The global copper mesh screen market is experiencing robust growth, driven by rising demand across industries such as electronics, healthcare, aerospace, and EMI shielding. According to Grand View Research, the global copper mesh market was valued at USD 1.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. This expansion is fueled by copper’s superior conductivity, antimicrobial properties, and increasing adoption in high-performance filtration and shielding applications. Furthermore, Mordor Intelligence projects steady growth in specialty metal mesh demand, particularly in emerging markets, where urbanization and industrial modernization are accelerating infrastructure development. As the market evolves, the need for reliable, high-quality copper mesh screen manufacturers has never been greater. This article identifies the top 8 manufacturers leading innovation, scalability, and product performance in this competitive landscape.

Top 8 Copper Mesh Screen Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Gerard Daniel

Domain Est. 2000

Website: gerarddaniel.com

Key Highlights: Place large orders of industrial mesh with Gerard Daniel. Our team has the mesh, supply chain and expertise to keep your production line running….

#2 W.S. Tyler

Domain Est. 1996

Website: wstyler.com

Key Highlights: Since 1872, W.S. Tyler has been dedicated to weaving innovative woven wire mesh solutions into the fabric of everyday life. Our mission?…

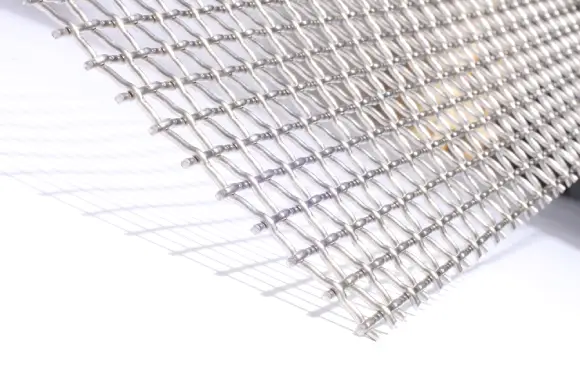

#3 GKDMETALFABRICS

Domain Est. 2000

Website: gkdmetalfabrics.com

Key Highlights: GKD Metal Fabrics is the leading supplier of custom-woven architectural wire mesh and designs for various architectural applications. Contact us today….

#4 Copper Wire Mesh Suppliers

Domain Est. 2020

Website: coppermeshscreen.com

Key Highlights: We offer a full range of copper mesh screen, including woven wire mesh screens, knitted wire mesh, hexagonal mesh screen, expanded metal mesh, perforated mesh ……

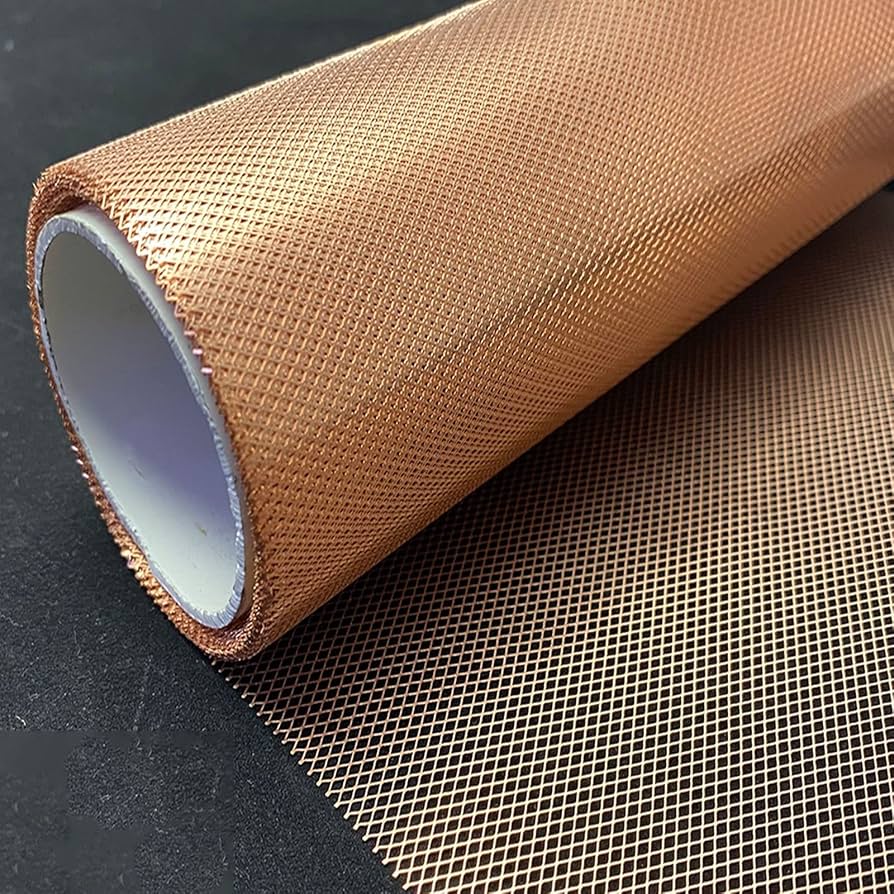

#5 Buy Copper Mesh Screen Rolls

Domain Est. 2000

#6 Copper Wire Mesh

Domain Est. 2007

Website: darbywiremesh.com

Key Highlights: Copper wire mesh is ductile, malleable and has high thermal and electrical conductivity. Darby’s copper wire mesh is woven to the industry standard, ……

#7 Copper Wire Mesh Screen System

Domain Est. 2013

Website: copper-mesh.com

Key Highlights: Boegger Industech Limited provides many type of copper mesh including woven, knitted and expanded, used in fireplace, garden, and rodent exclusion….

#8 Wire Mesh Technical Information by IWM

Domain Est. 2015

Website: iwmesh.com

Key Highlights: IWM is in continuous production of plain weave wire mesh constructed of aluminum, low carbon steel, stainless steel, commercial bronze and copper alloys….

Expert Sourcing Insights for Copper Mesh Screen

2026 Market Trends for Copper Mesh Screen

Growing Demand from EMI/RFI Shielding Applications

The copper mesh screen market is poised for significant expansion by 2026, driven primarily by escalating demand for electromagnetic interference (EMI) and radio frequency interference (RFI) shielding. As electronic devices become more compact, interconnected, and operate at higher frequencies—spanning 5G infrastructure, IoT devices, medical equipment, and aerospace systems—effective shielding is critical. Copper mesh, with its exceptional conductivity and flexibility, remains a preferred material for conductive gaskets, shielded enclosures, and window screens in sensitive environments. The rollout of advanced telecommunications networks and the proliferation of smart technologies will continue to bolster this segment, making EMI/RFI shielding the dominant application driving market growth.

Expansion in Sustainable Architecture and Green Building

By 2026, the adoption of copper mesh screens in architectural and sustainable construction is expected to rise substantially. Architects and designers are increasingly integrating copper mesh into building façades, sunscreens, and interior partitions due to its durability, aesthetic appeal, and natural antimicrobial properties. Its ability to allow airflow and natural light while providing insect resistance and partial solar shading aligns with green building standards such as LEED and BREEAM. Additionally, copper’s recyclability enhances its appeal in eco-conscious construction, further fueling demand in commercial and high-end residential projects.

Advancements in Antimicrobial and Hygienic Solutions

Copper’s inherent antimicrobial properties are gaining renewed attention post-pandemic, positioning copper mesh screens as a strategic solution in healthcare, food processing, and public infrastructure. By 2026, increased investment in hygiene-focused materials will drive the use of copper mesh in ventilation systems, cleanrooms, and protective barriers. The material’s ability to inhibit the growth of bacteria and viruses on surfaces offers long-term cost savings and improved safety, encouraging regulatory support and industry adoption in high-sanitation environments.

Supply Chain and Raw Material Volatility Challenges

Despite strong demand, the copper mesh screen market will face headwinds from copper price volatility and supply chain constraints. Geopolitical tensions, mining disruptions, and rising energy costs may impact raw material availability and increase production expenses. Manufacturers will likely respond by optimizing manufacturing processes, investing in recycling initiatives, and exploring hybrid materials to maintain margins. Strategic sourcing and vertical integration may become key differentiators among leading suppliers.

Regional Growth Dynamics and Technological Innovation

Asia-Pacific, particularly China and India, is expected to lead market growth by 2026 due to rapid industrialization, expanding electronics manufacturing, and infrastructure development. North America and Europe will maintain steady growth, supported by stringent EMI regulations and green building initiatives. Technological innovation—such as nano-coated copper meshes, improved weaving techniques for finer apertures, and integration with smart sensors—will further enhance functionality and open new application avenues, reinforcing the market’s upward trajectory.

Common Pitfalls Sourcing Copper Mesh Screen (Quality, IP)

Sourcing copper mesh screen for applications such as EMI shielding, RF enclosures, or insect screening requires careful attention to both material quality and intellectual property (IP) considerations. Overlooking key factors can lead to performance issues, compliance risks, or legal exposure. Below are the most common pitfalls to avoid.

Poor Material Quality and Specifications Mismatch

One of the biggest risks when sourcing copper mesh is receiving substandard material that doesn’t meet technical requirements. Suppliers may offer mesh that appears visually similar but differs in critical aspects such as:

- Copper Purity: Lower-grade copper (e.g., recycled or alloyed with non-conductive metals) reduces electrical conductivity and corrosion resistance.

- Mesh Count and Open Area: Incorrect weave density can compromise shielding effectiveness or airflow, depending on application needs.

- Tensile Strength and Durability: Thin or poorly woven mesh may tear easily during installation or degrade prematurely in harsh environments.

- Oxidation and Coating Issues: Unprotected copper oxidizes quickly, reducing performance. Some suppliers apply coatings that may interfere with conductivity or solderability.

Always request material certifications (e.g., ASTM B152 for copper sheet and plate) and conduct batch testing to verify specifications.

Lack of Traceability and Compliance Documentation

Many industrial and defense applications require full supply chain traceability. Buyers often overlook the need for:

- Mill Test Certificates (MTCs): These verify the chemical composition and mechanical properties of the copper used.

- RoHS and REACH Compliance: Essential for electronics and EU markets; non-compliant materials can result in product recalls.

- Conflict Minerals Reporting: Required under regulations like the Dodd-Frank Act, especially for U.S. federal contractors.

Failing to secure proper documentation exposes companies to regulatory penalties and reputational damage.

Counterfeit or Misrepresented Products

The global market includes vendors who mislabel products—such as selling brass or copper-plated steel as solid copper mesh. These materials may look identical but perform poorly under electromagnetic or environmental stress. Red flags include:

- Prices significantly below market average.

- Vague product descriptions or reluctance to provide samples.

- No verifiable manufacturing facility or quality control process.

Always conduct third-party lab testing for composition and performance, especially for high-reliability applications.

Intellectual Property (IP) Infringement Risks

When integrating copper mesh into proprietary designs (e.g., patented RF shielding solutions), sourcing from unauthorized or non-licensed suppliers can lead to IP violations. Risks include:

- Use of Patented Weave Patterns or Treatments: Some mesh designs (e.g., specific embossing or lamination techniques) are protected by patents.

- Unauthorized Resale of Proprietary Products: Distributors may sell branded mesh without authorization, violating trademark or licensing agreements.

- Reverse-Engineered Designs: Suppliers may copy patented mesh configurations, exposing downstream users to infringement claims.

To mitigate IP risks:

– Work only with authorized distributors or directly with IP holders.

– Conduct IP due diligence, including patent searches relevant to your application.

– Include IP indemnification clauses in supplier contracts.

Inadequate Supplier Vetting and Long-Term Reliability

Relying on short-term cost savings often leads to poor long-term outcomes. Buyers may select suppliers without evaluating:

- Manufacturing consistency and scalability.

- Quality management systems (e.g., ISO 9001 certification).

- Responsiveness to technical support and corrective actions.

Establishing a qualified supplier list through audits and sample evaluations reduces the risk of supply chain disruption and quality failures.

Conclusion

Sourcing copper mesh screen involves balancing technical performance, regulatory compliance, and legal risk. By focusing on verified material quality, full documentation, and IP compliance, organizations can avoid costly mistakes and ensure reliable, defensible supply chains.

Logistics & Compliance Guide for Copper Mesh Screen

Product Classification and HS Code

Copper mesh screen is typically classified under the Harmonized System (HS) codes for copper articles or wire mesh products. The most common HS code is 7419.19, which covers other articles of copper, including wire mesh and netting. However, exact classification may vary by country and specific product composition (e.g., coated, alloyed). Confirm the local HS code with customs authorities or a licensed customs broker to ensure accurate tariff application and import declaration.

Import and Export Regulations

Export of copper mesh screen may be subject to national export controls, particularly if sourced from countries with export restrictions on copper or strategic materials. Import regulations vary by destination and may include product safety, environmental, or industry-specific standards. Verify compliance with both origin and destination country export/import laws, including licensing requirements and trade sanctions.

Packaging and Handling Requirements

Copper mesh screen should be packaged to prevent physical damage, oxidation, and contamination during transit. Use moisture-resistant wrapping, protective plastic or cardboard spacers, and wooden crates or pallets for larger rolls or sheets. Avoid direct contact with corrosive materials. Clearly label packages with product details, handling instructions (e.g., “Fragile,” “Keep Dry”), and safety warnings if applicable.

Transportation Modes and Considerations

Copper mesh screen can be shipped via air, sea, or land freight. Due to its weight and susceptibility to corrosion, marine transport in dry, ventilated containers is common for bulk shipments. Ensure containers are sealed to prevent moisture ingress. For air freight, prioritize lightweight packaging to reduce costs. Always comply with IATA, IMDG, or local transportation regulations, especially when shipping internationally.

Storage Conditions

Store copper mesh screen in a dry, climate-controlled environment to prevent oxidation and tarnishing. Elevate from the floor on pallets to avoid moisture absorption from concrete. Keep away from acidic or sulfur-containing substances that can accelerate corrosion. Proper ventilation helps minimize condensation in storage facilities.

Customs Documentation

Required documentation typically includes a commercial invoice, packing list, bill of lading or air waybill, and certificate of origin. A material safety data sheet (MSDS) may be needed if copper dust or residues are a concern. Some countries may require import permits or product conformity certificates. Always provide accurate product descriptions, weight, value, and country of manufacture.

Environmental and Safety Compliance

Copper mesh is generally non-hazardous but may generate fine particles during cutting or handling. Follow OSHA or local occupational safety guidelines for dust control and worker protection. Comply with REACH (EU), RoHS, or other environmental regulations if the product is used in electronics or consumer goods. Confirm whether recycled content or conflict mineral reporting is required.

Country-Specific Compliance

Certain markets have additional requirements:

– United States: Comply with EPA and TSCA regulations; no significant restrictions for pure copper mesh.

– European Union: Adhere to REACH and potentially CE marking if integrated into machinery or construction products.

– China: May require CCC certification depending on end-use; monitor export controls on copper.

– Canada: Follow CBSA and Transport Canada guidelines; use of NAFTA/USMCA certificate of origin may reduce tariffs.

End-Use Restrictions

Ensure the copper mesh screen is not being exported for use in restricted applications such as unauthorized filtration of controlled substances or military applications, which may trigger additional licensing requirements under dual-use regulations (e.g., Wassenaar Arrangement).

Recordkeeping and Audits

Maintain detailed records of shipments, compliance documentation, and supplier certifications for a minimum of five years. These records may be required during customs audits or regulatory inspections to demonstrate due diligence and compliance.

In conclusion, sourcing copper mesh screen requires careful consideration of several key factors including mesh size, conductivity, corrosion resistance, and intended application—whether for EMI/RF shielding, filtration, architectural design, or scientific use. It is essential to identify reputable suppliers that provide high-quality, certified materials meeting industry standards such as ASTM or ISO specifications. Evaluating cost, lead times, minimum order quantities, and customization options will help ensure a reliable and efficient supply chain. Additionally, sustainability and ethical sourcing practices are increasingly important in material procurement. By balancing quality, cost, and reliability, organizations can secure a consistent supply of copper mesh screen that meets technical requirements and supports long-term project success.