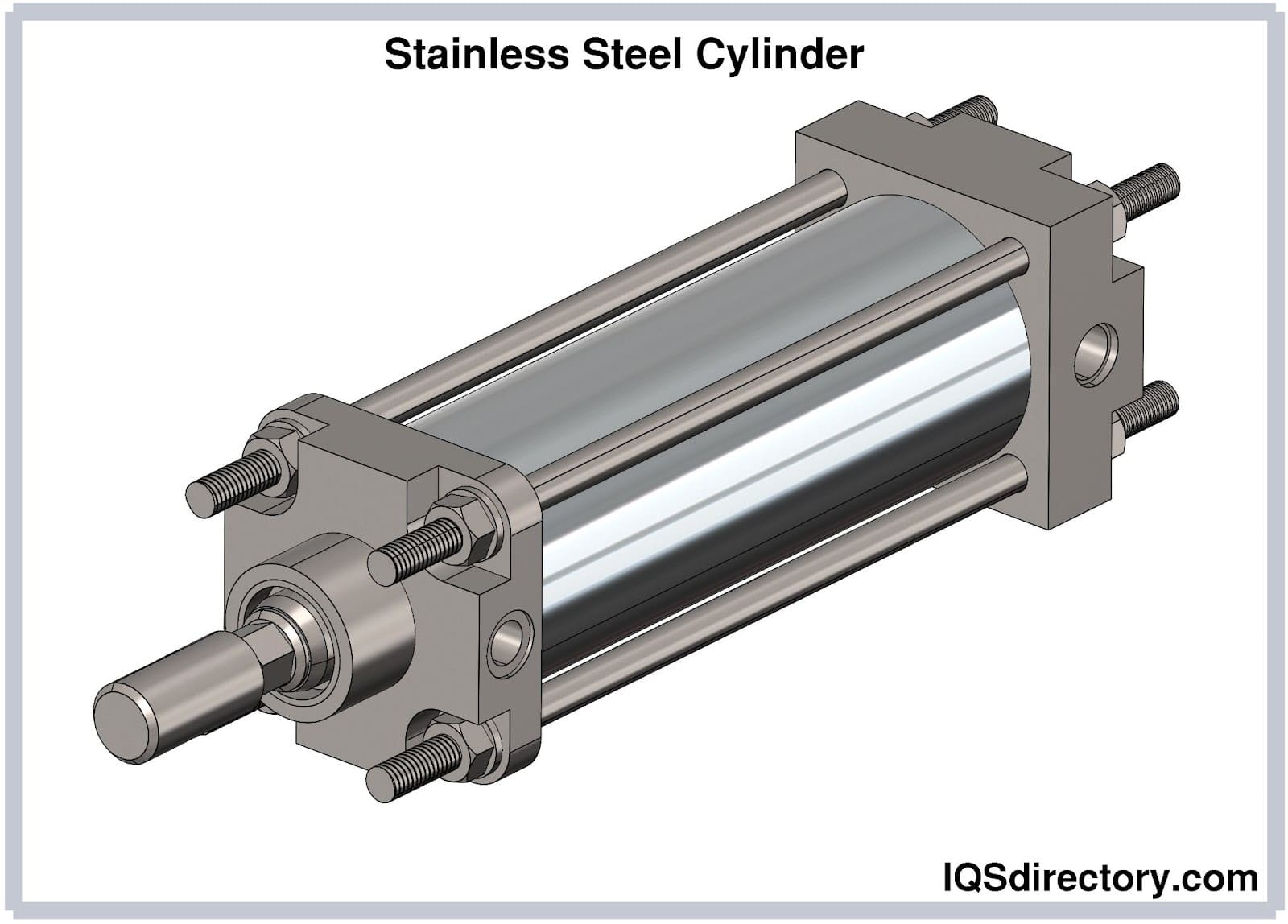

The global stainless steel cylinder market is experiencing robust growth, driven by increasing demand across industries such as automotive, healthcare, oil & gas, and renewable energy. According to Grand View Research, the global stainless steel market was valued at USD 73.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030, fueled by rising infrastructure development and industrial applications. Similarly, Mordor Intelligence projects a steady rise in specialty steel product demand, with stainless steel pressure cylinders gaining traction due to their durability, corrosion resistance, and compliance with stringent safety standards. As industries prioritize efficient gas storage and transportation solutions, the need for high-performance cylindrical containers has intensified. This growing demand has elevated the prominence of key manufacturers who combine advanced engineering, strict quality control, and scalable production capabilities. Below, we highlight the top 9 stainless steel cylinder manufacturers shaping the industry through innovation, global reach, and consistent performance.

Top 9 Cylinder Stainless Steel Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Hydraulic Cylinder Manufacturer

Domain Est. 1999

Website: cylval.com

Key Highlights: Cylinders & Valves, Inc. offers a wide variety of standard and custom hydraulic cylinders, pneumatic cylinders, replacement parts, and cylinder repair….

#2 Leading Stainless Steel Cylinder Manufacturers

Domain Est. 2014

Website: air-cylinders.com

Key Highlights: Discover top US suppliers of stainless steel cylinders, crafting premium-quality industrial products at competitive prices….

#3 Bulk Cylinders

Domain Est. 1997

Website: gelest.com

Key Highlights: Electropolished 316L stainless steel cylinders for storing and dispensing bulk quantities of corrosive or high purity liquids and compressible gases. Head ……

#4 North American Stainless

Domain Est. 1999 | Founded: 1990

Website: northamericanstainless.com

Key Highlights: Founded in 1990, North American Stainless (NAS) has undertaken several phases of expansion to become the largest, fully integrated stainless steel producer in ……

#5 Stainless Steel Cylinders

Domain Est. 1995

Website: norgren.com

Key Highlights: Stainless Steel cylinders are ideal in those harsh or extreme environments including pharmaceutical and food industry where improved corrosion resistance is ……

#6 Original Line® All Stainless Steel

Domain Est. 1996

Website: bimba.com

Key Highlights: The “Blue and Improved” all stainless steel Original Line® cylinder utilizes permanent FDA approved grease lubrication….

#7 Stainless Steel Series

Domain Est. 1996

Website: americancylinder.com

Key Highlights: American Cylinder provides non-repairable, stainless steel, aluminum, magnetic, corrosion-resistant, and three position pneumatic cylinders….

#8 Stainless Steel Air Cylinders

Domain Est. 2001

Website: smcpneumatics.com

Key Highlights: 2-day delivery 30-day returnsStainless steel cylinders are great for when you need a part that will not corrode or rust. SMC Pneumatics has all the sizes you need….

#9 Stainless Steel Extraction Cylinders

Domain Est. 2009

Website: buildingproducts.worthingtonenterprises.com

Key Highlights: Stainless Steel Construction. Crafted from corrosion-resistant stainless steel, each cylinder is built to withstand harsh environments and maintain material ……

Expert Sourcing Insights for Cylinder Stainless Steel

H2: Market Trends for Stainless Steel Cylinders in 2026

By 2026, the global market for stainless steel cylinders is anticipated to experience significant transformation, driven by technological advancements, evolving regulatory landscapes, and shifting end-user demands. Key trends shaping this market include:

1. Accelerated Adoption in Renewable Energy and Hydrogen Economy:

The most defining trend for 2026 will be the surge in demand for high-pressure stainless steel cylinders in hydrogen storage and transportation. As green hydrogen projects scale globally—driven by national energy transition strategies—Type III and Type IV composite-overwrapped stainless steel cylinders will see increased deployment. Stainless steel liners offer superior hydrogen permeation resistance and durability, making them essential for fuel cell vehicles, backup power systems, and hydrogen refueling infrastructure.

2. Growth in Medical and Life Sciences Applications:

Stringent regulatory standards (e.g., FDA, EU MDR) and the rising demand for portable medical gas solutions will boost the medical gas cylinder segment. 316L and ultra-high-purity stainless steel cylinders will be preferred for storing oxygen, nitrous oxide, and specialty gas mixtures. Advancements in cylinder design for enhanced safety, sterilization compatibility, and integration with smart monitoring systems will further drive market expansion in healthcare.

3. Emphasis on Lightweighting and Material Innovation:

Manufacturers will prioritize reducing cylinder weight without compromising safety or pressure ratings. Innovations in high-strength stainless steel alloys (e.g., duplex and super-austenitic grades) and hybrid designs combining stainless steel with carbon fiber will gain traction. These improvements will enhance portability and efficiency, especially in aerospace, defense, and mobile industrial applications.

4. Digitalization and Smart Cylinder Integration:

The integration of IoT sensors and RFID tags into stainless steel cylinders will become mainstream by 2026. Smart cylinders will enable real-time monitoring of pressure, temperature, location, and usage patterns, improving supply chain efficiency, predictive maintenance, and leak detection. This shift will be critical in industrial, pharmaceutical, and energy sectors seeking operational transparency and safety.

5. Sustainability and Circular Economy Pressures:

Environmental regulations and corporate ESG goals will push the industry toward sustainable practices. Recyclability of stainless steel (up to 100%) will be a major selling point. Manufacturers will focus on reducing carbon footprint in production, increasing recycled content, and offering cylinder lifecycle management services, including refurbishment and closed-loop recycling programs.

6. Regional Market Shifts and Supply Chain Resilience:

Asia-Pacific—particularly China, India, and South Korea—will remain the fastest-growing region due to industrialization and clean energy investments. However, geopolitical factors and trade policies will drive localization of production in North America and Europe to mitigate supply chain risks. Nearshoring and dual-sourcing strategies will become common among major cylinder producers.

7. Regulatory Harmonization and Safety Standards:

Global alignment of pressure vessel codes (e.g., ISO 11119, ASME, PED) will streamline certification processes and facilitate cross-border trade. Enhanced safety requirements, especially for hydrogen and cryogenic applications, will mandate advanced testing, traceability, and quality assurance, reinforcing the dominance of stainless steel over alternative materials.

In summary, the 2026 stainless steel cylinder market will be characterized by innovation, digital integration, and strong tailwinds from the clean energy transition. Companies that invest in R&D, sustainability, and smart technologies will be best positioned to capture growth in this dynamic landscape.

Common Pitfalls in Sourcing Cylinder Stainless Steel (Quality, IP)

Sourcing stainless steel cylinders—especially for critical applications in industries like pharmaceuticals, food & beverage, or high-purity gas systems—requires careful attention to both material quality and intellectual property (IP) considerations. Overlooking these aspects can lead to performance failures, regulatory non-compliance, and legal risks. Below are key pitfalls to avoid:

1. Overlooking Material Grade and Certification Validity

One of the most frequent mistakes is assuming that all “stainless steel” meets the required standard. Buyers may accept generic material claims without verifying the exact grade (e.g., 316L vs. 304) or sourcing from unreliable suppliers.

- Pitfall: Accepting mill test certificates (MTCs) without validating authenticity or traceability.

- Impact: Substandard alloys may corrode, contaminate contents, or fail under pressure.

- Best Practice: Require full material traceability (heat number), certified to relevant standards (e.g., ASTM A269, ASTM A270), and consider third-party inspection.

2. Inadequate Surface Finish and Passivation

For sanitary or high-purity applications, surface finish (e.g., Ra ≤ 0.8 µm) and proper passivation are critical to prevent microbial growth and contamination.

- Pitfall: Failing to specify surface roughness, electropolishing, or passivation processes in procurement agreements.

- Impact: Risk of product contamination, shortened equipment life, and non-compliance with FDA, ASME BPE, or EHEDG standards.

- Best Practice: Clearly define surface requirements in technical specifications and verify through inspection reports or on-site audits.

3. Ignoring Manufacturing Process and Welding Quality

The method used to form and join cylinder components (e.g., seamless vs. welded, orbital welding) significantly affects integrity and cleanliness.

- Pitfall: Not auditing welding procedures (WPS/PQR) or welder qualifications.

- Impact: Poor welds can lead to leaks, weak points, and contamination traps.

- Best Practice: Require documented welding procedures, welder certifications (e.g., ASME IX), and non-destructive testing (e.g., X-ray, dye penetrant).

4. Underestimating Intellectual Property (IP) Risks

Stainless steel cylinder designs—especially custom or patented systems—may be protected by patents, trade secrets, or design rights. Sourcing from unauthorized manufacturers can lead to IP infringement.

- Pitfall: Procuring “compatible” or “equivalent” cylinders without verifying IP clearance.

- Impact: Legal action, shipment seizures, reputational damage, and forced redesigns.

- Best Practice: Conduct IP due diligence; obtain written assurance from suppliers that products do not infringe third-party rights; consider licensing agreements when necessary.

5. Selecting Suppliers Without Proper Qualification

Choosing vendors based solely on cost or speed, without assessing their technical capability and compliance track record, is a high-risk strategy.

- Pitfall: Relying on uncertified or unqualified suppliers lacking ISO 9001, ISO 13485, or PED certification.

- Impact: Inconsistent quality, delayed deliveries, and non-compliant products.

- Best Practice: Perform supplier audits, request quality management system certifications, and review historical performance.

6. Failing to Define Acceptance Criteria and Testing Requirements

Ambiguous or missing quality control protocols can result in disputes and acceptance of defective goods.

- Pitfall: Not specifying pressure testing, helium leak testing, or dimensional tolerances in purchase orders.

- Impact: Safety hazards, system incompatibility, and costly rework.

- Best Practice: Include detailed inspection and testing requirements (e.g., hydrostatic test at 1.5x working pressure) in contracts and verify with test reports.

7. Neglecting Regulatory and Industry-Specific Compliance

Different sectors have unique requirements—for example, USP <800> for pharmaceuticals or PED for pressure equipment in Europe.

- Pitfall: Assuming global compliance based on local standards.

- Impact: Rejection at customs, regulatory fines, or operational shutdowns.

- Best Practice: Align cylinder specifications with target market regulations and ensure supplier compliance documentation is up to date.

By proactively addressing these pitfalls, organizations can ensure they source high-quality, compliant, and legally sound stainless steel cylinders that meet both performance and regulatory demands.

Logistics & Compliance Guide for Cylinder Stainless Steel

Introduction to Stainless Steel Cylinders

Stainless steel cylinders are widely used across industries such as food and beverage, pharmaceuticals, chemicals, medical gases, and industrial manufacturing due to their durability, corrosion resistance, and hygienic properties. Proper logistics and compliance management are essential to ensure safety, regulatory adherence, and product integrity during transportation, storage, and handling.

Classification and Regulatory Framework

Stainless steel cylinders may be classified based on content (e.g., gases, liquids), pressure rating, and intended use. Key regulatory bodies include:

– DOT (U.S. Department of Transportation) – Regulates the design, testing, and transportation of cylinders in the United States under 49 CFR.

– ISO (International Organization for Standardization) – Provides international standards such as ISO 9809 for seamless steel gas cylinders.

– TPED (Transportable Pressure Equipment Directive) – Applies in the European Union for design, manufacturing, and conformity assessment.

– ASME (American Society of Mechanical Engineers) – Governs pressure vessel standards, including certain cylinder types.

– ADR/RID/ADN/IMDG/IATA – Govern international transport by road, rail, inland waterways, sea, and air respectively.

Ensure cylinders comply with the relevant standards based on destination and mode of transport.

Design and Certification Requirements

- Cylinders must be manufactured according to recognized standards (e.g., ISO 9809, DOT-SP or DOT-3AL/3HT specifications).

- Each cylinder must bear permanent markings including:

- Manufacturer ID

- Serial number

- Test pressure

- Working pressure

- Water capacity

- Date of manufacture and requalification

- Certification mark (e.g., DOT, ISO, CE)

- Periodic hydrostatic testing and requalification are mandatory (typically every 3–10 years depending on type and jurisdiction).

Packaging and Handling

- Cylinders must be transported in upright positions, secured against movement, and protected from damage.

- Valve protection caps must be firmly in place during handling and transport.

- Use cradles, racks, or specialized containers designed for cylinder transport.

- Segregate empty and full cylinders; label clearly.

- Avoid exposure to extreme temperatures, direct sunlight, or corrosive environments.

Transportation Regulations

By Road (ADR / 49 CFR)

- Cylinders must be secured to prevent rolling or impact.

- Proper placarding and labeling based on contents (e.g., “Compressed Gas,” hazard class 2).

- Driver training in hazardous materials handling (if applicable).

By Air (IATA Dangerous Goods Regulations)

- Only allowed if the cylinder meets IATA specifications and is non-hazardous or properly classified.

- Pressure must be reduced, and valves closed and protected.

- Approval from airline required; certain gases are prohibited.

By Sea (IMDG Code)

- Cylinders must be stowed securely and segregated from incompatible materials.

- Documentation must include Dangerous Goods Declaration if transporting hazardous contents.

By Rail (RID)

- Follows similar rules to ADR with additional rail-specific securing requirements.

Documentation and Labeling

- Shipping Papers: Include proper shipping name, UN number, hazard class, and packing group.

- Safety Data Sheet (SDS): Required for hazardous contents under GHS regulations.

- Labels and Placards: Must be durable, legible, and compliant with transport mode regulations.

- Customs Documentation: Accurate HS codes (e.g., 7311.00 for stainless steel pressure vessels), commercial invoices, and certificates of origin may be required for international shipments.

Storage and Inventory Management

- Store in well-ventilated, dry, and secure areas away from heat sources and flammable materials.

- Follow “first in, first out” (FIFO) principles to manage requalification cycles.

- Maintain records of inspections, tests, and maintenance.

- Use designated storage areas with proper signage (e.g., “No Smoking,” “Compressed Gas”).

Compliance with Environmental and Safety Standards

- Adhere to OSHA (Occupational Safety and Health Administration) guidelines for workplace safety.

- Implement spill containment and emergency response plans for hazardous contents.

- Ensure proper disposal or recycling of end-of-life cylinders through certified facilities.

- Comply with REACH (EU) and TSCA (U.S.) if applicable to materials or coatings used.

Training and Personnel Requirements

- Personnel involved in handling, transport, or inspection must be trained in:

- Hazardous materials handling (if applicable)

- Emergency procedures

- Regulatory compliance

- Use of personal protective equipment (PPE)

- Maintain training records and conduct periodic refreshers.

Audits and Recordkeeping

- Conduct regular internal audits to verify compliance with regulatory standards.

- Retain documentation for:

- Manufacturing and certification

- Hydrostatic testing and requalification

- Transport records

- Maintenance and repairs

- Record retention periods vary by jurisdiction (typically 5–10 years).

Conclusion

Effective logistics and compliance for stainless steel cylinders require a thorough understanding of international and local regulations, proper handling and documentation practices, and ongoing personnel training. By adhering to established standards and maintaining rigorous quality control, companies can ensure the safe, legal, and efficient transport and use of stainless steel cylinders across global supply chains.

Conclusion for Sourcing Stainless Steel Cylinders

In conclusion, sourcing stainless steel cylinders requires a strategic approach that balances quality, cost, supplier reliability, and compliance with industry standards. Stainless steel cylinders are critical components in various sectors—including pharmaceuticals, food and beverage, petrochemicals, and medical gas systems—where durability, corrosion resistance, and hygiene are paramount.

Key considerations in the sourcing process include selecting the appropriate grade of stainless steel (such as 304, 316, or 316L) based on the application, ensuring suppliers adhere to international standards (e.g., ASME, ISO, PED), and verifying certifications for material traceability and pressure testing. Engaging with reputable suppliers who offer consistent quality, timely delivery, and technical support enhances operational efficiency and reduces risk.

Additionally, evaluating total cost of ownership—factoring in longevity, maintenance, and safety—rather than focusing solely on initial purchase price leads to more sustainable procurement decisions. Global sourcing opportunities may offer cost advantages, but these must be weighed against logistics, lead times, and regulatory compliance in the destination market.

Ultimately, establishing long-term partnerships with qualified manufacturers and conducting regular supplier assessments ensures a reliable supply chain and supports the consistent performance and safety of stainless steel cylinders across critical applications.