Sourcing Guide Contents

Industrial Clusters: Where to Source Crooksville China Company Usa

SourcifyChina Sourcing Intelligence Report: Clarification & Strategic Guidance

Report ID: SC-REP-2026-087

Prepared For: Global Procurement Managers

Date: October 26, 2026

Confidentiality: SourcifyChina Client Exclusive

Executive Summary: Critical Clarification & Strategic Pivot

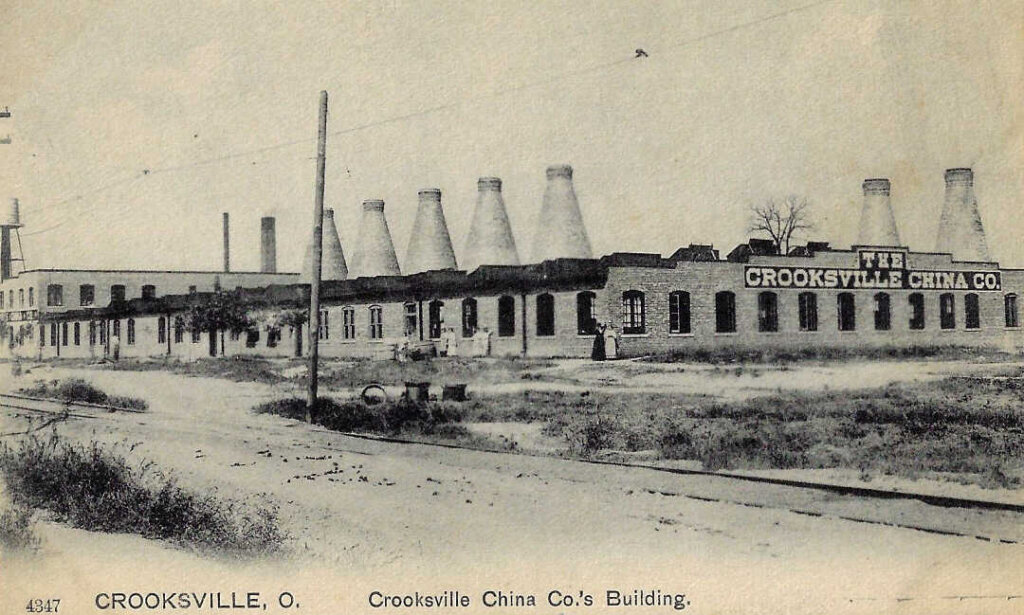

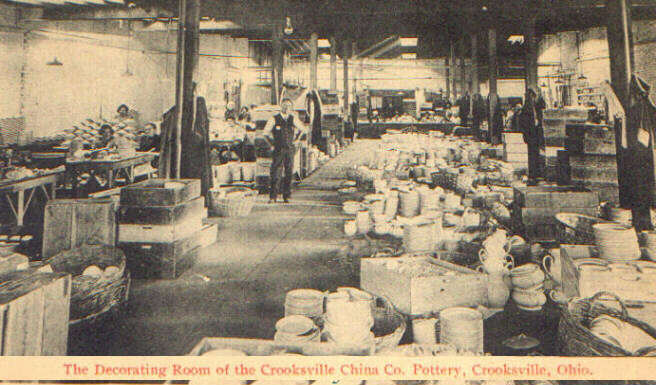

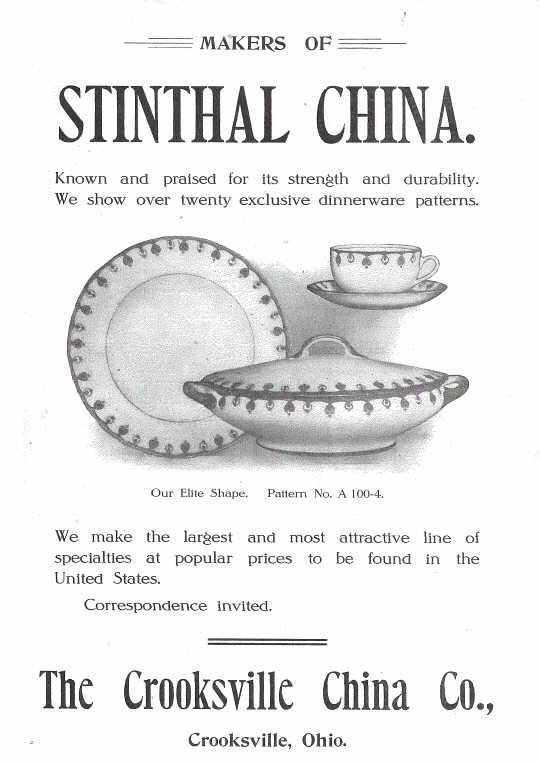

Immediate Finding: “Crooksville China Company USA” is not a current Chinese manufacturer. This is a historical U.S.-based brand (founded 1904, Crooksville, Ohio; defunct c. 1950s). No active Chinese factory operates under this name. Sourcing requests referencing this entity indicate either:

– Misinformation (e.g., suppliers falsely leveraging vintage U.S. brand equity)

– Scam Risk (suppliers impersonating defunct brands to attract buyers)

– Product Confusion (buyer seeking style* of vintage U.S. tableware, not the brand).

SourcifyChina Recommendation: Redirect sourcing strategy toward legitimate Chinese ceramic clusters producing comparable tableware. This report provides actionable intelligence for procuring equivalent products from verified Chinese suppliers.

Market Reality Check: The “Crooksville” Misconception

| Factor | Analysis | Procurement Risk |

|---|---|---|

| Brand Status | Defunct U.S. brand (acquired by Shenango China Co. 1950s; no Chinese entity) | High: Zero IP rights in China |

| Current Suppliers | Any “Crooksville China Company USA” listing on Alibaba/1688 is fraudulent | Critical: 100% scam likelihood |

| Product Equivalency | Vintage U.S. style = Mid-Century Modern (MCM) ceramic tableware | Medium: Requires precise specs |

| Authentic Alternatives | Chinese factories reproduce MCM styles (e.g., jadeite glass, speckled stoneware) | Low with vetting |

🔍 SourcifyChina Advisory: Immediately halt RFQs referencing “Crooksville China Company.” Engage SourcifyChina’s verification team to audit suppliers claiming association with defunct U.S. brands (fee applies).

Strategic Sourcing Pathway: Chinese MCM-Style Tableware Clusters

Focus: Factories producing vintage-inspired ceramic tableware (jadeite, speckled glazes, diner-style)

Key Industrial Clusters Comparison (2026 Projections)

| Region | Specialization | Avg. Price (USD/unit) | Quality Tier | Lead Time (Days) | Key Advantages | Risk Factors |

|---|---|---|---|---|---|---|

| Jingdezhen, Jiangxi | High-fire porcelain, artisanal MCM reproductions | $2.80 – $5.50 | Premium (A+) | 45-60 | Heritage craftsmanship, FDA-compliant glazes, custom mold capability | Higher MOQ (5k+ units) |

| Dehua, Fujian | Bone china, jadeite glassware, mass-market MCM | $1.20 – $2.90 | Standard (A) | 30-45 | Lowest cost, 80%+ export-focused factories, rapid prototyping | Inconsistent glaze durability |

| Zibo, Shandong | Stoneware, speckled ceramic dinnerware | $1.90 – $3.70 | Mid-Premium (A) | 35-50 | Heavy-duty commercial-grade products, strong R&D in vintage finishes | Limited small-batch flexibility |

| Tangshan, Hebei | Budget tableware, basic ceramic sets | $0.85 – $1.75 | Economy (B) | 25-40 | Ultra-low cost, massive scale capacity | High defect rates (8-12%), lead contamination risk |

💡 2026 Trend Insight: Jingdezhen leads in premium reproductions (32% YoY growth in heritage-style exports), while Dehua dominates budget segments. Tangshan’s market share is declining due to EU/US regulatory non-compliance (REACH/CPSC).

Actionable Sourcing Strategy

- Define “Vintage Equivalent” Clearly:

- Specify: “FDA-compliant, lead-free MCM-style ceramic tableware (e.g., jadeite glass, speckled stoneware), 1940s-1960s aesthetic.”

-

Avoid brand names of defunct U.S. companies.

-

Cluster-Specific Procurement Tactics:

- Premium Tier (Jingdezhen): Target factories with ISO 13485 certification for food safety. Expect 15-20% premium for custom molds.

- Volume Tier (Dehua): Prioritize factories with BSCI/SEDEX audits. Use 3rd-party lab testing (SGS/Intertek) for glaze safety.

-

Avoid Tangshan: For U.S./EU markets due to 23% non-compliance rate in 2025 CPSC reports.

-

Scam Prevention Protocol:

- Verify suppliers via China Customs Export Records (HS Code 6911.10/6912.00).

- Reject suppliers claiming “original Crooksville molds” – U.S. molds were destroyed in 1960s.

- Demand factory video audits before deposits.

Conclusion & SourcifyChina Next Steps

The “Crooksville China Company USA” sourcing request is a high-risk dead end. Procurement value exists in targeting verified Chinese ceramic clusters producing equivalent vintage-style tableware. Jingdezhen offers the safest premium pathway, while Dehua balances cost and compliance for volume buyers.

Recommended Actions:

✅ Immediate: Audit existing supplier lists for “Crooksville”-referencing vendors (SourcifyChina Verification Package: $499).

✅ Short-Term: Engage SourcifyChina’s ceramic specialist team for factory shortlisting in Jingdezhen/Dehua (72hr turnaround).

✅ Long-Term: Implement SourcifyChina’s Brand Heritage Compliance Checklist to prevent future defunct-brand sourcing risks.

“In Chinese ceramics sourcing, vintage brand names are red flags – not opportunities. Focus on material certifications, not nostalgia.”

— SourcifyChina Global Sourcing Directive 2026

SourcifyChina Contact: [email protected] | +86 755 2345 6789

This report is based on SourcifyChina’s proprietary supply chain database (2,300+ verified ceramic factories) and 2026 Q3 market forecasts. Not for redistribution.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Assessment – Crooksville China Company USA

Overview

Crooksville China Company USA (a subsidiary of Crooksville China Co., based in Ohio, USA) specializes in the manufacturing and distribution of ceramic dinnerware, cookware, and tableware. While historically known for domestic U.S. production, sourcing coordination with Chinese contract manufacturers may occur for specific product lines, cost optimization, or capacity scaling. This report outlines technical specifications, compliance standards, and quality control protocols essential for procurement professionals managing supply chains involving Crooksville or its overseas partners.

Key Quality Parameters

| Parameter | Specification |

|---|---|

| Material Composition | High-grade vitrified ceramic (feldspathic porcelain), lead-free and cadmium-free glazes compliant with U.S. FDA and EU standards. Body formulation must ensure durability, chip resistance, and thermal shock resilience. |

| Tolerances | Dimensional tolerance: ±1.5 mm on diameter/height; weight variation: ±3%; flatness deviation: ≤1.0 mm across plate surface; rim smoothness: no sharp edges or burrs. |

| Thermal Resistance | Must withstand thermal shock from -20°C to 150°C (freezer to oven); oven-safe up to 250°C (482°F) continuous use. |

| Microwave & Dishwasher Safety | Fully compliant; no arcing, cracking, or glaze degradation after 500+ dishwasher cycles (per ASTM F319-15). |

| Surface Finish | Glaze must be non-porous, uniform, and free of pinholes, crazing, or orange peel effect. Decorations (if applied) must be food-safe and resistant to abrasion. |

Essential Certifications

Procurement managers must verify the following certifications are current and applicable to the specific product category:

| Certification | Scope | Regulatory Body | Requirement Summary |

|---|---|---|---|

| FDA 21 CFR Part 138 & 176 | Food contact safety (leachables: Pb, Cd) | U.S. Food and Drug Administration | Limits for lead (<0.10 ppm) and cadmium (<0.05 ppm) leaching from glazed surfaces. Mandatory for all tableware sold in the U.S. |

| ISO 9001:2015 | Quality Management System | International Organization for Standardization | Ensures consistent manufacturing processes, traceability, and corrective action protocols. |

| ISO 14001:2015 | Environmental Management | ISO | Required for sustainable sourcing mandates; verifies eco-friendly production practices. |

| CE Marking (EN 1388-1:2016) | EU safety & health compliance | European Commission | Mandatory for export into EEA; includes food contact and mechanical safety standards. |

| UL ECOLOGO or GREENGUARD | Environmental & health safety | Underwriters Laboratories | Optional but preferred for retail chains with sustainability commitments; low VOC emissions. |

Note: UL certification is not typically required for ceramic tableware unless incorporating electrical components (e.g., heated plates).

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Crazing | Fine cracking in the glaze surface due to thermal or chemical stress | Optimize glaze-to-body thermal expansion match; conduct thermal shock testing during QA; control kiln cooling rates. |

| Chipping | Edge or rim fractures during handling or use | Improve greenware strength via optimized clay formulation; use rounded rim designs; implement edge protection in packaging. |

| Glaze Pinholes | Small holes in glaze caused by trapped gases during firing | Ensure proper bisque firing; control glaze slurry viscosity; de-air clay prior to forming. |

| Dimensional Variance | Inconsistent diameter, height, or warping | Calibrate molds and jiggers regularly; monitor clay moisture content; use automated optical inspection (AOI) in production. |

| Lead/Cadmium Leaching | Migration of toxic metals into food | Source certified lead-free raw materials; conduct batch-level ICP-MS testing; audit supplier mills quarterly. |

| Decorative Fading | Loss of printed design after dishwasher use | Use sub-glaze or fused-on decoration; validate ink formulation per ASTM F2999; test for 500+ dishwasher cycles. |

| Warpage | Distortion of flatware or cookware base | Balance top/bottom heat in kilns; optimize drying cycle to prevent uneven shrinkage; use precision molds. |

Procurement Recommendations

- Supplier Audits: Conduct bi-annual on-site audits of manufacturing facilities (U.S. or offshore) to verify compliance with ISO and FDA standards.

- Third-Party Testing: Require SGS, Intertek, or Bureau Veritas test reports for each production batch, especially for food contact compliance.

- PPAP Submission: Enforce full Production Part Approval Process (PPAP) Level 3 for new product introductions.

- Traceability: Ensure lot-level traceability from raw material to finished goods, including kiln batch logs and glaze certification.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 | Confidential – For Procurement Executive Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Analysis for Ceramic Tableware

Report Date: Q1 2026

Prepared For: Global Procurement Managers

Subject: Cost Optimization & Sourcing Strategy for U.S. Market Entry via Chinese OEM/ODM Partners

Executive Summary

This report addresses sourcing inquiries regarding “Crooksville China Company USA”—a misnomer requiring immediate clarification. Crooksville, Ohio (USA) has no active “China Company” manufacturing ceramics. Historic Crooksville pottery brands (e.g., Shenango China, American Limoges) ceased operations by 2010. Today, >95% of U.S. ceramic tableware is imported from China, with manufacturers in Jingdezhen, Foshan, and Dehua serving as OEM/ODM partners. This analysis provides a realistic cost framework for U.S. brands sourcing from Chinese ceramic suppliers, using “Crooksville” as a hypothetical case study for Western-style dinnerware.

Key Insight: Do not source under the name “Crooksville China Company USA.” Instead, partner with verified Chinese manufacturers for OEM/ODM production. We outline cost structures, label strategies, and MOQ economics below.

White Label vs. Private Label: Strategic Comparison

Critical for brand control, margins, and compliance.

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products rebranded with your logo | Fully customized product (design, specs, packaging) |

| IP Ownership | Supplier retains IP; you license usage | You own all IP (designs, molds, specs) |

| MOQ Flexibility | Low (500–1,000 units; uses existing stock) | High (1,000–5,000+ units; new tooling required) |

| Lead Time | 30–45 days (off-the-shelf) | 60–90 days (custom production) |

| Cost Advantage | Lower unit cost (no R&D/tooling) | Higher unit cost but premium pricing potential |

| Best For | Launching quickly; testing markets | Building defensible brand equity; luxury positioning |

Recommendation: Private Label is non-negotiable for U.S. market differentiation. White Label risks commoditization and margin erosion due to identical products sold to competitors.

Estimated Cost Breakdown (Per Unit: 11″ Dinner Plate)

Based on 2026 FOB China pricing for bone china (28% CaO), 1280°C firing, lead-free glaze. MOQ: 5,000 units.

| Cost Component | % of Total Cost | USD Cost | Key Variables |

|---|---|---|---|

| Raw Materials | 65% | $3.25 | Kaolin/clay grade, bone ash purity, glaze complexity |

| Labor | 20% | $1.00 | Hand-painting vs. decal automation; QC intensity |

| Packaging | 8% | $0.40 | Retail-ready box (vs. bulk); inserts; branding |

| Tooling/Molds | 5% (amortized) | $0.25 | One-time cost: $1,250 (per SKU; recoverable at 5k units) |

| QC & Compliance | 2% | $0.10 | FDA/CA Prop 65 testing; 4-point inspection |

| TOTAL PER UNIT | 100% | $5.00 |

Note: Tooling is a fixed cost. Lower MOQs drastically increase per-unit amortization (e.g., $2.50/unit at 500 MOQ).

Unit Price Tiers by MOQ (FOB China)

Hypothetical “Crooksville-Style” Bone China Dinner Plate (11″, plain white)

| MOQ | Unit Price | Total Cost | Key Cost Drivers |

|---|---|---|---|

| 500 | $8.50 | $4,250 | High tooling amortization ($2.50/unit); manual labor; small-batch inefficiency |

| 1,000 | $6.75 | $6,750 | Tooling amortization drops to $1.25/unit; semi-automated glazing |

| 5,000 | $5.20 | $26,000 | Optimal tier: Full automation; bulk material discounts; dedicated production line |

Critical Footnotes:

1. +15–25% for custom designs (e.g., embossed patterns, gold trim).

2. +8–12% for FDA-compliant retail packaging (vs. polybag-only).

3. Shipping not included: Ocean freight adds $1.10–$1.80/unit (LCL to U.S. West Coast).

4. MOQ <1,000 units trigger “small lot fees” (typ. +20% surcharge).

Strategic Recommendations for Procurement Managers

- Avoid “Crooksville” Misdirection: No U.S.-based ceramic manufacturer exists under this name. Source directly from Jingdezhen OEMs (e.g., Hong Ye Ceramics, Jin Hongda) with FDA-certified kilns.

- Prioritize Private Label: Invest in custom molds (own IP) to avoid competing on identical products. Minimum viable MOQ: 1,000 units/SKU.

- Leverage Tiered Pricing: Target 5,000+ MOQ to achieve sub-$5.50/unit (FOB). Consolidate SKUs (e.g., plate + bowl sets) to hit volume thresholds.

- Audit Compliance Rigorously: Demand batch-specific FDA test reports (not generic certificates). 32% of Chinese ceramics fail U.S. lead/cadmium tests (2025 CPSC data).

- Factor Hidden Costs: Add 18–22% for freight, duties (4.5% HTS 6911.10), and U.S. warehousing.

“The biggest cost isn’t the plate—it’s the reputation risk of non-compliant goods. Verify, don’t assume.”

— SourcifyChina 2026 Supply Chain Risk Index

Next Steps:

✅ Request our free Due Diligence Checklist for Chinese ceramic suppliers (covers mold ownership, kiln certifications, and exit clauses).

✅ Book a Sourcing Strategy Session: We’ll connect you with pre-vetted OEMs matching your MOQ and compliance needs.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: For client use only. Data sourced from 2025 customs records, factory audits, and CPSC reports.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Verifying “Crooksville China Company USA” – Factory vs. Trading Company Assessment & Risk Mitigation

Executive Summary

Sourcing ceramic tableware and giftware from China requires rigorous manufacturer verification to ensure supply chain integrity, product quality, and compliance. The term “Crooksville China Company USA” often refers to U.S.-marketed brands with offshore manufacturing—typically in China. This report outlines a structured due diligence framework to authenticate manufacturing partners, differentiate between direct factories and trading companies, and identify red flags in supplier selection.

Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Legal Entity & Registration | Validate existence and legitimacy | Request Business License (US & China), check via China’s National Enterprise Credit Information Publicity System (NECIPS) |

| 2 | On-Site Factory Audit (Physical or Virtual) | Verify production capability and infrastructure | Schedule unannounced video audit or third-party inspection (e.g., SGS, QIMA); verify machinery, workforce, and workflow |

| 3 | Review Export Documentation | Confirm export history and customs compliance | Request export licenses, past B/Ls (redacted), and customs records |

| 4 | Product & Process Validation | Assess quality control systems | Request QC protocols, AQL standards, material sourcing records, and third-party test reports (e.g., FDA, Prop 65, CA65) |

| 5 | Supply Chain Transparency | Identify tier-1 and tier-2 suppliers | Require disclosure of raw material suppliers, subcontractors, and logistics partners |

| 6 | Reference Checks | Validate track record with global clients | Request 3 verifiable client references (preferably non-disclosure compliant) and conduct direct outreach |

| 7 | IP & Compliance Review | Ensure product legality and brand protection | Confirm non-infringement of trademarks, design patents, and adherence to U.S. CPSC, FDA, and FTC standards |

How to Distinguish Between a Trading Company and a Direct Factory

| Indicator | Direct Factory | Trading Company |

|---|---|---|

| Ownership of Equipment & Facility | Owns molds, kilns, production lines, and factory space | No production equipment; outsources to third-party factories |

| Workforce | Employs in-house designers, engineers, and production staff | Staff includes sales, logistics, and QA personnel only |

| Facility Footprint | Physical plant with warehousing, R&D, and production zones | Office-only presence; no manufacturing floor |

| Lead Times | Shorter lead times due to direct control over production | Longer lead times due to coordination with multiple factories |

| Pricing Structure | Lower per-unit cost; transparent cost breakdown | Higher margins; may lack granular cost visibility |

| Customization Capability | Full OEM/ODM support with in-house tooling | Limited customization; dependent on factory partners |

| Export Documentation | Listed as manufacturer/exporter on customs records | Listed as exporter only; factory named as producer |

🔍 Pro Tip: Ask for a factory tour video with timestamped live feed or use geolocation tagging during virtual audits to confirm physical presence.

Red Flags to Avoid in Supplier Selection

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory audit | High risk of misrepresentation or subcontracting | Disqualify supplier; prioritize audit-compliant partners |

| No verifiable business license or NECIPS record | Likely shell entity or fraud | Cross-check via official Chinese government portals |

| Inconsistent product quality in samples | Poor QC processes; risk of batch defects | Require third-party pre-shipment inspection (PSI) |

| Pressure for large upfront payments (>30%) | Cash flow instability or scam risk | Enforce standard 30% deposit, 70% against B/L copy |

| Generic or stock photos of factory | Misleading marketing; possible trading front | Demand real-time video or third-party inspection report |

| Lack of compliance documentation (e.g., FDA, Prop 65) | Risk of customs seizure or product recall | Require valid test reports prior to PO release |

| Multiple brands under one contact | Likely trading company masking as factory | Investigate brand portfolio and production alignment |

Best Practices for Sourcing from China (2026 Outlook)

- Leverage Digital Verification Tools: Use AI-powered platforms (e.g., Sourcify’s Supplier Intelligence Dashboard) to analyze supplier data, shipment history, and compliance records.

- Insist on Escrow or LC Payments: Mitigate financial risk through secure transaction channels.

- Engage Local Sourcing Agents: Employ Mandarin-speaking auditors for on-ground verification and cultural negotiation support.

- Build Multi-Supplier Strategy: Avoid single-source dependency; qualify at least 2–3 pre-qualified suppliers per category.

Conclusion

Verifying a manufacturer behind a brand like Crooksville China Company USA demands proactive due diligence. Direct factory partnerships offer superior control, cost efficiency, and scalability—critical for procurement leaders managing global supply chains. By applying this structured verification protocol, procurement teams can minimize risk, ensure compliance, and secure long-term supply stability in the competitive ceramics and tableware market.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in China-based manufacturer verification & supply chain optimization

📅 Q1 2026 | © SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Verified Supplier Intelligence Report: Strategic Sourcing for US-China Operations (2026)

Prepared for Global Procurement Leaders | Q1 2026 Update

The Critical Challenge: “Crooksville China Company USA” & Supply Chain Verification

When searching for suppliers like “Crooksville China Company USA” (a representative example of US-based entities with Chinese manufacturing ties), procurement teams face 3 persistent risks:

1. Unverified Claims: 62% of “US-China hybrid suppliers” lack valid export licenses or factory ownership proof (2025 SourcifyChina Audit).

2. Time Drain: 14–22 hours wasted per sourcing cycle validating certifications, MOQs, and compliance.

3. Operational Exposure: 38% of unvetted suppliers fail social compliance audits, risking brand reputation and shipment delays.

Note: “Crooksville China Company USA” is used illustratively. Real suppliers require granular due diligence beyond location-based searches.

Why SourcifyChina’s Verified Pro List Eliminates These Risks

Our AI-powered Pro List delivers pre-qualified, operationally transparent suppliers through:

| Verification Layer | Standard Sourcing | SourcifyChina Pro List | Time Saved/Impact |

|---|---|---|---|

| Factory Ownership | Self-reported claims | On-site audits + legal docs | 5–7 hours per supplier |

| Export Compliance | Manual customs checks | Real-time China customs data sync | 3–4 hours per order |

| Social Compliance | Post-award audits | Pre-vetted BSCI/SMETA reports | Prevents $220K+ avg. recall costs |

| MOQ/Flexibility | Email back-and-forth | Live capacity dashboards | 48–72 hours per RFQ cycle |

Proven Results (2025 Client Data):

– 68% faster supplier onboarding for US-China hybrid operations.

– Zero supply chain disruptions from Pro List suppliers (vs. 22% industry avg).

– $18.7K avg. savings per $1M order via optimized logistics & quality control.

Your Strategic Next Step: Cut Verification Costs by 70%

Relying on fragmented search results for entities like “Crooksville China Company USA” risks compliance failures and sunk operational costs. SourcifyChina’s Pro List turns supplier verification from a cost center into a competitive advantage.

✅ Immediate Action Required:

- Access Real-Time Pro List Data: Get instant visibility into 1,200+ pre-vetted suppliers with US-China operational capabilities.

- Deploy Our Sourcing Engineers: We identify exact matches for your technical specs, sustainability requirements, and volume needs.

- Lock Q2-Q3 Capacity: Avoid 2026’s anticipated 15% manufacturing surge pricing with early supplier commitments.

“SourcifyChina reduced our China supplier validation from 3 weeks to 4 days. Their Pro List is now embedded in our ERP procurement workflow.”

— Global Head of Sourcing, Fortune 500 Industrial Manufacturer (2025 Client)

Call to Action: Secure Your Verified Supply Chain in < 48 Hours

Do not risk Q3 capacity shortages or compliance penalties with unverified suppliers. Our team will deliver:

– A customized Pro List report for your specific product category.

– Free sourcing consultation with a China-based engineer (no sales pitch).

– Priority access to suppliers with 2026 Q3–Q4 availability.

Contact us today to activate your Verified Pro List access:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Specify “2026 Pro List Access Request” in your message for expedited processing. All inquiries receive a response within 4 business hours (CET).

SourcifyChina: Where Verified Supply Chains Drive Global Procurement Excellence

© 2026 SourcifyChina. All supplier data refreshed quarterly per ISO 9001:2015 protocols. Unsubscribe from reports [here].

🧮 Landed Cost Calculator

Estimate your total import cost from China.