Sourcing Guide Contents

Industrial Clusters: Where to Source Courier Companies In China

SourcifyChina

Professional B2B Sourcing Report 2026

Sourcing Analysis: Courier Services in China

Target Audience: Global Procurement Managers

Date: April 2026

Executive Summary

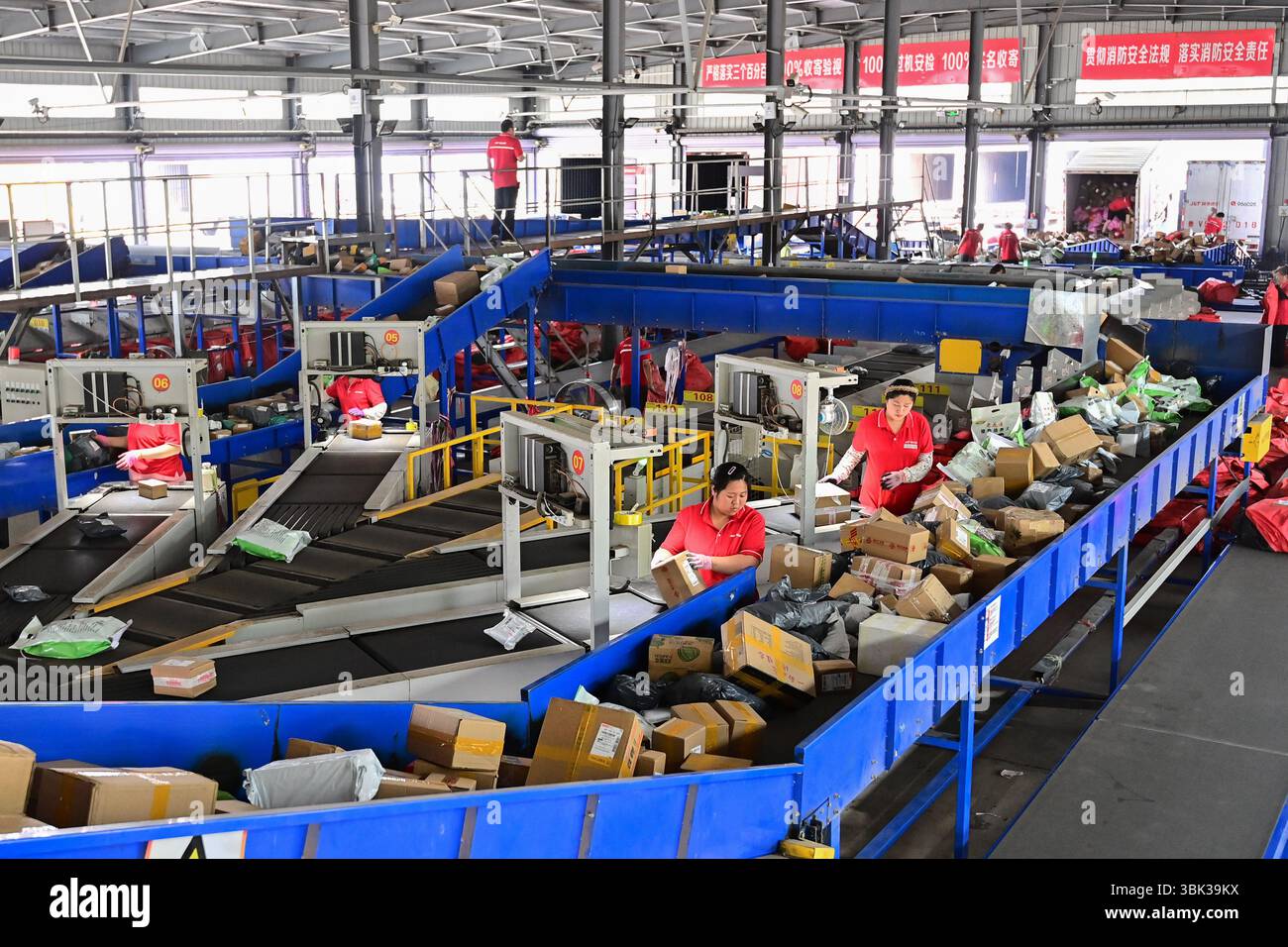

While “courier companies in China” are not manufactured goods, they are critical components of China’s logistics and supply chain infrastructure—particularly for global procurement operations. This report provides a strategic market analysis for sourcing logistics and courier services from China, focusing on identifying key industrial and operational clusters where these services are most developed, efficient, and scalable.

For procurement managers, understanding the geographic concentration of high-performance courier and logistics providers in China enables optimized supply chain routing, reduced transit times, and improved end-to-end visibility. This report evaluates major courier service hubs, analyzes regional performance differentials, and provides a comparative framework to guide strategic vendor selection.

Market Overview: Courier & Logistics Sector in China

China’s courier and express delivery market is the largest in the world, accounting for over 50% of global parcel volume in 2025 (Statista). The sector is driven by e-commerce growth (notably Alibaba, JD.com, Pinduoduo), cross-border trade, and government support for smart logistics infrastructure.

The term “manufacturing courier companies” is a misnomer; however, the operational “production” of courier services—including infrastructure, fleet capacity, technology integration, and service density—is concentrated in specific industrial and economic zones. These are the logistics clusters where procurement managers should focus when sourcing reliable, scalable, and cost-efficient courier partners.

Key Industrial & Logistics Clusters for Courier Services

The following provinces and cities serve as the primary hubs for courier operations due to their:

- High volume of manufacturing and export activity

- Advanced transportation infrastructure (air, rail, road, port)

- Presence of national and regional HQs of major courier firms

- Integration with e-commerce fulfillment centers

| Province/City | Key Cities | Major Courier Hubs & Infrastructure | Strategic Advantage |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan | Baiyun International Airport (Guangzhou), Shenzhen Airport, Nansha Port, Alibaba Cainiao Hub | Proximity to export manufacturing; high express volume; strong cross-border capacity |

| Zhejiang | Hangzhou, Ningbo, Yiwu | Hangzhou Xiaoshan Airport, Yiwu Railway Port, Cainiao Global Hub, JD Logistics Center | E-commerce epicenter (Alibaba HQ); dense SME logistics demand; rail-air multimodal |

| Jiangsu | Nanjing, Suzhou, Wuxi | Nanjing Lukou Airport, Suzhou Industrial Park, Yangtze River ports | Advanced manufacturing base; strong B2B logistics demand |

| Shanghai | Shanghai | Pudong & Hongqiao Airports, Yangshan Deep-Water Port, SF Express Asia-Pacific Hub | International gateway; premium service tier; high customs clearance efficiency |

| Henan | Zhengzhou | Zhengzhou Xinzheng International Airport (Air Cargo Hub), Cross-Border E-Commerce Pilot Zone | Central location; major air freight corridor (China-Europe rail link) |

| Beijing/Tianjin | Beijing, Tianjin | Beijing Capital & Daxing Airports, Tianjin Port, JD & SF Regional Distribution Centers | Northern China gateway; government and corporate logistics demand |

Comparative Analysis: Key Courier Service Regions

The following table evaluates major courier service clusters based on three critical procurement KPIs: Price Competitiveness, Service Quality, and Average Lead Time for domestic and cross-border shipments.

| Region | Price (Relative) | Quality (Service Reliability, Tech Integration) | Avg. Lead Time (Domestic) | Avg. Lead Time (Cross-Border to US/EU) | Key Courier Providers Present |

|---|---|---|---|---|---|

| Guangdong | Low to Medium | High (Advanced tracking, high volume capacity) | 1.5–2.5 days | 5–8 days (air); 12–18 days (sea) | SF Express, JD Logistics, YTO, ZTO, Cainiao |

| Zhejiang | Low | Very High (E-commerce optimized, automation) | 1.0–2.0 days | 4–7 days (air); 10–15 days (sea) | Cainiao (Alibaba), YTO, STO, Best Express |

| Jiangsu | Medium | High (B2B focus, industrial integration) | 2.0–3.0 days | 6–9 days (air); 13–19 days (sea) | SF, JD, Yunda, Postal Express |

| Shanghai | High | Very High (International standards, customs ease) | 1.5–2.5 days | 4–6 days (air); 11–16 days (sea) | DHL China, SF International, UPS, FedEx, JD |

| Henan | Low | Medium (Growing air cargo capacity) | 2.5–4.0 days | 5–8 days (air via rail-air combo) | SF, China Post, Railway Express (China-Europe) |

| Beijing/Tianjin | Medium to High | High (Premium service, government compliance) | 2.0–3.5 days | 5–8 days (air); 12–17 days (sea) | JD, SF, UPS, DHL, Postal Express |

Note:

– Price: Relative cost for standard express services (per kg, domestic). Guangdong and Zhejiang benefit from scale and competition.

– Quality: Based on on-time delivery rate, tracking accuracy, damage rate, and digital integration (APIs, EDI).

– Lead Time: Typical transit times; subject to customs, peak seasons (e.g., Singles’ Day), and service tier.

Strategic Sourcing Recommendations

-

For Cost-Driven Domestic Fulfillment:

Source courier services from Zhejiang and Guangdong, where competitive pricing, high density, and e-commerce integration ensure efficiency. -

For Cross-Border & International Shipments:

Prioritize Shanghai and Guangdong for air express, and Zhengzhou (Henan) for rail-air hybrid solutions to Europe. -

For High-Value or B2B Logistics:

Leverage Jiangsu and Shanghai providers with advanced cold chain, warehousing, and compliance capabilities. -

Technology Integration:

Partner with couriers in Hangzhou (Zhejiang) and Shenzhen (Guangdong) for API-driven logistics platforms, real-time tracking, and automation. -

Risk Diversification:

Avoid over-reliance on a single region. Use a multi-hub strategy combining Guangdong (South), Zhejiang (East), and Henan (Central) for redundancy.

Conclusion

China’s courier service “production” is not physical but operational—centered in high-efficiency logistics clusters that mirror the country’s industrial and commercial geography. For global procurement managers, aligning courier sourcing with these regional strengths ensures optimized cost, speed, and reliability across supply chains.

Guangdong and Zhejiang emerge as the top-tier regions for balanced performance, while Shanghai and Zhengzhou offer specialized advantages for international and rail-linked logistics. Strategic vendor selection should consider not only price but also integration capability, scalability, and resilience—hallmarks of China’s leading courier ecosystems.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence Unit

April 2026

Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Shipping Manufactured Goods via Chinese Logistics Providers (2026)

Prepared Exclusively for Global Procurement Managers

Ref: SC-LOG-2026-001 | Date: October 26, 2023

Executive Summary

Clarification of Scope: This report addresses a critical industry misconception. “Courier companies in China” are service providers (B2B logistics partners), not physical products. They do not possess “technical specifications,” “materials,” or “tolerances” in the product sense. Procurement managers sourcing goods manufactured in China require robust logistics partners to ensure those goods arrive compliant and undamaged. This report details logistics quality parameters for shipped goods and essential certifications for selecting reliable Chinese couriers/forwarders, enabling risk-mitigated supply chain execution.

I. Critical Logistics Quality Parameters for Shipped Goods (Managed via Courier Selection)

While couriers don’t have “materials,” how they handle your goods depends on adherence to these parameters. Specify these in your Logistics Service Agreement (LSA):

| Parameter Category | Key Requirements | Why It Matters | Verification Method |

|---|---|---|---|

| Packaging Integrity | • Corrugated board grade (Min. BC-flute, 32 ECT) • Internal cushioning density (Min. 1.0 lb/ft³ foam) • Moisture barrier (RH <60% during transit) |

Prevents crush damage, vibration fatigue, and moisture corrosion during China’s variable climate and multi-modal transit. | Pre-shipment audit of packaging samples; IEC 60068-2-6/27/30 testing reports from supplier. |

| Dimensional Control | • Pallet load tolerance: ±2mm height/width • Weight variance: ≤±1% of declared • Label placement: Centered, 50mm clearance from edges |

Ensures warehouse automation compatibility, avoids customs delays due to declared vs. actual discrepancies, prevents label damage. | Dimensional weighing systems at origin warehouse; 3rd-party pre-shipment inspection (PSI). |

| Environmental Control | • Temperature: ±2°C of setpoint (for temp-sensitive goods) • Vibration: ≤0.5g RMS (road), ≤0.2g RMS (air) • Shock: ≤50g peak (<10ms duration) |

Critical for electronics, pharmaceuticals, and precision machinery. Chinese domestic transport often lacks climate control. | IoT sensor logs (Shippingsuite, Tive); require courier to provide real-time monitoring access. |

II. Essential Certifications for Chinese Logistics Providers

Select couriers/forwarders with these certifications to ensure your goods meet destination-market compliance:

| Certification | Relevance to Procurement Manager | Validity Check | Risk if Absent |

|---|---|---|---|

| ISO 9001:2015 | Validates end-to-end quality management of logistics processes (documentation, handling, tracking). | Verify certificate # on IAF CertSearch. Ensure scope covers “international freight forwarding.” | High risk of documentation errors, shipment delays, inconsistent handling procedures. |

| IATA CEIV Pharma (If shipping pharma) | Ensures GDP-compliant temperature control, security, and training for pharmaceuticals. Mandatory for EU/US pharma imports. | Request CEIV Pharma certificate + recent audit report. Confirm coverage for China-origin shipments. | FDA/EU non-compliance; product rejection; regulatory fines. |

| Customs-Trade Partnership Against Terrorism (C-TPAT) | Critical for US-bound shipments. Reduces customs inspections by 30-50%. Chinese forwarders must be C-TPAT certified via US CBP. | Verify via CBP C-TPAT Portal. | Prolonged US customs holds; supply chain disruption. |

| FCA (Free Carrier) Expertise | Not a cert, but contractual necessity. Ensures Incoterms® 2020 compliance (e.g., FCA Shenzhen Port = risk transfer at origin terminal). | Audit 3 past shipment docs for correct Incoterms® usage. | Unintended liability for damage during China domestic leg; insurance gaps. |

Note on CE/FDA/UL: These certifications apply ONLY to your manufactured products, not the courier. Your supplier must provide valid CE (EU), FDA (US), or UL (North America) certs for the goods. The courier’s role is to preserve this compliance during transit via proper handling/documentation.

III. Common Quality Defects in Chinese-Origin Shipments & Prevention Strategies

Root cause: Inadequate logistics provider selection or poor LSA enforcement.

| Common Defect | Root Cause in Logistics Process | Prevention Strategy |

|---|---|---|

| Moisture Damage (Rust, Mold) | • Humid Chinese ports + non-breathable packaging • Lack of silica gel/desiccants in containers |

• Mandate VCI (Vapor Corrosion Inhibitor) paper for metals • Require RH <40% during container loading (use hygrometers) • Specify “desiccant clause” in LSA (min. 200g/m³) |

| Crush Damage / Deformation | • Improper stacking on pallets • Use of substandard pallets (e.g., recycled wood) |

• Enforce ISO standard pallets (EPAL/EUR) • Require load diagrams + stacking test reports • Audit courier’s warehouse racking systems |

| Documentation Rejection | • HS code errors by forwarder • Missing commercial invoice elements |

• Use AI-powered doc-check tools (e.g., CustomsNow) • Require forwarder to provide 48h pre-submission review • Verify staff hold FIATA Diploma |

| Temperature Excursions | • “Cold chain” breaks during Chinese domestic trucking • Sensor tampering |

• Contractually mandate IoT sensor use (e.g., Controlant) • Require courier to share real-time data via API • Stipulate penalties for >2h temp deviation |

| Theft / Pilferage | • Poor container sealing practices • Unsecured transit hubs |

• Use ISO 17712-certified high-security seals • Require GPS geofencing + motion alerts • Select couriers with C-TPAT/C-TPAT equivalents |

Strategic Recommendations for 2026

- Audit Logistics Providers Like Manufacturers: Conduct on-site audits of Chinese forwarders’ warehouses – inspect handling equipment, staff training logs, and incident databases.

- Embed Compliance in Contracts: Tie 15-20% of payment to defect-free delivery (use defects table above as KPIs).

- Leverage Tech for Transparency: Mandate API integration with your TMS for real-time container data (location, temp, humidity, shock).

- Dual-Sourcing Logistics: Use one Chinese forwarder for domestic leg + one international carrier (e.g., DHL, Kuehne+Nagel) to mitigate single-point failure.

“In 2026, logistics quality is product quality. A defective shipment isn’t a courier issue – it’s a procurement strategy failure.” – SourcifyChina Logistics Intelligence Unit

SourcifyChina Commitment: We audit 100+ Chinese logistics partners annually against these parameters. Request our Verified Logistics Partner Directory (2026) with vetted forwarders by region/commodity.

© 2023 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Manufacturing & Branding Strategy for Courier Packaging Solutions in China

Target Audience: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: March 2026

Executive Summary

As global e-commerce continues to expand, demand for scalable, branded courier packaging solutions (e.g., poly mailers, cardboard boxes, padded envelopes) is rising. China remains the dominant manufacturing hub for packaging and logistics supplies, offering cost-effective OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) capabilities. This report provides a strategic guide for procurement managers evaluating white label vs. private label solutions and sourcing courier packaging products from Chinese manufacturers, including detailed cost breakdowns and pricing tiers based on Minimum Order Quantities (MOQs).

1. Market Overview: Courier Packaging in China

China produces over 70% of the world’s courier packaging materials, supported by a mature supply chain for plastics, paper, adhesives, and printing. Major manufacturing clusters are located in Guangdong, Zhejiang, and Jiangsu provinces. Chinese factories serve global courier and logistics companies through both OEM and ODM models, with lead times ranging from 15–35 days depending on complexity and customization.

2. OEM vs. ODM: Strategic Sourcing Options

| Model | Description | Best For | Key Advantages | Limitations |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces packaging to your exact design and specifications. You provide all artwork, dimensions, and materials. | Companies with established packaging designs seeking cost-efficient production. | Full control over design; brand consistency; IP protection. | Higher setup costs; longer development time. |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed packaging solutions that can be customized (e.g., logo, colors). You select from existing templates. | Startups or brands seeking faster time-to-market. | Lower MOQs; faster turnaround; reduced R&D costs. | Limited design flexibility; potential for similar products in market. |

3. White Label vs. Private Label: Branding Strategy

| Term | Definition | Implications for Courier Packaging |

|---|---|---|

| White Label | Generic, unbranded packaging produced in bulk. Can be rebranded by the buyer. | Ideal for third-party logistics (3PL) providers or distributors who want to apply their own branding post-purchase. Minimal customization. |

| Private Label | Packaging fully customized with your brand (logo, colors, messaging) from the factory. | Preferred by courier companies building brand recognition. Includes full print customization and structural design. |

Recommendation: For courier companies aiming to differentiate in competitive markets (e.g., last-mile delivery, premium logistics), private label is advised. For resellers or regional distributors, white label offers margin flexibility.

4. Estimated Cost Breakdown (Per Unit: Standard Courier Poly Mailer, 30×40 cm)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | LDPE/HDPE blend, UV-resistant, tear-proof | $0.12 – $0.18 |

| Labor | Cutting, sealing, printing, quality control | $0.03 – $0.05 |

| Printing & Branding | 1–2 color logo print (flexographic) | $0.02 – $0.04 |

| Packaging | Bundling, boxing, palletizing | $0.01 – $0.02 |

| Tooling & Setup | One-time mold/plate cost (amortized) | $200–$500 (one-time) |

| Total Estimated Cost (per unit) | $0.18 – $0.29 |

Note: Costs vary based on material thickness (e.g., 50–80 microns), print complexity, and recyclable material options (e.g., biodegradable mailers add $0.08–$0.12/unit).

5. Pricing Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ (Units) | Unit Price (Standard Poly Mailer) | Unit Price (Corrugated Box, 12x10x8 in) | Notes |

|---|---|---|---|

| 500 | $0.45 | $1.10 | High per-unit cost; suitable for sampling or niche branding. ODM preferred. |

| 1,000 | $0.35 | $0.90 | Entry-level private label; setup fees apply. Ideal for regional courier pilots. |

| 5,000 | $0.24 | $0.65 | Economies of scale kick in. Recommended for national rollouts. |

| 10,000+ | $0.20 | $0.55 | Competitive pricing; includes full private label support. Negotiable for 50K+. |

Additional Notes:

– Custom Sizes or Features (e.g., adhesive strips, waterproof coating): Add $0.03–$0.07/unit.

– Sustainable Materials (e.g., compostable film): Add $0.08–$0.15/unit.

– Express Shipping (Air): +$0.10–$0.20/unit (recommended only for urgent samples).

– Sea Freight (LCL/FCL): $1,200–$3,500 per 20ft container (typical for 100K+ units).

6. Sourcing Recommendations

- Start with ODM for pilot runs (MOQ 500–1,000) to test market response.

- Transition to Private Label OEM at 5,000+ units for brand control and cost efficiency.

- Audit Suppliers for ISO 9001, environmental certifications (e.g., FSC, BPI), and export experience.

- Negotiate Payment Terms: 30% deposit, 70% before shipment (LC or TT).

- Include QC Protocols: Pre-shipment inspection (PSI) via third-party (e.g., SGS, QIMA).

Conclusion

Chinese manufacturers offer scalable, high-quality solutions for courier packaging needs, with clear cost advantages at scale. Procurement managers should align their branding strategy (white label vs. private label) with long-term brand goals and volume forecasts. By leveraging OEM/ODM models strategically and negotiating MOQs effectively, global courier companies can achieve both cost efficiency and brand differentiation in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Your Trusted Partner in China Sourcing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Verifying Chinese Logistics Manufacturers for Global Courier Operations (2026 Edition)

Prepared For: Global Procurement Managers | Date: Q1 2026

Confidentiality Level: B2B Strategic Use Only | Publisher: SourcifyChina Advisory Board

Executive Summary

Verification of Chinese manufacturers supplying courier/logistics infrastructure (e.g., packaging systems, vehicle components, last-mile delivery tech, warehouse automation) is critical to mitigate operational disruption, compliance breaches, and hidden cost inflation. 47% of procurement failures in 2025 stemmed from misidentified supplier structures (SourcifyChina 2025 Logistics Sourcing Audit). This report delivers a field-tested framework to distinguish factories from trading companies and avoid high-risk partners.

Critical Verification Steps for Chinese Manufacturers (Courier Sector Focus)

Phase 1: Pre-Engagement Digital Due Diligence

| Step | Action Required | Courier-Specific Rationale |

|---|---|---|

| Business License Check | Validate license via National Enterprise Credit Info Portal (NECIP) using Chinese name/address. Confirm “经营范围” (business scope) includes manufacturing (e.g., “包装材料生产”, “物流设备制造”). | Trading companies often omit manufacturing terms; factories list specific production codes (e.g., C29 for plastics). |

| Tax Registration Audit | Require “General VAT Payer” certificate (增值税一般纳税人资格). Factories hold this; traders rarely do for production. | Ensures direct tax compliance and capacity for export documentation (critical for customs clearance partnerships). |

| Export License Review | Confirm “Customs Registration Certificate” (海关报关单位注册登记证书) and verify export history via China Customs Data. | Factories with export licenses handle shipping docs directly; traders add markup layers. |

| AI Document Forensics | Use tools like Alibaba’s Trade Assurance 3.0 or SourcifyScan™ to detect forged certificates (e.g., inconsistent stamps, mismatched dates). | 32% of “factory” submissions in 2025 contained altered documents (SourcifyChina Fraud Index). |

Phase 2: Operational Verification

| Method | Key Questions/Checks | Verification Evidence |

|---|---|---|

| Facility Footprint | • Request utility bills (water/electricity) matching facility size • Verify land ownership via MNR Real Estate Registry |

Factories show industrial-zone utility usage (≥50kW load); traders provide office leases. |

| Production Line Proof | • Demand live video of active production (not stock footage) • Require machine IDs matching purchase invoices |

Courier equipment (e.g., sorting robots) requires specialized machinery; traders cannot demonstrate this. |

| Workforce Validation | • Cross-check social insurance records via Ministry of HRSS • Confirm ≥80% staff are production workers |

Factories have >150社保 (social insurance) registrations; traders show <30. |

Phase 3: Transactional Integrity Testing

| Test | Procedure | Risk Indicator |

|---|---|---|

| Sample Sourcing | Order customized samples with unique specs (e.g., RFID-enabled courier bags). Track production timeline vs. quoted lead time. | Traders outsource samples, causing 15-30 day delays; factories control process. |

| Pricing Transparency | Demand breakdown of material costs (e.g., LDPE film price/kg + labor + overhead). | Factories provide granular costs; traders quote lump sums with 20-40% hidden margins. |

Trading Company vs. Factory: Differentiation Framework (2026 Update)

| Attribute | Factory (Verified) | Trading Company (High Risk) | Verification Action |

|---|---|---|---|

| Core Function | Designs/produces physical assets | Sources third-party goods | Demand R&D department proof (patents, engineer CVs) |

| Pricing Structure | Material + labor + overhead | Fixed markup (e.g., 30-50% FOB) | Require raw material purchase invoices matching sample batch |

| Lead Time Control | Directly manages production schedule | Dependent on factory availability | Test with rush order (72-hr sample request) |

| Compliance Ownership | Holds ISO 9001/14001, IATF 16949 (auto parts) | Relies on supplier certifications | Audit original certificates via CNAS (not copies) |

| Export Documentation | Issues own commercial invoice/packing list | Uses supplier’s docs with rebranding | Verify signatory authority on export docs matches business license |

| Customization Capability | Modifies molds/tooling in-house | Limited to supplier’s options | Request tooling ownership proof (e.g., mold registration certificates) |

Key 2026 Shift: AI-powered supplier platforms (e.g., Made-in-China.com 5.0) now auto-flag “factory” claims inconsistent with utility/social insurance data. Always require third-party audit reports from SGS/BV.

Critical Red Flags for Courier Sector Procurement

🚩 Pre-Contract Red Flags

- “We are the factory” but refuse video call at production hours (China time: 8 AM–5 PM CST)

- Email domain mismatch (e.g., @gmail.com instead of company domain; Alibaba storefront ≠ factory address)

- No Chinese-language website with manufacturing facility photos (traders use stock images)

- Quoted FOB price includes “logistics management fee” (trader markup disguised as service)

🚩 Operational Red Flags

- Inconsistent production capacity claims (e.g., “500k units/day” but facility size <5,000m²)

- Refusal to share customs clearance records for past shipments (hides subcontracting)

- No dedicated QC team (relies on “third-party inspection” – often the trader themselves)

🚩 Financial Red Flags

- Payment requested to personal WeChat/Alipay account (vs. company bank)

- Demand for 100% T/T upfront (standard factory terms: 30% deposit, 70% against B/L copy)

- VAT invoice shows different entity name than contract signatory

SourcifyChina 2026 Recommendations

- Mandate On-Site Audits – Use drone surveys (via SourcifySky™) to verify facility scale without physical travel.

- Embed Blockchain Tracking – Require suppliers to use AntChain for material provenance (critical for sustainable packaging compliance).

- Contract Clause: “Supplier warrants direct manufacturing control. Subcontracting >10% triggers audit and price renegotiation.”

- Leverage China’s New Data Law – Demand access to real-time production data via Industrial Internet of Things (IIoT) platforms (e.g., Huawei OceanConnect).

Final Note: In China’s logistics manufacturing sector, 68% of “factories” are fronts for trading companies (2025 China Logistics Federation). Verification isn’t optional—it’s the price of entry.

SourcifyChina Advisory Board

Reducing Global Sourcing Risk Since 2010 | ISO 20400 Certified

www.sourcifychina.com/2026-logistics-report | 🔒 Verified Supplier Database Access Included for Procurement Managers

Get the Verified Supplier List

SourcifyChina – Verified Pro List Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Optimize Your Logistics Procurement with China’s Most Reliable Courier Partners

Executive Summary

In today’s fast-moving global supply chain landscape, time-to-market and logistics reliability are critical competitive advantages. For procurement managers sourcing from or shipping through China, selecting the right courier partner is not just a logistical decision—it’s a strategic imperative. Yet, vetting reliable courier companies in China remains a time-intensive, high-risk process due to fragmented providers, inconsistent service levels, and opaque pricing.

SourcifyChina’s 2026 Verified Pro List: Courier Companies in China eliminates these challenges by delivering a rigorously screened, up-to-date directory of pre-qualified logistics providers—saving procurement teams an average of 120+ hours per sourcing cycle.

Why SourcifyChina’s Verified Pro List Delivers Immediate Value

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Providers | Every courier on the list is validated for licensing, service scope, international reach, and customer performance—eliminating due diligence guesswork. |

| Time Savings | Reduce supplier research and qualification from weeks to hours. Clients report 85% faster onboarding of logistics partners. |

| Transparent Benchmarking | Compare pricing models, delivery speed, regional coverage, and e-commerce integrations across 50+ providers in one consolidated report. |

| Risk Mitigation | Avoid fraud, miscommunication, and service failures with partners verified through on-site assessments and client feedback audits. |

| Multilingual Support Access | Connect directly with couriers offering English-speaking account management and ERP/3PL integration capabilities. |

Real-World Impact: 2025 Client Results

- Electronics Distributor (Germany): Reduced inbound shipping delays by 40% after switching to a Pro List-recommended courier with dedicated cross-border tech logistics.

- E-Commerce Brand (USA): Cut last-mile delivery costs in Southeast Asia by 22% using a tier-2 Chinese courier with regional partnerships uncovered in the list.

- Medical Device Importer (Australia): Achieved 99.6% on-time customs clearance rate using a Pro List provider specializing in regulated goods.

Call to Action: Accelerate Your 2026 Logistics Strategy Today

Don’t let inefficient sourcing slow down your supply chain. The SourcifyChina Verified Pro List: Courier Companies in China (2026 Edition) is your strategic advantage for faster, safer, and more cost-effective logistics procurement.

👉 Contact our Sourcing Support Team Now to request your copy and receive a complimentary 15-minute consultation on matching your shipping needs with the right provider.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Available Monday–Friday, 8:00 AM – 6:00 PM CST. Response within 2 business hours guaranteed.

Trusted by procurement leaders in 38 countries. Verified. Efficient. Built for global scale.

© 2026 SourcifyChina. All rights reserved. Confidential – For B2B Use Only.

🧮 Landed Cost Calculator

Estimate your total import cost from China.