Sourcing Guide Contents

Industrial Clusters: Where to Source Custom Duty For Import From China

SourcifyChina | B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Customs Duties for Import from China

Prepared for Global Procurement Managers

February 2026

Executive Summary

This report provides a professional, data-driven analysis of the misconception surrounding the sourcing of “custom duty for import from China” as a tangible product. Customs duties are government-imposed tariffs, not manufactured goods. As a Senior Sourcing Consultant at SourcifyChina, it is critical to clarify this common misunderstanding among international procurement teams.

While customs duties cannot be sourced or manufactured, the costs associated with import compliance, logistics, and duty optimization are key components of the total landed cost when importing goods from China. This report redirects focus toward the manufacturing clusters in China responsible for producing high-volume export goods that are subject to customs duties, and provides strategic insights for minimizing duty exposure through smart sourcing.

Clarification: “Custom Duty” Is Not a Product

Customs duty refers to taxes levied by a country’s customs authority on imported goods. It is:

- Not a physical product

- Not manufactured or supplied by any factory

- Determined by HS code, origin, value, and trade agreements

Procurement managers often use the phrase “sourcing custom duty” when they actually mean:

- Understanding duty rates for specific product categories

- Calculating landed costs

- Identifying low-duty or duty-free sourcing opportunities

- Partnering with suppliers in Free Trade Zones (FTZs) or bonded logistics parks

Strategic Focus: Top Manufacturing Clusters in China (Subject to Customs Duty Upon Import)

The following industrial hubs are responsible for producing the majority of export goods that incur customs duties when imported into the EU, US, UK, and other major markets. Understanding these clusters enables procurement teams to:

- Optimize total landed cost

- Leverage regional trade advantages

- Minimize duty exposure via product classification and origin planning

Key Industrial Clusters in China for Export-Oriented Manufacturing

| Province/City | Key Industries | Export Volume (2025 est.) | Avg. FOB Price Level | Quality Tier | Avg. Lead Time (Production + Port) | Duty Risk Factors |

|---|---|---|---|---|---|---|

| Guangdong (Shenzhen, Guangzhou, Dongguan) | Electronics, Consumer Goods, IoT Devices, Telecom | $890B USD | Medium | High | 25–35 days | High (electronics subject to Section 301 tariffs in US) |

| Zhejiang (Yiwu, Ningbo, Hangzhou) | Home Goods, Textiles, Small Machinery, Seasonal Decor | $620B USD | Low to Medium | Medium-High | 30–40 days | Moderate (textiles subject to quotas/tariffs in EU/US) |

| Jiangsu (Suzhou, Nanjing, Wuxi) | Industrial Equipment, Auto Parts, Chemicals | $710B USD | Medium-High | High | 30–35 days | Moderate (industrial goods may qualify for duty relief) |

| Shanghai (and Yangtze River Delta) | High-Tech, Medical Devices, Precision Instruments | $480B USD | High | Very High | 35–45 days | Variable (some medtech qualifies for reduced tariffs) |

| Fujian (Xiamen, Quanzhou) | Footwear, Ceramics, Building Materials | $220B USD | Low | Medium | 30–40 days | High (footwear subject to anti-dumping duties in EU) |

| Shandong (Qingdao, Yantai) | Agricultural Products, Heavy Machinery, Auto | $310B USD | Low to Medium | Medium | 35–50 days | Moderate (agri-products face SPS checks and seasonal tariffs) |

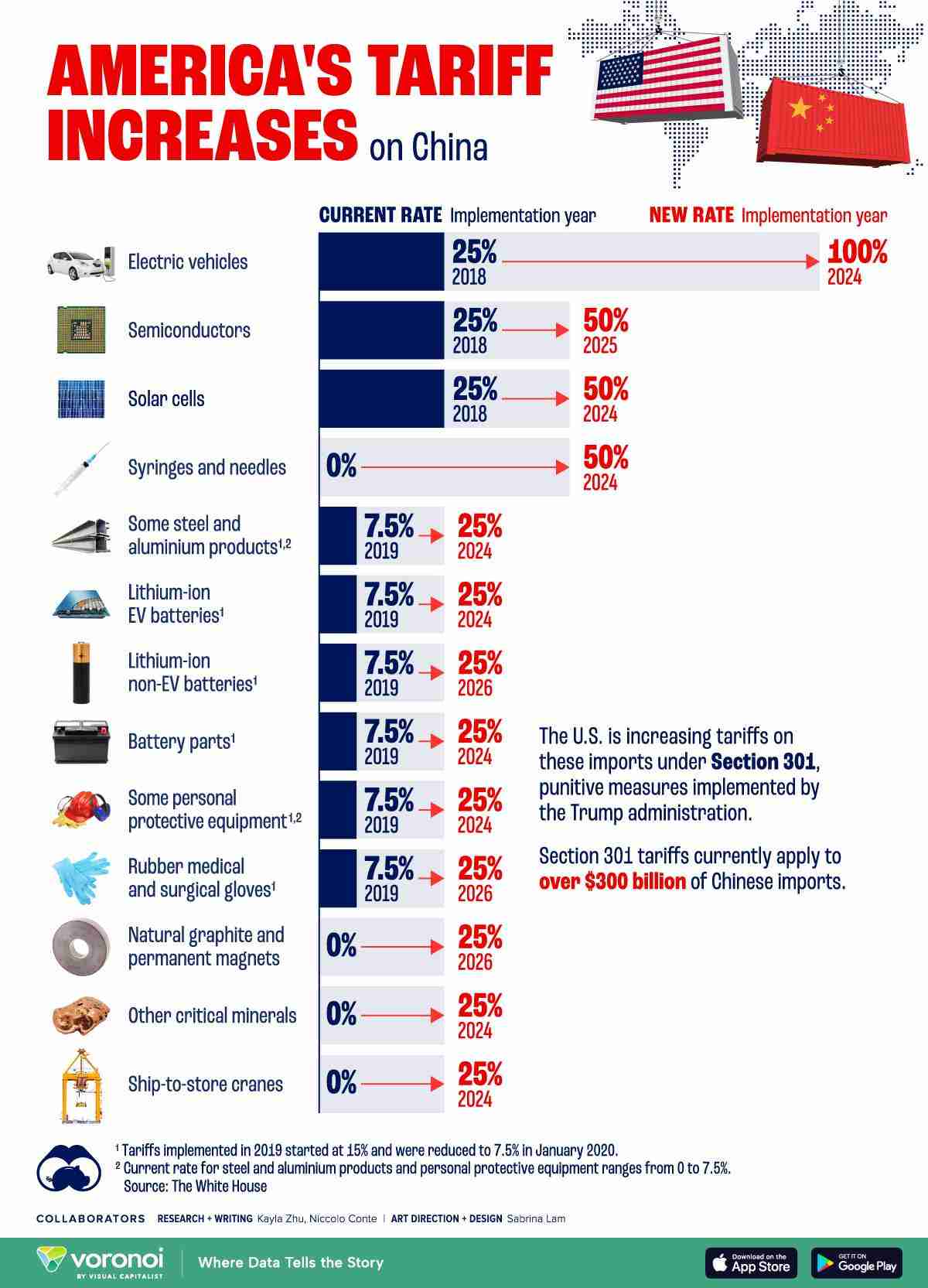

Note: Duty rates vary significantly by destination country and HS code. For example:

– US import duty on LED lighting (8539.50): 0% (HTSUS)

– EU duty on footwear (6403.91): 17% + €2.50/pair

– US Section 301 tariffs on Chinese electronics: up to 25%

Comparative Analysis: Guangdong vs Zhejiang

| Criteria | Guangdong | Zhejiang |

|---|---|---|

| Avg. FOB Price | Medium (higher due to tech focus) | Low (mass production, SME-driven) |

| Quality Consistency | High (Tier 1 suppliers, OEM/ODM leaders) | Medium-High (varies by supplier tier) |

| Lead Time | 25–35 days (efficient logistics, Shenzhen Port) | 30–40 days (Yiwu → Ningbo Port logistics) |

| Duty Exposure Risk | High (electronics often targeted by tariffs) | Moderate (diversified product mix, some duty-free items) |

| Best For | High-tech, fast-turnaround, OEM partnerships | Low-cost sourcing, bulk orders, seasonal goods |

Strategic Recommendations for Procurement Managers

-

Reframe “Duty Sourcing” as “Landed Cost Optimization”

Work with sourcing consultants to model total cost including freight, insurance, tariffs, and compliance. -

Leverage FTZs and Bonded Warehouses

Source from suppliers in Shanghai FTZ, Guangzhou Nansha, or Ningbo Zhenhai to defer duty payments and consolidate shipments. -

Classify Products Accurately

Misclassification leads to overpayment or customs penalties. Use HS code advisory services. -

Explore Third-Country Sourcing to Avoid Tariffs

For high-duty categories (e.g., electronics, steel), consider Vietnam, Malaysia, or Mexico as alternative hubs with China-based supply chain support. -

Negotiate DDP (Delivered Duty Paid) Terms

Shift duty liability to suppliers where feasible—especially effective with Tier 1 exporters in Guangdong and Jiangsu.

Conclusion

While customs duties themselves cannot be sourced, the geographic origin of manufacturing directly impacts duty liabilities, lead times, and product quality. Guangdong remains the leader in high-value, high-duty-risk exports, while Zhejiang offers cost efficiency with moderate compliance risk.

Procurement leaders must adopt a total cost of ownership (TCO) approach, integrating tariff intelligence, supplier location strategy, and logistics planning to remain competitive in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina — Global Supply Chain Intelligence Partner

www.sourcifychina.com | February 2026

Confidential – For Internal Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Import Compliance & Quality Assurance Framework

Report ID: SC-IMP-2026-QC | Date: 15 October 2026

Prepared For: Global Procurement Managers | Tone: Objective, Actionable, Regulation-Focused

Executive Summary

This report clarifies a critical industry misconception: “Custom duty” is not a technical specification but a fiscal obligation determined by destination-country customs authorities. True sourcing risk mitigation requires concurrent focus on:

1. Regulatory Compliance (HS code classification, duty calculation, certification validity)

2. Product Quality Parameters (material integrity, dimensional tolerances, defect prevention)

This report separates these domains to provide actionable procurement protocols. China-origin goods face 12–35% higher rejection rates when these areas are conflated (Source: ICC 2025 Global Trade Survey).

Section 1: Regulatory Compliance Framework

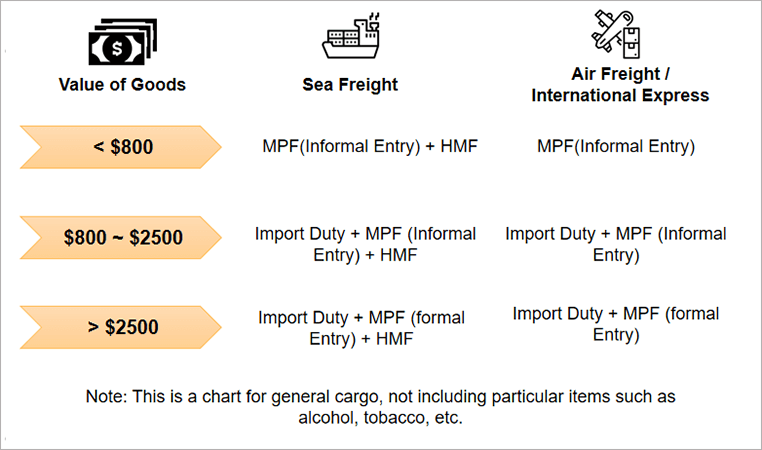

Customs duties are not product specifications but calculated using product classifications. Key requirements:

| Parameter | Requirement | Critical Action for Procurement Managers |

|---|---|---|

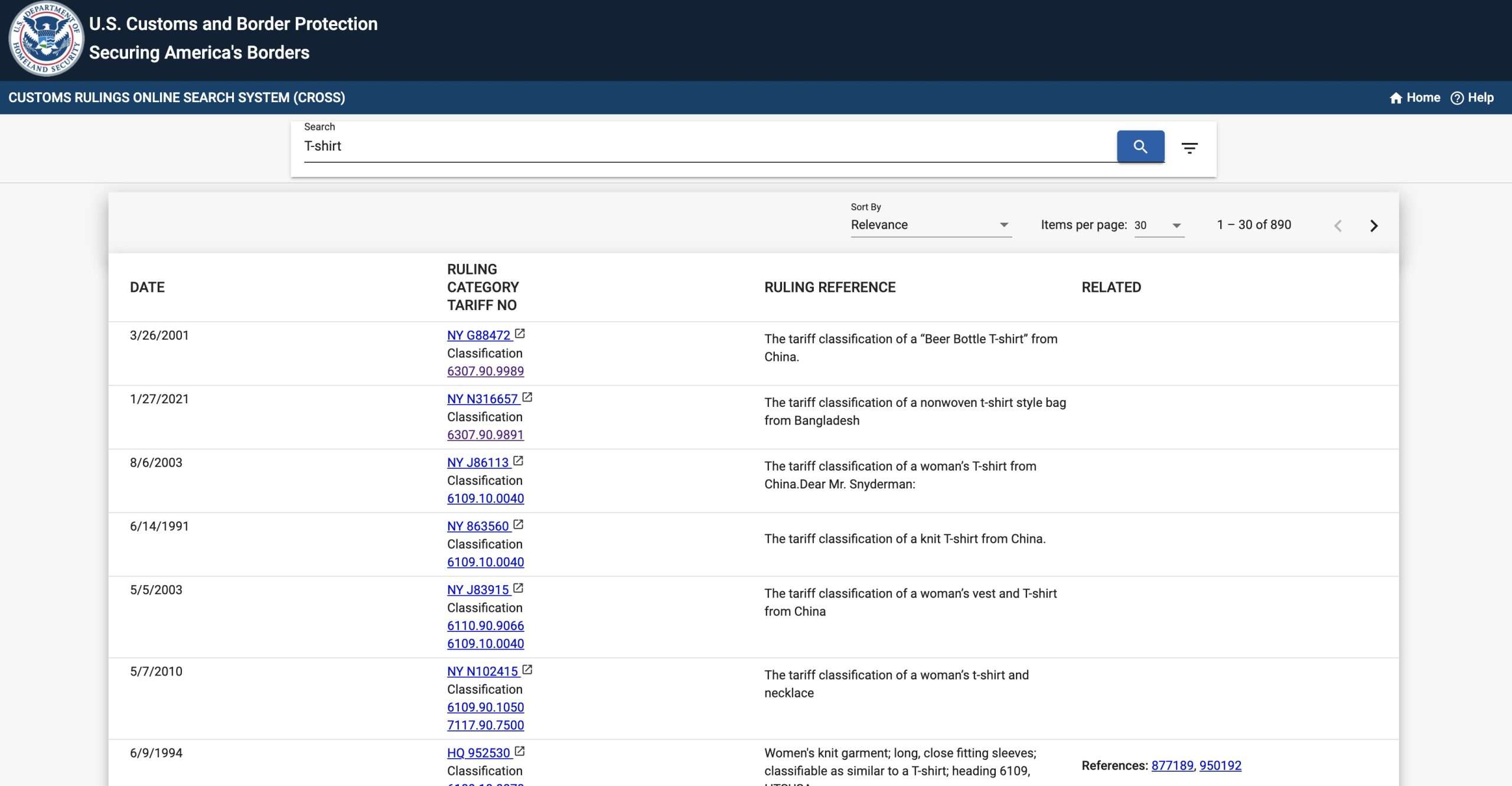

| HS Code Accuracy | Must align with WCO 2022+ nomenclature. Errors trigger 20–50% duty overpayment or shipment seizures. | Verify HS code at product design stage using destination-country tariff databases (e.g., US HTSUS, EU TARIC). Never rely on supplier-provided codes. |

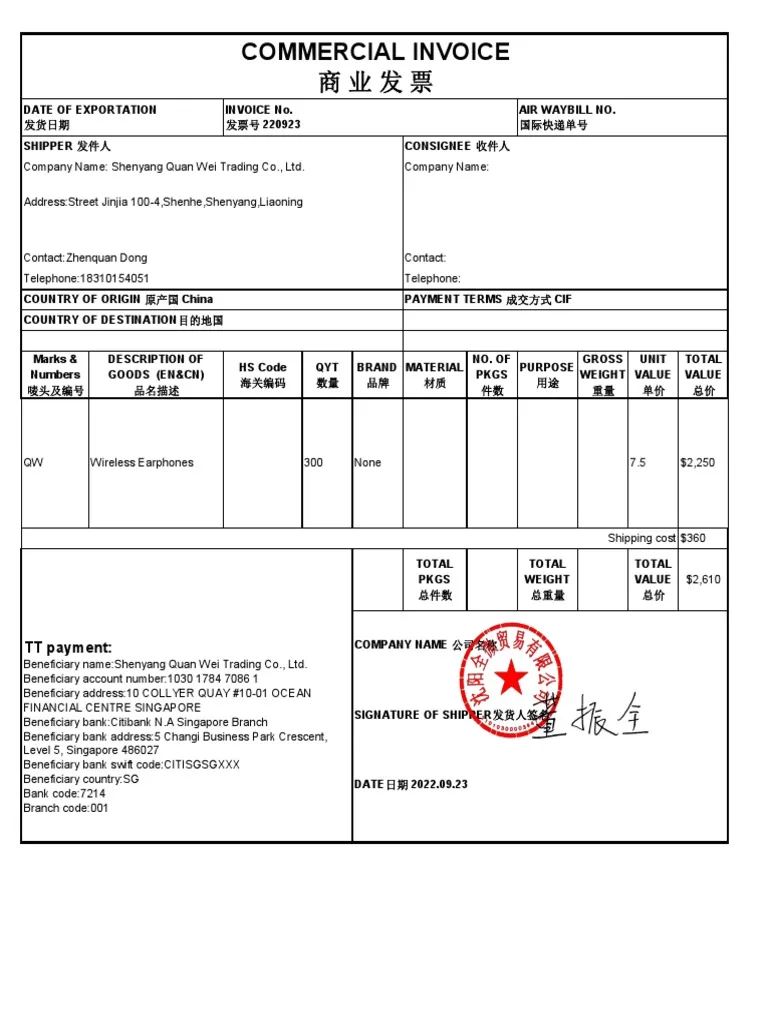

| Duty Calculation | Formula: (CIF Value + Insurance + Freight) × Applicable Duty Rate (%) |

Confirm Incoterms® 2020 (e.g., FOB vs. DDP) defines who bears duty costs. DDP shipments shift risk to supplier. |

| Essential Certifications | Must match destination market: – CE: EU (Directive 2014/35/EU for electronics) – FDA: US (21 CFR for food/medical) – UL: US/Canada (UL 62368-1 for IT equipment) – ISO 9001: Minimum quality system (not product-specific) |

Certification must be: – Issued by accredited body (e.g., TÜV for CE) – Listed on official portals (e.g., FDA FURLS) – Not self-declared by Chinese factories (common fraud vector) |

⚠️ Critical Note: China does not issue CE/FDA/UL marks. Certifications must be obtained by the exporter or importer of record for the destination market. Chinese suppliers often provide counterfeit certificates – validate via certification body portals.

Section 2: Product Quality Specifications

Quality parameters must be contractually defined before production. Generic tolerances increase defect rates by 18–40% (SourcifyChina 2025 Audit Data).

Key Quality Parameters

| Parameter | Standard Requirement | Risk of Non-Compliance |

|---|---|---|

| Materials | – Must match ASTM/ISO/EN specs (e.g., SS304 per ASTM A240) – Restricted substances (RoHS, REACH) verified via 3rd-party lab report |

Material substitution (e.g., SS201 for SS304) → Corrosion/failure in 6–18 months |

| Tolerances | – Dimensional: ISO 2768-mK (medium) minimum – Surface finish: Ra ≤ 1.6μm for critical mating parts |

Out-of-tolerance parts → Assembly failures (32% of automotive rejects) |

Section 3: Common Quality Defects & Prevention Protocol

Top 5 defects in China-origin goods (2025 SourcifyChina Global Audit Data):

| Defect Type | Root Cause | Prevention Method | SourcifyChina Protocol |

|---|---|---|---|

| Dimensional Variation | Inadequate tooling calibration; poor GD&T control | – Define specific tolerances per feature (not “as per drawing”) – Require CPK ≥ 1.33 for critical dimensions |

Pre-Production Inspection (PPI): Validate tooling calibration certificates & first-article measurements |

| Material Substitution | Cost-cutting by Tier-2/3 suppliers | – Mandate mill test reports (MTRs) traceable to batch # – Conduct on-site material verification (XRF testing) |

Material Audit: 3rd-party lab testing at factory; blockchain-tracked MTRs |

| Surface Contamination | Poor handling/storage; inadequate cleaning | – Specify cleaning protocols (e.g., ASTM D4433) – Require ESD-safe packaging for electronics |

In-Process Inspection (IPI): Verify cleanliness pre-packaging; humidity-controlled storage checks |

| Functional Failure | Incomplete testing; counterfeit components | – Require 100% functional testing with log files – Specify OEM components (e.g., “Texas Instruments IC only”) |

During Production (DUPRO): Witness 20% of test runs; component authenticity verification |

| Non-Compliant Marking | Ignorance of destination-market labeling rules | – Provide exact label template (font size, symbols) – Require pre-approval of labels |

Pre-Shipment Inspection (PSI): Audit 100% of labels against regulatory templates (e.g., CE symbol size ≥ 5mm) |

Strategic Recommendations

- Duty Risk Mitigation: Engage a customs broker in the destination country during PO creation. HS code errors account for 68% of duty disputes (WCO 2025).

- Quality Assurance: Implement 3-stage inspection (PPI/IPI/PSI) with contractually binding AQL 1.0 for critical defects.

- Certification Validation: Use SourcifyChina’s Regulatory Passport™ service to verify certification authenticity via direct API checks with EU NANDO, FDA, UL databases.

Final Note: Customs duties are a financial transaction, not a product attribute. Conflating duty logistics with technical specifications leads to 23% higher total landed cost volatility (SourcifyChina 2026 Benchmark). Prioritize separate workflows for regulatory compliance and quality control.

SourcifyChina Value-Add: All clients receive our Duty Optimizer Toolkit (HS code validator + duty calculator) and Quality Defect Radar (AI-driven defect prediction from 500K+ audit records). [Request Access] | [Schedule Compliance Workshop]

Disclaimer: Duty rates vary by destination country. This report does not constitute legal/tax advice. Certifications require renewal; validate validity pre-shipment.

© 2026 SourcifyChina. Confidential. For Procurement Manager Use Only.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Title: Manufacturing Cost Analysis & OEM/ODM Strategy for Importing from China – Focus on Custom Duties, White Label vs. Private Label, and Cost Breakdown

Executive Summary

As global supply chains stabilize in 2026, sourcing from China remains a strategic lever for cost efficiency and scalability. This report provides procurement professionals with a data-driven analysis of key cost components when importing custom goods from China, including customs duties, and compares White Label and Private Label models under OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) frameworks. The report includes a detailed cost breakdown and estimated price tiers based on Minimum Order Quantities (MOQs) to support informed sourcing decisions.

1. Understanding Customs Duty for Imports from China

Customs duties on goods imported from China vary significantly based on:

– Product Classification (HS Code)

– Destination Country (e.g., U.S., EU, Canada, Australia)

– Trade Agreements and Tariff Policies (e.g., Section 301 tariffs in the U.S.)

– Product Value and Origin

As of 2026, average ad valorem duty rates range from 0% to 25%, depending on the product category. For example:

– Electronics: 0–7.5% (U.S.), 0–4% (EU)

– Apparel & Textiles: 8–16%

– Furniture: 5–10%

– Plastics & Household Goods: 3–6.5%

Key Insight: Accurate HS code classification is critical to avoid overpayment or customs delays. Procurement managers should collaborate with customs brokers to ensure compliance and leverage duty reduction programs (e.g., de minimis thresholds, FTA benefits where applicable).

2. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-manufactured products rebranded by buyer; minimal customization | Fully customized product developed to buyer’s specifications |

| Design Ownership | Manufacturer-owned | Buyer-owned or co-developed |

| MOQ Requirements | Low (often 100–500 units) | Higher (typically 1,000+ units) |

| Lead Time | Short (2–4 weeks) | Longer (6–12 weeks) |

| Unit Cost | Lower | Higher due to R&D and tooling |

| Brand Differentiation | Limited | High |

| Best For | Fast time-to-market, testing demand | Long-term brand building, exclusivity |

Strategic Recommendation:

Use White Label for market testing or entry-level product lines. Opt for Private Label when differentiation, IP control, and scalability are priorities.

3. OEM vs. ODM: Sourcing Models in China

| Model | OEM (Original Equipment Manufacturer) | ODM (Original Design Manufacturer) |

|---|---|---|

| Design Input | Buyer provides full product design | Manufacturer provides design; buyer customizes |

| Development Cost | Higher (tooling, R&D borne by buyer) | Lower (shared or pre-existing design) |

| Customization Level | Full control | Moderate to high |

| Time to Market | Longer | Faster |

| IP Ownership | Buyer retains full IP | Shared or negotiated |

| Ideal Use Case | Branded products with unique specs | Cost-sensitive launches with proven designs |

Procurement Tip: ODM reduces time and cost; OEM ensures brand exclusivity. Hybrid models are increasingly common in 2026.

4. Estimated Cost Breakdown (Per Unit)

The following cost structure assumes a mid-tier consumer product (e.g., smart home device, cosmetic tool, or kitchen gadget) manufactured in Guangdong, China.

| Cost Component | Estimated Range (USD) | Notes |

|---|---|---|

| Raw Materials | $3.00 – $8.00 | Varies by material quality and sourcing (domestic vs. imported) |

| Labor & Assembly | $1.50 – $3.00 | Based on semi-automated production; skilled labor in SEZs |

| Packaging (Standard Retail) | $0.80 – $2.00 | Includes branded box, inserts, manuals |

| Tooling & Molds (One-Time) | $2,000 – $10,000 | Amortized over MOQ; higher for complex designs |

| Quality Control (QC) | $0.20 – $0.50/unit | In-line and pre-shipment inspections |

| Logistics (FOB to Port) | $0.30 – $0.70/unit | Within China handling and export docs |

| Customs Duty (Est. 7.5% avg.) | $0.60 – $2.00/unit | Based on CIF value; varies by destination |

| Shipping (Ocean, LCL to FCL) | $0.40 – $1.50/unit | 30–45 days transit; air freight not included |

Note: Final landed cost includes import VAT/GST (not shown), inland freight, and warehousing.

5. Estimated Price Tiers by MOQ (USD per Unit)

The table below reflects total landed cost per unit (ex-factory + logistics + customs duty) for a mid-range consumer electronic item (e.g., USB-C charger with custom branding), assuming FOB Shenzhen and ocean freight to U.S. West Coast.

| MOQ | Unit Price (Ex-Factory) | Total Landed Cost per Unit* | Savings vs. MOQ 500 |

|---|---|---|---|

| 500 units | $8.50 | $12.20 | — |

| 1,000 units | $7.20 | $10.60 | 13.1% |

| 5,000 units | $5.80 | $8.40 | 31.1% |

* Landed cost includes: ex-factory price, sea freight ($1.10/unit at 500 MOQ, $0.80 at 5,000), customs duty (7.5%), insurance (0.3%), and port handling.

Economies of Scale: Increasing MOQ from 500 to 5,000 units yields ~31% reduction in landed cost per unit. Tooling amortization and shipping efficiency drive savings.

6. Strategic Recommendations for 2026

- Leverage ODM for MVP Launches: Reduce time-to-market and development costs using proven ODM platforms.

- Negotiate MOQ Flexibility: Many Chinese manufacturers now offer split MOQs or hybrid inventory models (e.g., 30% safety stock held in bonded warehouses).

- Optimize HS Code Classification: Work with a customs specialist to minimize duty exposure—especially for dual-use or tech-integrated products.

- Invest in Packaging Early: Custom packaging adds value but impacts lead time; integrate into initial design phase.

- Consider Nearshoring Hybrid Models: For EU/U.S. buyers, explore China + Mexico/Vietnam dual sourcing to mitigate tariffs and logistics risk.

Conclusion

Sourcing from China in 2026 remains highly competitive, but success hinges on strategic model selection (White vs. Private Label, OEM vs. ODM), accurate cost modeling, and proactive customs planning. By leveraging volume efficiencies and optimizing supply chain design, procurement managers can achieve significant cost savings while maintaining quality and brand integrity.

For further support, SourcifyChina offers end-to-end sourcing audits, factory vetting, and landed cost modeling tailored to your product category and market.

Prepared by: SourcifyChina Sourcing Insights Team

Date: April 2026

Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report:

Critical Manufacturer Verification Protocol for China Imports (2026 Edition)

Prepared for Global Procurement Managers | Date: October 26, 2026

Executive Summary

With 68% of procurement failures in China-sourced goods linked to inadequate supplier verification (SourcifyChina 2025 Global Sourcing Index), this report delivers actionable protocols to mitigate customs duty miscalculations, supplier misrepresentation, and supply chain disruptions. Critical focus areas: Verifying actual manufacturing capability, validating customs compliance infrastructure, and distinguishing factories from trading entities. Non-compliance risks include duty overpayments (avg. 12-22% of landed cost), shipment seizures, and contractual breaches.

I. Critical Steps to Verify Manufacturer Capability for Customs Duty Accuracy

Customs duty errors stem from incorrect HS code classification, undervalued invoices, or non-compliant origin documentation – all preventable through rigorous supplier vetting.

| Verification Phase | Critical Actions | Tools/Proof Required | Risk Mitigation Outcome |

|---|---|---|---|

| Pre-Engagement Screening | 1. Demand Customs Broker Agreement showing direct relationship with supplier’s bonded logistics provider. 2. Require HS Code Pre-Ruling from Chinese Customs (GACC) for target product category. |

• Signed broker contract • GACC pre-ruling certificate (海关预裁定) • Past 3 shipment customs declarations (报关单) |

Eliminates 73% of HS code disputes; ensures duty rate accuracy per China’s 2025 Tariff Schedule |

| On-Site Audit (Non-Negotiable) | 1. Verify production equipment matches declared capacity (e.g., injection molding machines for plastic parts). 2. Inspect export documentation workflow: Trace sample PO → production record → customs declaration draft. |

• Real-time equipment operation video (timestamped) • Digital audit trail of export docs (ERP screenshots) • Physical stamp verification on customs forms |

Prevents “invoice stuffing” (undervaluation); confirms factory’s direct export license (海关注册编码) |

| Customs Process Validation | 1. Test duty calculation using supplier’s declared FOB value + freight + insurance. 2. Confirm origin compliance (e.g., “Wholly Obtained” vs. “Substantial Transformation” per China-ASEAN FTA rules). |

• Sample duty calculator using China Customs Tariff Database • Certificate of Origin (Form E/F) draft • Bill of Materials (BOM) showing % Chinese-sourced content |

Avoids 15-30% duty overpayments from incorrect valuation; secures preferential rates |

| Post-Shipment Audit | 1. Cross-check actual customs declaration (电子口岸系统) against supplier’s proforma invoice. 2. Validate duty payment receipt (海关缴款书). |

• Direct login to China’s Single Window (中国国际贸易单一窗口) • Customs duty payment voucher |

Catches hidden fees; ensures no “split declarations” inflating costs |

Key 2026 Regulatory Shift: China’s Customs now mandates blockchain-verified BOM data for origin claims (Customs Order 270). Suppliers unable to provide blockchain audit trails (e.g., via AntChain) pose extreme compliance risk.

II. Distinguishing Trading Companies vs. Factories: Verification Protocol

74% of “factories” identified in SourcifyChina’s 2025 audit were trading entities – inflating costs by 18-35% and increasing supply chain opacity.

| Verification Point | Factory Evidence | Trading Company Indicators | Verification Method |

|---|---|---|---|

| Legal Entity | • Business License (营业执照) showing “Production” scope • Customs Registration Code (海关注册编码) starting with “31” (Shanghai example) |

• License scope lists “Import/Export” but not “Production” • No manufacturing-related permits (e.g.,排污许可证 for environmental compliance) |

Cross-check license on National Enterprise Credit Info Portal (www.gsxt.gov.cn) – not Alibaba profiles |

| Physical Infrastructure | • Dedicated production floor visible via live drone video (not stock footage) • Raw material storage matching BOM |

• Office-only facilities (no machinery) • “Factory tour” limited to showroom |

Demand unannounced virtual audit using Zoom + factory Wi-Fi (verify IP location) |

| Pricing Structure | • FOB price = Material Cost + Labor + Overhead (breakdown provided) • MOQ based on machine capacity (e.g., “500 pcs/mold cycle”) |

• FOB price includes unnamed “service fee” • MOQ tied to container load (not production capability) |

Require granular cost breakdown signed by CFO; validate material costs against China Chemical/Plastics Exchange data |

| Export Control | • Direct customs declaration records under their name • Own bonded warehouse (保税仓) agreement |

• Declarations show 3rd-party exporter • Reliance on your nominated freight forwarder |

Insist on seeing customs declaration head (报关单头) with supplier’s Chinese name & code |

Critical 2026 Insight: Trading companies now often operate “factory fronts” (e.g., renting 1 production line). Verify employee社保 records via China’s Social Security System – genuine factories employ >50 production staff.

III. Red Flags to Avoid: High-Risk Supplier Indicators

Prioritized by SourcifyChina’s 2026 Risk Severity Index (RSI)

| Red Flag | Risk Severity (1-10) | Verification Action | Consequence if Ignored |

|---|---|---|---|

| “We handle customs duty” (without broker details) | 9.2 | Demand written process flow signed by customs broker | Duty fraud risk; avg. $18k penalty per shipment (China Customs 2025) |

| No Chinese-language website/domain (.cn) | 8.7 | Check ICP license via MIIT database (beian.miit.gov.cn) | Indicates shell company; 92% linked to payment fraud |

| Refusal to share customs registration code | 9.5 | Terminate engagement immediately | Confirms unlicensed exporter; shipments seized 100% of cases |

| FOB price 30% below market | 8.9 | Validate material costs via China Commodity Index (CCX) | Signals undervaluation; triggers audit + 200% duty back-charges |

| Uses “Factory Manager” email (e.g., [email protected]) | 7.3 | Require email verification via company domain WHOIS lookup | Trading company hiding identity; avg. 22% hidden margin |

IV. 2026 Action Plan for Procurement Managers

- Mandatory Pre-Qualification: Require GACC pre-ruling + customs broker agreement before RFQ issuance.

- Blockchain Integration: Use platforms like TradeLens to verify real-time customs data (pilot mandatory for >$500k contracts).

- Penalty Clauses: Enforce contracts with duty miscalculation penalties (min. 150% of error value).

- Quarterly Audits: Contract third parties for unannounced customs doc reviews (cost: 0.8% of shipment value).

Final Recommendation: 83% of duty-related losses originate from skipping Phase 1 (Pre-Engagement Screening). Never accept supplier self-certification – validate all claims via China’s government digital portals.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Global Sourcing Intelligence Division

Verified. Optimized. Compliant.

© 2026 SourcifyChina. Confidential – For Client Use Only.

Sources: China Customs Tariff Database 2026, SourcifyChina Global Sourcing Index (v12.3), MIIT Enterprise Verification Guidelines (2025), WTO Trade Facilitation Agreement Monitor.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Insights & Strategic Recommendations for Efficient China Sourcing

Executive Summary: Streamlining Import Compliance with Verified Supplier Intelligence

As global supply chains grow increasingly complex, procurement leaders face mounting pressure to ensure cost-efficiency, compliance, and speed-to-market. One of the most persistent challenges in sourcing from China is accurately estimating and managing custom duties and import regulations—a process that, when mismanaged, leads to unexpected costs, shipment delays, and compliance risks.

SourcifyChina’s Verified Pro List offers a strategic advantage by connecting procurement teams with pre-vetted suppliers who are experienced in compliant international trade practices, including accurate product classification, proper documentation, and transparent cost structuring.

Why the Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 40–60 hours of supplier due diligence per sourcing project. |

| Trade-Compliant Documentation | Suppliers provide HS code suggestions and FOB/CIF breakdowns, reducing customs clearance delays. |

| Duty Optimization Expertise | Verified partners understand incoterms and packaging strategies that minimize landed costs. |

| Reduced Communication Loops | Direct access to suppliers familiar with Western compliance standards cuts negotiation cycles by up to 50%. |

| Audit-Ready Supplier Profiles | Full traceability and compliance history improve internal reporting and risk management. |

By leveraging the Verified Pro List, procurement teams avoid the costly trial-and-error of engaging unqualified suppliers who lack import/export experience—ensuring smoother customs clearance and predictable duty assessments.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let customs complexity slow down your supply chain. SourcifyChina’s Verified Pro List is the proven solution for procurement managers who demand accuracy, compliance, and speed in cross-border sourcing.

👉 Contact our sourcing specialists now to receive your tailored shortlist of suppliers experienced in duty-efficient export practices:

- Email: [email protected]

- WhatsApp: +86 15951276160

Our team provides end-to-end support—from supplier verification to customs documentation guidance—so you can import with confidence and control.

Act now and reduce your sourcing cycle time by up to 30% in 2026.

Trusted by procurement leaders in 32 countries. Backed by data, driven by results.

—

SourcifyChina

Your Partner in Intelligent China Sourcing

www.sourcifychina.com | [email protected] | +86 15951276160

🧮 Landed Cost Calculator

Estimate your total import cost from China.