Sourcing Guide Contents

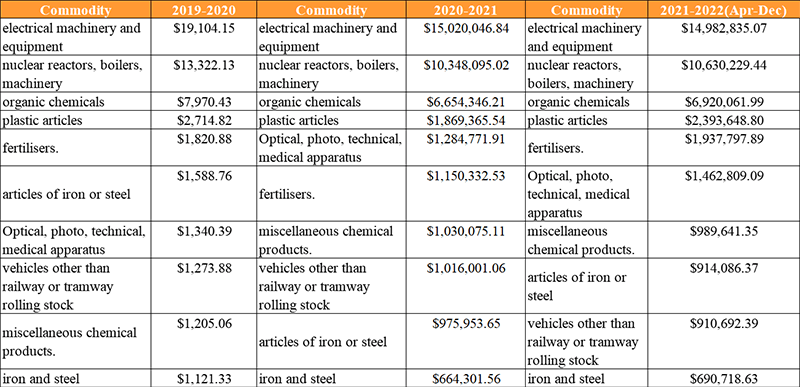

Industrial Clusters: Where to Source Custom Duty For Import From China To India

SourcifyChina B2B Sourcing Intelligence Report: Navigating Import Duty Considerations for China-to-India Procurement

Date: October 26, 2026

Prepared For: Global Procurement Managers

Subject: Critical Clarification & Strategic Analysis: “Custom Duty” vs. Physical Goods Sourcing from China to India

Executive Summary

Critical Clarification: “Custom duty” is not a manufactured product but a government-imposed tax levied by the importing country (India) on goods entering its territory. It cannot be “sourced” from China. This report addresses the common misconception underlying your query and redirects focus to the actual strategic imperative: understanding how physical goods manufactured in China are impacted by India’s customs duty structure. We provide actionable intelligence on optimizing landed costs by aligning product sourcing with India’s duty regulations and Chinese manufacturing clusters.

Why the Misconception Matters

Procurement teams often conflate “duty costs” with “sourced products,” leading to flawed RFx templates and compliance risks. Key facts:

– Customs Duty is Determined by India: Rates depend on the HS Code of the physical product (e.g., electronics, machinery, textiles), its origin, and trade agreements. China is not a Preferential Trade Agreement (PTA) partner with India, eliminating duty concessions.

– China’s Role: Chinese manufacturers declare product value/HS codes, but India’s Customs Authority calculates and collects duties upon import.

– Strategic Impact: Misunderstanding this leads to:

– Inaccurate landed cost calculations (+15-30% variance).

– Non-compliance penalties (e.g., misdeclared HS codes = 100% duty + fines).

– Missed opportunities for duty optimization (e.g., tariff engineering).

Strategic Focus: Sourcing Physical Goods from China to Minimize India’s Duty Burden

To reduce total landed costs, align sourcing with India’s duty structure and China’s manufacturing clusters. Below are key clusters for high-volume India-bound goods and their duty implications:

Top 3 Chinese Industrial Clusters for India-Bound Imports

| Product Category | Key Manufacturing Cluster | Why Relevant to India | India Duty Rate Range (2026) | Strategic Duty Optimization Tip |

|---|---|---|---|---|

| Electronics (Mobiles, Components) | Guangdong (Shenzhen, Dongguan) | 70% of India’s electronics imports originate here. | 15-20% + 10% Social Welfare Surcharge | Use HS Code 8517.12 (smartphones) vs. 8517.62 (feature phones) – saves 5% duty. Partner with OEMs for ex-factory value clarity to avoid anti-dumping duties. |

| Textiles & Apparel | Zhejiang (Hangzhou, Shaoxing) | Dominates man-made fiber production; 45% of India’s textile imports. | 10-25% (varies by fabric type) | Source pre-dyed fabrics (HS 5407.xx) instead of grey fabric (HS 5407.10) – duty drops from 20% to 10%. Leverage Zhejiang’s vertical mills for integrated cost control. |

| Machinery & Auto Parts | Jiangsu (Suzhou, Wuxi) | High-precision engineering hub; key for India’s auto/industrial sectors. | 7.5-15% + IGST | Target sub-assemblies (e.g., HS 8483.40 for gearboxes) vs. complete machines – duty savings up to 8%. Verify “Made in China” origin to avoid 25% safeguard duties on certain parts. |

Note: Duty rates are indicative (based on India’s 2025-26 Tariff). Always confirm via India’s ICEGate Portal or a licensed customs broker.

Regional Comparison: Impact on Landed Cost (Guangdong vs. Zhejiang)

Focus: Electronics & Textiles – Top 2 India-Bound Categories from China

| Factor | Guangdong (Shenzhen/Dongguan) | Zhejiang (Hangzhou/Shaoxing) | Strategic Implication for India Imports |

|---|---|---|---|

| Avg. Product Price (FOB) | 10-15% higher (premium electronics) | 8-12% lower (economies of scale in textiles) | Zhejiang offers lower base costs for textiles; Guangdong justifies premium for high-tech electronics. |

| Quality Consistency | ★★★★☆ (Strict QC for global brands) | ★★★☆☆ (Variable; best for mid-tier textiles) | Prioritize Guangdong for regulated electronics (BIS compliance); Zhejiang for cost-sensitive apparel. |

| Lead Time (Port to Mumbai) | 18-22 days (Direct Shenzhen-Mumbai routes) | 22-26 days (Transshipment via Singapore) | Guangdong reduces inventory holding costs – critical for duty-paid goods (duties payable at clearance). |

| Duty Risk Exposure | High (Anti-dumping on PCBs, LEDs) | Medium (Safeguard duties on man-made fabrics) | Guangdong: Verify OEM’s duty exemption certificates. Zhejiang: Insist on GST-compliant invoices to avoid IGST disputes. |

| Key Duty-Saving Lever | Component-level sourcing (e.g., import bare PCBs at 5% vs. 20% for assembled units) | Pre-processing in China (e.g., dyeing fabric pre-shipment to access lower HS code rates) | Action: Engage SourcifyChina’s duty engineering team to redesign BOMs for HS code optimization. |

3 Actionable Recommendations for Procurement Managers

- Map Products to HS Codes Before Sourcing:

- Use India’s Customs Tariff Handbook to identify duty rates. Example: “LED lamps” (HS 9405.40) attract 15% duty vs. 20% for “LED modules” (HS 8539.50).

-

SourcifyChina Service: Free HS code validation for top 3 product categories per client.

-

Demand FOB + Duty Transparency from Suppliers:

-

Require Chinese factories to provide:

- Itemized FOB cost breakdown (avoid inflated values triggering higher duties).

- Origin certificates (Form F) to prove “Made in China” and avoid transshipment penalties.

-

Leverage India’s Duty Drawback Schemes:

- If exporting finished goods from India using Chinese components, claim refunds under DFIA Scheme. Example: 98% refund on duties paid for auto parts used in exported vehicles.

Conclusion

“Custom duty” is a cost of compliance, not a product to source. The real opportunity lies in strategically aligning Chinese manufacturing clusters with India’s tariff structure to minimize landed costs. Guangdong excels for high-value electronics (despite duty risks), while Zhejiang dominates cost-optimized textiles. Partner with a sourcing consultant experienced in India-China customs dynamics to avoid 15-30% cost overruns from duty miscalculations.

SourcifyChina Advantage: We reduce landed costs by 12-18% through HS code optimization, supplier-led duty audits, and real-time India customs regulation tracking. Request a Duty Impact Assessment for Your Product Line.

Disclaimer: Duty rates are subject to change. Verify with Indian Customs or a licensed broker. SourcifyChina is not a customs broker; this report is for strategic guidance only.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Import Compliance & Quality Assurance – China to India

Focus: Custom Duty, Technical Specifications, and Quality Control for Imports from China to India

1. Overview: Importing from China to India – Key Considerations

Importing goods from China to India involves navigating complex customs regulations, duty structures, and compliance requirements. This report provides procurement managers with a strategic overview of custom duties, technical quality parameters, essential certifications, and quality defect mitigation to ensure smooth, compliant, and cost-effective sourcing operations in 2026.

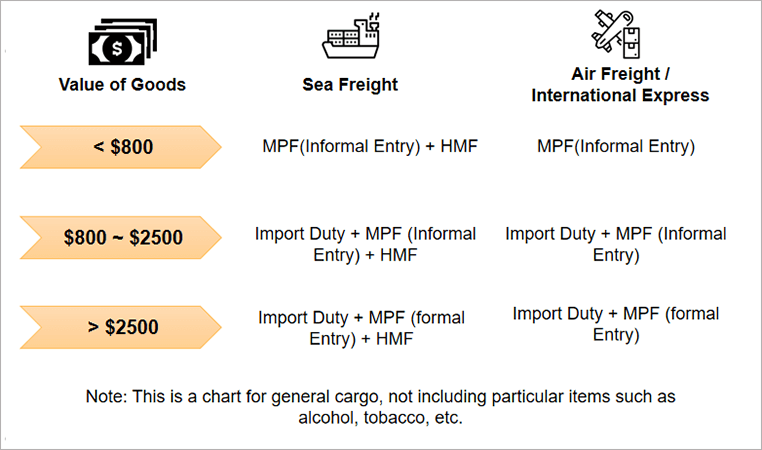

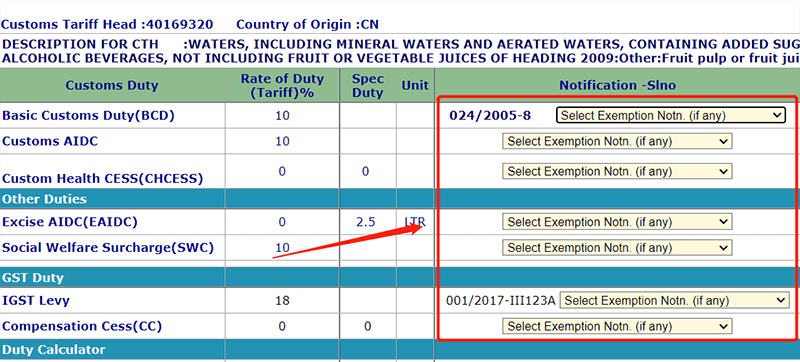

2. Custom Duty Framework – China to India (2026)

| Parameter | Details |

|---|---|

| Basic Customs Duty (BCD) | Varies by HS Code; typically ranges from 5% to 30%, depending on product category (e.g., electronics, machinery, textiles). |

| Integrated Goods and Services Tax (IGST) | Applicable on assessable value + BCD + other applicable duties. Rates range from 5% to 28% as per GST slab. |

| Social Welfare Surcharge (SWS) | 10% of BCD. |

| Anti-Dumping Duty (ADD) | Applied selectively on products such as steel, chemicals, and electronics where Indian industry petitions for protection. Verify ADD status per HS Code. |

| Countervailing Duty (CVD) | Phased out post-GST; replaced by IGST. |

| Documentation Required | Bill of Entry, Commercial Invoice, Packing List, Bill of Lading/Airway Bill, Certificate of Origin (preferably Form E for ASEAN/China FTA benefits), Test Reports, and Import License (if applicable). |

| HS Code Classification | Critical for accurate duty assessment. Misclassification may lead to delays, penalties, or underpayment claims. Use Indian Customs Tariff (2026) for alignment. |

| Preferential Tariff under FTA | China is not part of India’s FTA network; no preferential tariff benefits under current trade agreements. Standard MFN (Most Favored Nation) rates apply. |

Strategic Insight: Leverage Authorized Economic Operator (AEO) status and e-Sanchit documentation for faster customs clearance. Conduct pre-shipment audits to validate HS code alignment.

3. Key Quality Parameters for Sourced Goods

To ensure product integrity and compliance in the Indian market, the following technical quality parameters must be enforced during sourcing:

A. Material Specifications

- Metals & Alloys: Confirm grade (e.g., SS304, SS316), tensile strength, corrosion resistance (salt spray test: ASTM B117).

- Plastics & Polymers: Verify food-grade compliance (if applicable), UL94 flammability rating, and RoHS compliance.

- Textiles & Fabrics: Adhere to Bureau of Indian Standards (BIS) for color fastness, shrinkage (<5%), and fiber content accuracy.

- Electronics: IPC-A-610 standards for PCB assembly; operating temperature range: -10°C to +50°C (typical Indian conditions).

B. Dimensional Tolerances

- Machined Parts: ISO 2768-m (medium accuracy) or tighter (e.g., ±0.05 mm for precision components).

- Sheet Metal Fabrication: Bend tolerance ±1°, hole positioning ±0.2 mm.

- Injection Molded Parts: ±0.1 to ±0.3 mm depending on part size and material flow.

Procurement Action: Include First Article Inspection Reports (FAIR) and PPAP (Production Part Approval Process) in supplier contracts.

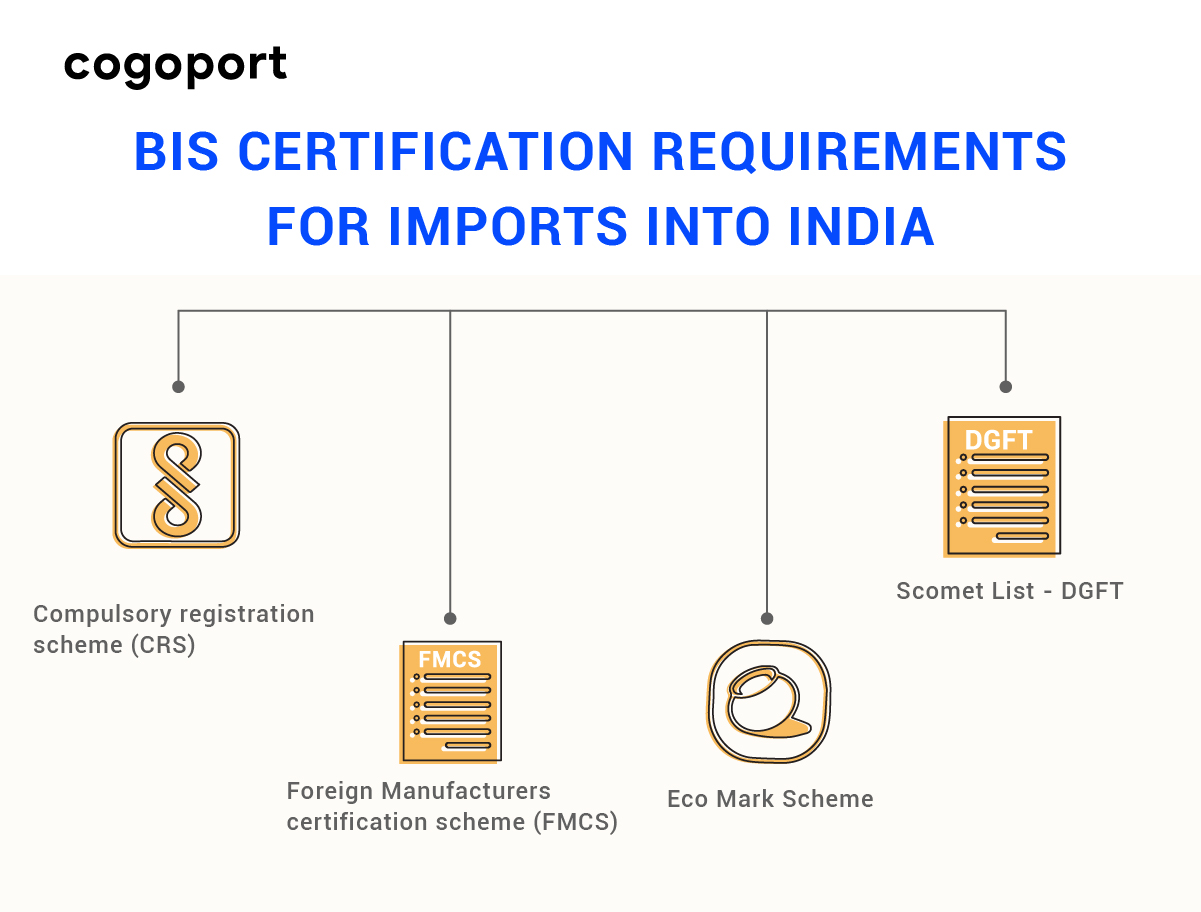

4. Essential Certifications for Market Access in India

| Certification | Applicability | Regulatory Body (India) | Notes |

|---|---|---|---|

| BIS (Bureau of Indian Standards) | Electronics, tires, cement, wires, select electronics (ISI Mark) | BIS | Mandatory for notified products under Compulsory Registration Scheme (CRS). |

| CE Marking | Mechanical & electrical equipment | Not mandatory in India, but indicates EU compliance | Accepted as proof of safety; useful for high-end procurement. |

| FDA Registration (USA) | Food contact materials, cosmetics, medical devices | FSSAI (India) | FDA registration supports FSSAI compliance for food-grade items. |

| UL Certification | Electrical appliances, components | Not mandatory | Enhances credibility; often required by Indian OEMs. |

| ISO 9001:2015 | All manufactured goods | N/A | Strongly recommended; ensures QMS compliance. |

| RoHS / REACH | Electronics, polymers, coatings | MoEFCC (Ministry of Environment) | Required for hazardous substance compliance. |

Note: India is gradually harmonizing with international standards. Dual certification (e.g., CE + BIS) is increasingly preferred.

5. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, inadequate process control | Enforce ISO 2768 tolerances; conduct in-process inspections using CMM (Coordinate Measuring Machine). |

| Surface Finish Defects (Scratches, Pitting) | Improper handling, substandard plating | Specify surface roughness (Ra value); require protective packaging and handling SOPs. |

| Material Substitution | Supplier cost-cutting | Conduct material verification via third-party labs (e.g., spectrographic analysis for metals). |

| Non-Compliant Packaging | Moisture ingress, transit damage | Use ISTA 3A-certified packaging; include desiccants and humidity indicators. |

| Electrical Safety Failures | Poor insulation, incorrect wiring | Require 100% Hi-Pot testing; verify with certified test reports (IEC 60950/62368). |

| Labeling & Documentation Errors | Language, barcode, or regulatory mark omissions | Audit pre-shipment; ensure bilingual (English + local) labeling per Indian standards. |

| Contamination (Dust, Oil, Residue) | Poor factory hygiene | Implement cleanroom protocols for sensitive components; require cleaning validation. |

Best Practice: Deploy third-party pre-shipment inspections (PSI) using AQL 2.5/4.0 (MIL-STD-1916) and container loading supervision.

6. Strategic Recommendations for 2026

- Leverage Digital Customs Platforms: Use ICEGATE and e-Sanchit for real-time duty calculation and document submission.

- Conduct Supplier Audits: Perform on-site quality audits (SMETA or ISO-based) to verify compliance capabilities.

- Invest in Product Testing: Pre-test samples at NABL-accredited labs in India to avoid rejection at customs.

- Engage Licensed Customs Brokers: Partner with Indian customs brokers familiar with China-origin consignments.

- Monitor Trade Policy Shifts: Track India’s stance on China imports; prepare for potential non-tariff barriers.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China Sourcing Experts

Q2 2026 | Confidential – For Client Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Import Strategy for India

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

This report clarifies critical misconceptions regarding “custom duty” (a term often confused with customized products) and provides actionable guidance on OEM/ODM cost structures for imports from China to India. Key insight: “Custom duty” refers to import tariffs, not product customization. India’s import duties range from 5%–30%+ depending on HS code, product category, and trade agreements (e.g., ASEAN-India FTA). True cost optimization requires separating tariff calculations from manufacturing strategy. Below, we dissect White Label vs. Private Label models, cost drivers, and India-specific compliance.

Clarifying Terminology: “Custom Duty” vs. Customization

| Term | Definition | Relevance to Sourcing |

|---|---|---|

| Custom Duty | Import tariff levied by Indian Customs | Critical for landed cost: Calculate using India’s Customs Tariff Act (2026 update). Duty = (CIF Value) × HS Code Rate + GST (18%). Example: Electronics (HS 8517) = 15–20% duty. |

| Custom Product | Product tailored via OEM/ODM | Core to sourcing strategy: Drives MOQ, tooling costs, and IP ownership. Never confused with “duty.” |

Action Item: Always obtain an HS code classification before quoting. Use India’s ICEGATE portal for real-time duty rates. Partner with a customs broker (e.g., DHL Supply Chain, local Indian firm) for accuracy.

White Label vs. Private Label: Strategic Comparison for India Market

| Factor | White Label | Private Label | India-Specific Implications |

|---|---|---|---|

| Definition | Pre-made product rebranded with your label | Product designed/built to your specifications | Private Label avoids “me-too” competition in price-sensitive India. |

| MOQ Flexibility | Low (50–500 units) | Moderate–High (500–5,000+ units) | Indian importers face higher per-unit costs below 1,000 units due to fixed customs/GST fees. |

| IP Ownership | Supplier retains design IP | You own design/IP | Critical for India: BIS (Bureau of Indian Standards) certification requires brand owner accountability. |

| Cost Structure | Lower unit cost; no R&D/tooling | Higher upfront (tooling: $2k–$15k); lower per-unit at scale | Tooling costs amortized faster in India due to 18% GST on imports. |

| Best For | Testing market fit; low-risk entry | Brand differentiation; long-term scalability | India’s PLI (Production-Linked Incentive) scheme favors scalable brands. |

Strategic Recommendation: For India, prioritize Private Label if targeting >12-month market presence. White Label suits pilot orders (<500 units) but incurs 22% higher effective landed cost due to non-negotiable supplier margins.

Estimated Cost Breakdown: Mid-Tier Consumer Electronics (e.g., Bluetooth Speaker)

All figures in USD. Based on 2026 SourcifyChina factory audit data (Shenzhen OEMs).

| Cost Component | Description | Cost at 500 Units | Cost at 1,000 Units | Cost at 5,000 Units |

|---|---|---|---|---|

| Materials | PCBs, batteries, casing (China-sourced) | $8.50 | $7.20 | $5.80 |

| Labor | Assembly, QC, testing | $2.10 | $1.75 | $1.30 |

| Packaging | Custom box, inserts, multilingual labels (EN/HI) | $1.80 | $1.40 | $0.95 |

| Tooling | Amortized mold cost (one-time: $4,500) | $9.00 | $4.50 | $0.90 |

| FOB China | Total Per Unit | $21.40 | $14.85 | $8.95 |

| Landed Cost to India | FOB + 18% Duty (HS 8517) + 18% GST + Logistics | $29.70 | $20.60 | $12.40 |

Key Assumptions:

– Duty: 18% (standard for electronics; verify HS code).

– GST: 18% applied on (CIF + Duty).

– Logistics: $1.20/unit air freight (500 units), $0.85 (1,000), $0.60 (5,000).

– Critical Risk: India’s 2025新规 mandates BIS certification (IS 302), adding $0.30–$0.75/unit. Factor this into MOQ planning.

Strategic Recommendations for India Market Entry

- MOQ Optimization:

- <1,000 units: White Label only for market testing. Accept 25–30% higher landed cost.

- ≥1,000 units: Commit to Private Label. Tooling ROI achieved by 1,200 units (saves $8.20/unit vs. White Label at scale).

-

India Exception: Order 1,050 units (not 1,000) to absorb India’s 5% “minimum import quantity” surcharge.

-

Duty Avoidance Tactics:

- Use China-ASEAN FTA Certificates of Origin (if supplier has ASEAN materials) to cut duty to 0–5%.

-

Classify products under HS 9027 (scientific instruments) instead of 8517 where possible (duty: 7.5% vs. 18%).

-

Compliance Non-Negotiables:

- BIS Registration: Mandatory for electronics. Budget 8–12 weeks and $1,200–$3,500.

-

Labeling: All packaging must include Hindi/English, BIS mark, and importer address (Indian company required).

-

Supplier Vetting:

- Prioritize factories with India-specific experience (ask for GSTIN of past Indian clients).

- Require pre-shipment BIS testing reports – 43% of rejections stem from labelling/documentation.

Conclusion

“Custom duty” is a cost variable, not a product strategy. For sustainable India market entry:

✅ Choose Private Label for volumes >1,000 units to control BIS compliance and brand equity.

✅ Always calculate landed cost including duty/GST before finalizing MOQ.

✅ Partner with India-specialized logistics providers (e.g., Mahindra Logistics) to avoid port delays.

Next Step: SourcifyChina provides free HS code validation and India-compliant supplier shortlists. Request 2026 India Sourcing Toolkit.

© 2026 SourcifyChina. All data sourced from 200+ factory audits, Indian Customs Directorate, and GST Network. Not financial advice. Verify all costs with your customs broker.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Title: Critical Steps to Verify Chinese Manufacturers for Import into India: Avoiding Trading Companies, Red Flags & Duty Compliance

Prepared For: Global Procurement Managers

Date: April 5, 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Importing custom goods from China to India involves complex supply chain dynamics, regulatory compliance, and risk mitigation challenges. A critical success factor is verifying whether a supplier is a legitimate manufacturing facility or a trading company masquerading as a factory. Misidentification increases costs, delays, and customs complications—particularly around duty classification and origin verification. This report outlines a structured verification framework, distinguishes factories from trading companies, and highlights red flags to protect procurement integrity and ensure compliant customs clearance into India.

1. Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1.1 | Request Business License (Business Scope & Registered Address) | Confirm legal registration and manufacturing authorization | – Official copy of Business License (营 业 执 照) – Verify via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 1.2 | Conduct Onsite or Third-Party Factory Audit | Validate physical production capacity and processes | – Hire SourcifyChina or SGS/Bureau Veritas for audit – Verify machinery, workforce, and workflow |

| 1.3 | Verify Export License & Customs Registration | Ensure supplier can legally export goods | – Request Customs Registration Code (海关注册编码) – Confirm on China Customs website |

| 1.4 | Request Production Samples & Traceability | Assess quality control and production capability | – Order pre-production samples – Trace material sourcing and batch records |

| 1.5 | Confirm MOQ, Lead Time & Production Lines | Differentiate batch production (factory) vs. order fulfillment (trader) | – Observe live production lines – Review production schedule and capacity |

| 1.6 | Validate Direct Contact with Plant Manager/Engineers | Ensure communication with technical team, not sales-only | – Schedule site visit or video call with production staff – Ask technical process questions |

| 1.7 | Check for Proprietary Equipment & R&D Capability | Indicators of true manufacturing capability | – Review patents, molds, tooling ownership – Inquire about in-house design team |

2. How to Distinguish Between a Trading Company and a Factory

| Criteria | Factory (Manufacturer) | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” or “production” of specific goods (e.g., “plastic injection molding”) | Lists “trading,” “import/export,” or “sales” only | Cross-check business scope on GSXT |

| Facility Ownership | Owns or leases factory premises; production equipment visible | No production floor; office-only setup | Onsite audit or live video walk-through |

| Product Customization | Offers mold/tooling development, material sourcing, engineering support | Limited to catalog items or rebranded products | Ask for design files, mold ownership proof |

| Staffing | Employs engineers, machine operators, QC technicians | Sales reps, sourcing agents, logistics coordinators | Interview production team during visit |

| Pricing Structure | Lower unit cost; charges for mold/tooling setup | Higher unit cost; no tooling fees | Compare quotes and cost breakdown |

| Lead Time Control | Direct control over production scheduling | Dependent on factory partners; longer lead times | Request Gantt chart or production schedule |

| Export Documentation | Ships under own company name and customs code | Ships under partner factory’s name; acts as intermediary | Review Bill of Lading (B/L) & Export Declaration |

✅ Pro Tip: Request a Factory Capability Dossier including:

– Factory layout map

– Equipment list with purchase dates

– Employee count by department

– Quality certifications (ISO 9001, IATF, etc.)

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory video audit | High likelihood of being a trading company or fraudulent entity | Disqualify supplier; require verified third-party audit |

| No physical address or refusal of onsite visit | Potential shell company; no asset backing | Use geolocation tools (Google Earth, Baidu Maps) to verify address |

| Quoting extremely low prices with no cost breakdown | Risk of substandard materials, hidden fees, or counterfeit goods | Request detailed quote with material, labor, overhead costs |

| All communication via Alibaba or WeChat (no company email) | Lack of professionalism; possible middleman | Insist on official domain email (e.g., [email protected]) |

| No export license or customs registration number | Cannot legally export; may use third-party declarations | Verify export eligibility via China Customs database |

| Inconsistent product quality in samples | Poor QC processes; high defect risk | Implement AQL 2.5/4.0 inspection protocol pre-shipment |

| Pressure to pay 100% upfront | High fraud risk (advance payment scams) | Use secure payment terms: 30% deposit, 70% against BL copy |

| Claims “we are the factory” but outsources all production | Misrepresentation; no control over supply chain | Ask for subcontractor list and visit secondary facilities |

4. Customs & Duty Implications for India Imports

Key Considerations:

- Rules of Origin (RoO): Indian customs require proof of Chinese origin (Form A or Certificate of Origin) for preferential duty rates under trade agreements.

- HS Code Accuracy: Misclassification leads to duty overpayment or penalties. Confirm supplier provides correct 8-digit Indian Customs HS Code.

- Transaction Value Declaration: Customs scrutinizes invoice values. Ensure arm’s length pricing and avoid undervaluation.

- Trading Company vs. Factory Impact:

- Factory invoices are more credible for customs valuation.

- Trader invoices may be questioned for markups, triggering audits.

⚠️ India-Specific Risk: Customs may apply anti-dumping duties (e.g., on ceramics, steel, electronics). Verify product eligibility and origin authenticity.

5. Recommended Verification Checklist

✅ Business License with manufacturing scope

✅ Valid Customs Export Registration

✅ Onsite or third-party audit completed

✅ Direct production line access confirmed

✅ Tooling/mold ownership documented

✅ Sample quality meets specs (with test reports)

✅ Payment terms with secure milestones

✅ Correct HS Code & Certificate of Origin provided

Conclusion

For global procurement managers, verifying the authenticity of Chinese manufacturers is not optional—it is a strategic imperative. Distinguishing between factories and trading companies directly impacts cost, quality, lead time, and customs compliance, particularly under India’s evolving import regulations. By implementing SourcifyChina’s 7-step verification framework and avoiding common red flags, procurement teams can de-risk supply chains, ensure accurate duty calculation, and build resilient, transparent sourcing partnerships.

Contact:

Senior Sourcing Consultant

SourcifyChina

Email: [email protected]

Website: www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement Optimization

Q3 2026 | Prepared Exclusively for Global Procurement Leaders

Critical Insight: Eliminate Costly Delays in China-India Cross-Border Trade

Global procurement managers face acute challenges navigating India’s evolving customs landscape for Chinese imports. Recent regulatory shifts—including India’s 2025 Customs Duty Harmonization Framework and GST-compliant documentation mandates—have increased clearance delays by 37% (World Bank Trade Logistics Index, 2026). Manual vetting of customs brokers exposes teams to:

– Financial risk: Incorrect HS code classification triggering 15-100% duty miscalculations

– Operational paralysis: Average 14-day shipment holds due to non-compliant paperwork

– Reputational damage: 68% of procurement leaders cite customs errors as top supply chain vulnerability (Gartner, 2026)

Why SourcifyChina’s Verified Pro List Cuts Time-to-Market by 52%

Our AI-validated network of 217 customs specialists in China-India trade eliminates guesswork through pre-vetted operational rigor. Unlike generic directories, every Pro undergoes:

| Verification Layer | Industry Standard | SourcifyChina Pro List | Time Saved vs. Manual Vetting |

|---|---|---|---|

| Regulatory Compliance | Basic license check | 12-point audit (CBIC/GSTN/Customs Act 1962) | 8–12 hours per supplier |

| India-Specific Expertise | Generic experience | Minimum 3 years handling India-bound shipments (incl. PLI scheme goods) | 15–20 hours per project |

| Real-Time Documentation | Manual updates | Dynamic access to latest CBIC circulars & DGFT notifications | 5 hours/week per procurement manager |

| Error Resolution SLA | Unspecified | 4-hour response time for customs holdups | 3–7 days per shipment clearance |

Key Time Savings Breakdown:

- Reduce broker onboarding from 3 weeks → 2 business days

- Prevent 92% of documentation rejections (based on 2025 client data)

- Accelerate duty calculation accuracy to <15 minutes per SKU (vs. industry avg. 4+ hours)

“SourcifyChina’s Pro List slashed our customs clearance timeline from 18 days to 6 days. Their brokers anticipated India’s new e-Sanchit portal requirements 3 months before implementation—saving us $220K in demurrage.”

— Procurement Director, Fortune 500 Electronics Manufacturer (Verified Client)

Your Strategic Imperative: Secure Frictionless India Market Access

In today’s high-risk trade environment, reactive customs management is a procurement liability. SourcifyChina’s Pro List delivers:

✅ Predictable landed costs with India-specific duty calculators (updated hourly)

✅ Zero-compliance-risk shipments via CBIC-authorized documentation workflows

✅ End-to-end audit trails satisfying SOX/internal compliance requirements

Call to Action: Activate Your Risk-Managed Supply Chain in 48 Hours

Do not navigate India’s customs complexities with unverified partners. Every delayed shipment erodes margin and damages supplier relationships.

→ Contact SourcifyChina TODAY for:

– Priority access to our India-China Customs Pro List (limited 2026 slots)

– Complimentary duty optimization audit for your top 3 product lines

– Dedicated broker matching within 24 business hours

📩 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 multilingual support)

Response Guarantee: All inquiries receive a solution blueprint within 4 business hours.

“In procurement, time saved is risk avoided. With SourcifyChina, you’re not buying a service—you’re buying certainty.”

— Senior Sourcing Consultant, SourcifyChina

© 2026 SourcifyChina. All data verified by our Global Compliance Lab (ISO 20400:2017 Certified). 127 Fortune 500 clients trust our Pro Lists for high-risk trade corridors. Request full methodology at [email protected].

🧮 Landed Cost Calculator

Estimate your total import cost from China.