthetics and functionality, increasing warranty claims and return rates.

IP and Proprietary Process Risks

Many dark chrome finishes rely on proprietary chemical formulations or patented processes. Sourcing from a supplier using protected technology without proper licensing exposes your company to legal risk. Furthermore, if your design or finish is unique, failing to secure IP agreements can allow the supplier to replicate or resell your concept to competitors.

Limited Supplier Transparency

Some plating vendors are reluctant to disclose the exact composition or process details, citing trade secrets. While understandable, this lack of transparency can hinder quality control, regulatory compliance (e.g., RoHS, REACH), and troubleshooting when defects occur. It also complicates efforts to qualify alternative suppliers.

Inadequate Testing and Certification

Suppliers may not provide comprehensive test reports for hardness, salt spray resistance, or coating thickness. Without documented performance data, it’s difficult to validate claims or ensure consistency over time. Relying solely on visual inspection increases the risk of undetected quality issues reaching end customers.

Long Lead Times and Scalability Issues

Due to the specialized nature of dark chrome plating, some suppliers may have limited capacity or extended processing times. This can create bottlenecks in production, especially during peak demand. Scaling up may also reveal inconsistencies if the supplier lacks robust process controls for high-volume runs.

Environmental and Compliance Concerns

Certain dark chrome processes involve hazardous chemicals or heavy metals. Sourcing from suppliers without proper environmental certifications or waste treatment procedures can expose your company to regulatory liability and reputational damage, particularly in eco-conscious markets.

To mitigate these pitfalls, conduct thorough due diligence on potential suppliers, require detailed specifications and test data, protect IP through legal agreements, and consider on-site audits to verify process controls and compliance.

Logistics & Compliance Guide for Dark Chrome Plating

Overview of Dark Chrome Plating

Dark chrome plating is an electroplating process used to apply a durable, decorative, and corrosion-resistant black chromium finish to metal components. Commonly used in automotive, aerospace, firearms, and consumer goods industries, this process involves strict logistics and regulatory compliance due to the hazardous materials involved.

Regulatory Compliance Requirements

Dark chrome plating operations are subject to stringent environmental, health, and safety regulations. Key compliance frameworks include:

– EPA Regulations (U.S.): Governed by the Clean Air Act (CAA), Clean Water Act (CWA), and Resource Conservation and Recovery Act (RCRA). Hexavalent chromium (Cr⁶⁺), a known carcinogen used in the plating process, is regulated under National Emission Standards for Hazardous Air Pollutants (NESHAP).

– OSHA Standards: 29 CFR 1910.1000 and 1910.1026 outline permissible exposure limits (PELs) for Cr⁶⁺ and require engineering controls, personal protective equipment (PPE), and employee training.

– REACH & RoHS (EU): Restrict the use of certain hazardous substances, including hexavalent chromium, in products placed on the European market.

– Globally Harmonized System (GHS): Requires proper labeling, safety data sheets (SDS), and hazard communication for all chemicals used.

Chemical Handling and Storage

- Hexavalent Chromium Solutions: Must be stored in corrosion-resistant, labeled containers in ventilated, secure areas away from incompatible materials.

- Acidic Bath Components: Sulfuric acid and catalysts require secondary containment to prevent leaks and spills.

- Waste Management: Spent plating baths, rinse waters, and sludge are classified as hazardous waste. On-site accumulation must comply with RCRA storage limits (90/180 days depending on generator status).

- Spill Response: Facilities must have spill kits, neutralizing agents, and documented procedures. Personnel must be trained in emergency response.

Transportation and Logistics

- Domestic Shipping (U.S.): Governed by Department of Transportation (DOT) regulations (49 CFR). Hazardous materials (e.g., Cr⁶⁺ solutions) must be classified, packaged, labeled, and accompanied by proper shipping papers.

- International Shipping: Subject to IATA (air) or IMDG (sea) regulations. Cr⁶⁺ compounds are typically classified as Class 6.1 (toxic substances).

- Carrier Qualifications: Use only licensed hazardous materials carriers with appropriate training and incident response plans.

- Tracking and Documentation: Maintain chain-of-custody records for all chemical shipments and waste manifests (e.g., EPA Form 8700-22).

Waste Disposal and Recycling

- Wastewater Treatment: On-site treatment systems (e.g., chemical reduction, precipitation, filtration) are required to remove Cr⁶⁺ and lower pH before discharge to sewer (with local pretreatment program approval).

- Sludge Disposal: Treated sludge must be tested (TCLP) to determine hazardous status. If hazardous, dispose of at permitted Treatment, Storage, and Disposal Facilities (TSDFs).

- Recycling Opportunities: Some plating solutions can be regenerated or metals recovered through ion exchange or reverse osmosis.

Monitoring and Reporting

- Air Emissions: Install fume suppressants (wetting agents) and ventilation systems with scrubbers. Conduct regular stack testing per NESHAP requirements.

- Wastewater Discharges: Monitor effluent for chromium, pH, and other regulated parameters. Submit Discharge Monitoring Reports (DMRs) to regulatory agencies.

- Employee Exposure Monitoring: Conduct initial and periodic air sampling. Maintain exposure records for 30 years as per OSHA.

- Spill and Incident Reporting: Report releases exceeding reportable quantities (RQs) to local, state, and federal agencies (e.g., EPA, SERC, LEPC).

Training and Documentation

- Employee Training: Provide initial and annual refresher training on Cr⁶⁺ hazards, PPE use, emergency procedures, and regulatory compliance.

- Recordkeeping: Maintain SDS files, training logs, monitoring data, manifests, and compliance audits for minimum 30 years (OSHA) or as required by state law.

- Compliance Audits: Conduct internal or third-party audits annually to verify adherence to environmental and safety regulations.

Best Practices for Sustainable Operations

- Substitute trivalent chromium processes where feasible (lower toxicity, easier waste treatment).

- Implement closed-loop rinse systems to reduce water and chemical consumption.

- Partner with certified recyclers for metal recovery and waste minimization.

- Develop a comprehensive environmental management system (EMS) aligned with ISO 14001.

Adhering to this guide ensures safe, legally compliant, and environmentally responsible dark chrome plating operations. Regular consultation with regulatory agencies and legal counsel is recommended to stay current with evolving standards.

Conclusion for Sourcing Dark Chrome Plating:

Sourcing dark chrome plating requires a strategic approach that balances aesthetic requirements, functional performance, and supplier capability. After evaluating material compatibility, surface preparation needs, coating specifications, and supplier expertise, it is clear that selecting a reputable plating provider with proven experience in decorative and durable dark chrome finishes is critical. Quality consistency, environmental compliance, and adherence to industry standards (such as ASTM B456 or ISO 1456) are essential factors in ensuring long-term performance and customer satisfaction.

Additionally, clear communication of technical specifications, finish expectations, and quality control protocols with suppliers minimizes risks related to adhesion, color variation, or premature wear. Given that true dark chrome plating is less common than standard chrome and may involve proprietary processes or alternative solutions like PVD (Physical Vapor Deposition) coatings, exploring both traditional electroplating and advanced coating technologies can provide optimal results.

In conclusion, successful sourcing of dark chrome plating hinges on thorough supplier vetting, technical due diligence, and a collaborative approach to meet both visual and functional demands. Investing time in selecting the right partner ensures a high-quality, durable, and aesthetically consistent finish that enhances product value and market appeal.