The global diesel engine turbocharger market is experiencing robust growth, driven by increasing demand for fuel-efficient and low-emission powertrains across automotive and industrial sectors. According to Mordor Intelligence, the turbocharger market was valued at USD 18.45 billion in 2023 and is projected to grow at a CAGR of over 6.2% from 2024 to 2029. This expansion is fueled by stringent emissions regulations and the rising adoption of turbocharged engines in commercial vehicles and heavy machinery. Within this evolving landscape, D17 turbo kits—known for their balance of performance, reliability, and cost-effectiveness—have gained significant traction among OEMs and aftermarket players alike. As demand surges, a select group of manufacturers has emerged as leaders in innovation, production scale, and global reach. Based on market presence, technological advancement, and customer adoption, here are the top seven D17 turbo kit manufacturers shaping the industry’s future.

Top 7 D17 Turbo Kit Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Turbocharger fits Allis Chalmers D17 D19 D21 190 190XT 200 7000 …

Domain Est. 2006

Website: tractorpartsasap.com

Key Highlights: In stock Free delivery over $250Turbocharger for Allis Chalmers Construction & Industrial(s) 545B, Tractor(s) D17, D19, D21, 190, 190XT, 200, 7000, 7010, 7020. Replaces Allis Chalm…

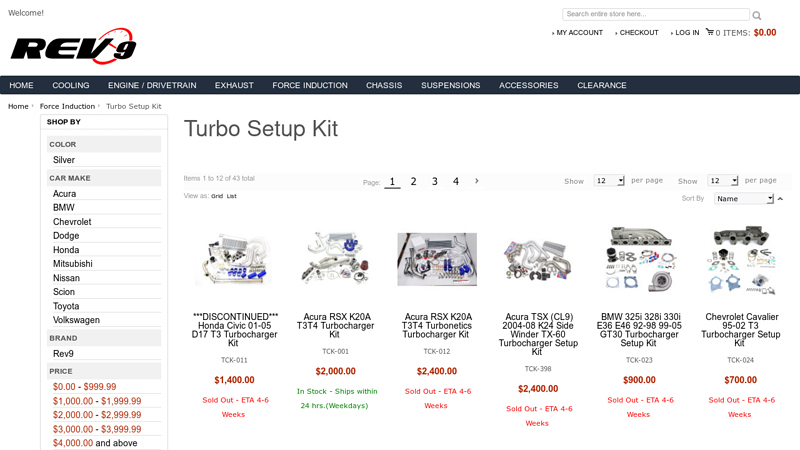

#2 Turbo Setup Kit

Domain Est. 2008

Website: rev9power.com

Key Highlights: Free delivery 30-day returns***DISCONTINUED*** Honda Civic 01-05 D17 T3 Turbocharger Kit … All manufacturers and car model names used in this website are for ……

#3 AEM Infinity Series 7 PnP Harness for 2001

Domain Est. 2000

Website: turbokits.com

Key Highlights: In stock 7-day deliveryAEM Infinity Series 7. These are harnesses for the use of AEM’s Infinity Series 7 units. *The Infinity has full control of fuel and ignition timing….

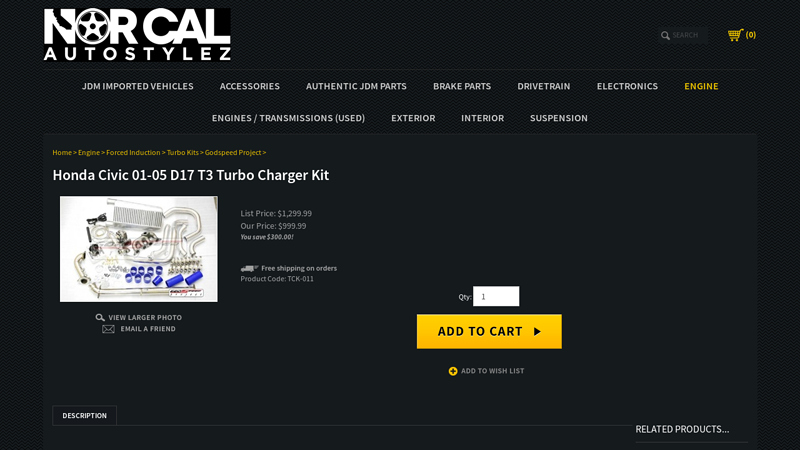

#4 Honda Civic 01

Domain Est. 2005

Website: norcalautostylez.com

Key Highlights: Direct bolt on! 2001 2002 2003 2004 2005 Honda Civic Includes: – T3 .48ar turbo charger (good for 325+ hp ) – D17 motor ……

#5 T3 Turbo Kits fit 01

Domain Est. 2006

#6 Honda D17 T3 turbo manifold

Domain Est. 2007

Website: spaturbousa.com

Key Highlights: In stock $29.67 deliverySPA Turbo exhaust manifolds are precision CNC machined from high quality ASTM 536 60-40-18 cast iron. These are ductile spheroidal (aka Nodular iron) castin…

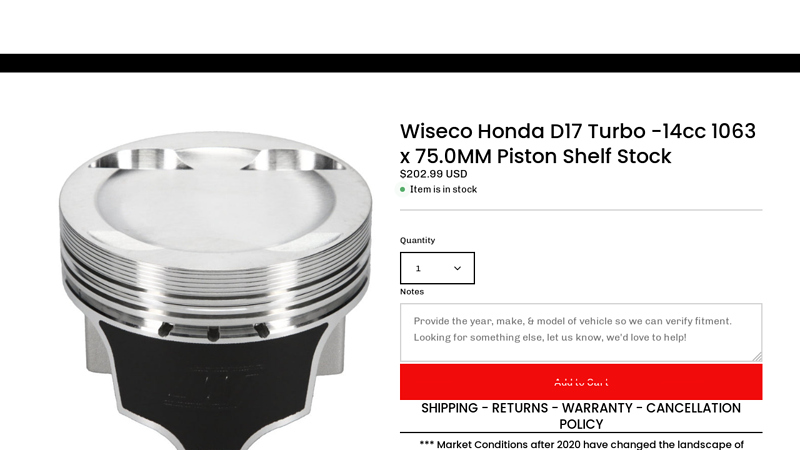

#7 Wiseco Honda D17 Turbo

Domain Est. 2018

Website: speedzone-web.com

Key Highlights: 5-day delivery 30-day returnsProfessional Series forged racing pistons from Wiseco are no-expense-spared pistons designed for the serious racers and builders….

Expert Sourcing Insights for D17 Turbo Kit

2026 Market Trends for D17 Turbo Kit

The market for D17 turbo kits in 2026 is poised for significant evolution, driven by tightening emissions regulations, rising consumer demand for performance efficiency, and advancements in turbocharger technology. As automakers increasingly focus on downsizing engines without sacrificing power, the D17 platform—a popular 1.7L engine found in various European and Asian vehicles—will see growing aftermarket and OEM-integrated turbo kit interest. Below are the key trends shaping the D17 turbo kit landscape in 2026.

Rising Demand for Performance-Efficiency Balance

By 2026, consumers are prioritizing vehicles that deliver both spirited performance and improved fuel economy. D17 turbo kits offer a compelling upgrade path for naturally aspirated 1.7L engines, enabling 30–50% power gains while maintaining or improving fuel efficiency under normal driving conditions. This balance aligns with global fuel economy standards (such as Euro 7 and CAFE updates), making turbo conversions attractive not only for enthusiasts but also for fleet operators seeking cost-effective performance upgrades.

Expansion of Plug-and-Play Kits and ECU Integration

A major trend in 2026 is the proliferation of complete, plug-and-play D17 turbo kits featuring pre-calibrated engine management solutions. Advances in aftermarket ECU tuning (e.g., via OBD2 flash tuning or standalone systems like Haltech and Hondata) allow for seamless integration with minimal modification. These kits reduce installation complexity and cost, broadening accessibility beyond expert tuners to DIY mechanics and regional performance shops.

Growth in Hybrid and Mild-Hybrid Compatible Systems

As mild-hybrid technology becomes more widespread, D17 turbo kits are beginning to incorporate compatibility with 48V electrical systems. Turbochargers with electric assist (e-turbos) or integrated motor-generators are emerging in prototype form, aiming to eliminate turbo lag and improve transient response. While full e-turbo D17 kits may remain niche in 2026, hybrid-ready turbo manifolds and wiring harnesses are expected to enter the market, anticipating future electrified engine trends.

Focus on Emissions Compliance and Certification

With stricter emissions testing in regions like the EU and California, D17 turbo kit manufacturers are investing in certified systems that meet or exceed OEM emissions standards. CARB (California Air Resources Board) and EU-type approval for aftermarket kits are becoming differentiators. In 2026, kits featuring high-efficiency intercooling, precise fuel management, and catalytic integration will dominate premium segments, ensuring vehicles remain street-legal post-installation.

Increased Competition and Price Diversification

The D17 turbo kit market is becoming more competitive, with both established brands (e.g., Garrett, BorgWarner) and emerging Chinese and Eastern European manufacturers offering affordable solutions. This competition is driving innovation and lowering entry costs. By 2026, consumers can expect a wider range of price points—from budget-friendly entry kits (~$1,200) to high-end, race-ready systems (~$3,500+)—with improved reliability and performance metrics.

Regional Market Dynamics

Europe and Asia remain the strongest markets for D17 turbo kits due to the prevalence of 1.7L engines in compact and hot-hatch models (e.g., older Peugeot, Citroën, and Hyundai platforms). In North America, demand is growing among import tuner communities and restomod enthusiasts. Online marketplaces and global shipping have enabled cross-border access, further fueling adoption.

Sustainability and Remanufactured Components

Environmental concerns are influencing the aftermarket. In 2026, remanufactured turbochargers and recycled kit components are gaining traction, offering cost-effective and eco-friendly alternatives. Some manufacturers are introducing take-back programs and modular designs to extend product lifecycles.

In conclusion, the 2026 D17 turbo kit market reflects a convergence of performance, efficiency, and regulatory adaptation. As technology advances and consumer expectations evolve, turbo kits for the D17 engine will become smarter, cleaner, and more accessible—positioning them as a key solution in the era of sustainable performance tuning.

Common Pitfalls When Sourcing a D17 Turbo Kit (Quality and Intellectual Property)

Sourcing a D17 turbo kit—especially for niche or high-performance applications—comes with significant risks related to both product quality and intellectual property (IP) concerns. Being aware of these pitfalls is essential to avoid costly mistakes, legal issues, and subpar performance.

Poor Manufacturing Quality and Component Reliability

One of the most frequent issues when sourcing D17 turbo kits, particularly from unverified suppliers or low-cost regions, is inconsistent or poor manufacturing quality. Many third-party kits use inferior materials such as low-grade turbine housings, weak compressor wheels, or substandard bearings that fail under high stress. These components may not meet OEM tolerances, leading to premature turbo failure, oil leaks, or poor boost response. Additionally, kits may lack proper balancing or heat treatment, increasing the risk of catastrophic engine damage.

Misrepresentation of Specifications and Performance Claims

Suppliers—especially online retailers or resellers—often exaggerate performance metrics such as horsepower gains, boost pressure, or spool-up time. A D17 turbo kit advertised as “race-ready” or “300+ HP capable” may not include supporting components like upgraded intercoolers, fuel injectors, or engine management systems. Without proper matching, the turbo can over-boost, cause detonation, or overwhelm stock engine components. Always verify specifications with independent technical documentation or trusted performance forums.

Lack of Compatibility and Fitment Issues

Even if a D17 turbo kit appears compatible, dimensional variances, incorrect flange types (e.g., T3 vs T4), or mismatched oil/coolant feed lines can make installation difficult or impossible without custom modifications. Some kits are reverse-engineered without access to original design data, leading to poor fitment and extended installation times. Always confirm compatibility with your specific engine variant, manifold, and ancillary systems before purchasing.

Intellectual Property (IP) Infringement Risks

Many D17 turbo kits, particularly those marketed as “direct replacements” or “OEM-spec,” may infringe on protected designs, trademarks, or patented technologies. Reputable turbo manufacturers like Garrett, BorgWarner, or IHI often hold IP rights over specific compressor housing shapes, bearing systems, or variable geometry mechanisms. Sourcing kits that copy these designs without licensing exposes buyers—especially commercial modifiers or tuners—to legal liability, product seizures, or warranty voidance. Always check whether the supplier holds proper licensing or partners with authorized manufacturers.

Absence of Certification and Compliance Documentation

Reliable turbo kits should come with performance certifications, emissions compliance (e.g., EPA, CARB), or ISO manufacturing standards. However, many generic D17 kits lack any verifiable documentation, making it difficult to confirm safety, reliability, or road legality. This is especially critical in regulated markets where modified vehicles must pass inspections. Without proper certification, you risk failing compliance checks or invalidating insurance coverage.

Inadequate Support and Warranty Limitations

Low-cost or off-brand D17 turbo kits often come with limited or voidable warranties, particularly if installed by non-certified technicians. Some suppliers exclude coverage for “improper installation” or “tuning errors,” even when root causes stem from design flaws. Additionally, technical support may be unavailable or unresponsive, leaving buyers stranded during installation or troubleshooting. Always confirm warranty terms and technical support availability before purchase.

Conclusion

To avoid these pitfalls, source D17 turbo kits from reputable manufacturers or authorized distributors, verify technical specifications independently, and ensure compliance with IP and regulatory standards. Investing in a quality, legally compliant kit not only safeguards performance and reliability but also protects against legal and financial exposure.

Logistics & Compliance Guide for D17 Turbo Kit

Product Overview

The D17 Turbo Kit is a high-performance aftermarket upgrade designed to enhance engine output and efficiency in compatible vehicle models. This guide outlines critical logistics and compliance considerations for the import, distribution, installation, and use of the D17 Turbo Kit in regulated markets.

Regulatory Compliance

Emissions and Environmental Standards

The D17 Turbo Kit must comply with applicable emissions regulations depending on the target market:

– United States (EPA & CARB): Installation of the D17 Turbo Kit may affect emissions systems. It is not CARB-exempt unless specifically certified. Use is restricted in California and other states adopting CARB standards unless accompanied by an Executive Order (EO) number.

– European Union (Euro Standards): The kit must comply with EU Type Approval regulations. Aftermarket performance parts may require individual vehicle re-testing under WLTP/RDE protocols. CE marking is not typically applicable to engine modification kits.

– Other Regions: Consult local environmental agencies (e.g., Environment Canada, ADR in Australia) for conformity requirements. Non-compliant installations may void vehicle warranties and fail mandatory inspections.

Safety & Roadworthiness

- Installation must not compromise vehicle safety systems (ABS, traction control, stability control).

- Modifications should not affect lighting, visibility, or structural integrity.

- In regions requiring periodic roadworthiness tests (e.g., MOT in the UK, TÜV in Germany), the modified vehicle must pass inspection with the turbo kit installed.

Import & Customs Documentation

Harmonized System (HS) Code

- Recommended HS Code: 8409.91.90 – Parts suitable for use solely or principally with turbochargers.

- Confirm classification with local customs authority; misclassification may result in delays or fines.

Required Documentation

For international shipments, ensure the following are available:

– Commercial Invoice (with full product description, value, and country of origin)

– Packing List

– Certificate of Origin

– Bill of Lading or Air Waybill

– Product Compliance Declaration (if requested)

– CARB EO Number (for shipments to California or CARB-adopting states)

Shipping & Handling

Packaging Requirements

- Kit components must be securely packaged to prevent damage during transit.

- Use anti-corrosion protection for metal parts (e.g., turbo housing, piping).

- Include moisture-absorbing desiccants in sealed packaging when shipping to humid environments.

Storage Conditions

- Store in a dry, temperature-controlled environment (10–25°C / 50–77°F).

- Avoid exposure to dust, chemicals, or direct sunlight.

- Keep packaging sealed until point of installation.

Installation & Certification

Qualified Installer Requirements

- Installation must be performed by ASE-certified or equivalent technicians familiar with turbocharged systems.

- Use OEM or equivalent-grade fasteners and gaskets.

- Post-installation diagnostics (including ECU remapping) must be conducted using approved tools.

Warranty & Liability

- Manufacturer warranty applies only to defects in materials or workmanship.

- Modifications may void original vehicle powertrain warranty—disclose this to end users.

- Installer assumes liability for improper installation or failure to follow guidelines.

End-User Responsibilities

Legal Use and Registration

- Users must ensure local laws permit performance modifications.

- In some jurisdictions, modified vehicles require re-registration or supplemental inspection.

- Failure to comply may result in fines, failed inspections, or vehicle impoundment.

Documentation Retention

- Retain all purchase receipts, installation records, and compliance documentation for audit or resale purposes.

Contact & Support

For compliance inquiries or technical support:

– Email: [email protected]

– Phone: +1 (800) 555-0198

– Website: www.d17turbo.com/compliance

Note: Regulations vary by jurisdiction. It is the responsibility of distributors, installers, and end users to verify compliance with local, state, and national laws.

Conclusion: Sourcing a D17 Turbo Kit

Sourcing a D17 turbo kit requires careful consideration of multiple factors to ensure reliability, performance, and compatibility. The Honda D17 engine, while not inherently built for forced induction, can handle a well-designed turbo setup when supported with proper upgrades. After evaluating various suppliers, kit configurations, and user experiences, it is clear that success hinges on selecting a reputable provider offering a complete, well-engineered system—including a compatible turbocharger, manifold, intercooler, fuel system upgrades, and proper engine management.

It is essential to prioritize quality components and professional support, especially since improper installation or subpar parts can lead to engine damage. Additionally, tuning by an experienced professional is critical to optimize performance and maintain engine longevity. While cost is a consideration, the lowest-priced option may compromise safety and durability.

In conclusion, sourcing a D17 turbo kit is feasible and can yield impressive performance gains when approached with thorough research, attention to detail, and a commitment to proper installation and tuning. Investing in a complete, high-quality system from a trusted supplier ensures a rewarding and reliable forced-induction experience for your D17-powered vehicle.