The global carbonless paper market is experiencing steady growth, driven by sustained demand across industries such as banking, logistics, healthcare, and government services. According to Grand View Research, the global carbonless paper market size was valued at USD 3.8 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 3.1% from 2023 to 2030. This growth is fueled by the continued reliance on multipart forms, invoices, and receipts—especially in emerging economies where digital transformation remains uneven. Additionally, Mordor Intelligence forecasts a CAGR of approximately 3.4% over the 2024–2029 period, citing increased customization needs and the resilience of paper-based documentation in regulated sectors. As demand for high-quality, tailor-made carbonless paper rises, manufacturers that offer specialized coatings, durability, and print compatibility are gaining competitive advantage. In this evolving landscape, the following eight companies have emerged as leading custom carbonless paper manufacturers, combining innovation, scale, and product diversification to meet global client requirements.

Top 8 Custom Carbonless Paper Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Custom Carbonless Forms

Domain Est. 2000

Website: carbonless.com

Key Highlights: We can create forms for you in just about any size and also allow you to use your own custom artwork or logo by simply emailing us the files….

#2 Custom Carbonless Forms

Domain Est. 2000

Website: printrunner.com

Key Highlights: In stock Rating 4.4 (242) Use carbonless forms to keep copies of important transactions and combine hundreds of sets in a pad with cardboard support. Choose from 2-part, 3-part, …

#3 NCR Forms: Custom Carbonless Forms Printing

Domain Est. 2002

Website: ncrforms.com

Key Highlights: NCR Forms specializes in custom carbonless forms, 2-5 part NCR printing paper products, and carbonless form services for businesses….

#4 Paper, Card Stock & Envelopes at The Paper Mill Store

Domain Est. 2004

Website: thepapermillstore.com

Key Highlights: Free delivery over $149 30-day returns…

#5 Custom Printing

Domain Est. 2005

Website: printit4less.com

Key Highlights: 8-day deliveryAt PrintIt4Less.com we produce professional quality multi-part, custom forms such as invoice forms, Contractor service forms, work order forms and more….

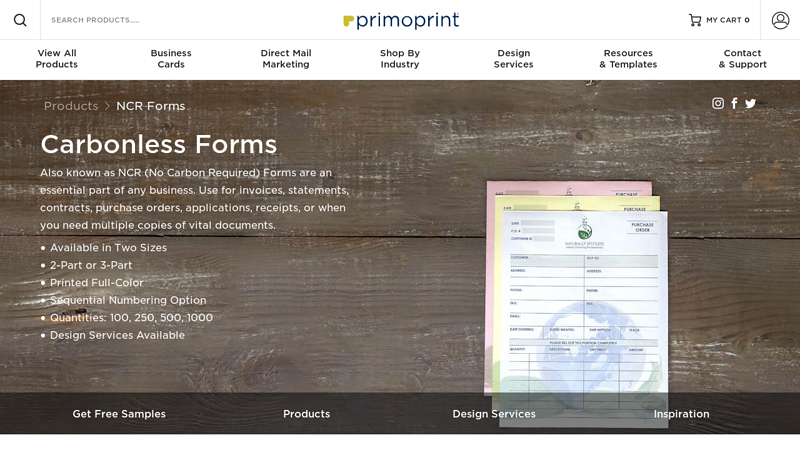

#6 NCR Forms

Domain Est. 2009

Website: primoprint.com

Key Highlights: Print high-quality, professional looking carbonless forms for your business. We offer two types: 2 Part Carbonless Paper Forms and 3 Part Carbonless NCR Forms….

#7 Custom Printed NCR Forms

Domain Est. 2009

Website: sinalite.com

Key Highlights: Suitable for writing invoices, receipts and work orders, NCR forms are the essential tool for many businesses. Also known as Carbonless Forms, our NCR Forms ……

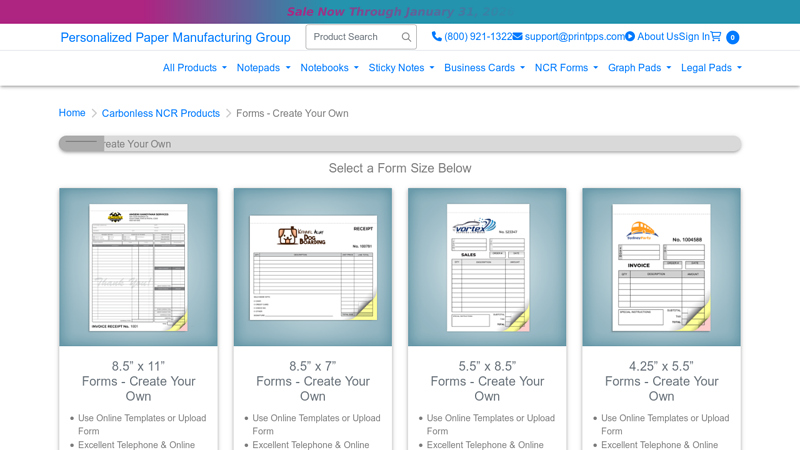

#8 Custom Carbonless NCR Forms

Domain Est. 2011

Website: printpps.com

Key Highlights: In stockCustom carbonless NCR forms by Personalized Paper Manufacturing Group in 2 or 3 part. Featuring templates for sales, invoice, statement, purchase order, ……

Expert Sourcing Insights for Custom Carbonless Paper

H2: 2026 Market Trends for Custom Carbonless Paper

As we approach 2026, the global market for custom carbonless paper is undergoing a significant transformation, shaped by technological advancements, evolving regulatory environments, and shifts in consumer demand across key industries. Despite the broader digitalization of documentation and record-keeping, custom carbonless paper continues to hold a strategic niche in several sectors due to its reliability, cost-effectiveness, and compatibility with existing workflows. This analysis explores the key market trends expected to influence the custom carbonless paper industry in 2026.

Digital Integration and Hybrid Documentation Systems

One of the dominant trends in 2026 is the integration of carbonless paper into hybrid documentation systems. While fully digital processes dominate in many sectors, industries such as logistics, field services, healthcare, and transportation still rely on physical forms for immediate processing or legal compliance. Custom carbonless paper is increasingly being designed to work in tandem with digital tools—such as mobile scanning apps and cloud-based document management systems—enabling seamless transition from paper to digital records. This hybrid model supports regulatory requirements and enhances traceability without abandoning proven paper-based workflows.

Sustainability and Eco-Friendly Innovations

Sustainability remains a major driver of change. Consumers and businesses alike are placing greater emphasis on environmentally responsible products. In response, manufacturers of custom carbonless paper are investing in chlorine-free bleaching processes, recyclable coatings, and bio-based dyes. By 2026, a growing number of suppliers are expected to offer carbonless paper made from post-consumer waste or sustainably sourced fibers, certified by recognized eco-labels such as FSC or PEFC. These developments are helping the industry counter the perception that paper-based solutions are inherently unsustainable.

Regional Market Divergence

Market dynamics for custom carbonless paper are diverging across regions. In North America and Western Europe, demand is stabilizing at a lower base due to high digital adoption, but there remains steady demand in specialized applications such as legal forms, medical records, and government documentation. In contrast, emerging markets in Southeast Asia, Africa, and Latin America are experiencing moderate growth, driven by expanding formal economies, rising infrastructure development, and slower digital transition in rural areas. These regions are expected to contribute the majority of volume growth in the custom carbonless paper market by 2026.

Customization and Niche Applications

The demand for highly customized carbonless paper solutions is on the rise. Businesses are increasingly seeking tailored formats—including specific sizes, carbon copy counts (2-part, 3-part, or 4-part), security features (e.g., watermarks, tamper-proof coatings), and branding elements (logos, colors, and sequential numbering). This trend is particularly evident in the logistics, construction, and insurance industries, where standardized forms often do not meet operational needs. Vendors are responding by offering on-demand printing and short-run customization, enabled by digital print technologies and agile supply chains.

Pricing Pressures and Raw Material Volatility

The cost structure for carbonless paper production remains sensitive to fluctuations in pulp prices, energy costs, and chemical supply chains (especially microcapsule and coating technologies). In 2026, ongoing geopolitical tensions and supply chain adjustments continue to create pricing volatility. As a result, manufacturers are focusing on operational efficiency, vertical integration, and long-term supplier contracts to mitigate risks. At the same time, price-sensitive markets are seeing increased competition from alternative low-cost suppliers, particularly in Asia.

Regulatory Compliance and Data Security

Regulatory frameworks around data privacy and document retention—such as GDPR in Europe and HIPAA in the U.S.—are influencing how carbonless paper is used and stored. While digital systems offer encryption and audit trails, physical forms still require secure handling. In response, some manufacturers are embedding security features into custom carbonless paper, such as invisible inks, time-sensitive coatings, and serialized numbering to deter fraud and support compliance. These innovations are helping maintain the legitimacy of paper-based forms in regulated environments.

Conclusion

While the long-term trajectory of the carbonless paper market is one of gradual decline due to digitization, the 2026 outlook for custom carbonless paper reveals resilience through adaptation. The industry is shifting toward higher-value, customized, and sustainable products that serve specific operational needs where digital alternatives are impractical or non-compliant. Companies that embrace innovation, sustainability, and regional market nuances are best positioned to thrive in this evolving landscape.

Common Pitfalls When Sourcing Custom Carbonless Paper (Quality, IP)

Sourcing custom carbonless paper involves specific challenges that, if overlooked, can lead to production delays, legal issues, or subpar end products. Understanding these pitfalls—particularly in quality control and intellectual property (IP) protection—is essential for businesses relying on this specialized material.

Poor Quality Control and Inconsistent Performance

One of the most frequent pitfalls is receiving carbonless paper that fails to meet required performance standards. Issues such as inconsistent chemical coating, smudging, or incomplete image transfer can render entire print runs unusable. This often stems from sourcing from manufacturers with inadequate quality assurance processes or those cutting corners to reduce costs. Variability in paper weight, moisture content, or coating thickness can also result in compatibility issues with printing equipment, leading to jams or poor print quality.

Lack of Batch-to-Batch Consistency

Carbonless paper performance is highly sensitive to formulation and manufacturing conditions. Without strict process controls, different production batches may vary significantly in reactivity and durability. This inconsistency can be especially problematic for businesses that rely on long-term supply contracts or need to maintain a uniform customer experience. Always verify that the supplier implements rigorous batch testing and traceability protocols.

Inadequate Testing for End-Use Conditions

Custom carbonless paper may be used in diverse environments—such as high humidity, extreme temperatures, or prolonged storage. Suppliers may not fully test the paper under real-world conditions, leading to premature degradation or failure. Ensure your supplier conducts environmental aging tests and provides performance data relevant to your application.

Intellectual Property Exposure

Custom carbonless paper often incorporates proprietary formulations, including unique CB (coated back), CF (coated front), or CFB (coated front and back) coatings. When working with third-party manufacturers—especially offshore—there is a risk of IP theft or unauthorized replication. Weak contractual protections, lack of confidentiality agreements, or limited control over the supply chain can expose your formulations and designs to misuse.

Insufficient Legal Protections and Contracts

Many buyers fail to secure robust contracts that explicitly define IP ownership, confidentiality obligations, and usage rights. Without clear terms, manufacturers may claim partial ownership or reuse your designs for other clients. Always include IP assignment clauses and non-disclosure agreements (NDAs) before sharing technical specifications.

Supply Chain Opacity and Subcontracting Risks

Some suppliers outsource production to unvetted subcontractors without informing the client. This not only increases the risk of quality issues but also dilutes IP protection, as your formula may be exposed to multiple unknown parties. Demand transparency in the supply chain and audit rights if possible.

Regulatory and Environmental Non-Compliance

Carbonless paper contains chemicals such as leuco dyes and developers, some of which may be subject to environmental or safety regulations (e.g., REACH, Prop 65). Sourcing from non-compliant suppliers can result in legal liabilities or import restrictions. Confirm that your supplier adheres to relevant regulations and can provide safety data sheets (SDS) and compliance certifications.

Avoiding these pitfalls requires thorough due diligence, clear contractual terms, and ongoing quality monitoring. Partnering with reputable, transparent suppliers who prioritize both quality and IP protection is key to a successful sourcing strategy for custom carbonless paper.

Logistics & Compliance Guide for Custom Carbonless Paper

Custom carbonless paper is widely used in industries requiring multi-part forms, such as logistics, manufacturing, and healthcare. Ensuring efficient logistics and adherence to compliance standards is critical to avoid delays, legal issues, and environmental impact. This guide outlines key considerations for handling, transporting, and complying with regulations related to custom carbonless paper.

Product Handling and Storage

Proper storage of carbonless paper helps maintain its quality and functionality:

- Environmental Conditions: Store in a cool, dry place with temperatures between 15–25°C (59–77°F) and relative humidity of 40–60%. Excessive heat or moisture can cause premature marking or degradation of the coating.

- Light Exposure: Minimize exposure to direct sunlight or UV light, which may activate the chemical coating and lead to ghost images.

- Stacking and Packaging: Keep paper flat and protected in original packaging to prevent curling, creasing, or contamination. Avoid placing heavy items on top to prevent pressure marks.

Transportation and Shipping

Efficient logistics practices ensure carbonless paper arrives undamaged and ready for use:

- Packaging Standards: Use sturdy, moisture-resistant packaging. Wrap pallets with stretch film and consider using edge protectors to prevent damage during transit.

- Climate Control: For long-distance or international shipments, use climate-controlled transport to avoid exposure to extreme temperatures or humidity.

- Labeling: Clearly label packages as “Fragile” and “Keep Dry.” Include handling instructions to prevent pressure damage, especially for coated surfaces.

- Stacking in Transit: Avoid over-stacking. Follow manufacturer stacking limits to prevent compression of bottom layers.

Regulatory Compliance

Custom carbonless paper may be subject to various environmental and safety regulations depending on its formulation and destination:

- Chemical Compliance (REACH, RoHS):

- Ensure the carbonless coating complies with REACH (EU) and RoHS regulations, particularly regarding bisphenol A (BPA) and other phenolic compounds.

- Provide Safety Data Sheets (SDS) to customers upon request, detailing chemical composition and handling precautions.

- BPA/BPS Restrictions:

- Many regions restrict or require labeling of BPA and BPS in thermal and carbonless papers. Verify that your product uses compliant alternatives if intended for sensitive applications (e.g., medical or food-related forms).

- Environmental Regulations:

- Comply with local waste disposal and recycling regulations. Carbonless paper may require special handling due to chemical coatings—do not mix with standard waste paper streams without verification.

- Consider offering take-back programs or guidance for environmentally responsible disposal.

International Trade Considerations

When exporting custom carbonless paper, additional compliance steps are essential:

- Customs Documentation: Prepare accurate commercial invoices, packing lists, and certificates of origin. Include product specifications and chemical compliance statements.

- Import Restrictions: Research destination country regulations—some nations have strict rules on phenolic compounds or coated papers.

- Tariff Classifications: Use the correct HS Code (e.g., 4802.60 or 4823.90, depending on form and coating) to ensure proper duty assessment.

Quality Assurance and Traceability

Maintain high standards throughout the supply chain:

- Batch Tracking: Implement a system to track production batches, including coating formulations and delivery dates, to support recalls or compliance audits.

- Customer Communication: Provide clear usage instructions and compliance information with shipments to ensure end-users remain compliant.

Summary

Effective logistics and compliance for custom carbonless paper require attention to storage conditions, transportation safety, chemical regulations, and international trade requirements. By following this guide, businesses can ensure product integrity, meet legal obligations, and support sustainable operations. Always verify local and international regulations specific to your market and stay updated on evolving chemical safety standards.

In conclusion, sourcing custom carbonless paper requires a strategic approach that balances quality, cost, customization capabilities, and supplier reliability. It is essential to partner with experienced and reputable manufacturers who can deliver consistent, high-quality multi-part forms tailored to specific business needs—whether in terms of size, color, numbering, coating type, or packaging. Evaluating suppliers based on certifications, production capacity, lead times, and environmental standards ensures long-term sustainability and compliance. Additionally, considering digital alternatives or hybrid solutions may enhance efficiency, but custom carbonless paper remains indispensable in industries requiring physical duplicate records, such as logistics, healthcare, and field services. By conducting thorough due diligence and maintaining clear communication with suppliers, businesses can secure a reliable supply of carbonless paper that supports operational efficiency and customer satisfaction.