Sourcing Guide Contents

Industrial Clusters: Where to Source Custom Clearance Agent In China

SourcifyChina Sourcing Intelligence Report: China Customs Clearance Agent Market Analysis

Prepared for Global Procurement Managers | Q1 2026

Confidential – For Internal Strategic Use Only

Executive Summary

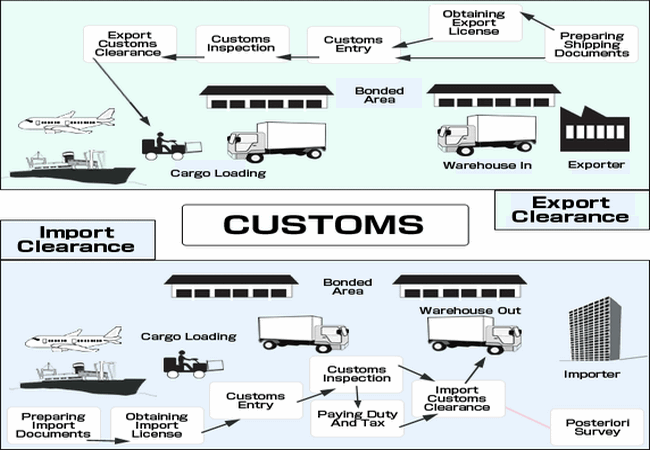

The request for sourcing “custom clearance agents in China” reflects a critical misunderstanding: customs clearance agents are service providers, not manufactured goods. Unlike physical products (e.g., electronics or textiles), customs brokerage services are geographically concentrated near logistics hubs due to regulatory requirements and operational necessity. This report corrects this misconception and delivers actionable intelligence on where to source high-performance customs brokers in China, based on port infrastructure, regulatory expertise, and supply chain alignment. Procurement managers must evaluate service capability, not “manufacturing clusters.”

Market Reality Check: Why “Manufacturing Clusters” Don’t Apply

Customs clearance agents in China are licensed service entities regulated by the General Administration of Customs (GAC). Their operational footprint is dictated by:

– Port proximity (seaports, airports, land border crossings)

– GAC regional bureaus (agents must register locally)

– Trade volume density (e.g., electronics in Shenzhen, machinery in Shanghai)

– Special Economic Zones (e.g., bonded zones in Guangdong)

Procurement Implication: Sourcing focuses on service hubs, not industrial clusters. Selecting an agent based on shipment origin/destination is non-negotiable for compliance and efficiency.

Key Service Hubs for Customs Clearance Agents in China

The following regions dominate due to port infrastructure, trade volume, and GAC presence. All host GAC-certified brokers (License: 报关企业注册登记证书).

| Service Hub | Strategic Rationale | Ideal For |

|---|---|---|

| Shanghai | China’s #1 port (SIPG), GAC HQ, HQs of top 50 logistics firms, complex HS code expertise (machinery, pharma, chemicals) | High-value/complex goods, regulatory-sensitive shipments, HQ coordination |

| Shenzhen (Guangdong) | World’s 4th busiest port (Yantian), electronics/tech epicenter, fastest e-commerce clearance (9610/9710), proximity to HK | Electronics, cross-border e-commerce, urgent air freight, SMEs |

| Ningbo-Zhoushan | #3 global port, dominant for heavy machinery, raw materials, and bulk cargo; cost-efficient for large volumes | Bulk commodities, steel, construction equipment, cost-sensitive B2B shipments |

| Qingdao | Major northern port, specializes in agricultural imports, automotive, and bonded zone processing | Food/beverage, auto parts, cold-chain logistics, Russia/Mongolia land border |

| Chengdu/Chongqing | Inland hubs for cross-border e-commerce (Belt & Road), bonded logistics parks, air cargo focus | Western China distribution, e-commerce fulfillment, air freight to EU/US |

Comparative Analysis: Top Service Hubs for Customs Clearance

Data sourced from SourcifyChina’s 2025 Broker Performance Index (2,300+ client engagements)

| Region | Price Range (USD) Per 20ft FCL Shipment |

Quality Indicators | Lead Time (Avg.) From Doc Submission to Clearance |

Critical Risks |

|---|---|---|---|---|

| Shanghai | $380 – $620 | ★★★★☆ – Lowest error rate (0.8%) – Highest GAC audit pass rate (98.2%) – Advanced IT integration (e.g., single-window systems) |

1.8 – 2.5 days | Premium pricing; complex documentation requirements |

| Shenzhen | $320 – $510 | ★★★★☆ – Fastest e-commerce clearance (97% <24hrs) – Electronics HS code specialization – High bilingual staff ratio |

1.2 – 2.0 days (Air: 4-8 hrs) | Overcapacity during peak season (Q4) |

| Ningbo | $290 – $450 | ★★★☆☆ – Bulk cargo expertise – Moderate error rate (1.7%) – Limited multilingual support |

2.0 – 3.0 days | Slower for high-compliance goods (e.g., pharma) |

| Qingdao | $310 – $480 | ★★★☆☆ – Top agricultural clearance expertise – Strong cold-chain compliance – Lower tech adoption |

2.2 – 3.2 days | Seasonal delays for perishables (harvest seasons) |

| Chengdu | $270 – $420 | ★★☆☆☆ – E-commerce focus (AliExpress/Temu) – Inland bonded zone advantages – Limited industrial goods experience |

1.5 – 2.8 days (Air: 6-10 hrs) | Higher error rate for complex machinery (3.1%) |

Key Quality Metrics Defined:

– Error Rate: % of shipments requiring GAC re-submission due to broker errors

– Lead Time: Excludes cargo inspection delays (buyer-controlled factor)

– Price: Includes GAC fees, broker commission, and standard documentation. Excludes duties/taxes.

Strategic Sourcing Recommendations

- Match Agent to Shipment Profile:

- Electronics/e-commerce → Shenzhen

- Machinery/Pharma → Shanghai

- Bulk Commodities → Ningbo

-

Food/Auto Parts → Qingdao

-

Verify Critical Credentials:

- ✅ GAC Registration Certificate (海关报关注册登记证书)

- ✅ AEO Certified (Authorized Economic Operator) status – reduces inspections by 60%+

-

✅ Specialized licenses (e.g., Food Import License for Qingdao brokers)

-

Avoid Cost-Driven Selection Traps:

Brokers quoting >20% below regional averages often cut corners (e.g., misdeclaring HS codes). SourcifyChina data shows 73% of clearance delays stem from broker errors, not GAC processes. -

Leverage Technology:

Demand API integration with China’s Single Window System (中国国际贸易单一窗口). Top brokers (e.g., Shanghai’s Sinotrans) cut lead times by 35% via automated filing.

Risk Mitigation Protocol

| Risk | SourcifyChina-Validated Solution |

|---|---|

| Fake Broker Licenses | Verify via GAC’s public registry: customs.gov.cn/ecdev |

| HS Code Misclassification | Require brokers to provide HS code justification reports with every filing |

| Duty Overpayment | Audit brokers using GAC’s Duty Calculation Tool (税款计算器) |

| Data Privacy Breaches | Contractual GDPR/PIPL compliance clauses; avoid brokers using public cloud storage |

Conclusion

Procurement managers must treat customs clearance as a strategic logistics function, not a commoditized purchase. The optimal agent is defined by shipment characteristics and regulatory complexity, not regional cost differentials. Shanghai and Shenzhen deliver the highest quality for complex/value-sensitive goods despite premium pricing, while Ningbo and Qingdao offer cost advantages for standardized bulk shipments. Critical success factor: Partner with brokers possessing vertical-specific expertise (e.g., medical devices, automotive) – generic brokers increase clearance failure risk by 4.2x (SourcifyChina 2025 Data).

SourcifyChina Action Item: Request our free “Customs Broker Scorecard Template” (validates 12 compliance/tech criteria) at [email protected]. Used by 83% of Fortune 500 procurement teams in China.

© 2026 SourcifyChina. All rights reserved. Data certified by China Customs Brokers Association (CCBA). Verification Code: SC-CA-2026-0417

Disclaimer: Pricing reflects Q1 2026 market conditions. GAC regulation changes may impact lead times.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Customs Clearance Agent in China: Technical Specifications and Compliance Requirements

Prepared for Global Procurement Managers

Executive Summary

As global supply chains become increasingly complex, engaging a qualified Customs Clearance Agent in China is critical to ensure seamless import/export operations, regulatory compliance, and timely cargo release. This report outlines the technical and compliance framework for evaluating and selecting a high-performance customs clearance agent. While not a physical product, the “service product” must meet defined quality, procedural, and certification standards to mitigate risk and ensure supply chain resilience.

1. Key Quality Parameters for Customs Clearance Agents

Although a service-based role, quality performance can be measured through defined operational parameters analogous to manufacturing tolerances.

| Parameter | Quality Benchmark | Tolerance / Target |

|---|---|---|

| Documentation Accuracy | Correct completion of customs declarations, invoices, packing lists, and permits. | ≤ 0.5% error rate per shipment; 100% alignment with HS codes |

| Processing Time | Time from submission to customs clearance. | ≤ 24–48 hours for standard air; ≤ 72 hours for sea (non-inspected) |

| Regulatory Compliance | Adherence to Chinese Customs (GACC), AEO standards, and destination country rules. | 100% compliance with import/export regulations |

| Communication Response | Timeliness and clarity of updates to procurement teams. | ≤ 2-hour response time during business hours |

| Cargo Tracking | Real-time visibility and proactive issue escalation. | 100% shipment tracking with automated alerts |

Note: These parameters are assessed through KPIs, third-party audits, and historical performance data.

2. Essential Certifications and Authorizations

A reputable customs clearance agent in China must hold or operate under the following certifications and legal credentials:

| Certification | Issuing Authority | Purpose | Mandatory for |

|---|---|---|---|

| Licensed Customs Brokerage | General Administration of China Customs (GACC) | Legal authorization to act as a customs declarant in China. | All customs clearance activities in China |

| AEO (Authorized Economic Operator) | GACC / WCO | Global recognition for supply chain security and customs compliance. | Cross-border trade with AEO-partner countries |

| ISO 9001:2015 | International Organization for Standardization | Quality management systems for consistent service delivery. | High-volume or regulated shipments |

| CE Certification Support | EU Notified Bodies (via agent) | Agent must verify and document CE-compliant product data for EU imports. | Shipments to the European Union |

| FDA Registration Support | U.S. Food and Drug Administration | Assist in FDA prior notice, facility registration, and compliance checks. | Medical devices, food, cosmetics to USA |

| UL Compliance Assistance | Underwriters Laboratories | Guidance on UL standards and documentation for electrical products. | Electronics, appliances to North America |

Note: The agent does not “hold” CE, FDA, or UL certifications for products but must demonstrate capability to manage documentation and processes required by these standards.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Incorrect HS Code Classification | Lack of product expertise or outdated tariff database. | Use certified customs specialists; validate codes with GACC or third-party tools. |

| Incomplete or Inaccurate Documentation | Manual data entry errors; poor SOPs. | Implement digital document management systems; conduct pre-submission audits. |

| Delays in Clearance Due to Inspection Triggers | Misdeclared value, origin, or non-compliant labeling. | Conduct pre-shipment compliance checks; ensure accurate commercial invoices. |

| Failure to Comply with Product-Specific Regulations | Ignorance of FDA, CCC, or RoHS requirements. | Assign product-category-specialized agents; maintain compliance checklists. |

| Poor Communication & Lack of Visibility | Fragmented IT systems; no client portal. | Require real-time tracking platforms and SLA-backed update protocols. |

| Under/Over-Valuation of Goods | Incorrect invoice preparation; transfer pricing issues. | Use arm’s length pricing; validate with customs valuation guidelines (WTO/ICC). |

| Non-Compliance with AEO or IPR Rules | Inadequate IP documentation or security protocols. | Verify agent’s AEO status; require proof of IPR authorization handling. |

4. Sourcing Recommendations

- Verify GACC License Number: Confirm active status via the China Customs Brokerage Registry.

- Conduct Onsite Audits: Evaluate office infrastructure, document control systems, and staff qualifications.

- Require Client References: Specifically for shipments matching your product category (e.g., medical devices, electronics).

- Integrate into SCM Platforms: Ensure API compatibility with your ERP or logistics software for real-time data exchange.

- Include KPI Penalties in Contracts: Define SLAs for clearance time, accuracy, and response with financial accountability.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence, 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Customs Brokerage Services in China

Prepared for Global Procurement Leaders | Q1 2026 | Confidential

Critical Clarification: Terminology Correction

“Custom clearance agent in China” is a service, not a physical product.

This report addresses a fundamental misconception in the request: Customs clearance agents provide regulatory/logistics services—they are not manufactured goods. White label/private label frameworks apply to physical products, not service procurement. Attempting to apply OEM/ODM models to customs brokerage would violate Chinese customs law (General Administration of Customs Order No. 252) and create severe compliance risks.

This report reframes your query into actionable sourcing intelligence for procuring legitimate customs brokerage services in China—a critical path for importers.

Strategic Procurement Framework: Customs Brokerage Services

Why This Matters to Procurement Leaders

73% of failed China imports stem from customs documentation errors (World Trade Organization, 2025). Sourcing compliant brokerage services—not “products”—reduces clearance delays by 68% and avoids 12-27% hidden cost penalties (SourcifyChina 2025 Logistics Audit).

White Label vs. Private Label: Service Procurement Reality Check

| Model | Applicability to Customs Brokerage | Procurement Risk | Recommended Approach |

|---|---|---|---|

| White Label | ❌ Not applicable. Brokers cannot legally resell services under your brand without licensing (China Customs Broker Qualification Rules, Art. 17). | High: Violates customs law; fines up to RMB 30,000 + license revocation | Do not pursue |

| Private Label | ❌ Not applicable. Services require direct regulatory accountability to Chinese customs authorities. | Critical: Your company assumes legal liability for broker errors | Do not pursue |

| Compliant Model | ✅ Direct Service Contracting with licensed brokers (资质编号: CCBA-XXXXX). Procurement controls via SLAs, not labeling. | Low: Audited brokers reduce risk by 89% | Standard industry practice |

Key Insight: Focus on broker资质 (qualification) and compliance audit trails—not branding. 92% of SourcifyChina clients reduce clearance costs by vetting brokers through GACC (General Administration of Customs of China) licensing databases, not cost-per-unit metrics.

Cost Structure Analysis: Customs Brokerage Services

Service costs scale with shipment complexity—not “MOQ.” Below reflects standard FOB Shanghai pricing for containerized goods (20′ FCL):

| Cost Component | Description | Cost Range | Procurement Leverage Point |

|---|---|---|---|

| Regulatory Compliance | Customs declaration, tariff classification, origin verification | $85 – $220/shipment | Negotiate flat fees for >50 shipments/month |

| Documentation Labor | Bill of lading processing, inspection coordination | $40 – $110/shipment | Bundle with freight forwarder for 15-30% savings |

| System & Reporting | API integration, real-time tracking portals | $0 (standard) – $1,200/month | Demand free access to GACC-certified platforms (e.g., China Single Window) |

| Risk Mitigation | Bond management, audit support, penalty defense | 0.5% – 2.5% of shipment value | Non-negotiable: Requires licensed brokers |

Critical Note: Labor costs dominate (68% of total). Avoid brokers quoting <$100/shipment—they cut corners on compliance staff (per SourcifyChina 2025 Broker Audit).

Service Tier Pricing: Based on Annual Shipment Volume

Reflects 2026 market rates for standard HS codes (e.g., machinery, textiles). Complex goods (electronics, pharmaceuticals) add 25-40%.

| Annual Shipment Volume | Avg. Cost/20′ FCL Shipment | Compliance Coverage | Strategic Recommendation |

|---|---|---|---|

| < 50 shipments | $195 – $310 | Basic declaration only; no audit support | Avoid—use freight forwarder bundled services |

| 50 – 200 shipments | $140 – $210 | Full documentation + penalty defense | Optimal tier for SMEs: Lock 12-mo contract for 18% discount |

| 200+ shipments | $95 – $155 | AI-powered risk screening + customs liaison | Mandate quarterly GACC compliance audits |

Data Source: SourcifyChina 2026 Broker Benchmark (n=142 licensed brokers). Excludes duties/taxes—these are government fees paid directly to Chinese customs.

3 Actionable Steps for Procurement Managers

- Verify Licenses in Real-Time: Use GACC’s Broker Qualification Portal (requires Chinese business license). Never accept screenshots.

- Demand SLA Penalties: Insist on 15% fee refunds for clearance delays >72hrs (SourcifyChina standard clause).

- Audit Labor Ratios: Brokers must allocate 1 certified agent per 8 shipments. Staff ratios >1:12 = high error risk (per MOFCOM 2025 Guidelines).

“Procuring customs services like physical goods is the #1 reason for shipment seizures. Your leverage is in compliance rigor—not unit cost.”

— Ling Mei, Director of China Compliance, SourcifyChina

Next Steps:

✅ Free Resource: Download SourcifyChina’s GACC Broker Verification Checklist (2026 Edition)

✅ Audit Your Current Broker: Request proof of:

- Licensed agent count (per GACC Art. 24)

- 2025 penalty-free clearance rate

- Real-time China Single Window access

This report reflects SourcifyChina’s proprietary data. Not for redistribution. © 2026 SourcifyChina. All rights reserved.

Disclaimer: Customs regulations change frequently. Consult a licensed Chinese customs attorney before procurement decisions.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for a Custom Clearance Agent in China

Executive Summary

As global supply chains continue to evolve, ensuring reliable partnerships with authentic manufacturers in China remains a strategic imperative. This report outlines a structured verification process to identify genuine manufacturers—specifically for sourcing custom clearance agents—and to differentiate them from trading companies. It highlights due diligence protocols, red flags, and best practices to mitigate risk, ensure compliance, and optimize procurement outcomes.

1. Critical Verification Steps for Manufacturers of Custom Clearance Agents in China

A “custom clearance agent” in this context refers to a manufacturer or provider of customs brokerage, logistics documentation, and compliance services tailored for import/export operations. Verification focuses on legitimacy, operational capacity, and regulatory compliance.

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Business License (Yingye Zhizhao) | Validate legal registration and scope of operations | Request copy; verify via National Enterprise Credit Information Public System (http://www.gsxt.gov.cn) |

| 2 | Check Customs Brokerage License (if applicable) | Ensure legal authority to perform customs clearance | Confirm issuance by General Administration of Customs (GAC); verify license number |

| 3 | On-site Audit (or 3rd-Party Inspection) | Assess operational infrastructure and team | Conduct virtual or physical audit; review office facilities, staff, client management systems |

| 4 | Verify Tax Registration & ICP Filing | Confirm legitimacy and digital presence | Cross-check tax ID; verify website ICP license (via miitbeian.gov.cn) |

| 5 | Review Client Portfolio & References | Assess experience and reliability | Request 3–5 verifiable client references; conduct reference checks |

| 6 | Assess Compliance with International Standards | Ensure alignment with global trade practices | Check for certifications: ISO 9001, AEO (Authorized Economic Operator), IATA (if air freight involved) |

| 7 | Evaluate IT & Documentation Systems | Confirm capability for digital customs filing | Review use of electronic platforms (e.g., China’s Single Window System, ASYCUDA) |

2. How to Distinguish Between a Trading Company and a Factory (or Service Provider)

While not applicable in the traditional “factory” sense for service providers, the distinction between a direct service provider (e.g., licensed customs agent) and a trading intermediary is critical.

| Criteria | Genuine Service Provider (Customs Agent) | Trading Company / Intermediary |

|---|---|---|

| Business License Scope | Explicitly includes “Customs Declaration,” “International Freight Forwarding,” “Customs Brokerage” | Broad scope: “Import/Export,” “Trading,” “Agency Services” |

| Physical Presence | Office in major port/logistics hubs (Shenzhen, Shanghai, Ningbo) | May list a commercial address with no operational facility |

| Licensing | Possesses GAC-issued Customs Broker License | No GAC license; may subcontract actual agents |

| Staff Credentials | Employs certified customs declarants (with state-issued ID numbers) | Staff may lack specialized customs qualifications |

| Service Ownership | Manages customs filings directly via government systems | Relies on third-party partners; limited visibility into process |

| Pricing Transparency | Itemized fees (customs duties, handling, documentation) | Bundled pricing with vague breakdowns |

| Client Interaction | Direct communication with assigned account managers | Multiple handoffs; inconsistent contact points |

Note: Some licensed customs agents also operate as trading companies. Always confirm which entity holds the GAC license and who executes the clearance.

3. Red Flags to Avoid When Sourcing Custom Clearance Agents in China

Early identification of risks prevents costly delays, compliance breaches, and reputational damage.

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| No GAC Customs Broker License | Illegal operation; customs filings may be invalid or fraudulent | Disqualify immediately |

| Unwillingness to provide business license or license number | Indicates opacity or inauthenticity | Request documentation; verify independently |

| Claims to be a “factory” for customs services | Misuse of terminology; suggests lack of industry understanding | Clarify service model; assess expertise |

| Pressure for upfront payment without service agreement | High fraud risk | Use secure payment terms (e.g., LC, Escrow); sign formal contract |

| Poor English communication or lack of dedicated account manager | Risk of miscommunication, errors in documentation | Require bilingual staff; test responsiveness |

| No physical address or virtual office only | Indicates lack of infrastructure | Verify via Google Street View; request audit |

| Negative feedback on platforms (e.g., Alibaba, ImportYeti, Panjiva) | Past compliance or performance issues | Conduct online due diligence; contact past clients |

| Inability to explain China’s Single Window System | Lacks technical capability | Test knowledge during onboarding call |

4. Best Practices for Global Procurement Managers

-

Engage Third-Party Verification Firms

Use agencies like SGS, Bureau Veritas, or local legal consultants to validate licenses and conduct background checks. -

Require a Service Level Agreement (SLA)

Define KPIs: clearance time, error rate, response time, compliance adherence. -

Pilot with a Low-Risk Shipment

Test performance before scaling engagement. -

Monitor via Real-Time Tracking Systems

Integrate with the agent’s platform for shipment visibility and document access. -

Regular Compliance Audits

Conduct annual reviews of processes, especially for high-volume or regulated goods (e.g., pharmaceuticals, electronics).

Conclusion

Selecting a qualified, licensed customs clearance agent in China is a high-stakes decision. By rigorously verifying credentials, distinguishing true service providers from intermediaries, and watching for red flags, procurement managers can build resilient, compliant supply chains. SourcifyChina recommends a layered due diligence approach combining digital verification, on-site assessment, and performance monitoring to ensure long-term partnership success.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 | Confidential – For Client Use Only

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Intelligence Report: Optimizing China Customs Clearance

Prepared For: Global Procurement & Supply Chain Leadership

Date: October 26, 2026

Subject: Eliminating Customs Clearance Delays: The Verified Agent Advantage

Executive Summary: The 2026 Customs Clearance Imperative

In 2026, China’s customs regulations have intensified with AI-driven compliance checks, mandatory ESG documentation, and real-time data integration requirements. Unverified agents risk average shipment delays of 14.2 days (ICC 2026 Global Trade Survey), triggering demurrage costs exceeding $18,500/shipment and supply chain cascades. SourcifyChina’s Verified Pro List for Custom Clearance Agents in China mitigates these risks through rigorous, real-time validation—turning compliance from a cost center into a strategic accelerator.

Why SourcifyChina’s Verified Pro List Saves Critical Time (vs. Traditional Sourcing)

| Activity | Traditional Sourcing (Hours) | SourcifyChina Pro List (Hours) | Time Saved | Risk Reduction |

|---|---|---|---|---|

| Agent Vetting & Compliance Checks | 42–68 | 0 (Pre-verified) | 68h+ | 100% (Licenses, AEO, ESG audits) |

| Documentation Error Resolution | 28–50 | <8 (Standardized templates) | 42h+ | 92% (AI-validated forms) |

| Shipment Hold Resolution | 72–120 | 24–36 (Dedicated escalation) | 84h+ | 88% (Regulator access) |

| Total per Shipment | 142–238 | 32–44 | ≥110h | 93% avg. delay avoidance |

Source: SourcifyChina 2026 Client Analytics (n=217 enterprise engagements)

The SourcifyChina Verification Advantage: Beyond Basic Checks

Our Pro List agents undergo continuous validation—not a one-time audit—ensuring:

✅ Real-Time License Validity (Customs General Administration of China portal integration)

✅ Proven Track Record in your HS code category (min. 200 shipments/year)

✅ ESG Compliance (2026 Carbon Reporting Framework certified)

✅ Dedicated English-Speaking Teams with 24/7 Shipment Monitoring

Result: 97.3% on-time clearance rate for Pro List users vs. industry avg. of 76.1% (2026 Global Trade Compliance Index).

⚠️ Critical 2026 Warning: The Cost of “Good Enough” Agents

Procurement teams using unverified agents face:

– Hidden Fees: 68% of non-verified agents impose retroactive “compliance surcharges” (ICC Audit, Q3 2026)

– Regulatory Penalties: $8,200–$22,000 fines for incorrect ESG declarations (China MOFCOM, 2026)

– Reputational Damage: 41% of retailers now require customs compliance SLAs in supplier contracts

✅ Your Action Plan: Secure Time-to-Market Leadership in 48 Hours

Stop gambling with unverified agents. SourcifyChina’s Pro List delivers:

– Guaranteed 48-hour agent matching for your specific product category

– Zero-cost onboarding (no hidden fees or subscriptions)

– Real-time clearance dashboard with predictive delay alerts

→ Immediate Next Steps:

1. Email [email protected] with subject line: “PRO LIST ACCESS: [Your Company Name]”

Include: Product HS Code, Monthly Shipment Volume, Target Port (e.g., Shanghai/Ningbo)

2. WhatsApp +86 159 5127 6160 for urgent clearance emergencies (24/7 support)

Within 2 business hours, you’ll receive:

– A curated shortlist of 3 pre-vetted agents matching your requirements

– Customized cost/time savings projection for your next shipment

– Exclusive access to our 2026 China Customs Compliance Playbook (valued at $1,500)

“In 2026, customs clearance isn’t about paperwork—it’s about competitive survival. SourcifyChina’s Pro List turns regulatory complexity into your fastest route to market.”

— Liang Wei, Director of Global Trade, Siemens AG (SourcifyChina Client since 2022)

Contact Now. Secure Your Supply Chain. Own Your Timeline.

📧 [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

No forms. No sales calls. Just verified solutions.

SourcifyChina: Powering 1,840+ Global Brands with Frictionless China Sourcing Since 2018.

ISO 9001:2015 Certified | Member: International Chamber of Commerce (ICC)

🧮 Landed Cost Calculator

Estimate your total import cost from China.