The container room market has experienced robust growth in recent years, driven by rising demand for modular, sustainable, and cost-effective construction solutions across residential, commercial, and industrial sectors. According to a report by Mordor Intelligence, the global modular construction market—of which container-based buildings are a key segment—is projected to grow at a CAGR of over 7.5% from 2023 to 2028. This expansion is fueled by shortened construction timelines, increasing urbanization, and stronger regulatory support for green building practices. Additionally, Grand View Research values the modular construction market at USD 133.8 billion in 2022, with expectations for continued acceleration due to innovations in off-site fabrication and growing adoption in emergency housing, pop-up retail, and remote infrastructure projects. As demand surges, manufacturers specializing in container rooms are scaling production, enhancing design flexibility, and integrating smart technologies to meet diverse client needs. Below, we spotlight the top 9 container room manufacturers leading this transformation through innovation, quality, and market responsiveness.

Top 9 Container Room Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

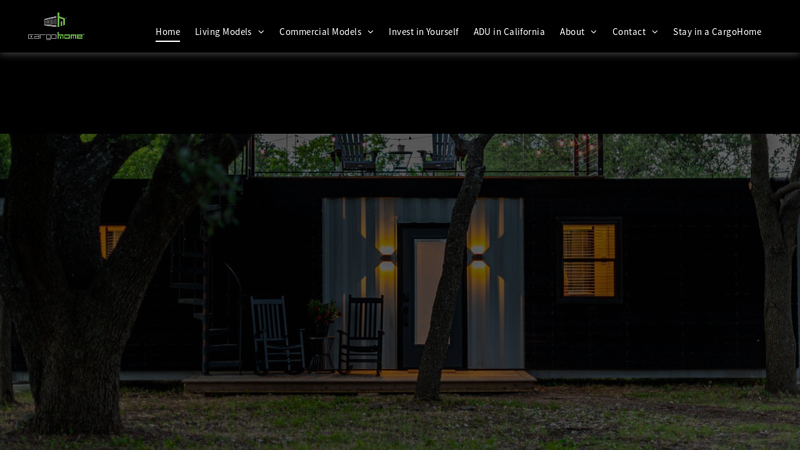

#1 Cargo

Domain Est. 1999

Website: cargohome.com

Key Highlights: By repurposing industrial-grade containers and transforming them into modern residences, Cargo Home delivers housing that feels timeless, practical, and ……

#2 TD Container

Domain Est. 2014

Website: tdcontainer.com

Key Highlights: TD Container is a leading Chinese container house manufacturer offering a wide range of flat-pack houses, shipping containers, and prefab homes worldwide….

#3

Domain Est. 2021

Website: sicontainerbuilds.com

Key Highlights: Whether you’re looking to generate rental revenue or build a functional space to work from home, S.I. Container Builds works to ‘Build For Your Purpose’ all ……

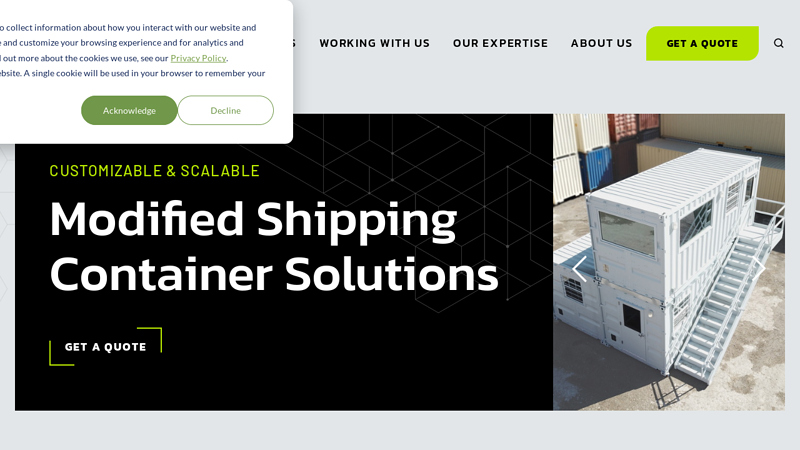

#4 Customizable & Scalable Modified Shipping Container Solutions

Domain Est. 2009

Website: falconstructures.com

Key Highlights: Falcon Structures is the leader in repurposing shipping containers that are fully customized or ordered at scale for a variety of organizations nationwide….

#5 Giant Containers

Domain Est. 2013

Website: giantcontainers.com

Key Highlights: Discover innovative custom modular shipping containers in North America. Transform your space with our unique designs. Get your free quote today!…

#6 Custom Shipping Containers for Living, Workspaces, and Storage

Domain Est. 2015

Website: customcontainerliving.com

Key Highlights: Explore custom shipping containers for homes, offices, or storage. Durable, stylish, and eco-friendly solutions built to match your needs….

#7 Container Homes USA

Domain Est. 2015

Website: containerhomesusa.com

Key Highlights: Our modular container homes turn your needs into reality. No matter what your “why” is, we can get it done, affordably, just the way you want….

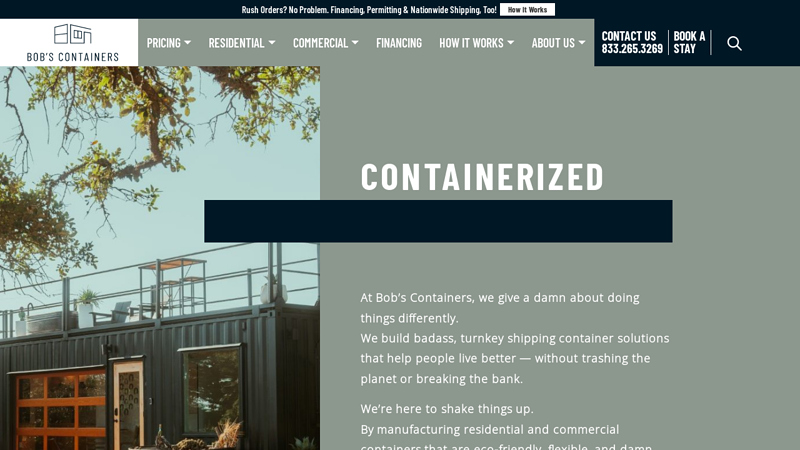

#8 Bob’s Containers

Domain Est. 2019

Website: bobscontainers.com

Key Highlights: By manufacturing residential and commercial containers that are eco-friendly, flexible, and damn good-looking, we’re cutting the crap out of traditional ……

#9 Craftspace

Domain Est. 2020

Website: craftspaceinc.com

Key Highlights: Shipping Container Homes & Cabins. Craftspace creates prefabricated shipping container homes and cabins that are a great fit for the backyard and beyond….

Expert Sourcing Insights for Container Room

2026 Market Trends for Container Rooms

Rising Demand for Sustainable and Modular Living Solutions

By 2026, the global demand for container rooms is projected to grow significantly, driven by increasing awareness of sustainable construction practices. As governments and consumers prioritize eco-friendly alternatives, repurposed shipping containers offer a low-carbon footprint housing and commercial solution. The upcycling of steel containers reduces construction waste and energy consumption compared to traditional building methods. Urban planners and developers are increasingly adopting container rooms for affordable housing, pop-up retail, student accommodations, and disaster relief shelters, accelerating market expansion.

Technological Integration and Smart Container Rooms

Advancements in smart home technology and IoT are shaping the next generation of container rooms. By 2026, a growing number of container units are expected to feature integrated energy-efficient systems, solar panels, smart climate control, and modular automation. Prefabrication techniques combined with digital design tools (such as BIM and 3D modeling) allow for faster customization and precision manufacturing. This technological shift enhances user experience, reduces on-site construction time, and expands the appeal of container rooms beyond temporary structures to long-term, high-comfort living spaces.

Expansion in Commercial and Hybrid Applications

While initially popular for residential and temporary uses, container rooms are diversifying into commercial applications. By 2026, industries such as hospitality (container hotels and glamping), retail (pop-up stores and kiosks), education (modular classrooms), and healthcare (mobile clinics) are expected to utilize container-based structures at a larger scale. Hybrid designs—combining containers with traditional building materials—are gaining traction, offering aesthetic flexibility and improved insulation. This versatility positions container rooms as scalable, cost-effective solutions in both urban and remote environments.

Regional Market Growth and Regulatory Support

The Asia-Pacific region, particularly China, India, and Southeast Asia, is anticipated to lead the container room market by 2026 due to rapid urbanization and infrastructure development. North America and Europe will also see growth, supported by green building regulations and incentives for modular construction. Governments are increasingly updating zoning laws and building codes to accommodate container architecture, reducing previous regulatory barriers. This evolving policy environment will further legitimize and accelerate the adoption of container rooms across public and private sectors.

Challenges and Future Outlook

Despite positive trends, the container room market faces challenges such as thermal insulation limitations, perception issues related to durability and aesthetics, and supply chain fluctuations for used containers. However, ongoing innovations in insulation materials, anti-corrosion treatments, and architectural design are mitigating these concerns. By 2026, the global container room market is expected to reach multi-billion dollar valuation, fueled by sustainability goals, urban density pressures, and the need for rapid, adaptable infrastructure.

Common Pitfalls When Sourcing Container Rooms (Quality, IP)

Poor Structural Quality and Workmanship

One of the most frequent issues when sourcing container rooms is substandard build quality. Many suppliers cut corners by using thin-gauge steel, inadequate insulation, or improper welding techniques. This can lead to structural weakness, poor thermal performance, and reduced durability, especially in harsh weather conditions. Buyers may also encounter misaligned doors, leaking seams, or premature rust due to poor surface treatment.

Inadequate or Non-Compliant Insulation

Insulation is critical for habitable container rooms, yet many low-cost suppliers use insufficient or low-grade materials like poor-density foam or single-layer vapor barriers. This results in uncomfortable interior temperatures, condensation buildup, and higher energy costs. Additionally, some insulation solutions may not meet local building codes or fire safety standards, creating regulatory and safety risks.

Lack of Waterproofing and Weatherproofing

Container rooms must be fully sealed against moisture, but poorly manufactured units often have gaps around doors, windows, and roof joints. Inadequate sealants or improper installation of cladding can lead to water ingress, mold growth, and structural degradation over time. This is especially problematic in humid or rainy climates.

Use of Non-Original or Counterfeit Components

Some suppliers use counterfeit or off-brand electrical fixtures, HVAC units, or plumbing components to reduce costs. These parts may not meet safety certifications, fail prematurely, or void insurance coverage. Buyers should verify component authenticity and compliance with regional standards (e.g., UL, CE, RoHS).

Intellectual Property (IP) Infringement Risks

Sourcing container rooms—especially from overseas manufacturers—can expose buyers to IP violations. Some suppliers replicate patented modular designs, proprietary connection systems, or branded architectural features without authorization. Importing such units may result in customs seizures, legal disputes, or liability for contributory infringement, particularly in markets with strong IP enforcement (e.g., EU, U.S.).

Hidden Design or Manufacturing Defects

Container rooms are often sold based on marketing images or prototypes, but delivered units may deviate significantly. Common issues include incorrect dimensions, missing outlets, or non-functional layouts. Without clear contracts and third-party inspections, buyers have limited recourse for design flaws or misrepresentation.

Non-Compliance with Local Building Codes and Standards

Container rooms must meet zoning, safety, and construction regulations in their destination country. Many imported units fail to comply with requirements for egress, electrical wiring, fire resistance, or foundation systems. This can prevent legal occupancy and lead to costly retrofits or demolition.

Insufficient Documentation for IP and Compliance

Reputable suppliers should provide proof of design ownership, material certifications, and test reports. A red flag is the absence of technical documentation or refusal to disclose manufacturing processes. Without proper paperwork, buyers cannot verify IP legitimacy or regulatory compliance, increasing project risk.

Overlooking Service and After-Sales Support

Many container room suppliers, particularly offshore ones, offer little to no after-sales service. If quality issues arise or modifications are needed, buyers may face long delays, language barriers, or unresponsive support—exacerbating problems related to both quality and IP concerns.

Failure to Conduct Supplier Due Diligence

Rushing the sourcing process without vetting suppliers increases exposure to both quality defects and IP risks. Buyers should inspect manufacturing facilities, request references, and conduct third-party quality audits. Skipping these steps often results in receiving subpar or infringing products.

Logistics & Compliance Guide for Container Rooms

Overview

Container rooms—repurposed shipping containers used as modular buildings—offer a cost-effective, sustainable, and rapidly deployable solution for offices, retail spaces, housing, and more. However, their transport, placement, and use are governed by various logistical and regulatory requirements. This guide outlines key considerations to ensure a smooth and compliant container room project.

Transportation & Delivery Logistics

Proper planning is essential to move container rooms safely and efficiently from manufacturer or storage to the final site.

-

Route Assessment

Evaluate road width, overhead clearance (bridges, power lines), turning radius, and traffic restrictions. Notify local authorities if oversized loads require permits. -

Permits for Oversized Loads

Most container rooms exceed standard road dimensions. Secure transport permits from state or provincial transportation departments. Costs and processing times vary by jurisdiction. -

Equipment Requirements

Use heavy-duty flatbed trucks for transport. Unloading typically requires a crane or telehandler with sufficient lifting capacity. Confirm site access for such equipment. -

Delivery Timing

Schedule deliveries during off-peak hours to minimize traffic disruption. Coordinate with utility companies if temporary service interruptions are expected.

Site Preparation & Placement

A well-prepared site ensures stability, safety, and compliance with building codes.

-

Foundation & Leveling

Container rooms require a stable, level foundation. Options include concrete pads, piers, or gravel beds. Local building codes may specify frost depth and load-bearing requirements. -

Access & Egress

Ensure adequate space for delivery vehicles and future maintenance. Provide clear access paths for occupants, especially for emergency egress in commercial or residential use. -

Utilities Connection

Plan for electrical, plumbing, HVAC, and data connections. Work with licensed contractors to meet local utility standards. Temporary hookups may be needed during installation.

Building Code & Zoning Compliance

Container rooms must comply with local zoning, land use, and construction regulations.

-

Zoning Approval

Verify that the intended use (e.g., office, dwelling, retail) is permitted in the zoning district. Some areas restrict temporary or modular structures. -

Building Permits

Submit plans for review by the local building department. Include structural details, insulation, fire safety, and egress plans. Modifications (e.g., cutting windows, adding stairs) often require engineering stamps. -

International Building Code (IBC) & Local Amendments

Container rooms must meet IBC standards for occupancy, wind, snow, and seismic loads. Local amendments may impose additional requirements based on climate and geography.

Safety & Fire Regulations

Ensure occupant safety through compliance with fire codes and structural standards.

-

Fire Resistance & Sprinklers

Use fire-rated insulation and materials. In commercial or multi-occupancy settings, automatic sprinkler systems may be required. -

Smoke Detectors & Exits

Install code-compliant smoke alarms and ensure at least two accessible exits for rooms over a certain size or occupancy. -

Electrical & Gas Safety

All electrical and gas installations must be performed by licensed professionals and pass inspection. Use GFCI outlets in wet areas.

Environmental & Sustainability Compliance

Container rooms offer sustainability benefits, but proper handling is critical.

-

Asbestos & Lead Paint

Older shipping containers may contain hazardous materials. Conduct environmental testing before modification. Hire certified abatement professionals if needed. -

Stormwater Management

Implement drainage solutions to prevent runoff and erosion, especially on impermeable surfaces. May require compliance with local environmental regulations. -

Energy Efficiency

Insulate walls, roof, and floor to meet local energy codes. Consider solar panels, efficient HVAC, and LED lighting to reduce environmental impact.

Accessibility Standards

Ensure container rooms are accessible to all users, particularly in public or commercial settings.

-

ADA Compliance (U.S.) or Equivalent

Provide accessible entrances, ramps, door widths (minimum 32”), turning radius (5’ diameter), and accessible fixtures (sinks, counters, toilets) where applicable. -

Design for Inclusivity

Even in non-mandated cases, consider universal design principles to improve usability for people of all ages and abilities.

Import & Customs Considerations (International Projects)

For container rooms sourced overseas, customs and import compliance is essential.

-

Customs Documentation

Provide bill of lading, commercial invoice, packing list, and certificate of origin. Classify the container under the correct HS code (typically 9406.00 for prefabricated buildings). -

Duties & Taxes

Import duties vary by country. In the U.S., container rooms may be duty-free if classified as modular structures, but VAT or GST may apply elsewhere. -

Biosecurity & Pest Inspection

Some countries require fumigation certificates or inspection for wood components to prevent pest introduction.

Maintenance & Long-Term Compliance

Ongoing upkeep ensures continued safety and regulatory adherence.

-

Structural Integrity Checks

Regularly inspect for corrosion, foundation settling, and structural fatigue—especially in coastal or high-moisture environments. -

Permit Renewals & Inspections

Temporary structures may require annual renewals. Schedule periodic inspections for fire, electrical, and plumbing systems. -

Decommissioning & Relocation

Plan for end-of-life scenarios. Remove the unit responsibly, restore the site, and recycle materials where possible.

Conclusion

Successfully deploying a container room requires coordination across logistics, engineering, and regulatory domains. By proactively addressing transportation, site, code, and safety requirements, you can ensure a compliant, durable, and functional space. Always consult local authorities and licensed professionals during planning and execution.

Conclusion for Sourcing Container Rooms

Sourcing container rooms presents a cost-effective, sustainable, and versatile solution for a wide range of accommodation, commercial, and industrial needs. The repurposing of shipping containers into functional spaces offers numerous advantages, including faster construction timelines, reduced environmental impact, and high mobility. As demand for modular and flexible building solutions continues to grow, container rooms have emerged as a smart alternative to traditional construction methods.

When sourcing container rooms, it is essential to partner with reputable suppliers who adhere to quality standards, provide customization options, and ensure compliance with local building codes and regulations. Key considerations such as insulation, structural integrity, safety features, and long-term durability must be thoroughly evaluated to ensure the suitability of the container for its intended use.

Additionally, conducting a comprehensive cost-benefit analysis—including transportation, modifications, and installation—will help in making informed procurement decisions. By leveraging the modular nature and scalability of container rooms, businesses and organizations can achieve scalable, eco-friendly, and rapidly deployable infrastructure solutions.

In conclusion, with proper planning, due diligence, and collaboration with experienced providers, sourcing container rooms is a strategic investment that aligns with modern needs for agility, sustainability, and efficiency in the built environment.