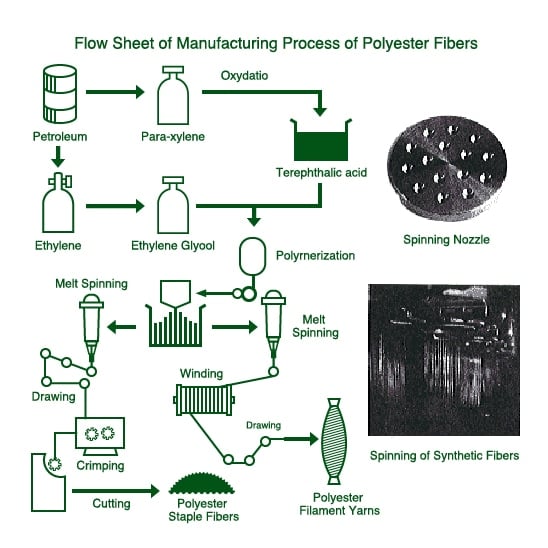

The global textile market, particularly the segment focused on cotton and polyester fabrics, continues to expand amid rising demand from apparel, home textiles, and industrial applications. According to a 2023 report by Grand View Research, the global polyester fiber market size was valued at USD 76.3 billion and is expected to grow at a compound annual growth rate (CAGR) of 4.7% from 2023 to 2030. This growth is driven by polyester’s durability, affordability, and versatility across end-use sectors. Simultaneously, the cotton fabric market remains resilient, supported by increasing consumer preference for natural fibers and sustainable textiles. Mordor Intelligence projects that the cotton fabrics market will register steady growth, fueled by innovations in organic cotton production and recycling technologies. As demand escalates, a select group of manufacturers has emerged as leaders, combining scale, innovation, and sustainability to dominate the global supply chain. Here are the top 10 cotton and polyester fabric manufacturers shaping the industry’s future.

Top 10 Cotton And Polyester Fabric Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Clothing Manufacturers

Domain Est. 2016

Website: createfashionbrand.com

Key Highlights: CFB uses organic fabrics / Gots / recycled cotton / recycled polyester with an eco-responsible and sustainable philosophy. By using recycled garments, CFB ……

#2 Klopman

Domain Est. 1996

Website: klopman.com

Key Highlights: Klopman International is Europe’s leading manufacturer of polyester/cotton clothing fabrics for workwear, protective and casual apparel. It was 1967 when ……

#3 Fabrics, Fibers, and Nonwovens

Domain Est. 1987

Website: dupont.com

Key Highlights: DuPont delivers the fabrics, fibers, and nonwovens industries and companies trust for performance, protection, and versatility of use….

#4 Cotton Incorporated

Domain Est. 1996

Website: cottoninc.com

Key Highlights: Textile Sourcing Cotton Incorporated has compiled this easy-to-use searchable online resource to help you find domestic textile companies who process cotton….

#5 CORDURA®

Domain Est. 1997

Website: cordura.com

Key Highlights: As an INVISTA brand, CORDURA Advanced Fabrics utilize more than a dozen different technologies to deliver unmatched durability and reliability….

#6 High-Quality Woven Fabrics

Domain Est. 1998 | Founded: 1900

Website: hamrickmills.com

Key Highlights: Since 1900, Hamrick Mills has taken pride in producing high-quality woven fabrics in both polyester/cotton blends as well as 100% cotton….

#7 stoffabrics

Domain Est. 2014

Website: stoffabrics.com

Key Highlights: Quality fabric with a Scandinavian twist. Your new B2B supplier. Choose from thousands of different designs, as well as various qualities made from the finest ……

#8 Fabric

Domain Est. 2017

Website: swatchon.com

Key Highlights: Polyester-blend Twill$5.11P 74 Wool 9 Rayon 9 Linen 8280 gsm colors icon 25 … Cotton-blend Enzyme Twill$ -CO 68 P 32392 gsm colors icon 10 Colors….

#9 Ocean State Innovations: Textile Solutions

Domain Est. 2018

Website: osinnovate.com

Key Highlights: Our product line includes a variety of weights and constructions in Nylon, Polyester, Cotton, Vinyl, Canvas and blended woven and knit fabrics. We continue ……

#10 policott

Domain Est. 2024

Website: policott.jp

Key Highlights: At policott, we deal in woven fabrics with strech and knitted fabrics. We are committed to Japan-made manufacturing and offer high-quality, highly reliable ……

Expert Sourcing Insights for Cotton And Polyester Fabric

2026 Market Trends for Cotton and Polyester Fabric

Rising Demand for Sustainable and Recycled Fibers

By 2026, sustainability will be a dominant force shaping the cotton and polyester fabric markets. Consumers and brands alike are prioritizing eco-friendly materials, driving significant growth in organic cotton and recycled polyester (rPET). Recycled polyester, derived from post-consumer plastic bottles, is expected to capture a larger market share as major apparel brands commit to circularity goals. Meanwhile, organic cotton cultivation is expanding due to increased environmental awareness and stricter regulations on water use and pesticide application in conventional cotton farming.

Technological Innovation in Fabric Performance

Advancements in textile technology will enhance the functionality of both cotton and polyester fabrics. Hybrid textiles—blends engineered for optimal comfort, durability, and moisture-wicking—are gaining traction in activewear and athleisure segments. Polyester will continue to dominate performance apparel due to its strength and quick-drying properties, while cotton innovations such as lyocell-blended cotton and enzyme-treated finishes will improve softness, shrink resistance, and sustainability. Digital printing and smart textile integrations are also expected to grow, especially in premium and technical apparel.

Supply Chain Resilience and Regional Shifts

Geopolitical tensions and post-pandemic disruptions have prompted brands to reevaluate supply chains. By 2026, there will be a noticeable shift toward nearshoring and regional production, especially in North America and Europe, to reduce lead times and carbon footprints. Countries like India and Vietnam are likely to strengthen their roles as key producers of both cotton and polyester fabrics, supported by investments in spinning and weaving infrastructure. Cotton supply may face volatility due to climate change impacts on yield, while polyester production could be influenced by fluctuating crude oil prices and regulatory pressures on virgin plastic.

Consumer Preferences Driving Blended Fabrics

Blends of cotton and polyester will remain highly popular due to their balanced properties—cotton offers breathability and comfort, while polyester adds wrinkle resistance and durability. In 2026, demand for 50/50 and 65/35 cotton-polyester blends is projected to grow, particularly in casual wear, uniforms, and workwear. However, transparency in labeling and fiber content will become more critical as consumers demand authenticity and ethical sourcing, pushing brands to adopt traceability technologies like blockchain in their fabric supply chains.

Regulatory and Environmental Pressures

Environmental regulations will intensify by 2026, affecting both fibers differently. Polyester may face increased scrutiny due to microplastic pollution, prompting innovation in biodegradable or filter-equipped washing technologies. Cotton production will come under greater oversight regarding water usage and land management, accelerating adoption of regenerative agriculture practices. Policies such as extended producer responsibility (EPR) and carbon taxes could reshape production costs and influence material selection across the fashion and home textile industries.

Common Pitfalls When Sourcing Cotton and Polyester Fabric (Quality, IP)

Sourcing cotton and polyester fabric involves navigating a complex landscape where quality inconsistencies and intellectual property (IP) risks can significantly impact your business. Overlooking these pitfalls may lead to production delays, legal disputes, reputational damage, and financial losses. Below are key challenges to watch for:

Quality Inconsistencies

One of the most frequent issues in textile sourcing is variability in fabric quality. Both cotton and polyester are prone to inconsistencies due to raw material fluctuations and manufacturing practices.

-

Fiber Quality Variability: Cotton sourced from different regions or harvests often varies in staple length, strength, and color, directly affecting fabric softness, durability, and dye uptake. Similarly, polyester batches may differ in tenacity and dye affinity due to variations in polymerization processes.

-

Dye Lot Differences: Even minor changes in dyeing conditions—temperature, chemical concentration, or machine calibration—can lead to shade variations between batches. This is particularly problematic for brands requiring color consistency across product lines.

-

Fabric Defects: Common weaving or knitting flaws—such as slubs, holes, mispicks, or pilling—can go undetected without rigorous inspection. Low-quality finishing processes may also result in shrinkage, fading, or poor hand feel.

-

Lack of Standard Testing: Suppliers may not perform standardized quality tests (e.g., for tensile strength, colorfastness, or pilling resistance), leaving buyers exposed to subpar materials. Relying solely on supplier claims without third-party lab verification is risky.

Intellectual Property (IP) Risks

Textile designs, innovative fabric technologies, and brand-specific finishes are often protected by IP laws. Sourcing without due diligence can lead to unintentional infringement.

-

Pattern and Design Infringement: Many fabric prints are copyrighted or protected by design patents. Sourcing a fabric with a pattern resembling a well-known designer’s collection—even if purchased from a third-party mill—can expose you to legal liability.

-

Counterfeit or Unauthorized Mill Usage: Some suppliers falsely claim affiliation with reputable mills or use logos/branding of premium fabric producers (e.g., Lenzing, Arvind, or Bossa) without authorization. This misrepresentation can compromise both product quality and brand integrity.

-

Technology Licensing Violations: Certain performance fabrics (e.g., moisture-wicking, UV-protective, or antimicrobial treatments) are proprietary and require licensing. Using such fabrics without proper authorization—even if sourced through a distributor—can result in IP disputes.

-

Private Label and Development Theft: When working with suppliers to develop custom fabrics, there is a risk they may replicate and sell your design to competitors, especially in regions with weaker IP enforcement.

Mitigation Strategies

To avoid these pitfalls:

- Request Certifications: Look for Oeko-Tex, GOTS (for cotton), or bluesign certifications to verify quality and compliance.

- Conduct Factory Audits: Evaluate supplier facilities for consistency in processes and quality control systems.

- Enforce Contracts with IP Clauses: Clearly define ownership of custom designs and prohibit unauthorized resale or replication.

- Use Independent Inspection Services: Engage third parties for pre-shipment quality checks and lab testing.

- Verify Fabric Origin and Authenticity: Demand mill documentation and batch traceability, especially for premium or technical fabrics.

By proactively addressing quality and IP concerns, brands can build more reliable supply chains and protect their market position.

Logistics & Compliance Guide for Cotton and Polyester Fabric

Overview

Cotton and polyester fabrics are widely traded textiles used in apparel, home furnishings, and industrial applications. Efficient logistics and strict compliance with international regulations are essential for smooth import/export operations. This guide outlines key considerations for handling cotton and polyester fabrics across the supply chain.

Classification and Harmonized System (HS) Codes

Accurate classification ensures proper tariffs and regulatory adherence.

- Cotton Fabric: Typically classified under HS Chapter 52 (Cotton). Common codes include:

- 5208: Woven fabrics of cotton, containing ≥ 85% cotton by weight.

- 5209: Other woven cotton fabrics (e.g., mixed with man-made fibers).

- Polyester Fabric: Falls under HS Chapter 55 (Man-Made Staple Fibers). Common codes include:

- 5512: Woven fabrics of polyester staple fibers.

- 5513: Polyester fabrics, often mixed with other fibers.

Note: Final classification depends on fiber composition, fabric weight, and finish. Consult local customs authorities for precise codes.

Import/Export Documentation

Ensure all required documentation is complete and accurate:

- Commercial Invoice: Must detail product description, quantity, value, HS code, country of origin, and Incoterms®.

- Packing List: Specifies dimensions, weight, and number of packages.

- Bill of Lading (B/L) or Air Waybill (AWB): Contract of carriage; must match invoice and packing list.

- Certificate of Origin: May be required for preferential tariffs under free trade agreements (e.g., USMCA, RCEP).

- Textile Declaration: Some countries (e.g., EU, USA) require fiber content labeling (e.g., FTC rules in the U.S.).

Regulatory Compliance

Adhere to destination country regulations:

- United States (FTC & CBP):

- FTC Care Labeling Rule: Requires permanent care instructions.

- Fiber Content Labeling: Must list fiber types and percentages.

- CBP Entry Filing: Submit through the Automated Commercial Environment (ACE).

- European Union (EU):

- EU Textile Regulation (EU) No 1007/2011: Mandates accurate fiber labeling and traceability.

- REACH & SCIP: Restrictions on hazardous substances (e.g., azo dyes, phthalates).

- EPR (Extended Producer Responsibility): Applicable in some member states for textile waste.

- Other Markets:

- Canada: Textile Labeling Act and Care Labelling Regulations.

- Japan: JIS L 0001 labeling standards.

- China: GB 18401 safety technical code for textile products.

Packaging and Handling

Proper packaging prevents damage during transit:

- Rolls vs. Bundles: Fabrics are typically shipped in rolls (on cardboard cores) or folded bundles.

- Protective Wrapping: Use plastic film or kraft paper to prevent moisture, dust, and abrasion.

- Palletization: Secure rolls on wooden or plastic pallets; stretch-wrap for stability.

- Labeling: Clearly mark each package with SKU, color, lot number, and handling instructions (e.g., “This Side Up,” “Protect from Moisture”).

Transportation and Storage

Optimize logistics for fabric integrity:

- Container Shipping: Use dry, ventilated containers. Desiccants recommended in humid climates.

- Air Freight: Suitable for high-value or time-sensitive shipments.

- Storage Conditions: Store in clean, dry, temperature-controlled environments. Avoid direct sunlight to prevent fading.

- Stacking: Limit stack height to prevent crushing of lower rolls.

Sustainability and Ethical Compliance

Increasingly important for brand reputation and market access:

- Organic Cotton: Certified by standards like GOTS (Global Organic Textile Standard).

- Recycled Polyester: Verify through certifications such as GRS (Global Recycled Standard) or RCS (Recycled Claim Standard).

- Social Compliance: Adhere to labor standards (e.g., BSCI, SMETA) across the supply chain.

Risk Mitigation

- Inspection Services: Use third-party inspectors (e.g., SGS, Bureau Veritas) for pre-shipment quality checks.

- Insurance: Cover goods against loss, damage, or delay during transit.

- Incoterms®: Clearly define responsibilities (e.g., FOB, CIF, DDP) in sales contracts.

Conclusion

Successful logistics and compliance for cotton and polyester fabric require attention to classification, documentation, labeling, and sustainability standards. Partnering with experienced freight forwarders and staying updated on regulatory changes ensures efficient and compliant global trade operations.

In conclusion, sourcing cotton and polyester fabrics requires a strategic balance between quality, cost, sustainability, and supply chain reliability. Cotton, as a natural fiber, offers breathability, comfort, and biodegradability, making it ideal for apparel and home textiles; however, its production is water-intensive and can be subject to price volatility due to climate and agricultural factors. Organic and sustainably grown cotton options are increasingly important to meet growing environmental and ethical consumer demands.

Polyester, as a synthetic fiber, provides durability, wrinkle resistance, and lower production costs, making it suitable for performance and mass-market textiles. Recycled polyester presents a more sustainable alternative, helping reduce plastic waste and dependence on virgin petroleum-based materials.

When sourcing, it is crucial to evaluate suppliers based on certification standards (such as GOTS for cotton or GRS for recycled polyester), production transparency, and compliance with environmental and labor regulations. Building long-term relationships with ethical and reliable suppliers, leveraging global sourcing opportunities, and staying informed about innovations in sustainable textile production will ultimately support cost-efficiency, brand integrity, and environmental responsibility.

Ultimately, a blended sourcing strategy that combines conventional, organic, and recycled fibers—based on product requirements and sustainability goals—will position businesses for long-term success in a competitive and increasingly eco-conscious market.