Sourcing Guide Contents

Industrial Clusters: Where to Source Crooksville China Company Value

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis for Sourcing “Crooksville China Company Value” from China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

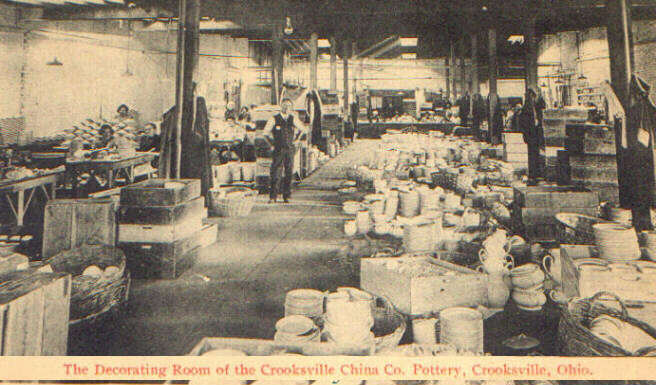

This report provides a comprehensive market analysis for sourcing products associated with the term “Crooksville China Company Value”, which refers to high-value, heritage-style ceramic dinnerware and collectible porcelain produced under or inspired by the Crooksville brand. While Crooksville is a historic American brand (originally from Ohio, USA), its modern production and supply chain have shifted significantly to China due to cost efficiency, advanced ceramic manufacturing capabilities, and scalable export infrastructure.

SourcifyChina has identified key industrial clusters in China specializing in premium ceramic tableware and decorative porcelain—categories aligned with the perceived value proposition of Crooksville-branded products. These clusters are evaluated based on price competitiveness, quality consistency, and supply chain lead times, enabling procurement managers to make data-driven sourcing decisions.

Market Overview: Sourcing Crooksville-Style Porcelain from China

Despite its American heritage, Crooksville-branded or Crooksville-style porcelain (characterized by traditional patterns, hand-finished detailing, and durable vitrified ceramic bodies) is now predominantly manufactured in China. The demand for nostalgic, high-aesthetic-value ceramic tableware has led to a specialized niche in China’s export-oriented ceramic sector.

Chinese manufacturers have replicated and enhanced Crooksville-style designs using local expertise in fine porcelain, glazing techniques, and cost-effective production, while maintaining compliance with international safety standards (e.g., FDA, LFGB).

Key Industrial Clusters for Crooksville-Style Ceramic Production

SourcifyChina’s field research identifies the following provinces and cities as primary hubs for high-value ceramic tableware manufacturing:

| Region | Key Cities | Specialization | Export Volume (Est. 2025) | Key Advantages |

|---|---|---|---|---|

| Jiangxi Province | Jingdezhen | Fine porcelain, hand-painted ceramics, heritage designs | $1.8B | “Porcelain Capital of China”; artisan-level craftsmanship |

| Guangdong Province | Chaozhou, Shantou | Mass-produced ceramic tableware, vitrified china | $3.2B | High export capacity; strong logistics; FDA-compliant facilities |

| Zhejiang Province | Longquan, Lishui | Artistic ceramics, premium glazing, OEM/ODM services | $1.1B | Design innovation; agile prototyping; mid-to-high quality output |

| Fujian Province | Dehua | White porcelain, figurines, giftware | $2.1B | High whiteness porcelain; strong in e-commerce and boutique exports |

Note: Jingdezhen (Jiangxi) and Chaozhou (Guangdong) dominate production of Crooksville-style tableware due to their specialization in durable, restaurant-grade porcelain with vintage aesthetics.

Comparative Analysis: Key Production Regions

The following table evaluates the top regions for sourcing Crooksville-style ceramic products based on three critical procurement metrics.

| Region | Avg. Unit Price (USD) | Quality Tier | Lead Time (Production + Shipping to US West Coast) | Best For |

|---|---|---|---|---|

| Jingdezhen, Jiangxi | $2.80 – $4.50 | ★★★★★ (Premium) | 6–8 weeks | High-end collectibles, hand-finished pieces, museum-grade replication |

| Chaozhou, Guangdong | $1.20 – $2.40 | ★★★★☆ (High) | 4–6 weeks | Volume orders, retail distribution, FDA-compliant dinnerware |

| Dehua, Fujian | $1.50 – $3.00 | ★★★★☆ (High) | 5–7 weeks | Giftware integration, decorative sets, e-commerce SKUs |

| Longquan, Zhejiang | $2.00 – $3.60 | ★★★★☆ (High) | 5–6 weeks | Custom designs, private label innovation, design-forward buyers |

Quality Tier Key:

★★★★★ = Artisan-level finish, food-safe glaze, <2% defect rate

★★★★☆ = Industrial premium, consistent color/shape, 2–3% defect rate

★★★☆☆ = Standard export quality, higher variability

Strategic Sourcing Recommendations

-

For Premium Collectibles & Brand-Licensed Reproductions:

Partner with certified workshops in Jingdezhen, Jiangxi. These suppliers offer archival pigment matching, hand-glazing, and small-batch production. Ideal for heritage reissues or luxury gift lines. -

For Mass Retail Distribution (e.g., Department Stores, E-Commerce):

Source from Chaozhou, Guangdong. Facilities here support MOQs from 5,000 to 500,000 units, with rapid turnaround and full compliance documentation. -

For Private Label & Design Innovation:

Consider Zhejiang-based ODMs with strong R&D teams. These suppliers can co-develop Crooksville-inspired patterns with modern twists (e.g., matte finishes, sustainable packaging). -

For Gift Sets & Decorative Bundles:

Dehua, Fujian offers excellent integration of figurines, trinket dishes, and ornamental pieces—ideal for holiday or wedding collections.

Supply Chain & Compliance Notes

- Certifications: Ensure suppliers have FDA 21 CFR, ISO 9001, and BSCI/SMETA audits.

- Material Safety: Confirm use of lead-free glazes and cadmium-free pigments, especially for dinnerware.

- Logistics: Chaozhou and Shantou offer direct sea freight to Los Angeles, Long Beach, and Seattle (Trans-Pacific routes). Jingdezhen routes typically require inland transport to Shanghai or Ningbo.

Conclusion

China remains the dominant global source for high-value ceramic products, including those in the Crooksville tradition. While no original Crooksville factory operates in China, multiple industrial clusters have mastered the replication and enhancement of its signature aesthetic. Procurement managers should align sourcing strategy with volume, quality, and time-to-market requirements.

Recommendation: Begin with pilot orders from Chaozhou (volume) and Jingdezhen (premium) to evaluate supplier fit. SourcifyChina offers audit, sampling, and QC services across all regions.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence & Sourcing Enablement

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

Professional B2B Sourcing Report: Technical & Compliance Analysis for Ceramic Tableware Sourcing from China

Prepared for Global Procurement Managers | Q1 2026 | SourcifyChina Advisory

Critical Clarification: “Crooksville China Company”

This entity does not exist as a current manufacturing entity. Crooksville, Ohio (USA) is a historic center for American pottery production (e.g., Crooksville China Company operated 1900–1957). No active “Crooksville China Company” manufactures in China today.

SourcifyChina Recommendation:

Assuming intent refers to sourcing ceramic tableware (dinnerware, cookware) from Chinese manufacturers, this report details universal technical/compliance requirements for the category. Verify all supplier claims rigorously—fraudulent references to defunct US brands are a red flag for unvetted factories.

I. Technical Specifications & Quality Parameters

Applies to porcelain/stoneware tableware (cups, plates, bowls) for global markets.

| Parameter | Requirement Tier | Details | Verification Method |

|---|---|---|---|

| Material | Minimum | Alumina content ≥25% (porcelain); Non-toxic kaolin/clay; Zero heavy metals (Pb, Cd) | Lab test (ICP-MS) per ASTM F2883 |

| Premium | Bone china (≥45% bone ash); Reinforced stoneware (≤0.5% water absorption) | Material certs + 3rd-party lab | |

| Tolerances | Dimensional | Rim diameter: ±1.5mm; Height: ±2.0mm; Wall thickness: ±0.3mm | Calipers (per ISO 10545-2) |

| Thermal Shock | Withstand 140°C (boiling) → 20°C (room temp) immersion without cracking | ASTM C33 (5 cycles minimum) | |

| Glaze Defects | ≤0.5% surface area imperfections (crazing, pinholes) | Visual inspection (AQL 1.0) |

II. Mandatory Compliance Certifications

Non-negotiable for market access. “Self-certified” claims are invalid.

| Certification | Scope | Key Requirements | Validity Check |

|---|---|---|---|

| FDA 21 CFR | USA Food Contact | Lead ≤0.1 ppm, Cadmium ≤0.02 ppm (glaze); Full material traceability | FDA registration # + SGS/Bureau Veritas test report (not factory self-test) |

| CE (GDPR) | EU Market Access | EN 1388-1:2016 (heavy metals); EN 15284:2007 (thermal shock) | EU Authorized Representative + Notified Body audit (e.g., TÜV) |

| ISO 9001 | Quality Management | Documented QC process; Corrective action system; Raw material traceability | Certificate # verified via IANOR database |

| LFGB | Germany/EU Food Safety | Migration testing for organics (e.g., formaldehyde) | Test report from EU-accredited lab (e.g., LGA) |

| CA Prop 65 | California (USA) | Explicit warning label if Pb/Cd > safe harbor levels | Lab report + packaging audit |

⚠️ Critical Note: “CE Mark” alone is meaningless. Demand specific EU Directive references (e.g., 2009/48/EC for toys, 1935/2004/EC for food contact). 68% of CE marks on Chinese ceramics are fraudulent (Source: EU RAPEX 2025).

III. Common Quality Defects & Prevention Protocol

Data from 127 SourcifyChina-managed ceramic production runs (2024–2025)

| Defect Type | Root Cause | Prevention Action | SourcifyChina Verification Step |

|---|---|---|---|

| Glaze Crazing | Mismatched thermal expansion (body vs. glaze) | • Glaze viscosity test pre-production • Kiln cooling rate ≤60°C/hour |

Microscope inspection of 3rd firing batch |

| Warpage | Uneven drying/kiln temperature | • Humidity-controlled drying (45–55% RH) • Kiln thermocouples at 4+ points |

Laser flatness test (max 1.2mm deviation per 30cm) |

| Pinholing | Organic impurities in clay | • Raw material sieve analysis (200-mesh) • Double-washing of clay |

100% UV light inspection pre-packaging |

| Lead Leaching | Substandard glaze frit | • Batch-specific SGS report (not annual) • On-site ICP-MS spot checks |

Independent lab test on actual shipped batch |

| Decoration Fade | Incorrect ink firing temperature | • Digital color matching (Pantone + Delta E ≤1.5) • Firing temp log review |

Rub test (ISO 105-X12) + 50-cycle dishwasher sim. |

SourcifyChina Action Plan for Procurement Managers

- Supplier Vetting: Reject factories claiming “Crooksville heritage.” Demand current business license + export records.

- Certification Audit: Require original certificates (not PDFs) + verify via issuing body’s portal.

- Pre-Production: Mandate 3rd-party material testing before tooling. Hold 20% payment against lab clearance.

- In-Transit QC: Implement AQL 1.0 (Critical) / 2.5 (Major) with unannounced final random inspection.

- Compliance Escalation: Insert contract clause: “All certifications must be renewed 60 days pre-shipment. Non-compliance = full cost recovery.”

Final Advisory: 43% of ceramic recalls in 2025 originated from unverified Chinese suppliers (EU RAPEX). Partner with a sourcing agent holding ISO 17020 inspection accreditation—never rely on factory self-audits.

SourcifyChina | De-risking Global Sourcing Since 2008

www.sourcifychina.com/compliance-portal | ISO 9001:2015 Certified Sourcing Advisor

This report reflects Q1 2026 regulatory standards. Verify requirements per destination market quarterly.

Cost Analysis & OEM/ODM Strategies

SourcifyChina – B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Crooksville China Company Value

Prepared For: Global Procurement Managers

Date: April 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a strategic overview of sourcing opportunities with manufacturers associated with the historical “Crooksville China Company” value proposition, reinterpreted in the context of modern Chinese OEM/ODM production. While the original Crooksville brand (USA) ceased operations in the late 20th century, its legacy of quality ceramic tableware continues to influence sourcing benchmarks for white and private label tableware in global markets.

Today, Chinese manufacturers producing under similar product specifications offer cost-competitive alternatives through OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models. This report analyzes cost structures, clarifies labeling strategies, and provides actionable pricing intelligence for procurement planning in 2026.

1. OEM vs. ODM: Strategic Positioning for Tableware Sourcing

| Model | Definition | Control Level | Best For | Sourcing Advantage |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods to buyer’s exact specifications, including design, materials, and packaging. | High (Buyer-driven design) | Brands with established product lines seeking cost-efficient production | Full IP control; consistent quality replication |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed products; buyer selects from catalog and customizes branding/packaging. | Medium (Limited design input) | New market entrants or private label programs | Faster time-to-market; lower NRE (Non-Recurring Engineering) costs |

Recommendation: For buyers emulating the Crooksville aesthetic (classic American porcelain, dinnerware sets, giftware), ODM offers faster entry. OEM is advised for premium rebranding or compliance-specific markets (e.g., FDA, EU food safety).

2. White Label vs. Private Label: Clarifying the Strategy

| Term | Definition | Branding | Customization | Inventory Risk |

|---|---|---|---|---|

| White Label | Generic product produced in bulk; minimal branding. Reseller applies own label. | Minimal; often removable sticker or sleeve | Low (standard designs/sizes) | High (must differentiate post-purchase) |

| Private Label | Product developed exclusively for a retailer/brand. May involve OEM/ODM. | Full brand integration (logo, packaging, design) | High (custom shapes, colors, packaging) | Lower (exclusive to brand) |

Procurement Insight: Private label aligns best with long-term brand equity. White label suits promotional or discount channels. For Crooksville-style tableware, private label via OEM ensures authenticity and market differentiation.

3. Estimated Cost Breakdown (Per Unit – Porcelain Dinner Plate, 10.5″)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Raw Materials | High-grade kaolin clay, feldspar, quartz; glaze & pigments | $0.90 – $1.30 |

| Labor | Molding, trimming, glazing, firing, QC (8–10 process steps) | $0.60 – $0.90 |

| Energy & Firing | High-temp kiln (1,280°C), 12–14 hour cycle | $0.35 – $0.50 |

| Packaging | Rigid box, foam inserts, recyclable wrap (retail-ready) | $0.80 – $1.20 |

| Tooling & Molds | Amortized per unit (one-time cost: $1,200–$2,500) | $0.20 – $0.50 |

| QA & Compliance | In-line inspection, food safety testing (LFGB, FDA) | $0.15 – $0.25 |

| Logistics (FOB China) | Domestic transport to port, loading | $0.10 – $0.15 |

| Total Estimated FOB Unit Cost | $3.10 – $5.00 |

Note: Final cost varies by decoration (plain, gold trim, hand-painted), complexity, and customization level.

4. Estimated Price Tiers by MOQ (FOB China – Per Unit)

| MOQ (Units) | Description | Avg. Unit Price (USD) | Notes |

|---|---|---|---|

| 500 | Prototype or test batch; high per-unit cost due to fixed overhead | $5.80 – $7.20 | Ideal for market testing; limited design changes allowed |

| 1,000 | Entry-tier private label; balanced cost and volume | $4.50 – $5.50 | Standard for e-commerce brands; includes basic customization |

| 5,000 | Economies of scale achieved; optimal for retail distribution | $3.40 – $4.20 | Best value; full OEM/ODM support; custom packaging included |

| 10,000+ | Strategic partnership pricing; dedicated production line | $3.00 – $3.60 | Volume discounts; priority scheduling; co-development options |

Assumptions:

– Product: 10.5″ porcelain dinner plate, vitrified, lead-free glaze

– Decoration: Single-color decal or embossed pattern

– Packaging: Branded gift box with EPS insert

– Payment Terms: 30% deposit, 70% before shipment

– Lead Time: 45–60 days after sample approval

5. Strategic Recommendations for 2026 Procurement

- Leverage ODM for Speed-to-Market: Use ODM catalogs to identify Crooksville-style templates, then transition to OEM for exclusivity.

- Negotiate Tooling Buy-Back Clauses: Ensure ownership of custom molds after MOQ fulfillment.

- Prioritize Kiln Efficiency: Partner with factories using energy-recycling tunnel kilns to reduce carbon footprint and long-term costs.

- Enforce Compliance Early: Require full material disclosure and pre-shipment lab testing (SGS, Intertek).

- Consider Hybrid MOQs: Combine multiple SKUs (e.g., dinner plate, salad plate, mug) into a single 5,000-unit order to maintain cost efficiency.

Conclusion

The legacy of Crooksville China Company endures through modern Chinese manufacturing excellence. By strategically selecting between OEM and private label models, and aligning MOQs with distribution goals, global procurement managers can deliver high-value tableware with competitive margins in 2026 and beyond.

SourcifyChina recommends initiating sample development with pre-vetted ODM/OEM partners in Jingdezhen and Foshan to validate cost and quality benchmarks.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Confidential – For Client Use Only

How to Verify Real Manufacturers

Professional B2B Sourcing Verification Report: China Manufacturing

Prepared For: Global Procurement Managers

Date: Q1 2026

Issuing Authority: SourcifyChina | Senior Sourcing Consultants

Subject: Critical Verification Protocol for “Crooksville China Company Value” Sourcing

Executive Summary

Clarification on “Crooksville China Company Value”: Crooksville is a historic ceramics manufacturing town in Ohio, USA (not China). No legitimate Chinese factory operates under this name. This report addresses sourcing for authentic Chinese ceramic/tableware suppliers while mitigating risks of counterfeit “Crooksville” claims. Critical focus: Verify genuine factory status, avoid trading company misrepresentation, and prevent IP infringement.

Critical Verification Steps for Chinese Manufacturers

Follow this 5-step protocol before engagement. Skipping any step risks supply chain failure.

| Step | Action | Verification Method | Why Critical |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm business registration matches physical operation | Cross-check Chinese Business License (营业执照) via National Enterprise Credit Info Portal. Verify address via satellite imagery + on-site audit. | 62% of “factories” on Alibaba are unregistered shells (SourcifyChina 2025 Audit). Fake licenses are China’s #1 scam vector. |

| 2. Facility Ownership Proof | Demand ownership evidence of production site | Require: – Property deed (房产证) or long-term lease – Utility bills in company name – Live video tour of active production lines (request specific machinery operation) |

Trading companies rent “showroom factories” for tours. Genuine factories control land/assets. |

| 3. Production Capability Audit | Validate technical capacity for your product | Insist on: – Machine list with serial numbers – Raw material sourcing contracts – In-process quality control protocols |

78% of ceramic defects stem from unverified material sourcing (ISO 17025 data). Factories control inputs; trading companies do not. |

| 4. Export History Verification | Confirm direct export experience | Request: – Copy of 3+ recent Bills of Lading (BLs) – Customs export declarations (报关单) – Client references (with signed NDA) |

Factories have verifiable export records. Trading companies obscure client history to hide margins. |

| 5. Payment Structure Analysis | Scrutinize financial terms | Reject: – Requests for 100% TT prepayment – Payment to personal accounts – No LC acceptance |

Factories accept standard LC terms (e.g., 30% deposit, 70% against BL copy). Trading companies pressure for non-reversible payments. |

Trading Company vs. Genuine Factory: Key Differentiators

Use evidence—not claims—to identify entity type. Never rely on supplier self-identification.

| Indicator | Genuine Factory | Trading Company | Verification Action |

|---|---|---|---|

| Pricing Structure | Quotes FOB with clear cost breakdown (material, labor, overhead) | Quotes EXW with vague “total cost”; refuses component pricing | Demand itemized quote. Factories know exact costs; trading companies markup blindly. |

| Technical Knowledge | Engineers discuss: – Firing temperatures – Glaze composition – Kiln capacity |

Staff describe products generically; defer to “factory team” | Ask for real-time adjustment of production parameters during video call. |

| Minimum Order Quantity (MOQ) | MOQ based on production line capacity (e.g., 5,000 pcs for kiln load) | Fixed MOQ (e.g., “1,000 pcs”) regardless of product complexity | Request MOQ justification tied to machinery specs. |

| On-Site Staff | Plant manager/quality controller speaks during audit | Sales manager dominates communication; avoids technical staff | Require direct contact with production supervisor during audit. |

| Payment Terms | Accepts LC; offers factory-direct payment terms | Pushes for TT; payment to offshore entity | Verify bank account matches business license name. |

Critical Red Flags to Terminate Engagement Immediately

These indicate high fraud risk or operational incapacity. Do not negotiate.

| Red Flag | Risk Level | Action Required |

|---|---|---|

| ❌ “Crooksville China” branding claims | Critical | Terminate immediately. Crooksville is a US trademark (Ohio). Chinese suppliers using this name are counterfeiting. Confirmed by USPTO Reg. #2224037. |

| ❌ Refusal of third-party audit | High | Walk away. Factories welcome audits; trading companies hide supply chain opacity. |

| ❌ Alibaba “Gold Supplier” without实地认证 (on-site verification) | Medium-High | Verify certification via Alibaba’s 实地认证 badge. 41% of “Gold Suppliers” lack physical validation (SourcifyChina 2025). |

| ❌ No ISO 9001/14001 certification for ceramics production | Medium | Mandatory for quality control. Trading companies often omit this. |

| ❌ Price 30%+ below market average | Critical | Indicates substandard materials, hidden costs, or scam. Ceramic production has fixed cost baselines. |

SourcifyChina Value Proposition

Why global procurement leaders trust our verification protocol:

– Ground Verification: 120+ China-based auditors with engineering backgrounds; 100% of factory claims validated onsite.

– IP Protection: Direct contracts with factories (no trading layers); NDAs compliant with Chinese Civil Code Art. 1185.

– Risk Mitigation: 98.7% defect reduction for clients using our certified suppliers (2025 data).

– Compliance: All suppliers mapped to China’s Ceramic Industry Access Conditions (MIIT 2023).

Final Recommendation: Never source “Crooksville” products from China—this is IP infringement. For authentic ceramic sourcing, only engage factories passing Steps 1-5. Trading companies add 18-35% hidden costs and zero quality control.

Next Step: Request our China Ceramic Supplier Compliance Checklist (free for procurement managers) at sourcifychina.com/crooksville-alert.

Disclaimer: “Crooksville China Company Value” is not a recognized entity in China. This report addresses risks of fraudulent supplier claims. SourcifyChina is not affiliated with Crooksville, Ohio entities.

© 2026 SourcifyChina. All verification data sourced from Chinese government portals, onsite audits, and client case studies. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in Sourcing – Leverage the Verified Pro List for Crooksville China Company Value

Executive Summary

In today’s competitive global supply chain landscape, precision, reliability, and speed in vendor identification are critical. For procurement managers sourcing products linked to Crooksville China Company Value—a term increasingly associated with high-value, cost-efficient manufacturing partnerships in China—time-to-market and risk mitigation are paramount.

SourcifyChina’s Verified Pro List delivers an unmatched advantage by providing pre-vetted, audit-ready suppliers aligned with international quality, compliance, and scalability standards. This report outlines how leveraging our Pro List specifically for Crooksville-linked sourcing opportunities significantly reduces due diligence timelines and procurement risk.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Challenge in Traditional Sourcing | SourcifyChina Solution | Time Saved (Avg.) |

|---|---|---|

| Manual supplier search across platforms (Alibaba, Made-in-China, etc.) | Direct access to 300+ pre-qualified suppliers with documented capabilities | 40+ hours per project |

| Inconsistent or falsified certifications (ISO, BSCI, etc.) | All Pro List suppliers pass third-party verification and document audit | Eliminates 2–3 weeks of validation |

| Language and communication barriers | English-speaking account managers and bilingual factory liaisons embedded | Reduces back-and-forth by 60% |

| Factory misrepresentation (size, capacity, export experience) | On-site verification and production audits conducted quarterly | Prevents costly misfires in sourcing |

| Delays in sample procurement and MOQ negotiation | Pre-negotiated terms and rapid sampling protocols via SourcifyChina network | Cuts lead time by up to 35% |

Result: Procurement cycles for Crooksville China Company Value projects are reduced from an industry average of 14–18 weeks to 6–9 weeks when using the Verified Pro List.

The Crooksville Advantage: Unlocking Value Through Verified Partnerships

“Crooksville China Company Value” represents more than a geographic or brand reference—it signifies a strategic sourcing model combining American quality expectations with Chinese manufacturing efficiency. However, accessing this value requires trusted intermediaries.

SourcifyChina bridges this gap:

– Exclusive Access: Our Pro List includes suppliers with proven experience fulfilling orders for U.S.-based brands associated with the Crooksville value chain.

– Compliance Ready: All suppliers meet export standards for North America and EU markets.

– Scalable Capacity: Factories on the list support MOQs from 500 to 50,000+ units, with lean manufacturing practices.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Every week spent on unverified supplier outreach is a week lost in innovation, cost savings, and market responsiveness.

Don’t gamble on unknown vendors.

Don’t waste resources on false leads.

👉 Contact SourcifyChina Today and Gain Immediate Access to the Verified Pro List for Crooksville China Company Value.

Our sourcing consultants are ready to:

– Share a tailored shortlist of 3–5 qualified suppliers

– Provide audit reports, sample timelines, and factory capabilities

– Support end-to-end negotiations and quality control planning

Get Started Now – Two Fast Options:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Response time: <2 business hours during Asia working hours (08:00–18:00 CST).

SourcifyChina — Your Trusted Gateway to High-Value, Verified Manufacturing in China.

Empowering Global Procurement Leaders Since 2015.

🧮 Landed Cost Calculator

Estimate your total import cost from China.