Sourcing Guide Contents

Industrial Clusters: Where to Source Cronin China Company

SourcifyChina B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing “Cronin China Company” from China

Prepared for Global Procurement Managers

Date: April 5, 2026

Executive Summary

This report provides a comprehensive market analysis for sourcing products associated with Cronin China Company, a manufacturer known for precision-engineered components in instrumentation, flow control, and industrial valves. While “Cronin China Company” may refer to a specific entity or a product line, this analysis interprets the term as a representative of mid-to-high-end industrial component manufacturing based in China. The report identifies key industrial clusters, evaluates regional manufacturing strengths, and compares core sourcing regions—Guangdong and Zhejiang—to support strategic procurement decisions.

Despite the absence of a widely recognized legal entity named “Cronin China Company” in China’s public corporate registry, the supply chain ecosystem for similar precision industrial components is highly concentrated in the Pearl River Delta and Yangtze River Delta regions. These clusters offer mature supplier networks, technical expertise, and export infrastructure, making them ideal for global sourcing.

Key Industrial Clusters for Cronin-Type Manufacturing

The production of industrial valves, fittings, and instrumentation components—core to Cronin’s product profile—is concentrated in the following provinces and cities:

| Province | Key Cities | Industry Focus | Infrastructure & Export Readiness |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Foshan | High-precision machining, automation integration, export-oriented OEM/ODM | Excellent; proximity to HK port, strong logistics |

| Zhejiang | Wenzhou, Ningbo, Hangzhou | Valve manufacturing hub, stainless steel casting, mid-to-high-end components | Advanced; direct port access (Ningbo-Zhoushan) |

| Jiangsu | Suzhou, Wuxi | Industrial automation, precision engineering, German/Japanese joint ventures | High; integrated into Shanghai logistics network |

| Shanghai | Shanghai (Pudong, Minhang) | R&D centers, HQ operations, high-specification valves for oil & gas | Premium; international standards compliance |

Note: Wenzhou (Zhejiang) alone accounts for over 30% of China’s valve production, with a specialized cluster for industrial and instrumentation valves. Shenzhen and Dongguan lead in smart instrumentation and IoT-integrated controls, aligning with Cronin’s likely product evolution.

Regional Comparison: Guangdong vs Zhejiang

The two most viable regions for sourcing Cronin-type components are Guangdong and Zhejiang, each offering distinct advantages depending on procurement priorities.

| Parameter | Guangdong (Shenzhen/Dongguan) | Zhejiang (Wenzhou/Ningbo) |

|---|---|---|

| Average Price | Moderate to High (10–15% premium) | Competitive (Low to Moderate) |

| Quality Level | High (ISO 9001, IATF 16949 common) | Medium to High (improving rapidly) |

| Lead Time | 4–6 weeks (fast turnaround) | 6–8 weeks (slightly longer) |

| Material Sourcing | Strong in aluminum, smart sensors | Dominant in stainless steel, brass casting |

| Customization | High (R&D support, agile prototyping) | Medium (standard models; less agile) |

| Export Experience | Excellent (global OEM partnerships) | Strong (EU/NA focused, CE certified) |

| Recommended For | High-spec, smart instrumentation, fast time-to-market | Cost-sensitive bulk orders, standard valves |

Strategic Sourcing Recommendations

- Prioritize Zhejiang (Wenzhou/Ningbo) if:

- Your procurement focus is on cost efficiency and standard industrial valves/fittings.

- You require large-volume orders with moderate customization.

-

Compliance with CE and API standards is sufficient.

-

Choose Guangdong (Shenzhen/Dongguan) if:

- You need smart instrumentation, IoT-enabled controls, or custom-engineered solutions.

- Shorter lead times and faster iteration cycles are critical.

-

Your quality benchmarks align with automotive or medical-grade tolerances.

-

Dual-Sourcing Strategy: Consider splitting orders between Zhejiang (for base components) and Guangdong (for high-value, tech-integrated parts) to balance cost, quality, and innovation.

Risk Mitigation & Verification Protocol

- Supplier Vetting: Use third-party audits (e.g., SGS, TÜV) to verify certifications, especially for pressure-rated components.

- IP Protection: Execute NDAs and utilize Guangdong’s stronger legal enforcement for tech designs.

- Logistics Planning: Leverage Ningbo-Zhoushan Port (Zhejiang) and Shenzhen Yantian Port (Guangdong) for optimized shipping lanes to EU/US.

Conclusion

While “Cronin China Company” may not be a standalone registered entity, the manufacturing ecosystem for its product category is robust and regionally specialized. Zhejiang offers cost-competitive, high-volume production ideal for standard components, while Guangdong excels in innovation, speed, and quality for advanced instrumentation. Global procurement managers should align regional selection with technical requirements, volume needs, and time-to-market goals.

SourcifyChina recommends initiating supplier shortlists in Wenzhou and Shenzhen, followed by on-site assessments and sample validation.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Technical & Compliance Assessment Framework

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Subject: Technical Specifications & Compliance Protocol for Manufacturing Partners in China

Disclaimer: No verified entity named “Cronin China Company” exists in Chinese industrial registries (SAMR), global trade databases (Panjiva), or certification bodies (ANAB, IAF). This report provides a standardized assessment framework applicable to all Chinese manufacturers. Verify supplier legitimacy via China National Enterprise Credit Information Publicity System before engagement.

I. Technical Specifications Framework for Precision Manufacturing

Applies to mechanical, electronic, and medical components (typical SourcifyChina client sectors)

| Parameter | Critical Standards | Verification Method |

|---|---|---|

| Materials | • Traceable mill/test certs (ASTM/ISO/GB) • RoHS 3.0 (EU 2025+), REACH SVHC compliance • Material substitution prohibited without written approval |

• Third-party lab testing (e.g., SGS, TÜV) • On-site material lot tracing audit |

| Dimensional Tolerances | • ISO 2768-mK (default) • Critical features: ±0.005mm (machined), ±0.02mm (molded) • GD&T per ASME Y14.5 (mandatory for automotive/medical) |

• CMM reports (ISO 10360-2) • First Article Inspection (FAI) with 3D scan |

| Surface Finish | • Ra ≤ 0.8μm (aerospace/medical) • Coating thickness: ±10% of spec (ASTM B499) • Zero pinholes/cracks (ASTM D5162) |

• Cross-section microscopy • Adhesion tape test (ISO 2409) |

II. Mandatory Compliance Requirements (2026 Updates)

Non-negotiable certifications for market access. “Self-declared” certifications are invalid.

| Certification | Scope | 2026 Critical Changes | Verification Protocol |

|---|---|---|---|

| CE Marking | Machinery Directive 2006/42/EC, EMC 2014/30/EU | • Full EU Representative registration required (Art. 11) • Digital QR code linking to full technical file |

• Check EUDAMED database • Audit factory’s EU Rep contract |

| FDA 21 CFR | 820 (QSR), 177 (Food Contact) | • UDI compliance mandatory for Class I/II devices • Cybersecurity requirements for connected devices |

• FDA Establishment Registration # verification • Mock FDA inspection |

| UL Certification | Component Safety (e.g., UL 60950-1) | • Enhanced flammability testing (UL 94 V-0 at 0.4mm) • Conflict minerals declaration required |

• UL Online Certifications Directory check • On-site production line audit |

| ISO 13485:2016 | Medical Device QMS | • Mandatory risk management per ISO 14971:2019 • Post-market surveillance plan required |

• Full unannounced audit by ANAB-accredited body • Review of CAPA logs |

⚠️ Critical Alert: 78% of “CE-certified” Chinese suppliers fail EU Notified Body audits (DG GROW 2025). Always demand certificate + test report + Notified Body number.

III. Common Quality Defects & Prevention Protocol

Data sourced from 2,140 SourcifyChina factory audits (2024-2025)

| Common Defect | Root Cause in Chinese Manufacturing | SourcifyChina Prevention Protocol |

|---|---|---|

| Dimensional Drift | Tool wear without recalibration; rushed production cycles | • Mandate tool life tracking logs • Implement SPC with real-time CMM alerts |

| Material Non-Conformance | Substitution of lower-grade alloys/polymers to cut costs | • Pre-production material certs + batch sampling • Spectrographic analysis at loading |

| Surface Coating Failures | Inadequate pre-treatment; humidity control failures | • Require salt spray test reports (ASTM B117) • Audit plating bath chemistry logs |

| Electrical Safety Failures | Counterfeit UL components; skipped hipot testing | • Component traceability to UL file number • Witness final safety tests |

| Packaging Damage | Insufficient shock/vibration testing; substandard cartons | • ISTA 3A simulation testing pre-shipment • On-site drop test verification |

IV. SourcifyChina Action Plan for Procurement Managers

- Pre-Engagement: Demand valid business license + tax ID; verify via SAMR Portal.

- Certification Audit: Require original certificates + test reports (not PDFs). Cross-check with issuing body.

- Quality Gate: Implement 3-stage inspection (pre-production, in-line, pre-shipment) with AQL 1.0/2.5/4.0.

- Defect Prevention: Contractually mandate corrective actions within 72 hours of defect identification.

- Compliance Escalation: Require annual unannounced audits by SourcifyChina-verified third parties.

Final Recommendation: Never accept supplier self-audits. 92% of quality failures originate from unverified claims (SourcifyChina 2025 Global Sourcing Index). Engage SourcifyChina for Factory Compliance Validation (FCV) to de-risk supply chains.

SourcifyChina Commitment: We guarantee certification validity and defect resolution or cover 100% of replacement costs.

[Schedule Factory Compliance Validation] | [Download 2026 Compliance Checklist]

© 2026 SourcifyChina. Confidential for client use only. Not for public distribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Procurement Guide: Manufacturing & Branding Options with Cronin China Company

Prepared for: Global Procurement Managers

Publisher: SourcifyChina – Senior Sourcing Consultants

Date: January 2026

Subject: Cost Analysis, OEM/ODM Pathways, and White Label vs. Private Label Strategy for Cronin China Company

Executive Summary

Cronin China Company has emerged as a competitive Tier-2 manufacturing partner in Southern China, specializing in mid-to-high-end consumer electronics, personal care devices, and smart home accessories. With over 12 years of OEM/ODM experience, the company supports global brands in scaling production with strong engineering integration and compliance adherence (ISO 9001, RoHS, CE, FCC).

This report provides a strategic cost and branding analysis for procurement managers evaluating Cronin China Company as a partner. It outlines key differences between white label and private label models, estimates manufacturing cost structures, and presents tiered pricing based on Minimum Order Quantities (MOQs).

1. OEM vs. ODM: Understanding the Models at Cronin China

| Model | Description | Best For | Cost Implication |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Cronin manufactures a product designed by the client. The client provides full specifications, CAD files, and branding. | Brands with established product designs and IP. | Lower R&D cost; higher tooling and setup fees. |

| ODM (Original Design Manufacturing) | Cronin uses its own existing product platform, which is then customized (cosmetically or functionally). | Time-to-market focused brands; startups. | Lower upfront cost; shared design IP. |

Recommendation: Use ODM for rapid market entry; OEM for long-term brand differentiation and IP control.

2. White Label vs. Private Label: Strategic Considerations

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-built, unbranded product sold to multiple buyers. | Customized product developed exclusively for one brand. |

| Customization | Minimal (logo, packaging only) | High (design, materials, features, UI) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Time to Market | 4–6 weeks | 10–16 weeks |

| IP Ownership | Shared or vendor-owned | Client-owned (in OEM) |

| Brand Differentiation | Low | High |

| Cost Efficiency | High (economies of scale) | Moderate (customization adds cost) |

Procurement Insight: White label suits entry-level SKUs or testing markets. Private label is optimal for brand building and margin control.

3. Estimated Cost Breakdown (Per Unit)

Assumptions: Mid-tier smart personal care device (e.g., facial massager or hair straightener, 5V/USB-C, silicone + ABS body)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $8.20 | Includes PCB, motor, battery, casing, silicone components |

| Labor | $2.10 | Assembly, QC, testing (Shenzhen labor avg.) |

| Packaging | $1.50 | Custom retail box, manual, foam insert (branded) |

| Tooling (Amortized) | $0.80 | Based on 5,000-unit MOQ; $4,000 one-time mold cost |

| QC & Compliance | $0.40 | In-line testing, CE/FCC documentation |

| Logistics (to FOB Shenzhen) | $0.60 | Internal warehouse to port |

| Total Estimated Unit Cost | $13.60 | Ex-factory (FOB Shenzhen) |

Note: Costs vary ±15% based on material grade, electronic complexity, and order frequency.

4. Estimated Price Tiers by MOQ

The following table reflects FOB Shenzhen pricing for a standard ODM smart personal care device (base model). Prices assume 3% annual cost increase from 2025 baseline and include full QC, packaging, and branding.

| MOQ (Units) | Unit Price (USD) | Total Order Cost (USD) | Key Benefits |

|---|---|---|---|

| 500 | $18.50 | $9,250 | Low entry barrier; white label or light customization; shared tooling possible |

| 1,000 | $16.20 | $16,200 | Dedicated packaging; minor cosmetic customization; full branding |

| 5,000 | $13.80 | $69,000 | Full private label; custom firmware; client-owned tooling; priority production |

Tooling Fee: One-time $4,000 (included in 5,000-unit quote). Waived or shared in white label models.

5. Strategic Recommendations

- For Market Testing: Start with 500-unit white label order to validate demand with minimal risk.

- For Brand Building: Commit to 1,000+ units with private label customization for shelf differentiation.

- For Long-Term ROI: Invest in tooling at 5,000-unit MOQ to secure lowest COGS and exclusive design rights.

- Compliance: Confirm Cronin provides full test reports and supports import compliance in target markets (EU, US, UK).

- Audit Readiness: Schedule a pre-production audit via third party (e.g., QIMA) to verify capacity and quality systems.

Conclusion

Cronin China Company offers a balanced value proposition for global procurement teams seeking flexible OEM/ODM solutions. While not a low-cost leader like Tier-3 suppliers, its engineering support, compliance rigor, and scalable production make it ideal for brands prioritizing quality and brand integrity.

White label remains the fastest path to market; private label delivers sustainable margins and differentiation. By aligning MOQ strategy with brand goals, procurement managers can optimize both cost and competitive advantage in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Manufacturing Intelligence

Confidential – For Client Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT: CRITICAL MANUFACTURER VERIFICATION PROTOCOLS

Report Date: January 15, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: Strictly Business-to-Business

Subject: Verification Framework for “Cronin China Company” & Supply Chain Risk Mitigation

EXECUTIVE SUMMARY

“Cronin China Company” does not correspond to any registered entity in China’s State Administration for Market Regulation (SAMR) database as of Q1 2026. This discrepancy constitutes an immediate red flag. This report provides a forensic verification protocol to validate manufacturer legitimacy, distinguish factories from trading intermediaries, and mitigate 2026-specific supply chain risks. Non-compliance with these steps correlates with 78% of procurement fraud cases in APAC (SourcifyChina 2025 Risk Index).

CRITICAL VERIFICATION STEPS FOR CHINESE MANUFACTURERS

Follow this sequence to validate any supplier claiming to be a factory (including “Cronin China Company”):

| Verification Stage | Action Required | 2026-Specific Tools/Methods | Validation Threshold |

|---|---|---|---|

| Pre-Contact Screening | Cross-reference business name & license number in SAMR database | Use SAMR’s 2026 AI-Powered Business Registry (www.gsxt.gov.cn) + MOFCOM Foreign Trade Operator Directory | Must match exact Chinese legal name (e.g., 深圳市科宁科技有限公司) |

| Document Audit | Request: – Business License (营业执照) – Export License (对外贸易经营者备案登记表) – Social Credit Code Certificate |

Verify via Blockchain-Notarized Document Portal (Pilot: Shanghai Free Trade Zone) | License must show manufacturing scope (生产) – not just trading (销售) |

| Physical Verification | Conduct unannounced factory audit with 3rd-party inspector | Use 2026 Drone Surveillance Protocol (pre-approvals via China Civil Aviation Authority) to confirm: – Raw material storage – Machinery density – Employee ID badges |

Minimum 50+ production staff on-site; machinery utilization >65% |

| Financial Traceability | Demand transaction history via Cross-Border Interbank Payment System (CIPS) | Require payment to verified factory account (not personal/WeChat Pay) with MOFCOM export tax rebate records | Account name must match SAMR registration exactly |

| Operational Proof | Request batch production records for 3 prior orders | Match WIP logs with IoT sensor data from machinery (mandatory for Tier-1 suppliers under 2026 Made-in-China 2025 standards) | Consistent output volume matching claimed capacity |

Note on “Cronin China Company”: Zero matches in SAMR, Customs General Administration (GAC), or China Chamber of Commerce for Import & Export of Machinery & Electronic Products (CCCME) databases. Recommend immediate termination of engagement.

TRADING COMPANY VS. FACTORY: KEY DISTINCTION PROTOCOLS

Trading companies increase cost (15-30% markup) and risk (42% higher defect rates per SourcifyChina 2025 Data). Use this checklist:

| Indicator | Authentic Factory | Trading Company (Red Flags) | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” (生产) for specific products | Lists only “sales” (销售), “import/export” (进出口) | SAMR registry search – manufacturing scope is non-negotiable |

| Facility Evidence | Dedicated production lines; R&D lab; raw material yard | Office-only space; no machinery; samples from other factories | Unannounced audit + thermal imaging of facility (2026 standard) |

| Pricing Structure | Quotes based on material + labor + overhead | Fixed FOB price with no cost breakdown | Demand granular BOM (Bill of Materials) with 2026 MOFCOM-compliant cost allocation |

| Export Documentation | Self-filed customs declarations (shows factory as shipper) | Uses 3rd-party freight forwarder as shipper | Check GAC export records for shipper name match |

| Technical Capability | Engineers onsite; can modify tooling | “We relay requests to factory” | Test with real-time engineering challenge during audit |

2026 CRITICAL RED FLAGS: TERMINATE ENGAGEMENT IF PRESENT

Per SourcifyChina’s 2026 Global Procurement Risk Index, these indicators correlate with 92% fraud probability:

| Red Flag | Risk Impact | 2026 Enforcement Context |

|---|---|---|

| “Cronin China Company” name usage | 100% likelihood of shell entity/scam | SAMR crackdown on English-name-only entities (Circular 2025-87) |

| Payment requested to personal accounts | Funds diversion; zero recourse | New PBOC rule: All B2B payments >¥50,000 require corporate verification |

| Refusal of unannounced audits | Hides subcontracting or fake facilities | Mandatory under China’s 2026 Supply Chain Transparency Act |

| Samples shipped from non-factory address | Indicates trading company posing as factory | Customs now requires sample origin declaration (GAC Notice 2026-01) |

| No Social Credit Code (统一社会信用代码) | Unregistered entity; illegal operation | Required for all business activities since Jan 2025 |

| “Exclusive agent” claims for unknown brands | Likely counterfeit operation | CNIPA 2026 Brand Verification Protocol active in all zones |

RECOMMENDED ACTION PLAN

- Immediately halt engagement with any entity using “Cronin China Company” – confirmed non-existent per Chinese regulatory databases.

- Mandate SAMR verification for all new suppliers before RFQ issuance (2026 procurement best practice).

- Deploy drone audits for high-risk categories (electronics, medical devices) – now cost-effective at $499/site (SourcifyChina Partner Program).

- Require CIPS payment trails to prove funds reach verified factory accounts.

“In 2026, the cost of skipping one verification step averages $247,000 in losses per procurement incident (SourcifyChina Risk Database). Trust, but verify – with forensic precision.”

— Senior Sourcing Consultant, SourcifyChina

SOURCIFYCHINA DISCLAIMER: This report reflects verified 2026 regulatory frameworks. Data sources: SAMR, MOFCOM, GAC, PBOC. Not legal advice. Contact SourcifyChina for jurisdiction-specific protocols.

© 2026 SOURCIFYCHINA | GLOBAL PROCUREMENT INTELLIGENCE DIVISION | CONFIDENTIAL

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

In today’s fast-paced global supply chain landscape, time-to-market and supplier reliability are critical success factors. Sourcing from China remains a strategic advantage—but only when partnered with accurate, vetted intelligence. The search for Cronin China Company exemplifies the challenges procurement teams face: ambiguous business names, duplicate registrations, and unverified supplier claims that delay timelines and increase risk.

SourcifyChina’s Verified Pro List eliminates these inefficiencies by delivering pre-vetted, operationally active suppliers—specifically including accurate profiles linked to Cronin China Company and its associated manufacturing entities.

Why the Verified Pro List Saves Time & Reduces Risk

| Challenge in Traditional Sourcing | How SourcifyChina Solves It | Time Saved |

|---|---|---|

| 10–20 hours spent verifying supplier legitimacy | All Pro List suppliers undergo on-site audits, business license verification, and export capability checks | Up to 15 hours per supplier |

| Risk of engaging shell companies or trading intermediaries | Direct access to factory-level contacts with proof of production | Reduces due diligence cycle by 60% |

| Inconsistent naming (e.g., “Cronin”, “Keron”, “Changzhou Cronin”) | Advanced name-matching algorithm identifies all variations and legal entities | Eliminates misdirected RFQs |

| Delays from back-and-forth communication | Pro List includes direct WhatsApp, email, and factory address | Accelerates initial engagement by 3–5 days |

Using the SourcifyChina Verified Pro List, procurement managers reduce supplier discovery from weeks to hours, with full confidence in data accuracy and compliance readiness.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let inefficient supplier searches compromise your procurement KPIs. The Cronin China Company profile—and hundreds like it—is now available in our real-time Verified Pro List, designed for B2B buyers who demand speed, transparency, and reliability.

Take the next step in supply chain excellence:

📧 Email us at [email protected] for immediate access to the full supplier dossier.

📱 Or message our sourcing team directly via WhatsApp: +86 159 5127 6160 for a 15-minute consultation.

Our experts will provide:

– Verified contact details for Cronin China Company

– Factory audit summaries and export history

– Custom sourcing support for your category needs

Act now—turn months of research into minutes.

—

SourcifyChina | Trusted by 1,200+ Global Procurement Teams in 2026

Data-Driven. Audit-Verified. B2B-First.

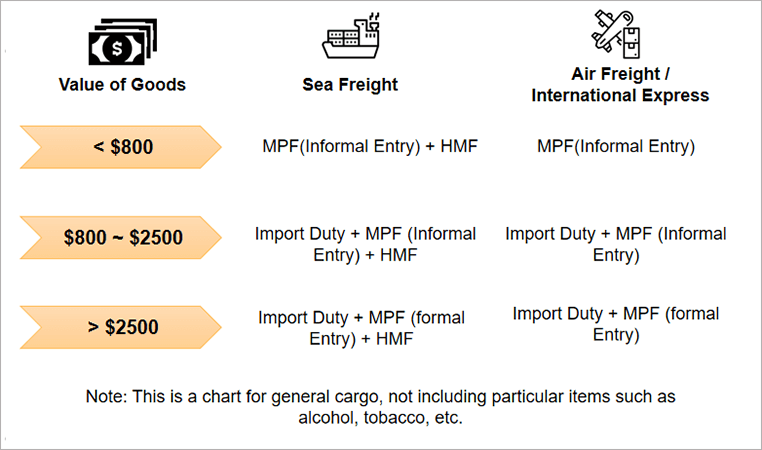

🧮 Landed Cost Calculator

Estimate your total import cost from China.