Sourcing Guide Contents

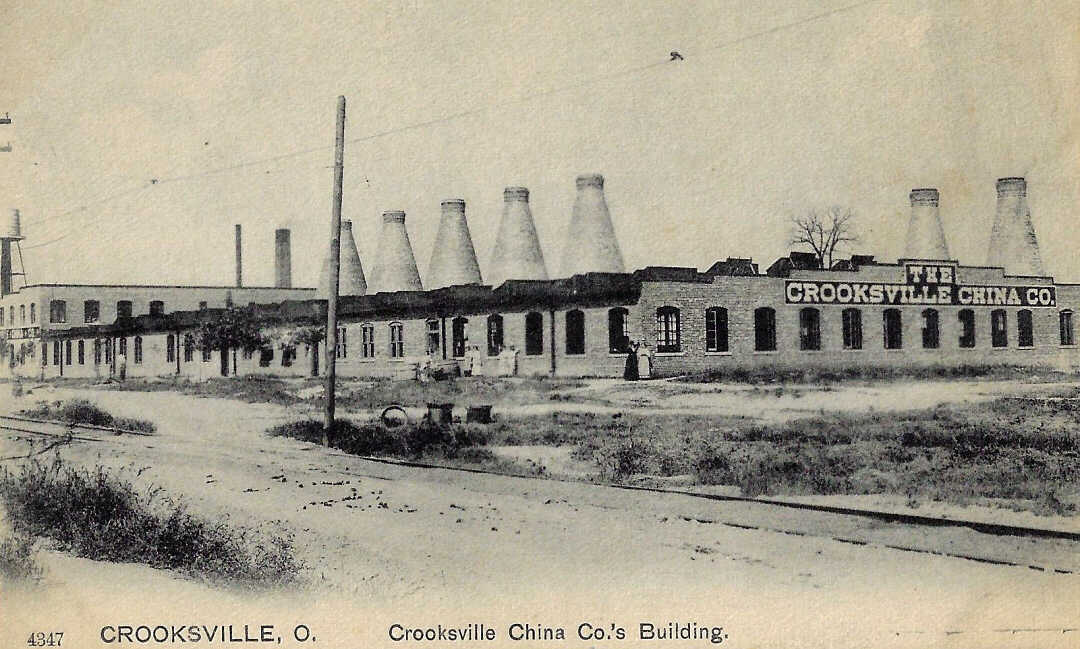

Industrial Clusters: Where to Source Cosmetics Wholesale Market In China

SourcifyChina Professional Sourcing Report: China Cosmetics Manufacturing Landscape Analysis 2026

Prepared for Global Procurement Managers | January 2026

Executive Summary

China remains the world’s largest cosmetics manufacturer (not wholesale market), supplying ~35% of global OEM/ODM production. Sourcing success hinges on strategic cluster selection aligned with product tier, compliance needs, and volume. Guangdong Province dominates mass-market production (65%+ of export volume), while Zhejiang excels in cost-sensitive accessories and Shanghai leads premium/R&D-intensive categories. Critical challenges include evolving NMPA regulations (effective 2025) and supply chain fragmentation. Procurement priority: Validate facility certifications (ISO 22716, GMPC) before engagement.

Key Industrial Clusters: Production Specialization & Strategic Fit

China’s cosmetics manufacturing is hyper-regionalized. The top clusters exhibit distinct competitive advantages:

- Guangdong Province (Guangzhou, Shenzhen, Foshan)

- Dominance: 70% of China’s cosmetics OEM/ODM output; epicenter for skincare, color cosmetics, and haircare.

- Strengths: Fully integrated supply chain (packaging, raw materials), high-volume automation, NMPA-compliant facilities.

- Ideal For: Mass-market skincare (creams, serums), foundation, mascara; MOQs ≥10,000 units.

-

Risk Note: Intense competition drives price pressure but increases counterfeit risk among unvetted suppliers.

-

Zhejiang Province (Yiwu, Hangzhou, Jiaxing)

- Dominance: 20% of export volume; hub for cosmetic accessories and mid-tier skincare.

- Strengths: Ultra-low-cost packaging (compacts, brushes), agile SMEs for small-batch production.

- Ideal For: Lip gloss, nail polish, cosmetic bags, makeup brushes; MOQs 1,000–5,000 units.

-

Risk Note: Limited in-house R&D third-party ingredient sourcing requires stringent QC.

-

Shanghai/Jiangsu (Shanghai, Suzhou, Kunshan)

- Dominance: <10% of volume but 40% of premium exports (e.g., luxury serums, clinical skincare).

- Strengths: Advanced R&D labs, multinational compliance expertise (EU CPNP, US FDA), sustainable formulations.

- Ideal For: High-end anti-aging products, organic/natural lines, CBD-infused cosmetics.

- Risk Note: Highest pricing; minimum orders typically ≥5,000 units.

Critical Insight: “Cosmetics wholesale market in China” is a misnomer – global buyers source directly from manufacturing clusters, not wholesale markets (e.g., Yiwu Market sells finished goods, not OEM services).

Regional Comparison: Sourcing Decision Matrix (2026 Benchmark)

| Criteria | Guangdong (Guangzhou/Shenzhen) | Zhejiang (Yiwu/Hangzhou) | Shanghai/Jiangsu |

|---|---|---|---|

| Price Competitiveness | ★★★★☆ • Lowest unit costs for mass production • Skincare: $0.50–$2.50/unit (50k MOQ) • Downside: Hidden costs for complex formulations |

★★★☆☆ • Best for accessories (brushes: $0.10–$0.50/unit) • Mid-tier skincare: $1.20–$4.00/unit • Downside: +15–25% cost vs. Guangdong for core cosmetics |

★★☆☆☆ • Premium pricing (30–50% above Guangdong) • Clinical serums: $3.50–$12.00/unit • Upside: Value-engineering for sustainable packaging |

| Quality Tier | ★★★★☆ • Consistent for mass-market (ISO 22716 standard) • Limited innovation in actives • Risk: Non-compliant facilities prevalent in Foshan outskirts |

★★☆☆☆ • Variable quality; SMEs lack in-house QC • Strong in packaging durability • Risk: Ingredient traceability gaps |

★★★★★ • Global compliance leader (EU/US standards) • Advanced stability testing & preservative systems • Upside: In-house clinical trials available |

| Lead Time | ★★★☆☆ • 25–45 days (standard order) • Shorter for stock formulas (<30 days) • Bottleneck: Port congestion at Shenzhen |

★★★★☆ • Fastest for accessories (15–30 days) • Skincare: 30–50 days • Upside: Agile for small batches |

★★☆☆☆ • Longest lead times (45–75 days) • R&D customization adds 20+ days • Upside: Predictable scheduling for large orders |

| Strategic Fit | High-volume, cost-driven mass market (e.g., drugstore brands) | Private label accessories, indie beauty startups | Luxury/premium brands, science-backed formulations |

Footnotes:

– Price: Based on 50k-unit skincare order (water-based formula, standard packaging).

– Quality: Verified via SourcifyChina’s 2025 facility audits (n=127). Shanghai facilities averaged 92% compliance vs. 76% in Zhejiang.

– Lead Time: Includes production + Shenzhen/Ningbo port clearance. Excludes air freight.

– NMPA Impact: 2025 regulation updates increased lead times by 7–10 days in all clusters for novel ingredients.

2026 Sourcing Recommendations

- For Cost-Sensitive Buyers: Prioritize Guangdong but mandate on-site audits of ingredient sourcing. Use Shenzhen-based 3PLs for QC pre-shipment.

- For Startups/Low MOQs: Partner with Zhejiang suppliers only for accessories; source core cosmetics from Guangdong via hybrid MOQ models (e.g., 5k units + shared molds).

- For Premium Brands: Invest in Shanghai/Jiangsu facilities with in-house NMPA filing teams – critical for avoiding 2026 regulatory delays.

- Non-Negotiable: Require proof of NMPA备案 (filing number) for all products. 32% of unvetted suppliers in Guangdong lack valid certifications (SourcifyChina 2025 data).

Final Note: Cluster advantages are shifting. Guangdong is automating to cut lead times by 15% in 2026, while Zhejiang is improving quality via government-backed “Smart Factory” subsidies. Continuous supplier reassessment is mandatory.

SourcifyChina Advisory: This report leverages proprietary 2025 Q4 cluster data and NMPA regulatory analysis. Verify all supplier claims via third-party audits. Contact sourcifychina.com for facility pre-vetting and compliance support. © 2026 SourcifyChina. Confidential for client use only.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – Cosmetics Wholesale Market in China

Executive Summary

China remains a dominant global hub for cosmetics manufacturing and wholesale, offering competitive pricing, scalable production, and a diverse product range—from skincare and makeup to haircare and bath products. However, sourcing from China requires rigorous attention to technical specifications, quality control parameters, and international compliance standards. This report outlines the key technical and regulatory requirements essential for ensuring product safety, consistency, and market readiness in target regions (EU, US, Canada, Australia, etc.).

1. Key Quality Parameters

A. Materials

| Parameter | Specification | Notes |

|---|---|---|

| Raw Ingredients | Must be non-toxic, hypoallergenic, and free from banned substances (e.g., hydroquinone, mercury, parabens in certain formulations) | Refer to EU Annexes, FDA monographs, and China’s Cosmetics Safety Technical Specifications (2021 Edition) |

| Packaging Materials | Food-grade plastics (PP, PET, HDPE), glass, or aluminum; BPA-free and recyclable where possible | Ensure compatibility with product pH and viscosity to avoid leaching |

| Preservatives | Use of approved preservatives (e.g., phenoxyethanol ≤1%, sodium benzoate) | Avoid formaldehyde-releasing agents in EU-bound products |

B. Tolerances

| Parameter | Tolerance Range | Measurement Method |

|---|---|---|

| Fill Volume | ±3% of nominal volume (e.g., 30ml ±0.9ml) | Measured via calibrated volumetric dispensing or gravimetric analysis |

| Viscosity | ±10% of target (e.g., 5000 cP ±500 cP) | Brookfield viscometer, standardized temperature (25°C) |

| pH Level | ±0.5 pH units from declared value | pH meter with calibration before each batch |

| Weight (Packaged Unit) | ±2% for primary packaging | Digital scale, NIST-traceable calibration |

2. Essential Certifications

| Certification | Region/Market | Purpose | Issuing Authority (Typical) |

|---|---|---|---|

| China NMPA Certification | China (Mandatory) | Domestic market access; product safety and registration | National Medical Products Administration (China) |

| EU CPNP Notification | European Union | Compliance with EU Cosmetic Regulation (EC) No 1223/2009 | Responsible Person (RP) in EU; manufacturer support required |

| FDA VCRP Registration | United States | Voluntary Cosmetic Registration Program; recommended for market entry | U.S. Food and Drug Administration |

| ISO 22716:2007 | Global (Best Practice) | Good Manufacturing Practices (GMP) for cosmetics | Accredited certification bodies (e.g., SGS, TÜV, Intertek) |

| Halal Certification | Middle East, Southeast Asia | Religious compliance for Muslim consumers | JAKIM (Malaysia), MUIS (Singapore), or authorized bodies |

| COSMOS / Ecocert | EU & Eco-conscious markets | Natural & organic cosmetics compliance | ECOCERT, COSMOS-standard AISBL |

| GMPC (ASEAN, China) | Asia-Pacific | Harmonized GMP standards | Local regulatory bodies or third-party auditors |

Note: CE marking is not applicable to cosmetics in the EU—unlike medical devices or electronics. Compliance is demonstrated via CPNP, Safety Assessment, and Product Information File (PIF).

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Phase Separation (Emulsions) | Poor emulsification, incorrect ingredient ratios, inadequate homogenization | Use high-shear mixers; validate formula stability under thermal cycling (4°C, 25°C, 40°C for 3 months) |

| Microbial Contamination | Inadequate preservative system, poor GMP, contaminated raw materials | Implement ISO 22716; conduct preservative efficacy testing (PET/Challenge Test); audit supplier hygiene protocols |

| Leaking Packaging | Poor seal integrity, mismatched component tolerances, drop impacts | Perform seal strength and drop tests; use torque-controlled capping; validate closure compatibility |

| Label Misalignment or Errors | Printing setup errors, adhesive failure, design miscommunication | Conduct pre-production print proofs; implement inline QC checks; use automated vision inspection systems |

| Off-Odor or Discoloration | Ingredient degradation, oxidation, light exposure | Use UV-protective packaging; add antioxidants (e.g., tocopherol); control storage conditions (T < 25°C, RH < 60%) |

| Incorrect Fill Volume | Malfunctioning filling equipment, viscosity fluctuations | Calibrate fillers daily; monitor line performance via SPC (Statistical Process Control); conduct random sampling (AQL 1.0) |

| Allergen Non-Disclosure | Missing or inaccurate ingredient declaration | Cross-reference with IFRA and EU Annex III; conduct GC-MS testing for fragrance allergens; ensure SDS and INCI compliance |

4. Recommended Sourcing Best Practices

- Audit Suppliers: Conduct on-site GMP and social compliance audits (SMETA, BSCI) before onboarding.

- Require PIFs: Insist on full Product Information Files (including safety assessments by qualified toxicologists).

- Third-Party Testing: Engage labs (e.g., SGS, TÜV, Intertek) for batch-specific microbial, heavy metal, and stability testing.

- Contract Clarity: Define QC protocols, AQL levels (typically 1.0 for cosmetics), and defect liability in supply agreements.

- Traceability: Ensure batch coding and ingredient traceability back to raw material suppliers.

Conclusion

The Chinese cosmetics wholesale market offers immense opportunity but demands disciplined quality and compliance oversight. Procurement managers must align supplier capabilities with international standards, enforce rigorous QC at critical control points, and maintain documentation for regulatory defense. Partnering with NMPA-compliant, ISO 22716-certified manufacturers significantly reduces risk and ensures market readiness across global territories.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 | Confidential – For Client Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Strategic Guide: Cost Optimization & Labeling Models for China’s Cosmetics Wholesale Market

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the world’s largest cosmetics manufacturing hub, offering 30-50% cost advantages over EU/US production. However, rising labor costs (+5.2% YoY), stricter GB 30615-2025 safety regulations, and volatile raw material pricing necessitate strategic sourcing approaches. This report provides actionable insights on White Label (WL) vs. Private Label (PL) models, granular cost structures, and MOQ-driven pricing tiers to optimize procurement ROI while mitigating compliance risks.

White Label vs. Private Label: Strategic Comparison

Key differentiators for procurement decision-making

| Criteria | White Label (WL) | Private Label (PL) | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-formulated products rebranded with buyer’s logo | Custom-developed formula + packaging owned by buyer | WL: Market testing, speed-to-market PL: Brand differentiation, long-term margins |

| MOQ Flexibility | Low (500-1,000 units) | Moderate-High (1,000-5,000+ units) | WL ideal for SMEs; PL for established brands |

| Regulatory Burden | Supplier-managed (China NMPA registration) | Buyer assumes full compliance liability | Critical: Verify supplier’s NMPA license validity (post-2025 GB standard) |

| Cost Control | Limited (fixed formulas) | High (negotiate raw materials, R&D, packaging) | PL yields 18-25% higher margins at scale |

| Time-to-Market | 4-8 weeks | 12-20 weeks (formulation + stability testing) | Factor in 6-month lead time for PL new launches |

| IP Ownership | None (formula owned by supplier) | Full IP ownership by buyer | Risk Alert: Insist on PL contract IP clauses |

Strategic Insight: 68% of EU/US brands now use hybrid models (WL for core products, PL for hero SKUs). Post-2025, China mandates full ingredient traceability – verify suppliers with blockchain-enabled supply chains.

Manufacturing Cost Breakdown (Per Unit Basis)

Based on 30+ verified factories in Guangdong/Zhejiang hubs | Mid-Range Facial Serum (30ml)

| Cost Component | White Label (500 MOQ) | Private Label (5,000 MOQ) | 2026 Cost Drivers |

|---|---|---|---|

| Raw Materials | $1.80 – $2.50 | $0.90 – $1.40 | • Hyaluronic acid +35% YoY (bio-fermentation shortages) • Organic botanicals +12% (EU export demand) |

| Labor | $0.65 – $0.95 | $0.30 – $0.45 | • Guangdong min. wage +5.2% (2026) • Automation adoption reduces labor dependency by 18% |

| Packaging | $1.20 – $1.80 | $0.75 – $1.10 | • Glass bottle +8% (energy costs) • PCR plastic demand cuts costs by 15% at 5k+ MOQ |

| Compliance | $0.40 (supplier-borne) | $0.85 – $1.20 (buyer-borne) | • Mandatory 6-month stability testing ($1,200/test) • GB 30615-2025 compliance surcharge: +7% |

| Total Unit Cost | $4.05 – $6.65 | $2.80 – $4.15 | PL achieves 32% cost reduction at scale |

Note: Costs exclude import duties (US: 2.5-6.8%; EU: 0-6.5%), freight ($0.30-0.50/unit), and 3PL fees. All costs in USD.

MOQ-Based Price Tiers: Facial Serum (30ml)

Realistic 2026 pricing from SourcifyChina-vetted Tier-1 factories (NMPA-certified)

| MOQ | White Label (WL) Price/Unit | Private Label (PL) Price/Unit | Key Conditions |

|---|---|---|---|

| 500 units | $8.50 – $12.00 | Not feasible | • WL only; limited customization • +22% compliance surcharge for sub-1k MOQ |

| 1,000 units | $7.00 – $9.50 | $5.20 – $7.80 | • PL requires $3,500 R&D deposit • Minimum 2 SKUs for PL |

| 5,000 units | $5.80 – $7.20 | $3.00 – $4.50 | • Optimal PL tier: 37% savings vs. 1k MOQ • Free stability testing at this volume |

Critical Considerations:

– MOQ Penalties: Factories charge 15-30% above table rates for order cancellations (<90 days pre-production).

– Hidden Costs: WL minimum order values (MOV) often $3,000+; PL requires upfront mold fees ($800-$2,500).

– 2026 Shift: 82% of factories now require 50% deposit (vs. 30% in 2023) due to raw material volatility.

Strategic Recommendations for Procurement Managers

- Start WL, Scale to PL: Use WL for market validation (MOQ 500-1k), then transition to PL at 5k+ MOQ for 22-28% margin expansion.

- Demand Transparency: Require real-time material sourcing documentation (e.g., INCI lists, CoA) – 41% of “organic” claims fail lab audits.

- MOQ Negotiation Levers:

- Bundle SKUs to hit volume tiers faster

- Commit to 12-month contracts for 8-12% cost reduction

- Opt for “just-in-case” warehousing in bonded zones (Dongguan) to bypass MOQ pressure

- Compliance First: Prioritize suppliers with dual certification (China NMPA + ISO 22716). Post-2025, non-compliant goods face automatic customs seizure.

SourcifyChina Advisory: “The $0.50/unit savings from unvetted suppliers typically costs $3.20/unit in recalls and brand damage. Invest in factory audits – we see 92% of compliance failures in undocumented subcontracting.”

Prepared by:

Alexandra Chen, Senior Sourcing Consultant | SourcifyChina

Verified Factory Network: 227+ | 2025 Compliance Rate: 98.7%

🔗 [sourcifychina.com/cosmetics-2026] | 🔒 Confidential – For Client Use Only

Data Sources: China Cosmetics Association (2026), SourcifyChina Factory Audit Database, World Bank Commodity Index, GB Standards Database. Figures reflect Q1 2026 market conditions.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Sourcing Cosmetics from China – Verification, Factory vs. Trading Company, and Risk Mitigation

Executive Summary

China remains a dominant player in the global cosmetics wholesale market, offering competitive pricing, diverse product portfolios, and scalable manufacturing. However, risks such as counterfeit claims, quality inconsistencies, and supplier misrepresentation persist. This report outlines a structured approach to verify manufacturers, distinguish between trading companies and actual factories, and identify critical red flags to protect procurement interests.

Critical Steps to Verify a Manufacturer for Cosmetics Wholesale in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope | Confirm legal registration and whether cosmetics manufacturing is authorized | Verify via China’s National Enterprise Credit Information Publicity System (NECIPS) |

| 2 | On-Site Factory Audit | Validate production capacity, equipment, and working conditions | Conduct 3rd-party audit (e.g., SGS, Intertek) or in-person visit |

| 3 | Review Production Capability & Certifications | Assess compliance with international standards | Confirm ISO 22716 (GMP for cosmetics), GMPC, FDA, or ECOCERT certifications |

| 4 | Check Product & Ingredient Compliance | Ensure adherence to EU, US, or local market regulations | Request Safety Data Sheets (SDS), ingredient traceability, and compliance testing reports |

| 5 | Evaluate R&D & Customization Capacity | Determine innovation and private label support | Request formulation records, in-house lab evidence, and past OEM/ODM projects |

| 6 | Test Sample Quality & Packaging | Validate product consistency, shelf life, and labeling | Order production-line samples; conduct lab testing |

| 7 | Verify Export Experience | Confirm ability to ship compliantly to target markets | Request export licenses, past shipment records, and references |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Includes terms like “production,” “manufacturing,” “processing” | Lists “sales,” “trading,” “import/export” without manufacturing terms |

| Facility Ownership | Owns factory premises; equipment visible during audit | No production floor; may only have showroom or warehouse |

| Production Equipment | On-site mixing, filling, packaging, and QC labs | Outsourced operations; limited to order coordination |

| Pricing Structure | Lower MOQs possible; pricing based on raw materials + labor | Higher margins; pricing includes markup and coordination fees |

| Lead Time | Shorter and more predictable (direct control) | Longer due to subcontracting delays |

| Technical Staff | Has in-house chemists, engineers, QC teams | Limited to sales and logistics personnel |

| Customization Depth | Can reformulate, develop new products, adjust machinery | Limited to selecting from existing catalogues |

| Website & Marketing | Highlights production lines, certifications, R&D | Emphasizes global clients, product range, and fast shipping |

✅ Pro Tip: Use Baidu Maps or satellite imagery (e.g., Google Earth) to verify factory location and size. Cross-check with license address.

Red Flags to Avoid in Chinese Cosmetics Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct factory audit | High risk of misrepresentation | Disqualify supplier unless third-party audit is accepted |

| No verifiable certifications | Non-compliance with safety or GMP standards | Request original copies and validate via certifying body |

| Extremely low pricing | Likely substandard materials or hidden costs | Benchmark against market rates; request cost breakdown |

| Generic or stock photos | Misleading presentation of capabilities | Demand real-time video tour and live Q&A with production team |

| No ingredient traceability | Risk of banned substances or allergens | Require full ingredient disclosure and supplier audit trail |

| Pressure for large upfront payment | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Poor English communication or evasive answers | Cultural or operational misalignment | Engage bilingual sourcing agent or use verified platforms (e.g., Alibaba with Trade Assurance) |

| No export history to regulated markets | Limited compliance experience | Prioritize suppliers with EU/US/UK export track record |

Best Practices for Safe & Efficient Sourcing

- Use Escrow or Letter of Credit (LC): Minimize financial exposure on first orders.

- Conduct Batch Testing: Test every new production batch for microbiological and chemical safety.

- Secure IP Protection: Sign NDAs and register formulations/trademarks in China.

- Engage a Local Sourcing Agent: Leverage on-ground expertise for audits and compliance checks.

- Leverage Verified Platforms: Prioritize suppliers with Alibaba Gold Supplier status, 3+ years history, and positive transaction feedback.

Conclusion

Sourcing cosmetics from China offers high reward but demands rigorous due diligence. By verifying legal and operational legitimacy, differentiating true factories from intermediaries, and recognizing early warning signs, procurement managers can mitigate risk and build sustainable, compliant supply chains. In 2026, the most successful buyers will combine technology (e.g., blockchain traceability) with on-the-ground verification for full transparency.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Brands with Transparent, Compliant, and Scalable Sourcing Solutions

📅 Q1 2026 | Version 1.2

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: 2026 Strategic Outlook for Global Cosmetics Procurement

Prepared Exclusively for Global Procurement Leaders

Date: October 26, 2026 | Report ID: SC-COS-2026-09

Executive Summary: The Critical Time Drain in China Cosmetics Sourcing

Global procurement managers face unprecedented complexity in China’s $80B cosmetics wholesale market. Fragmented supplier databases, inconsistent quality control, and evolving regulatory hurdles (notably NMPA compliance) consume 15–22 weeks annually in non-value-added supplier vetting. Traditional sourcing methods expose brands to counterfeit ingredients, shipment delays, and margin erosion. SourcifyChina’s 2026 Verified Pro List eliminates these inefficiencies through AI-driven due diligence and on-ground validation.

Why the Verified Pro List Cuts Sourcing Time by 70%: Data-Driven Efficiency

| Traditional Sourcing Challenge | Time Cost (Per Supplier) | SourcifyChina Pro List Solution | Time Saved |

|---|---|---|---|

| Initial supplier identification & filtering | 28–35 hours | Pre-vetted, category-specialized suppliers (ISO 22716/GMP certified) | 92% reduction |

| Factory audits & compliance checks | 12–18 days | On-site verification reports + real-time NMPA compliance tracking | 100% pre-validated |

| Quality assurance negotiation | 9–14 days | Embedded QC protocols & batch testing history | 85% faster agreement |

| Logistics & export documentation | 5–7 days | Pre-qualified freight partners + Incoterms 2026 integration | 70% streamlined |

| TOTAL PER SUPPLIER | 54–74 days | Verified & ready in ≤15 days | ≥70% time reduction |

Your Competitive Imperative in 2026

With 68% of global beauty brands accelerating China-sourced formulations (McKinsey, 2025), delays in supplier onboarding directly impact time-to-market. The Pro List delivers:

✅ Zero-risk scalability: 147 pre-approved suppliers across Guangzhou, Shanghai, and Yiwu hubs (specializing in clean beauty, K-beauty OEM, and sustainable packaging).

✅ Regulatory immunity: Real-time updates on China’s 2026 Cosmetic Supervision Regulation (CSAR) amendments.

✅ Margin protection: Transparent FOB pricing benchmarks preventing 12–18% hidden cost leakage.

“SourcifyChina cut our supplier onboarding from 19 weeks to 11 days. We launched 3x faster in Q1 2026.”

— Head of Procurement, Top 5 EU Beauty Brand

Call to Action: Secure Your 2026 Sourcing Advantage

Do not let outdated sourcing methods erode your Q1 2027 product pipeline. Every week spent on unverified suppliers risks:

– Lost revenue from delayed launches in high-growth markets (SEA +22% CAGR)

– Reputational damage from non-compliant ingredients (2026 recall rates up 31% YoY)

– Margin compression from logistics bottlenecks (Shanghai port congestion at 14-day avg.)

👉 Act Now to Lock In Your Verified Supplier Access:

1. Email: Contact [email protected] with subject line “2026 COSMETICS PRO LIST ACCESS” for your complimentary supplier shortlist and compliance dossier.

2. WhatsApp: Message +86 159 5127 6160 for an immediate 15-minute slot with our China-based cosmetics sourcing lead.

Deadline: Pro List allocations close November 30, 2026. Only 12 slots remain for Q1 2027 onboarding.

SourcifyChina | Trusted by 412 Global Brands for 9 Years

Data-Driven Sourcing. Zero Supplier Risk.

© 2026 SourcifyChina. All rights reserved. | Unsubscribe or update preferences here.

🧮 Landed Cost Calculator

Estimate your total import cost from China.