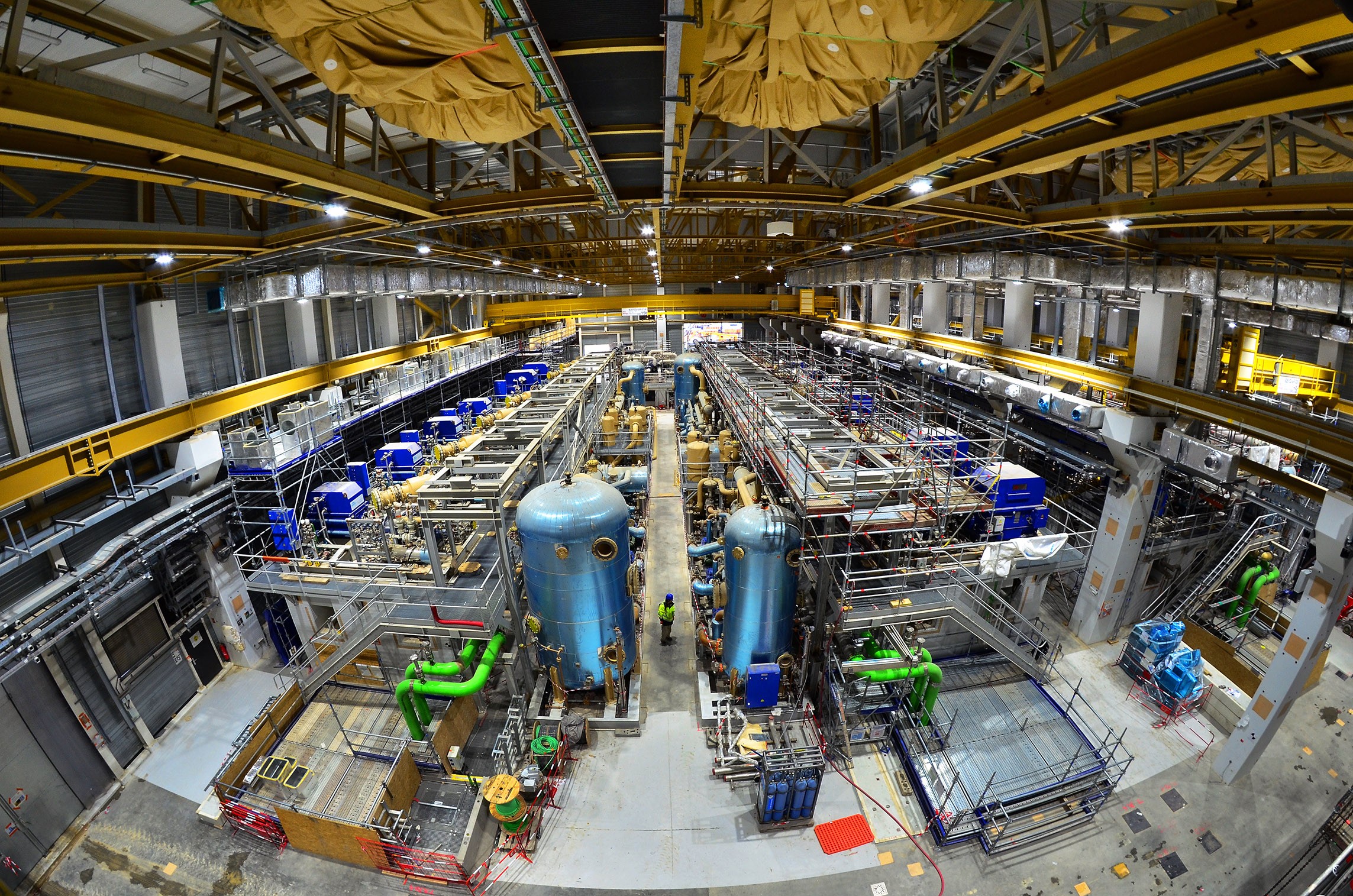

The global cryogenic pump market is experiencing robust growth, driven by rising demand for advanced cooling solutions in healthcare, aerospace, and energy sectors. According to a 2023 report by Mordor Intelligence, the market was valued at USD 5.6 billion in 2022 and is projected to grow at a CAGR of 6.8% through 2028, reaching an estimated value of USD 8.3 billion. This expansion is fueled by increasing applications in MRI systems, semiconductor manufacturing, and the storage and transportation of liquefied gases. Additionally, advancements in vacuum technology and the development of more energy-efficient cryopumps are further accelerating adoption. In this competitive and evolving landscape, manufacturers are pushing innovation to enhance reliability, reduce operational costs, and improve performance under extreme conditions. With market dynamics shifting rapidly, identifying the leading players becomes crucial for stakeholders across industries. Based on market share, technological capabilities, and global reach, the following ten companies represent the forefront of cryotherapy pump manufacturing in 2024.

Top 10 Cryotherapy Pump Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 SHI Cryogenics Group

Domain Est. 2003

Website: shicryogenics.com

Key Highlights: The SHI Cryogenics Group has been a leading designer and manufacturer of quality cryogenic equipment for over half a century….

#2 CRYOSTAR industrial cryogenics

Domain Est. 1994

Website: cryostar.com

Key Highlights: For more than four decades Cryostar has specialized in designing and manufacturing cryogenic equipment….

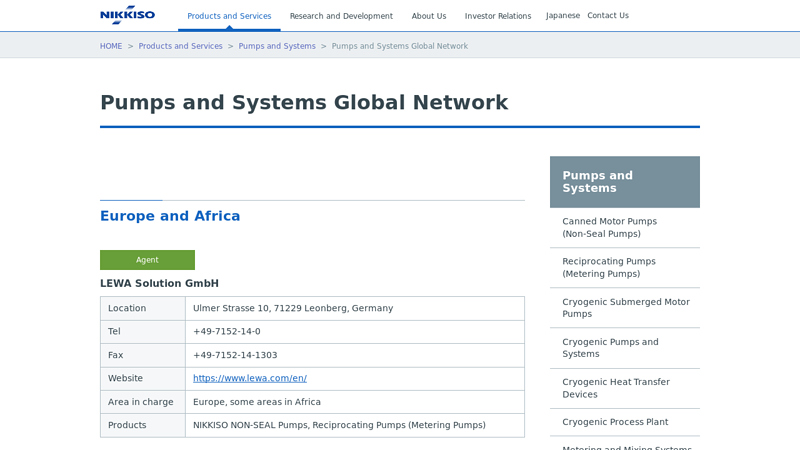

#3 Pumps and Systems Global Network

Domain Est. 1997

Website: nikkiso.com

Key Highlights: Nikkiso Cryo, Inc. ; +1-702-643-4900 · +1-702-643-0391 · https://www.nikkisoceig.com/brand/nikkiso-cryo/ · All areas except Japan · Cryogenic pumps ……

#4 Nikkiso Clean Energy & Industrial Gases Group

Domain Est. 2019

Website: nikkisoceig.com

Key Highlights: Nikkiso Clean Energy & Industrial Gases Group – Leading provider of cryogenic technologies, hydrogen fueling solutions, and industrial gas equipment….

#5 CTI

Domain Est. 2005

Website: edwardsvacuum.com

Key Highlights: Edwards CTI-Cryogenics offers a broad array of cryopumps and cryopump systems designed to deliver exceptional performance, reliability and productivity….

#6 Energy

Domain Est. 2007

Website: fivesgroup.com

Key Highlights: Fives provides brazed heat exchangers, cold boxes, core-in-drums and Cryomec® cryogenic pumps for the gas production and processing industry….

#7 Cryopump

Domain Est. 2008

Website: appliedcryogenics.com

Key Highlights: Applied Cryogenics rebuilds a broad array of cryo pump and CTI cryopump systems designed to deliver exceptional performance, reliability and productivity….

#8 CRYO-MACH Series Cryogenic Centrifugal Pumps

Domain Est. 2011

Website: psgdover.com

Key Highlights: Explore Blackmer CRYO-MACH Series cryogenic pumps engineered for oxygen, argon, and nitrogen applications….

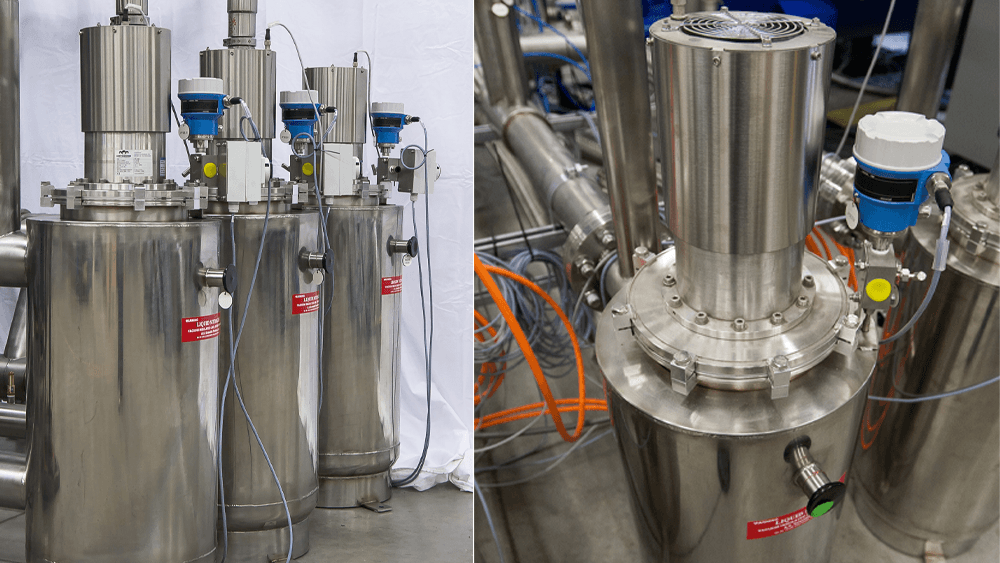

#9 Cryo pump for Both Liquid and Gaseous Cryogens

Domain Est. 2019

Website: stirlingcryogenics.com

Key Highlights: Cryo pumps are designed for circulation of a cryogenic liquid in order to transport cooling power from a cold source to and/or through a customer ……

#10 POWER/POWER ECO Series Cryo Pump

Website: anelva.canon

Key Highlights: The POWER/POWER ECO series cryopump system can be used in a wide range of applications from R & D equipment to mass production equipment by combining various ……

Expert Sourcing Insights for Cryotherapy Pump

H2: Global Cryotherapy Pump Market Trends Forecast for 2026

The global cryotherapy pump market is poised for significant growth and transformation by 2026, driven by rising demand for minimally invasive medical treatments, technological advancements, and increasing awareness of cryotherapy applications across healthcare and wellness sectors. Key market trends shaping the industry include:

-

Expansion in Medical Applications

Cryotherapy pumps—critical components in delivering controlled cryogenic fluids for tissue freezing—are seeing increased adoption in oncology (especially in cryoablation for tumors), dermatology, and sports medicine. By 2026, the integration of cryotherapy pumps in interventional radiology and outpatient clinics is expected to grow, supported by clinical validation and favorable reimbursement policies in developed economies. -

Technological Innovations

Advancements in pump precision, temperature regulation, and automation are enhancing treatment safety and efficacy. Manufacturers are focusing on developing compact, portable cryotherapy pumps with smart monitoring systems, enabling real-time feedback and remote diagnostics. These innovations are anticipated to improve user experience and expand deployment in non-hospital settings. -

Rise of Wellness and Aesthetic Cryotherapy

Beyond clinical use, the demand for whole-body and localized cryotherapy in wellness centers, fitness facilities, and aesthetic clinics is accelerating. By 2026, non-medical cryotherapy applications are projected to account for a growing share of pump demand, fueled by consumer interest in recovery, anti-aging, and pain management. -

Regional Market Dynamics

North America is expected to dominate the market due to high healthcare spending, strong R&D infrastructure, and early adoption of advanced therapies. However, the Asia-Pacific region—particularly China, India, and Japan—is forecasted to register the highest CAGR, driven by expanding healthcare access, rising disposable incomes, and government support for medical technology. -

Regulatory and Safety Considerations

As the market grows, regulatory scrutiny around device safety and efficacy is intensifying. Compliance with standards such as ISO 13485 and FDA guidelines will be critical for market entry and expansion. Companies investing in clinical trials and regulatory approvals will gain a competitive edge. -

Sustainability and Energy Efficiency

Environmental concerns are prompting manufacturers to develop cryotherapy pumps with reduced helium dependency and improved energy efficiency. Innovations in closed-loop cooling systems and alternative refrigerants are expected to emerge as key differentiators.

In conclusion, the 2026 cryotherapy pump market will be characterized by technological sophistication, diversification of applications, and geographic expansion. Stakeholders who align with evolving clinical needs, regulatory frameworks, and sustainability goals are likely to capture significant market share in this dynamic landscape.

Common Pitfalls When Sourcing a Cryotherapy Pump

Sourcing a cryotherapy pump requires careful evaluation to ensure performance, safety, and compliance. Overlooking key factors can lead to equipment failure, regulatory issues, or compromised patient treatments. Below are critical pitfalls to avoid.

Quality-Related Pitfalls

Inadequate Material Compatibility

Cryotherapy pumps operate at extremely low temperatures, often handling liquid nitrogen or other cryogenic fluids. Using materials not rated for cryogenic service—such as standard stainless steel or elastomers—can lead to embrittlement, cracks, or seal failure. Always verify that wetted parts are made from cryogenically compatible materials like 316L stainless steel and specialized polymers (e.g., PTFE, PEEK).

Poor Thermal Insulation Design

Insufficient insulation increases heat ingress, leading to excessive boil-off, reduced efficiency, and potential frost formation. Pumps with poorly designed vacuum jackets or inadequate multilayer insulation (MLI) can compromise system reliability. Ensure the pump includes robust insulation and has been tested under real-world thermal loads.

Lack of Proven Reliability and Testing

Some suppliers may offer pumps without comprehensive performance validation under cryogenic conditions. Avoid vendors that cannot provide test data on flow rates, pressure stability, or mean time between failures (MTBF) at operational temperatures. Request third-party certifications or case studies from medical or industrial cryogenic applications.

Insufficient Leak Integrity

Even minute leaks in a cryogenic system can lead to performance degradation or safety hazards. Poorly assembled pumps may develop leaks at flanges, seals, or welds over time. Verify that the pump has undergone helium leak testing and meets industry standards such as ISO 15869 or ASTM E493.

Intellectual Property (IP) and Compliance Pitfalls

Use of Counterfeit or Reverse-Engineered Designs

Low-cost suppliers may offer pumps that mimic patented technologies without proper licensing. This exposes the buyer to legal liability and risks product recalls. Always verify that the pump design is original or properly licensed, and request documentation of IP ownership or freedom-to-operate (FTO) assessments.

Non-Compliance with Medical Device Regulations

If the cryotherapy pump is used in clinical settings, it may fall under medical device regulations (e.g., FDA 21 CFR Part 820, EU MDR). Sourcing a pump not designed or manufactured under a quality management system (QMS) such as ISO 13485 can prevent regulatory approval. Confirm the supplier adheres to applicable medical standards.

Missing Safety and Industry Certifications

Pumps should comply with pressure equipment directives (e.g., PED 2014/68/EU), CE marking, or ASME B31.3 for piping systems. Lack of certification increases liability and may void insurance. Require documentation of conformity with relevant safety and design codes.

Ambiguous Warranty and Support Terms

Some vendors offer limited or unclear support for IP-related repairs or spare parts. This can result in downtime or forced reverse engineering. Ensure service agreements include access to genuine parts, technical support, and protection against IP infringement claims.

By addressing these quality and IP-related pitfalls during the sourcing process, organizations can ensure reliable, compliant, and legally secure integration of cryotherapy pumps into their systems.

Logistics & Compliance Guide for Cryotherapy Pump

Overview and Purpose

This guide outlines the essential logistics and regulatory compliance requirements for the safe and legal handling, transportation, storage, and use of cryotherapy pumps. These devices are used in medical and wellness applications to deliver controlled cooling for therapeutic purposes and may involve the use of cryogenic fluids or closed-loop cooling systems. Ensuring proper logistics and adherence to compliance standards is critical for patient safety, equipment integrity, and regulatory approval.

Regulatory Classification

Cryotherapy pumps are typically classified as medical devices under regulatory frameworks such as:

– U.S. FDA (Food and Drug Administration): Regulated under 21 CFR Part 888 (Orthopedic Devices) or general medical device regulations, depending on intended use. Most cryotherapy pumps are Class II devices requiring 510(k) clearance.

– European Union (EU): Classified under the Medical Device Regulation (MDR) (EU) 2017/745. Classification typically falls under Rule 10 or 11, often as Class IIa or IIb depending on duration and invasiveness of use.

– Other Regions: Health Canada (under the Medical Devices Regulations), Australia (TGA), and other national authorities have similar classifications requiring conformity assessment and technical documentation.

Manufacturers and distributors must ensure proper classification, technical file preparation, and CE marking (for EU) or FDA listing (for U.S.).

Labeling and Documentation Requirements

All cryotherapy pumps must be accompanied by compliant labeling and documentation, including:

– Unique Device Identifier (UDI): Required in the U.S. (FDA) and EU (MDR) for traceability.

– Instructions for Use (IFU): Must be provided in the official language(s) of the destination country and include safety warnings, contraindications, and maintenance procedures.

– Declaration of Conformity (DoC): Required under EU MDR and other international standards to declare compliance with applicable regulations.

– Safety Data Sheets (SDS): If the pump uses refrigerants or cryogenic fluids (e.g., nitrogen, argon), SDS must be available per GHS standards.

Transportation and Shipping

Transport of cryotherapy pumps must comply with international and national shipping regulations:

– Non-hazardous Units: If the pump does not contain cryogenic fluids, it can be shipped as standard medical equipment using temperature-controlled logistics to prevent damage.

– Units with Cryogenic Components: If shipped with coolant or pressurized gas, they are subject to:

– IATA Dangerous Goods Regulations (DGR): For air transport of hazardous materials.

– ADR (Europe) / 49 CFR (USA): For road and rail transport of compressed or liquefied gases.

– Proper UN-certified packaging, hazard labels (e.g., Class 2.2 Non-Flammable Gas), and shipper declarations are required.

Shipping documentation must include proper classification, emergency response information, and shipper/consignee details.

Storage Conditions

Proper storage ensures device functionality and regulatory compliance:

– Temperature: Store in a dry, climate-controlled environment (typically 10°C to 30°C). Avoid freezing or excessive heat.

– Humidity: Relative humidity should be maintained below 80% to prevent condensation and corrosion.

– Positioning: Store upright and secure to prevent physical damage.

– Hazardous Fluids: If coolant cylinders are attached or stored nearby, they must be stored in a well-ventilated area, upright, and secured to prevent tipping.

Import and Export Compliance

Cross-border shipment requires adherence to trade and medical device regulations:

– Customs Classification: Use correct HS (Harmonized System) codes, typically under 9018 (Medical Instruments).

– Import Licenses: Some countries require import permits for medical devices (e.g., Saudi Arabia SFDA, India CDSCO).

– Conformity Assessment: Devices may need local authorization (e.g., ANVISA in Brazil, PMDA in Japan).

– Customs Documentation: Commercial invoice, packing list, bill of lading, and certificates of origin and conformity must be accurate and complete.

Quality and Post-Market Compliance

Ongoing compliance includes:

– ISO 13485 Certification: Required for quality management systems in medical device manufacturing and distribution.

– Post-Market Surveillance (PMS): Manufacturers must monitor device performance, report adverse events (e.g., via FDA MAUDE, EUDAMED), and conduct periodic safety updates.

– Field Safety Notices (FSNs): Issue alerts for recalls, software updates, or safety corrections as needed.

Training and Handling

Personnel involved in logistics, installation, and operation must be trained in:

– Safe handling of cryogenic materials (if applicable)

– Emergency procedures (e.g., gas leaks, frostbite)

– Device setup and calibration

– Regulatory documentation and traceability

Training records should be maintained as part of quality assurance.

Conclusion

Compliance with logistics and regulatory standards ensures the safe and effective use of cryotherapy pumps across global markets. Adherence to transportation rules, storage guidelines, labeling requirements, and post-market obligations is essential for legal distribution and patient safety. Always consult local regulations and involve regulatory experts when expanding into new regions.

Conclusion on Sourcing a Cryotherapy Pump

After thorough evaluation of technical requirements, supplier capabilities, cost considerations, and long-term operational needs, sourcing a cryotherapy pump requires a strategic balance between performance, reliability, and total cost of ownership. It is essential to partner with suppliers who demonstrate proven expertise in cryogenic systems, offer robust after-sales support, and comply with relevant industry standards (such as ISO, ASME, or CE certifications).

Key factors influencing the final decision include pump compatibility with cryogenic fluids (e.g., liquid nitrogen or argon), flow consistency, thermal efficiency, and minimal maintenance requirements. Additionally, scalability and supplier responsiveness are critical for future expansion and operational continuity.

In conclusion, the optimal sourcing strategy involves selecting a high-quality, energy-efficient cryotherapy pump from a reputable supplier with a strong service network. This ensures reliable performance, regulatory compliance, and reduced downtime—ultimately supporting safe and effective cryotherapy applications in medical, wellness, or research settings. Conducting due diligence, including supplier audits and pilot testing, will further mitigate risks and optimize long-term outcomes.