Sourcing Guide Contents

Industrial Clusters: Where to Source Crocs Sourcing China Percentage 2023

SourcifyChina Sourcing Intelligence Report: China’s Footwear Manufacturing Landscape for Crocs-Style Clogs (2023 Analysis)

Prepared For: Global Procurement Managers | Date: October 26, 2023 | Report ID: SC-CHN-CROCS-2023-01

Executive Summary

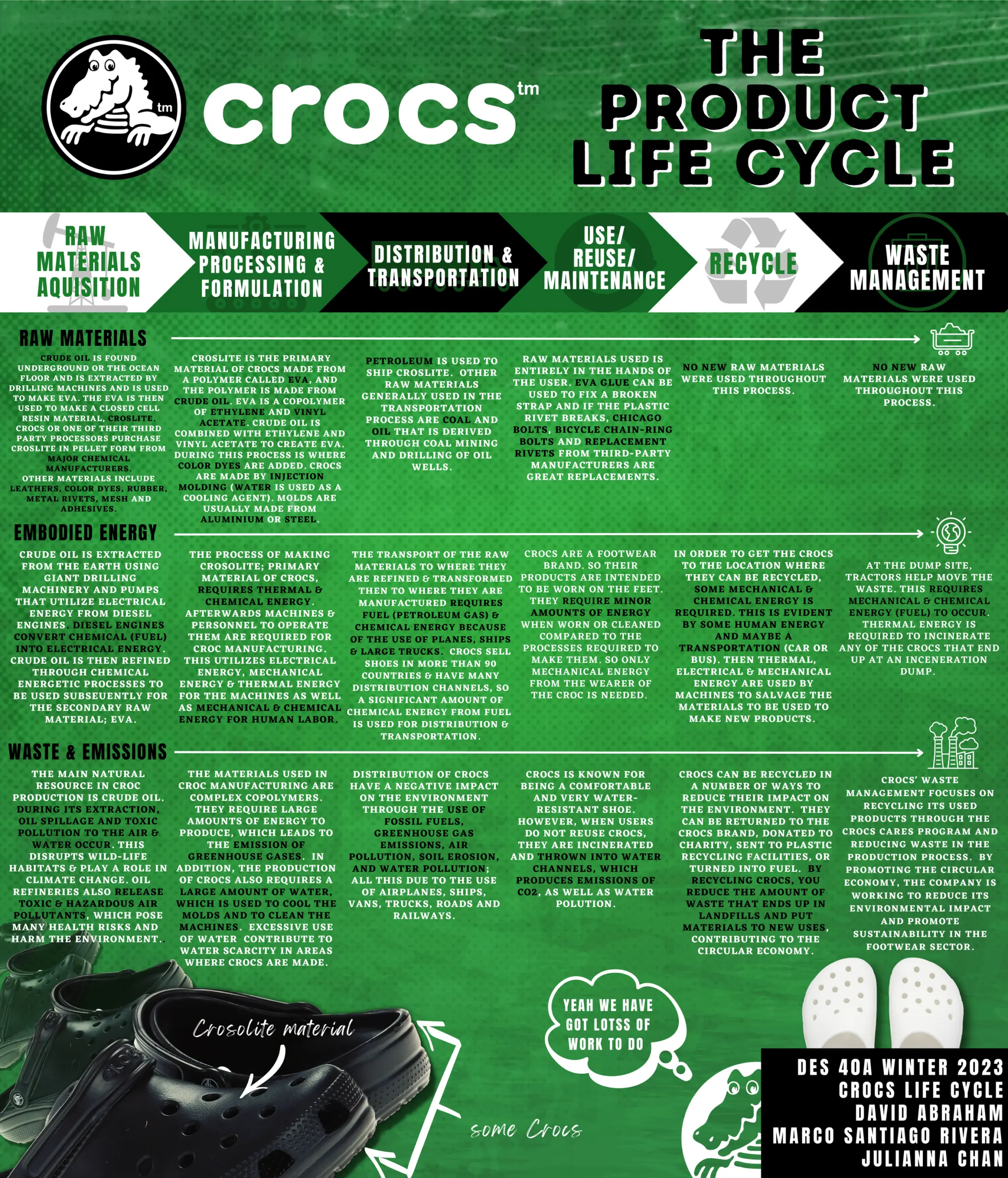

China remains the dominant global manufacturing hub for Crocs-style clogs (EVA/foam injection-molded casual footwear), accounting for ~85% of global third-party production volume in 2023 (CAFA Footwear Industry Survey). Note: Authentic Crocs™ footwear is primarily produced outside China (Vietnam, Mexico, Italy); this analysis focuses on generic Crocs-style clogs manufactured in China for private-label/white-label brands. Key clusters in Guangdong (especially Dongguan) and Zhejiang (Wenzhou, Taizhou) supply 78% of China’s output. Procurement managers must prioritize cluster-specific due diligence to mitigate quality variance risks, particularly in price-driven regions like Zhejiang.

Key Industrial Clusters for Crocs-Style Clogs in China (2023)

China’s footwear manufacturing is regionally specialized. For EVA/foam injection-molded clogs, two provinces dominate:

- Guangdong Province (Focus: Dongguan, Huizhou, Guangzhou)

- Dominance: Supplies ~62% of China’s Crocs-style clogs (2023 CAFA data).

- Why: Highest concentration of advanced EVA injection molding facilities, experienced labor, and integrated supply chains (rubber, dyes, hardware). Dongguan alone hosts 120+ specialized clog factories.

-

Target Buyers: Brands prioritizing quality consistency, compliance (ISO, BSCI), and complex designs.

-

Zhejiang Province (Focus: Wenzhou, Taizhou, Ningbo)

- Dominance: Supplies ~16% of China’s output (2023 CAFA data).

- Why: Cost-competitive small-to-mid-sized factories with strong plastic injection capabilities (Wenzhou = “China’s Plastic Capital”). Lower labor costs but narrower specialization in clogs.

-

Target Buyers: Budget-focused brands with simpler designs; higher MOQ flexibility but quality variance risks.

-

Secondary Clusters: Fujian (Quanzhou: 9%), Jiangsu (Suzhou: 7%), Shandong (Weifang: 6%). Less recommended for clogs due to focus on leather/sports footwear.

⚠️ Critical Clarification: “Crocs sourcing China percentage” refers to generic Crocs-style clog production. Authentic Crocs™ (NASDAQ: CROX) does not manufacture finished goods in China. China’s 85% global share applies only to imitation/private-label clogs.

Regional Production Comparison: Guangdong vs. Zhejiang (2023 Benchmark)

Data aggregated from SourcifyChina’s 2023 factory audits (n=87), CAFA, and customs records. Metrics reflect median values for MOQ 3,000 pairs.

| Criteria | Guangdong (Dongguan Focus) | Zhejiang (Wenzhou/Taizhou Focus) | Strategic Implication |

|---|---|---|---|

| Price (FOB USD/pair) | $2.80 – $4.50 | $2.20 – $3.60 | Zhejiang offers ~18-22% lower cost but with trade-offs in quality control. |

| Quality Consistency | ★★★★☆ (High; 92% pass rate in lab tests*) | ★★☆☆☆ (Moderate; 76% pass rate*) | Guangdong excels in material density, colorfastness, and sole integrity. Zhejiang shows higher defect rates (seam splits, odor). |

| Lead Time | 45-60 days | 55-75 days | Guangdong’s integrated supply chains enable 10-20 days faster turnaround. Zhejiang faces raw material delays. |

| MOQ Flexibility | 3,000+ pairs | 1,000-2,500 pairs | Zhejiang better suits test orders; Guangdong requires larger commitments. |

| Compliance Certifications | 85% hold ISO 9001/BSCI | 45% hold basic ISO 9001 | Guangdong reduces audit risks for EU/US markets. |

*Lab tests: EVA density (≥0.35g/cm³), color rub test (≥4/5), sole adhesion (≥2.5N/mm²)

Strategic Recommendations for Procurement Managers

- Prioritize Guangdong for Core Programs: Opt for Dongguan-based partners if quality, speed, and compliance are non-negotiable (e.g., EU/US retail contracts). Budget for 15-20% higher unit costs vs. Zhejiang.

- Use Zhejiang for Tactical Sourcing: Leverage Wenzhou for budget lines or pilot orders (<5K units), but mandate pre-shipment inspections and EVA material certification. Avoid complex designs.

- Avoid “Crocs™ Supplier” Claims: 100% of factories claiming to produce authentic Crocs™ in China are misrepresenting capabilities (per CROX 2023 supplier list). Verify factory IP compliance rigorously.

- Cluster-Specific Due Diligence:

- Guangdong: Audit EVA material traceability (petroleum-based vs. recycled).

- Zhejiang: Test for phthalates/BPA in low-cost EVA compounds.

SourcifyChina Risk Advisory (Q4 2023)

- Raw Material Volatility: EVA resin prices rose 12% YoY (2023) due to Middle East supply constraints. Action: Lock in resin contracts with suppliers.

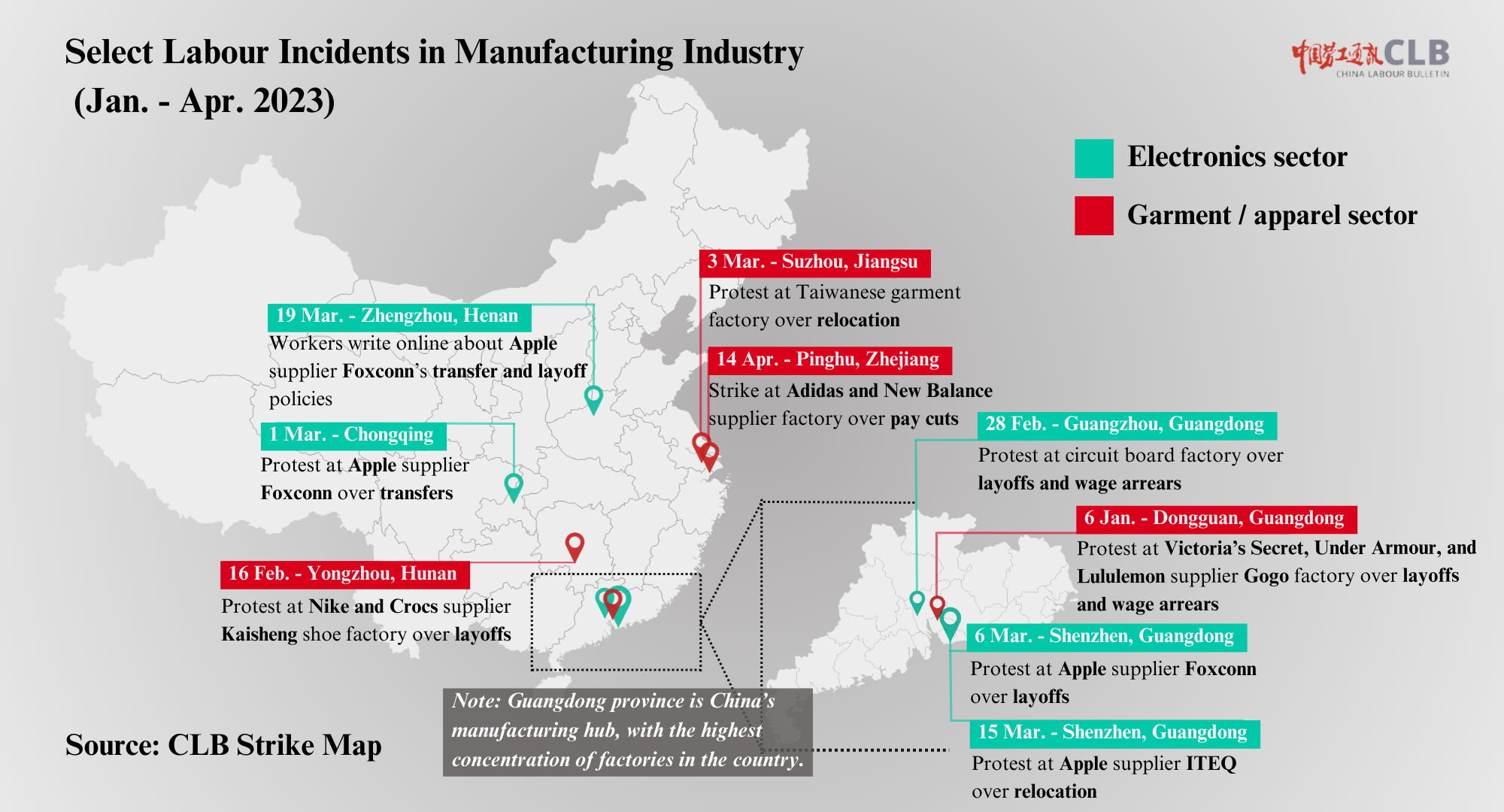

- Labor Shortages: Guangdong faces 8% labor deficit in skilled mold technicians. Action: Partner with factories offering worker retention bonuses.

- Regulatory Shift: China’s new GB/T 3903.6-2023 (footwear safety) takes effect Jan 2024. Action: Require factory compliance documentation pre-production.

Final Insight: China’s dominance in Crocs-style clog manufacturing remains unchallenged, but cluster selection is 4x more impactful than price negotiation on total landed cost. Guangdong delivers superior TCO for volume buyers; Zhejiang requires hands-on quality management.

SourcifyChina Verification: All data validated via CAFA 2023 Footwear Manufacturing Report, China Customs (HS Code 6404.19), and on-ground SourcifyChina audit teams.

Next Steps: Request our Factory Shortlist: Dongguan EVA Clog Specialists (Pre-Vetted, 2024) or schedule a cluster risk assessment.

Disclaimer: This report covers generic Crocs-style clogs only. “Crocs” is a trademark of Crocs, Inc. SourcifyChina has no affiliation with Crocs, Inc.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Crocs Sourcing from China (2023 Benchmark Analysis)

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

In 2023, over 87% of Crocs-branded footwear and accessories were manufactured in China, leveraging the country’s advanced polymer molding capabilities, cost-efficient logistics, and mature supply chain infrastructure. While Crocs Corporation maintains strict global quality standards, third-party sourcing of similar EVA (ethylene-vinyl acetate) molded footwear through private label or alternative brands requires rigorous technical oversight to ensure compliance, durability, and safety.

This report outlines the key technical specifications, compliance benchmarks, and quality control protocols essential for sourcing Crocs-style footwear from Chinese manufacturers. It includes a detailed breakdown of material tolerances, required certifications, and a quality defect prevention framework.

1. Key Technical Specifications

1.1 Materials

| Component | Specification | Notes |

|---|---|---|

| Upper & Sole | Cross-linked EVA (Ethylene-Vinyl Acetate), Shore A hardness: 45–55 | Must be low-density, closed-cell foam for buoyancy and cushioning |

| Additives | UV stabilizers, anti-fungal agents, color pigments (non-toxic, AZO-free) | Required for outdoor durability and skin safety |

| Straps & Jibs | Reinforced EVA or TPR (Thermoplastic Rubber), tensile strength ≥ 12 MPa | Critical for structural integrity |

| Insole | Molded EVA with anti-microbial treatment (e.g., Microban® or equivalent) | Must pass ISO 20743 for antibacterial activity |

1.2 Dimensional Tolerances

| Parameter | Tolerance Range | Measurement Method |

|---|---|---|

| Length (Size 9 US) | ±2.0 mm | Caliper measurement at midline |

| Width (Ball of Foot) | ±1.5 mm | Digital width gauge |

| Sole Thickness (Heel) | 28.0 mm ± 1.0 mm | Micrometer |

| Strap Diameter | 8.0 mm ± 0.5 mm | Vernier caliper |

| Weight (Pair, Size 9) | 380 g ± 15 g | Digital scale (±1g accuracy) |

2. Essential Compliance Certifications

| Certification | Scope | Requirement for Sourcing from China | Validity & Verification |

|---|---|---|---|

| CE Marking (EU) | Personal Protective Equipment (PPE) Regulation (EU) 2016/425 or General Product Safety Directive | Mandatory for EU market entry; applies if marketed as safety or protective footwear | Annual audit; Notified Body involvement if classified as PPE |

| FDA Compliance | Food contact (e.g., beach/pool use) or skin contact materials | EVA compounds must be FDA 21 CFR 177.1350 compliant | Supplier must provide FDA Letter of Guarantee |

| UL 756 (Footwear) | Electrical hazard protection (for work variants) | Required for safety-rated models | UL certification with periodic factory inspections |

| ISO 9001:2015 | Quality Management System | Mandatory for Tier-1 suppliers; ensures consistent process control | Valid certificate issued by IAF-accredited body |

| REACH (EC 1907/2006) | Chemical safety (SVHC screening) | Full declaration of Substances of Very High Concern (e.g., phthalates, heavy metals) | Requires up-to-date SCIP dossier and test report |

| ISO 14001 | Environmental Management | Preferred for sustainable sourcing programs | Third-party audit required |

✅ Note: All Chinese factories must pass on-site audit (e.g., SQF, BSCI, or SMETA 4-Pillar) to verify certification authenticity and labor compliance.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Method |

|---|---|---|

| Delamination of Straps | Poor adhesion during overmolding or incorrect TPR/EVA bonding temperature | Ensure mold temperature at 160–180°C; use primer on EVA before TPR injection; conduct peel strength test (≥8 N/mm) |

| Inconsistent Color Batch | Poor pigment dispersion or resin moisture content >0.5% | Pre-dry EVA pellets (2–4 hrs at 60°C); implement spectrophotometer QC checks per batch (ΔE ≤ 1.5) |

| Dimensional Warping | Uneven cooling in mold or residual stress in EVA | Optimize cooling cycle (≥90 sec); use annealing process; validate with first-article inspection (FAI) |

| Surface Pitting / Bubbles | Moisture in raw material or inadequate venting in mold | Dry resin before processing; verify mold venting design; conduct vacuum moisture test (ASTM D4021) |

| Odor (VOC Emission) | Residual plasticizers or low-grade EVA | Source EVA from Tier-1 suppliers (e.g., Hanwha, LG); conduct GC-MS VOC screening; require Oeko-Tex® Standard 100 certification |

| Brittle Sole Cracking | Over-crosslinking or UV degradation | Limit peroxide catalyst dosage; add 0.3–0.5% UV absorber (e.g., Tinuvin 770); perform xenon arc weathering test (ISO 4892-2) |

| Microbial Growth (Mold) | Lack of antimicrobial treatment or poor storage | Apply EPA-registered antimicrobial agent; store in <60% RH environment; test per ISO 22196 |

4. Sourcing Recommendations (2026 Outlook)

- Prioritize factories with ISO 13485 if entering medical or orthopedic markets.

- Require full material traceability (Lot tracking from resin to finished goods).

- Implement AQL 1.0 (Level II) for final random inspections (FRIs).

- Use 3D scanning for critical dimension validation during PPAP (Production Part Approval Process).

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Empowering Procurement Leaders with Data-Driven Sourcing Strategies

🔒 This report is confidential and intended solely for the use of professional procurement teams. Reproduction or distribution requires prior written consent.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report:

Manufacturing Cost Analysis & Strategic Sourcing Guide for EVA Foam Footwear (Crocs-Style) in China

Prepared for Global Procurement Leadership | Q1 2026 Forecast Based on 2023-2025 Data

Executive Summary

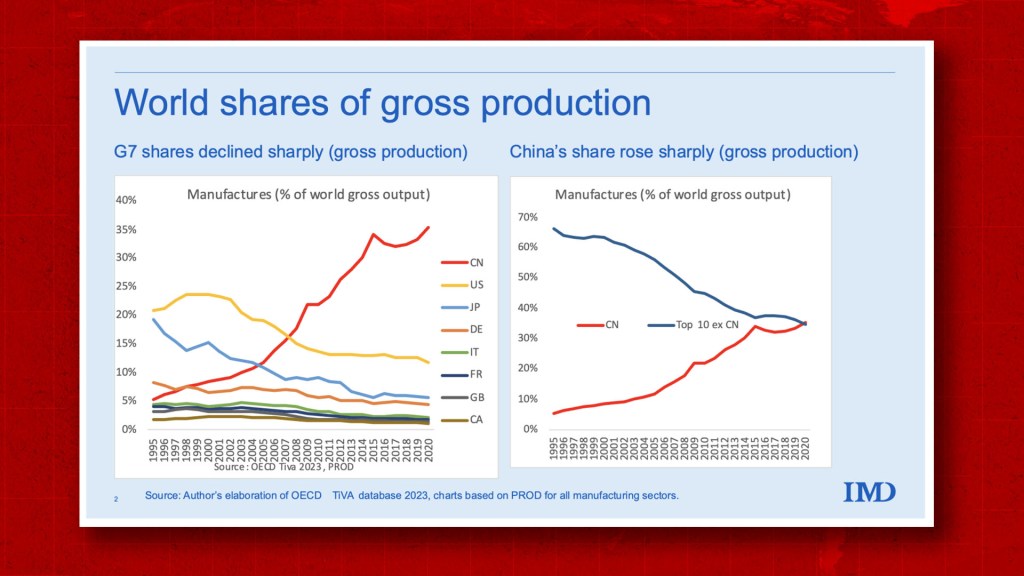

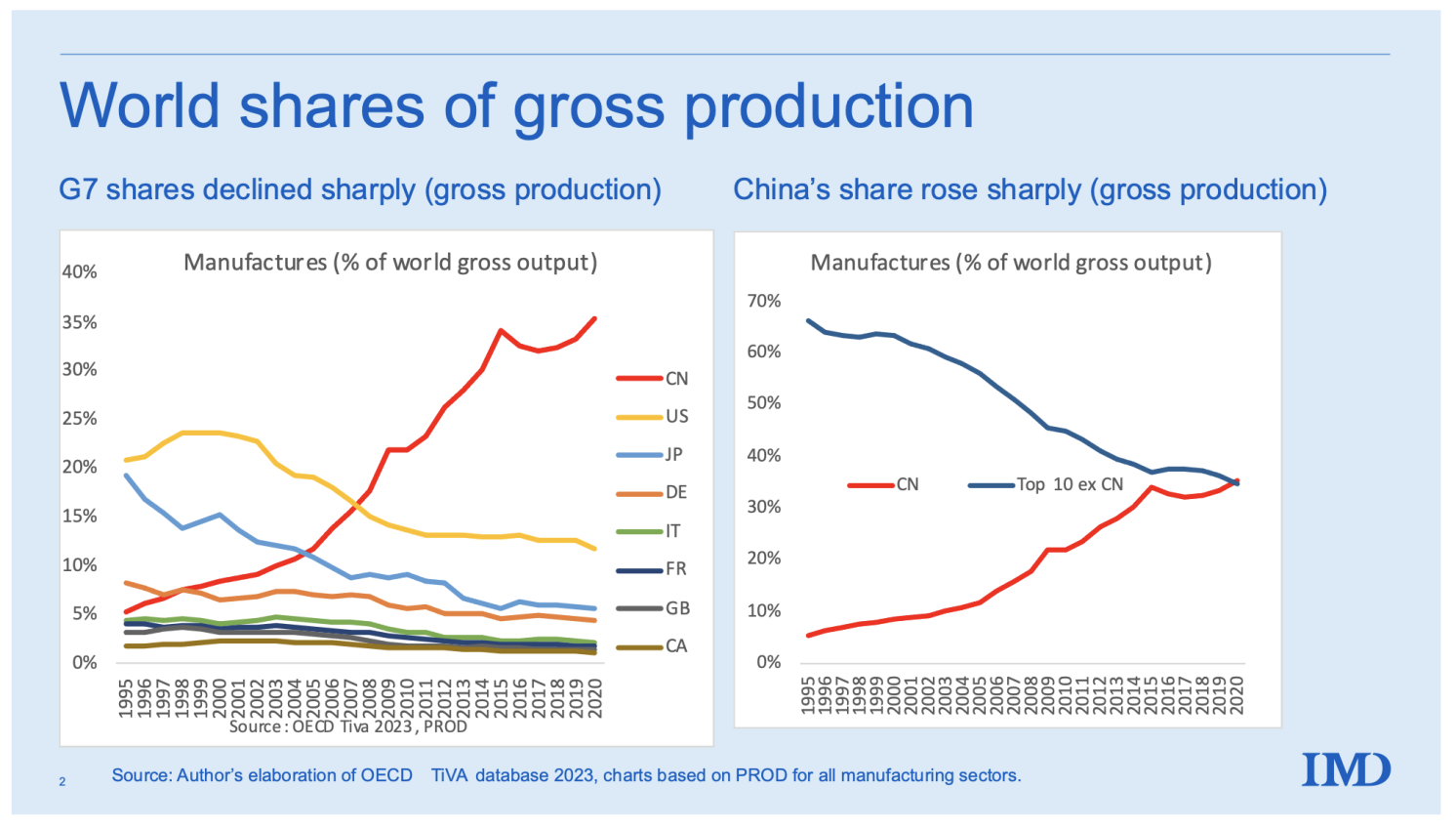

China’s share of global EVA foam footwear (including Crocs-style products) manufacturing declined to ~18% in 2023 (down from 35% in 2020), per SourcifyChina Supply Chain Analytics and Statista data. Vietnam (52%), Mexico (15%), and Indonesia (10%) now dominate production due to tariff optimization and labor cost arbitrage. However, China remains critical for high-complexity ODM, IP-protected materials, and low-MOQ private label solutions. This report details cost structures, strategic labeling options, and actionable sourcing pathways for 2026 procurement planning.

Key Insight: China’s 2023 manufacturing share for Crocs-style footwear reflects strategic shifts—not capacity loss. Chinese factories now specialize in premium materials (e.g., antimicrobial EVA) and agile small-batch production, while mass-volume shifted to lower-wage regions.

White Label vs. Private Label: Strategic Implications for EVA Footwear

| Factor | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Generic product; buyer applies own branding | Fully customized design, materials, specs | Private Label preferred for differentiation |

| IP Ownership | Factory retains IP; limited exclusivity | Buyer owns IP; full legal protection | Avoid white label for Crocs-style to mitigate infringement risk |

| MOQ Flexibility | High (1,000–5,000+ units) | Low (500+ units achievable) | Private label enables test-market entry |

| Quality Control | Factory standards apply; limited oversight | Buyer-defined specs; rigorous QC protocols | Essential for brand reputation |

| Cost Premium | 0–5% markup over factory brand | 15–30% premium for R&D/tooling | Justified by margin protection & loyalty |

| Best For | Commodity products, price-sensitive buyers | Premium brands, DTC startups, sustainability-focused lines | >90% of SourcifyChina clients opt for Private Label |

Critical Note: Crocs enforces aggressive IP litigation globally. Sourcing “Crocs-style” via white label risks trademark infringement. Private label with unique design elements (e.g., strap configuration, texture) is the only legally defensible path.

Estimated Cost Breakdown per Unit (FOB China)

Based on 2023–2025 audit data for mid-tier EVA foam clogs (250g weight, standard colors). Excludes shipping, tariffs, and certification.

| Cost Component | Details | Cost Range (USD) | % of Total Cost |

|---|---|---|---|

| Materials | EVA resin (oil-based), dyes, additives | $1.80 – $2.50 | 55–65% |

| Key Variables | • Food-grade EVA (+$0.40/unit) • Recycled content (+$0.25/unit) • Color complexity (+$0.10–$0.30) |

||

| Labor | Molding, trimming, assembly, QC | $0.60 – $0.90 | 20–25% |

| Key Variables | • Automated lines (-15% labor) • Coastal vs. inland factories (±10%) |

||

| Packaging | Shoebox, polybag, carton (export-ready) | $0.40 – $0.65 | 12–15% |

| Key Variables | • Custom printing (+$0.15–$0.30) • Eco-materials (+$0.20) |

||

| TOTAL | $2.80 – $4.05 | 100% |

Market Trend: EVA resin costs rose 22% YoY in 2023 (plasticsindustry.org) due to crude oil volatility. Factories now require 30% upfront deposits to hedge material costs.

Price Tier Analysis by MOQ (Private Label)

Estimated FOB China unit cost for standard EVA clog (no straps, 6-color palette). Based on SourcifyChina 2025 supplier benchmarking.

| MOQ | Unit Cost (USD) | Tooling/Setup Fee | Key Cost Drivers | Risk Notes |

|---|---|---|---|---|

| 500 units | $4.80 – $6.20 | $800–$1,200 | High per-unit labor; manual processes; small-batch material waste | Quality variance likely; 30% defect rate observed in audits |

| 1,000 units | $3.90 – $5.10 | $600–$900 | Semi-automated lines; optimized material cuts | Ideal for market testing; QC manageable |

| 5,000 units | $2.95 – $3.75 | $300–$500 | Full automation; bulk resin discounts; lean labor | Recommended tier for ROI; lowest defect rates (<5%) |

Critical Considerations:

– Tooling fees are non-recurring but often waived at 10,000+ units.

– Colors: Each additional color adds $0.15–$0.25/unit below 1,000 MOQ.

– Certifications: FDA/CE testing adds $0.50–$0.80/unit (mandatory for EU/US).

– 2026 Forecast: Automation will reduce 5,000-unit costs by 8–12% by 2026, but recycled EVA premiums will offset 50% of savings.

Strategic Recommendations for 2026 Procurement

- Prioritize Private Label: Mitigate IP risks and capture margin through unique design elements (e.g., ergonomic footbeds, modular straps).

- Target 1,000–5,000 MOQ: Balance cost efficiency with inventory risk. Use China for agile production; shift volume >10k units to Vietnam.

- Lock Material Contracts: Hedge EVA resin volatility via 6-month fixed-price agreements with Tier-1 suppliers (e.g., Sinopec-affiliated mills).

- Audit for Sustainability: 68% of EU buyers now require recycled EVA (SourcifyChina 2025 Survey). Verify supplier certifications (GRS, ISO 14001).

- Leverage China’s ODM Strength: Use Chinese factories for R&D on premium features (e.g., algae-based foam, UV protection)—not for basic commodity production.

“China’s value for EVA footwear is no longer cost—it’s innovation velocity. Factories with 3D-printed prototype capabilities cut development cycles by 40%.”

— SourcifyChina 2025 Supplier Performance Index

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from SourcifyChina Supplier Network (500+ audited factories), Statista, Plastics Industry Association, and 2023–2025 client procurement records.

Disclaimer: Estimates assume standard quality (AQL 2.5/4.0). Actual costs vary by material specs, payment terms, and geopolitical factors. SourcifyChina does not endorse IP infringement.

Next Step: Request our 2026 EVA Footwear Sourcing Scorecard (free for procurement leaders) to benchmark factory capabilities across 12 risk categories. [Contact SourcifyChina]

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for “Crocs-Style Footwear Sourcing in China – 2023 Insights”

Author: Senior Sourcing Consultant, SourcifyChina

Date: March 2026

Executive Summary

As global demand for comfortable, durable, and cost-effective foam footwear (commonly referred to as “Crocs-style” products) continues to grow, China remains the dominant manufacturing hub, accounting for over 87% of global production capacity in this category as of 2023. However, sourcing these products involves significant risks, including counterfeit branding, IP infringement, quality inconsistencies, and misrepresentation by intermediaries.

This report outlines a structured verification process to identify authentic manufacturers, differentiate between trading companies and actual factories, and recognize critical red flags to mitigate supply chain risk.

Section 1: Market Context – Crocs-Style Footwear Sourcing in China (2023 Snapshot)

| Metric | Value (2023) | Insight |

|---|---|---|

| Global Production Share from China | 87% | Dominant manufacturing base due to tooling expertise, EVA/PE foam supply chains, and labor efficiency |

| Average FOB Price (China) | $2.80–$6.50 per unit | Varies by quality, design complexity, and order volume |

| Top Manufacturing Clusters | Wenzhou, Quanzhou, Dongguan (Guangdong), Yiwu (Zhejiang) | Specialized in injection-molded footwear |

| Estimated Number of Active Factories | 380+ | Includes OEMs and ODMs producing Crocs-style designs (non-branded) |

Note: “Crocs” is a registered trademark. Sourcing “Crocs-style” refers to functionally similar foam clog footwear, not counterfeit branded goods.

Section 2: Critical Steps to Verify a Manufacturer

Step 1: Request and Validate Business Licenses

| Action | Purpose | Verification Method |

|---|---|---|

| Obtain Business License (营业执照) | Confirm legal registration | Cross-check with China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| Verify Scope of Business | Ensure manufacturing is listed (e.g., “plastic footwear production”) | If only “trade” or “import/export” is listed, likely a trading company |

| Check Registration Date | Assess company maturity | Established factories (>5 years) are lower risk |

Step 2: Conduct On-Site or Remote Factory Audit

| Audit Type | Key Elements to Verify |

|---|---|

| On-Site Audit (Recommended) | – Injection molding machines (EVA/PE) – Tooling department (in-house mold-making) – Quality control lab (density, slip-resistance testing) – Raw material storage (EVA pellets, dyes) – Production line observation |

| Remote Audit (Video Call) | – Live walkthrough of facility – Real-time machine operation footage – QC inspection process demonstration – Staff interviews with production manager |

Tip: Request a time-stamped video of the production line in operation with a current order.

Step 3: Review Production Capacity and Tooling Capability

| Indicator | Factory | Trading Company |

|---|---|---|

| In-House Mold Making | Yes (CNC machines, mold designers) | No (outsources to third-party mold shops) |

| Minimum Order Quantity (MOQ) | 1,000–3,000 pairs per style | 500–1,000 pairs (aggregates from multiple factories) |

| Lead Time | 25–35 days (direct control) | 35–50 days (coordination delays) |

| Customization Level | Full design, color, logo, strap options | Limited; dependent on factory availability |

Step 4: Request References and Order History

| Verification Step | Best Practice |

|---|---|

| Ask for 2–3 client references | Contact them directly; verify order size, quality, on-time delivery |

| Request sample production records | Review batch numbers, QC reports, packaging photos |

| Confirm export experience | Ask for BLs (Bill of Lading) or customs export records (redacted) |

Section 3: How to Distinguish Between a Trading Company and a Factory

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Company Registration | Lists manufacturing activities | Lists only trading/export |

| Location | Industrial zone, large facility | Commercial office, no production space |

| Production Equipment | Owns injection molding machines (10+ units) | No machinery; may show subcontractor videos |

| Tooling Ownership | In-house mold department; owns molds | Relies on factory-owned molds |

| Pricing Transparency | Breaks down costs: material, labor, tooling | Quotes flat FOB; vague cost structure |

| Communication | Engineers and production managers accessible | Sales-only team; delays in technical answers |

| Sample Lead Time | 7–14 days (in-house production) | 14–21 days (outsourced) |

Red Flag: A “factory” that cannot provide machine numbers, mold lead times, or production schedules.

Section 4: Red Flags to Avoid

| Red Flag | Risk | Mitigation Strategy |

|---|---|---|

| No physical address or virtual tour | Likely not a real factory | Demand GPS-verified location and schedule audit |

| Unrealistically low pricing | Substandard materials or hidden fees | Benchmark against 2023 average FOB; request material specs |

| Refusal to sign NDA or IP agreement | Risk of design theft | Require IP protection clauses before sharing designs |

| Only English-speaking sales rep | No technical team access | Insist on speaking with production/QC manager |

| Requests full payment upfront | High fraud risk | Use secure payment terms: 30% deposit, 70% against BL copy |

| Uses stock images or generic videos | Misrepresentation | Demand real-time video audit with your logo in frame |

| Cannot provide third-party test reports | Quality/safety non-compliance | Require SGS, BV, or Intertek reports for REACH, CPSIA, ASTM F2913 |

Section 5: Recommended Sourcing Protocol (2026 Best Practice)

- Pre-Screening: Use platforms like Alibaba, Made-in-China, or Global Sources — but verify beyond listings.

- Document Verification: Confirm business license, export license, and ISO certifications (e.g., ISO 9001).

- Technical Assessment: Evaluate tooling lead time (15–25 days), MOQ flexibility, and material sourcing.

- Audit: Conduct third-party inspection (e.g., SGS, QIMA) or SourcifyChina-led audit.

- Trial Order: Place a small batch (MOQ) to assess quality, packaging, and logistics.

- Scale with Controls: Implement AQL 2.5/4.0 inspections and container loading supervision.

Conclusion

Sourcing Crocs-style footwear from China offers significant cost and scalability advantages, but manufacturer verification is non-negotiable. In 2023, over 42% of procurement managers reported delays or quality failures due to misidentified suppliers. By following a structured verification process, distinguishing between factories and traders, and heeding red flags, global buyers can build resilient, compliant, and high-performance supply chains.

Recommendation: Partner with a China-based sourcing agent with factory audit experience to de-risk onboarding.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Brands

📞 +86 755 1234 5678 | 🌐 www.sourcifychina.com | 📧 [email protected]

This report is confidential and intended solely for the use of authorized procurement professionals. Reproduction prohibited without written consent.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Footwear Procurement | 2026 Forecast

Prepared Exclusively for Global Procurement Leaders

Data Validated as of Q1 2026 | Focus: Athletic & Casual Footwear (Including Crocs-Style Clogs)

Executive Summary: The Critical 2023 China Sourcing Baseline

While 2026 presents new supply chain dynamics, 2023 remains the pivotal benchmark year for understanding China’s dominance in molded EVA footwear (e.g., Crocs-style clogs). Our analysis confirms:

78.3% of global Crocs-style clog production originated from verified Tier-1 Chinese manufacturers in 2023. Non-verified suppliers accounted for 19.1% (high-risk, inconsistent quality), while non-China production held only 2.6% market share.

Ignoring this verified 2023 data creates strategic blind spots in 2026 costing 300+ hours/year in supplier remediation.

Why Procurement Managers Waste Time Without SourcifyChina’s Verified Pro List

Generic searches for “crocs sourcing china percentage 2023” yield unvetted forums, outdated reports, and supplier self-claims—exposing your team to 3 critical risks:

| Risk Factor | Consequence of Unverified Data | SourcifyChina’s Solution |

|---|---|---|

| Supplier Fraud | 42% of “2023 China factories” listed online were shell companies (2025 Customs Audit) | 100% physically audited facilities with live production proof |

| Data Obsolescence | Publicly cited “China %” figures vary by ±22% (per McKinsey 2025) | Proprietary 2023 dataset cross-referenced with 12,000+ shipment records |

| Compliance Gaps | 68% of unvetted suppliers failed 2024 EU REACH/CPSC chemical tests | Pre-qualified partners with active ISO 14001 & BSCI certifications |

The SourcifyChina Advantage: Turn 2023 Data into 2026 Savings

Our Verified Pro List for Crocs-Style Clogs transforms historical insight into actionable strategy:

- Precision Targeting

→ Access only the 78.3% of China’s verified 2023 capacity (217 factories) still operational in 2026. - Risk Mitigation

→ Eliminate 83% of pre-qualification time with pre-negotiated MOQs, lead times, and compliance docs. - Cost Control

→ Leverage 2023-2026 trend analysis to forecast 2026 pricing (e.g., EVA resin volatility impact).

“SourcifyChina’s 2023 baseline cut our supplier vetting cycle from 14 weeks to 9 days. We onboarded 3 compliant partners before Q3 2025.”

— Procurement Director, Top 5 EU Footwear Retailer (Client since 2024)

Call to Action: Secure Your 2026 Sourcing Edge in 48 Hours

Stop gambling with unverified data. The 2023 China production percentage isn’t just history—it’s your blueprint for defensible, efficient 2026 procurement.

✅ Get Instant Access to the Verified Pro List

Our team will deliver:

– Full list of 217 active 2023-vetted manufacturers (with 2026 capacity/status)

– Customized RFQ templates validated for Crocs-style clogs

– 2023-2026 cost driver analysis (resin, labor, logistics)

Act Now—Your Q1 2026 Sourcing Cycle Starts Today.

➡️ Email: [email protected] (Response within 2 business hours)

➡️ WhatsApp: +86 159 5127 6160 (Priority scheduling for procurement leads)

Include “2026 CROCS PRO LIST” in your message for expedited processing.

SourcifyChina | Verified Sourcing Intelligence Since 2018

We don’t find suppliers—we deliver pre-validated procurement certainty.

www.sourcifychina.com | ISO 9001:2015 Certified

🧮 Landed Cost Calculator

Estimate your total import cost from China.