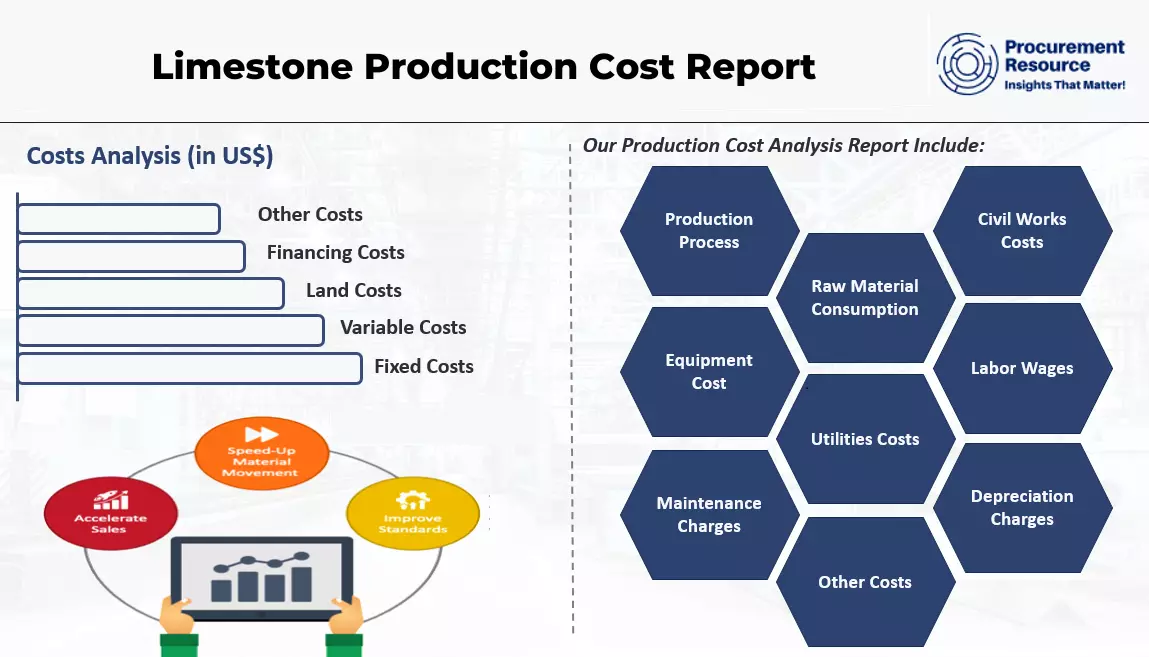

The global limestone market is experiencing steady growth, driven by rising demand across construction, agriculture, and industrial sectors. According to Grand View Research, the global limestone market size was valued at USD 56.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. This growth is fueled by increased infrastructure development, particularly in emerging economies, as well as the mineral’s essential role in steel manufacturing and pollution control applications. As demand rises, the cost of limestone production and supply has become a critical factor for downstream industries optimizing their input expenses. Regional variations in extraction costs, energy prices, transportation logistics, and environmental regulations significantly influence manufacturer pricing structures. In this analysis, we examine the top nine limestone manufacturers worldwide, evaluating their production scale, geographic reach, and cost efficiency to provide a data-driven perspective on the competitive landscape shaping the economics of this foundational industrial material.

Top 9 Cost Of Limestone Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Products

Domain Est. 1996

Website: greerlime.com

Key Highlights: Greer Lime Company is a manufacturer of high calcium quicklime from our own on-site deposits of high calcium limestone….

#2 Limestone, Sand & Gravel

Domain Est. 1998

Website: mulzer.com

Key Highlights: Mulzer supplies the limestone, sand, and gravel for international airport runways, roads, interstate highways, dams, and chemical operations and utilities….

#3 3D Stone, Inc. – Indiana Limestone

Domain Est. 2009 | Founded: 1992

Website: 3dstoneinc.com

Key Highlights: Founded in 1992 3D Stone, Inc. was established with the goal of becoming a leader in the Indiana limestone products marketplace. Contact us today!…

#4 National Lime & Stone

Domain Est. 1999

Website: natlime.com

Key Highlights: National Lime & Stone provides high quality aggregates, minerals, concrete, asphalt and paving services throughout Ohio and the United States….

#5 Limestone Products

Domain Est. 2001

Website: conklinlimestone.com

Key Highlights: Discover an exceptional range of limestone products at Conklin Limestone. We have everything you need for a healthy, green lawn….

#6 Cost of Limestone Pavers

Domain Est. 2010

Website: planner5d.com

Key Highlights: Below you will find our Limestone Pavers cost estimator based on values reflecting market wages and material costs in 2024 so as to help you save money while ……

#7 Limestone

Domain Est. 2019

Website: naturalbrickandstonedepot.com

Key Highlights: $431.64 deliveryLimestone – Thin Veneer (Flats) ; Harvest Gold Limestone Thin Veneer – Random – Flats · $8.65 USD ; Timothy’s Blend Ledgerock Thin Veneer – Flats · $9.40 USD ……

#8 Limestone

Domain Est. 2023

#9 The Cost of Limestone: Yard Price Guide

Domain Est. 2024

Website: hellogravel.com

Key Highlights: The average cost per yard of limestone can range from $30 to $55. This cost typically includes the stone itself, delivery, and basic ……

Expert Sourcing Insights for Cost Of Limestone

2026 Market Trends for the Cost of Limestone

The cost of limestone in 2026 is expected to be shaped by a confluence of global macroeconomic forces, regional supply-demand dynamics, and evolving industrial priorities. While limestone remains a relatively stable commodity due to its abundance, several key trends are likely to influence pricing and market behavior in the coming years.

1. Steady Demand from Core Industries with Regional Variations

Construction and infrastructure development will continue to be the primary drivers of limestone demand. In emerging economies across Asia, Africa, and Latin America, ongoing urbanization and government-led infrastructure projects (roads, housing, airports) will sustain robust demand, potentially exerting upward pressure on prices in these regions. Conversely, developed markets like North America and Western Europe may see more moderate growth, influenced by economic cycles and housing market fluctuations. The cement industry, a major consumer of limestone, will be particularly sensitive to infrastructure spending and green building regulations.

2. Energy and Transportation Costs as Key Price Influencers

The cost of extracting, processing, and transporting limestone is heavily dependent on energy prices. With ongoing volatility in global oil and natural gas markets, and the long-term transition toward cleaner energy, energy costs will remain a critical factor. Higher fuel prices directly increase operational and freight expenses, which are typically passed on to consumers. In 2026, logistics bottlenecks or regional fuel shortages could lead to localized price spikes, especially for areas reliant on imported limestone or with limited local quarries.

3. Environmental Regulations and Carbon Pricing Pressures

Environmental policies are increasingly impacting the limestone market. Stricter emissions standards, quarrying regulations, and the potential expansion of carbon pricing mechanisms (such as carbon taxes or cap-and-trade systems) could raise production costs for limestone suppliers. Compliance with environmental impact assessments, land reclamation requirements, and dust/noise control measures adds to operational expenses. These regulatory costs are likely to be reflected in higher market prices, particularly in regions with aggressive climate policies like the European Union.

4. Technological Advancements and Operational Efficiency

On the supply side, technological improvements in quarrying, crushing, and processing equipment may help offset some cost pressures. Automation, predictive maintenance, and more efficient energy use in processing plants can reduce per-unit production costs. Suppliers investing in digitalization and process optimization may maintain competitive pricing or improve margins, potentially moderating overall market increases. However, the upfront capital required for such upgrades may initially be reflected in pricing strategies.

5. Geopolitical Stability and Trade Dynamics

Global trade policies, geopolitical tensions, and supply chain resilience will influence regional limestone prices. Trade restrictions, import tariffs, or disruptions due to political instability could affect the availability and cost of limestone in certain markets. Countries with domestic limestone reserves may have a cost advantage, while import-dependent regions could face higher prices due to freight costs and trade barriers. Supply chain localization trends may also encourage greater reliance on regional sources, impacting price differentials.

6. Substitution and Market Competition

Although limestone has few direct substitutes in construction and cement production, alternative materials (such as recycled aggregates or geopolymers) are gaining traction in niche applications. Increased competition from recycled materials, driven by sustainability goals and circular economy initiatives, could marginally affect limestone demand and pricing in specific segments. However, for most structural applications, limestone’s cost-effectiveness and performance ensure its dominance.

Conclusion

By 2026, the cost of limestone is projected to experience moderate increases, driven primarily by energy and transportation expenses, regulatory compliance, and strong demand in developing regions. While technological efficiencies may mitigate some cost growth, environmental policies and global economic conditions will remain pivotal. Market participants should anticipate regional price variations and prepare for a landscape where sustainability and operational resilience play an increasingly important role in cost structures and competitiveness.

Common Pitfalls When Sourcing Limestone (Quality, IP)

Sourcing limestone while ensuring consistent quality and protecting intellectual property (IP) presents several challenges. Overlooking these pitfalls can lead to operational inefficiencies, product inconsistencies, and legal vulnerabilities. Key issues include:

Inadequate Quality Specification and Testing

Failing to define precise quality parameters—such as calcium carbonate (CaCO₃) content, particle size distribution, moisture levels, and impurities (e.g., silica, iron, magnesium)—can result in receiving substandard material. Without rigorous, third-party testing protocols and clear acceptance criteria in supply agreements, buyers risk inconsistent performance in downstream applications, especially in industries like construction, agriculture, or manufacturing where limestone purity is critical.

Lack of Supply Chain Transparency

Many suppliers source limestone from multiple quarries with varying geological profiles. Without transparency into the origin and blending practices, buyers may unknowingly receive batches with inconsistent chemical or physical properties. This inconsistency can affect product reliability and damage brand reputation. It is essential to audit quarry operations and require documentation of sourcing practices.

Overlooking Intellectual Property Risks

When limestone is processed into proprietary formulations (e.g., specialty fillers, coatings, or construction materials), shared specifications or custom processing methods may expose IP. Suppliers might reverse-engineer formulations or use sensitive data to serve competing customers. Without strong contractual safeguards—such as non-disclosure agreements (NDAs), IP ownership clauses, and restrictions on data reuse—companies risk losing competitive advantages.

Poor Contractual Agreements

Vague contracts that omit quality benchmarks, testing frequency, delivery tolerances, or remedies for non-compliance increase the risk of disputes. Additionally, failing to include IP protection terms or audit rights undermines control over both material quality and proprietary information.

Geographic and Logistical Constraints

Transportation costs and lead times can influence both quality and cost. Long-distance shipping increases the risk of contamination or moisture absorption. Moreover, regional limestone variations mean that switching suppliers may require reformulation—posing both quality and IP adaptation challenges.

Insufficient Supplier Vetting

Choosing suppliers based solely on price, without evaluating their quality control systems, certifications (e.g., ISO 9001), or track record, can lead to supply disruptions and compromised material standards. A supplier’s lack of investment in quality assurance may reflect poorly on the buyer’s final product.

Avoiding these pitfalls requires a strategic sourcing approach that combines technical due diligence, robust contracts, and proactive IP management.

Logistics & Compliance Guide for Cost of Limestone

Understanding the logistics and compliance aspects involved in sourcing, transporting, and utilizing limestone is essential for accurately calculating its total cost. These factors significantly influence supply chain efficiency, regulatory adherence, and overall project budgeting.

Sourcing and Procurement Logistics

The geographic location of limestone quarries directly impacts transportation costs and lead times. Procuring limestone from nearby sources reduces freight expenses and delivery duration, while importing from distant or international quarries increases costs due to longer hauls, fuel surcharges, and potential customs delays. Engaging with reliable suppliers who offer consistent quality and volume is critical for maintaining project timelines and minimizing cost fluctuations.

Transportation and Handling

Limestone is typically transported via truck, rail, or barge, depending on volume and destination. Trucking offers flexibility for smaller loads and direct delivery but can be costlier over long distances. Rail and barge are more economical for bulk shipments but require access to appropriate infrastructure. Handling limestone requires proper equipment such as loaders, conveyors, and storage silos to prevent degradation and dust emissions. These handling systems represent additional capital or operational costs that must be factored into the total cost equation.

Regulatory Compliance

Limestone operations must comply with environmental, safety, and transportation regulations. Quarrying activities are subject to local, state, and federal environmental laws, including air quality standards (dust control), water runoff management, and land reclamation requirements. Non-compliance can result in fines, project delays, or operational shutdowns, all of which increase costs. Additionally, transporting limestone may require adherence to weight restrictions, hazardous material classifications (if processed with additives), and Department of Transportation (DOT) regulations.

Documentation and Import/Export Considerations

When sourcing limestone internationally, compliance with customs regulations, import duties, and tariffs becomes essential. Accurate documentation, including certificates of origin, material safety data sheets (MSDS), and import licenses, is required to avoid delays and penalties. These administrative requirements add time and cost to the supply chain, affecting the landed cost of limestone.

Sustainability and Certification Requirements

Increasingly, projects in construction and manufacturing require sustainable sourcing practices. Compliance with environmental management systems (e.g., ISO 14001) or green building standards (e.g., LEED) may necessitate certified limestone from responsibly operated quarries. While such certifications can increase procurement costs, they may be necessary to meet client or regulatory demands and avoid reputational risk.

Risk Management and Contingency Planning

Supply chain disruptions—such as weather events, labor strikes, or regulatory changes—can affect limestone availability and pricing. A robust logistics strategy includes contingency sourcing, inventory buffers, and contractual safeguards to mitigate cost volatility. Proactively addressing these risks ensures cost predictability and project continuity.

In conclusion, the sourcing cost of limestone is influenced by a combination of factors including geological location, extraction methods, transportation logistics, market demand, environmental regulations, and processing requirements. Proximity to quarries, infrastructure quality, and economies of scale play significant roles in determining the overall cost-efficiency of limestone supply. Additionally, long-term sustainability and compliance with environmental standards may impact operational expenses. Therefore, a comprehensive cost analysis should be conducted when selecting a limestone source, balancing initial procurement costs with transportation, quality, reliability, and regulatory considerations to ensure optimal value and supply chain efficiency.