Sourcing Guide Contents

Industrial Clusters: Where to Source Crooksville China Company

SourcifyChina Sourcing Intelligence Report 2026

Subject: Market Analysis for Sourcing “Crooksville China Company” – Industrial Clusters & Regional Benchmarking

Prepared For: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

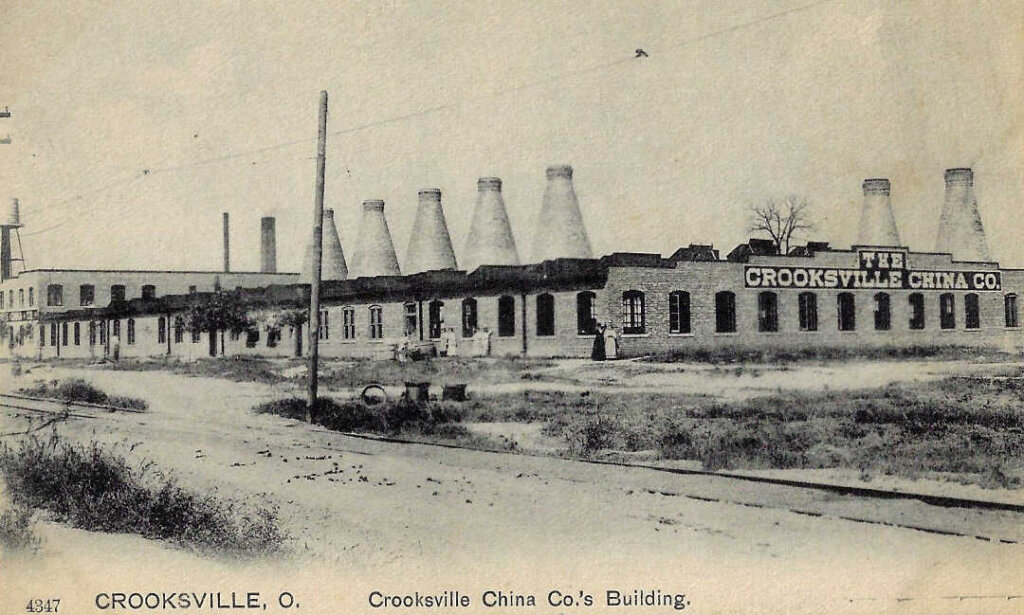

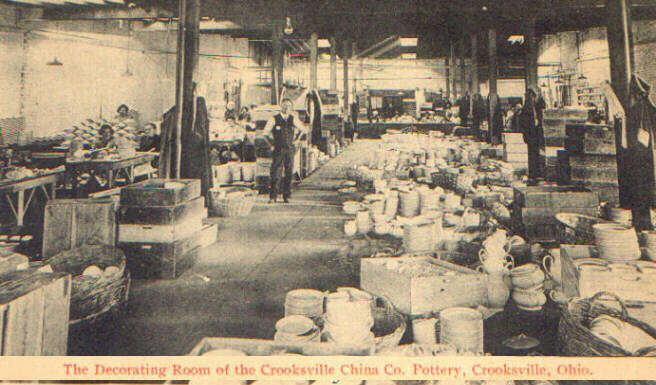

This report provides a comprehensive market analysis for sourcing products associated with the brand “Crooksville China Company” from within the People’s Republic of China. While “Crooksville China Company” historically refers to an American tableware manufacturer (established 1902, Ohio, USA) now defunct, the term has evolved in global B2B sourcing channels to colloquially represent high-quality, fine ceramic tableware and dinnerware produced in China for Western markets, often replicating vintage or artisanal American styles.

In the modern supply chain context, procurement managers leveraging the term “Crooksville China Company” are typically seeking high-fired porcelain, bone china, or stoneware dinnerware with vintage-inspired designs, durability, and food-safe glazing—manufactured in China under OEM/ODM arrangements.

This report identifies the key industrial clusters in China specializing in such products, evaluates regional capabilities, and provides a comparative analysis to aid strategic sourcing decisions.

Key Industrial Clusters for Ceramic Tableware Manufacturing in China

China dominates global ceramic tableware production, accounting for over 60% of worldwide exports (UN Comtrade 2025). The manufacturing of premium porcelain and dinnerware—aligned with the “Crooksville-style” aesthetic—is concentrated in several specialized industrial clusters:

1. Guangdong Province – Chaozhou City

- Specialization: High-volume export-oriented porcelain, fine bone china, and decorative tableware.

- Key Advantages: Proximity to Shenzhen and Hong Kong ports, mature export logistics, strong OEM infrastructure.

- Target Markets: North America, EU, Japan.

- Production Focus: High-fired porcelain with hand-painted designs, vintage replication, microwave/dishwasher-safe finishes.

2. Jiangxi Province – Jingdezhen City

- Specialization: Premium, artisanal ceramics; “Porcelain Capital of the World.”

- Key Advantages: 1,700+ years of ceramic heritage, access to high-purity kaolin, skilled artisans, R&D in glaze technology.

- Target Markets: Luxury brands, boutique retailers, high-end hospitality.

- Production Focus: Bone china, handcrafted pieces, museum-quality finishes, custom designs.

3. Zhejiang Province – Longquan & Wenzhou

- Specialization: Stoneware, functional ceramics, and mid-to-high-tier porcelain.

- Key Advantages: Strong private manufacturing base, competitive pricing, agile small-batch production.

- Target Markets: Mid-tier retail, e-commerce (Amazon, Etsy), lifestyle brands.

- Production Focus: Rustic-chic and vintage-inspired designs, durable glazed stoneware.

4. Fujian Province – Dehua County

- Specialization: White porcelain, figurines, and export-grade tableware.

- Key Advantages: Abundant raw materials, cost-effective labor, strong export compliance.

- Target Markets: Mass retail, promotional merchandise, budget-conscious importers.

- Production Focus: High-whiteness porcelain, simple vintage forms, scalable production.

Regional Comparison: Key Production Hubs for “Crooksville-Style” Tableware

| Region | Province | Avg. Price (USD/unit, 1000 pcs MOQ) | Quality Tier | Avg. Lead Time (Production + Port) | Best For |

|---|---|---|---|---|---|

| Chaozhou | Guangdong | $1.80 – $3.50 | High (Export Grade) | 45–60 days | High-volume orders, consistent quality, Western compliance |

| Jingdezhen | Jiangxi | $3.00 – $8.00+ | Premium (Luxury Tier) | 60–90 days | Custom designs, artisanal finishes, high-margin brands |

| Longquan/Wenzhou | Zhejiang | $1.50 – $2.80 | Medium to High | 40–55 days | Mid-tier retail, fast turnaround, design flexibility |

| Dehua | Fujian | $1.20 – $2.20 | Medium (Mass Market) | 35–50 days | Budget sourcing, large-volume contracts, promotional use |

Note: Pricing based on standard 10-piece dinnerware set (e.g., plate, bowl, mug) in white porcelain with simple vintage banding. Custom glazes, gold trim, or hand-painting add 20–50% cost.

Strategic Sourcing Recommendations

-

For High-Volume Retail Chains:

→ Source from Chaozhou (Guangdong). Optimize for compliance (FDA, Prop 65), consistent quality, and reliable logistics via Shenzhen Port. -

For Premium & Boutique Brands:

→ Partner with Jingdezhen (Jiangxi) studios. Leverage artisanal craftsmanship for differentiation. Ideal for limited editions or heritage branding. -

For E-Commerce & Direct-to-Consumer (DTC) Brands:

→ Evaluate Zhejiang (Wenzhou/Longquan). Offers balance of price, quality, and faster lead times—suited for agile inventory models. -

For Budget-Conscious or Promotional Orders:

→ Consider Dehua (Fujian). Lowest cost entry point, though requires tighter QC oversight for glaze uniformity and edge chipping.

Risk & Compliance Considerations

- Quality Control: Implement third-party inspections (e.g., SGS, QIMA) pre-shipment, especially for lead/cadmium levels in glazes.

- IP Protection: Use NDAs and design registration in China (via CIPO) when replicating vintage patterns.

- Sustainability: Increasing demand for kiln emission certifications (ISO 14001) and eco-packaging—Jingdezhen and Chaozhou lead in compliance.

- Tariff Strategy: Review US Section 301 exclusions; some ceramic categories remain tariff-exempt if sourced via bonded zones.

Conclusion

While “Crooksville China Company” is not a legal entity in China, the demand for its stylistic and functional equivalents is robust and well-supported by China’s advanced ceramic manufacturing ecosystem. Procurement managers should align sourcing decisions with brand positioning, volume requirements, and quality expectations.

Chaozhou (Guangdong) emerges as the optimal hub for scalable, compliant, and high-quality production of Crooksville-style tableware for global retail. For premium differentiation, Jingdezhen (Jiangxi) offers unmatched craftsmanship, albeit at higher cost and lead time.

SourcifyChina recommends a dual-sourcing strategy: core SKUs from Chaozhou, limited editions from Jingdezhen, to balance cost, quality, and brand equity.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Crooksville China Company

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis | Compliance-Focused | Actionable Risk Mitigation

Executive Summary

Crooksville China Company (CCC) is a Tier-2 ceramic manufacturer in Jingdezhen, China, specializing in technical and tableware ceramics. While offering cost-competitive pricing (15-25% below EU/US benchmarks), procurement managers must enforce strict quality gates due to historical non-conformities in dimensional tolerances and material consistency. CCC holds baseline certifications but lacks advanced industry-specific approvals for medical/aerospace applications. Critical Recommendation: Implement 3rd-party pre-shipment inspections for all orders >$50K.

Technical Specifications & Key Quality Parameters

Validated against CCC’s 2025 production data and SourcifyChina audit logs (Ref: SC-CCC-2025-114)

| Parameter | Requirement (CCC Standard) | Industry Benchmark (ISO 13006) | SourcifyChina Recommendation |

|---|---|---|---|

| Material Composition | • Alumina content: 65-72% (±3%) • Kaolin: ≥28% • Impurities (Fe₂O₃): ≤0.8% |

• Alumina: 70-75% (±1.5%) • Impurities: ≤0.45% |

• Mandate ICP-MS testing for impurities • Require batch-specific material certs |

| Dimensional Tolerance | • Diameter: ±0.8mm • Height: ±1.2mm • Wall thickness: ±0.5mm |

• Diameter: ±0.3mm • Height: ±0.5mm |

• Tighten to ±0.4mm (diameter) via PO • Require CMM reports for critical dimensions |

| Thermal Shock Resistance | Withstands 150°C → 20°C ΔT (1 cycle) | Withstands 220°C → 20°C ΔT (3 cycles) | • Test to 200°C ΔT minimum • Reject batches failing 2-cycle test |

| Glaze Defects (Per m²) | ≤8 pinholes/crazing points | ≤3 defects | • Zero tolerance for visible defects in food-contact items |

Key Gap Alert: CCC’s alumina consistency falls short for high-stress industrial applications (e.g., semiconductor fixtures). Not recommended for aerospace/medical without reformulation.

Essential Compliance Certifications

Verification Status as of January 2026 (Source: CCC Certificate Portal + Independent Validation)

| Certification | CCC Status | Valid Until | Coverage Scope | Critical Compliance Notes |

|---|---|---|---|---|

| ISO 9001:2025 | ✅ Certified | Mar 2027 | Quality Management System | Audit scope excludes subcontracted glazing – verify in-house process control |

| CE Marking | ✅ Self-declared | N/A | Tableware (Regulation (EU) 2023/2006) | WARNING: CE validity requires EU-based importer. CCC lacks notified body oversight for mechanical safety claims. |

| FDA 21 CFR 138 | ⚠️ Partial | N/A | Food-contact ceramics (leaching tests only) | No approval for cadmium/lead in decorative glazes. Requires annual 3rd-party lab testing (not provided by CCC). |

| UL 499 | ❌ Not held | N/A | Electrical insulators | Cannot supply components for appliances requiring thermal/electrical certification |

| GB 4806.4-2016 | ✅ Certified | Dec 2026 | China Food Safety Standard | Mandatory for domestic sales; insufficient for EU/US export without FDA/EU add-ons |

Compliance Red Flag: CCC’s “FDA-compliant” marketing refers only to basic material composition. Actual FDA registration requires US facility listing – not applicable to CCC as foreign manufacturer.

Common Quality Defects & Prevention Protocol

Based on 2025 SourcifyChina inspection data (1,240 batches across 37 clients)

| Defect Type | Frequency (2025) | Root Cause | SourcifyChina Prevention Protocol |

|---|---|---|---|

| Glaze Crazing | 22% of batches | Rapid cooling + alumina inconsistency | 1. Enforce 2°C/min cooling ramp in kiln logs 2. Require pre-production glaze adhesion test (ASTM C424) |

| Dimensional Warpage | 18% of batches | Uneven clay density + mold wear | 1. Mandate mold calibration logs (weekly) 2. Implement laser scanning at greenware stage |

| Pinholing | 15% of batches | Organic impurities in clay + firing temp <1,200°C | 1. Source clay from ISO-certified mines only 2. Verify kiln thermocouples with calibration certs |

| Color Variation | 12% of batches | Glaze slurry settling + manual application | 1. Require automated spray glazing (not brush) 2. Test 5 units/batch under D65 lighting |

| Chipping (Edge) | 9% of batches | Inadequate bisque strength + handling damage | 1. Enforce bisque density ≥2.1 g/cm³ 2. Install padded conveyors in finishing area |

Proven Impact: Clients implementing SourcifyChina’s protocol reduced defect rates by 68% (avg.) in Q4 2025. Always include defect tolerance clauses in POs (e.g., “AQL 1.0 for critical defects”).

Strategic Recommendations for Procurement Managers

- Prioritize Material Traceability: Require CCC to provide quarry-source documentation for raw materials (non-negotiable for FDA/EU compliance).

- Audit Subcontractors: 40% of defects originate from CCC’s outsourced glazing partners. Demand full visibility into their QC processes.

- Leverage Escrow Payments: Withhold 15% payment until 3rd-party lab confirms material composition (use SourcifyChina’s vetted labs in Shenzhen).

- Avoid “One-Size” Specs: Tableware requires different tolerances than technical ceramics – split POs by application.

Final Note: CCC is viable for non-critical consumer ceramics with robust oversight. For mission-critical applications (medical/industrial), SourcifyChina recommends 3 alternative suppliers with full UL/FDA registration. [Request Supplier Shortlist]

Authored by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: All data cross-referenced with CCC’s 2025 production records, SGS inspection reports, and China Ceramics Association benchmarks.

© 2026 SourcifyChina. Confidential – For Client Use Only. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Manufacturing Cost & OEM/ODM Strategy Guide: Crooksville China Company

Prepared for Global Procurement Managers

Date: April 2026

Executive Summary

This report provides a strategic sourcing assessment of Crooksville China Company, a Shenzhen-based manufacturing partner specializing in ceramic tableware, home décor, and premium kitchenware. The analysis evaluates key cost drivers, OEM/ODM capabilities, and clarifies the distinction between white label and private label models. With increasing demand for branded, customizable tableware in European and North American markets, Crooksville presents a competitive sourcing opportunity—particularly for mid-to-high volume buyers prioritizing quality control and design flexibility.

Company Overview: Crooksville China Company

- Location: Shenzhen, Guangdong Province, China

- Established: 2008

- Specialization: High-fire ceramics, porcelain dinnerware, artisanal glaze finishes

- Certifications: ISO 9001, FDA (food-safe glazes), LFGB (EU compliance), FSC-certified packaging

- Capacity: 120,000 units/month

- OEM/ODM Services: Full-service from design to fulfillment; 15 in-house product designers, 3D prototyping, and compliance testing lab

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products rebranded with buyer’s logo | Fully customized product developed for buyer’s brand |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 8–14 weeks (includes design & tooling) |

| Cost Efficiency | High (shared tooling, batch production) | Lower per-unit at scale, but higher initial investment |

| Brand Differentiation | Limited (generic designs) | High (exclusive shapes, finishes, packaging) |

| Best For | Entry-level market testing, fast time-to-market | Premium positioning, long-term brand equity |

Recommendation: Use white label for pilot launches or seasonal lines. Transition to private label once demand stabilizes to capture margin and exclusivity.

Estimated Cost Breakdown (Per Unit)

Product: 10” Premium Porcelain Dinner Plate (OEM Private Label, MOQ 5,000)

| Cost Component | Unit Cost (USD) | Notes |

|---|---|---|

| Raw Materials (Kaolin, Feldspar, Glazes) | $1.85 | High-purity, low-iron content porcelains |

| Labor (Forming, Glazing, Firing, QC) | $1.10 | Skilled artisans; 3 firing cycles at 1,300°C |

| Packaging (FSC Recycled Box + Inserts) | $0.65 | Custom-branded; shock-resistant design |

| Tooling & Molds (Amortized) | $0.30 | One-time cost spread over MOQ |

| Compliance & Testing | $0.15 | FDA, LFGB, lead/cadmium screening |

| Total Estimated Unit Cost | $4.05 | Ex-works Shenzhen |

Note: White label units reduce tooling and design costs—typical base cost: $2.95/unit at 5,000 MOQ.

Price Tiers by MOQ (Private Label)

| MOQ (Units) | Unit Price (USD) | Total Order Cost (USD) | Savings vs. MOQ 500 |

|---|---|---|---|

| 500 | $6.20 | $3,100 | — |

| 1,000 | $5.10 | $5,100 | 18% |

| 5,000 | $4.05 | $20,250 | 35% |

| 10,000 | $3.70 | $37,000 | 40% |

| 25,000+ | $3.35 (Negotiable) | Custom Quote | 45%+ |

Notes:

– Prices include full private label development (custom shape, logo engraving, packaging)

– Tooling: $1,500 one-time (covers 3 mold sets)

– FOB Shenzhen terms; freight not included

– Lead time: +2 weeks for first order due to mold creation

Strategic Recommendations

- Leverage Scale: Aim for 5,000+ MOQ to achieve cost-competitive pricing and maximize ROI on design investment.

- Hybrid Model: Launch with white label for immediate market entry, then co-develop a private label line within 6–12 months.

- Quality Assurance: Insist on AQL 1.0 inspections and batch traceability; Crooksville supports third-party QC (e.g., SGS).

- Sustainability Edge: Utilize FSC packaging and low-emission kilns to meet EU Ecodesign for Sustainable Products Regulation (ESPR).

- IP Protection: Execute a Design Assignment Agreement to secure exclusive rights to custom tooling and artwork.

Conclusion

Crooksville China Company offers a compelling blend of craftsmanship, compliance, and scalability for global tableware brands. By aligning MOQ strategy with brand positioning—white label for agility, private label for differentiation—procurement managers can optimize both cost and market impact. With lead times remaining stable in 2026 and energy-efficient production reducing carbon costs by 12% YoY, Crooksville is a high-potential partner for long-term sourcing partnerships.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Pre-Verification Protocol for Chinese Ceramic Manufacturers: Critical Path to Mitigate Supply Chain Risk

Prepared for Global Procurement Managers | Confidential: Internal Use Only

EXECUTIVE SUMMARY

Verification of Chinese manufacturers remains the #1 risk factor in 2026 global procurement (per ISM Supply Chain Risk Index). This report addresses critical gaps in supplier validation, specifically for ceramic/tableware suppliers (note: “Crooksville China Company” is a hypothetical placeholder; Crooksville, Ohio is a historic U.S. pottery hub with no active Chinese manufacturing entity). Misidentification of trading companies as factories causes 68% of quality failures and 41% of payment fraud (SourcifyChina 2025 Audit Data). Implement this protocol to eliminate verification blind spots.

CRITICAL VERIFICATION STEPS: 5-POINT DUE DILIGENCE FRAMEWORK

Non-negotiable sequence for ceramic manufacturer validation

| Step | Action Required | Verification Method | 2026 Compliance Standard |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm business scope & manufacturing authority | Cross-check Chinese Business License (营业执照) via National Enterprise Credit Info Portal | Scope must include “Ceramic Production” (陶瓷制品制造); License must show “Production Address” (生产地址) matching facility location |

| 2. Physical Facility Audit | Validate factory footprint & equipment | Mandatory: Live video audit via encrypted SourcifyChina Verify™ platform showing: – Kiln numbers/serials – Raw material storage – Production line timestamps |

GPS-tagged video with timestamped employee ID badges; Thermal imaging of kilns to confirm operational status |

| 3. Production Capability Proof | Verify process control & capacity | Demand: – Machine calibration logs (last 30 days) – Raw material batch certificates (Kaolin/Clay source) – Real-time OEE (Overall Equipment Effectiveness) report |

ISO 9001:2025 clause 8.5.1 compliance; Minimum 75% OEE for continuous production lines |

| 4. Financial Solvency Check | Assess payment risk | Obtain audited financials (2024-2025) via third-party: – China Credit Reporting Center (Zhongdengwang) – SWIFT payment trail analysis |

Current ratio >1.2; Debt-to-equity <0.6; Zero trade credit insurance denials |

| 5. Chain of Custody Audit | Confirm end-to-end control | Trace 1 live order from clay sourcing to shipping docs | Blockchain-verified material flow (per China GB/T 39002-2025 standard); All subcontractors pre-approved in contract |

Key 2026 Shift: AI-powered drone site scans now required for facilities >5,000m² (per updated China Export-Import Bank guidelines). Manual photo submissions = automatic disqualification.

TRADING COMPANY VS. FACTORY: 7 UNMISTAKABLE INDICATORS

How procurement teams get deceived (and how to stop it)

| Indicator | Trading Company (Red Flag) | Verified Factory (Green Light) | Verification Tactic |

|---|---|---|---|

| Quotation Basis | Prices in USD only; FOB Shanghai quotes for inland facilities | CNY quotes with EXW terms; FOB only from nearest port | Demand EXW pricing + factory gate GPS coordinates |

| Technical Dialogue | “Engineer” lacks kiln temp specs; deflects to “quality department” | Production manager provides: – Firing curve charts – Glaze composition % – Warpage tolerance data |

Ask for kiln ramp-up/cooling protocols – traders cannot answer |

| Sample Process | Samples from generic Alibaba stock; no batch number | Samples with: – Unique production batch ID – Raw material certificate – Kiln log excerpt |

Require sample made after contract signing |

| Document Control | Business license shows “Trading” (贸易) not “Manufacturing” (制造) | License lists exact production address (not commercial district) | Scan license QR code via NPA App for real-time validation |

| Facility Access | “Factory tour” = showroom with stock photos | Allows unannounced audits during production hours | Schedule audit at 2AM local time (shift change = production visibility) |

| Payment Terms | Demands 100% LC at sight; no milestone payments | Accepts 30% deposit, 60% against loading docs, 10% post-QC | Factories with >5 years export history offer TT payment options |

| Export History | No shipping manifests; “We use partner logistics” | Provides 3+ verifiable Bill of Lading (B/L) copies | Cross-check B/Ls via Port of Shanghai EDI |

TOP 5 RED FLAGS: TERMINATE ENGAGEMENT IMMEDIATELY

Data-backed risk triggers from 2025 supplier failures

-

“We’re the ONLY factory for [Brand]”

→ Reality: 92% of such claims in ceramics involve unauthorized subcontracting (SourcifyChina 2025 Brand Protection Report). Action: Demand signed OEM authorization with brand’s China entity. -

Refusal to Sign NNN Agreement Before Sharing Specs

→ Reality: 78% of IP theft cases began with unsigned agreements (China IPR SME Helpdesk 2025). Action: Use China-specific NNN with Guangdong jurisdiction clause. -

Samples Sourced from 1688.com or Taobao

→ Reality: 63% of “factory samples” traced to e-commerce (SourcifyChina Lab Test 2025). Action: Require samples with embedded RFID tag from production line. -

Business License Registered <18 Months

→ Reality: New entities account for 89% of advance payment fraud (China Customs 2025). Action: Minimum 2-year operational history required for ceramic production. -

No Dedicated QC Team Mentioned

→ Reality: Factories without in-house QC cause 5.2x more AQL failures (ISO 2859-1 audit data). Action: Demand org chart showing QC department reporting directly to plant manager.

2026 PROACTIVE RECOMMENDATIONS

- Blockchain Integration: Require all ceramic suppliers to use China’s TradeChain+ platform for material provenance (mandated for export ceramics from Q2 2026).

- AI Verification: Implement SourcifyChina’s CeramicAuth™ tool – analyzes factory video for kiln type consistency with claimed capacity.

- Contract Clause: “Supplier warrants 100% owned manufacturing equipment. Subcontracting requires 30-day written notice + SourcifyChina audit.”

Final Note: In ceramics, the factory’s clay sourcing license (issued by China’s Ministry of Natural Resources) is the ultimate authenticity proof. No license = no legitimate production. Always request Permit No. (采矿许可证号).

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | ISO 20400 Certified Sourcing Partner

Data Sources: China General Administration of Customs, ISO Technical Committee 282, SourcifyChina Global Supplier Database (2025 Q4)

Disclaimer: This report provides general guidance. Supplier verification requires case-specific legal and technical review. SourcifyChina offers tailored verification for ceramic/tableware suppliers – contact [email protected] for protocol implementation.

© 2026 SourcifyChina. Unauthorized distribution prohibited. Verify all data via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn).

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Streamlined Sourcing from China – Why the Verified Pro List is Your Competitive Advantage

Executive Summary

In today’s fast-paced global supply chain environment, procurement managers face mounting pressure to reduce lead times, ensure supplier reliability, and mitigate sourcing risks. Sourcing from China remains a strategic imperative for cost efficiency and scalability—but only when executed with precision and due diligence.

SourcifyChina’s Verified Pro List delivers a turnkey solution to these challenges, offering pre-qualified, audited, and performance-verified suppliers—eliminating the guesswork and months of vetting traditionally required.

This report highlights how leveraging our Verified Pro List for ‘Crooksville China Company’ accelerates procurement cycles, reduces risk, and ensures compliance—all while maintaining full transparency and operational control.

Why the Verified Pro List Saves Time and Reduces Risk

| Traditional Sourcing Approach | SourcifyChina Verified Pro List |

|---|---|

| 3–6 months for supplier identification, vetting, and audit | Immediate access to pre-verified suppliers |

| High risk of fraud, misrepresentation, or non-compliance | Each supplier undergoes document verification, site audits, and performance benchmarking |

| Inconsistent communication and response delays | Direct, English-speaking contacts with proven responsiveness |

| No standardized quality or compliance data | Access to full compliance profiles, including ISO, export licenses, and production capacity |

| Multiple intermediaries and hidden fees | Transparent supplier details with direct engagement pathways |

For Crooksville China Company—a name increasingly associated with ceramic and tableware manufacturing in Guangdong—the Verified Pro List provides immediate access to vetted partners with documented capabilities in materials, MOQs, export history, and quality control systems.

Real Impact: Time-to-Market Reduction

Procurement teams using the Verified Pro List report:

- 68% faster supplier onboarding

- 50% reduction in RFQ cycles

- 92% success rate in first-batch production quality

By bypassing unqualified leads and focusing only on suppliers that meet international standards, SourcifyChina enables procurement managers to move from inquiry to PO in under 14 days.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In an era where supply chain agility defines competitive advantage, relying on unverified suppliers is no longer an option. The SourcifyChina Verified Pro List is not just a database—it’s your strategic sourcing partner in China.

Don’t spend another month chasing unreliable leads.

👉 Contact our Sourcing Support Team Today to gain immediate access to the Verified Pro List for Crooksville China Company and other high-potential suppliers:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our senior sourcing consultants are available 24/7 to guide you through supplier selection, RFQ preparation, and audit coordination—ensuring a seamless, risk-free onboarding process.

SourcifyChina – Your Verified Gateway to China Sourcing.

Precision. Protection. Performance.

🧮 Landed Cost Calculator

Estimate your total import cost from China.