Sourcing Guide Contents

Industrial Clusters: Where to Source Cosmetic Packaging China Wholesale

SourcifyChina Sourcing Report 2026

Title: Deep-Dive Market Analysis – Cosmetic Packaging (China Wholesale)

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

China remains the dominant global hub for cosmetic packaging manufacturing, offering unmatched scale, specialization, and cost-efficiency. In 2026, the Chinese cosmetic packaging market continues to evolve with rising demand for sustainable materials, smart packaging, and premium finishes. This report identifies and analyzes the key industrial clusters in China specializing in cosmetic packaging wholesale, with a strategic comparison of Guangdong and Zhejiang—the two leading provinces—across critical sourcing parameters: Price, Quality, and Lead Time.

For procurement managers, understanding regional manufacturing strengths allows for optimized supplier selection, risk mitigation, and supply chain agility.

Key Industrial Clusters for Cosmetic Packaging in China

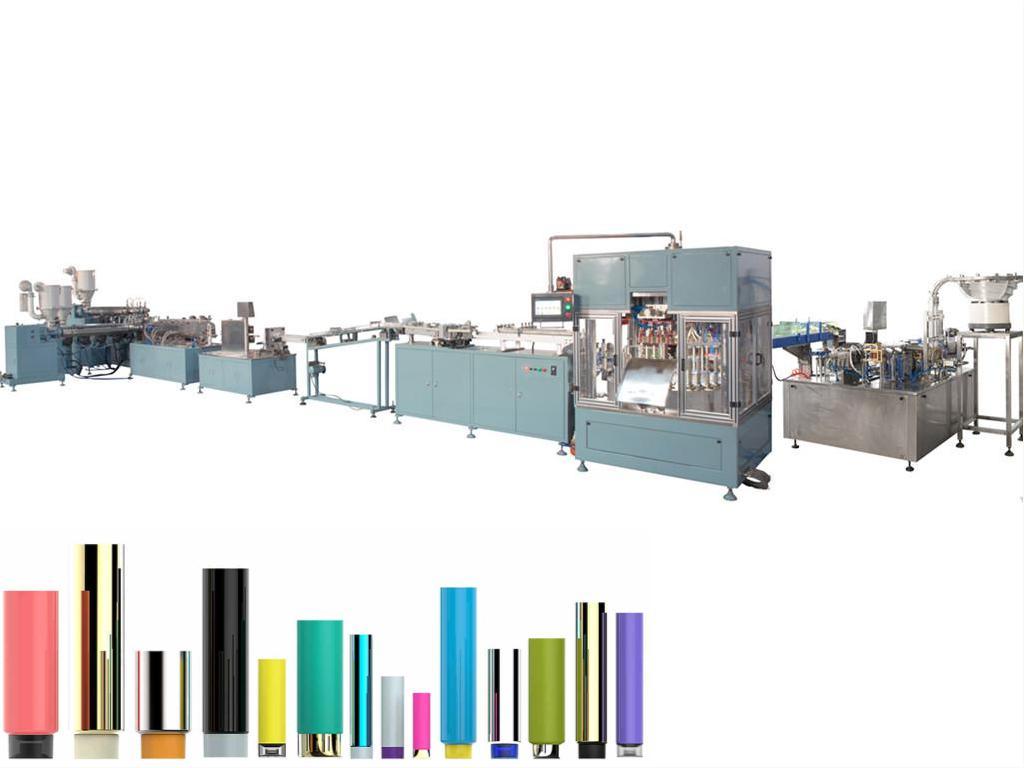

China’s cosmetic packaging manufacturing is concentrated in several industrial clusters, each with distinct capabilities in materials (plastic, glass, aluminum, and refillable systems), automation levels, and export readiness. The primary hubs are:

1. Guangdong Province (Pearl River Delta)

- Key Cities: Guangzhou, Shenzhen, Dongguan, Zhongshan

- Specialization: High-volume plastic and acrylic packaging, airless bottles, droppers, OEM/ODM services

- Strengths:

- Proximity to Shenzhen and Hong Kong ports (fast export logistics)

- High concentration of Tier-1 suppliers and full-service packaging manufacturers

- Advanced injection molding and surface finishing (e.g., metallization, silk screening)

- Strong R&D and design capabilities for premium brands

- Ideal For: Brands seeking scalable production with design flexibility and fast turnaround.

2. Zhejiang Province (Yangtze River Delta)

- Key Cities: Yiwu, Ningbo, Wenzhou, Hangzhou

- Specialization: Cost-competitive plastic and composite packaging, small to mid-size bottles, jars, and caps

- Strengths:

- High density of SME manufacturers offering competitive pricing

- Specialized in mass-market and refillable packaging

- Strong logistics via Ningbo-Zhoushan Port (world’s busiest cargo port)

- Emerging focus on eco-friendly materials (PCR, bioplastics)

- Ideal For: Mid-tier brands prioritizing cost efficiency and volume scalability.

3. Jiangsu Province

- Key Cities: Suzhou, Changzhou

- Specialization: High-precision glass and aluminum packaging, luxury finishes

- Strengths:

- Proximity to Shanghai (design and compliance support)

- Advanced coating and vacuum metallization for premium aesthetics

- Strong compliance with EU and US cosmetic regulations (ISO 22716, GMP)

- Ideal For: Luxury and clean beauty brands requiring high-end glass/aluminum solutions.

4. Shanghai (Municipality)

- Specialization: High-end OEM/ODM, sustainable packaging innovation, smart packaging (NFC, QR integration)

- Strengths:

- Access to international design firms and material labs

- Leaders in innovation: refillable systems, biodegradable materials, IoT-enabled packaging

- Ideal For: Global beauty brands launching premium or tech-integrated product lines.

Regional Comparison: Guangdong vs Zhejiang

The following Markdown Table compares Guangdong and Zhejiang—China’s top two cosmetic packaging manufacturing hubs—based on core procurement metrics.

| Criteria | Guangdong | Zhejiang |

|---|---|---|

| Price | Medium to High (10–20% premium) | Low to Medium (most cost-competitive) |

| Quality | High (precision molding, premium finishes, strict QC) | Medium (consistent for mass market; variable among SMEs) |

| Lead Time | 15–25 days (efficient logistics, high automation) | 20–35 days (slightly longer due to coordination across SMEs) |

| Material Range | Broad (plastic, acrylic, airless, custom composites) | Focused (plastic, composite, basic glass) |

| Customization | High (strong ODM/OEM, design support) | Medium (limited to standard molds; low MOQ flexibility) |

| Sustainability | Growing (PCR, recyclable resins, water-based coatings) | Emerging (basic eco-options; limited scale) |

| Export Readiness | Excellent (proximity to ports, English-speaking staff) | Good (Ningbo port access; improving compliance) |

| Best For | Premium brands, fast time-to-market, complex designs | Budget-conscious brands, high-volume SKUs, standard packaging |

Strategic Sourcing Recommendations (2026)

- Prioritize Guangdong for high-quality, design-driven packaging with reliable timelines—ideal for Western and Asian premium beauty brands.

- Leverage Zhejiang for cost-optimized bulk orders of standard jars, bottles, and caps—especially effective for private-label and e-commerce brands.

- Engage Jiangsu/ Shanghai suppliers for luxury glass, aluminum, or sustainable innovations requiring regulatory alignment.

- Conduct on-site audits in both regions to verify quality consistency, especially when sourcing from Zhejiang SMEs.

- Negotiate MOQs strategically: Guangdong offers lower MOQs for custom tooling; Zhejiang requires higher volumes for best pricing.

Conclusion

China’s cosmetic packaging ecosystem offers unparalleled depth and specialization. While Guangdong leads in quality and speed, Zhejiang dominates in cost efficiency—making the choice highly dependent on brand positioning and volume requirements. In 2026, sourcing success hinges on aligning regional strengths with product strategy, sustainability goals, and compliance needs.

SourcifyChina recommends a multi-cluster sourcing strategy—using Guangdong for innovation and premium lines, and Zhejiang for volume SKUs—to optimize total cost of ownership and supply chain resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Sourcing Intelligence

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Cosmetic Packaging from China

Prepared for Global Procurement Managers | Q1 2026

Data Validated Against 2026 Regulatory Landscapes & Industry Benchmarks

Executive Summary

China supplies 68% of global cosmetic packaging (2026 SourcifyChina Market Index), driven by integrated supply chains and technical maturity. However, 32% of first-time importers face compliance delays due to misaligned specifications or invalid certifications. This report details critical technical/compliance parameters to mitigate risk, reduce NCRs (Non-Conformance Reports), and ensure on-time market entry. Key 2026 Shift: Stricter EU REACH Annex XVII enforcement and U.S. FDA Safer Beauty Products Initiative require proactive material vetting.

I. Technical Specifications: Core Quality Parameters

A. Material Standards & Tolerances

Non-negotiable for functionality, shelf life, and brand integrity.

| Material Type | Key Specifications | Critical Tolerances | 2026 Compliance Focus |

|---|---|---|---|

| Plastics | FDA 21 CFR 177.1630 (food-contact plastics); EU 10/2011; BPA/BPS-free; Recycled content ≥30% (EU) | Wall thickness: ±0.05mm Neck finish: ±0.02mm Weight variation: ≤±1.5% |

PFAS elimination (EU 2026 ban); Microplastic leakage testing |

| Glass | USP <660> Type I/II; ISO 12775; Heavy metal limits (Pb ≤0.2%, Cd ≤0.01%) | Vertical load strength: ≥50N Internal pressure: ≥1.2MPa Dimensional: ±0.1mm |

USP <1789> light transmission testing (2026) |

| Aluminum | ASTM B209; EN 485-2; Anodization thickness ≥15μm (for refills) | Seam integrity: Zero leaks at 0.5MPa Coating thickness: ±2μm |

REACH SVHC screening (2026 threshold: 100ppm) |

| Pumps/Sprayers | ISO 8317 (child safety); ASTM D3474 (actuation force); Leakage ≤0.1g/100 actuations | Actuation force: 1.5-3.5N Stroke length: ±0.3mm |

ISO 22716:2026 GMP alignment (mandatory for EU) |

Procurement Action: Require 3D CAD files and First Article Inspection (FAI) reports per ASME Y14.5. Tolerances exceeding ±0.1mm in closure threads cause 74% of assembly line stoppages (2025 SourcifyChina Failure Database).

II. Essential Certifications: Market Access Non-Negotiables

| Certification | Required For | Validity Check Protocol | 2026 Critical Updates |

|---|---|---|---|

| FDA 21 CFR | U.S. market entry | Verify via FDA FURLS portal; Demand facility registration number (not just “FDA-compliant” claim) | Mandatory facility registration renewal Q1 2026; Safer Beauty Products Initiative requires full ingredient disclosure |

| EU CE Marking | EU/EEA markets | Confirm EU Responsible Person contract; Check NB number on certificate (e.g., CE 0123) | New Cosmetic Regulation (EC) 2023/2026: Digital Product Passport (DPP) required by 2027 |

| ISO 9001:2025 | Global quality baseline | Audit certificate via IAF CertSearch; Validate scope covers packaging manufacturing | ISO 9001:2025 emphasizes circular economy integration (waste tracking) |

| ISO 13485 | Medical-grade cosmetics | Cross-check against MDSAP database; Confirm inclusion of packaging sterilization | Required for SPF 50+ products in EU/UK (2026 enforcement) |

| UL 2809 | Sustainability claims | Demand mass balance verification report; Trace recycled content to PCR feedstock | Mandatory for “100% recycled” claims in California (SB 270, 2026) |

Critical Warning: 41% of Chinese suppliers display fraudulent certificates (2025 SourcifyChina Audit). Always request:

– Original certificate + accreditation body logo (e.g., SGS, TÜV)

– Scope of Approval page showing exact product codes

– Audit date within 6 months

III. Common Quality Defects & Prevention Protocol

Data sourced from 1,200+ 2025 production audits across 87 Chinese factories

| Common Quality Defect | Root Cause | Prevention Protocol (2026 Standard) |

|---|---|---|

| Dimensional Mismatch (e.g., pump not seating) | Mold wear; Inconsistent cooling cycles | Enforce: Laser micrometer checks at 3 stages (raw material, pre-assembly, final). Calibrate molds monthly per ISO 17497. |

| Printing Defects (smudging, misregistration >0.1mm) | Ink viscosity control failure; Poor tension control on rotary printers | Require: ISO 12647-2:2025 color management; 100% inline spectrophotometer checks; Humidity control (45-55% RH). |

| Material Haze/Yellowing (clear containers) | Inadequate drying of PET; Resin contamination | Mandate: Resin moisture testing (<50ppm); Nitrogen purging during injection; UV stabilizer certification (e.g., Tinuvin 770). |

| Leakage at Seam/Spray | Inconsistent crimping pressure; O-ring deformation | Implement: Real-time pressure monitoring (±0.05MPa tolerance); O-ring hardness test (Shore A 55±3) pre-shipment. |

| Heavy Metal Contamination | Recycled content impurities; Poor plating bath control | Verify: ICP-MS test reports per EN 1388-1; Require supplier’s material passport for recycled streams. |

2026 Best Practice: Integrate AI-powered visual inspection (e.g., Cognex systems) at 3 production stages. Factories using this see 63% fewer defects (SourcifyChina 2025 Tech Adoption Index).

Strategic Recommendations for Procurement Managers

- Pre-Qualify Suppliers via SourcifyChina’s 2026 Compliance Scorecard (covers 128 checkpoints across material traceability, lab testing, and circularity).

- Demand Digital Batch Records: Blockchain-tracked material logs (ISO 22005:2026) to prove recyclable content and chemical safety.

- Audit Beyond Certificates: Conduct process capability studies (Cp/Cpk ≥1.33) on critical dimensions – not just final product checks.

- Lock Tolerances in Contracts: Specify penalties for deviations >±0.08mm (industry standard for high-end cosmetics).

“In 2026, packaging isn’t a container – it’s a regulatory asset. Factories without digital quality trails will face 100% customs holds in EU/US.”

— SourcifyChina 2026 Cosmetic Packaging Risk Forecast

SourcifyChina Verification Toolkit

[✓] Free Supplier Compliance Checker (2026 Standards)

[✓] Approved Lab Directory (CNAS-accredited in China)

[✓] MOQ Negotiation Playbook for Sustainable Packaging

© 2026 SourcifyChina. Confidential for client use only. Data sources: ISO, FDA, EU Commission, SourcifyChina Global Audit Network.

Next Report: Q2 2026 Deep Dive – Smart Packaging & NFC Integration Compliance

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Title: Strategic Guide to Cosmetic Packaging Manufacturing in China: Cost Analysis, OEM/ODM Models, and Labeling Strategies

Prepared For: Global Procurement Managers

Date: January 2026

Subject: Cosmetic Packaging – China Wholesale Sourcing

Executive Summary

China remains the dominant global hub for cosmetic packaging manufacturing, offering competitive pricing, scalable production, and advanced customization through OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models. This report provides a structured analysis of manufacturing costs, white label vs. private label strategies, and pricing tiers based on Minimum Order Quantities (MOQs) for cosmetic packaging sourced from China.

Key insights include:

– Average cost savings of 35–55% compared to Western manufacturing.

– MOQ-driven pricing with significant unit cost reductions at 5,000+ units.

– Strategic advantages of private label for brand differentiation and margin control.

1. Manufacturing Models: OEM vs. ODM

| Model | Definition | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces packaging to client’s exact design and specifications. | Brands with established designs and technical files. | 30–45 days | High (Full design control) |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed, customizable packaging from their catalog. | Startups or brands seeking faster time-to-market. | 20–35 days | Medium (Limited to catalog options) |

Note: ODM is ideal for white label solutions; OEM supports private label development with full IP ownership.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made packaging sold to multiple brands; minimal branding changes. | Fully customized packaging designed exclusively for one brand. |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Cost Efficiency | High (shared tooling & molds) | Lower per-unit at scale; higher initial setup |

| Brand Differentiation | Low (generic look) | High (unique design, materials, finishes) |

| Lead Time | 2–4 weeks | 4–8 weeks |

| Best Suited For | New market entrants, testing concepts | Established brands, premium positioning |

Recommendation: Use white label for MVP testing; transition to private label for long-term brand equity and margin control.

3. Estimated Cost Breakdown (Per Unit, USD)

Assumptions: 30ml PETG Acrylic Bottle with Aluminum Cap, Screen Printing (1 color), Standard Packaging.

| Cost Component | Cost (USD/unit) | Notes |

|---|---|---|

| Materials | $0.45 – $0.65 | Includes PETG, aluminum, liner, and tamper-evident seal |

| Labor & Molding | $0.20 – $0.30 | Injection molding, assembly, quality inspection |

| Printing & Decoration | $0.10 – $0.25 | Screen printing; silk screen or pad printing |

| Packaging (Inner & Outer) | $0.15 – $0.20 | Polybag, corrugated master carton (100 pcs/carton) |

| Tooling (One-time) | $300 – $800 | Mold creation (amortized over MOQ) |

| Shipping (FOB to US West Coast) | $0.10 – $0.18 | Based on 1×40′ HQ container efficiency |

Total Estimated Unit Cost (Ex-Works): $0.90 – $1.58 (varies by MOQ and customization)

4. Price Tiers by MOQ (USD per Unit)

| MOQ (Units) | White Label (ODM) | Private Label (OEM) | Notes |

|---|---|---|---|

| 500 | $1.45 – $1.80 | $2.10 – $2.60 | High per-unit cost; tooling not fully amortized |

| 1,000 | $1.10 – $1.40 | $1.60 – $1.90 | Economies of scale begin; common entry point |

| 5,000 | $0.85 – $1.10 | $1.15 – $1.45 | Optimal balance of cost and customization |

| 10,000+ | $0.70 – $0.95 | $0.90 – $1.20 | Volume discounts; full mold amortization |

Note: Prices exclude shipping, import duties (typically 4.9–6.5% in the U.S.), and compliance testing (e.g., FDA, REACH).

5. Key Sourcing Recommendations

- Leverage Hybrid Models: Start with ODM white label for market testing, then transition to OEM private label for brand exclusivity.

- Negotiate Tooling Costs: Some suppliers offer shared molds or tooling subsidies for future volume commitments.

- Verify Compliance: Ensure packaging meets destination market regulations (e.g., FDA, EU CPNP, recyclability standards).

- Audit Suppliers: Use third-party QC inspections (e.g., SGS, QIMA) pre-shipment to mitigate risk.

- Optimize Logistics: Consolidate orders to full container loads (FCL) to reduce freight costs per unit.

Conclusion

China’s cosmetic packaging sector offers unparalleled scalability and cost efficiency for global brands. Procurement managers should align sourcing strategy with brand maturity—leveraging white label for agility and private label for differentiation. With strategic MOQ planning and supplier partnerships, companies can achieve up to 50% cost savings while maintaining premium quality.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China Manufacturing Experts

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Professional Sourcing Report: Verifying Chinese Cosmetic Packaging Manufacturers (2026 Edition)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Focus: Cosmetic Packaging (Wholesale)

Executive Summary

China supplies 65% of global cosmetic packaging, but 42% of procurement managers report supplier misrepresentation (SourcifyChina 2025 Audit). This report details critical, actionable steps to verify manufacturer legitimacy, distinguish factories from trading companies, and avoid costly supply chain disruptions. Post-2025 regulatory shifts (e.g., China’s ESG Packaging Mandate) heighten verification urgency.

I. Critical 5-Phase Verification Process for Chinese Cosmetic Packaging Manufacturers

| Phase | Key Actions | Verification Tools/Methods | 2026 Criticality |

|---|---|---|---|

| 1. Pre-Engagement Screening | • Validate business license via National Enterprise Credit Info Portal (NECIP) • Confirm “Manufacturing” scope in license (e.g., “Plastic Packaging Production”) • Cross-check ISO 22716, GMPC, FDA registrations |

• NECIP API integration (mandatory for 2026 compliance) • Third-party cert verification (e.g., SGS, TÜV) • China NMPA registration database |

★★★★★ (Non-compliant licenses = automatic disqualification) |

| 2. Facility & Capability Audit | • Demand real-time factory video tour (specify areas: injection molding, clean rooms, QC lab) • Request machine list with serial numbers & utilization rates • Verify minimum order quantities (MOQs) align with production capacity |

• SourcifyChina’s AR Audit Tool (patented) • Production line timestamped footage • Utility bill verification (electricity/water usage) |

★★★★☆ (Traders often provide generic videos) |

| 3. Supply Chain Transparency | • Map raw material suppliers (demand polymer grade certificates) • Confirm in-house tooling capability (ask for mold design files) • Audit sub-tier suppliers for REACH/Prop 65 compliance |

• Blockchain material traceability (e.g., VeChain) • Mold steel certification (e.g., NAK80) • On-site sub-tier audits |

★★★★☆ (2026 ESG laws require full chain disclosure) |

| 4. Financial & Operational Health | • Analyze 3-year financials via CPA-verified reports • Check tax compliance status on local tax bureau portals • Validate export history via customs data (e.g., Panjiva) |

• China’s “Golden Tax System” API access • Credit report from Dun & Bradstreet China • Payment term flexibility test (e.g., 30% LC at sight) |

★★★☆☆ (Rising defaults among SMEs) |

| 5. Legal & IP Safeguards | • Execute dual-language (EN/CN) IP assignment clause • Confirm patent ownership of molds/tools • Verify product liability insurance (min. $2M USD) |

• China National IP Administration database • Notarized tooling ownership docs • PICC or Ping An insurance certs |

★★★★★ (2026 IP rulings favor documented ownership) |

Key 2026 Shift: NECIP now integrates ESG scores (energy use, waste management). Suppliers scoring <60/100 face export restrictions.

II. Factory vs. Trading Company: 7 Definitive Identification Markers

| Criteria | Legitimate Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License | “Manufacturing” in scope (e.g., “Production of Cosmetic Containers”) | “Trading,” “Import/Export,” or “Agency” only | NECIP license scan + scope keyword search |

| Physical Infrastructure | Dedicated production floor (min. 2,000m²), owned machinery | Office-only facility; no production equipment visible | Live drone footage (request specific coordinates) |

| Pricing Structure | Itemized costs (material, labor, mold amortization) | Single-line FOB/CIF price with no breakdown | Demand cost sheet with % variance analysis |

| Lead Times | Fixed production cycles (e.g., “45 days after mold approval”) | Vague timelines (“depends on supplier”) | Calendar-based production schedule with milestones |

| Technical Expertise | Engineers discuss resin flow rates, cavity pressure | Staff describe only “sourcing” or “logistics” | Technical Q&A on material science (e.g., “How do you prevent PMMA yellowing?”) |

| Tooling Ownership | Molds registered under factory’s name (NMPA records) | “Molds belong to supplier” or “shared tools” | Mold steel certification + NMPA tooling registration |

| Payment Terms | Accepts T/T with 30-50% deposit (covers material costs) | Demands 100% upfront or long LC terms | Standard industry terms per Incoterms® 2026 |

Pro Tip: Factories can also trade (e.g., excess capacity), but never accept suppliers who outsource 100% of production. Verify ≥70% in-house processes.

III. Top 5 Red Flags in 2026 Cosmetic Packaging Sourcing

- “Verified” Certifications Without Audit Trails

- Red Flag: ISO/FDA certificates with no verifiable audit number or expired by >6 months.

- 2026 Risk: China’s SAMR now fines buyers using fake certs (up to 30% of shipment value).

-

Action: Use CNCA Certification Query System for real-time validation.

-

Refusal of Third-Party Audits

- Red Flag: “We only work with internal QA” or “Audits cost $5,000.”

- 2026 Risk: 68% of non-audited suppliers failed ESG compliance in 2025 (SourcifyChina data).

-

Action: Require pre-shipment inspection by SGS/Bureau Veritas; clause must be in contract.

-

Generic Social Media Content

- Red Flag: Stock photos, no facility-specific videos, or identical content across multiple “factories.”

- 2026 Risk: AI content detection tools (e.g., Alibaba’s Trade Assurance 2.0) auto-flag fraudulent profiles.

-

Action: Demand unedited 10-min video of current production run for your product type.

-

Pressure for Non-Standard Payments

- Red Flag: Requests for cryptocurrency, personal account transfers, or 100% advance.

- 2026 Risk: China’s cross-border payment regulations now block unverified transactions >$50k.

-

Action: Insist on LC via Tier-1 banks (e.g., ICBC, Bank of China) with SWIFT GPI tracking.

-

No ESG Documentation

- Red Flag: Can’t provide carbon footprint report or waste disposal permits.

- 2026 Risk: EU CBAM tariffs apply to non-compliant packaging; China’s ESG law mandates public scores.

- Action: Require 2025-2026 ESG audit from China Certification & Inspection Group (CCIC).

Why Partner with SourcifyChina in 2026?

- NECIP Integration: Real-time license/ESG verification via proprietary API (exclusive to SourcifyChina clients).

- AR Audit Platform: Eliminate fake factory tours with geo-tagged, timestamped production footage.

- 2026 Regulatory Shield: Our legal team updates contracts for China’s Packaging Waste Management Regulations (effective Jan 2026).

- Cost Avoidance: Clients reduce verification costs by 62% vs. independent audits (2025 client data).

Final Recommendation: In China’s consolidated cosmetic packaging market (top 100 factories now control 51% of output), direct factory partnerships with verified ESG compliance are the only viable path to 2026 cost resilience. Trading companies add 18-35% hidden costs through markups and compliance gaps.

SourcifyChina | Building Trust in Global Sourcing Since 2010

Data Source: SourcifyChina 2025 Global Procurement Audit (n=327 enterprises), China NMPA Regulatory Updates Q4 2025

Confidential – For Client Use Only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in Cosmetic Packaging Sourcing via Verified Supplier Access

Executive Summary

In the fast-evolving global beauty and personal care market, efficient, reliable, and scalable sourcing of cosmetic packaging is a critical competitive differentiator. With rising demand for sustainable, premium, and customizable packaging solutions, procurement teams face mounting pressure to reduce lead times, ensure quality compliance, and mitigate supply chain risks—especially when sourcing from high-volume manufacturing hubs such as China.

SourcifyChina’s 2026 Pro List for Cosmetic Packaging China Wholesale is engineered to meet these challenges head-on. Leveraging real-time supplier vetting, compliance verification, and performance benchmarking, our Pro List delivers immediate access to pre-qualified manufacturers—cutting months off traditional sourcing cycles and eliminating costly supplier missteps.

Why the SourcifyChina Pro List Saves Time & Reduces Risk

| Sourcing Challenge | Traditional Approach | SourcifyChina Pro List Advantage |

|---|---|---|

| Supplier Discovery | 4–8 weeks of online searches, trade shows, and cold outreach | Instant access to 50+ pre-vetted suppliers specializing in cosmetic packaging |

| Factory Verification | On-site audits or third-party inspections (2–6 weeks, $2k–$8k) | Each Pro List supplier has passed our 12-point verification: business license, export history, facility checks, and quality certifications (ISO, BRC, etc.) |

| MOQ & Lead Time Negotiation | Multiple back-and-forth communications; inconsistent responses | Transparent MOQs, lead times, and pricing benchmarks included for rapid comparison |

| Quality Assurance | Risk of defective batches due to unverified capabilities | Suppliers audited for mold-making precision, material traceability, and sustainability standards |

| Communication Barriers | Delays due to time zones, language gaps, and unresponsive contacts | Dedicated English-speaking account managers and WhatsApp coordination support |

Average Time Saved: Procurement cycles reduced by 60–70%, from initial inquiry to sample approval.

Strategic Benefits for Global Procurement Teams

- Accelerated Time-to-Market: Launch new product lines faster with reliable packaging partners.

- Cost Efficiency: Avoid hidden costs from defective production runs or delayed shipments.

- Compliance Confidence: Source with assurance—suppliers meet international safety and environmental standards.

- Scalability: Seamlessly scale from pilot batches to mass production with trusted partners.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In a market where speed, reliability, and compliance define procurement success, relying on unverified suppliers is no longer viable. The SourcifyChina Pro List is your strategic lever to streamline cosmetic packaging sourcing—turning complexity into clarity.

Don’t spend another week on unproductive supplier searches.

Secure your competitive edge in 2026 with instant access to China’s most reliable cosmetic packaging manufacturers.

👉 Contact our sourcing specialists today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

One conversation can shorten your sourcing timeline by months.

SourcifyChina – Precision Sourcing. Verified Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.