The global circular saw market, which includes curve cutting saws, is experiencing steady growth driven by rising demand in woodworking, construction, and metal fabrication industries. According to Grand View Research, the global circular saw market size was valued at USD 3.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. This growth is fueled by advancements in cutting technology, increased automation in industrial processes, and a growing emphasis on precision and efficiency in material processing. As demand for specialized tools like curve cutting saws rises—particularly in cabinetry, furniture making, and architectural millwork—manufacturers are innovating to deliver enhanced blade control, motor performance, and cutting accuracy. In this evolving landscape, nine key players have emerged as leaders, combining engineering excellence with scalable production to dominate the curve cutting segment.

Top 9 Curve Cutting Saw Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Industrial Radius Cutting Saws

Domain Est. 1998

Website: forrestmfg.com

Key Highlights: Forrest manufactures radius cutting saws used for special applications requiring a curved saw cut which are available for a variety of applications….

#2 OX Tools USA: OX

Domain Est. 2021

Website: oxtoolsusa.com

Key Highlights: World’s most advanced cutting blades. Only the finest quality of diamond is used in the production of our products. State of the art laser technology….

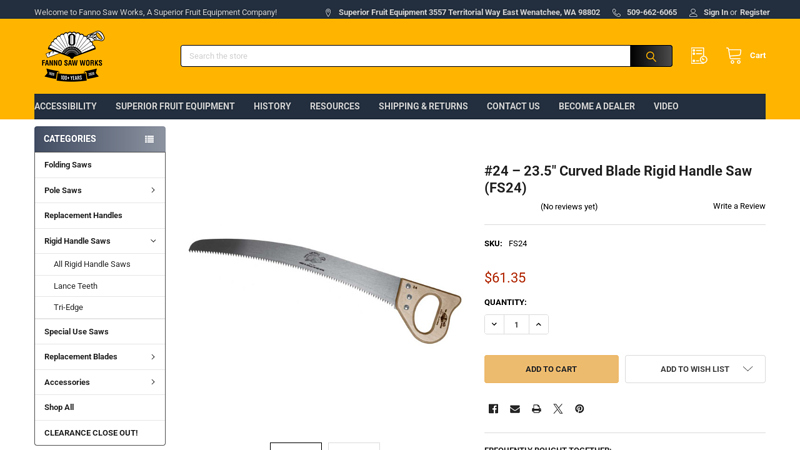

#3 Fanno #24

Domain Est. 1997

Website: fannosaw.com

Key Highlights: In stock 30-day returnsThese saws are curved, pull cutting tree saws designed for close work. The curved blade plus the self-feeding and self-cleaning tooth design make these tree …

#4 to Kreg Tool

Domain Est. 1999

Website: kregtool.com

Key Highlights: Cutting solutions that make it easy to get straight, accurate cuts. a gallery image of kreg tools and some of their kreg ……

#5 Gomboy Curve 210

Domain Est. 2000

Website: silkysaws.com

Key Highlights: In stock Free delivery over $100The Gomboy Curve is the reworked version of the classic Gomboy folding saw with a curved blade for more cutting power, especially when in a tree….

#6 Timber Wolf® blades from 1/8” to 1” for every cutting application …

Domain Est. 2004

Website: timberwolfblades.com

Key Highlights: Timber Wolf® blades from 1/8” to 2-1/8” for every cutting application; scroll cutting, curve cutting, ripping, cross-cutting, resawing, milling, metal cutting ……

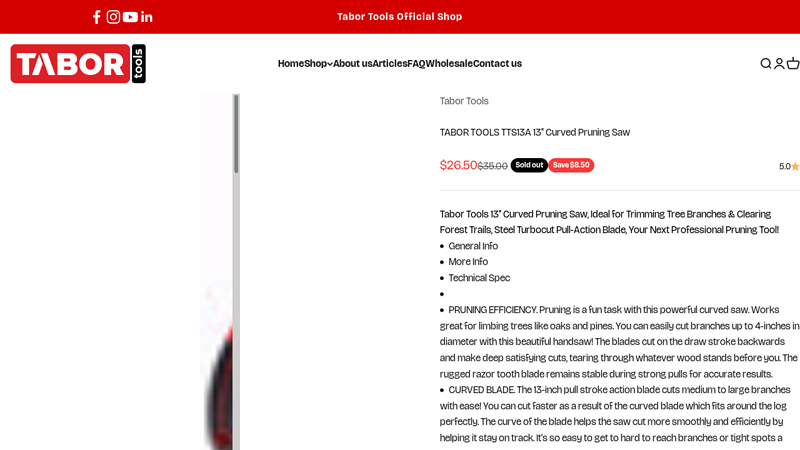

#7 TABOR TOOLS TTS13A 13″ Curved Pruning Saw

Domain Est. 2005

Website: store.tabortools.com

Key Highlights: Free delivery 30-day returnsPruning is a fun task with this powerful curved saw. Works great for limbing trees like oaks and pines. You can easily cut branches up to 4-inches in di…

#8 Curve Pruning Saws KW09

Domain Est. 2017

Website: kwcttools.com

Key Highlights: Curved single edge cuts evenly on the pull stroke. · Finished hardwood handle or ABS+TPR handle. · Filed & three side sharpened teeth for your selection….

#9 Oregon Curved 13″ Arborist Hand Saw

Domain Est. 2018

Website: arbsession.com

Key Highlights: In stock Free deliveryOregon Curved 13″ Arborist Hand Saw. $74.95. The Oregon Curved 13″ Hand Saw provides you with quick-cutting power and uncompromising performance. Developed in…

Expert Sourcing Insights for Curve Cutting Saw

H2: 2026 Market Trends for Curve Cutting Saws

The global curve cutting saw market is poised for dynamic evolution by 2026, driven by technological innovation, shifting industry demands, and increasing focus on precision and efficiency. Key trends shaping the landscape include:

1. Rising Demand in Construction and Renovation:

The surge in residential and commercial construction, particularly in emerging economies, coupled with extensive renovation projects in developed regions, is fueling demand for versatile cutting tools. Curve cutting saws, capable of making precise curved and intricate cuts in wood, drywall, plastics, and composites, are becoming essential for tasks like cabinetry, flooring, and architectural detailing.

2. Advancements in Cordless and Battery Technology:

By 2026, cordless curve cutting saws are expected to dominate the market. Improvements in lithium-ion battery technology—offering longer run times, faster charging, and lighter weight—will enhance portability and usability, especially in confined or elevated workspaces where power cords are impractical.

3. Integration of Smart Features and IoT:

Smart tools are gaining traction. By 2026, leading manufacturers are likely to incorporate features such as Bluetooth connectivity, usage tracking, performance diagnostics, and app-based customization. These capabilities will appeal to professional contractors seeking efficiency, tool management, and predictive maintenance.

4. Focus on Ergonomics and User Safety:

Increased emphasis on worker safety and comfort will drive design innovations. Expect lightweight materials, improved grip designs, reduced vibration, and enhanced dust extraction systems. Safety features like electronic brake systems and blade guards will become standard to comply with global safety regulations.

5. Growth in DIY and Home Improvement Segments:

The expanding DIY culture, accelerated by online tutorials and home improvement retail growth, will boost demand for user-friendly curve cutting saws. Entry-level models with intuitive designs and safety features will become more prevalent, targeting homeowners and hobbyists.

6. Sustainable Manufacturing and Materials:

Environmental concerns are pushing manufacturers toward sustainable practices. By 2026, expect more brands to use recycled materials in housing and packaging, reduce energy consumption in production, and offer longer product lifespans and repairability to support circular economy principles.

7. Regional Market Expansion:

Asia-Pacific, particularly China and India, will be key growth regions due to rapid urbanization and infrastructure development. North America and Europe will maintain strong demand, driven by remodeling activities and high adoption of advanced power tools.

8. Competitive Landscape and Brand Differentiation:

The market will see intensified competition among major players (e.g., Bosch, Makita, DeWalt, Festool) and emerging brands. Differentiation will come through innovation in blade technology, motor efficiency, and modular design, allowing for greater versatility across materials.

In summary, by 2026, the curve cutting saw market will be characterized by smarter, safer, and more efficient tools, driven by technological progress and evolving user needs across professional and consumer segments.

Common Pitfalls When Sourcing a Curve Cutting Saw (Quality and Intellectual Property)

Sourcing a curve cutting saw, especially from international suppliers, involves several risks related to product quality and intellectual property (IP) protection. Being aware of these pitfalls can help mitigate potential issues and ensure a reliable, legally compliant supply chain.

Poor Build Quality and Inconsistent Performance

Many low-cost suppliers offer curve cutting saws that appear functional but use substandard materials and manufacturing processes. This can result in premature wear, blade misalignment, and inconsistent cutting accuracy. Buyers may face high maintenance costs, frequent replacements, and production downtime. Always request samples, conduct factory audits, and verify compliance with industry standards (e.g., CE, ISO) to assess build quality.

Misrepresentation of Technical Specifications

Suppliers may exaggerate key performance metrics such as cutting speed, precision, motor power, or blade durability. These inaccuracies can lead to mismatched equipment that fails to meet production requirements. Conduct independent testing of samples and clarify technical details in writing before placing large orders.

Lack of After-Sales Support and Spare Parts Availability

Inadequate customer service, limited technical support, and unavailability of spare parts are common with some overseas manufacturers. This can severely impact operations when repairs are needed. Confirm the supplier’s service network, warranty terms, and spare parts logistics prior to finalizing a purchase.

Intellectual Property Infringement Risks

Some manufacturers produce curve cutting saws that copy patented designs, control systems, or proprietary technologies from established brands. Sourcing such products—even unknowingly—can expose your company to legal liability, customs seizures, and reputational damage. Perform due diligence by reviewing patents in relevant jurisdictions and requiring suppliers to certify that their products do not infringe on third-party IP.

Use of Counterfeit or Unauthorized Components

Low-cost saws may include counterfeit motors, bearings, or electronics that fail prematurely or pose safety hazards. These components can void warranties and compromise overall machine reliability. Request documentation on critical component suppliers and consider third-party inspections to verify authenticity.

Insufficient Compliance with Safety Standards

Non-compliant saws may lack essential safety features such as emergency stops, proper guarding, or dust extraction interfaces. This not only increases workplace risks but may also result in regulatory fines or import denials. Ensure the product meets safety standards applicable in your market (e.g., OSHA, EN, CSA).

Hidden Costs and Unclear Contract Terms

Initial quotes may omit shipping, import duties, certifications, or customization fees. Vague contracts with poor IP clauses can also leave buyers vulnerable. Negotiate all-inclusive pricing and include clear terms on ownership of designs, confidentiality, and liability in sourcing agreements.

By proactively addressing these pitfalls—through thorough vetting, clear contracts, and independent verification—buyers can secure high-quality, IP-compliant curve cutting saws that support long-term operational success.

Logistics & Compliance Guide for Curve Cutting Saw

Product Classification and Documentation

Ensure accurate product classification using the Harmonized System (HS) code, typically under Chapter 84 (Nuclear Reactors, Boilers, Machinery). Confirm the specific code (e.g., 8467.21 or 8467.89, depending on motor type and function) with local customs authorities. Maintain complete technical documentation, including user manuals, safety data sheets (SDS) if applicable, CE/UL markings, and certificates of conformity.

Packaging and Labeling Requirements

Package the curve cutting saw securely to prevent damage during transit, using shock-absorbent materials and rigid outer cartons. Clearly label each package with product name, model number, weight, dimensions, HS code, country of origin, and handling instructions (e.g., “Fragile,” “This Side Up”). Include compliance labels such as CE (for EU), UKCA (for UK), or UL (for USA) directly on the product and packaging as required.

International Shipping and Handling

Use freight carriers experienced in handling industrial tools and machinery. For air freight, comply with IATA regulations regarding lithium batteries or flammable components if applicable. For sea freight, follow IMDG Code standards if hazardous components are present. Ensure proper palletization and securing of loads to prevent shifting during transport.

Import/Export Regulations

Verify export controls based on the saw’s technical specifications—some high-precision or motorized tools may be subject to dual-use regulations (e.g., EU Dual-Use Regulation or U.S. EAR). Obtain necessary export licenses if required. For imports, confirm duty rates, import taxes, and any restrictions in the destination country. Use a licensed customs broker to facilitate clearance.

Regulatory Compliance

Ensure the curve cutting saw meets regional safety and electromagnetic compatibility (EMC) standards:

– European Union: Comply with Machinery Directive (2006/42/EC), Low Voltage Directive (2014/35/EU), and EMC Directive (2014/30/EU). Issue an EU Declaration of Conformity and affix CE marking.

– United States: Meet OSHA and ANSI safety standards; obtain UL or ETL listing if applicable. FCC compliance required if the saw includes electronic controls emitting radio frequencies.

– Canada: Comply with CSA standards and obtain certification through organizations like CSA Group or cUL.

– Other Regions: Check local requirements (e.g., PSE in Japan, KC in South Korea, RoHS in China).

Environmental and Safety Compliance

Adhere to environmental regulations such as RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) in applicable markets. Provide safety warnings and operational instructions in the local language(s) of the destination country. Include information on proper disposal and recycling of the tool and packaging.

Warranty and After-Sales Support

Establish logistics for warranty claims and spare parts distribution. Ensure compliance with local consumer protection laws regarding warranty duration, repair rights, and return policies. Maintain records of product serial numbers and shipping destinations for traceability and recall preparedness.

Record Keeping and Audits

Retain all compliance documentation, shipping records, and certificates for a minimum of 10 years (as required in the EU for machinery). Conduct regular internal audits to verify ongoing compliance with logistics and regulatory standards across all markets.

Conclusion for Sourcing a Curve Cutting Saw

After a thorough evaluation of market options, technical requirements, and supplier capabilities, sourcing a curve cutting saw should be guided by specific operational needs, material types, precision requirements, and long-term cost considerations. It is evident that selecting the right curve cutting saw involves balancing performance, durability, automation features, and after-sales support.

Key factors such as cutting accuracy, blade compatibility, speed control, and ease of integration into existing production lines play a crucial role in maximizing efficiency and minimizing downtime. Additionally, suppliers offering strong warranties, technical training, and readily available spare parts contribute significantly to sustainable operations.

Based on this analysis, we recommend procuring curve cutting saws from reputable manufacturers with proven track records in delivering reliable, high-precision equipment tailored to specific industry applications—such as woodworking, metal fabrication, or composite material processing. Prioritizing suppliers who provide customization options and responsive customer service will ensure optimal performance and return on investment.

In conclusion, a strategic and criteria-based sourcing approach will enable the acquisition of a curve cutting saw that enhances productivity, supports quality standards, and aligns with long-term operational goals.