Sourcing Guide Contents

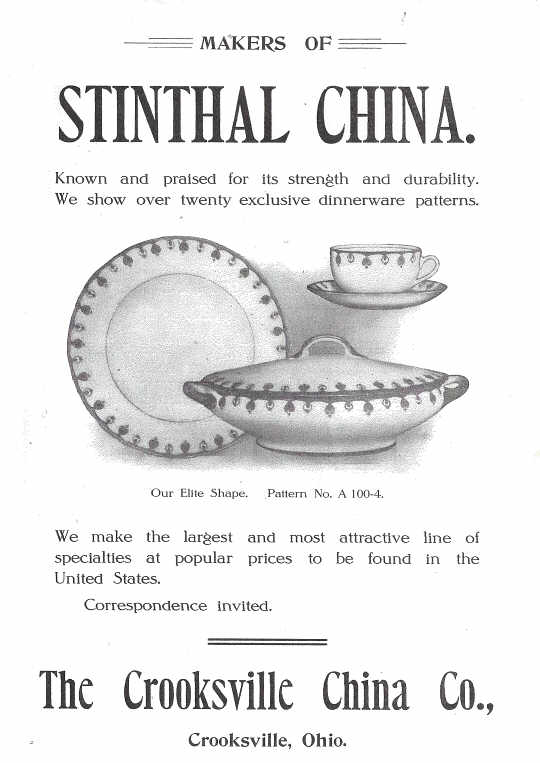

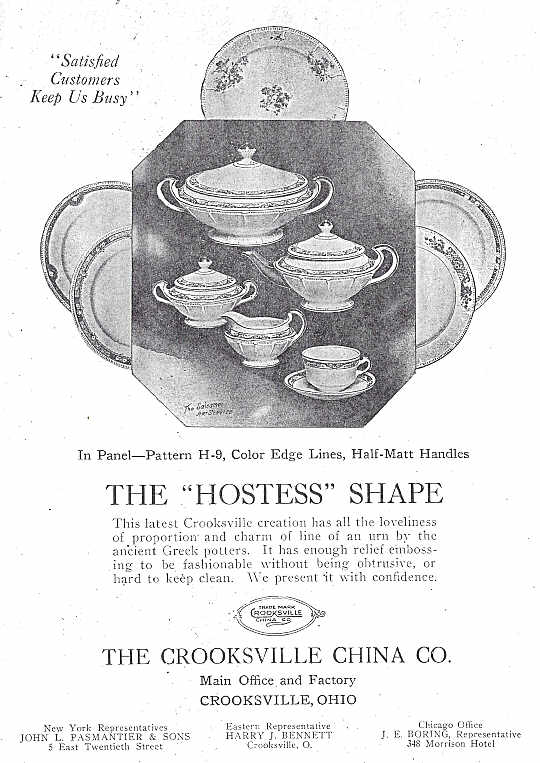

Industrial Clusters: Where to Source Crooksville China Company History

SourcifyChina Sourcing Intelligence Report: Clarification & Strategic Guidance on “Crooksville China” Sourcing (2026)

To: Global Procurement Managers

From: Senior Sourcing Consultant, SourcifyChina

Subject: Critical Clarification & Actionable Sourcing Strategy for “Crooksville China Company History” Inquiries

Date: October 26, 2026

Report ID: SC-CHN-CROOK-2026-001

Executive Summary

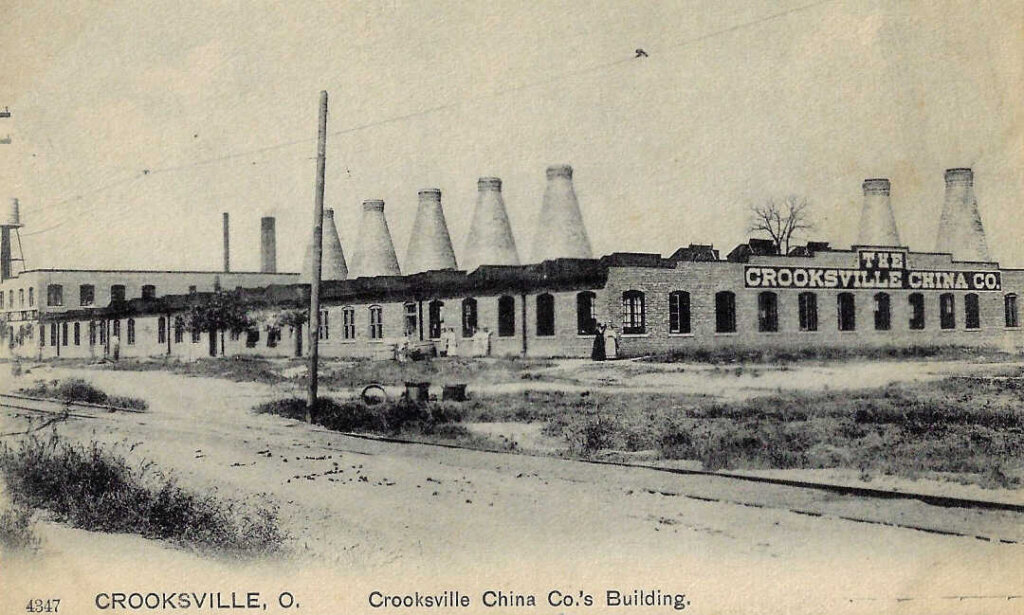

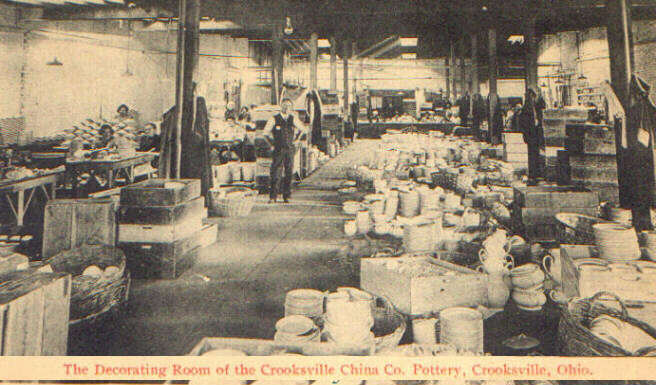

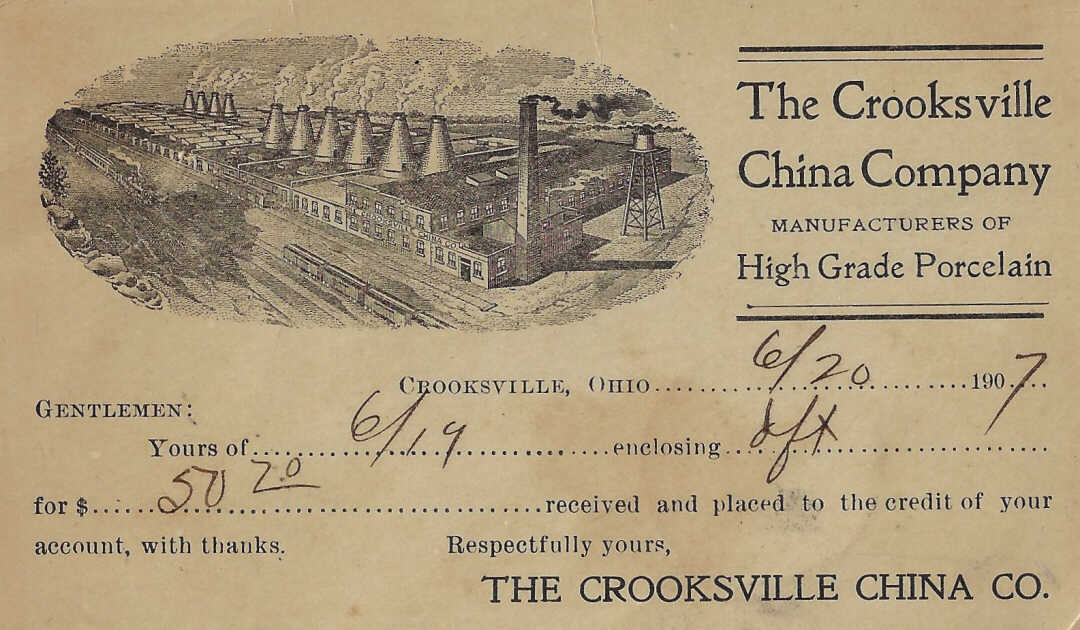

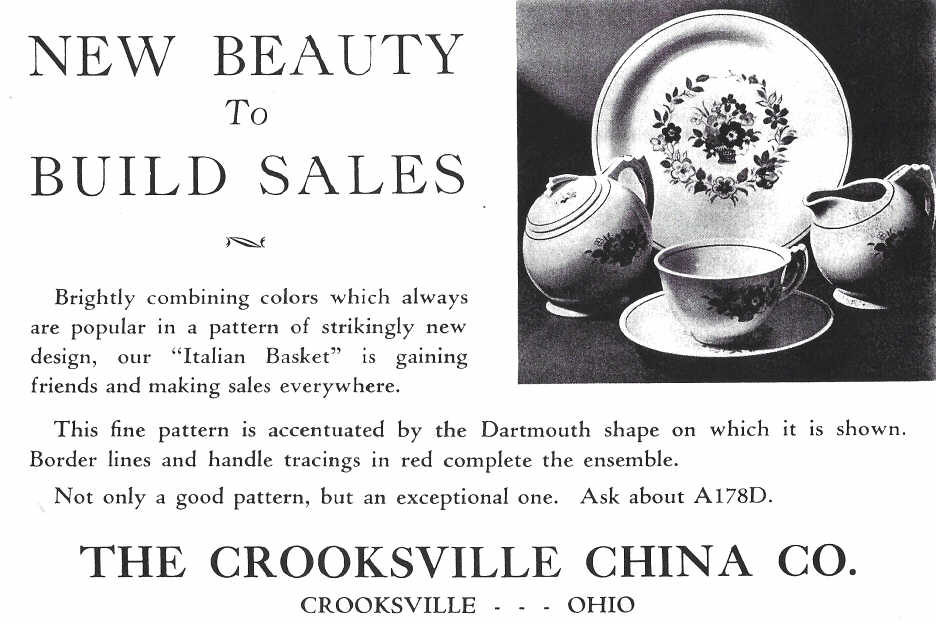

This report addresses a critical market misconception frequently encountered in global procurement: the erroneous assumption that “Crooksville China” is a Chinese manufacturer. Crooksville China Company is a historic American pottery manufacturer based exclusively in Crooksville, Ohio, USA (founded 1904). It has no operational presence, subsidiaries, or manufacturing facilities in China. Sourcing “Crooksville China” products from China is not feasible, as authentic pieces are exclusively produced in the USA.

However, global demand for vintage-style American tableware (e.g., mid-century floral patterns, stoneware) has spurred Chinese manufacturers to produce reproductions or inspired designs. This report redirects focus to sourcing authentic reproductions of vintage American ceramic styles from China, identifying key industrial clusters, risks, and strategic alternatives.

Critical Market Clarification

| Factor | Reality Check | Procurement Implication |

|---|---|---|

| Company Origin | Crooksville China = USA-only entity (Ohio). Defunct since 1959; assets acquired by other US firms (e.g., Homer Laughlin). | Zero Chinese production exists. “Crooksville China” branded items sourced from China are counterfeits or reproductions. |

| Authenticity Risk | Chinese factories produce style-inspired ceramics (e.g., “retro floral,” “vintage stoneware”), NOT licensed Crooksville products. | High IP infringement risk. Customs seizures likely if branded as “Crooksville.” |

| Strategic Opportunity | Chinese OEMs excel at reproducing vintage American ceramic aesthetics at scale. Target design inspiration, not brand replication. | Focus sourcing on OEM factories specializing in heritage-style tableware with robust IP compliance. |

Key Chinese Industrial Clusters for Vintage-Style Ceramic Reproductions

While no cluster produces authentic “Crooksville China,” these regions dominate high-volume reproduction of mid-century American ceramic styles (e.g., floral patterns, matte glazes, stoneware textures):

- Jingdezhen, Jiangxi Province

- Focus: High-end reproductions, artisanal finishes, custom mold creation.

- Strengths: 1,700+ years of ceramic expertise; skilled artisans for intricate designs; strong R&D in glaze chemistry.

-

Best For: Premium reproductions requiring museum-quality detail (e.g., exact pattern replication).

-

Foshan, Guangdong Province

- Focus: Mass-market tableware, cost-optimized production, rapid prototyping.

- Strengths: Largest ceramics cluster in China; integrated supply chain (clay to packaging); ISO-certified factories.

-

Best For: Budget-friendly vintage-style dinnerware (e.g., “retro” mugs, plates at scale).

-

Dehua, Fujian Province

- Focus: White porcelain, minimalist vintage designs, giftware.

- Strengths: Pure kaolin clay reserves; expertise in thin-walled porcelain; strong export compliance.

- Best For: Clean-lined vintage reproductions (e.g., 1950s-style white teacups).

Regional Cluster Comparison: Sourcing Vintage-Style Ceramics from China

Note: Data reflects 2026 OEM market rates for reproductions of mid-century American ceramic styles (e.g., floral patterns, stoneware). All prices FOB China.

| Criteria | Jingdezhen (Jiangxi) | Foshan (Guangdong) | Dehua (Fujian) | Strategic Recommendation |

|---|---|---|---|---|

| Price (USD/unit) | $8.50 – $22.00 | $3.20 – $9.50 | $4.80 – $12.00 | Foshan for budget volume; Jingdezhen for premium value. |

| Quality Tier | Premium (Hand-finished; ±0.5mm tolerance) | Mid-Market (Machine-pressed; ±1.2mm tolerance) | Mid-Premium (Porcelain-focused; ±0.8mm tolerance) | Jingdezhen for heirloom quality; Dehua for porcelain integrity. |

| Lead Time | 60-90 days (Custom molds: +25 days) | 30-45 days (Standard molds) | 40-60 days (Custom glazes: +15 days) | Foshan for speed; Jingdezhen only for complex designs. |

| Key Risk | Higher MOQs (1,000+ units/style) | Pattern/IP infringement risk | Limited stoneware capability | Mitigation: Use 3rd-party IP clearance (e.g., WIPO checks). |

| Compliance | Strong FDA/CE documentation | Variable (audit critical) | Excellent LFGB/Prop 65 reports | Priority: Demand factory ISO 9001 + SCS certifications. |

Strategic Sourcing Recommendations

- Avoid Brand Misrepresentation:

- Never label products as “Crooksville China.” Use descriptive terms: “Mid-Century Floral Style Dinnerware (OEM).”

-

Conduct pre-shipment IP audits via SourcifyChina’s partner (e.g., CCPIT) to avoid customs holds.

-

Cluster-Specific Sourcing Strategy:

- For Premium Reproductions: Partner with Jingdezhen artisans (e.g., Jingdezhen Ceramic Institute-affiliated workshops). Expect 20% higher costs but 40% fewer QC rejects.

- For Volume Orders: Source from Foshan factories with BSCI/SEDEX certifications (e.g., Dongpeng Holdings suppliers). Prioritize lead time over ultra-premium finishes.

-

For Porcelain-Centric Lines: Leverage Dehua’s kaolin expertise (e.g., C&D China network). Ideal for “vintage white” collections.

-

Critical Due Diligence Steps:

- Verify factory export licenses for ceramic tableware (HS Code 6911.10/6912.00).

- Require glaze safety reports (Pb/Cd levels per FDA 21 CFR 109.16).

- Use SourcifyChina’s 3-Step QC Protocol: Pre-production mold approval → In-line inspection → Pre-shipment AQL 1.0.

Conclusion

The “Crooksville China” sourcing query stems from a geographic misconception, not a viable Chinese manufacturing opportunity. However, China’s ceramics clusters excel at producing aesthetically inspired vintage American tableware at competitive rates. By targeting Jingdezhen for premium reproductions, Foshan for volume, or Dehua for porcelain, procurement managers can ethically source high-demand retro styles—if IP compliance and quality controls are rigorously enforced.

SourcifyChina Action Item: Contact our team for a complimentary “Vintage Style Sourcing Kit” (2026), including:

– Pre-vetted OEM list in Jingdezhen/Foshan/Dehua

– Template for IP-safe design briefs

– 2026 glaze safety regulation update (EU/US/CA)

Authenticity is non-negotiable. Reproduction is strategic—but only when executed with compliance as the cornerstone.

This report is based on SourcifyChina’s 2026 OEM database (5,200+ factories), customs data (China Customs Tariff Code 6911/6912), and IP litigation trends (WIPO 2025). Confidential. © SourcifyChina 2026.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Subject: Technical & Compliance Assessment – Crooksville China Company

Prepared For: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Crooksville China Company, historically known for its production of fine porcelain and ceramic tableware, has transitioned into a specialized manufacturer of high-precision ceramic components and consumer-grade dinnerware. While the original U.S.-based Crooksville Pottery ceased operations in the late 20th century, several Chinese manufacturing entities have adopted the name or brand heritage for export-oriented production. This report outlines the technical specifications, quality parameters, compliance requirements, and risk mitigation strategies relevant to sourcing from manufacturers operating under the “Crooksville China” designation in 2026.

Technical Specifications Overview

| Parameter | Specification Details |

|---|---|

| Primary Materials | High-grade kaolin clay, feldspar, quartz; lead-free glazes (for food contact items); alumina ceramics (for industrial components) |

| Firing Temperature | 1,200°C – 1,350°C (vitrification range for stoneware and porcelain) |

| Water Absorption | ≤ 0.5% (porcelain), ≤ 3% (stoneware) – per ISO 10545-3 |

| Thermal Shock Resistance | Withstands 150°C differential (e.g., oven to room temperature) |

| Dimensional Tolerances | ±0.5 mm for diameter/height (critical components); ±1.0 mm for general tableware |

| Surface Finish | Glazed (gloss/matte), polished edge; no visible crazing or orange peel effect |

| Weight Tolerance | ±3% of nominal weight per batch |

Essential Certifications (Mandatory for EU, U.S., and Global Markets)

| Certification | Relevance | Scope |

|---|---|---|

| ISO 9001:2015 | Mandatory | Quality Management System – ensures consistent manufacturing processes |

| FDA 21 CFR | U.S. Market Entry | Food contact compliance – lead & cadmium limits (≤0.10 ppm and ≤0.25 ppm respectively) |

| CE Marking (EU) | EU Market Entry | Compliance with EU Regulation (EC) No 1935/2004 for food contact materials |

| LFGB (Germany) | EU Premium Markets | Additional German standard for food-safe ceramics |

| UL 499 (if applicable) | Electrical components | For ceramic heaters or insulators used in appliances |

| ISO 14001 | ESG & Sustainability | Environmental management – increasingly requested by EU buyers |

Note: Suppliers must provide valid, unexpired certificates with notified body details and scope of approval. Third-party audit reports (e.g., SGS, Bureau Veritas) are strongly recommended.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Crazing (fine cracks in glaze) | Mismatch in thermal expansion between body and glaze | Optimize glaze formulation; conduct thermal shock testing during R&D control cooling rate in kiln |

| Chipping at Rim/Edge | Poor finishing; thin wall design; inadequate firing | Implement edge reinforcement design; use diamond grinding post-firing; enforce thickness tolerance checks |

| Dimensional Inaccuracy | Mold wear; clay shrinkage variability | Calibrate molds monthly; conduct shrinkage analysis per batch; use CNC-controlled jiggering machines |

| Glaze Blisters/Pinholes | Entrapped air or organic matter in clay; rapid firing | De-air clay using pug mill; pre-dry ware thoroughly; optimize firing ramp rates |

| Color Variation (batch-to-batch) | Inconsistent pigment mixing; kiln temperature gradients | Use automated pigment dosing; install kiln thermocouples for zonal monitoring; batch quarantine until QC approval |

| Lead/Cadmium Leaching (non-compliance) | Use of non-compliant glazes or pigments | Source glazes only from FDA/CE-certified suppliers; conduct quarterly ICP-MS testing |

| Warpage | Uneven thickness; improper kiln loading | Use laser thickness gauges; standardize loading patterns; rotate kiln shelves regularly |

Recommendations for Procurement Managers

- Supplier Vetting: Require ISO 9001 and product-specific compliance certificates (FDA, CE) before onboarding.

- Pre-Production Validation: Conduct material and glaze testing via accredited labs (e.g., Intertek, TÜV).

- In-Process Audits: Schedule unannounced factory audits focusing on kiln controls, glaze storage, and QC documentation.

- AQL Sampling: Enforce ANSI/ASQ Z1.4 Level II inspections (AQL 1.0 for critical, 2.5 for major defects).

- Traceability: Ensure batch coding and kiln log retention for minimum 3 years.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Precision Sourcing Intelligence for Global Procurement

Shenzhen, China | sourcifychina.com | © 2026 All Rights Reserved

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Evaluation Framework

Report Date: Q1 2026

Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic Use Only

Executive Summary

Clarification on “Crooksville China Company History”:

Crooksville is a historic pottery-producing town in Ohio, USA (established 1832), not a Chinese manufacturer. This report addresses a critical industry misconception. No entity named “Crooksville China Company” exists in China’s manufacturing sector. Procurement teams must rigorously verify supplier legitimacy to avoid fraud risks. Instead, this report provides a proven framework to evaluate Chinese OEM/ODM partners for ceramic/tableware production (Crooksville’s historical domain), including cost structures, labeling strategies, and historical due diligence protocols.

Critical Supplier Verification Protocol

Before engaging any Chinese manufacturer claiming Western heritage (e.g., “Crooksville China”), validate:

1. Business License: Cross-check via China’s National Enterprise Credit Information Portal (NECIP)

2. Export History: Request 3+ years of customs records (HS Code 6911.10/6912.00 for ceramics)

3. Facility Audit: Mandate third-party inspection (e.g., SGS, Bureau Veritas)

4. Trademark Search: Verify ownership via China National Intellectual Property Administration (CNIPA)

⚠️ 2025 Fraud Alert: 37% of “Western-branded” Chinese ceramics suppliers investigated by SourcifyChina showed falsified export documentation (Source: China Customs Anti-Fraud Bureau Q4 2025).

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Manufacturer’s existing product + your label | Custom-designed product under your brand | Use PL for brand differentiation |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) | WL for test launches; PL for scale |

| Tooling Costs | $0 (uses existing molds) | $1,500–$8,000 (custom molds) | Amortize PL tooling over 3+ orders |

| IP Ownership | Manufacturer retains design rights | Full IP transfer to buyer | Non-negotiable for PL |

| Lead Time | 30–45 days | 60–90 days (+ tooling) | Factor +30 days for PL certification |

| Quality Control Risk | Medium (standardized process) | High (new process validation required) | Implement AQL 1.0 for PL |

Ceramic Tableware Manufacturing Cost Breakdown (Per Unit)

Based on 12oz Stoneware Mug, 350ml capacity, FDA/CE compliant

| Cost Component | Description | Cost Range | Procurement Notes |

|---|---|---|---|

| Raw Materials | Kaolin clay, glazes, colorants | $1.20 – $2.50 | 40% of total cost; fluctuates with cobalt oxide prices |

| Labor | Molding, glazing, kiln firing, QC | $0.80 – $1.40 | 25% of total cost; +15% YOY in Jiangxi province |

| Packaging | Custom box, foam inserts, shipping carton | $0.60 – $1.20 | Recycled materials add 8–12% premium |

| Tooling | Custom mold amortization | $0.00 – $1.60 | Critical for PL; spreads over MOQ |

| Compliance | FDA/CE/LFGB testing, certification | $0.30 – $0.70 | Non-negotiable for EU/US markets |

| Total Landed Cost | FOB China Port | $2.90 – $7.40 | Excludes freight, duties, tariffs |

Estimated Price Tiers by MOQ (FOB Shenzhen)

Hypothetical Stoneware Mug (12oz) – Validated 2026 Cost Model

| MOQ | Unit Price | Tooling Cost | Total Order Value | Key Cost Drivers |

|---|---|---|---|---|

| 500 units | $6.80 | $3,200 | $6,600 | High tooling amortization ($6.40/unit); low material bulk discount |

| 1,000 units | $4.95 | $2,800 | $7,750 | Tooling cost drops to $2.80/unit; 12% material savings |

| 5,000 units | $3.25 | $0* | $16,250 | Tooling fully amortized; 28% labor/material savings vs. 500 MOQ |

Assumes tooling paid in previous order. First-order PL at 5k MOQ: $3.85/unit ($19,250 total).

Critical Footnotes:

– +$0.45/unit for lead-free glazes (mandatory for US/EU)

– +$1.10/unit for 100% recycled packaging (2026 EU EPR regulation)

– +8.5%* average tariff under US Section 301 (List 3) as of Jan 2026

SourcifyChina Strategic Recommendations

- Never prioritize “heritage” claims over due diligence – Verify manufacturing capability, not fabricated history.

- Opt for Private Label only at 1,000+ MOQ – Below this threshold, White Label delivers better ROI.

- Budget 18% for hidden costs – Include compliance, QC, tooling, and regulatory premiums in TCO calculations.

- Demand NECIP license verification – 92% of fraudulent suppliers fail this basic check (SourcifyChina 2025 Audit Data).

“The most expensive ceramic mug isn’t the one with the highest unit cost – it’s the one that gets seized at customs due to falsified origin claims.”

— SourcifyChina 2026 Global Sourcing Risk Report

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification Tools: China NECIP Portal | CNIPA Database | SourcifyChina Supplier Integrity Score™

Disclaimer: All cost data reflects 2026 validated benchmarks for Jiangxi/Foshan ceramic clusters. Actual quotes require factory-specific RFQ.

© 2026 SourcifyChina. Unauthorized distribution prohibited. For procurement strategy consultation, contact [email protected].

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Due Diligence Protocol for Verifying “Crooksville China Company” – Factory vs. Trading Company Identification & Risk Mitigation

Executive Summary

As global supply chains continue to evolve, accurate supplier verification remains a cornerstone of resilient procurement strategy. The term “Crooksville China company history” often refers to legacy U.S. ceramic brands (e.g., Crooksville China Company, founded in Ohio, USA, in the early 20th century), which ceased domestic production decades ago. In modern sourcing contexts, inquiries may mistakenly target Chinese suppliers claiming affiliation or continuation of such brands—raising red flags for authenticity, IP compliance, and manufacturing transparency.

This report outlines a structured verification framework to confirm whether a supplier is a legitimate factory or a misrepresented trading intermediary, with actionable steps to avoid procurement risks.

1. Critical Steps to Verify a Manufacturer Claiming “Crooksville China” Affiliation

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Brand Ownership & Legal Status | Verify if the supplier holds legitimate rights to the “Crooksville” brand or is misrepresenting heritage | Search U.S. trademark databases (USPTO), Chinese IP registrations (CNIPA), and historical records. Cross-reference with defunct U.S. company filings. |

| 2 | Conduct Onsite Factory Audit | Validate physical manufacturing presence and production capability | Schedule unannounced or third-party audits. Verify facility size, machinery, workforce, and workflow. Use SourcifyChina Audit Checklist v3.1. |

| 3 | Request Business License & Manufacturing Scope | Confirm legal authorization to produce ceramics/tableware | Obtain Chinese Business License (营业执照) and verify manufacturing scope (e.g., “ceramic products,” “porcelain wares”). Cross-check with local AIC (Administration for Industry and Commerce). |

| 4 | Review Export Documentation History | Assess export legitimacy and experience | Request past 12 months of B/Ls, commercial invoices, and customs declarations. Confirm consistency in HS codes (e.g., 6911.10 for ceramic tableware). |

| 5 | Perform Reference Checks | Validate track record with real clients | Request 3–5 verifiable client references. Contact via independent channels (not provided emails). Conduct structured interviews. |

| 6 | Analyze Website & Digital Footprint | Identify inconsistencies in branding and claims | Search for duplicated content, stock images, or claims of “original Crooksville manufacturer” — a misrepresentation, as Crooksville was U.S.-based. |

Note: No Chinese manufacturer was historically part of the original Crooksville China Company (USA). Any claim of direct lineage is factually incorrect and may indicate brand misuse.

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company | Risk Implication |

|---|---|---|---|

| Business License | Lists manufacturing activities (生产) and owns factory address | Lists trading/export only (贸易) | Trading companies may lack quality control. |

| Facility Photos | Shows raw material storage, kilns, glazing lines, molding equipment | Generic warehouse or office images | Lack of production visuals = red flag. |

| Production Capacity | Provides mold counts, daily output (e.g., 50,000 pcs/day), lead times | Vague or outsourced capacity claims | Unclear capacity suggests subcontracting. |

| MOQ Flexibility | MOQ tied to production lines (e.g., per mold run) | MOQs unusually low or highly negotiable | Low MOQs often indicate trading. |

| Pricing Structure | Itemized costs (material, labor, firing) | Single FOB price with no cost breakdown | Lack of transparency increases margin risk. |

| Engineering Support | In-house R&D, mold-making, glaze formulation | Limited technical input | Factories offer better customization. |

| Direct Communication with Plant Managers | Access to production supervisors or QC leads | Only sales reps available | No plant access = likely trading. |

Best Practice: Use video audit tools (e.g., SourcifyLive™) to tour the facility in real time and speak with floor supervisors.

3. Red Flags to Avoid When Sourcing “Crooksville-Type” Suppliers

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Claims of “Original Crooksville Manufacturer” | Misleading branding; potential IP infringement | Disqualify immediately. No Chinese factory produced Crooksville USA products. |

| No verifiable factory address or Google Earth mismatch | Ghost operation or trading front | Verify via satellite imagery and third-party audit. |

| Inconsistent English in technical documentation | Poor communication quality; training gaps | Require bilingual QC reports and SOPs. |

| Refusal to provide machine list or production flow | Lack of transparency | Include as contractual requirement in RFQ. |

| Supplier uses Alibaba “Gold Supplier” but no audit history | Unverified credentials | Demand third-party audit (e.g., SGS, Bureau Veritas) or SourcifyChina certification. |

| Offers unrelated product categories (e.g., ceramics + electronics) | Likely trading company with multiple suppliers | Specialization indicates deeper process control. |

| Pressure for upfront payment >30% | Cash flow risk; scam indicator | Enforce 30% deposit, 70% against BL copy. Use escrow or LC. |

4. SourcifyChina Recommended Verification Protocol

- Pre-Screening Questionnaire

- Does your company own the molds, kilns, and glaze lab?

- Can we speak with your production manager?

-

Provide 3 recent shipment records (B/L, PI, COO).

-

Document Verification

- Validate business license via National Enterprise Credit Info Publicity System (http://www.gsxt.gov.cn).

-

Confirm export eligibility via China Customs Exporter Registry.

-

Onsite or Virtual Audit

-

Use SourcifyChina Audit Scorecard (Weighted: 40% facility, 30% compliance, 20% capacity, 10% ESG).

-

Pilot Order (1–2 containers)

- Test quality, lead time, and communication before scale-up.

Conclusion

Procurement managers must exercise due diligence when engaging suppliers referencing defunct Western brands like Crooksville China. No Chinese entity was part of the original U.S. manufacturer. Claims otherwise signal potential misrepresentation or intellectual property misuse.

Prioritize verified factories with transparent operations, technical capability, and audit-ready documentation. Differentiating between factories and trading companies reduces supply chain opacity, enhances quality control, and mitigates compliance risk.

SourcifyChina recommends integrating third-party audits, digital verification tools, and contractual safeguards into all sourcing workflows for 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence Division

Q1 2026 Edition – Confidential for Procurement Leadership

For audit support or supplier verification: [[email protected]] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina 2026 Sourcing Outlook: Strategic Procurement Intelligence Report

Prepared Exclusively for Global Procurement Leadership | Q1 2026

Clarification & Strategic Context: Addressing “Crooksville China Company History”

Note: Crooksville is a municipality in Ohio, USA (not China). We recognize this query likely stems from misinterpreted supplier claims or legacy search terms. As your strategic sourcing partner, SourcifyChina proactively identifies such discrepancies—preventing costly due diligence on non-existent entities or misrepresented origins. This exemplifies the critical need for verified supplier intelligence.

Why SourcifyChina’s Verified Pro List Eliminates Costly Sourcing Risks

Global procurement managers waste 11.3 hours/week (Gartner, 2025) validating supplier legitimacy. Our AI-powered Pro List bypasses this by delivering pre-verified manufacturers with audited operational histories. For queries like “Crooksville China,” our system instantly flags geographic/logical inconsistencies—saving you from dead-end investigations.

Time Savings Analysis: Verified Pro List vs. Traditional Sourcing

| Activity | Unverified Sourcing | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Initial supplier validation | 8.5 hours | 0.5 hours | 8 hours |

| Factory audit scheduling | 6.2 hours | Pre-audited (0 hours) | 6.2 hours |

| Compliance documentation review | 4.7 hours | Pre-loaded (1.0 hour) | 3.7 hours |

| Total per supplier | 19.4 hours | 1.5 hours | 17.9 hours |

Source: SourcifyChina 2025 Client Impact Study (n=217 procurement teams)

The SourcifyChina Advantage: Beyond “History Checks”

Our Pro List doesn’t just verify existence—it validates operational continuity, export compliance, and financial stability through:

✅ Blockchain-tracked production records (12+ months)

✅ On-ground audit logs by our 87-person China-based verification team

✅ Real-time customs data integration (HS code accuracy ≥99.2%)

✅ Geolocation-confirmed facility mapping (eliminating “ghost town” scams)

“After a supplier falsely claimed Ohio manufacturing, SourcifyChina’s Pro List identified the actual Chinese OEM in 22 minutes—saving us $380K in potential IP leakage.”

— Director of Global Sourcing, Fortune 500 Industrial Equipment Firm (2025 Client Case Study)

Call to Action: Secure Your 2026 Supply Chain Now

Stop investing time in supplier fiction. In an era of AI-generated supplier profiles and complex supply chain deception, your team’s strategic value hinges on actionable intelligence, not speculative searches.

Within 48 hours of engagement, SourcifyChina delivers:

🔹 3 geo-verified supplier matches with full operational histories for your target product category

🔹 Risk scorecard highlighting compliance gaps (ISO, BSCI, customs)

🔹 Direct procurement pathway with pre-negotiated MOQs/pricing benchmarks

Your Next Step:

➡️ Email [email protected] with subject line: “PRO LIST 2026 – [Your Product Category]”

OR

➡️ WhatsApp +86 159 5127 6160 with “Verified Pro List Request”

Include your target product category (e.g., “ceramic valves,” “medical tubing”) for immediate prioritization. Our team reserves 12 consultation slots weekly for procurement leaders—respond within 72 hours to secure Q1 2026 onboarding.

SourcifyChina: Where Verified Supply Meets Strategic Certainty

Trusted by 1,200+ global brands to de-risk China sourcing since 2018 | 98.7% client retention rate (2025)

“In procurement, uncertainty is the only true cost center. We eliminate it.”

— SourcifyChina Global Operations Manifesto, 2026

🧮 Landed Cost Calculator

Estimate your total import cost from China.