The global corn grinding industry is experiencing steady expansion, driven by rising demand for corn-based products in food, animal feed, and industrial applications such as biofuels and starch production. According to Grand View Research, the global corn processing market size was valued at USD 67.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.1% from 2023 to 2030. This growth is fueled by increasing urbanization, shifting dietary preferences, and the expanding use of corn derivatives in processed foods and renewable energy. As the demand for finely milled, high-quality corn flour, meal, and grits continues to rise, manufacturers are investing in advanced grinding technologies to improve efficiency, consistency, and throughput. In this competitive landscape, nine key players have emerged as leaders in innovation, capacity, and global reach—shaping the future of corn grinding across continents.

Top 9 Corn Grinding Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 WinTone Grain Processing Equipment Manufacturer

Domain Est. 2012

Website: wintonemachinery.com

Key Highlights: Professional grain processing machinery manufacturer. We provide design of forefront grain processing machinery, such as maize milling machine, ……

#2 Grain Processing Corporation

Domain Est. 1996

Website: grainprocessing.com

Key Highlights: For over 80 years, our family business has provided great service and superior product quality, while turning the Midwest’s abundance into ingredients….

#3 Corn

Domain Est. 1997

Website: seedburo.com

Key Highlights: 8-day deliveryCorn is the most widely produced feed grain in the United States, accounting for more that 95 percent of total feed grain production and use….

#4 Kenyon’s Grist Mill

Domain Est. 1998

Website: kenyonsgristmill.com

Key Highlights: About Kenyon’s Grist Mill. A grist mill is a grain mill that turns whole berries of grain or whole kernels of corn into meal or flour….

#5 Commercial & Steel Burr Mill Grain Grinder

Domain Est. 1999

#6 North American Millers’ Association

Domain Est. 2000

Website: namamillers.org

Key Highlights: Our 37 members mill wheat, corn, oats, and rye and have locations across 30+ states, Puerto Rico, and Canada. Milling is the process of cleaning, tempering ……

#7 SEMO Milling

Domain Est. 2005

Website: semomilling.com

Key Highlights: SEMO Milling has been committed to providing the highest quality dry corn ingredients to food and beverage companies across the US and throughout the world….

#8 PVSONS

Domain Est. 2007

Website: pvcornmilling.com

Key Highlights: We take utmost care to follow international safety and hygiene standards and hold a BRCGS A+ certification. All our equipment is from one of the leading food ……

#9 Imagine What Corn Can Do!

Website: lifeline-group.com

Key Highlights: The LifeLine Group is we are committed to producing the highest-quality corn ingredients on the market. Let us show you what corn can do….

Expert Sourcing Insights for Corn Grinding

2026 Market Trends for Corn Grinding: Key Drivers and Forecasts

The global corn grinding market is poised for continued evolution in 2026, shaped by shifting consumer demands, technological advancements, and macroeconomic factors. This analysis examines the key trends expected to define the industry landscape in the coming years.

Rising Demand for Plant-Based and Functional Ingredients

The surge in consumer preference for plant-based foods and beverages is a primary driver for corn grinding. Corn gluten meal, corn gluten feed, corn germ meal, and specialty starches derived from grinding are increasingly sought after as high-protein, non-GMO, and allergen-friendly ingredients. In 2026, demand will be amplified by the growing popularity of meat analogs, dairy alternatives, and fortified snacks, where corn-based proteins and fibers play crucial functional roles. Additionally, the focus on clean-label and natural ingredients favors corn derivatives over synthetic additives, further boosting market growth.

Technological Innovation and Process Efficiency

By 2026, advancements in grinding and separation technologies will enhance yield, purity, and sustainability. Precision dry and wet milling techniques, coupled with AI-driven process optimization, will allow producers to extract higher-value components more efficiently. Adoption of smart manufacturing systems will improve real-time monitoring, reduce energy consumption, and minimize waste. Furthermore, innovations in enzymatic processing will enable the production of specialized corn fractions tailored for niche applications in nutraceuticals and bioplastics, expanding the market’s reach beyond traditional food and feed uses.

Sustainability and Circular Economy Pressures

Environmental concerns are reshaping corn grinding operations. Stakeholders in 2026 will prioritize reducing water usage, carbon emissions, and byproduct waste. Companies investing in closed-loop water systems, renewable energy integration, and valorization of co-products (e.g., converting corn fiber into biofuels or biodegradable packaging) will gain competitive advantage. Regulatory pressures and consumer expectations will push the industry toward more transparent and sustainable supply chains, making ESG (Environmental, Social, and Governance) performance a critical differentiator.

Geopolitical and Supply Chain Dynamics

Global trade policies, climate volatility, and agricultural commodity prices will continue to influence corn grinding in 2026. Regions with stable corn production—such as the U.S., Brazil, and Ukraine—will remain key hubs, though supply chain resilience will be paramount. Companies are expected to diversify sourcing strategies and invest in regional processing facilities to mitigate risks from trade disruptions or extreme weather events affecting crop yields. Additionally, rising feedstock costs may drive innovation in alternative corn varieties or hybrid processing models to maintain profitability.

Expansion in Emerging Markets

Developing economies in Asia-Pacific, Africa, and Latin America will see accelerated growth in corn grinding due to urbanization, rising disposable incomes, and expanding food processing industries. In 2026, local demand for affordable animal feed, edible oils, and processed foods will drive investment in small- to medium-scale grinding facilities. Government support for agricultural value addition and food security will further stimulate market development in these regions, creating new opportunities for technology transfer and international partnerships.

In summary, the 2026 corn grinding market will be characterized by innovation, sustainability, and diversification. Success will depend on the industry’s ability to adapt to evolving consumer needs, embrace digital transformation, and operate within increasingly complex global and environmental frameworks.

Common Pitfalls in Sourcing Corn Grinding (Quality, IP)

Sourcing corn grinding services or products involves several critical risks, particularly concerning quality consistency and intellectual property (IP) protection. Failing to address these areas can lead to product defects, legal disputes, and reputational damage. Below are key pitfalls to avoid:

Quality Inconsistency and Contamination

One of the most frequent issues in corn grinding is receiving inconsistent product quality. Variations in particle size, moisture content, or the presence of foreign materials (e.g., stones, metal, or mycotoxins) can significantly affect downstream processing and final product performance. Sourcing from facilities without stringent quality control protocols—such as ISO certifications, routine testing, or HACCP plans—increases the risk of contamination and batch-to-batch variability.

Lack of Traceability and Certification

Corn used in grinding may originate from genetically modified (GM) or non-GM sources, organic or conventional farms. Without proper documentation and traceability systems, buyers risk non-compliance with regulatory requirements or consumer expectations. Failure to verify certifications (e.g., Non-GMO Project Verified, organic, gluten-free) can result in rejected shipments or brand damage, especially in sensitive markets like food, pharmaceuticals, or infant nutrition.

Inadequate Intellectual Property Safeguards

When working with custom grinding specifications—such as proprietary particle size distributions, specialty blends, or value-added formulations—there is a risk of IP exposure. Many suppliers lack robust confidentiality agreements (NDAs) or clear contractual terms defining ownership of formulations, processes, or data. Without these protections, your proprietary methods or product innovations could be replicated or shared with competitors.

Poor Supplier Vetting and Audit Processes

Relying on cost alone when selecting a corn grinding partner often leads to compromised quality and reliability. Suppliers may lack the necessary equipment calibration, maintenance schedules, or trained personnel to meet exacting standards. Skipping on-site audits or third-party assessments increases the likelihood of undetected operational deficiencies that impact output quality and consistency.

Inflexibility in Meeting Custom Specifications

Some grinding facilities operate with standardized processes and limited capacity to accommodate unique customer requirements. This inflexibility can be a major pitfall when specific grind sizes, packaging formats, or sanitary handling (e.g., allergen-free lines) are needed. Without clear communication and alignment during the sourcing phase, unmet specifications can disrupt production timelines and increase costs.

Insufficient Legal Clarity on IP Rights

Ambiguous contracts that fail to specify who owns process improvements, custom tooling, or data generated during grinding operations can lead to disputes. For example, if a supplier develops a more efficient method while processing your corn, unclear IP clauses may allow them to retain rights or license the innovation to others. Ensure that agreements explicitly assign IP rights to the buyer when appropriate and restrict the supplier’s use of proprietary information.

By proactively addressing these pitfalls—through rigorous supplier evaluation, clear contractual terms, and robust quality and IP protections—businesses can ensure reliable, compliant, and secure corn grinding sourcing outcomes.

Logistics & Compliance Guide for Corn Grinding

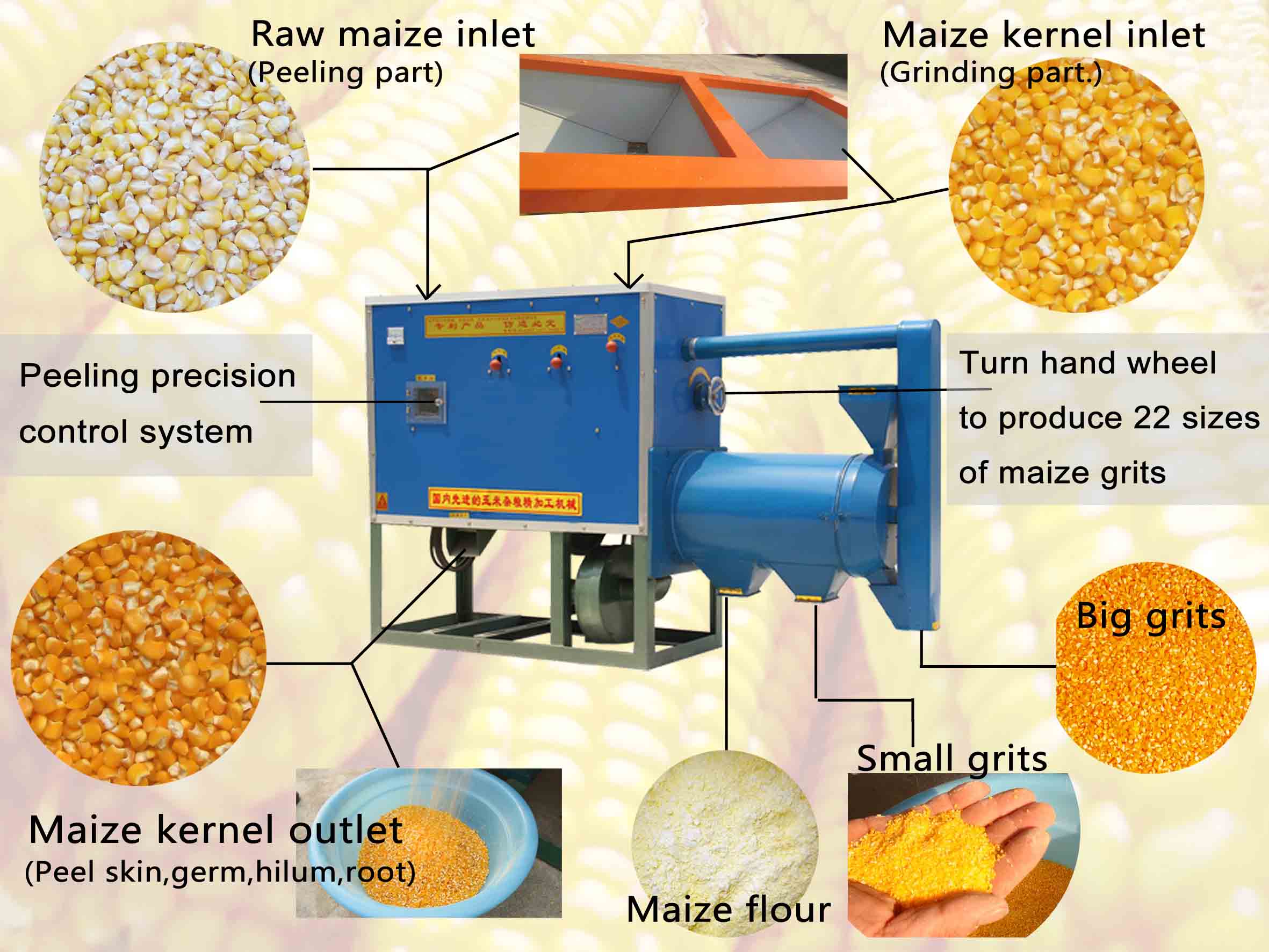

Overview of Corn Grinding Operations

Corn grinding is a critical step in the production of animal feed, ethanol, food ingredients, and industrial products. The process involves reducing whole corn kernels into various particle sizes, such as grits, meal, or flour. Effective logistics and compliance management are essential to ensure operational efficiency, product quality, and regulatory adherence across the supply chain.

Regulatory Compliance Requirements

Corn grinding facilities must comply with a range of federal, state, and local regulations. Key compliance areas include:

– FDA Food Safety Modernization Act (FSMA): Requires implementation of Preventive Controls for Animal Food (if producing feed) or Human Food, including hazard analysis, sanitation procedures, and supply chain verification.

– Occupational Safety and Health Administration (OSHA): Enforces workplace safety standards, particularly regarding grain handling facilities (29 CFR 1910.272), combustible dust, lockout/tagout (LOTO), and confined space entry.

– Environmental Protection Agency (EPA): Regulates air emissions (e.g., particulate matter from grinding), stormwater discharge, and hazardous waste management. Facilities may need a Title V air permit or stormwater pollution prevention plan (SWPPP).

– Grain Inspection, Packers and Stockyards Administration (GIPSA): Ensures fair practices in grain trading and handling for commercial transactions.

– Local Zoning and Building Codes: Must be followed for facility construction, noise, and dust control.

Facilities should maintain up-to-date licenses, conduct regular audits, and train staff on compliance protocols.

Raw Material Sourcing and Transportation

Corn procurement relies on consistent supply from farms, elevators, or cooperatives. Key logistics considerations include:

– Supplier Verification: Ensure corn meets quality standards (moisture content <15%, low aflatoxin levels, minimal foreign material) through certificates of analysis (COA).

– Transportation Modes: Corn is typically transported via truck, rail, or barge. Trucking offers flexibility for short distances; rail is cost-effective for bulk shipments over long distances.

– Seasonal Planning: Coordinate with harvest cycles to secure supply and manage storage capacity.

– Traceability: Implement a lot-tracking system from farm to finished product to support recalls and compliance.

Storage and Inventory Management

Proper storage prevents spoilage and contamination:

– Silos and Bins: Use aeration systems to control temperature and moisture. Monitor for mold, insects, and spoilage.

– First-In, First-Out (FIFO): Enforce inventory rotation to minimize degradation.

– Segregation: Store different corn grades or treated grains separately to avoid cross-contamination.

– Pest Control: Implement integrated pest management (IPM) and routine inspections.

In-Plant Handling and Grinding Process Controls

Efficient material flow and operational safety are vital:

– Conveying Systems: Use bucket elevators, pneumatic conveyors, or drag chains designed to minimize dust and material degradation.

– Grinding Equipment: Hammer mills or roller mills should be maintained regularly and calibrated for desired particle size.

– Dust Control: Install dust collection systems (e.g., baghouses) and conduct housekeeping to reduce explosion risks (NFPA 61 and 652 compliance).

– Metal Detection and Magnets: Install at intake and post-grinding points to remove tramp metal and protect equipment.

Finished Product Handling and Distribution

Post-grinding logistics involve packaging, labeling, and shipping:

– Packaging Options: Bulk loads (tanker trucks, railcars) for feed mills or ethanol plants; bags or supersacks for retail or specialty markets.

– Labeling Compliance: Include product name, net weight, manufacturer info, lot number, and allergen statements where applicable.

– Loadout Procedures: Calibrate scales, inspect transport vehicles for cleanliness, and use dust-suppression measures during loading.

– Cold Chain (if applicable): Not typically needed for dry corn meal, but humidity and temperature control may be required in tropical climates.

Safety and Environmental Management

Proactive risk mitigation supports compliance and sustainability:

– Dust Explosion Prevention: Follow NFPA 61 standards—implement deflagration venting, isolation, suppression, and grounding/bonding.

– Hazard Communication (HazCom): Label all chemicals and provide safety data sheets (SDS) for maintenance and cleaning agents.

– Spill and Waste Management: Prepare spill response plans; recycle metal, paper, and packaging; dispose of waste per local regulations.

– Energy Efficiency: Optimize grinding operations to reduce power consumption and carbon footprint.

Documentation and Recordkeeping

Maintain accurate records to demonstrate compliance:

– Supplier COAs and certificates of conformance

– Equipment maintenance logs

– Pest control reports

– Employee training records (FSMA, OSHA, etc.)

– Environmental monitoring data (air, water)

– Batch production and traceability records

Records should be retained per regulatory requirements (typically 1–3 years).

Audits and Continuous Improvement

Conduct internal and third-party audits to identify gaps. Use findings to refine:

– Standard operating procedures (SOPs)

– Employee training programs

– Emergency response plans

– Supply chain resilience

Regular review ensures ongoing compliance and operational excellence in corn grinding operations.

In conclusion, sourcing corn grinding services or equipment requires careful consideration of several key factors, including the intended scale of production, quality of the final product, cost-efficiency, reliability of suppliers, and technological capabilities. Whether opting for in-house grinding with purchased equipment or outsourcing to a third-party mill, businesses must evaluate their specific needs to ensure consistent output, minimize operational downtime, and maintain profitability. Additionally, building strong relationships with reputable suppliers or service providers, adhering to food safety standards, and staying informed about advances in milling technology can greatly enhance efficiency and product quality. Ultimately, a well-structured sourcing strategy for corn grinding supports long-term sustainability and competitiveness in the agricultural and food processing industries.