The global copper joint manufacturing industry is experiencing robust growth, driven by increasing demand in plumbing, HVAC, and industrial applications. According to a report by Grand View Research, the global copper fittings market was valued at USD 36.9 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is fueled by urbanization, infrastructure development, and the rising adoption of energy-efficient systems that rely on reliable fluid transfer solutions. Additionally, Mordor Intelligence forecasts a similar upward trajectory, citing Asia-Pacific’s rapid industrialization and residential construction as key drivers. As demand intensifies, manufacturers are focusing on enhancing product durability, expanding production capacities, and complying with international standards. In this competitive landscape, the top eight copper joint manufacturers have emerged as leaders through innovation, global reach, and consistent quality, shaping the future of piping and connection technologies across critical sectors.

Top 8 Copper Joint Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Mueller Industries

Domain Est. 1996

Website: muellerindustries.com

Key Highlights: Mueller Industries, Inc. is an industrial manufacturer that specializes in copper and copper alloy manufacturing while also producing goods made from aluminum, ……

#2 Cerro Flow Products

Domain Est. 1996

Website: cerro.com

Key Highlights: Welcome to Cerro Flow Products LLC®. We manufacture world-class copper tube and supply fittings for the Plumbing, HVAC/Refrigeration, and Industrial markets….

#3 Copper

Domain Est. 2007

Website: copper-joint.com

Key Highlights: Copper-joint is a leading company committed to providing high-quality products, services, and solutions for the wind power industry, power electronics and ……

#4 Viega USA

Domain Est. 2002

Website: viega.us

Key Highlights: Providing secure pipe connections for 125 years. Viega piping systems deliver unparalleled quality and durability in plumbing projects across the nation and ……

#5 COPPER

Domain Est. 2007 | Founded: 2007

Website: en.copper-joint.com

Key Highlights: Founded in 2007 and headquartered in Singapore, Copper-joint is a leading company committed to providing high-quality products, services, and solutions for ……

#6 Streamline Your System

Domain Est. 2013 | Founded: 1930

Website: muellerstreamline.com

Key Highlights: ACR COPPER PRESS FITTINGS. The industry’s most innovative and reliable press fittings for refrigerant applications. · Since 1930, Streamline® has been the ……

#7 CopperJoint® Compression Socks & Sleeves

Domain Est. 2014

Website: copperjoint.com

Key Highlights: Premium copper-infused compression socks and sleeves for pain relief, swelling reduction, and all-day mobility. Trusted by athletes, nurses, ……

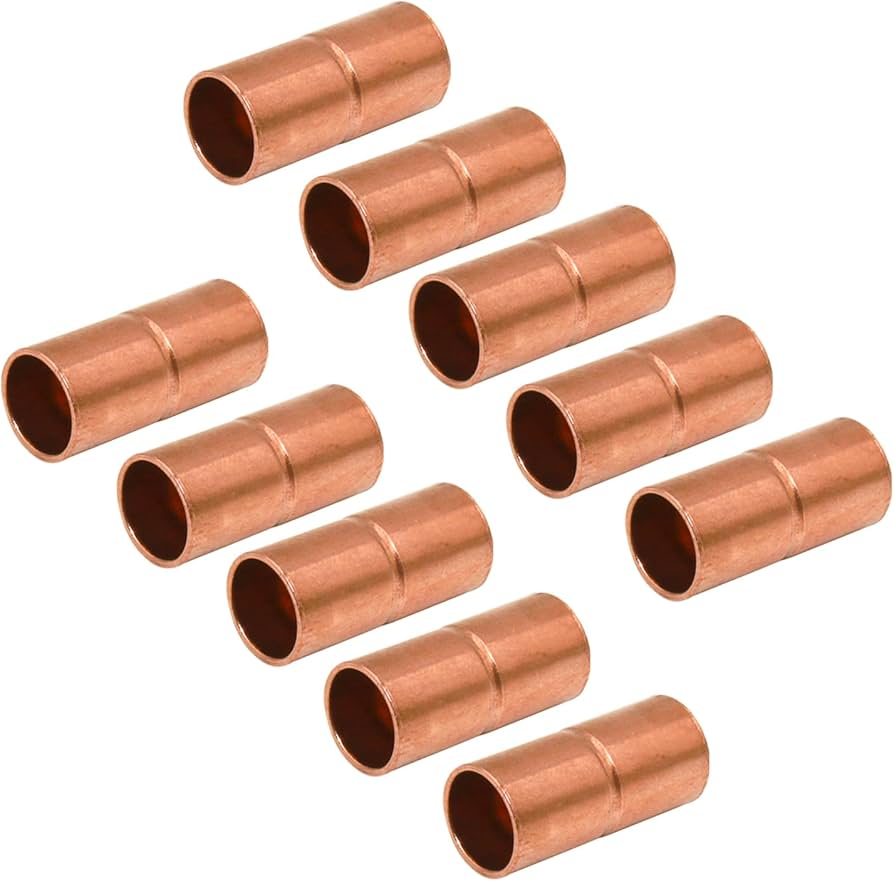

#8 My Copper Joints

Domain Est. 2023

Website: mycopperjoints.com

Key Highlights: At #MCJ, we pay homage to copper’s legacy by meticulously crafting joints and fittings that embody its timeless qualities….

Expert Sourcing Insights for Copper Joint

H2: 2026 Market Trends for Copper Joint

The global market for copper joints—fittings used in plumbing, HVAC (heating, ventilation, and air conditioning), industrial piping, and renewable energy systems—is poised for significant transformation by 2026. Driven by evolving infrastructure demands, sustainability imperatives, and technological advancements, several key trends are expected to shape the copper joint landscape in the coming years.

1. Rising Demand from Green Infrastructure and Renewable Energy

By 2026, the global push toward carbon neutrality will continue to accelerate investments in renewable energy, particularly solar and geothermal systems, where copper joints are integral due to their thermal conductivity and durability. Governments in North America, Europe, and parts of Asia are expected to enforce stricter green building codes, increasing the adoption of copper-based piping solutions in both residential and commercial construction. This regulatory tailwind will support sustained demand for high-quality copper joints.

2. Urbanization and Infrastructure Modernization

Rapid urbanization—especially in emerging markets such as India, Southeast Asia, and parts of Africa—will drive demand for modern plumbing and HVAC systems. Aging infrastructure in developed nations, including the United States and Western Europe, is also undergoing renewal, with copper joints favored for their long service life and leak resistance. Public infrastructure programs, such as the U.S. Bipartisan Infrastructure Law, will likely continue funding water system upgrades, further boosting copper joint consumption through 2026.

3. Supply Chain Resilience and Regionalization

Post-pandemic supply chain disruptions have prompted manufacturers to reevaluate sourcing strategies. By 2026, there will be a greater emphasis on regional production hubs to reduce dependency on single-source suppliers and mitigate geopolitical risks. Localized manufacturing of copper joints—particularly in North America and Europe—is expected to grow, supported by automation and nearshoring initiatives. This shift will improve delivery times and reduce logistics costs.

4. Technological Innovation and Smart Plumbing Integration

The integration of smart building technologies will influence copper joint design and application. While copper itself is not a smart material, hybrid systems combining copper piping with digital monitoring (e.g., leak detection sensors) will become more common. Manufacturers may develop copper joints compatible with IoT-enabled plumbing systems, offering enhanced reliability and predictive maintenance features—especially in commercial and institutional buildings.

5. Price Volatility and Sustainability Pressures

Copper prices are expected to remain volatile through 2026 due to fluctuating mining output, global economic conditions, and speculative trading. This will pressure manufacturers to improve cost efficiency and explore alternative alloys or coatings. Additionally, environmental regulations will place greater emphasis on recyclability and low-carbon production. Copper joints, being 100% recyclable, will benefit from this trend, but producers will need to demonstrate sustainable practices across the lifecycle to meet ESG (Environmental, Social, and Governance) standards.

6. Competitive Landscape and Consolidation

The copper joint market is expected to see increased consolidation as larger players acquire niche manufacturers to expand product portfolios and geographic reach. Innovation in manufacturing techniques—such as precision forging and automated threading—will differentiate market leaders. Companies investing in R&D for corrosion-resistant coatings and lead-free alloys will gain competitive advantages, especially in regions with strict health and safety regulations.

Conclusion

By 2026, the copper joint market will be shaped by a confluence of environmental mandates, infrastructure development, and digital integration. While challenges such as raw material costs and supply chain complexity persist, the long-term outlook remains positive. Market participants that embrace sustainability, invest in innovation, and adapt to regional regulatory frameworks will be best positioned to capitalize on emerging opportunities.

Common Pitfalls When Sourcing Copper Joints (Quality, IP)

Sourcing copper joints—whether for plumbing, HVAC, industrial piping, or electrical applications—requires careful attention to both material quality and intellectual property (IP) considerations. Overlooking these aspects can lead to performance failures, safety hazards, compliance issues, and legal risks. Below are key pitfalls to avoid:

1. Compromising on Material Quality

a. Substandard Copper Alloys

Using non-compliant copper alloys (e.g., low-grade brass or recycled copper with impurities) can result in joint failure, leaks, or corrosion. Always verify that the copper joints meet recognized standards like ASTM B88 (for plumbing), ASTM B68 (for tubing), or EN 1254 (European standard).

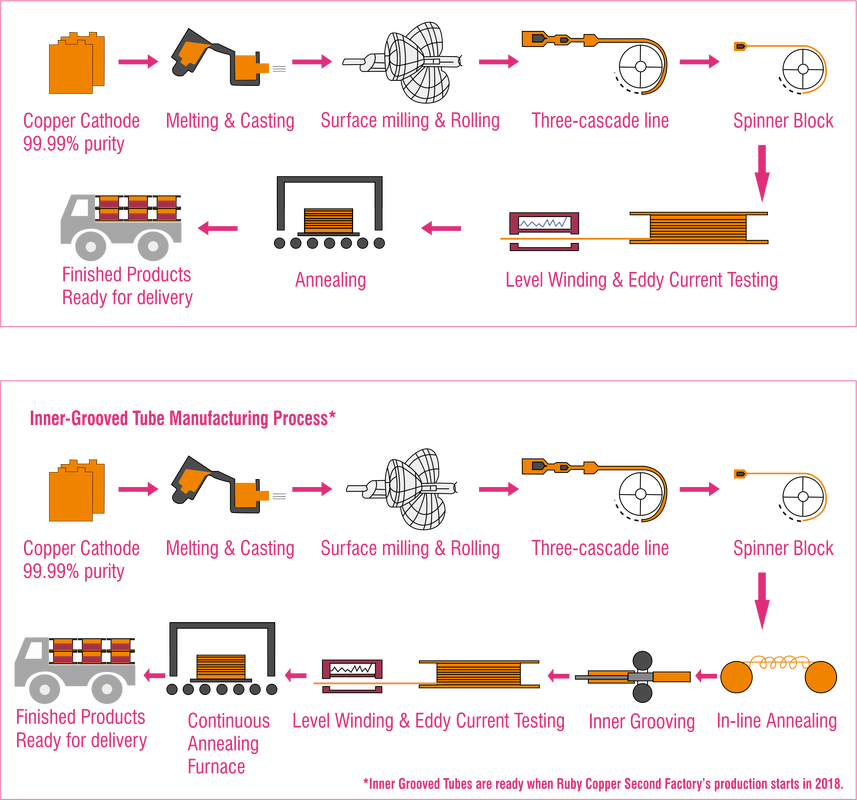

b. Poor Manufacturing Processes

Low-cost suppliers may use improper casting, brazing, or threading techniques, leading to weak joints, inconsistent wall thickness, or surface defects. Insist on quality certifications (e.g., ISO 9001) and conduct factory audits when possible.

c. Inadequate Testing and Certification

Failing to demand test reports (e.g., pressure testing, non-destructive testing) or third-party certifications (e.g., NSF, WRAS, UL) increases the risk of installing non-compliant components, especially in potable water or high-pressure systems.

2. Ignoring Intellectual Property (IP) Risks

a. Counterfeit or Imitation Products

Some suppliers offer joints that mimic branded designs (e.g., flareless fittings, compression joints) protected by patents or trademarks. Sourcing such products can expose your company to IP infringement lawsuits, shipment seizures, or product recalls.

b. Unauthorized Use of Patented Designs

Even if a joint appears generic, specific connection mechanisms or sealing technologies (e.g., crimp, press-fit, or push-to-connect systems) may be protected by patents. Always verify the design freedom-to-operate, especially when sourcing OEM or private-label parts.

c. Lack of IP Due Diligence in Supplier Contracts

Failing to include IP indemnity clauses in procurement agreements leaves buyers liable for infringement claims. Ensure contracts require suppliers to warrant that products do not violate third-party IP rights.

3. Overlooking Regulatory and Environmental Compliance

a. Lead Content Violations

In many regions (e.g., U.S. under the Safe Drinking Water Act), copper joints for potable water must be “lead-free” (<0.25% lead). Using non-compliant joints risks regulatory penalties and health liabilities.

b. Conflict Minerals and Sustainability Standards

Sourcing copper from unethical or non-compliant supply chains (e.g., involving conflict minerals) can damage brand reputation and violate regulations like the Dodd-Frank Act or EU Conflict Minerals Regulation.

4. Inconsistent Dimensional and Performance Standards

a. Non-Standard Thread Types or Sizes

Using joints with incorrect thread standards (NPT vs. BSP, for example) causes leaks and installation issues. Confirm dimensional accuracy and compatibility with existing systems.

b. Poor Surface Finish and Tolerances

Rough interiors or inconsistent dimensions increase turbulence, pressure drop, and risk of particle shedding—especially critical in high-purity or high-flow applications.

5. Inadequate Supply Chain Transparency

a. Hidden Subcontracting and Multi-Tier Sourcing

Suppliers may outsource production without disclosure, making it difficult to trace quality control or ensure consistent manufacturing standards. Demand transparency in the supply chain and conduct unannounced audits.

b. Lack of Traceability

Without batch-level traceability (heat numbers, mill test reports), it’s impossible to manage recalls or investigate field failures effectively.

Conclusion

To mitigate these pitfalls, establish a robust sourcing strategy that includes supplier qualification, rigorous quality inspections, IP risk assessments, and compliance verification. Partner with reputable manufacturers, use independent testing, and maintain clear contractual protections to ensure both the performance and legality of sourced copper joints.

Logistics & Compliance Guide for Copper Joint

This guide outlines the essential logistics and compliance considerations for handling, transporting, and managing copper joints in accordance with industry standards and regulatory requirements.

Regulatory Compliance

Ensure all copper joint products meet applicable national and international standards, including ASTM B88 (Standard Specification for Seamless Copper Water Tube), ASME B16.22 (Wrought Copper and Copper Alloy Solder Joint Pressure Fittings), and local plumbing codes such as IPC (International Plumbing Code). Verify material certifications (e.g., Mill Test Reports) are available and retained for traceability. Confirm compliance with environmental regulations such as RoHS (Restriction of Hazardous Substances) and REACH, especially when exporting.

Material Handling & Storage

Copper joints must be stored in a dry, climate-controlled environment to prevent oxidation, moisture damage, and contamination. Keep products off the ground using pallets or racks and cover with protective wrapping if stored outdoors temporarily. Avoid contact with dissimilar metals to prevent galvanic corrosion. Handle with clean gloves or tools to minimize surface contamination and maintain performance integrity.

Packaging & Labeling

Package copper joints securely to prevent physical damage during transit. Use corrosion-inhibiting materials where necessary. Clearly label packages with product type, size, material grade, quantity, batch/lot number, and handling instructions (e.g., “Fragile,” “Keep Dry”). Include compliance markings and safety data sheets (SDS) when required, especially for international shipments.

Transportation & Shipping

Use carriers experienced in handling metal components. Secure loads to prevent shifting during transit. For international shipments, ensure adherence to Incoterms (e.g., FOB, CIF) and complete all export documentation, including commercial invoices, packing lists, and certificates of origin. Monitor temperature and humidity during transport if sensitive coatings or treatments are applied.

Customs & Import/Export Requirements

Prepare accurate Harmonized System (HS) codes — typically 7412.10 for copper pipe fittings — to facilitate customs clearance. Maintain records of import/export licenses if required by destination country. Conduct due diligence on sanctions and restricted party lists. Engage licensed customs brokers for complex international logistics.

Quality Assurance & Traceability

Implement a traceability system linking each batch of copper joints to its manufacturing origin, test results, and distribution path. Conduct regular quality audits and inspections at receiving and dispatch points. Retain documentation for a minimum of seven years to support compliance during regulatory audits.

Environmental & Safety Compliance

Dispose of packaging and damaged materials in accordance with local environmental regulations. Train personnel in safe handling practices to prevent injury (e.g., sharp edges). Maintain SDS for any ancillary materials used (e.g., flux, lubricants). Report spills or incidents per OSHA and EPA guidelines where applicable.

Supplier & Vendor Management

Source copper joints only from certified and audited suppliers. Require compliance documentation as part of procurement agreements. Conduct periodic supplier evaluations to ensure ongoing adherence to quality and regulatory standards.

Conclusion for Sourcing Copper Joints:

After a thorough evaluation of suppliers, quality standards, cost structures, and logistical considerations, sourcing copper joints requires a balanced approach that prioritizes material quality, compliance with industry standards (such as ASTM B88 or ISO 21567), and long-term reliability. The chosen supplier should demonstrate consistent manufacturing capabilities, offer certifications for materials and welding processes, and provide competitive pricing without compromising on performance. Additionally, proximity to supply hubs, lead times, and sustainability practices are key factors that can influence supply chain efficiency. Ultimately, establishing a strategic partnership with a reputable copper joint supplier ensures operational efficiency, reduces maintenance risks, and supports the integrity of plumbing, HVAC, and industrial systems where copper joints are critical.