The global copper foil sheet market is experiencing robust growth, driven by rising demand in the electronics, printed circuit board (PCB), and lithium-ion battery sectors. According to a report by Grand View Research, the global copper foil market was valued at USD 9.6 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This growth is largely fueled by the expanding electric vehicle (EV) industry, where copper foil serves as a critical component in battery anodes. Mordor Intelligence further supports this outlook, noting increased investments in renewable energy infrastructure and consumer electronics as key demand drivers. As production scales to meet these needs, a competitive landscape of manufacturers has emerged, with leading companies investing in thinner, higher-performance foils to meet evolving industry standards. In this dynamic environment, identifying the top copper foil sheet manufacturers is essential for supply chain stakeholders aiming to align with innovation, reliability, and scalability.

Top 10 Copper Foil Sheet Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 COPPER FOIL

Domain Est. 1995

Website: insulectro.com

Key Highlights: Insulectro offers Copper Foils from many world-class producers that are designed to help our customers achieve their high-performance design parameters….

#2 Circuit Foil

Domain Est. 1998

Website: circuitfoil.com

Key Highlights: Circuit Foil is a global company which develops, produces and markets high-quality copper foil, ranging from 1μm to 210μm….

#3 Luvata

Domain Est. 2005

Website: luvata.com

Key Highlights: Luvata brings together people, innovation and technology to make the most of copper, specializing in technically demanding copper products….

#4 Wieland Rolled Products (formerly Olin Brass)

Domain Est. 2019

Website: wieland-rolledproductsna.com

Key Highlights: Wieland Rolled Products NA is the leading manufacturer and converter of copper and copper-alloy sheet, strip, foil, tube and fabricated components in North ……

#5 Copper Foil

Domain Est. 1993

Website: goodfellow.com

Key Highlights: In stock Free deliveryDesigned for precision and versatility, Goodfellow’s Copper Foil combines high conductivity, thermal efficiency, and mechanical flexibility – making it ideal …

#6 Copper Coils, Rolls Sheets and Adhesives

Domain Est. 1997

Website: allfoils.com

Key Highlights: All Foils stocks copper foil in a variety of alloys, tempers and gauges. Our extensive inventory consists of copper alloys 101, 102 and 110, as well as ……

#7 Copper Foil

Domain Est. 1997

Website: globalmetals.com

Key Highlights: Global Metals provides a full range of precision copper foil for almost any application. Our copper foil is produced in a wide variety of copper alloys….

#8 Copper Foil

Domain Est. 2012

Website: ufo.uacj-group.com

Key Highlights: UACJ Foil offers world-quality, wide-sheet copper foil for FPC, batteries, electrical lines and other applications….

#9 Copper Foil (Cu Foil) Supplier

Domain Est. 2013

Website: samaterials.com

Key Highlights: Starting from $100.00 In stockOur copper coil rolls are ideal for electrical conductivity uses. Stanford Advanced Materials provides high quality copper foils with competitive pric…

#10 Copper Foil / Copper Alloy

Domain Est. 2021

Website: jx-nmm.com

Key Highlights: JX Advanced Metals supply a one-stop service with two kinds of copper foil products ― treated rolled copper foil and electro-deposited copper foil….

Expert Sourcing Insights for Copper Foil Sheet

H2: Projected 2026 Market Trends for Copper Foil Sheet

The global copper foil sheet market is poised for substantial growth by 2026, driven by escalating demand across high-tech and renewable energy sectors. Key trends shaping the market include:

-

Surge in Electric Vehicle (EV) and Battery Production:

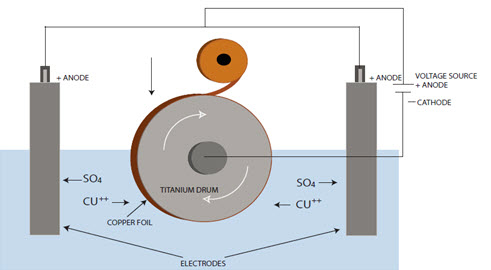

Copper foil is a critical component in lithium-ion batteries, primarily used as the anode current collector. With global EV adoption accelerating due to government mandates and environmental policies, demand for high-performance copper foil sheets—especially thin, high-ductility versions—is expected to rise sharply. By 2026, the EV sector is forecasted to be the largest end-user, pushing manufacturers to expand production capacities and invest in advanced rolling and electrodeposition technologies. -

Growth in Flexible Printed Circuits (FPCs) and 5G Infrastructure:

The proliferation of 5G networks and the miniaturization of consumer electronics are increasing the need for flexible and high-conductivity copper foils. Ultra-thin copper foils (below 9 µm) are essential for FPCs used in smartphones, wearables, and IoT devices. By 2026, Asia-Pacific—particularly China, South Korea, and Japan—will remain the dominant hub for electronics manufacturing, sustaining strong regional demand. -

Technological Advancements and Product Innovation:

Manufacturers are focusing on producing high-purity, low-roughness electrolytic copper foils to enhance battery efficiency and signal integrity in high-frequency applications. Innovations such as nano-coated foils and surface treatments to improve adhesion and thermal stability are gaining traction. These advancements will be critical in meeting the performance requirements of next-gen batteries and advanced electronics. -

Supply Chain Resilience and Raw Material Volatility:

Copper prices are subject to geopolitical and macroeconomic fluctuations. By 2026, companies are expected to adopt vertical integration strategies and secure long-term copper supply contracts to mitigate price volatility. Additionally, recycling initiatives for scrap copper foil from battery and electronics waste streams will gain importance, supporting sustainability goals and reducing dependency on primary copper. -

Regional Market Dynamics:

Asia-Pacific will continue to dominate the copper foil sheet market due to its robust electronics and battery manufacturing base. However, North America and Europe are projected to witness faster growth due to new EV battery gigafactories and investments in domestic supply chains under initiatives like the U.S. Inflation Reduction Act and the EU’s Green Deal. -

Sustainability and Regulatory Pressures:

Environmental regulations are pushing manufacturers toward energy-efficient production processes and reduced emissions. By 2026, eco-friendly manufacturing practices—such as closed-loop water systems in electrolytic foil production—will become standard, influencing competitive positioning in the market.

In summary, the 2026 copper foil sheet market will be defined by strong demand from the EV and electronics sectors, technological innovation, and a growing emphasis on sustainability and supply chain security. Companies that invest in R&D, scale production efficiently, and align with global decarbonization goals are likely to lead the market.

Common Pitfalls When Sourcing Copper Foil Sheet: Quality and Intellectual Property Concerns

Sourcing copper foil sheet, particularly for high-performance applications like printed circuit boards (PCBs), batteries, or electromagnetic shielding, involves navigating several critical pitfalls related to quality consistency and intellectual property (IP) protection. Failing to address these can lead to product failures, supply chain disruptions, and legal liabilities.

Inconsistent Material Quality and Specifications

One of the most significant challenges is ensuring consistent quality across batches and suppliers. Copper foil that deviates from specified parameters can compromise the performance and reliability of end products. Key quality pitfalls include:

- Thickness Variability: Even minor deviations in foil thickness (e.g., ±10% instead of ±5%) can affect electrical conductivity, thermal management, and lamination processes in PCB manufacturing.

- Surface Roughness and Morphology: Inconsistent surface profiles (e.g., drum vs. matte side roughness) impact adhesion in laminates. Excessive or uneven roughness may lead to delamination or signal loss in high-frequency circuits.

- Purity and Contamination: Impurities such as iron, sulfur, or organic residues can reduce conductivity and accelerate corrosion. Foils intended for lithium-ion battery anodes require ultra-high purity (e.g., 99.99%+), and trace contaminants can degrade battery cycle life.

- Mechanical Properties: Tensile strength and elongation must meet specifications to prevent tearing during handling or processing. Poor ductility can result in yield loss during roll-to-roll manufacturing.

- Pinholes and Defects: Microscopic holes or inclusions compromise barrier effectiveness and electrical integrity, especially in sensitive applications like flexible electronics or medical devices.

Mitigation Strategy: Require detailed material certifications (e.g., CoA, CoC), conduct independent third-party testing, and establish clear quality gates in supplier agreements. Perform regular audits of supplier production lines.

Lack of Traceability and Certification

Without proper traceability, verifying the origin, processing history, and compliance of copper foil becomes difficult. This is critical for industries requiring adherence to environmental, safety, or regulatory standards (e.g., RoHS, REACH, conflict minerals regulations).

- Unverified Supply Chains: Sourcing from intermediaries without direct oversight may result in mixed lots or non-compliant materials entering the supply chain.

- Inadequate Documentation: Missing or falsified test reports, mill certifications, or chain-of-custody records increase the risk of counterfeit or substandard foil.

Mitigation Strategy: Insist on full traceability from smelter to finished foil, including batch-level documentation. Use blockchain or digital ledgers where feasible, and conduct periodic supplier audits.

Intellectual Property (IP) Risks and Technology Leakage

Copper foil, especially specialized variants like low-profile, high-ductility, or surface-treated foils, often incorporates proprietary manufacturing processes or chemical treatments protected by patents and trade secrets. Key IP pitfalls include:

- Use of Counterfeit or Reverse-Engineered Foil: Some suppliers may offer “compatible” foils that infringe on patented technologies (e.g., specific surface treatments or alloy compositions). Using such materials can expose the buyer to infringement lawsuits.

- Unprotected Custom Specifications: When working with suppliers to develop custom foil grades, failure to formalize IP ownership and confidentiality agreements may result in the supplier replicating and selling the design to competitors.

- Lack of Freedom-to-Operate (FTO) Analysis: Sourcing foil without verifying that its manufacture or use doesn’t violate existing patents can lead to costly litigation or supply chain interruptions.

Mitigation Strategy: Conduct thorough FTO assessments before adopting new foil types. Sign robust Non-Disclosure Agreements (NDAs) and clearly define IP ownership in development contracts. Prefer suppliers with transparent innovation practices and valid IP portfolios.

Overlooking Process Compatibility

Even high-quality foil may fail if it is not compatible with the buyer’s manufacturing processes.

- Adhesion Issues: Foil surface treatments (e.g., silane, chromium-free coatings) must match the resin system used in lamination. Incompatibility leads to poor bond strength.

- Thermal Stability: Foil used in high-temperature processes (e.g., lead-free soldering) must resist oxidation and maintain integrity under thermal cycling.

Mitigation Strategy: Perform process validation trials with sample lots before full-scale procurement. Collaborate with suppliers on technical data sheets and application support.

By proactively addressing these quality and IP-related pitfalls, companies can secure reliable, compliant, and innovative copper foil supplies while minimizing operational and legal risks.

Logistics & Compliance Guide for Copper Foil Sheet

Overview of Copper Foil Sheet

Copper foil sheet is a thin, flexible material made from high-purity copper, widely used in printed circuit boards (PCBs), flexible electronics, electromagnetic shielding, and renewable energy applications. Due to its electrical conductivity, malleability, and susceptibility to oxidation, proper logistics and compliance handling are essential to maintain product quality and meet regulatory standards.

International Shipping & Transportation

Copper foil sheets are typically transported via air, sea, or ground freight depending on volume, destination, and urgency. Key considerations include:

– Packaging: Sheets must be moisture-resistant and packed in anti-tarnish paper or vacuum-sealed plastic with desiccants to prevent oxidation. Rolls or stacked sheets should be protected with edge guards and placed in sturdy wooden or composite crates.

– Labeling: Clearly label packages with handling instructions such as “Fragile,” “Do Not Bend,” and “Moisture Sensitive.” Include product details, weight, dimensions, and handling orientation.

– Temperature & Humidity Control: Maintain storage and transport conditions between 15–30°C and relative humidity below 60% to minimize oxidation and contamination.

– Stacking & Load Securing: Avoid excessive stacking to prevent deformation. Secure loads with straps or dunnage in containers or trucks to avoid shifting during transit.

Customs & Import/Export Compliance

Copper foil is classified under international trade codes and may be subject to export controls, tariffs, and customs documentation:

– HS Code: Typically 7410.11 or 7410.12 (Unalloyed copper foil, thickness ≤ 0.15 mm). Confirm with local customs authorities as classification may vary by region and alloy content.

– Export Licenses: Check if export restrictions apply, particularly for shipments to sanctioned countries or high-purity grades that may fall under strategic material regulations.

– Documentation: Prepare commercial invoice, packing list, bill of lading/air waybill, certificate of origin, and material safety data sheet (MSDS). Some countries may require import permits or conformity assessments.

– Duty & Taxation: Copper products may attract variable import duties. Utilize free trade agreements where applicable to reduce costs.

Regulatory & Environmental Compliance

Ensure adherence to environmental, safety, and industry-specific regulations:

– REACH & RoHS (EU): Confirm copper foil is free from restricted substances (e.g., lead, cadmium) above threshold levels. Provide compliance documentation for electronics applications.

– TSCA (USA): Verify that imported copper foil meets Toxic Substances Control Act requirements.

– Conflict Minerals: Although copper is not a 3TG mineral, supply chain due diligence may be required if sourced from conflict-affected regions. Some customers may request a CMRT (Conflict Minerals Reporting Template).

– Waste & Recycling: Follow local regulations for handling production scrap. Copper is recyclable, and waste streams should be managed through certified recyclers to comply with environmental standards.

Storage & Handling Best Practices

Proper warehouse procedures help preserve foil integrity:

– Store indoors on pallets, away from direct sunlight, moisture, and corrosive chemicals.

– Limit exposure to air by keeping packaging sealed until use.

– Rotate stock using FIFO (First In, First Out) to prevent long-term storage issues.

– Train personnel in safe handling to avoid scratches, creasing, or contamination from oils and dirt.

Quality Assurance & Documentation

Maintain traceability and quality throughout the supply chain:

– Provide mill test certificates (MTC) or material test reports indicating copper purity, thickness tolerance, tensile strength, and surface finish.

– Implement QC checks upon receipt and before shipment to detect damage or deviations.

– Keep records of compliance documents, shipping logs, and customer certifications for audit purposes.

By following this guide, businesses can ensure safe, efficient, and compliant logistics operations for copper foil sheet, reducing risks and supporting customer satisfaction.

Conclusion for Sourcing Copper Foil Sheet:

Sourcing copper foil sheet requires a strategic approach that balances quality, cost, supplier reliability, and specific application requirements. After evaluating various suppliers, material grades (such as electrolytic or rolled copper), thickness tolerances, surface finishes, and certifications, it is essential to select a supplier that consistently delivers high-purity copper foil meeting industry standards (e.g., ASTM B152). Additionally, considerations such as lead times, minimum order quantities, and logistical support play a critical role in ensuring uninterrupted production. Establishing long-term partnerships with reputable suppliers, preferably those with proven experience in industries like electronics, printed circuit boards (PCBs), or renewable energy, can enhance supply chain stability and product performance. Ultimately, effective sourcing of copper foil sheet supports manufacturing efficiency, product reliability, and overall cost optimization.