The global copper market is experiencing robust growth, driven by rising demand across key industries such as electrical and electronics, construction, renewable energy, and automotive. According to a report by Mordor Intelligence, the copper market was valued at USD 166.6 billion in 2023 and is projected to reach USD 215.2 billion by 2029, growing at a CAGR of 4.3% during the forecast period. This expansion is largely fueled by the increasing adoption of electric vehicles (EVs), advancements in power infrastructure, and the global push toward sustainable energy systems—all of which rely heavily on high-conductivity copper materials. As demand escalates, the role of copper grades manufacturers becomes increasingly critical, with differentiation emerging through purity levels, alloy compositions, and production scalability. In this competitive landscape, the top 10 copper grades manufacturers are not only meeting but shaping industry standards—combining technological innovation with reliable supply chains to support the world’s transition toward electrification and low-carbon technologies.

Top 10 Copper Grades Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Aviva Metals

Domain Est. 2017

Website: avivametals.com

Key Highlights: Large Inventory of Copper Alloys. We list over one hundred different grades of copper alloys in excess of 10 million pounds! · Extensive Machining Capabilities….

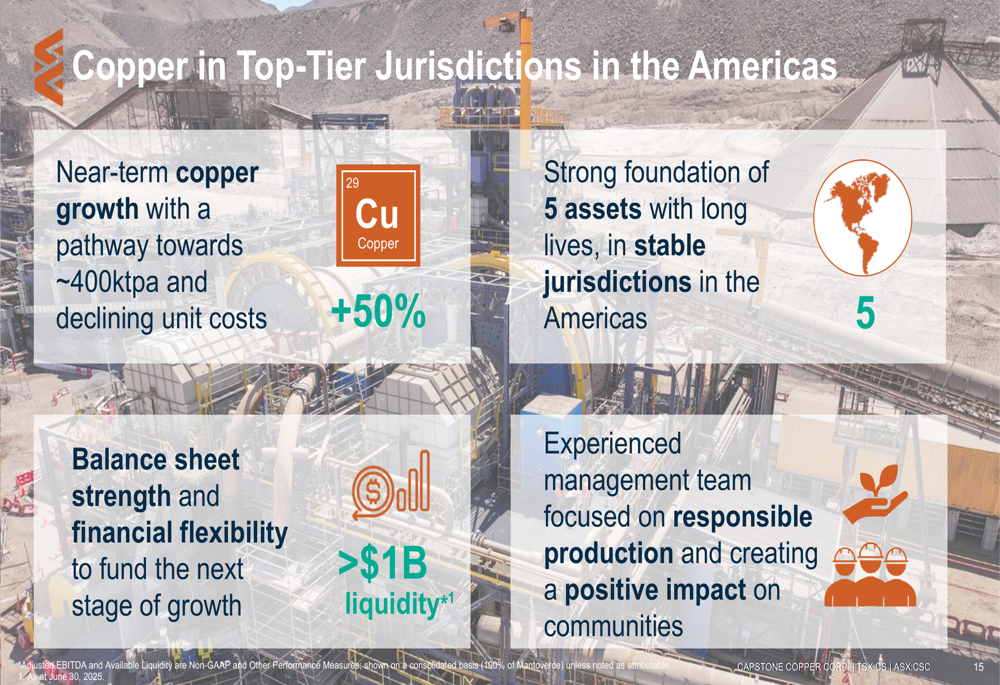

#2 Capstone Copper, Leading Copper Producer in the Americas

Domain Est. 2019

Website: capstonecopper.com

Key Highlights: Capstone Copper has a portfolio of long-life copper operations in the Americas and a fully permitted development project in one of the world’s most prolific ……

#3 Copper

Domain Est. 1996

Website: angloamerican.com

Key Highlights: Our two major copper mining operations in Chile include the Los Bronces and Collahuasi mines. Learn about our other copper mines here….

#4 Copper

Domain Est. 1997

Website: belmontmetals.com

Key Highlights: Belmont offer High Purity Electrolytic Copper, the most widely used grade of pure copper, in a wide variety of forms to meet your specific application. Made ……

#5 Superior Non-Ferrous Metals Supplier

Domain Est. 1998

Website: southerncopper.com

Key Highlights: Southern Copper offers top-tier raw non-ferrous metals and precision machining services. Elevate your project with our expertise and commitment to quality….

#6 Copper Suppliers

Domain Est. 1998

Website: americanelements.com

Key Highlights: Copper qualified commercial & research quantity preferred supplier. Buy at competitive price & lead time. In-stock for immediate delivery….

#7 Farmers Copper, LTD.: Copper Metal Supplier

Domain Est. 1998

Website: farmerscopper.com

Key Highlights: Farmers’ Copper is a certified copper metal supplier stocking not only over 40 alloys of copper, but maintaining a very diverse inventory of other metals….

#8 Copper Products for Sale

Domain Est. 2013

Website: samaterials.com

Key Highlights: Welcome to a journey through copper materials and their properties from Elemental wonders, versatile Alloys and compounds….

#9 Main page

Domain Est. 2020

Website: udokancopper.ru

Key Highlights: JORC copper mineral resources. 150 thousand tonnes. Annual copper production. >15 million tonnes. Ore processing capacity. 1.05%. Copper grade. Video. 0104….

#10 Algo Grande

Website: algo-grande.com

Key Highlights: Algo Grande is a copper exploration company advancing the Adelita project, anchored by a near-surface Cu-Au-Ag skarn discovery, located within the prolific ……

Expert Sourcing Insights for Copper Grades

H2: 2026 Market Trends for Copper Grades

As we move toward 2026, the global copper market is undergoing significant transformation, driven by technological advancements, shifting supply dynamics, and growing demand from clean energy and electrification sectors. Among the most critical aspects of this evolution is the differentiation in demand and pricing across various copper grades, particularly high-purity (Grade A), standard blister/refined copper (Grade B), and lower-grade scrap or by-product copper (Grade C). Here’s an in-depth analysis of the expected market trends for these copper grades in 2026:

1. Rising Demand for High-Purity Copper (Grade A)

– Drivers: The surge in electric vehicles (EVs), high-efficiency motors, renewable energy systems (especially solar inverters and wind turbines), and 5G infrastructure is increasing demand for high-conductivity, high-purity copper (typically 99.99%+ Cu, ASTM B3 or IACS Grade 1).

– Market Impact: By 2026, Grade A copper is expected to command a premium of 8–12% over standard-grade refined copper. Producers capable of consistently delivering ultra-pure copper will gain a competitive edge.

– Supply Constraints: Limited refining capacity capable of producing Grade A copper, especially in regions with strict environmental regulations, may create localized shortages.

2. Stabilizing Demand for Standard Refined Copper (Grade B)

– Grade B Definition: Typically 99.5–99.9% purity, used in construction, general electrical wiring, and industrial machinery.

– Trend Outlook: Demand for Grade B copper will remain stable but grow at a slower pace (~2.5% CAGR) compared to Grade A (~5.8% CAGR through 2026). This is due to market saturation in traditional sectors and moderate growth in emerging economies.

– Competition with Recycled Copper: Grade B faces increasing competition from upgraded secondary copper, especially in regions with advanced recycling infrastructure (e.g., EU and North America).

3. Growth in Lower-Grade and Recycled Copper (Grade C)

– Definition: Includes scrap-derived copper, off-spec material, and by-product copper from mining (e.g., from porphyry deposits with lower Cu content).

– Trend Drivers: Circular economy policies, cost efficiency, and decarbonization goals are boosting the use of recycled copper. By 2026, recycled copper is expected to supply ~25% of global demand (up from ~20% in 2023).

– Challenges: Quality variability and contamination risks limit Grade C’s use in high-tech applications. However, advancements in sorting and refining (e.g., sensor-based separation, electrorefining of scrap) are improving consistency.

– Economic Role: Grade C copper acts as a price stabilizer, providing supply elasticity during periods of deficit in primary production.

4. Regional Divergence in Grade Preferences

– Asia-Pacific (especially China): Strong demand for both Grade A (in EVs and electronics) and Grade B (infrastructure). China is investing heavily in upgrading secondary smelters, increasing the share of higher-quality recycled copper.

– Europe: Emphasis on sustainable sourcing and recycled content favors the use of refined scrap (upgraded toward Grade B). EU regulations may require minimum recycled content in electrical products by 2026.

– Americas: North America sees growing Grade A demand aligned with U.S. infrastructure and clean energy plans. South America, as a major producer, focuses on exporting high-grade cathodes, though political risks in key producing countries (e.g., Chile, Peru) could affect consistent supply.

5. Price Differentials and Market Structuring

– By 2026, expect formalized price benchmarks for copper grades beyond the standard LME cash settlement:

– Grade A: Potential premiums tracked via regional adders (e.g., +$300–$500/tonne over LME).

– Grade C: Traded at discounts, but narrowing due to improved recycling tech.

– Contractual shifts: Long-term off-take agreements increasingly specify copper grade, purity, and carbon footprint, reflecting buyer sophistication.

6. Technological and ESG Influences

– Traceability and Certification: Blockchain-enabled tracking of copper grade and origin will gain traction, especially for ESG-compliant procurement.

– Low-Carbon Premium: Copper produced with renewable energy and high-grade efficiency may attract additional premiums, indirectly favoring high-grade producers with modern, green refineries.

Conclusion

In 2026, copper markets will be increasingly segmented by grade, with Grade A copper leading growth due to high-tech demand, while recycled and lower-grade copper (Grade C) expands its role in sustainability-driven supply chains. Producers, traders, and consumers must adapt to a more nuanced pricing and quality landscape, where purity, origin, and environmental impact are as critical as volume. Strategic investments in refining technology, recycling infrastructure, and certification will determine competitive advantage in the evolving copper ecosystem.

Common Pitfalls in Sourcing Copper Grades (Quality, IP)

Sourcing copper, particularly for industrial or high-performance applications, involves navigating complex quality specifications and intellectual property (IP) considerations. Overlooking key aspects can lead to supply disruptions, performance failures, or legal risks. Below are common pitfalls grouped under these two critical areas.

Quality-Related Pitfalls

1. Inadequate Specification Alignment

A frequent error is assuming industry-standard grades (e.g., C11000, C10100) guarantee suitability for all applications. Buyers often overlook nuanced differences in conductivity, purity, alloy composition, or mechanical properties required for specific uses—such as electronics or high-stress environments. Failure to define exact tolerances (e.g., oxygen content in oxygen-free copper) can result in material that meets nominal standards but underperforms.

2. Inconsistent Certification and Traceability

Accepting material without proper mill test certificates (MTCs) or third-party verification exposes buyers to counterfeit or substandard copper. Lack of traceability from smelter to final product increases the risk of receiving material with unknown origins or adulterated content, especially in complex supply chains.

3. Overlooking Physical and Surface Quality

Even chemically pure copper can fail if surface defects (e.g., cracks, pits, or scale) are present. Buyers sometimes focus solely on chemical composition and neglect visual and dimensional inspections. This can cause issues during downstream processing such as drawing, plating, or welding.

4. Misunderstanding Processing History Effects

Copper’s performance depends heavily on its temper (e.g., annealed vs. hard-drawn) and manufacturing method (e.g., continuous casting vs. electrorefining). Sourcing without specifying required temper or processing history may yield material that does not meet mechanical or electrical requirements.

Intellectual Property (IP)-Related Pitfalls

1. Unlicensed Use of Proprietary Copper Alloys

Many high-performance copper alloys (e.g., beryllium copper, tellurium copper) are protected by patents or trade secrets. Sourcing equivalents without proper licensing can lead to legal liability, especially if the substitute infringes on a patented composition or manufacturing process.

2. Failure to Protect Internal Specifications

Buyers who develop custom copper formulations or processing requirements may inadvertently disclose proprietary data during sourcing negotiations. Without robust non-disclosure agreements (NDAs) or secure procurement processes, this IP can be compromised or reverse-engineered by suppliers.

3. Ambiguous Ownership of Co-Developed Materials

In joint development projects with suppliers, unclear IP agreements can result in disputes over ownership of new alloys, processes, or applications. This undermines competitive advantage and may restrict future manufacturing flexibility.

4. Overreliance on Supplier Claims Without Verification

Suppliers may assert that their copper grades are “patent-free” or “equivalent to” branded materials. Accepting such claims without independent legal or technical due diligence risks infringement and exposes the buyer to litigation or supply chain disruption if the claims are false.

Avoiding these pitfalls requires rigorous specification management, third-party verification, and proactive IP due diligence throughout the sourcing lifecycle.

Logistics & Compliance Guide for Copper Grades

This guide outlines the key logistical and compliance considerations when handling, transporting, and trading different grades of copper. Adhering to these standards ensures safety, regulatory compliance, and market acceptance.

Understanding Copper Grades

Copper is classified into various grades based on purity, chemical composition, and physical form. The most commonly traded grades include:

– Grade A (99.99% Cu): High-purity copper, typically used in electrical applications.

– Grade B (99.95% Cu): Slightly lower purity, suitable for industrial uses.

– Refinery Shapes (e.g., cathodes, wire rod): Form-specific products with defined dimensions and tolerances.

– Scrap Grades (e.g., Bare Bright, #1 & #2 Copper): Recycled copper categorized by contamination levels.

Each grade is governed by international standards such as those from the London Metal Exchange (LME), ASTM International, and ISO.

International Standards and Specifications

Compliance with recognized standards is essential for global trade:

– LME Delivery Standards: Define acceptable copper cathode specifications (e.g., minimum 99.99% Cu, dimensions, packaging).

– ASTM B115: Standard specification for electrolytic copper cathode.

– ISO 11175: Specifies copper cathodes for industrial use.

– Copper Mark Certification: Ensures responsible sourcing and environmental, social, and governance (ESG) compliance.

Suppliers must provide material test certificates (MTCs) validating compliance with relevant standards.

Packaging and Handling Requirements

Proper packaging preserves quality and ensures safe transport:

– Copper Cathodes: Typically strapped onto wooden pallets, wrapped in plastic, and protected from moisture.

– Wire Rod: Spooled on reels, sealed in moisture-resistant wraps.

– Scrap Copper: Sorted by grade, baled or containerized to prevent contamination.

Handling must avoid contamination from oil, dirt, or dissimilar metals. Use clean, dedicated equipment.

Transportation and Shipping Logistics

Transport methods depend on volume, destination, and copper form:

– Maritime Shipping: Most common for bulk copper cathodes; use dry bulk carriers or containerized loads.

– Rail and Trucking: Used for regional or domestic transport; require secure loading to prevent shifting.

– Air Freight: Rare due to cost, reserved for high-value samples or urgent small shipments.

Ensure proper labeling, including UN number (UN 3089 for copper waste, UN 2846 for copper compounds if applicable), hazard class (usually non-hazardous for pure copper), and grade identification.

Customs and Import/Export Compliance

Adherence to trade regulations is critical:

– HS Codes: Use correct Harmonized System codes (e.g., 7403 for refined copper, 7404 for copper waste/scrap).

– Export Controls: Some countries regulate copper exports to protect domestic industries.

– Import Duties and Tariffs: Vary by country and trade agreements; verify current rates.

– Documentation: Include commercial invoice, packing list, bill of lading, certificate of origin, and compliance certificates.

Verify destination country requirements, such as REACH (EU) or TSCA (USA), for chemical substance registration.

Environmental, Health, and Safety (EHS) Considerations

Although copper is not highly toxic, EHS protocols must be followed:

– Dust Control: Prevent inhalation of copper dust during handling (use PPE and ventilation).

– Spill Management: Clean spills promptly to avoid environmental contamination.

– Waste Disposal: Recycle copper scrap responsibly; comply with local hazardous waste rules if contaminated.

Ensure SDS (Safety Data Sheets) are available for all copper forms, especially alloys or treated materials.

Anti-Fraud and Chain of Custody

Maintain a clear chain of custody to prevent fraud:

– Weighing and Inspection: Conduct at load, transit, and delivery points.

– Seals and Tracking: Use tamper-evident seals and GPS tracking for high-value shipments.

– Independent Assaying: Third-party verification of copper grade and purity at critical handover points.

Blockchain or digital ledger technologies are increasingly used for traceability.

Conclusion

Effective logistics and compliance for copper grades require adherence to international standards, proper handling and documentation, and robust EHS practices. By following this guide, stakeholders can ensure safe, legal, and efficient movement of copper across global supply chains. Regular audits and staying updated on regulatory changes are recommended to maintain compliance.

Conclusion on Sourcing Copper Grades:

Sourcing copper involves careful consideration of copper grades, which significantly impact cost, processing efficiency, and end-use suitability. High-grade copper (e.g., Cathode Copper A, Grade 1) is preferred for electrical and high-conductivity applications due to its purity (typically 99.99% Cu), while lower grades may be suitable for industrial or alloying purposes where minor impurities are acceptable. The choice of copper grade depends on the balance between quality requirements, sourcing availability, market prices, and refining capabilities.

Effective sourcing strategies involve evaluating suppliers based on purity standards, certification (e.g., LME or COMEX approval), geographic origin, environmental and ethical mining practices, and logistical factors. As global demand for copper rises—driven by renewable energy, electric vehicles, and infrastructure—securing reliable access to consistent, high-quality copper grades is crucial for maintaining production efficiency and product integrity.

In conclusion, a well-informed copper sourcing strategy must align the required grade with application needs, cost constraints, and sustainability goals, ensuring long-term supply chain resilience and competitiveness.