The global container totes market is experiencing robust growth, driven by increasing demand for efficient, reusable logistics solutions across industries such as retail, manufacturing, and cold chain logistics. According to Grand View Research, the global intermediate bulk container (IBC) totes market was valued at USD 3.3 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This surge is fueled by rising emphasis on supply chain sustainability, advancements in material durability, and regulatory support for reusable packaging. As e-commerce and just-in-time inventory systems continue to scale globally, the need for standardized, stackable, and durable container totes has made them a cornerstone of modern material handling. In this competitive landscape, a select group of manufacturers stand out for their innovation, global reach, and data-backed performance—shaping the future of bulk transportation and storage.

Top 10 Container Totes Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Industrial Tote Systems & Bins for Bulk Material Handling

Domain Est. 1997

Website: totesystems.com

Key Highlights: Tote® Systems specializes in manufacturing high-quality stainless steel tote bins and material handling equipment for dry powder and liquid applications….

#2 Sæplast

Domain Est. 2002

Website: saeplast.com

Key Highlights: Discover Sæplast insulated containers built for fisheries, food, recycling, and logistics. Trusted worldwide for durability, sustainability, and innovation….

#3 Encore Container

Domain Est. 2012

Website: encorecontainer.com

Key Highlights: Encore Container is a leading manufacturer and reconditioner of IBC totes and drums, headquartered in SC. Request free collection of empties….

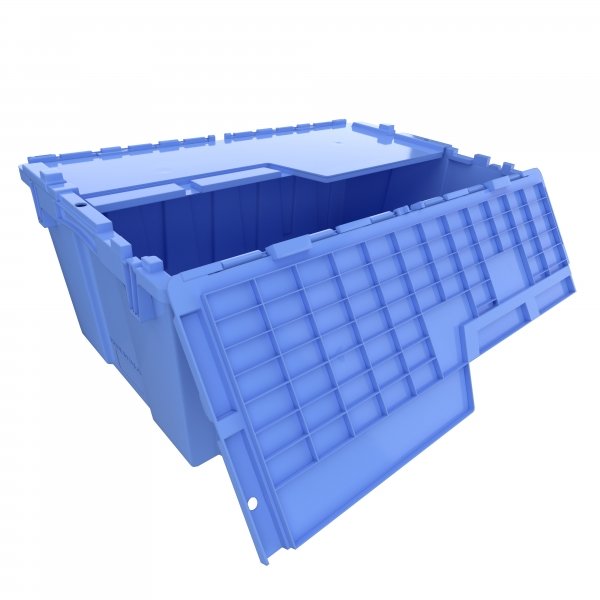

#4 Plastic Tote Box Manufacturer

Domain Est. 2015

Website: versatote.com

Key Highlights: We design, tool and manufacture plastic tote boxes – all in house! Our robust storage boxes are designed with longevity in mind….

#5 Beverage & Food Packaging

Domain Est. 1995

Website: dartcontainer.com

Key Highlights: From to-go containers and dinnerware to tamper-evident food packaging, our products have been keeping people on the go and having fun for 60+ years….

#6 Sterilite > Storage > Totes

Domain Est. 1996

#7 Snyder Industries: Poly Tanks

Domain Est. 1998

Website: snydernet.com

Key Highlights: Snyder Industries manufactures plastic & steel tanks, IBC totes, bins, containers, pallets & more including custom products….

#8 IBC Totes For Sale

Domain Est. 2003

Website: ibctanks.com

Key Highlights: Your Go-To Source for IBC Containers. IBC Tanks provides the best selection of intermediate bulk containers for sale at the industry’s most competitive ……

#9 Stackable containers

Domain Est. 2008

Website: utzgroup.com

Key Highlights: Stackable containers are engineered to meet the demands of modern supply chains, offering a balance of strength, flexibility, and efficiency….

#10 Smurfit Westrock

Domain Est. 2023

Website: smurfitwestrock.com

Key Highlights: We create, design and manufacture paper-based packaging made from renewable materials that protect and promote our customers’ products. In 2024, we manufactured ……

Expert Sourcing Insights for Container Totes

2026 Market Trends for Container Totes

The global container tote market is poised for significant evolution by 2026, driven by shifting logistics demands, technological advancements, and growing sustainability imperatives. As supply chains become increasingly complex and environmentally conscious, container totes—also known as bulk containers, IBCs (Intermediate Bulk Containers), or pallet boxes—are adapting to meet new challenges and opportunities.

Increased Demand for Sustainable and Reusable Solutions

By 2026, environmental regulations and corporate sustainability goals will heavily influence the container tote market. Companies will prioritize reusable totes made from recyclable materials such as recycled HDPE or PP to reduce single-use plastic waste. Circular economy models—including take-back programs and tote pooling systems—will gain traction, especially in industries like food & beverage, pharmaceuticals, and automotive. Biodegradable or compostable tote options may emerge in niche applications, though durability and cost remain barriers to widespread adoption.

Smart Container Integration and IoT Adoption

The integration of IoT (Internet of Things) sensors into container totes will accelerate by 2026. Smart totes equipped with GPS, temperature, humidity, and fill-level sensors will enable real-time tracking and condition monitoring across supply chains. This trend is particularly vital for cold chain logistics and high-value goods. Data collected from smart totes will enhance inventory accuracy, reduce loss, and improve predictive maintenance of returnable assets, increasing overall operational efficiency.

Growth in E-Commerce and Last-Mile Logistics

The expansion of e-commerce will drive demand for standardized, stackable, and durable container totes in fulfillment centers and last-mile delivery networks. Retailers and logistics providers will invest in collapsible or foldable totes that optimize warehouse space and reduce return freight costs. Lightweight yet robust designs will be favored to improve fuel efficiency and ease of handling in high-throughput environments.

Regional Market Diversification and Localization

While North America and Europe maintain strong demand due to mature logistics infrastructure and strict environmental standards, the Asia-Pacific region—especially China, India, and Southeast Asia—will experience the fastest growth. This surge will be fueled by industrialization, rising consumer demand, and investments in cold chain and pharmaceutical logistics. Localization of manufacturing and supply networks will also encourage regional customization of tote designs to meet specific regulatory and operational requirements.

Material and Design Innovation

By 2026, material science advancements will yield container totes with improved strength-to-weight ratios, UV resistance, and chemical compatibility. Hybrid materials and multi-layer composites will offer enhanced protection for sensitive cargo. Design innovations—such as modular totes, integrated handling features, and improved drainage or cleaning mechanisms—will support automation in warehouses and reduce labor costs.

Regulatory Compliance and Standardization

As global trade evolves, compliance with international safety and hygiene standards (e.g., FDA, ISO, UN) will be critical. Container totes used in food, pharmaceutical, and hazardous material transport will require certifications and traceability. Industry-wide standardization efforts will continue to streamline interoperability across supply chains, reducing handling inefficiencies.

In conclusion, the 2026 container tote market will be shaped by sustainability, digitalization, and operational efficiency. Companies that invest in smart, reusable, and compliant tote solutions will gain a competitive edge in an increasingly dynamic and environmentally aware logistics landscape.

Common Pitfalls Sourcing Container Totes (Quality, IP)

Poor Material Quality and Durability

One of the most frequent issues when sourcing container totes is receiving products made from substandard materials. Low-grade plastics can lead to brittleness, cracking under stress, or failure in extreme temperatures. Buyers may unknowingly receive totes that don’t meet load-bearing or environmental specifications, resulting in damaged goods and safety hazards.

Inconsistent Dimensional Accuracy

Container totes that do not adhere to standard dimensions can cause logistical problems, especially when used in automated systems or standardized racking. Slight variations in size or shape due to poor mold quality or manufacturing inconsistencies can prevent proper stacking or fitting into transport containers, reducing efficiency.

Lack of Load Capacity Verification

Many suppliers overstate the dynamic and static load ratings of their container totes. Without third-party testing or certification, buyers risk purchasing totes that collapse under normal operational loads, leading to product damage, workplace injuries, and increased replacement costs.

Counterfeit or IP-Infringing Designs

Sourcing from unvetted suppliers increases the risk of receiving container totes that infringe on intellectual property (IP) rights. Many popular tote designs are patented or trademarked. Using counterfeit versions can expose companies to legal liability, fines, and supply chain disruptions if enforcement actions are taken.

Misrepresentation of Compliance and Certifications

Suppliers may falsely claim compliance with industry standards such as NSF, FDA, or EU food safety regulations. Without proper documentation or verifiable certifications, totes may not be suitable for food-grade, pharmaceutical, or cleanroom applications, putting end-users at regulatory risk.

Inadequate Traceability and Supplier Transparency

A lack of transparency in the supply chain—such as unknown manufacturing origins or untraceable production batches—can hinder quality control and recall management. This opacity makes it difficult to address defects or verify ethical and environmental practices.

Hidden Costs from Low-Cost Suppliers

While some suppliers offer attractively low prices, hidden costs often emerge from poor quality, higher defect rates, shipping delays, or the need for reordering. These factors can outweigh initial savings and disrupt operations, particularly when totes fail prematurely in the field.

Logistics & Compliance Guide for Container Totes

Container totes, also known as intermediate bulk containers (IBCs), are widely used for transporting and storing bulk liquids, semi-solids, and granulated materials. Ensuring safe, efficient logistics and compliance with international regulations is essential. This guide outlines key considerations for handling, transporting, and complying with standards when using container totes.

Design and Construction Standards

Container totes must conform to internationally recognized design and safety standards. The most common include:

– UN Certification: Totes used for hazardous materials must be UN-certified (e.g., UN 11A/Y), indicating compliance with performance testing for drop, stack, and hydraulic pressure.

– ISO Standards: IBCs should meet ISO 18180 for general requirements and testing procedures.

– Material Compatibility: Totes must be constructed from materials compatible with the intended contents (e.g., high-density polyethylene for chemicals, stainless steel for food-grade products).

Regulatory Compliance

Compliance with transportation and safety regulations is mandatory across all modes of transport:

– DOT (U.S. Department of Transportation): Governs domestic transport of hazardous materials. Requires proper labeling, marking, and documentation.

– IMDG Code (International Maritime Dangerous Goods): Applies to sea freight. Mandates UN-certified packaging, hazard class labeling, and stowage requirements.

– ADR (European Agreement concerning the International Carriage of Dangerous Goods by Road): Regulates road transport in Europe.

– IATA Dangerous Goods Regulations: Applies to air transport; stricter than other modes, especially regarding weight and packaging.

Labeling and Documentation

Proper labeling and documentation are critical for regulatory compliance and safety:

– Hazard Labels: Include GHS pictograms, hazard class, UN number, and proper shipping name.

– Durability: Labels must be weather-resistant and affixed securely to remain legible during transport.

– Shipping Papers: Include Safety Data Sheets (SDS), dangerous goods declarations, and transport manifests.

– Tracking: Use barcodes or RFID tags for inventory and traceability.

Handling and Storage

Safe handling procedures reduce risk of spills, damage, and worker injury:

– Forklift Compatibility: Totes must be lifted using the designated base pallet; never by the tote body or top cage.

– Stacking: Only stack certified stackable IBCs, and never exceed the manufacturer’s specified stack height.

– Storage Environment: Store indoors when possible; protect from direct sunlight, extreme temperatures, and incompatible substances.

– Secondary Containment: Use spill pallets or bunded areas to contain leaks.

Cleaning and Reuse

For reusable container totes:

– Decontamination: Thoroughly clean and purge residues, especially when switching contents.

– Inspection: Check for cracks, deformation, or degradation before reuse.

– Certification Renewal: Re-certify periodically if used for regulated materials.

Environmental and Sustainability Considerations

- Recyclability: Many plastic totes are recyclable; follow local waste regulations.

- Returnable Systems: Use closed-loop logistics to return empty totes for reuse, reducing waste and cost.

- Spill Prevention: Implement containment and response plans to prevent environmental contamination.

Training and Safety

Personnel must be trained in:

– Hazardous material handling (if applicable)

– Proper lifting and transport techniques

– Emergency response (spill containment, PPE use)

– Regulatory requirements for transport and storage

Adhering to this logistics and compliance guide ensures the safe, legal, and efficient use of container totes across supply chains. Always consult the latest regulatory updates and manufacturer guidelines for your specific application.

Conclusion for Sourcing Container Totes

After a thorough evaluation of suppliers, materials, cost structures, durability, and logistical requirements, sourcing container totes is a strategic decision that can significantly enhance supply chain efficiency, improve inventory management, and reduce long-term operational costs. The selected totes meet necessary industry standards for strength, stackability, and reusability, ensuring compatibility with existing handling equipment and storage systems.

Prioritizing suppliers that offer high-quality, customizable, and sustainable options not only supports environmental goals but also contributes to a reliable and scalable supply chain. Additionally, building partnerships with vendors who provide consistent lead times, strong customer service, and opportunities for volume discounts will further maximize return on investment.

In conclusion, the recommended sourcing strategy balances cost-effectiveness with performance and sustainability, positioning the organization for improved material handling, reduced waste, and long-term operational resilience. Ongoing supplier performance reviews and periodic market analysis will ensure continued optimization of the container tote supply chain.