The global cylinder tank market is experiencing robust growth, driven by increasing demand across industries such as oil & gas, chemical processing, pharmaceuticals, and renewable energy. According to a 2023 report by Grand View Research, the global pressure vessel market—of which cylinder tanks are a critical component—was valued at USD 28.9 billion and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is fueled by rising industrialization, stringent safety regulations, and the expanding use of compressed gases in clean energy applications such as hydrogen storage and LNG transportation. Additionally, Mordor Intelligence forecasts heightened demand in emerging economies, where infrastructure development and manufacturing activities are accelerating the need for reliable storage and process solutions. As industries prioritize efficiency, safety, and compliance, the role of advanced cylinder tank manufacturers becomes increasingly pivotal. In this evolving landscape, we spotlight the top 10 cylinder tank manufacturers leading innovation, quality, and global market share.

Top 10 Cylinder Tank Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Faber Italy

Domain Est. 1998

Website: faber-italy.com

Key Highlights: Faber Industrie is a world’s leading company in the design, manufacturing, testing and marketing of high-pressure gas cylinders and systems….

#2 Ragasco

Domain Est. 2001

Website: ragasco.com

Key Highlights: Transforming the use of liquid gas with lighter and safer cylinders. We are a leading global manufacturer of composite cylinders for liquid gas applications….

#3 AMS Composite Cylinders

Domain Est. 2016

Website: ams-composites.com

Key Highlights: AMS supply state of the art lightweight gas cylinders using the latest technology. Our cylinders are used all round the world in healthcare for oxygen therapy….

#4 The largest U.S. manufacturer of aluminum gas cylinders

Domain Est. 2021

Website: thunderbird-cylinders.com

Key Highlights: Thunderbird Cylinders manufactures a variety of custom-engineered gas cylinders for a range of markets around the world….

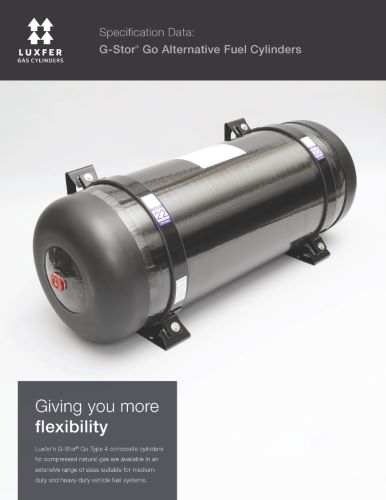

#5 Luxfer Gas Cylinders

Domain Est. 1997

Website: luxfercylinders.com

Key Highlights: We manufacture gas cylinders for a variety of applications: Type 1 Aluminum Cylinders. Type 2 Aluminum and Carbon Fiber Hoop-Wrapped Cylinders. Type 3 ……

#6 Norris Cylinder

Domain Est. 1998

Website: norriscylinder.com

Key Highlights: Cylinders Forged in the USA. Norris Cylinder produces a wide range of high and low pressure, seamless and welded steel cylinders. Read more….

#7 Ortman Cylinders

Domain Est. 1999

Website: ortmanfluidpower.com

Key Highlights: We use state of the art CNC machinery to manufacture each cylinder, valve actuator, booster, and tank component in Quincy, Illinois. This manufacturing ……

#8 Chesterfield Special Cylinders

Domain Est. 2000

Website: chesterfieldcylinders.com

Key Highlights: Chesterfield Special Cylinders offers compressed gas storage solutions serving safety-critical applications across diverse sectors….

#9 Faber diving

Domain Est. 2000

Website: divefaber.com

Key Highlights: To give divers the lightest steel tanks with ideal buoyancy, our scuba diving cylinders are diligently manufactured using high quality steel plates….

#10

Website: eurocylinders.de

Key Highlights: Precise production of steel cylinders. Our production processes are highly coordinated, ensuring efficient and error-free manufacturing of our products….

Expert Sourcing Insights for Cylinder Tank

H2: 2026 Market Trends for Cylinder Tanks

The global cylinder tank market is poised for significant transformation by 2026, driven by technological innovation, increasing industrial demand, and evolving regulatory standards. These cylindrical pressure vessels—used across sectors such as oil & gas, chemicals, food & beverage, pharmaceuticals, and renewable energy—are adapting to new market dynamics. Key trends shaping the cylinder tank industry in 2026 include:

-

Growth in Clean Energy Applications

The global push toward decarbonization is accelerating demand for cylinder tanks in hydrogen storage and transportation. With hydrogen emerging as a critical energy vector, high-pressure composite and metal-lined cylinder tanks are being developed for use in fuel cell vehicles and stationary energy storage. Countries investing heavily in hydrogen infrastructure—such as Germany, Japan, South Korea, and the U.S.—are expected to drive market growth, with the hydrogen cylinder tank segment projected to expand at a CAGR exceeding 12% through 2026. -

Adoption of Lightweight Composite Materials

Composite cylinder tanks (Type III and Type IV), made from carbon fiber-reinforced polymers, are gaining traction due to their high strength-to-weight ratio and corrosion resistance. These materials are particularly favored in the transportation and aerospace industries to improve fuel efficiency and reduce emissions. By 2026, composite tanks are expected to capture over 30% of the high-pressure gas cylinder market, especially in mobile and portable applications. -

Stringent Safety and Regulatory Standards

Increasing emphasis on safety is prompting stricter certification requirements (e.g., ISO 11119, ASME BPVC, and TPED). Manufacturers are investing in advanced testing, digital monitoring, and smart sensors integrated into cylinder tanks for real-time pressure, temperature, and leak detection. These innovations enhance compliance and reduce operational risks, particularly in hazardous environments. -

Expansion in Emerging Markets

Rapid industrialization in Asia-Pacific, Latin America, and Africa is fueling demand for industrial and LPG cylinder tanks. Urbanization and rising energy needs in countries like India, Indonesia, and Nigeria are driving LPG adoption for domestic and commercial use. By 2026, the Asia-Pacific region is expected to account for nearly 45% of global cylinder tank consumption. -

Digitalization and IoT Integration

Smart cylinder tanks equipped with IoT-enabled tracking systems are becoming more common. These systems allow for remote monitoring, predictive maintenance, and improved supply chain logistics. Companies are leveraging data analytics to optimize refilling schedules and reduce cylinder loss—theft or misplacement—enhancing operational efficiency. -

Sustainability and Circular Economy Initiatives

Environmental concerns are pushing manufacturers toward recyclable materials and extended producer responsibility (EPR) programs. Refurbishment and requalification of steel and composite cylinders are gaining momentum to reduce waste and lifecycle costs. Additionally, lifecycle assessments (LCA) are becoming standard in product development. -

Consolidation and Strategic Partnerships

The market is witnessing increased M&A activity and joint ventures, particularly between material suppliers, technology firms, and cylinder manufacturers. These collaborations aim to accelerate R&D in next-generation tanks and expand geographic reach.

In conclusion, by 2026, the cylinder tank market will be characterized by innovation in materials and digital integration, strong growth in clean energy applications, and a geographic shift toward emerging economies. Companies that invest in sustainable, smart, and lightweight solutions will be best positioned to capitalize on these evolving trends.

H2: Common Pitfalls When Sourcing Cylinder Tanks (Quality and Intellectual Property)

Sourcing cylinder tanks, especially for high-pressure or specialized applications such as hydrogen (H₂) storage, involves significant technical, regulatory, and legal considerations. Buyers and procurement teams often encounter pitfalls related to quality assurance and intellectual property (IP) rights. Understanding these risks is critical to ensuring safety, compliance, and long-term supply chain reliability.

1. Compromised Material Quality and Manufacturing Standards

- Use of Substandard Materials: Suppliers may use inferior-grade steel or composite materials that do not meet required pressure, temperature, or corrosion resistance standards (e.g., failing to comply with ISO 11119 or ASME BPVC Section VIII).

- Inadequate Certification: Lack of proper certification (e.g., CE, PED, DOT, TPED) or falsified documentation can lead to unsafe tanks entering service.

- Poor Welding or Composite Winding: Inconsistent manufacturing processes, especially in low-cost regions, can result in weak structural integrity and catastrophic failure under pressure.

Impact: Safety hazards, regulatory non-compliance, increased maintenance, and liability in case of accidents.

2. Inconsistent Quality Control and Testing

- Insufficient Non-Destructive Testing (NDT): Skipping or inadequately performing tests like ultrasonic, radiographic, or hydrostatic testing increases the risk of undetected flaws.

- Inconsistent Batch Testing: Variability between production batches due to lax quality management systems (e.g., absence of ISO 9001 certification).

Impact: Unreliable performance, field failures, and costly recalls or replacements.

3. Intellectual Property (IP) Infringement

- Counterfeit or Reverse-Engineered Designs: Some suppliers may replicate patented cylinder designs (e.g., Type III or Type IV composite tanks for hydrogen) without authorization.

- Use of Proprietary Technology Without Licensing: Unauthorized use of patented liner materials, winding patterns, or valve integration systems can expose the buyer to legal risk.

- Lack of IP Due Diligence: Procurement teams may not verify whether the supplier owns or has rights to the technology used in manufacturing.

Impact: Legal disputes, import/export bans, reputational damage, and forced redesigns.

4. Ambiguous or Inadequate Technical Documentation

- Missing Design Dossiers: Suppliers may not provide full technical files required for conformity assessment under regulations like the EU Pressure Equipment Directive (PED).

- Incomplete Traceability: Lack of material test reports (MTRs), heat numbers, or production records hampers quality audits and incident investigations.

Impact: Delays in regulatory approvals, difficulties in maintenance, and challenges during inspections.

5. Non-Compliance with Hydrogen-Specific Requirements

- Hydrogen Embrittlement Risks: Use of materials not resistant to hydrogen embrittlement (e.g., certain steels or composites) reduces lifespan and safety.

- Lack of H₂ Compatibility Certification: Tanks not tested or certified for hydrogen service may degrade prematurely.

Impact: Reduced operational lifespan, safety incidents, and non-compliance with hydrogen infrastructure standards.

6. Supplier Reliability and Transparency

- Hidden Subcontracting: Suppliers may outsource critical manufacturing steps without disclosure, leading to inconsistent quality.

- Lack of Audit Access: Refusal to allow factory inspections or third-party audits raises red flags about quality and IP practices.

Impact: Supply chain vulnerabilities, difficulty enforcing contractual terms, and increased risk of non-conformance.

Mitigation Strategies

- Conduct thorough supplier audits, including on-site inspections and review of quality management systems.

- Require full traceability documentation and independent certification from accredited bodies.

- Perform IP due diligence: verify patents, request licensing evidence, and include IP indemnity clauses in contracts.

- Prioritize suppliers with proven experience in hydrogen-compatible tank manufacturing and compliance with international standards.

- Engage third-party testing labs for sample validation before full-scale procurement.

By proactively addressing these quality and IP-related pitfalls, organizations can ensure the safe, compliant, and legally sound sourcing of cylinder tanks—particularly critical in emerging sectors like hydrogen energy.

H2: Logistics & Compliance Guide for Cylinder Tanks

-

Overview

Cylinder tanks are pressure vessels designed to store and transport compressed, liquefied, or dissolved gases. Due to their pressurized contents, they are subject to strict logistics and compliance regulations to ensure safety during handling, transportation, storage, and use. This guide outlines key considerations for the safe and compliant movement and management of cylinder tanks, with a focus on international and national regulatory frameworks. -

Regulatory Frameworks

Cylinder tanks must comply with multiple regulatory standards depending on the region and type of gas. Key standards include: -

UN Recommendations on the Transport of Dangerous Goods (UN Model Regulations)

The foundation for most international transport regulations. Cylinders are classified under Class 2 (Gases) and must meet construction, testing, and labeling requirements. -

DOT (U.S. Department of Transportation) – 49 CFR

Governs the transportation of hazardous materials in the United States. Cylinders must be: - Designed and tested per ASME or DOT-SP specifications.

- Periodically requalified (e.g., hydrostatic testing every 3–10 years depending on type).

-

Properly marked with service pressure, serial number, manufacturer, and test dates.

-

TPED (Transportable Pressure Equipment Directive) – EU

Applies to the design, manufacture, and conformity assessment of transportable pressure equipment in the European Union. Requires CE marking and periodic inspection. -

ISO Standards (e.g., ISO 9809, ISO 11119)

Define technical specifications for seamless and welded gas cylinders, including materials, design, testing, and markings. -

ADR (Europe), IMDG Code (Maritime), IATA (Air)

Mode-specific regulations for road, sea, and air transport, respectively. These govern packaging, labeling, documentation, and segregation. -

Classification of Gases in Cylinder Tanks

Cylinder content determines hazard classification and handling: -

Flammable Gases (e.g., hydrogen, propane) – Class 2.1

- Non-Flammable, Non-Toxic Gases (e.g., nitrogen, CO₂) – Class 2.2

- Toxic Gases (e.g., chlorine, ammonia) – Class 2.3

Each classification has specific requirements for labeling, transport vehicle signage, and emergency response.

-

Cylinder Markings and Documentation

Compliant cylinders must display permanent markings, including: -

UN number (e.g., UN 1013 for nitrogen)

- Service pressure (PS or WP)

- Test pressure and date

- Manufacturer ID and serial number

- Requalification stamp

- Tare weight and water capacity

Transport Documentation Must Include:

– Dangerous Goods Declaration (Shipper’s Declaration)

– Safety Data Sheet (SDS)

– Proper shipping name and hazard class

– Emergency contact information

- Handling and Storage Requirements

- Handling: Use appropriate lifting gear; never drag, roll, or drop cylinders. Secure valves with caps when not in use.

- Storage: Store upright and secured in well-ventilated areas, away from heat sources and incompatible materials. Segregate flammable, oxidizing, and toxic gases.

-

Temperature Control: Avoid exposure to temperatures exceeding 50°C (122°F); some gases may require thermal protection.

-

Transportation Best Practices

- Mode-Specific Compliance:

- Road (ADR): Use certified vehicles with appropriate placards and restraints.

- Maritime (IMDG): Cylinders must be stowed securely and comply with vessel segregation rules.

-

Air (IATA): Limited quantities and hazardous materials allowed; strict packaging and approval requirements.

-

Securing Loads: Cylinders must be immobilized to prevent movement during transit. Use racks, cradles, or straps.

-

Ventilation: Ensure cargo areas are ventilated to prevent gas accumulation in case of leaks.

-

Periodic Inspection and Requalification

- Hydrostatic testing: Required every 3–10 years based on gas type and cylinder material.

- Visual inspection: Annually or before each filling to check for corrosion, dents, or valve damage.

-

Recordkeeping: Maintain logs of inspections, tests, and maintenance.

-

Emergency Preparedness

- Provide accessible emergency response information (e.g., ERG – Emergency Response Guidebook).

- Train personnel in leak response, evacuation, and use of PPE.

-

Equip transport vehicles and storage areas with fire extinguishers and gas detection systems where applicable.

-

Environmental and Sustainability Considerations

- Recycle or properly dispose of damaged or obsolete cylinders.

- Use returnable and refillable cylinders to reduce waste.

-

Monitor for fugitive emissions during filling and transport.

-

Conclusion

Safe and compliant logistics of cylinder tanks require strict adherence to international, national, and mode-specific regulations. Operators must ensure proper classification, documentation, handling, and maintenance throughout the cylinder lifecycle. Regular training and audits are essential to maintain regulatory compliance and operational safety.

For further details, consult:

– IATA Dangerous Goods Regulations

– IMDG Code

– ADR Agreement

– OSHA and EPA guidelines (U.S.)

– Local regulatory authorities

Note: Regulations may vary by jurisdiction and gas type. Always verify current requirements with the relevant authority before transport.

Conclusion for Sourcing Cylinder Tanks:

The sourcing process for cylinder tanks has been completed through a comprehensive evaluation of technical specifications, supplier capabilities, cost-effectiveness, quality assurance, and delivery timelines. After assessing multiple vendors, the selected supplier offers a strong balance of reliability, compliance with industry standards (such as ASME, PED, or ISO, as applicable), competitive pricing, and proven performance in similar applications. The chosen cylinder tanks meet the required material, capacity, pressure rating, and safety criteria essential for the intended use.

Additionally, the supplier demonstrates robust quality control procedures, traceability of materials, and after-sales support, minimizing operational risks. Long-term benefits such as durability, low maintenance, and energy efficiency further justify the procurement decision. Moving forward, establishing a strategic partnership with the supplier will ensure consistent supply, potential volume discounts, and improved lead times.

In conclusion, the sourced cylinder tanks align with both technical requirements and organizational objectives, supporting safe, efficient, and sustainable operations. Regular performance monitoring and supplier relationship management will be implemented to maintain quality and service standards over time.