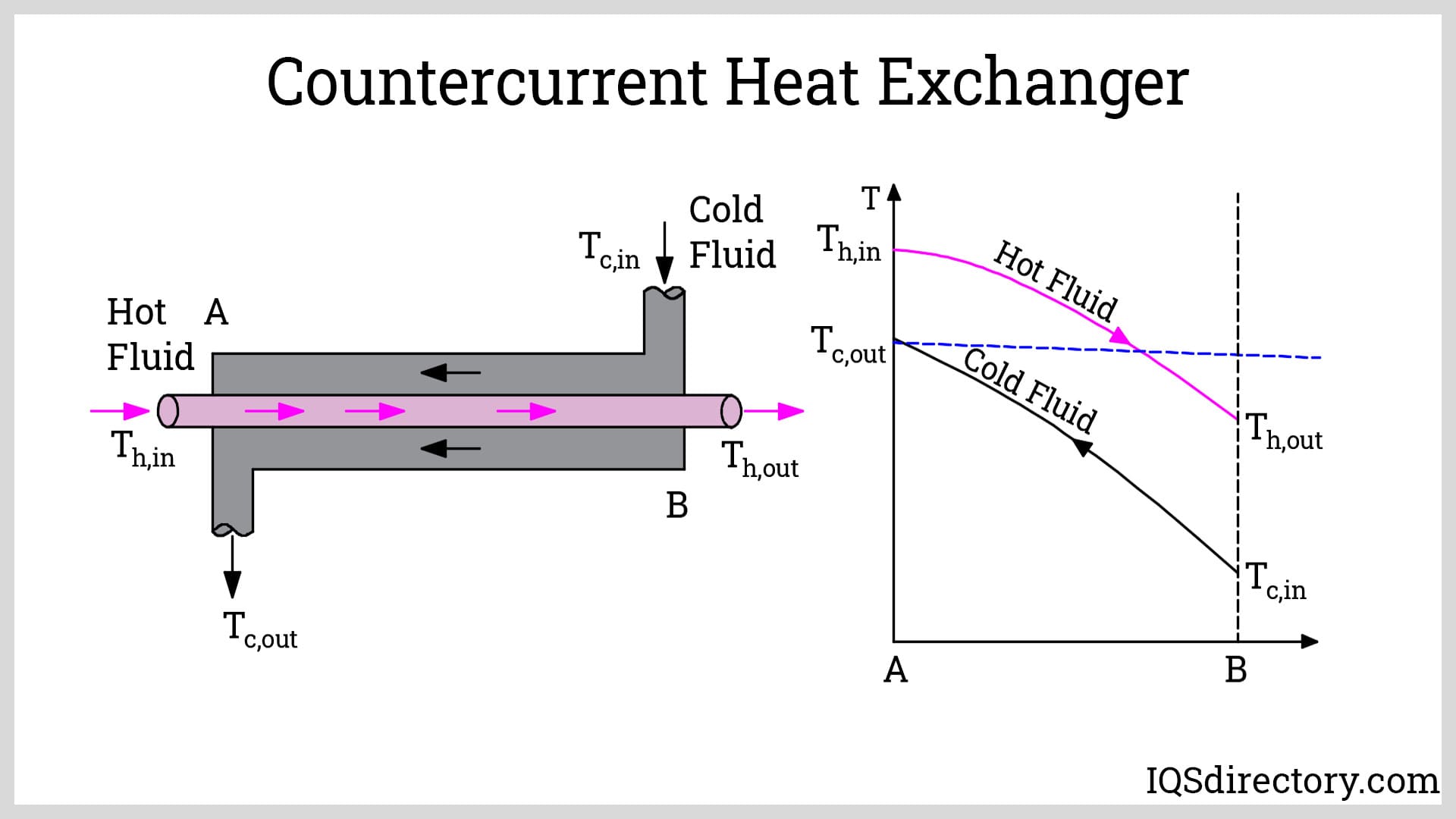

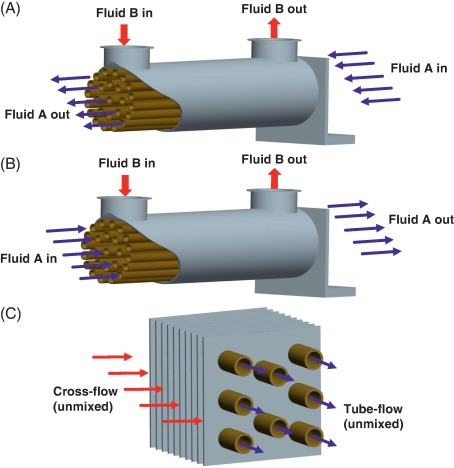

The global heat exchanger market is witnessing robust expansion, driven by rising energy efficiency demands and growing industrialization, particularly in the chemical, food & beverage, and power generation sectors. According to Mordor Intelligence, the market was valued at USD 20.5 billion in 2023 and is projected to grow at a CAGR of over 5.8% from 2024 to 2029. A key technological advancement fueling this growth is the adoption of counter current heat exchange systems, renowned for their superior thermal efficiency compared to parallel-flow designs. These systems maximize temperature differentials across the heat transfer surface, resulting in improved energy recovery and lower operational costs—critical factors in sustainability-focused industries. With increasing emphasis on reducing carbon footprints and optimizing process efficiency, manufacturers specializing in counter current configurations are gaining strategic importance. Based on market presence, innovation, global reach, and product performance metrics, the following ten companies have emerged as leaders in the counter current heat exchange manufacturing landscape.

Top 10 Counter Current Heat Exchange Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

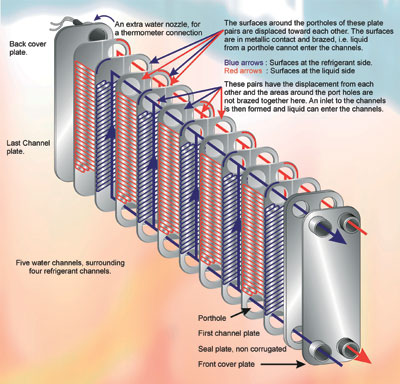

#1 Heat exchangers – brazed and gasketed

Domain Est. 1995

Website: danfoss.com

Key Highlights: Our cutting-edge heat exchangers are engineered to deliver exceptional heat transfer efficiency, optimized for both HVAC systems and a wide range of industrial ……

#2 Tranter: Responsive Heat Exchangers

Domain Est. 1995

Website: tranter.com

Key Highlights: At Tranter, we specialize in advanced gasketed and welded plate heat exchangers. As a global manufacturer, we are committed to precision and localized service….

#3 Platular® smart hybrid welded plate heat exchanger

Domain Est. 1997

Website: barriquand.com

Key Highlights: Exclusive patented technology · Custom manufacturing in France · For viscous and / or difficult fluids · Fully visitable and openable, easy to maintain….

#4 Global Manufacturer of Heat Exchangers

Domain Est. 1998

Website: heatex.com

Key Highlights: Heatex specializes in plate and rotary heat exchangers used in ventilation and thermal management applications worldwide….

#5 SWEP

Domain Est. 2023

Website: swepgroup.com

Key Highlights: SWEPs comprehensive range of brazed plate heat exchangers and ground breaking technology and quality makes us a force to be reckoned with. Visit us!…

#6 Heat Exchangers

Domain Est. 1997

Website: westank.com

Key Highlights: Wessels manufactures three heat exchanger designs: Plate and Frame, Brazed Plate, and Shell and Tube. All heat exchanger styles have models that are either ……

#7 Alfa Laval

Domain Est. 1997

Website: alfalaval.com

Key Highlights: Alfa Laval offers a variety of solutions for on-site water and waste treatment plus recovery of water, heat and even products from your process….

#8 Heat Transfer Systems

Domain Est. 2001

Website: chartindustries.com

Key Highlights: Hairpin heat exchangers use true counter-current flow. Unlike multi-pass shell and tube designs where correction factors are used to account for inefficiencies ……

#9 Cubic graphite heat exchangers

Domain Est. 2006

Website: us.mersen.com

Key Highlights: The Graphite Cubic Block Heat Exchanger is adapted to the heating, cooling, condensation and absorption of highly corrosive liquid chemicals….

#10 Heat Exchanger Products

Domain Est. 2010

Website: cgthermal.com

Key Highlights: Countercurrent exchangers facilitate parallel movement in opposite directions, which allows for a higher level of heat exchange between fluids. Crossflow….

Expert Sourcing Insights for Counter Current Heat Exchange

H2: Projected 2026 Market Trends for Counter-Current Heat Exchangers

By 2026, the global market for counter-current heat exchangers is expected to experience significant growth, driven by increasing energy efficiency demands, technological advancements, and expanding applications across key industrial sectors. This growth trajectory is supported by several interrelated trends:

-

Rising Emphasis on Energy Efficiency and Sustainability

As governments and industries prioritize carbon reduction and sustainable operations, counter-current heat exchangers—known for their superior thermal efficiency compared to parallel-flow systems—are gaining favor. Their ability to maximize temperature gradients across fluids enables higher heat recovery rates, reducing energy consumption in processes such as HVAC, chemical processing, and power generation. Regulatory frameworks like the EU’s Green Deal and U.S. clean energy initiatives are accelerating adoption in energy-intensive industries. -

Growth in Renewable Energy and Waste Heat Recovery

The integration of counter-current heat exchangers in waste heat recovery systems (WHRS) is expanding, particularly in industries such as steel, cement, and glass manufacturing. By 2026, the growing deployment of organic Rankine cycle (ORC) systems and combined heat and power (CHP) plants is expected to significantly increase demand for high-efficiency heat exchangers. These systems rely on counter-current designs to optimize low-grade heat utilization, enhancing overall plant efficiency. -

Advancements in Materials and Design

Innovations in corrosion-resistant alloys, composite materials, and compact heat exchanger designs (e.g., plate-and-fin and printed circuit heat exchangers) are improving the performance and durability of counter-current systems. These advancements allow operation under extreme temperatures and pressures, broadening their use in aerospace, LNG processing, and nuclear applications. Additive manufacturing is also enabling more complex internal geometries, further enhancing thermal transfer efficiency. -

Expansion in Industrial and Commercial Applications

The chemical, petrochemical, food and beverage, and pharmaceutical industries continue to adopt counter-current heat exchangers for precise temperature control and energy savings. In particular, the global push for food safety and efficient pasteurization is driving demand in the dairy and beverage sectors. Additionally, rising construction of data centers is increasing the need for advanced liquid cooling systems, where counter-current designs offer superior thermal management. -

Regional Market Dynamics

Asia-Pacific is expected to lead market growth by 2026, fueled by rapid industrialization in China, India, and Southeast Asia, along with government investments in infrastructure and clean technology. North America and Europe will maintain strong demand due to stringent energy regulations and modernization of aging industrial facilities. The Middle East is also emerging as a growth region, particularly in desalination and oil & gas processing, where efficient heat recovery is critical. -

Digital Integration and Predictive Maintenance

The integration of IoT sensors and AI-driven analytics into heat exchanger systems is enabling real-time performance monitoring and predictive maintenance. By 2026, smart counter-current heat exchangers with digital twins and condition-based monitoring will become more common, reducing downtime and optimizing efficiency across industrial operations.

In conclusion, the 2026 market for counter-current heat exchangers will be shaped by a convergence of regulatory, technological, and economic forces favoring high-efficiency thermal systems. With an anticipated compound annual growth rate (CAGR) of 5.8–7.2% from 2021 to 2026 (depending on region and sector), the counter-current heat exchanger market is poised for robust expansion, underpinned by its critical role in advancing energy sustainability and industrial innovation.

H2: Common Pitfalls When Sourcing Counter-Current Heat Exchangers – Quality and Intellectual Property (IP) Concerns

Sourcing counter-current heat exchangers involves technical, operational, and legal considerations that, if overlooked, can lead to performance issues, supply chain vulnerabilities, or legal risks. Two critical areas prone to pitfalls are product quality and intellectual property (IP) protection. Understanding these challenges helps ensure reliable procurement and safeguards innovation.

1. Quality-Related Pitfalls

a. Inadequate Material Specifications

Counter-current heat exchangers often operate under extreme temperatures, pressures, or corrosive environments. Sourcing units with substandard materials (e.g., incorrect alloy grades or thin wall thicknesses) can lead to premature failure, leaks, or contamination. Buyers may assume standard materials are sufficient without verifying compatibility with process fluids.

b. Poor Manufacturing Tolerances

Precision in tube alignment, sealing, and flow channel dimensions is crucial for optimal heat transfer efficiency. Low-cost suppliers may cut corners during fabrication, resulting in uneven flow distribution, reduced thermal performance, or mechanical stress points.

c. Lack of Third-Party Certification

Many suppliers claim compliance with standards such as ASME, ISO, or PED but fail to provide verifiable certification. Without independent validation, there is no assurance of design integrity, pressure testing, or non-destructive examination (NDE) procedures.

d. Inconsistent Performance Testing

Some suppliers do not conduct factory acceptance tests (FAT) under simulated operating conditions. This omission increases the risk of discovering performance shortfalls only after installation, leading to costly downtime and retrofits.

2. Intellectual Property (IP) Risks

a. Design Infringement

Counter-current heat exchanger designs—especially enhanced-surface tubes, baffle configurations, or modular layouts—may be protected by patents or trade secrets. Sourcing from suppliers using unlicensed or copied designs can expose the buyer to legal liability, particularly in regulated industries or export-sensitive applications.

b. Reverse Engineering and IP Theft

When working with offshore or low-cost manufacturers, there is a risk that proprietary designs shared during customization or co-development may be reverse-engineered and sold to competitors. Clear contractual safeguards are often missing in procurement agreements.

c. Ambiguity in Ownership of Custom Designs

If a heat exchanger is custom-engineered for a specific application, disputes can arise over who owns the design IP—the buyer, the engineering firm, or the manufacturer. Without explicit clauses in sourcing contracts, companies may lose control over future manufacturing or modification rights.

d. Use of Open-Source or Generic Designs Without Due Diligence

Some buyers opt for “generic” designs to avoid IP costs, but these may inadvertently infringe on existing patents. A lack of freedom-to-operate (FTO) analysis increases litigation risk, especially in international markets.

Mitigation Strategies

- Conduct thorough supplier audits, including factory visits and review of quality management systems (e.g., ISO 9001).

- Require material test reports (MTRs), pressure test records, and design calculations.

- Insist on FATs under real-world operating conditions.

- Perform IP due diligence, including patent landscape reviews and FTO assessments.

- Use robust contracts that define IP ownership, confidentiality, and restrictions on reverse engineering.

- Work with reputable suppliers who respect IP and have a track record in thermal systems.

By proactively addressing quality and IP concerns, organizations can ensure reliable, legally secure sourcing of counter-current heat exchangers, minimizing operational risks and protecting innovation.

H2: Logistics & Compliance Guide for Counter Current Heat Exchangers

Implementing and operating counter-current heat exchangers (CCHEs) efficiently and safely requires careful attention to logistics and regulatory compliance throughout their lifecycle. This guide outlines key considerations.

H2: Logistics Considerations

-

Siting & Installation:

- Space Requirements: Ensure adequate space for the heat exchanger, associated piping, valves, pumps, maintenance access (especially for tube bundle removal in shell-and-tube types), and future expansion.

- Support & Foundation: Design robust foundations capable of handling the unit’s weight (including fluids), thermal expansion/contraction, and potential vibration. Consider seismic requirements.

- Piping Layout: Optimize piping for straight runs to minimize pressure drop. Ensure proper slope for drainage and venting. Include isolation valves upstream/downstream for maintenance. Allow for thermal expansion (use expansion loops or bellows).

- Accessibility: Plan for crane access, scaffolding points, and clear pathways for maintenance personnel and equipment (e.g., tube pullers, cleaning tools).

- Utility Connections: Secure reliable connections for cooling water, steam, electrical power (for pumps, controls), instrument air, and drains.

-

Transportation & Handling:

- Weight & Dimensions: Verify road/bridge weight limits, tunnel heights, and turning radii for transport. Obtain necessary permits for oversized loads.

- Fragility: Protect tube sheets, fins (on air coolers), and instrument connections during lifting and transport. Use certified lifting lugs.

- Environmental Protection: Prevent contamination during transit (e.g., cover open ends, protect coatings).

-

Commissioning:

- Pre-Startup Checks: Verify piping alignment, support integrity, valve operation, instrumentation calibration, lubrication, and safety system functionality (relief valves, alarms).

- Cleaning & Flushing: Perform thorough cleaning (chemical or mechanical) to remove fabrication debris, scale inhibitors, or preservatives before introducing process fluids. Flush associated piping.

- Leak Testing: Conduct hydrostatic or pneumatic pressure testing per design codes (e.g., ASME) on both shell and tube sides.

- Gradual Start-Up: Introduce fluids slowly, starting with the higher pressure side if applicable. Monitor temperatures, pressures, and flow rates closely. Perform thermal cycling checks.

-

Operation & Maintenance:

- Monitoring: Continuously monitor key parameters: inlet/outlet temperatures, pressures, flow rates, pressure drops (indicative of fouling), vibration, and fluid levels (if applicable).

- Fouling Management: Implement a regular cleaning schedule (mechanical, chemical, or online methods like backflushing or soot blowing) based on fluid characteristics and observed performance decline.

- Preventive Maintenance (PM): Schedule inspections, lubrication, seal replacements, instrument calibration, and structural integrity checks. Maintain detailed logs.

- Spare Parts: Stock critical spare parts (gaskets, seals, tubes, instrument sensors) to minimize downtime.

- Decommissioning & Disposal: Plan for safe fluid draining, cleaning, decontamination (if handling hazardous materials), and environmentally responsible disposal or recycling of the unit and components at end-of-life.

H2: Compliance Requirements

-

Pressure Equipment Regulations:

- ASME Boiler and Pressure Vessel Code (BPVC), Section VIII: Mandatory in the US and widely adopted globally for design, fabrication, inspection, and testing of pressure vessels (shell side). Requires Certified Manufacturer and Authorized Inspector (AI) oversight. Compliance marked by ASME “U” Stamp.

- Pressure Equipment Directive (PED) 2014/68/EU: Essential for placing equipment on the EU market. Requires conformity assessment (involving Notified Bodies for higher-risk categories) and CE marking.

- Other National Codes: CRN (Canada), PED (UK), GOST (Russia), etc. – Compliance is mandatory based on location.

-

Safety & Environmental Regulations:

- Process Safety Management (PSM – OSHA 1910.119, USA): Required for facilities handling specific quantities of regulated highly hazardous chemicals. Applies to CCHEs within covered processes, mandating Process Hazard Analysis (PHA), Mechanical Integrity (MI), Management of Change (MOC), etc.

- Seveso III Directive (EU): Similar to PSM for major accident hazard sites in the EU.

- Environmental Protection Regulations (e.g., EPA Clean Air/Water Acts, REACH, RoHS): Govern emissions (e.g., fugitive VOC leaks from flanges/packing), wastewater discharge (from cleaning, cooling water blowdown), and use of hazardous substances in construction or operation. Requires permits and monitoring.

- Hazardous Materials (HAZMAT) Regulations (e.g., DOT, ADR, IMDG): Apply during transportation of the heat exchanger (if containing residues) or associated fluids.

-

Fire & Building Codes:

- NFPA Codes (e.g., NFPA 30, NFPA 70 – NEC): Govern storage of flammable/combustible liquids near the unit, electrical area classification (if handling flammable fluids), and fire protection requirements.

- Local Building Codes: Address structural requirements, fire separation, and egress.

-

Design & Engineering Standards:

- Tubular Exchanger Manufacturers Association (TEMA) Standards: Provide detailed guidelines for design, fabrication, and operation of shell-and-tube heat exchangers (common CCHE type), covering materials, dimensions, tolerances, and testing. While not legally binding like codes, adherence is industry best practice and often specified in contracts.

- API Standards (e.g., API 660, API 661): Specific standards for shell-and-tube exchangers (API 660) and air-cooled heat exchangers (API 661) used in oil & gas.

- Material Compatibility: Selection must comply with regulations regarding material use (e.g., lead content restrictions) and ensure compatibility with process fluids to prevent corrosion and failure (referenced in codes like ASME BPVC Section II).

-

Documentation & Record Keeping:

- Manufacturer’s Data Report (MDR): Required by ASME, documenting design, materials, tests, and inspection results.

- Pressure Vessel Data Plate: Permanently attached, showing key design parameters (MAWP, Temp, Volume, Code, Stamp).

- Risk Assessments (PHA, HAZOP): Required by PSM/Seveso for covered processes.

- Permits: Operational permits (air, water, waste).

- Maintenance & Inspection Records: Critical for demonstrating ongoing compliance with Mechanical Integrity requirements (PSM) and pressure equipment regulations.

- As-Built Drawings & P&IDs: Accurate records are essential for safe operation, maintenance, and future modifications (MOC).

Key Takeaway: Successful deployment of a counter-current heat exchanger hinges on integrating logistical planning with rigorous compliance from the initial design phase through operation and decommissioning. Always consult relevant local, national, and international regulations and standards specific to your location, industry, and the fluids involved. Engage qualified engineers and inspectors throughout the process.

Conclusion on Sourcing Counter-Current Heat Exchangers:

Sourcing counter-current heat exchangers offers significant advantages in terms of thermal efficiency, energy savings, and process optimization. Due to their design, which allows fluids to flow in opposite directions, counter-current heat exchangers maximize the temperature gradient along the heat transfer surface, resulting in superior heat recovery compared to parallel-flow configurations. This leads to reduced energy consumption, lower operational costs, and a smaller environmental footprint.

When sourcing such equipment, it is essential to consider factors including material compatibility, operating conditions (temperature, pressure), maintenance requirements, and overall lifecycle costs. Selecting reputable suppliers with proven expertise in thermal systems ensures reliability, performance, and compliance with industry standards.

In summary, investing in counter-current heat exchangers—carefully sourced based on technical specifications and quality assurance—provides long-term operational benefits and supports sustainable industrial practices. Their enhanced efficiency makes them a preferred choice in applications ranging from chemical processing to HVAC and food production, where optimal heat transfer is critical.