The global constant velocity (CV) axle joint parts market is experiencing steady growth, driven by rising automotive production, increasing demand for fuel-efficient vehicles, and the proliferation of front-wheel-drive systems that rely heavily on CV axles. According to a report by Mordor Intelligence, the CV joint market was valued at USD 8.6 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 4.5% from 2024 to 2029. This expansion is further supported by Grand View Research, which highlights the increasing replacement demand in the after-sales segment due to wear and tear in harsh driving conditions. As vehicle complexity increases and OEMs emphasize durability and performance, the need for high-quality CV axle joint components has never been greater. In this competitive landscape, a handful of manufacturers have emerged as leaders, combining innovation, global reach, and rigorous quality standards to dominate supply chains worldwide. Here’s a look at the top 10 CV axle joint parts manufacturers shaping the future of drivetrain technology.

Top 10 Cv Axle Joint Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 RCV Performance

Domain Est. 2003

Website: rcvperformance.com

Key Highlights: Free delivery over $150Ultimate CV Axles and drive line components for a wide range of OEM and custom applications. Strongest Axles on the Planet available for Jeep, GM, Ford, ……

#2 Buy CV Joint & CV Axle?

Domain Est. 2010

Website: cvjoint.org

Key Highlights: We specialize in manufacturing CV joint & CV Axle. Contact ODM/LEE company. Dealers and distributors in North America, South America, Europe, Australia, ……

#3 Land Rover Axles, CV Joints & Parts

Domain Est. 1996

Website: roverparts.com

Key Highlights: 1–6 day delivery · 30-day returnsHigh quality Land Rover axles, CV joints and parts. When it comes time to replacing parts on your Land Rover or Range Rover, go to Atlantic Britis…

#4 CV Joints

Domain Est. 2001

Website: gknautomotive.com

Key Highlights: Our joint kits contain all the individual parts needed for professional repairs: joint, boot, boot circlips, tightening straps, bolts, nuts, spacers, etc….

#5 Axle Shafts

Domain Est. 2004

Website: spicerparts.com

Key Highlights: Genuine Spicer axle shafts are precision-manufactured with quality materials and fatigue-tested to ensure that each one meets or exceeds OE requirements and ……

#6 Constant Velocity Axles

Domain Est. 2005

Website: moogparts.com

Key Highlights: MOOG Constant Velocity (CV) Axles. Engineered, built, and tested to deliver long – lasting performance you can count on….

#7 CV Axles Archives

Domain Est. 2005

#8 New Premium CV Axles

Domain Est. 2013

Website: trakmotive.com

Key Highlights: TrakMotive Automotive CV Axles transfer power from the transmission to the drive wheels of a vehicle. They consist of a CV Joint and Drive Shaft….

#9 American Axle & Manufacturing

Domain Est. 2013

Website: demandaam.com

Key Highlights: AAM has developed a series of axle and driveshaft components to make it easier for the installer to perform a repair or a complete replacement job….

#10 East Lake Axle

Domain Est. 2014

Website: eastlakeaxle.com

Key Highlights: Discover top-quality axles, differentials, shocks, belts, bearings, wheel hubs and accessories at East Lake Axle. We offer a wide range of durable solutions ……

Expert Sourcing Insights for Cv Axle Joint Parts

H2: 2026 Market Trends for CV Axle Joint Parts

The global market for constant velocity (CV) axle joint parts is poised for significant evolution by 2026, shaped by technological innovation, shifting automotive production trends, and increasing demand for vehicle maintenance and replacement components. As the automotive industry transitions toward electrification and advanced mobility solutions, CV axle joint parts remain critical components in both internal combustion engine (ICE) vehicles and many electric vehicles (EVs), particularly those with front- or all-wheel drive configurations.

One major trend driving the CV axle joint parts market in 2026 is the rising volume of vehicle maintenance and repair activities. With the global vehicle parc expanding—especially in emerging economies—there is a growing need for aftermarket replacement parts. CV axles are susceptible to wear due to constant motion and exposure to road debris, making them common repair items. This sustained demand supports a robust aftermarket segment, projected to account for over 60% of CV axle joint part sales by 2026.

Another key trend is the impact of electric vehicle (EV) adoption on drivetrain design. While many EVs utilize simplified drivetrains with fewer moving parts, models featuring dual-motor configurations or all-wheel drive still incorporate CV axles. As EV production rises, especially in regions like North America, Europe, and China, demand for specialized CV axle components designed for high-torque electric motors is expected to grow. Manufacturers are adapting by developing durable, lightweight CV joints capable of handling the instant torque delivery typical of electric powertrains.

Geographically, Asia-Pacific is expected to dominate the CV axle joint parts market in 2026 due to high vehicle production volumes in China, India, and Japan, along with a burgeoning aftermarket infrastructure. Meanwhile, North America and Europe will see steady growth driven by stringent emission standards promoting EV adoption and aging vehicle fleets requiring replacement components.

Technological advancements are also shaping the industry. Leading suppliers are investing in improved materials—such as advanced alloys and high-performance rubber boots—to extend the lifespan of CV axle joints and reduce maintenance frequency. Additionally, the integration of predictive maintenance technologies, enabled by IoT sensors in premium vehicles, may influence aftermarket dynamics by allowing earlier detection of CV joint wear, thus increasing replacement part demand.

In conclusion, the 2026 market for CV axle joint parts will be characterized by strong aftermarket demand, adaptation to electrified drivetrains, regional production shifts, and material and design innovations. Companies that can offer reliable, EV-compatible, and cost-effective solutions are likely to gain competitive advantage in this evolving landscape.

Common Pitfalls Sourcing CV Axle Joint Parts (Quality, IP)

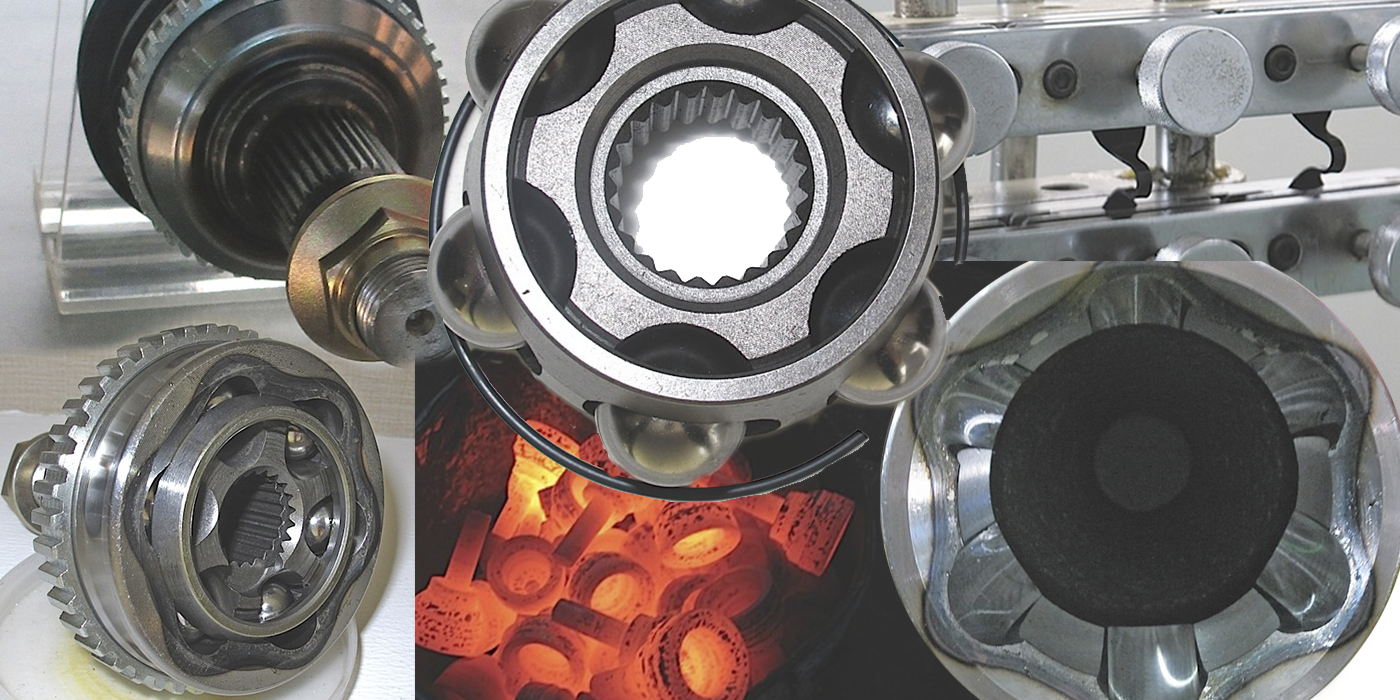

Sourcing CV (Constant Velocity) axle joint parts—such as boots, clamps, grease, inner and outer joints, or complete half-shafts—can be fraught with challenges, particularly concerning quality and intellectual property (IP) issues. Avoiding these pitfalls is crucial for ensuring vehicle safety, reliability, and legal compliance.

Poor Quality Components

One of the most significant risks when sourcing CV axle parts is receiving substandard components that fail prematurely or compromise vehicle performance.

- Inferior Materials: Low-cost suppliers may use subpar steel, rubber, or grease that degrade quickly under stress, heat, or exposure to road contaminants. This leads to joint wear, boot cracking, and eventual driveline failure.

- Inconsistent Manufacturing Tolerances: Poorly machined joints or housings can cause vibration, clicking noises, and accelerated wear. Precision is critical in CV joints to maintain smooth power transfer at varying angles.

- Lack of Quality Control: Many aftermarket manufacturers, especially in unregulated markets, lack rigorous testing and certification processes. Parts may not meet OEM (Original Equipment Manufacturer) performance or durability standards.

- Counterfeit or “Look-Alike” Parts: Some suppliers rebrand generic or non-OEM parts as compatible with specific vehicle models without proper validation, misleading buyers about compatibility and quality.

Intellectual Property (IP) Infringement

Sourcing CV axle components also presents legal risks related to intellectual property rights, particularly with branded or patented designs.

- Trademark Violations: Using OEM logos, part numbers, or branding without authorization constitutes trademark infringement. This is common with counterfeit or grey-market parts falsely labeled as “genuine” OEM.

- Patented Designs: Many CV joint designs (e.g., Rzeppa, Tripod) are protected by patents. Manufacturing or selling exact replicas without licensing can lead to legal action, especially in markets with strong IP enforcement.

- Reverse Engineering Risks: While limited reverse engineering for interoperability may be legally permissible in some jurisdictions, producing direct copies of patented geometries or internal mechanisms can still expose buyers or distributors to liability.

- Grey Market and Unauthorized Distribution: Purchasing parts from unauthorized channels may involve IP-infringing products. Even if unintentional, businesses can be held liable for distributing counterfeit or illegally produced components.

Additional Sourcing Challenges

Beyond quality and IP, other pitfalls include:

- Mislabeling and Inaccurate Specifications: Parts may be inaccurately described (e.g., wrong spline count, incorrect flange type), leading to fitment issues and costly returns.

- Lack of Traceability and Certification: Reputable suppliers provide material certifications, test reports, and traceable batch numbers. Absence of these documents increases risk in regulated industries or warranty claims.

- Supply Chain Transparency: Opaque supply chains make it difficult to verify manufacturing origins or ensure ethical labor practices, which can impact brand reputation.

Best Practices to Mitigate Risks

- Source from Reputable Suppliers: Choose manufacturers with ISO certifications, OEM partnerships, or strong aftermarket reputations.

- Request Documentation: Obtain material specs, test results, and conformity certificates (e.g., ISO/TS 16949).

- Verify IP Compliance: Ensure parts are either licensed, legally reverse-engineered, or clearly labeled as non-OEM equivalents without infringing trademarks.

- Conduct Pre-Shipment Inspections: Use third-party audits or sample testing to validate quality before large orders.

- Consult Legal Counsel: When sourcing in high-risk categories, legal review can help avoid IP exposure.

By proactively addressing these pitfalls, businesses can ensure reliable, compliant, and high-performing CV axle joint parts in their supply chain.

Logistics & Compliance Guide for CV Axle Joint Parts

Overview of CV Axle Joint Parts

Constant Velocity (CV) axle joint parts are critical components in automotive drivetrains, enabling smooth power transmission from the transmission to the wheels at varying angles. These parts include inner and outer CV joints, boots, clamps, grease, and complete axle shaft assemblies. Due to their mechanical importance and international trade volume, proper logistics planning and regulatory compliance are essential for manufacturers, distributors, and importers.

Packaging and Handling Requirements

Proper packaging ensures CV axle joint parts arrive undamaged and ready for installation. Components should be protected against corrosion, impact, and moisture.

– Use rust-inhibitive coatings or VCI (Vapor Corrosion Inhibitor) paper for metal surfaces.

– Secure parts in sturdy corrugated boxes or custom crates with foam or molded inserts to prevent movement.

– Label packages clearly with part numbers, SKUs, handling instructions (e.g., “Fragile,” “This Side Up”), and barcodes for traceability.

– Avoid stacking heavy loads on packaged CV joints to prevent deformation.

Storage Conditions

CV axle parts should be stored in a dry, temperature-controlled environment to prevent rust and degradation of rubber boots.

– Ideal storage: 10°C to 30°C (50°F to 86°F) with relative humidity below 60%.

– Keep away from direct sunlight and sources of heat or chemicals.

– Use first-in, first-out (FIFO) inventory practices to minimize aging of rubber components.

Transportation and Shipping Logistics

Efficient transportation ensures timely delivery while minimizing damage and cost.

– Use palletized shipments for bulk orders to facilitate forklift handling and optimize container/truck space.

– Secure loads with stretch wrap and corner boards to prevent shifting during transit.

– Choose carriers experienced in automotive parts logistics; consider temperature-controlled options for extreme climates.

– For international shipments, coordinate with freight forwarders to ensure timely customs clearance.

Import and Export Compliance

CV axle joint parts are subject to international trade regulations depending on origin, destination, and materials used.

– Classify parts correctly using the Harmonized System (HS) Code—common codes include 8708.80 (for driveshafts and joints).

– Obtain necessary export licenses if shipping to embargoed or restricted countries.

– Comply with destination country’s automotive safety and environmental standards (e.g., DOT in the U.S., ECE in Europe).

– Provide accurate commercial invoices, packing lists, and certificates of origin.

Regulatory and Safety Standards

CV axle components must meet regional and industry-specific safety and quality standards.

– In North America: Comply with FMVSS (Federal Motor Vehicle Safety Standards) and EPA regulations.

– In the EU: Adhere to ECE Regulations and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) for material safety.

– ISO/TS 16949 or IATF 16949 certification is recommended for manufacturers to ensure quality management.

– Ensure materials (e.g., rubber, grease) are RoHS and ELV compliant where applicable.

Documentation and Traceability

Maintain comprehensive documentation for compliance, warranty claims, and recalls.

– Each batch should have a traceability code linking to manufacturing date, location, and materials.

– Retain shipping records, inspection reports, and compliance certificates for at least 5–7 years.

– Use ERP or inventory management systems to track parts from production to delivery.

Returns and Reverse Logistics

Establish clear procedures for handling defective or incorrect shipments.

– Define return authorization (RMA) processes for customers.

– Inspect returned parts for warranty validation and potential refurbishment or recycling.

– Ensure environmentally responsible disposal of non-repairable components, especially rubber and metal parts.

Environmental and Sustainability Considerations

- Recycle packaging materials (cardboard, plastic, metal) through certified programs.

- Source materials from suppliers with sustainable practices.

- Minimize transport emissions by optimizing shipping routes and consolidating orders.

Conclusion

Efficient logistics and strict compliance are vital for the successful distribution of CV axle joint parts. By following standardized packaging, transport, and regulatory practices, businesses can ensure product integrity, customer satisfaction, and adherence to global trade requirements. Regular audits and staff training further support continuous improvement in supply chain operations.

Conclusion for Sourcing CV Axle Joint Parts:

Sourcing CV axle joint parts requires a strategic approach that balances quality, cost, and reliability. After evaluating various suppliers, manufacturing standards, and market options, it is evident that selecting the right components is critical to ensuring vehicle performance, safety, and longevity. Prioritizing reputable suppliers who adhere to OEM specifications and international quality standards—such as ISO/TS 16949—helps mitigate the risks of premature failure and warranty claims. Additionally, considering factors such as material durability, production capabilities, and after-sales support enhances supply chain efficiency. In conclusion, a well-informed sourcing strategy that combines technical evaluation with supplier vetting ensures the procurement of high-quality CV axle joint parts, ultimately supporting optimal vehicle operation and customer satisfaction.