The global stainless steel fabrication market is experiencing robust expansion, driven by rising demand across industries such as construction, automotive, energy, and food processing. According to a report by Mordor Intelligence, the global stainless steel market was valued at USD 210.43 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.2% over the forecast period through 2029. Similarly, Grand View Research estimates that the stainless steel market size was valued at USD 190.7 billion in 2022 and is expected to expand at a CAGR of 6.1% from 2023 to 2030. This growth is fueled by increasing urbanization, infrastructure development, and the material’s superior corrosion resistance and recyclability. As demand for customized, high-precision fabricated stainless steel components rises, a select group of manufacturers have emerged as leaders in engineering capability, production scale, and global reach—setting the benchmark for quality and innovation in the industry.

Top 10 Custom Fabricated Stainless Steel Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Stainless Fabrication, Inc.

Domain Est. 1997 | Founded: 1985

Website: stainlessfab.com

Key Highlights: Custom Stainless Steel Tank, Vessel, & Equipment Fabricator. SFI has been building stainless steel tanks and equipment since 1985, working with our customers ……

#2 Pacific Stainless Products: Metal Fabrication

Domain Est. 1999

Website: pacificstainless.com

Key Highlights: Pacific Stainless Products is a world-class metal fabricator and manufacturer of high-quality metal products….

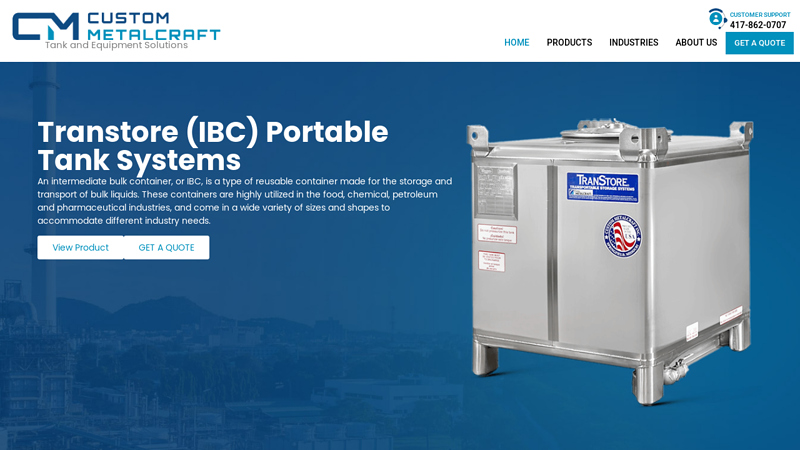

#3 Custom Metalcraft

Domain Est. 1997

Website: custom-metalcraft.com

Key Highlights: Custom Metalcraft delivers durable, hygienic stainless steel tanks & equipment across industries. Explore custom metal fabrication and request a quote today!…

#4 Custom Sheet Metal, Stainless Steel & Aluminum Fabrication

Domain Est. 1997

Website: nobleindustries.com

Key Highlights: Noble Industries is a leader in custom sheet metal, stainless steel and aluminum fabrication services, offering precision and quality….

#5 Custom Stainless

Domain Est. 1999

Website: customstainless.com

Key Highlights: Custom Stainless is a multidisciplinary design-build powerhouse focused on crafting the best custom stainless-steel equipment to fit your needs….

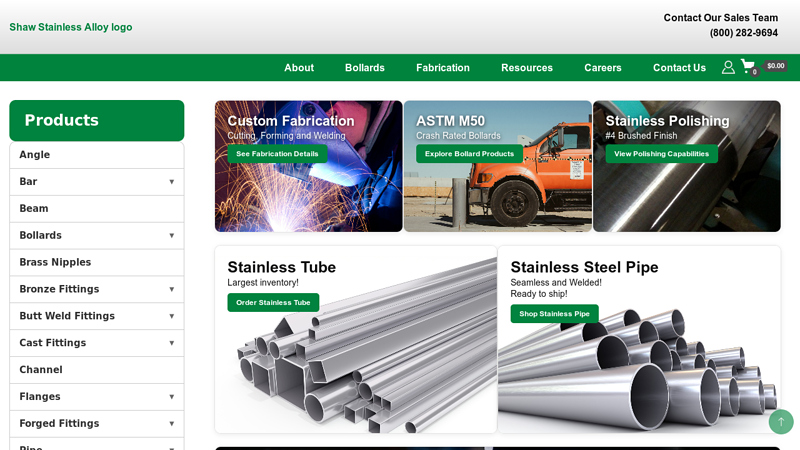

#6 Shaw Stainless, Steel Pipe & Tube Supplier

Domain Est. 1999 | Founded: 1979

Website: stainlessandalloy.com

Key Highlights: Shaw Stainless & Alloy: Leading supplier of 304/316 stainless steel pipe, tube, fittings, bollards & custom fabrication since 1979….

#7 Custom Stainless Steel Fabrication

Domain Est. 2000

Website: aeromfg.com

Key Highlights: Aero’s stainless steel custom fabrication department will collaborate with your architect, engineer or consultant to transform your custom ideas into reality….

#8 Stainless Steel Products & Custom Metal Fabrication

Domain Est. 2004

Website: awimfg.com

Key Highlights: AWI Manufacturing has been providing quality U.S.A.-made stainless steel products and custom manufacturing for food production businesses for over 50 years….

#9 Stainless Steel

Domain Est. 2009

#10 Titan Stainless

Domain Est. 2013

Website: titan-stainless.com

Key Highlights: We here at Titan are proud to be a part of the fast growing and changing stainless steel manufacturing process. We offer a line of standard catalog items to ……

Expert Sourcing Insights for Custom Fabricated Stainless Steel

H2: Market Trends in Custom Fabricated Stainless Steel for 2026

The global market for custom fabricated stainless steel is poised for significant transformation by 2026, driven by evolving industrial demands, technological advancements, sustainability imperatives, and shifting regional dynamics. This analysis examines the key trends shaping the sector under the H2 framework—highlighting Hydrogen Economy Integration and High-Precision Manufacturing as pivotal drivers.

H2.1: Hydrogen Economy Integration

One of the most influential macro-trends impacting the custom fabricated stainless steel market is the global push toward a hydrogen-based energy economy. As governments and industries commit to decarbonization, hydrogen production, storage, and transportation infrastructure are expanding rapidly—creating new demand for corrosion-resistant, high-integrity materials.

-

Demand Surge in Green Hydrogen Infrastructure: Electrolyzers, hydrogen refueling stations, and high-pressure storage tanks require custom-fabricated stainless steel components due to their resistance to hydrogen embrittlement and extreme operating conditions. Grades such as 316L and duplex stainless steels are increasingly specified for hydrogen service.

-

Investment in Hydrogen-Ready Facilities: Major energy and industrial players are retrofitting or building new plants compatible with hydrogen blending. Custom fabricators are adapting their designs to meet ASME B31.12 and ISO 19880 standards, ensuring compatibility with hydrogen environments.

-

Regional Policy Impacts: The European Union’s REPowerEU plan, the U.S. Inflation Reduction Act (IRA), and Japan’s Green Growth Strategy are accelerating investments in hydrogen. These policies are directly stimulating demand for custom stainless steel solutions in hydrogen value chains.

By 2026, it is projected that over 25% of new custom stainless steel fabrication orders in the energy sector will be tied to hydrogen infrastructure projects.

H2.2: High-Precision Manufacturing and Digitalization

Advancements in manufacturing technologies and digital integration are redefining the capabilities and competitiveness of custom stainless steel fabricators.

-

Adoption of Industry 4.0 Technologies: Fabricators are increasingly deploying IoT-enabled machinery, AI-driven design optimization, and digital twins to enhance precision, reduce waste, and improve lead times. This shift supports complex, low-volume, high-mix production typical of custom orders.

-

Laser Cutting and Additive Manufacturing: High-precision laser cutting, waterjet systems, and hybrid techniques (e.g., laser-hybrid welding) are enabling intricate geometries and tighter tolerances. Additionally, metal 3D printing is being used for prototyping and small-batch production of highly customized stainless steel components.

-

BIM and CAD Integration in Construction and Engineering: In sectors such as pharmaceuticals, food processing, and architecture, Building Information Modeling (BIM) and advanced CAD software allow seamless integration of custom stainless steel elements into larger systems, reducing errors and improving project timelines.

-

Supply Chain Resilience via Nearshoring: Geopolitical uncertainties and logistics disruptions are prompting clients to favor regional fabricators. By 2026, North America and Europe are expected to see increased local fabrication capacity, supported by automation to offset higher labor costs.

Conclusion

By 2026, the custom fabricated stainless steel market will be increasingly shaped by its alignment with the hydrogen economy and the adoption of high-precision digital manufacturing. Fabricators who invest in hydrogen-compatible materials expertise and embrace smart manufacturing technologies will gain a competitive edge. These H2-driven trends underscore a transition from traditional metalworking to a high-tech, sustainability-focused industry at the intersection of energy innovation and advanced engineering.

Common Pitfalls in Sourcing Custom Fabricated Stainless Steel (Quality, IP)

Sourcing custom fabricated stainless steel components involves navigating a complex landscape where quality and intellectual property (IP) risks can significantly impact project success, cost, and competitiveness. Failing to address these pitfalls can lead to compromised performance, legal disputes, and reputational damage.

Quality-Related Pitfalls

Inadequate Material Certification and Traceability

One of the most critical quality risks is accepting fabricated parts without proper material certification. Buyers may overlook the need for mill test reports (MTRs) or material test certificates (MTCs), allowing suppliers to use substandard or incorrect stainless steel grades (e.g., substituting 304 for 316). Without full traceability from raw material to final product, it becomes impossible to verify compliance with industry standards (e.g., ASTM, ASME), especially in regulated sectors like pharmaceuticals or food processing.

Poor Welding and Fabrication Standards

Custom fabrication often involves welding, bending, and machining processes that can compromise corrosion resistance and structural integrity if not properly controlled. Pitfalls include using unqualified welders, incorrect filler materials, inadequate heat treatment (e.g., post-weld annealing), or poor surface finishing. These issues may not be immediately visible but can lead to premature failure in service due to stress corrosion cracking or pitting.

Insufficient Quality Control and Inspection Protocols

Relying solely on visual inspection or supplier assurances without defined acceptance criteria is a common oversight. Buyers may fail to specify required testing—such as dye penetrant inspection (DPI), radiographic testing (RT), or hydrostatic testing—leading to undetected defects. Additionally, inconsistent inspection processes across batches or lack of third-party verification increases the risk of non-conforming parts entering production.

Inconsistent Surface Finishes and Passivation

Stainless steel’s corrosion resistance heavily depends on a properly formed passive oxide layer. Pitfalls arise when suppliers skip or inadequately perform passivation, or deliver inconsistent surface finishes (e.g., varying Ra values). This not only affects performance but can also violate hygiene or aesthetic requirements in industries like biotech or architecture.

Intellectual Property-Related Pitfalls

Lack of IP Protection Agreements

Sharing detailed designs, CAD files, or proprietary manufacturing specifications with suppliers without robust non-disclosure agreements (NDAs) or IP ownership clauses exposes companies to misappropriation. Suppliers may reverse-engineer designs, replicate parts for competitors, or claim partial ownership if not contractually prohibited.

Unsecured Design Files and Digital Data

Transmitting sensitive design data without encryption or access controls increases the risk of data breaches. Suppliers with weak cybersecurity practices may inadvertently expose design files to third parties. Furthermore, failing to retain digital rights or control over revisions can lead to unauthorized modifications or use beyond the agreed scope.

Absence of Clear IP Ownership Clauses in Contracts

Ambiguous contracts may allow suppliers to assert rights over tooling, jigs, or improvements made during fabrication. Without explicit language stating that all IP developed during the project belongs to the buyer, companies risk costly legal disputes or loss of exclusivity, particularly when investing in custom tooling or innovative processes.

Geopolitical and Jurisdictional IP Risks

Sourcing from regions with weak IP enforcement increases vulnerability to imitation and counterfeiting. Even with agreements in place, legal recourse may be limited or impractical abroad. Companies may unknowingly enable the creation of “gray market” versions of their products, undermining market position and brand integrity.

Avoiding these pitfalls requires thorough due diligence, clear contractual terms, rigorous quality audits, and proactive IP management throughout the sourcing lifecycle.

Logistics & Compliance Guide for Custom Fabricated Stainless Steel

Material Specifications and Documentation

Ensure all stainless steel materials used in fabrication meet recognized international standards such as ASTM, ASME, or ISO. Maintain detailed mill test certificates (MTCs), also known as material test reports (MTRs), for every batch of raw material. These documents must include chemical composition, mechanical properties, heat number, and compliance with specified grades (e.g., 304, 316, 316L). Accurate documentation is essential for traceability and regulatory compliance, especially in industries such as food processing, pharmaceuticals, and oil & gas.

Fabrication Standards and Quality Control

Custom stainless steel fabrication must adhere to industry-specific codes and standards, including AWS D1.6 (Structural Welding Code – Stainless Steel) and ASME B31.3 (Process Piping). Implement a documented quality control (QC) program that includes weld procedure specifications (WPS), welder qualification records (PQR), and non-destructive testing (NDT) such as X-ray, ultrasonic, or dye penetrant inspection where required. Final inspections should verify dimensional accuracy, surface finish, and passivation or pickling treatments.

Export Compliance and Regulatory Requirements

When shipping custom fabricated stainless steel internationally, verify compliance with export control regulations such as the U.S. Export Administration Regulations (EAR) or equivalent in your jurisdiction. Although most stainless steel components are not classified as controlled goods, certain high-performance alloys or end-use applications (e.g., defense, nuclear) may require export licenses. Classify products using the appropriate Harmonized System (HS) code—typically under 7326 (Other Articles of Iron or Steel)—and confirm country-specific import restrictions or certifications.

Packaging, Handling, and Transportation

Use protective packaging to prevent surface damage, corrosion, and contamination during transit. Common methods include plastic wrapping, VCI (Vapor Corrosion Inhibitor) paper, wooden crates for large assemblies, and desiccants in enclosed packaging. Label all packages with handling instructions (e.g., “Fragile,” “This Side Up”) and include traceability tags with project ID, heat number, and certification references. For heavy or oversized items, coordinate with freight carriers experienced in handling industrial metal fabrications and ensure compliance with transportation safety standards (e.g., IMDG for sea, ADR for road in Europe).

Certifications and Industry-Specific Compliance

Depending on the application, additional certifications may be required:

– Pressure Equipment Directive (PED) 2014/68/EU for products used in the European market.

– ASME U Stamp for pressure vessels.

– FDA Compliance (21 CFR) for components in food, beverage, or pharmaceutical contact.

– 3A Sanitary Standards for dairy and biopharma applications.

Provide certified documentation such as Declaration of Conformity (DoC), CE marking (if applicable), and third-party inspection reports from bodies like TÜV or Lloyd’s Register.

Environmental and Safety Regulations

Ensure fabrication processes comply with environmental regulations concerning emissions, waste disposal, and energy use. Adhere to OSHA or local workplace safety standards for welding fumes, noise, and machine guarding. For international shipments, comply with REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) in the EU, ensuring no restricted substances are present in coatings or treatments applied during fabrication.

Record Keeping and Traceability

Maintain a comprehensive record-keeping system for full traceability from raw material receipt through final shipment. Store digital and physical copies of MTRs, inspection reports, weld logs, NDT results, and shipping documents for a minimum of 10 years, or as required by industry standards. This ensures rapid response to audits, warranty claims, or field failures.

In conclusion, sourcing custom fabricated stainless steel requires a strategic approach that balances quality, cost, lead time, and supplier reliability. By clearly defining project specifications—including grade of stainless steel, dimensional accuracy, fabrication techniques (such as cutting, welding, and polishing), and finishing requirements—buyers can effectively communicate their needs to potential suppliers. Conducting thorough due diligence on fabricators, including assessments of their capabilities, certifications, quality control processes, and industry experience, is essential to ensure consistent and compliant results.

Additionally, considering factors such as geographic proximity, scalability, and capacity for prototyping can help mitigate risks related to logistics and production delays. Building strong, long-term relationships with trusted suppliers not only enhances supply chain stability but also supports continuous improvement and innovation in custom fabrication projects. Ultimately, a well-managed sourcing strategy for custom fabricated stainless steel contributes to the durability, performance, and cost-efficiency of the final product across industries such as food processing, pharmaceuticals, construction, and manufacturing.