The global backflow prevention market is experiencing robust growth, driven by increasing regulatory mandates, aging infrastructure, and rising investments in water safety across municipal and industrial sectors. According to Mordor Intelligence, the backflow prevention devices market was valued at approximately USD 2.8 billion in 2023 and is projected to grow at a CAGR of over 5.5% from 2024 to 2029. This expansion reflects heightened awareness of water contamination risks and stricter plumbing codes in North America, Europe, and parts of Asia-Pacific. As demand for reliable and compliant backflow solutions rises, manufacturers are scaling innovation and production to meet evolving safety standards. Against this backdrop, identifying leading backflow valve manufacturers becomes critical for engineers, contractors, and procurement professionals seeking cost-effective, high-performance solutions. The following analysis highlights the top nine manufacturers based on a data-driven evaluation of production scale, geographic reach, material cost efficiency, and compliance with ANSI, ASSE, and WRAS standards—offering stakeholders insight into both pricing strategies and long-term value.

Top 9 Cost Of Backflow Valve Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 BAVCO

Domain Est. 1996

Website: bavco.com

Key Highlights: BAVCO is the largest parts distributor of original factory repair parts for backflow prevention assemblies….

#2 Backflow Preventers

Domain Est. 1995

Website: zurn.com

Key Highlights: Zurn provides the complete line of backflow prevention products for fire protection, irrigation, plumbing, retrofit, and waterworks ……

#3 Flomatic Valves

Domain Est. 1996 | Founded: 1933

Website: flomatic.com

Key Highlights: Since 1933, Flomatic Valves has focused on the design, development, and manufacturing of high-quality valve products for the water and wastewater industries….

#4 Apollo Backflow Assemblies & Valves

Domain Est. 1997

Website: backflow-supply.com

Key Highlights: 6-day deliveryBackflow Assemblies ; APOLLO 4A205A2F RP4A 1″ RP ASSEMBLY (Not For Potable Use) · $ 2,038.64 · $ 372.00 ; APOLLO 4A204A2F RP4A 3/4″ RP ASSEMBLY (Not For Potable Use)….

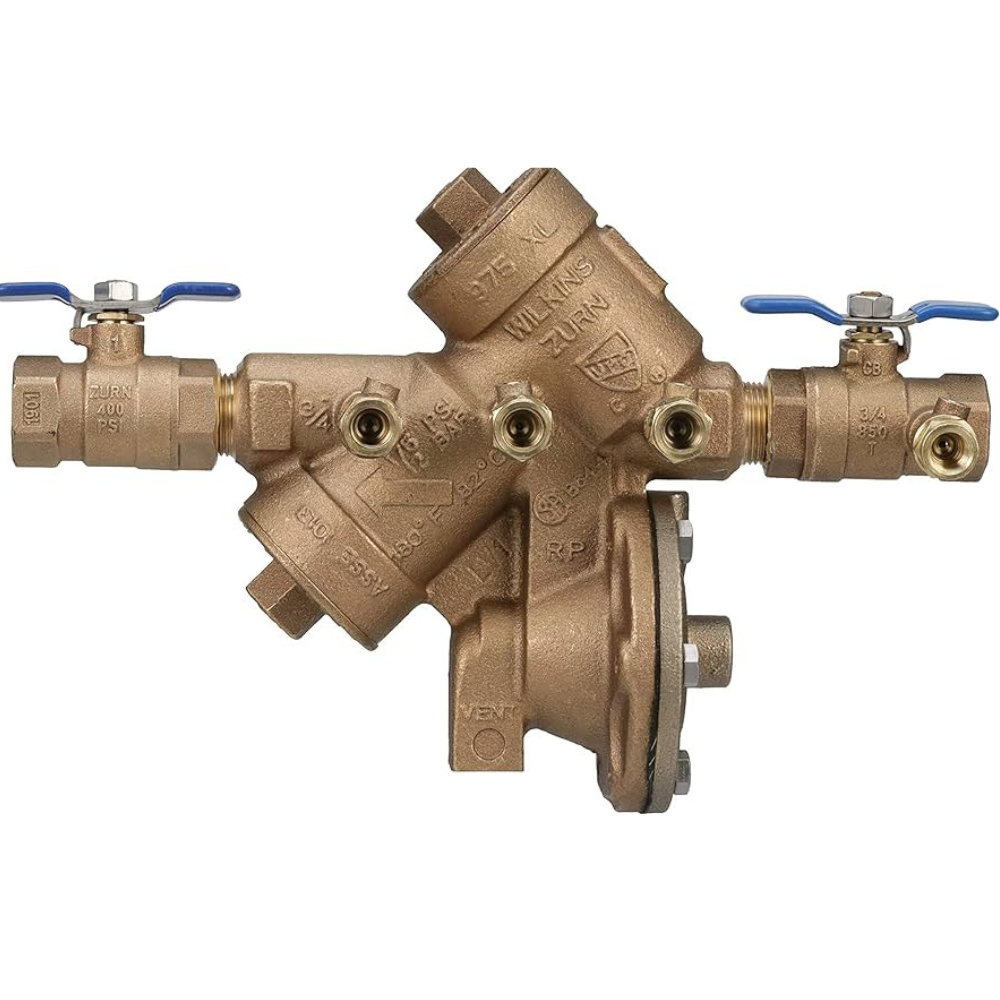

#5 Zurn

Domain Est. 1999

Website: sprinklerwarehouse.com

Key Highlights: 1–4 day deliveryZurn Wilkins continues to design and manufacture industry-leading products, including some of the world’s most reliable backflow prevention assemblies….

#6 How Much Does a Backflow Preventer Cost?

Domain Est. 2006

Website: home.costhelper.com

Key Highlights: Most backflows that are on the CCC list of approved devices will cost you anywhere from $100 to $300 just for the backflow unit….

#7 Shop Backflow Preventers and Fire System Parts

Domain Est. 2010

Website: backflowdirect.com

Key Highlights: Free delivery · 30-day returnsBronze Double Check Valve Assembly Backflow Preventers with Gear Operated Valves · Double Check Valve Backflow Preventer · $2,969.00 ; Bronze ……

#8 Backflow Preventer Valve Replacement Cost Guide

Domain Est. 1999

Website: pacificbackflow.com

Key Highlights: Learn average costs to replace a backflow preventer valve, including parts, labor, residential vs. commercial pricing, and key factors….

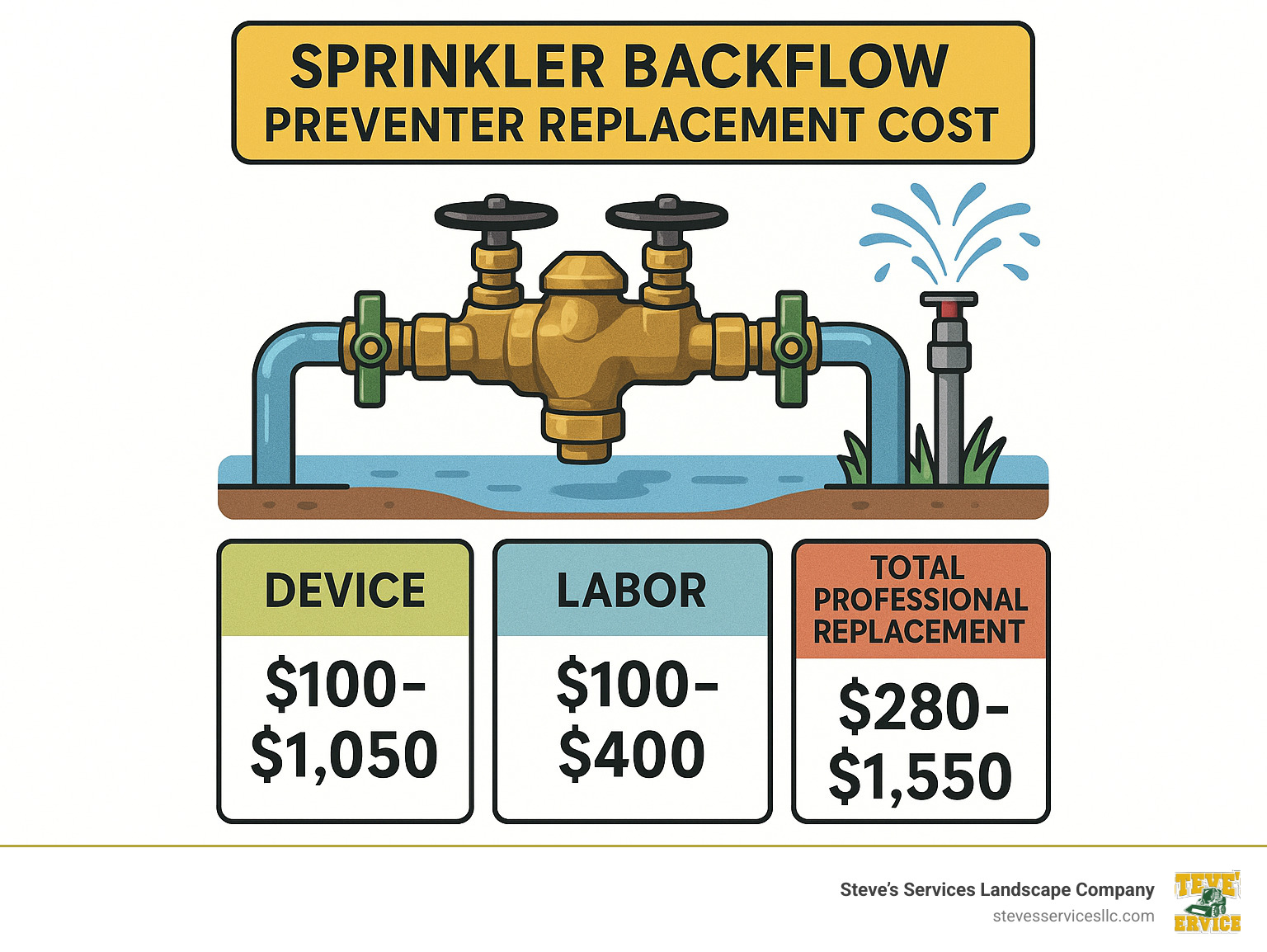

#9 Best 2025 Sprinkler Backflow Preventer Replacement Cost

Domain Est. 2016

Website: stevesservicesllc.com

Key Highlights: You can expect to pay between $150 and $500 for the device itself. A typical 3/4-inch double check backflow preventer might cost around $164….

Expert Sourcing Insights for Cost Of Backflow Valve

2026 Market Trends for Cost of Backflow Valve

The market for backflow valves is poised for notable shifts by 2026, influenced by technological innovation, regulatory changes, and global economic dynamics. These factors are expected to directly impact the cost structure of backflow prevention devices across residential, commercial, and industrial sectors.

Rising Demand Driven by Regulatory Enforcement

Stringent water safety regulations are being adopted worldwide to prevent contamination of potable water supplies. Governments and municipal bodies are increasingly mandating the installation and regular testing of backflow prevention assemblies, particularly in commercial buildings, healthcare facilities, and multi-unit residential complexes. By 2026, this heightened regulatory scrutiny is expected to boost demand, potentially exerting upward pressure on prices—especially for certified, high-performance models. Compliance requirements may also increase installation and maintenance costs, contributing to the total cost of ownership.

Advancements in Materials and Smart Technology

Manufacturers are investing in durable, corrosion-resistant materials such as reinforced polymers and high-grade stainless steel, which improve valve lifespan and performance. Additionally, the integration of smart monitoring technology—such as IoT-enabled sensors that detect backflow events and send real-time alerts—is gaining traction. While these innovations enhance reliability and reduce long-term maintenance, they also add to the upfront cost of advanced backflow valves. By 2026, smart valves are anticipated to command a premium price, particularly in industrial and critical infrastructure applications.

Supply Chain Stabilization and Material Costs

After disruptions caused by global supply chain challenges in the early 2020s, the industry is moving toward stabilization. However, fluctuations in the prices of raw materials—especially brass, bronze, and stainless steel—will continue to influence manufacturing costs. If commodity prices remain volatile in 2025–2026, this could lead to moderate price increases for traditional metallic valves. Conversely, economies of scale in plastic valve production may help keep costs lower for less complex applications.

Regional Market Variations

Regional differences will play a significant role in pricing. Markets in North America and Western Europe, with mature plumbing codes and high compliance rates, are likely to see stable or slightly increasing prices due to demand for high-end, certified products. In contrast, emerging markets in Asia-Pacific and Latin America may experience faster growth in lower-cost valve segments, fostering competition and potentially moderating average prices through local manufacturing.

Conclusion

By 2026, the cost of backflow valves is expected to reflect a balance between rising compliance demands and technological advancements on one side, and supply chain efficiency and regional competition on the other. While premium and smart valves may see price increases, cost-effective options will remain available, particularly in developing regions. Overall, the market trend points toward a segmentation in pricing, with value shifting toward performance, reliability, and long-term compliance assurance.

Common Pitfalls Sourcing Cost of Backflow Valve (Quality, IP)

When sourcing backflow valves, focusing solely on initial cost can lead to significant long-term issues, particularly concerning quality and Ingress Protection (IP) ratings. Overlooking these factors may result in system failures, safety hazards, and increased maintenance expenses. Below are common pitfalls to avoid:

Prioritizing Low Cost Over Material Quality

Choosing the cheapest backflow valve often means compromising on material integrity. Low-cost valves may use inferior brass, plastic, or substandard seals that degrade quickly when exposed to water contaminants or fluctuating pressures. This can lead to premature failure, leaks, or an inability to properly prevent backflow—potentially violating plumbing codes and endangering potable water supplies.

Ignoring Ingress Protection (IP) Ratings

Backflow valves used in outdoor or harsh environments require appropriate IP ratings to resist dust and moisture ingress. Sourcing valves without verifying the IP rating (e.g., IP65 or higher for outdoor installations) risks internal component damage from water or debris. This is especially critical for valves in irrigation systems or industrial settings where exposure is unavoidable.

Assuming All Certifications Are Equal

Not all backflow valves carry the same level of certification. Some may claim compliance without third-party validation. Always verify certifications such as WRAS (UK), NSF/ANSI 61 (USA), or local plumbing standards. Sourcing non-certified or counterfeit valves to save costs undermines safety and may result in failed inspections or liability issues.

Overlooking Installation and Maintenance Requirements

Cheaper valves may lack design features that simplify installation or servicing. Valves with poor access to test ports or complex disassembly increase labor costs and downtime. Factor in lifecycle costs—including maintenance and potential replacements—rather than just the upfront price.

Failing to Match Valve Type to Application

Different applications (e.g., residential, commercial, fire suppression) demand specific valve types and performance standards. Using a low-cost, general-purpose valve in a high-risk setting can compromise system integrity. Ensure the valve’s design, pressure rating, and IP classification align with the intended use.

By addressing these pitfalls, buyers can make informed decisions that balance cost with quality and protection, ensuring reliable backflow prevention and compliance with safety standards.

Logistics & Compliance Guide for Cost of Backflow Valve

Understanding the logistics and compliance aspects related to backflow valves is essential for accurate cost estimation, procurement, installation, and long-term maintenance. These factors directly influence the total cost of ownership and regulatory adherence.

Procurement and Supply Chain Considerations

Sourcing backflow valves involves evaluating suppliers based on product availability, delivery timelines, and geographic logistics. Lead times can vary significantly depending on valve type (e.g., reduced pressure principle, double check), material (brass, stainless steel), and certification standards. Importing valves may incur tariffs, customs duties, and shipping costs, particularly for specialized or internationally certified models. To minimize delays and additional expenses, procurement should align with local inventory availability and use distributors authorized by manufacturers.

Regulatory and Code Compliance

Backflow prevention devices are strictly regulated to protect public water supplies. Costs are influenced by compliance with local, state, and national codes such as the Uniform Plumbing Code (UPC), International Plumbing Code (IPC), and standards set by the American Society of Sanitary Engineering (ASSE) and Foundation for Cross-Connection Control and Hydraulic Research (FCCCHR). Devices must be certified (e.g., ASSE 1013, 1014, 1047) and approved by local water authorities. Non-compliant installations can result in fines, rework, and service disconnection—adding unforeseen costs.

Installation and Permitting Requirements

Installation must be performed by licensed plumbers or certified backflow testers, contributing to labor costs. Most jurisdictions require permits and post-installation inspections. Some areas mandate annual testing and certification by accredited professionals, which should be factored into ongoing operational expenses. Failure to meet inspection standards may lead to penalties or reinstallation fees.

Transportation and Handling

Backflow valves vary in size and weight, affecting shipping and handling. Larger assemblies (e.g., 6-inch RPZ valves) may require special freight services, lift equipment, and additional labor, increasing logistical costs. Proper packaging and handling are critical to prevent damage during transit, especially for valves with sensitive internal components.

Documentation and Record-Keeping

Compliance requires meticulous documentation, including product data sheets, certification reports, test records, and maintenance logs. Digital tracking systems may be necessary to manage recurring testing schedules and regulatory reporting. Inadequate record-keeping can lead to compliance violations and increased administrative costs.

Environmental and Disposal Regulations

At end-of-life, backflow valves—especially those containing lead or hazardous materials—must be disposed of in accordance with environmental regulations (e.g., EPA guidelines, local waste codes). Recycling or safe disposal adds minor but necessary costs to the lifecycle budget.

By addressing these logistics and compliance factors early in the planning process, stakeholders can achieve accurate cost projections, avoid regulatory penalties, and ensure the long-term effectiveness of backflow prevention systems.

Conclusion: Sourcing Cost of Backflow Valve

In conclusion, the sourcing cost of a backflow valve is influenced by several key factors including material quality, valve type, compliance with industry standards, supplier location, order volume, and lead times. While initial procurement costs may vary significantly between suppliers and regions, it is essential to consider the total cost of ownership—encompassing installation, maintenance, durability, and potential risks associated with valve failure. Sourcing from reputable suppliers who adhere to regulatory standards (such as ASSE, WRAS, or local plumbing codes) ensures reliability and long-term savings by minimizing leaks, contamination risks, and costly repairs.

Additionally, bulk purchasing, strategic supplier negotiations, and exploring alternative materials or certified aftermarket options can lead to substantial cost reductions without compromising performance. Ultimately, a balanced approach that weighs upfront costs against quality and compliance will result in the most cost-effective and reliable sourcing strategy for backflow valves.