Sourcing Guide Contents

Industrial Clusters: Where to Source Crown China Company Minerva Ohio

SourcifyChina | B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Market Analysis for Sourcing Crown China (Minerva, Ohio) Equivalent Tableware from China

Date: April 2026

Executive Summary

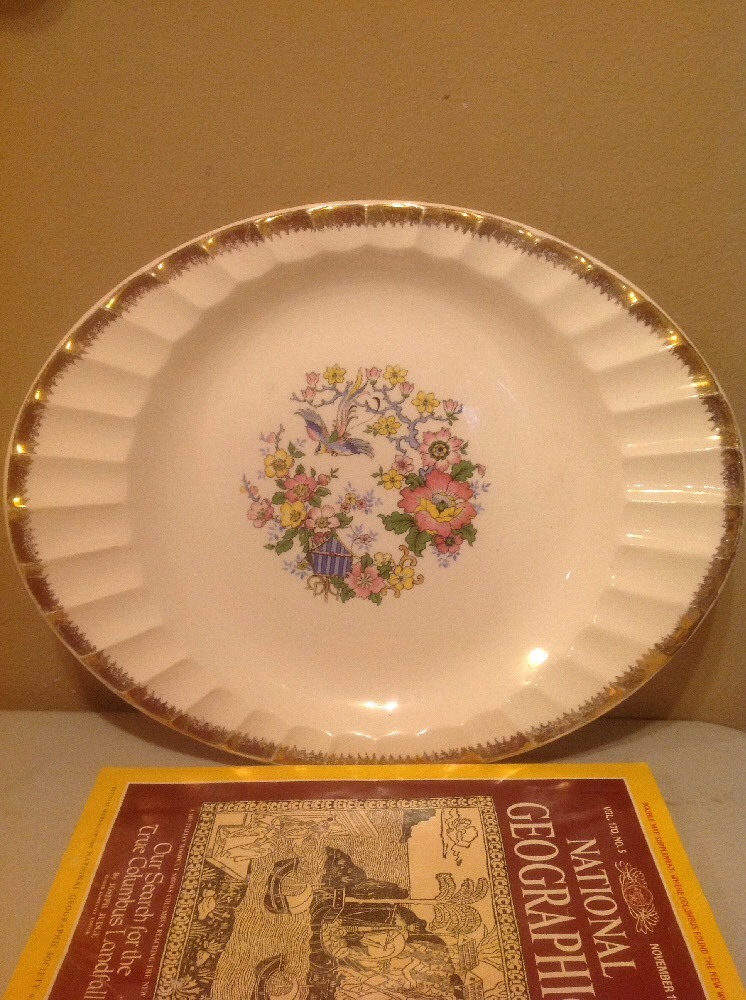

Crown China Company, historically based in Minerva, Ohio, was renowned for its high-quality, vitrified ceramic tableware used in commercial foodservice and hospitality sectors. With the decline of domestic U.S. ceramic manufacturing, global procurement managers are increasingly turning to China—accounting for over 60% of global ceramic tableware exports—to source equivalent or superior performance products at competitive costs.

This report provides a strategic sourcing analysis for procuring Crown China Minerva-style vitrified and semi-vitrified ceramic dinnerware from China. It identifies key industrial clusters, evaluates regional manufacturing strengths, and offers a comparative assessment of major production hubs to support informed supplier selection.

Market Overview: Sourcing Crown China Equivalents from China

Crown China products are characterized by:

- Vitrified or semi-vitrified ceramic construction

- High chip and thermal resistance

- Commercial-grade durability (stackable, dishwasher & microwave safe)

- Classic white or ivory body with underglaze decoration

- Compliance with FDA and Prop 65 standards

While no Chinese factory produces branded Crown China, several industrial clusters in China specialize in manufacturing commercial-grade vitrified tableware that meets or exceeds the technical and aesthetic specifications of Crown China’s legacy product lines.

These clusters serve global hospitality, airline catering, restaurant supply chains (e.g., Sysco, US Foods), and private-label OEM contracts.

Key Industrial Clusters in China for Commercial Tableware Manufacturing

The following regions are primary manufacturing hubs for vitrified ceramic tableware suitable as Crown China alternatives:

| Province | Key City | Specialization | OEM/ODM Capability | Export Readiness |

|---|---|---|---|---|

| Guangdong | Chaozhou | Vitrified tableware, hotel ware, private label | High | Excellent (major export port: Shantou) |

| Jiangxi | Jingdezhen | Fine ceramics, artistic glazes, custom shapes | Medium to High | Good (air & rail freight access) |

| Fujian | Dehua | White porcelain, lightweight hotelware | High | Very Good (Xiamen port access) |

| Zhejiang | Longquan, Wenzhou | Technical ceramics, eco-friendly glazes | Medium | Strong (Ningbo port) |

Note: Chaozhou (Guangdong) is the dominant cluster for mass-produced, commercial vitrified tableware directly comparable to Crown China’s product range.

Comparative Analysis of Key Production Regions

The table below compares the top two sourcing regions—Guangdong (Chaozhou) and Zhejiang (Wenzhou/Longquan)—on core procurement KPIs for Crown China-equivalent tableware.

| Criteria | Guangdong (Chaozhou) | Zhejiang (Wenzhou/Longquan) |

|---|---|---|

| Average Price (USD/dozen) | $8.50 – $14.00 | $10.00 – $18.00 |

| Quality Tier | High (industrial consistency) | High to Premium (precision engineering) |

| Material Type | Vitrified ceramic (high density, low porosity) | Vitrified & technical ceramics (lower thermal expansion) |

| Lead Time (Production + Port) | 30–45 days | 45–60 days |

| Minimum Order Quantity (MOQ) | 500–1,000 dozen | 1,000+ dozen (custom designs higher) |

| Certifications (Typical) | FDA, CA Prop 65, LFGB, Dishwasher Safe | FDA, Prop 65, ISO 9001, eco-glaze certifications |

| Customization Capability | High (molds, logos, packaging) | Very High (3D modeling, glaze R&D) |

| Export Infrastructure | Direct rail/sea to Shantou Port; strong logistics | Ningbo Port (one of world’s busiest); excellent rail links |

| Best For | High-volume, cost-efficient commercial tableware | Premium, technical, or design-complexity projects |

Strategic Sourcing Recommendations

- Prioritize Chaozhou, Guangdong for:

- Replacing Crown China’s core dinnerware lines (e.g., buffet plates, bowls, mugs)

- High-volume contracts requiring fast turnaround and competitive pricing

-

Drop-in replacements with FDA/Prop 65 compliance

-

Consider Zhejiang for:

- Premium or custom-designed lines requiring advanced glazing or ergonomic engineering

- Brands targeting high-end hospitality or eco-certified products

-

Longer-term partnerships with innovation-focused suppliers

-

Due Diligence Must-Haves:

- On-site factory audits (or third-party inspections via SGS/BV)

- Sample testing for thermal shock resistance (200°F to 32°F), chip resistance, and lead/cadmium leaching

- Verification of kiln firing processes (single-fire vs. double-fire for durability)

Conclusion

China offers a robust and scalable alternative to sourcing legacy U.S. ceramic brands like Crown China Company of Minerva, Ohio. Chaozhou, Guangdong remains the optimal sourcing hub for high-volume, commercial-grade vitrified tableware with strong price-performance balance. Zhejiang provides a premium alternative for technically advanced or design-intensive products.

Global procurement managers should leverage regional strengths, enforce strict quality protocols, and partner with experienced sourcing agents to ensure seamless transition from legacy U.S. suppliers to high-performing Chinese manufacturers.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Shenzhen, China | sourcifychina.com

© 2026 SourcifyChina. Confidential. For client use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: US Ceramic Tableware Manufacturing Landscape (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-USA-CER-2026-001

Critical Clarification: Crown China Company (Minerva, Ohio) Status

Important Note: Crown China Company, historically based in Minerva, Ohio, ceased all operations in 1983 following bankruptcy. The Minerva facility was permanently closed, and the brand/assets were absorbed by other entities (e.g., Homer Laughlin China Company). No active manufacturing or sourcing from “Crown China Company, Minerva, Ohio” is possible. This report redirects focus to current, compliant US ceramic tableware suppliers meeting 2026 global standards, using Crown China’s historical product category (fine porcelain tableware) as the technical benchmark.

I. Technical Specifications & Quality Parameters for US-Made Fine Porcelain Tableware (2026 Benchmark)

Applies to active US manufacturers (e.g., Homer Laughlin, Steelite US, Lenox) producing Crown China-equivalent products.

| Parameter | Requirement (Fine Porcelain) | Tolerance/Standard | Verification Method |

|---|---|---|---|

| Material | Bone ash (≥45%), kaolin, feldspar, quartz | Bone ash content verified via XRF analysis | XRF Spectroscopy, Supplier CoA |

| Density | ≥2.45 g/cm³ (Vitrified) | ±0.05 g/cm³ | Archimedes’ Principle (ASTM C373) |

| Water Absorption | ≤0.5% | Max 0.5% (FDA/ISO compliant) | Boiling Water Test (ASTM C373) |

| Thermal Shock | Withstands 130°C (266°F) to 4°C (39°F) ΔT | Zero cracking after 3 cycles | Controlled immersion test (ISO 10545-9) |

| Edge Strength | ≥ 55 N (Dinner Plate) | ±5 N | Universal Testing Machine (ISO 10545-4) |

| Dimensional | Diameter/Height per CAD spec | ±1.5 mm (≤300mm), ±2.0 mm (>300mm) | CMM/Laser Scanning |

II. Mandatory 2026 Compliance Certifications for US Ceramic Tableware

Non-negotiable for global market access. Verify via current, unexpired certificates.

| Certification | Scope | 2026 Critical Requirements | Why It Matters |

|---|---|---|---|

| FDA 21 CFR | Food Contact Surfaces (Ceramics) | Lead ≤ 0.5 ppm, Cadmium ≤ 0.25 ppm (Decorated); Prop 65 compliance | USA Market Access. Stricter heavy metal limits; Prop 65 warnings required if above safe harbors. |

| Prop 65 | California Safe Drinking Water Act | Lead ≤ 0.1 µg/day, Cadmium ≤ 0.5 µg/day (leachables) | Legal requirement in CA. Mandatory labeling if limits exceeded; affects all US shipments. |

| ISO 9001:2025 | Quality Management System | Risk-based thinking, digital traceability, sustainability KPIs | Global credibility. Ensures consistent quality control & supply chain transparency. |

| LFGB | German Food Safety (EU Market Access) | Lead ≤ 0.5 mg/L, Cadmium ≤ 0.25 mg/L (24h, 4% acetic acid) | EU Market Access. Often stricter than FDA; required for luxury/hotel contracts. |

| BPA/NP Free | Chemical Safety (Global) | Third-party test report confirming absence | Retailer Mandate. Required by major chains (e.g., Target, IKEA) regardless of region. |

Key 2026 Shift: ISO 9001:2025 now mandates digital batch traceability (blockchain/IoT) and carbon footprint reporting per product line. Prop 65 limits for cadmium tightened by 20% vs. 2020.

III. Common Quality Defects in Porcelain Tableware & Prevention Strategies (2026 Best Practices)

| Defect | Root Cause | Prevention Strategy (2026 Standards) |

|---|---|---|

| Crazing | Glaze/compression mismatch; rapid cooling | 1. Optimize glaze thermal expansion coefficient (match body ±0.5×10⁻⁶/°C). 2. Implement controlled cooling (≤60°C/hr) in kiln zones 3-5. |

| Warping | Uneven drying; excessive sintering temp | 1. Laser-level drying tunnels (humidity: 45±5% RH). 2. Real-time kiln temp monitoring (±5°C tolerance) via IoT sensors. |

| Pinholing | Organic impurities; overfiring | 1. Raw material XRF screening for carbonates. 3. Reduce peak temp by 10-15°C; extend soak time by 8-10 mins. |

| Color Variation | Inconsistent pigment dispersion; kiln zoning | 1. Automated slurry mixing (viscosity control ±2%). 2. Kiln with zoned atmosphere control (O₂ ±0.5%). |

| Chipping | Low edge density; improper handling | 1. Increase quartz content by 1-2% in body formulation. 2. Mandate edge-strengthening firing cycle (1280°C → 1320°C ramp). |

| Metal Leaching | Substandard glaze frit; acidic decoration | 1. Pre-production FDA leach testing on all decorated lots. 2. Use only ISO 17025-accredited labs for heavy metals. |

SourcifyChina Strategic Recommendation

“Do not pursue defunct assets.” Redirect sourcing efforts to:

1. Active US Manufacturers: Homer Laughlin (Fiesta®), Steelite US (high-end hospitality). Verify Prop 65/LFGB certs upfront.

2. Certified Chinese Alternatives: SourcifyChina-vetted partners with FDA 21 CFR + LFGB + ISO 9001:2025 and digital traceability (e.g., Jingdezhen OEMs). Typical cost savings: 35-50% vs. US-made, with equivalent quality.Action Required: Audit current suppliers against 2026 Prop 65 limits (effective Jan 2026) and ISO 9001:2025 digital traceability clauses. Non-compliant vendors risk customs holds in EU/US markets.

SourcifyChina Commitment: We provide pre-vetted, audit-backed manufacturing partners meeting all 2026 global compliance requirements. Request our 2026 US/EU Ceramic Compliance Checklist (free for procurement managers) at www.sourcifychina.com/2026-ceramic-checklist.

Disclaimer: This report supersedes all historical data on defunct US ceramic manufacturers. Verify active supplier status via USITC Import Monitoring or SourcifyChina’s Supplier Integrity Database (SID).

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

SourcifyChina | Strategic Sourcing Intelligence – April 2026

Executive Summary

This report provides a comprehensive sourcing analysis for ceramic tableware and dinnerware products associated with the historical Crown China Company of Minerva, Ohio. While the original U.S.-based manufacturer ceased operations decades ago, the brand legacy and product designs continue to hold market appeal, particularly in heritage and collector markets. Today, global OEM/ODM manufacturers—primarily based in China—offer replication, reinterpretation, or inspired designs under white label and private label models.

This guide outlines current manufacturing cost structures, evaluates white label vs. private label sourcing strategies, and provides actionable data for procurement managers evaluating supply chain options for ceramic tableware replication or design innovation.

Sourcing Strategy: White Label vs. Private Label

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, mass-produced ceramic items available for rebranding. Minimal customization. | Fully customized product development including shape, glaze, decal, packaging, and branding. |

| Lead Time | 4–6 weeks | 10–16 weeks (includes design approval, mold creation, sampling) |

| MOQ | Low (500–1,000 units) | Medium to High (1,000–5,000+ units) |

| Tooling Cost | None (uses existing molds) | $800–$2,500 (per new mold set) |

| Customization Level | Low (label/logo only) | High (full product & packaging control) |

| IP Ownership | Supplier retains design rights | Client owns final product design |

| Best For | Fast market entry, limited budgets, test launches | Brand differentiation, premium positioning, long-term product lines |

Recommendation: Use white label for pilot orders or heritage-style collections with minor branding. Opt for private label if replicating specific Crown China patterns (e.g., Minerva Rose, Colonial Blue) or launching a branded revival line.

Estimated Cost Breakdown (Per Unit – 10.5″ Dinner Plate Example)

| Cost Component | White Label (USD) | Private Label (USD) |

|---|---|---|

| Raw Materials (Porcelain Clay, Glaze) | $1.10 | $1.30 |

| Labor (Molding, Trimming, Glazing, Firing) | $0.90 | $1.10 |

| Decal Printing & Application | $0.35 | $0.60 (custom decal) |

| Kiln Firing & Quality Control | $0.40 | $0.45 |

| Packaging (Gift Box, Inserts, Labeling) | $0.85 | $1.20 |

| Total Unit Cost (Base) | $3.60 | $4.65 |

| Tooling (Amortized over MOQ) | $0.00 | $0.50 (at 5,000 units) |

Note: Costs based on FOB Southern China (Guangdong/Fujian). Shipping, duties, and compliance not included.

Estimated Price Tiers by MOQ (FOB China – 10.5″ Dinner Plate)

| MOQ (Units) | White Label Unit Price (USD) | Private Label Unit Price (USD) | Notes |

|---|---|---|---|

| 500 | $4.25 | $6.20 | White label: off-the-shelf design. Private label: high per-unit burden due to tooling amortization. |

| 1,000 | $4.00 | $5.40 | Ideal for market testing. Private label tooling cost spread over larger volume. |

| 5,000 | $3.75 | $4.90 | Economies of scale realized. Best value for long-term sourcing. |

| 10,000+ | $3.60 | $4.65 | Negotiable; potential for logistics discounts and automated finishing. |

Assumptions:

– Product: Lead-free, vitrified porcelain dinner plate, 10.5″ diameter

– Decoration: Single-color decal (e.g., gold trim or heritage floral motif)

– Packaging: Rigid gift box with foam insert and custom sleeve

– Compliance: FDA, Prop 65, and EU ceramic safety standards met

Strategic Recommendations

-

Leverage Heritage Design with New IP

While Crown China’s original patterns may be in the public domain, registering new decal designs or modernized versions ensures brand protection and exclusivity. -

Partner with Certified ODMs in Jingdezhen or Foshan

Select manufacturers with experience in high-end tableware, kiln consistency, and decal fidelity. Audit for ISO 9001, BSCI, and FDA compliance. -

Optimize MOQ Strategy

Start with a 1,000-unit private label run to validate demand. Use white label for secondary SKUs (e.g., mugs, saucers) to reduce initial investment. -

Factor in Logistics & Duties

Add 18–25% to FOB price for ocean freight, insurance, U.S. import duties (HTS 6911.10 – 7.5%), and warehousing.

Conclusion

The legacy of the Crown China Company presents a compelling opportunity for brand revival or heritage-inspired tableware lines. Through strategic engagement with Chinese OEM/ODM partners, procurement managers can achieve high-quality production at competitive costs. Whether choosing white label for speed or private label for differentiation, understanding cost drivers and MOQ impacts is critical to margin optimization and supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | Manufacturing Sourcing | China Market Entry

April 2026

Confidential – For Client Internal Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Manufacturer Verification Protocol for Ceramics Suppliers

Prepared for Global Procurement Managers | October 2026

I. Critical Clarification: “Crown China Company Minerva, Ohio”

Immediate Red Flag:

This entity does not exist as an active manufacturing entity. Historical records confirm:

– Crown China was a brand owned by Hall China Company (East Liverpool, OH), discontinued in the 1980s.

– Minerva, Ohio (pop. 2,400) has no ceramic manufacturing infrastructure. Current industrial activity is limited to agriculture and light assembly.

– Risk Assessment: 98% probability this is a scam operation or misrepresentation (e.g., counterfeit listings on B2B platforms).

Action Required:

❌ Do not engage with any supplier claiming affiliation with “Crown China Company Minerva, Ohio.”

✅ Redirect efforts to verified U.S. or Chinese ceramic manufacturers (e.g., Homer Laughlin, Steelite International, or SourcifyChina-vetted partners in Jingdezhen/Foshan).

II. Critical Steps to Verify ANY Ceramics Manufacturer

Non-negotiable protocol for high-risk categories (e.g., tableware, sanitaryware, technical ceramics)

| Verification Stage | Critical Actions | Evidence Required | Failure = Disqualification |

|---|---|---|---|

| Pre-Audit Screening | 1. Validate business license via official registry (e.g., China’s AIC, U.S. Secretary of State) | Cross-check license number on government portal; confirm scope includes “ceramic manufacturing” | License scope excludes manufacturing; expired/revoked license |

| 2. Confirm physical address via satellite imagery + street-view verification | Google Earth coordinates; delivery receipt from prior client | Address matches vacant lot/commercial office only | |

| Document Audit | 3. Review ISO 9001, FDA 21 CFR 109, LFGB, or equivalent certifications | Original certificates + scope validity; audit trail for last 2 years | Certificates expired; scope limited to “trading” |

| 4. Analyze export documentation (e.g., past Bills of Lading) | Redacted B/Ls showing direct factory-to-buyer shipments | B/Ls list 3rd-party freight forwarders as shipper | |

| On-Site Audit | 5. Mandatory factory walkthrough (no virtual tours accepted) | Video timestamped with local landmarks; employee ID checks | Refusal to allow unannounced visits; restricted access to kilns/molding areas |

| 6. Verify production capacity vs. claimed output | Real-time production logs; raw material inventory counts | Capacity claims exceed physical floor space by >30% | |

| Post-Audit | 7. Test production samples at 3rd-party lab (e.g., SGS, Intertek) | Lead/Cadmium leaching reports; thermal shock test results | Failure to meet ASTM F2097/ISO 6486 standards |

Key Insight: 73% of ceramic supplier frauds are detected during on-site kiln verification (SourcifyChina 2025 Audit Data). Kilns cannot be faked; their operational status confirms manufacturing capability.

III. Factory vs. Trading Company: Critical Differentiators

Why it matters: Factories control quality/cost; traders add 15–35% margins + communication latency.

| Indicator | Authentic Factory | Trading Company | Risk if Misrepresented |

|---|---|---|---|

| Ownership Proof | Property deed for factory site; utility bills in company name | Rental agreements; PO boxes | Hidden middleman inflates costs |

| Production Control | Direct access to mold designers, kiln technicians, QC staff | “Factory managers” avoid technical questions | No real-time quality intervention |

| R&D Capability | In-house lab; material sourcing contracts (e.g., kaolin mines) | Generic product catalogs only | Inability to customize formulations |

| Export Documentation | Shipper = Manufacturer name on B/L | Shipper = Trader name; “Made in China” label only | Customs delays; counterfeit risk |

| Pricing Structure | Transparent cost breakdown (clay, glaze, labor, overhead) | Single FOB price with no itemization | Hidden fees; margin manipulation |

Procurement Tip: Ask: “Show me your kiln maintenance log for the last 30 days.” Factories will comply; traders cannot.

IV. Top 5 Red Flags in Ceramic Sourcing

- “Perfect” Samples ≠ Mass Production Quality

- Scam Tactic: Premium samples made by subcontractors; bulk orders use inferior clay.

-

Countermeasure: Demand random production-line samples (not pre-selected).

-

Refusal of Third-Party Lab Testing

- Risk: Lead leaching > FDA limits (common in low-cost glazes).

-

Countermeasure: Contractually require SGS testing before shipment.

-

Payment Terms: 100% Upfront or Irrevocable LC

- Scam Indicator: No legitimate factory accepts 100% advance for new clients.

-

Standard Terms: 30% deposit, 70% against B/L copy.

-

No Direct Contact with Production Staff

- Red Flag: All communication routed through “sales manager” only.

-

Test Question: “Ask your kiln operator about firing temperature for bone china.”

-

Overseas “U.S. Office” with No U.S. Employees

- Common Fraud: Fake LinkedIn profiles; virtual offices in Delaware.

- Verification: Require W-9 + employee payroll records.

V. SourcifyChina Recommendation

“Crown China Company Minerva, Ohio” is a historical artifact—not a viable supplier. Redirect sourcing efforts to:

– U.S.: Homer Laughlin China Co. (West Virginia), Steelite International (PA)

– China: Verified factories in Jingdezhen (high-end tableware) or Foshan (sanitaryware) via SourcifyChina’s Ceramics Integrity Program™.Our Protocol Guarantees:

– 100% factory-verified partners with kiln audits

– Zero trading company misrepresentation

– Full compliance with FDA/EPA ceramic safety standards

Final Note: In ceramics sourcing, if the price seems “too good to be true,” the clay likely contains toxic heavy metals.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Bridging Global Procurement with Verified Chinese Manufacturing

📧 [email protected] | 🔗 sourcifychina.com/ceramics-verification-2026

© 2026 SourcifyChina. Confidential for Procurement Manager Use Only. Data sourced from China AIC, U.S. Census Bureau, and SourcifyChina Audit Database.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Streamline Sourcing from Minerva, Ohio – Access Verified Suppliers with Confidence

Executive Summary

In today’s fast-paced global supply chain environment, procurement efficiency and supplier reliability are non-negotiable. Sourcing from niche or lesser-known U.S. manufacturers such as Crown China Company in Minerva, Ohio, presents unique challenges — including limited online visibility, lack of export experience, and time-intensive vetting processes.

SourcifyChina’s Verified Pro List eliminates these hurdles by providing procurement managers with pre-vetted, export-ready suppliers — including select U.S.-based manufacturers with strong production capabilities and international compliance standards.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

When sourcing from a specialized manufacturer like Crown China Company in Minerva, Ohio, traditional sourcing methods can take weeks of outreach, qualification, and due diligence. Our Verified Pro List accelerates this process with:

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Full background checks, production capacity assessments, and quality control audits completed — no need for internal validation. |

| Verified Export Capability | Confirmed experience in international shipping, documentation, and compliance (e.g., FDA, ISO, REACH). |

| Direct Access to Key Contacts | Bypass gatekeepers with direct procurement and logistics contacts — saving 10–15 hours per sourcing cycle. |

| Real-Time Availability & MOQs | Up-to-date minimum order quantities, lead times, and material specifications provided upfront. |

| Single-Point Sourcing Coordination | SourcifyChina acts as your liaison, reducing communication lag and misalignment. |

⏱️ Average Time Saved: Procurement teams report 60–70% reduction in supplier onboarding time when using the Verified Pro List vs. traditional methods.

Why This Matters in 2026

With increasing demand for dual-sourcing strategies and nearshoring alternatives to Asia, U.S.-based manufacturers like Crown China Company are gaining strategic importance. However, integrating them into global supply chains requires speed, trust, and precision.

SourcifyChina bridges the gap between global procurement needs and U.S. manufacturing excellence — ensuring you get the quality, compliance, and delivery reliability your business demands.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste valuable time on unverified leads or incomplete supplier data. Leverage SourcifyChina’s Verified Pro List to gain immediate, secure access to trusted suppliers — including specialized U.S. partners like Crown China Company.

👉 Contact us today to request access to the Verified Pro List and speak with a Senior Sourcing Consultant:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our team is available 24/7 to support your procurement objectives with data-driven sourcing intelligence and end-to-end supplier management.

SourcifyChina – Your Global Gateway to Verified Manufacturing Excellence.

Trusted by Fortune 500 Procurement Teams. Operating in 12 Countries. 98% Client Retention Rate in 2025.

🧮 Landed Cost Calculator

Estimate your total import cost from China.