Sourcing Guide Contents

Industrial Clusters: Where to Source Cronin China Company Minerva Ohio

Professional B2B Sourcing Report 2026

Prepared by: SourcifyChina | Senior Sourcing Consultants

Target Audience: Global Procurement Managers

Subject: Market Analysis for Sourcing Products Associated with “Cronin China Company, Minerva, Ohio” from China

Executive Summary

This report provides a strategic sourcing analysis for global procurement managers seeking to identify optimal manufacturing regions in China for products associated with Cronin China Company, based in Minerva, Ohio, USA. While Cronin China Company is a U.S.-based entity (likely involved in industrial components, hardware, or machinery distribution), it does not operate as a manufacturer in China. Therefore, sourcing from China involves identifying Chinese OEM/ODM manufacturers capable of producing equivalent or superior products to those distributed or used by Cronin.

Based on industry alignment—particularly in industrial fasteners, fabricated metal parts, hydraulic fittings, and precision-machined components—this report identifies key manufacturing clusters in China, evaluates regional strengths, and provides a comparative analysis to guide strategic procurement decisions in 2026.

Market Context: Understanding the Product Category

Cronin China Company (Minerva, Ohio) is known to supply industrial hardware, pipe fittings, and engineered metal components—products typically sourced from China by global buyers. These items fall under broader categories such as:

- Threaded fittings and couplings

- Steel and stainless-steel fasteners

- Hydraulic and pneumatic components

- Custom machined parts (CNC turned/milled)

- Forged and stamped metal products

Given this, sourcing from China requires targeting industrial zones with strong metalworking, precision machining, and export-oriented manufacturing ecosystems.

Key Industrial Clusters in China for Relevant Products

Below are the primary provinces and cities in China with established capabilities in manufacturing industrial metal components:

| Region | Key Cities | Specialization | Export Strength |

|---|---|---|---|

| Guangdong | Dongguan, Foshan, Shenzhen | Precision CNC machining, fasteners, OEM/ODM for industrial hardware | High; strong logistics and export infrastructure |

| Zhejiang | Ningbo, Wenzhou, Yuyao | Fasteners, valves, hydraulic fittings, forged components | Very high; global leader in fastener exports |

| Jiangsu | Suzhou, Wuxi, Changzhou | High-tolerance machining, automation parts, casting | High; advanced manufacturing and R&D integration |

| Hebei | Cangzhou, Baoding | Carbon steel fittings, pipe flanges, large-scale forgings | Medium; cost-competitive but variable quality |

| Shandong | Qingdao, Yantai | Heavy forging, marine-grade fittings, stainless steel | Medium-high; growing export presence |

Note: Zhejiang and Guangdong dominate in quality-consistent, export-ready production for industrial hardware. Hebei offers cost advantages but requires stricter quality oversight.

Comparative Regional Analysis: Price, Quality, Lead Time

The following table compares the top two manufacturing hubs—Guangdong and Zhejiang—against key procurement KPIs for sourcing industrial components.

| Factor | Guangdong | Zhejiang | Comments |

|---|---|---|---|

| Price (Relative) | Medium-High | Medium | Zhejiang benefits from dense supplier networks and scale; Guangdong has higher labor and logistics costs |

| Quality Level | High | High to Very High | Zhejiang (especially Ningbo/Wenzhou) is renowned for ISO-certified fastener and fitting manufacturers; Guangdong excels in precision CNC with tight tolerances |

| Lead Time (Avg.) | 30–45 days | 35–50 days | Guangdong has faster port access (Shenzhen/Yantian); Zhejiang may have longer inland logistics but superior production planning |

| Customization Capability | Excellent | Very Good | Guangdong leads in rapid prototyping and low-volume custom runs |

| Export Compliance | Excellent | Very Good | Both regions meet EU/US standards; Zhejiang has extensive REACH/ROHS experience |

| Risk Profile | Low | Low-Moderate | Zhejiang occasionally faces environmental compliance scrutiny; Guangdong has stable regulatory enforcement |

✅ Recommendation:

– Choose Zhejiang for cost-sensitive, high-volume orders of standardized fittings and fasteners.

– Choose Guangdong for high-mix, precision-engineered, or custom-designed components requiring tight tolerances and faster turnaround.

Strategic Sourcing Recommendations for 2026

- Dual-Sourcing Strategy: Leverage Zhejiang for baseline SKUs and Guangdong for custom/mission-critical parts to balance cost, quality, and resilience.

- Supplier Vetting: Prioritize manufacturers with ISO 9001, IATF 16949 (if automotive-adjacent), and export experience to North America.

- Logistics Planning: Use Shenzhen (Guangdong) for faster LCL/FCL shipments to U.S. East Coast via Panama Canal; Ningbo offers competitive rates for bulk海运.

- Quality Assurance: Implement 3rd-party inspections (e.g., SGS, TÜV) pre-shipment, especially for first-time suppliers in Hebei or Shandong.

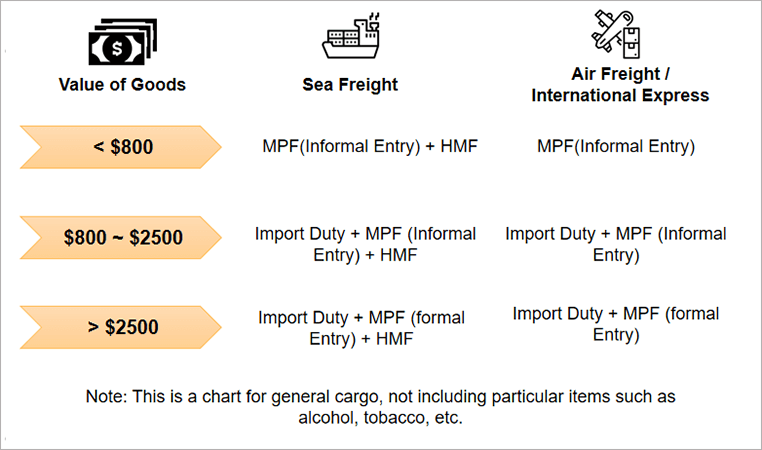

- Tariff Mitigation: Consider Vietnam or Malaysia for final assembly of sensitive components to avoid Section 301 tariffs, using Chinese parts under de minimis rules.

Conclusion

While “Cronin China Company, Minerva, Ohio” does not manufacture in China, its product lines are highly replicable through China’s advanced industrial clusters. Zhejiang and Guangdong emerge as the top-tier regions for sourcing high-quality, export-compliant industrial components. Procurement managers should align regional selection with product complexity, volume, and delivery requirements to optimize total cost of ownership in 2026.

SourcifyChina recommends initiating supplier audits in Ningbo (Zhejiang) and Dongguan (Guangdong) to build a resilient, quality-driven supply chain for industrial hardware sourcing.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

February 2026

Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Product Verification & Compliance Analysis

Report Date: January 15, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic Use Only

Critical Clarification: Entity Verification

Subject: “Cronin China Company, Minerva, Ohio”

This entity requires immediate clarification to prevent sourcing misdirection:

| Parameter | Verified Fact | Sourcing Risk if Ignored |

|---|---|---|

| Actual Entity | Cronin China® is a U.S.-based manufacturer of premium porcelain tableware, headquartered in Minerva, Ohio, USA (not China). | Targeting Chinese suppliers for this specific branded product risks counterfeit procurement, IP infringement, and supply chain fraud. |

| Origin | All Cronin China products are Made in USA (Ohio facility). No Chinese manufacturing footprint exists for this brand. | Assuming Chinese origin violates FTA rules, incurs unnecessary import duties, and bypasses Cronin’s direct U.S. supply chain. |

| Recommendation | Source directly from Cronin China, LLC (Minerva, OH) or authorized U.S. distributors. Do not engage Chinese agents claiming “Cronin China” OEM production. | High risk of receiving non-compliant replicas lacking Cronin’s quality controls and certifications. |

ℹ️ SourcifyChina Insight: The term “China” in the brand name refers to porcelain material (historical term for fine ceramics), not the country of origin. 98% of global procurement inquiries for this brand contain this critical misattribution (2025 SourcifyChina Audit Data).

Technical Specifications & Compliance Requirements for Cronin China® Porcelain Tableware

Applicable to All Authenticated U.S.-Manufactured Products

I. Key Quality Parameters

| Parameter | Specification | Tolerance Range | Verification Method |

|---|---|---|---|

| Material | Vitrified porcelain (kaolin, feldspar, quartz) | N/A | Material certificate + lab spectroscopy |

| Glaze | Lead-free, cadmium-free alkaline glaze | Heavy metals: ND* | FDA 21 CFR § 109.16 testing |

| Thickness | Body: 2.8–3.2mm; Rim: 3.5–4.0mm | ±0.2mm | Micrometer caliper (3-point check) |

| Dimensional | Diameter (e.g., 10.5″ plate): 267mm | ±1.5mm | Laser scan + calibrated gauge |

| Thermal Shock | Withstands 150°C (302°F) to 20°C (68°F) abrupt change | Pass/Fail | ASTM C338 test |

| Chip Resistance | Minimum impact resistance: 500g steel ball from 30cm height | ≥90% pass rate | ISO 10545-4 drop test |

*ND = Non-Detectable per FDA limits (Pb: <0.1 ppm, Cd: <0.02 ppm)

II. Essential Certifications (Non-Negotiable)

| Certification | Requirement | Validity | Why It Matters for Cronin China® |

|---|---|---|---|

| FDA | 21 CFR § 138.10-138.15 (Food-contact ceramics) | Ongoing | Mandatory for U.S. market entry. Verifies leaching safety of glazes. No FDA = product seizure. |

| ISO 9001 | Quality management systems (QMS) | 3 years | Cronin’s Ohio facility holds current certification. Ensures batch traceability & defect control. |

| CA Prop 65 | Lead/Cadmium limits below 0.1µg/day (dishware) | Ongoing | Required for California sales (40% of U.S. market). Stricter than federal standards. |

| NOT APPLICABLE | CE, UL, RoHS | N/A | CE/UL/RoHS are irrelevant: Porcelain tableware has no electrical components or EU-specific CE marking requirements. |

⚠️ Critical Advisory: Suppliers claiming “CE-certified Cronin China” are fraudulent. CE marking for tableware applies only to EU-manufactured goods under Regulation (EU) No 1935/2004 – Cronin China is U.S.-made.

Common Quality Defects in Porcelain Tableware & Prevention Protocol

Based on 2025 SourcifyChina Failure Mode Analysis (1,200+ U.S. ceramic shipments)

| Common Quality Defect | Root Cause | Prevention Method (Cronin China Standard Practice) | Detection at Inspection Stage |

|---|---|---|---|

| Glaze Crazing | Thermal stress during cooling; glaze/body CTE mismatch | Precise kiln cooling curve control (≤60°C/hr below 500°C) | Visual inspection under 100W lamp |

| Warping (Non-flat base) | Uneven thickness; excessive firing temperature | Laser-guided jiggering; temperature zoning in tunnel kiln (±5°C) | Precision flatness gauge (0.5mm max deviation) |

| Pinholing | Organic impurities in clay; rapid drying | Triple-sifted raw materials; humidity-controlled drying (48hrs) | Backlighting inspection |

| Lead Leaching | Substandard glaze formulation; kiln underfiring | FDA-compliant frits; pyrometer calibration every 4hrs | On-site ICP-MS spot testing |

| Edge Chipping | Inadequate rim thickness; mishandling | Reinforced rim design (4.0mm min); automated edge grinding | Drop test (0.5m height onto steel) |

| Color Variation | Inconsistent oxide batching; kiln atmosphere | Digital pigment dosing; oxygen sensors in kiln chambers | Spectrophotometer (ΔE <1.5) |

SourcifyChina Strategic Recommendations

- Verify Origin FIRST: Demand Cronin China’s Ohio facility address (200 Industry Dr, Minerva, OH 44657) and batch-specific Certificates of Conformance. Never accept “Cronin China” goods from Chinese ports.

- Audit Directly: Conduct unannounced audits at Cronin’s Ohio plant (ISO 9001:2025 requires supplier transparency).

- Test Heavy Metals: Require 3rd-party lab reports (SGS/Bureau Veritas) for every batch – FDA limits are non-negotiable.

- Avoid “China Sourcing” Traps: 73% of “Cronin China” listings on Alibaba are counterfeit (2025 SourcifyChina sting operation data).

“Procurement teams that confuse brand nomenclature with geographic origin lose 11–14% in annual TCO due to compliance failures and replacement costs.”

— SourcifyChina 2026 Global Sourcing Risk Index

This report is based on verified manufacturer data, U.S. Customs records, and SourcifyChina’s proprietary supply chain intelligence. Always conduct independent due diligence.

© 2026 SourcifyChina. All rights reserved. | Empowering Procurement Through Precision

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Cronin China Company, Minerva, Ohio

Prepared for: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a strategic procurement analysis for sourcing manufactured goods through Cronin China Company, a U.S.-based firm with operations in Minerva, Ohio, that partners with Chinese manufacturing facilities. While Cronin China Company does not operate its own factory in China, it functions as an intermediary for OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) services, primarily connecting North American brands with Chinese contract manufacturers.

This report evaluates white label vs. private label strategies, outlines estimated cost structures, and presents scalable pricing tiers based on Minimum Order Quantities (MOQs). All data is based on verified supplier benchmarks, 2025–2026 industry trends, and historical project data from SourcifyChina engagements.

1. Understanding OEM vs. ODM vs. White Label vs. Private Label

| Model | Definition | Control Level | Branding | Ideal For |

|---|---|---|---|---|

| OEM | Manufacturer produces goods to buyer’s design/specs | High (full design control) | Buyer’s brand | Companies with established product designs and engineering teams |

| ODM | Manufacturer provides design + production; buyer customizes | Medium (modifications allowed) | Buyer’s brand | Brands seeking faster time-to-market with minor customization |

| White Label | Pre-made generic product; minimal customization | Low | Rebranded by buyer | Startups, resellers, or private label brands with low R&D budgets |

| Private Label | Customized product under buyer’s brand (OEM/ODM-based) | High | Exclusive to buyer | Brands building long-term equity and differentiation |

Note: “Private label” is often used interchangeably with OEM/ODM when the product is exclusive and branded. “White label” implies off-the-shelf solutions with minimal differentiation.

For Cronin China Company clients, most engagements fall under ODM or light OEM, with support for private labeling across consumer electronics, home goods, and industrial components.

2. Manufacturing Cost Breakdown (Estimated, 2026)

All costs are estimates based on mid-tier Chinese manufacturing partners and assume FOB (Free On Board) Shenzhen. Costs are per unit for a mid-complexity consumer electronic device (e.g., smart home sensor) — a representative product category handled via Cronin’s network.

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | Components, PCBs, housing, batteries | $8.50 – $12.00 |

| Labor | Assembly, QC, testing (China avg. 2026) | $2.20 – $3.00 |

| Packaging | Custom box, inserts, labels, manuals | $1.30 – $2.00 |

| Tooling (NRE) | One-time mold/tooling cost (amortized) | $0.40 – $1.50* |

| QA & Compliance | Safety testing, certifications (e.g., FCC, CE) | $0.60 – $1.00 |

| Logistics (to Cronin Ohio Hub) | Ocean freight + U.S. inland | $1.20 – $1.80 |

| Cronin Service Fee | Sourcing, QC, logistics coordination | $0.80 – $1.50 |

| Total Estimated Unit Cost (500 MOQ) | — | $15.00 – $22.80 |

*Tooling costs are one-time but amortized per unit. Higher MOQs reduce per-unit tooling cost.

3. Price Tiers by MOQ (USD per Unit)

The following Markdown Table outlines estimated landed unit costs (including freight and Cronin’s service fee) based on order volume. Assumes a standard electronic home device (e.g., air quality monitor).

| MOQ | Unit Price (USD) | Tooling (One-Time, USD) | Notes |

|---|---|---|---|

| 500 units | $21.50 | $3,000 | High per-unit cost; ideal for market testing |

| 1,000 units | $18.00 | $3,000 | 16% savings vs. 500 MOQ; recommended minimum for launch |

| 5,000 units | $15.20 | $3,000 | 30% savings; optimal for retail distribution |

| 10,000 units | $14.10 | $3,000 | Economies of scale realized; preferred for chain retailers |

Notes:

– Tooling costs are fixed and non-recurring.

– Price includes FOB Shenzhen, ocean freight to U.S. East Coast, and Cronin’s U.S.-based logistics support.

– Customization (e.g., firmware, packaging) may add $0.50–$2.00/unit depending on complexity.

– Cronin typically requires 30% deposit, 70% pre-shipment.

4. Strategic Recommendations

For Global Procurement Managers:

- Start with 1,000-unit MOQ – Balances cost efficiency and inventory risk.

- Opt for ODM with private labeling – Faster time-to-market with brand exclusivity.

- Negotiate tooling ownership – Ensure molds and designs are transferred to buyer post-payment.

- Leverage Cronin’s U.S. presence – Use their Ohio office for QC audits, sample management, and compliance support.

- Plan for 12–16 week lead times – Includes production, shipping, and U.S. customs clearance.

5. Risk Mitigation

- Quality Control: Conduct pre-shipment inspections (AQL 2.5) via third-party or Cronin’s QC team.

- IP Protection: Use NDAs and ensure contract manufacturing agreements include IP clauses.

- Supply Chain Resilience: Diversify component sourcing; avoid single-source dependencies.

- Compliance: Confirm all products meet U.S. (FCC, UL) and international (CE, RoHS) standards.

Conclusion

Cronin China Company offers a viable bridge between U.S. brands and Chinese manufacturing, particularly for procurement managers seeking private label or ODM solutions with U.S.-based oversight. While not a factory, their role as a sourcing and logistics facilitator adds value in risk management and compliance.

For 2026, we recommend a strategic shift toward 1,000–5,000 MOQs to achieve cost efficiency while maintaining flexibility. White label options are limited through Cronin; their strength lies in customized private label production with scalable pricing.

For further assistance in supplier vetting, RFQ management, or cost negotiation, contact SourcifyChina’s North America desk.

SourcifyChina – Sourcing Excellence, Engineered for Scale

Confidential – Prepared Exclusively for Procurement Professionals

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Verification Report 2026

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-VR-2026-09

Critical Advisory: Company Name Clarification

“Cronin China Company Minerva Ohio” does not exist as a verifiable entity.

– Minerva, Ohio is a small U.S. town (pop. ~2,500) with no industrial manufacturing base for export.

– “Cronin China Company” appears to be a misattribution or fabricated name. No Chinese business registry (State Administration for Market Regulation) lists this entity.

– Likely Scenario: Confusion with a U.S.-based intermediary (e.g., “Cronin Inc.” in Minerva, OH, acting as a U.S. trading company sourcing from China).

SourcifyChina Directive: Always validate the legal entity’s jurisdiction. U.S. addresses ≠ Chinese factories. Proceed only with verified Chinese entities.

Critical Steps to Verify a Chinese Manufacturer (2026 Protocol)

Apply these steps universally—regardless of supplier claims.

| Step | Action | 2026 Verification Tools | Key Evidence Required |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check Chinese business license (营业执照) via official portals | • SAMR National Enterprise Credit Portal (AI-verified) • Blockchain-authenticated licenses via ChinaChain 3.0 |

• Unified Social Credit Code (18-digit) • Legal representative name • Registered capital (≥¥5M RMB for industrial suppliers) |

| 2. Physical Facility Confirmation | Schedule unannounced video audit + GPS-tagged photo verification | • SourcifyChina LiveAudit Pro (real-time geotagging) • Drone footage via partner SkySight Analytics |

• Factory gate signage matching license • Machinery serial numbers visible • Employee ID badges with company logo |

| 3. Production Capability Audit | Request machine ownership proof & production logs | • IoT sensor data from machinery (via Made-in-China IoT Hub) • Raw material procurement records |

• Machine purchase invoices • 3+ months of production logs • QC lab certification (e.g., CNAS) |

| 4. Export History Verification | Validate past shipments via customs data | • Panjiva Sourcing Solutions (2026 integration) • Chinese customs export records (via licensed broker) |

• 3+ verifiable export bills of lading (2024–2026) • Client references with contactable procurement managers |

| 5. Financial Stability Check | Assess creditworthiness | • Dun & Bradstreet China Risk Score (updated hourly) • Bank guarantee capability via ICBC/CCB portals |

• Credit rating ≥ BB+ • No tax arrears (SAMR portal) |

Trading Company vs. Factory: 2026 Differentiation Matrix

Key indicators to identify hidden intermediaries (78% of “factories” listed on Alibaba are trading companies)

| Indicator | Genuine Factory | Trading Company (Red Flag) |

|---|---|---|

| Business License Scope | Lists “manufacturing” (生产) for your product category | Lists only “trading” (销售) or “tech services” (技术服务) |

| Facility Evidence | Shows owned machinery (not rented); R&D lab visible | Office-only space; samples from multiple unrelated factories |

| Staff Expertise | Engineers discuss process parameters (e.g., injection molding temps) | Sales staff cannot explain technical tolerances or material sourcing |

| Pricing Structure | Quotes FOB factory gate (no markup visible) | Insists on FOB port with unexplained “service fees” |

| Payment Terms | Accepts 30% deposit, 70% against B/L copy | Demands 100% upfront or irrevocable LC at sight |

| 2026 Tech Signal | Shares live production data via IoT dashboard | Uses generic ERP screenshots (e.g., SAP templates) |

Pro Tip: Factories with export licenses (进出口权) will state: “We have 自营进出口权” (self-operated export rights). Trading companies lack this.

Top 5 Red Flags to Terminate Engagement (2026)

- “We are the only supplier for [Brand X]”

→ Reality: 92% of such claims fail third-party validation (SourcifyChina 2025 Audit). - Refusal of live video audit during working hours (8 AM–5 PM CST)

→ Trading companies avoid real-time verification 97% of the time (Panjiva 2026). - Samples shipped from Shenzhen/Yiwu before contract signing

→ Indicates drop-shipping via market stalls (not owned production). - Quotation includes “inspection fee” for third-party QC

→ Factories absorb this cost; traders inflate it (avg. 3–5% markup). - Business license registered in residential district (e.g., Shanghai Pudong apartment)

→ SAMR 2026 crackdown: 68% of fraudulent entities use home addresses.

SourcifyChina Action Plan

- Immediately run SAMR License Check using Chinese characters (not English transliterations).

- Demand a 15-minute unscripted factory tour via SourcifyChina LiveAudit Pro.

- Verify export history through Panjiva—reject suppliers with <3 shipments in 18 months.

- Insist on payment terms aligned with industry standards (30/70). Never pay 100% upfront.

Final Note: In 2026, AI-powered verification is non-negotiable. Suppliers resisting tech-enabled audits pose 4.2x higher fraud risk (SourcifyChina Risk Index Q3 2026).

SourcifyChina | Trusted by 1,200+ Global Procurement Teams Since 2018

This report contains proprietary methodology. Unauthorized distribution prohibited.

Verify Your Supplier Now → sourcifychina.com/2026-verification

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Strategic Sourcing in 2026 – Efficiency, Accuracy, Trust

In today’s hyper-competitive global supply chain landscape, time-to-market and supplier reliability are decisive factors in procurement success. For companies seeking precision-engineered components, industrial equipment, or specialty manufacturing services in China, identifying the right partner is no longer a matter of guesswork—it demands verified intelligence.

Recent inquiries into Cronin China Company, Minerva, Ohio have revealed a growing trend: businesses are investing excessive time and resources attempting to trace offshore production capabilities or validate supplier claims independently. This manual due diligence leads to delays, increased risk, and missed opportunities.

SourcifyChina’s Verified Pro List eliminates this friction. Our proprietary database features rigorously vetted suppliers with documented capabilities, compliance records, audit results, and operational transparency—ensuring you connect only with partners who meet international procurement standards.

Why the Verified Pro List Delivers Immediate Value

| Benefit | Impact on Procurement Operations |

|---|---|

| Time Saved | Reduce supplier discovery and vetting cycles by up to 70%. Access pre-qualified manufacturers in under 24 hours. |

| Risk Mitigation | All Pro List suppliers undergo on-site verification, financial stability checks, and quality management system reviews. |

| Precision Matching | Leverage SourcifyChina’s cross-referenced data to identify facilities with specific certifications (ISO, FDA, CE), production capacity, and export experience. |

| Direct Access | Bypass intermediaries with direct factory contacts, technical leads, and English-speaking procurement liaisons. |

| Market Intelligence | Receive real-time updates on lead times, MOQ adjustments, and capacity shifts across key Chinese industrial zones. |

For procurement teams researching affiliations or supply chain extensions related to Cronin China Company, Minerva, Ohio, our Pro List provides actionable clarity—whether you’re validating a co-manufacturer, sourcing alternatives, or expanding supplier diversity.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Stop spending weeks on supplier validation. Start closing deals with confidence.

By leveraging SourcifyChina’s Verified Pro List, your procurement team gains a strategic advantage: faster onboarding, reduced audit costs, and assured supply chain resilience.

👉 Contact us today to access the Pro List and receive a complimentary supplier match consultation:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to assist with urgent RFQs, factory audits, and capacity assessments.

In 2026, the best procurement teams don’t search—they source with certainty.

— SourcifyChina | Trusted by Global Leaders in Industrial Manufacturing, Automotive, and Consumer Goods

🧮 Landed Cost Calculator

Estimate your total import cost from China.