The global control card market is experiencing robust growth, driven by rising automation across industrial, automotive, and consumer electronics sectors. According to Grand View Research, the global industrial control systems market was valued at USD 18.9 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. This expansion is fueled by increasing demand for programmable logic control (PLC) devices, real-time monitoring solutions, and smart manufacturing technologies. Similarly, Mordor Intelligence projects that the control systems market will grow at a CAGR of over 7% during the forecast period 2023–2028, citing heightened adoption of IoT-enabled control cards and investments in Industry 4.0 infrastructure. As the backbone of automated operations, control cards are critical in ensuring precision, efficiency, and reliability across applications ranging from robotics to HVAC systems. With such strong market momentum, identifying leading manufacturers who deliver innovation, scalability, and quality has become essential for integrators and OEMs alike. Below are the top 9 control card manufacturers shaping the future of automation and industrial control.

Top 9 Control Card Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 AMCI

Domain Est. 2000

Website: amci.com

Key Highlights: AMCI is a leading US based manufacturer with a global presence. AMCI’s expertise with PLC Networked products provides the best PLC integration available….

#2 RAID Controller Cards

Domain Est. 1994

Website: broadcom.com

Key Highlights: Our RAID controllers address virtually all direct-attached storage (DAS) environments – SATA or SAS, hard drives or solid state drives (SSDs)…

#3 Allen

Domain Est. 1997

Website: rockwellautomation.com

Key Highlights: Allen Bradley industrial automation components, integrated control and information solutions from Rockwell Automation make you as productive as possible….

#4 motion control card

Domain Est. 2019

Website: wixhc.cn

Key Highlights: Wixhc technology has been used in wireless transmission and motion control for more than 20 years, accumulating different applications of tens of thousands of ……

#5 Intel® Ethernet Products

Domain Est. 1986

Website: intel.com

Key Highlights: The Intel Ethernet portfolio offers a comprehensive range of controllers and network adapters from 1-200 GbE OCP and PCIe scalable connectivity….

#6 Access Control Systems & Solutions

Domain Est. 1995

Website: security.gallagher.com

Key Highlights: Discover Gallagher’s integrated access control systems, designed to provide advanced security, ensure compliance, and improve operational efficiency….

#7 Access Control Systems & Software

Domain Est. 2004

Website: avigilon.com

Key Highlights: A complete range of access control security systems and products to safeguard every entry, turnstile, elevator, parking garage and interior space….

#8 HID Global

Domain Est. 2005

Website: hidglobal.com

Key Highlights: HID makes it easy for organizations to secure access, protect people and assets, and improve operations with confidence. Access Control Biometrics Card Printing…

#9 Universal Access Control Solutions by ELATEC

Domain Est. 2010

Website: elatec-rfid.com

Key Highlights: ELATEC RFID readers provide fast, convenient user authentication and access for all the locations, equipment and systems users need….

Expert Sourcing Insights for Control Card

H2: 2026 Market Trends for Control Cards

Looking ahead to 2026, the control card market is poised for significant transformation driven by technological innovation, evolving industrial demands, and global macroeconomic shifts. Control cards—the specialized electronic boards used to manage and regulate machinery, automation systems, and electronic devices across industries—are becoming increasingly intelligent, connected, and integrated. The following key trends are expected to define the market landscape in 2026:

1. Accelerated Adoption of AI and Edge Intelligence

By 2026, control cards will increasingly embed AI capabilities at the edge, enabling real-time decision-making without relying on cloud connectivity. This shift will be fueled by advancements in low-power AI chips and machine learning models optimized for embedded systems. Industries such as manufacturing, robotics, and smart infrastructure will deploy AI-enhanced control cards for predictive maintenance, adaptive process control, and anomaly detection, improving efficiency and reducing downtime.

2. Integration with Industrial IoT (IIoT) and Industry 4.0

The convergence with IIoT platforms will be a dominant trend. Control cards will serve as critical data gateways, collecting and transmitting operational data from machines to cloud or on-premise analytics systems. Standardized communication protocols (such as OPC UA, MQTT, and TSN) will be widely adopted, enabling seamless interoperability across heterogeneous systems. This will support digital twin implementations and closed-loop automation, enhancing visibility and control in smart factories.

3. Demand for Modular and Customizable Solutions

As applications diversify—from renewable energy systems to autonomous vehicles—there will be a growing demand for modular control cards that can be easily customized for specific functions. Vendors will increasingly offer configurable platforms with plug-and-play interfaces, allowing OEMs and system integrators to tailor performance, I/O options, and communication modules. This flexibility will shorten time-to-market and reduce development costs.

4. Focus on Cybersecurity and Functional Safety

With increased connectivity comes heightened cybersecurity risks. By 2026, control cards will feature built-in security modules, including hardware-based encryption, secure boot, and over-the-air (OTA) update capabilities with authentication. Simultaneously, compliance with functional safety standards (e.g., IEC 61508, ISO 13849) will become table stakes, especially in high-risk sectors like automotive, medical devices, and industrial automation.

5. Sustainability and Energy Efficiency

Environmental regulations and corporate ESG goals will drive demand for energy-efficient control cards. Manufacturers will focus on low-power designs, recyclable materials, and longer product lifecycles. In sectors like electric vehicle charging and solar inverters, control cards will play a crucial role in optimizing energy conversion and minimizing losses.

6. Supply Chain Resilience and Regionalization

Ongoing geopolitical tensions and past semiconductor shortages have prompted a shift toward regionalized supply chains. By 2026, we expect increased investment in local manufacturing and design hubs—particularly in North America, Europe, and Southeast Asia—to reduce dependency on single-source suppliers. This will also accelerate partnerships between control card makers and local semiconductor foundries.

7. Growth in Emerging Applications

Beyond traditional industrial automation, control cards will find expanding use in emerging domains such as:

– Smart Agriculture: For automated irrigation, climate control in greenhouses, and drone-based monitoring.

– Urban Air Mobility (UAM): In electric vertical takeoff and landing (eVTOL) aircraft for flight control systems.

– Home and Building Automation: As smart homes adopt more integrated control systems for HVAC, lighting, and security.

Conclusion

By 2026, the control card market will evolve from a component-focused industry to a strategic enabler of intelligent, connected, and sustainable systems. Success will depend on vendors’ ability to combine advanced functionality with robust security, adaptability, and supply chain agility. Companies that embrace these trends early will be well-positioned to lead in the next era of automation and digital transformation.

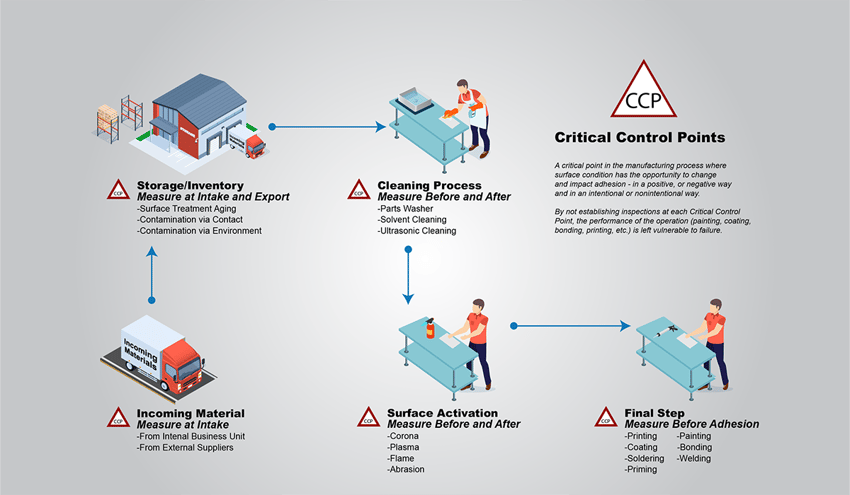

Common Pitfalls Sourcing Control Cards (Quality, IP)

Sourcing control cards—especially for electronics, automation, or proprietary systems—can be fraught with challenges related to both quality and intellectual property (IP). Failing to address these pitfalls can lead to product failures, legal liabilities, and supply chain disruptions. Below are key issues to watch for:

Poor Quality Components and Manufacturing

One of the most frequent issues when sourcing control cards is receiving units that do not meet performance or durability standards. This often stems from suppliers using substandard components, inadequate testing procedures, or inconsistent manufacturing processes. Low-quality control cards may fail prematurely, cause system malfunctions, or require costly rework and replacements.

Counterfeit or Non-Compliant Parts

The risk of counterfeit integrated circuits (ICs), microcontrollers, or passive components is significant, especially when sourcing from non-franchised or gray-market suppliers. Fake or recycled parts can mimic genuine components but fail under operational stress, leading to unreliable system behavior and safety hazards. Additionally, control cards may not comply with industry standards (e.g., RoHS, UL, CE), which can prevent market entry or violate regulatory requirements.

Lack of Traceability and Documentation

Reputable sourcing requires full traceability of components and manufacturing processes. Without proper documentation—such as bills of materials (BOMs), test reports, and certifications—it becomes difficult to verify quality, troubleshoot issues, or ensure compliance. Inadequate traceability also complicates recall management and quality audits.

Intellectual Property (IP) Infringement

Sourcing control cards from third parties, particularly offshore manufacturers, increases the risk of unintentional IP violations. This includes using cloned firmware, replicated circuit designs, or software libraries without proper licensing. Such actions can expose your company to legal action, cease-and-desist orders, and damage to brand reputation.

Insufficient IP Protection in Contracts

Many procurement agreements fail to clearly define IP ownership, especially for custom-designed control cards. Without explicit clauses, suppliers may retain rights to design improvements or reuse your designs for other clients. This undermines competitive advantage and can lead to disputes over ownership and usage rights.

Reverse Engineering and Design Theft

Untrusted suppliers may reverse engineer your control card designs to replicate or sell them to competitors. This is particularly concerning when sharing detailed schematics, layout files, or firmware. Without robust non-disclosure agreements (NDAs) and secure development practices, your proprietary technology becomes vulnerable.

Inadequate Testing and Validation

Some suppliers provide control cards that pass only basic functionality checks, missing rigorous environmental, thermal, or EMI testing. Without thorough validation, these cards may fail under real-world operating conditions, leading to field failures and increased warranty costs.

Over-Reliance on Single or Unverified Suppliers

Depending on a single source—especially one without a proven track record—increases supply chain risk. If the supplier delivers low-quality units or faces production issues, your entire project timeline can be jeopardized. Verifying supplier资质, conducting audits, and having backup sources are essential risk mitigation strategies.

Avoiding these pitfalls requires due diligence in supplier selection, clear contractual terms protecting IP, strict quality controls, and ongoing supply chain monitoring.

Logistics & Compliance Guide for Control Card

This guide outlines the essential logistics and compliance considerations for managing Control Cards within regulated environments, particularly in industries such as pharmaceuticals, medical devices, or quality assurance. Proper handling ensures traceability, regulatory compliance, and operational integrity.

Purpose of the Control Card

The Control Card serves as a documented record that tracks the status, location, and handling of controlled items or documentation throughout their lifecycle. It ensures accountability and supports audit readiness by providing a verifiable trail of actions taken.

Key Logistics Procedures

- Issuance: Control Cards must be issued by authorized personnel only, with clear documentation of issue date, recipient, and item details.

- Tracking: Maintain a centralized log or digital system to monitor the real-time status and movement of each Control Card.

- Storage: Store physical Control Cards in a secure, access-controlled environment. Digital versions must be stored on encrypted, backed-up systems with user access logs.

- Transfer: Any transfer of responsibility must be formally documented on the Control Card, including signatures or electronic approvals.

- Return & Closure: Upon completion of the process, the Control Card must be returned to the issuing authority for review and formal closure.

Compliance Requirements

- Regulatory Alignment: Ensure Control Card processes comply with relevant standards such as ISO 13485, FDA 21 CFR Part 820, or EU MDR, as applicable.

- Audit Trail: Maintain a complete, unalterable audit trail. Modifications must be tracked with timestamps, user IDs, and change rationale.

- Retention Period: Retain Control Cards for the duration specified by regulatory requirements—typically a minimum of 5–10 years post-product lifecycle, depending on jurisdiction and product type.

- Training: Personnel involved in handling Control Cards must receive documented training on procedures and compliance obligations.

- Inspection Readiness: Control Cards must be readily available for internal audits or regulatory inspections with minimal retrieval time.

Roles & Responsibilities

- Quality Assurance (QA): Oversees Control Card system integrity, conducts periodic audits, and ensures compliance.

- Logistics/Operations Staff: Responsible for accurate completion, timely transfer, and secure handling.

- Document Control Manager: Maintains master copies, version control, and archive management.

Best Practices

- Use standardized templates for consistency.

- Implement barcode or RFID tagging for digital tracking.

- Conduct periodic reconciliation of Control Cards against inventory or process records.

- Automate workflows where possible to reduce human error and improve traceability.

Adhering to this guide ensures that Control Card management supports both efficient logistics and stringent regulatory compliance.

Conclusion for Sourcing Control Card:

In conclusion, the implementation of a Sourcing Control Card serves as a vital tool in ensuring procurement efficiency, compliance, and supply chain transparency. It enables organizations to standardize sourcing processes, monitor supplier performance, mitigate risks, and maintain cost control. By clearly defining approval workflows, supplier qualifications, and key procurement criteria, the sourcing control card enhances accountability and supports strategic decision-making. Its consistent use fosters vendor reliability, reduces operational disruptions, and aligns purchasing activities with organizational objectives. Ultimately, the sourcing control card is a cornerstone of effective procurement governance and sustainable supply chain management.