Sourcing Guide Contents

Industrial Clusters: Where to Source Contact Lenses Wholesale China

SourcifyChina Sourcing Intelligence Report 2026

Sector: Medical & Vision Care – Contact Lenses (Wholesale)

Focus: China Manufacturing Clusters & Regional Sourcing Strategy

Prepared For: Global Procurement & Supply Chain Leaders

Executive Summary

China remains the world’s leading manufacturing hub for disposable and corrective contact lenses, driven by mature industrial ecosystems, competitive labor costs, and increasing regulatory compliance with international standards (ISO 13485, CE, FDA). This report provides a strategic deep-dive into the key industrial clusters producing contact lenses at scale for wholesale export. The analysis evaluates regional strengths in price competitiveness, product quality, and supply chain lead time, enabling procurement managers to align sourcing strategies with business objectives — whether cost leadership, premium quality, or speed-to-market.

Key Industrial Clusters for Contact Lens Manufacturing in China

China’s contact lens production is concentrated in two primary provinces: Guangdong and Zhejiang, with emerging capabilities in Jiangsu and Shanghai. These clusters benefit from proximity to raw material suppliers (e.g., hydrogel/ silicone hydrogel polymers), precision molding technology, and export logistics infrastructure.

1. Guangdong Province – The Export Powerhouse

- Primary City: Guangzhou, Shenzhen, Dongguan

- Profile: High-volume OEM/ODM manufacturers catering to global distributors and private-label brands.

- Strengths:

- Strong export infrastructure (proximity to Guangzhou Nansha and Shenzhen Yantian ports)

- Mature supply chain for packaging, sterilization, and logistics

- High compliance with international regulatory standards

- Product Focus: Daily disposables, 2-week, and monthly lenses; colored cosmetic lenses (high demand in EU/US markets)

2. Zhejiang Province – Precision & Mid-Tier Quality

- Primary City: Hangzhou, Ningbo, Wenzhou

- Profile: Mid-sized manufacturers with strong engineering capabilities and focus on process control.

- Strengths:

- Advanced CNC molding and automation

- Strong R&D investment in lens hydration and oxygen permeability

- Competitive pricing with better consistency than lower-tier regions

- Product Focus: Silicone hydrogel lenses, toric and multifocal variants

3. Jiangsu/Shanghai – High-End & Regulatory-Focused

- Primary City: Suzhou, Shanghai

- Profile: Joint ventures and Sino-foreign partnerships producing FDA/CE-compliant lenses.

- Strengths:

- Proximity to multinational R&D centers

- Higher adherence to GMP and ISO 13485

- Preferred for regulated markets (North America, EU)

- Product Focus: Premium daily disposables, specialty lenses (keratoconus, post-surgical)

Comparative Analysis: Key Production Regions

| Region | Price Competitiveness (1–5) | Quality Tier | Average Lead Time (Days) | Best For | Regulatory Compliance |

|---|---|---|---|---|---|

| Guangdong | 5 (Lowest) | Mid to High (Tier 2–3) | 25–35 | High-volume private label, cost-sensitive markets | Strong (CE, ISO 13485); select FDA-ready |

| Zhejiang | 4 | Mid-High (Tier 2) | 30–40 | Balanced cost/quality; stable OEM partnerships | Moderate to Strong (CE, ISO); some FDA audits |

| Jiangsu/Shanghai | 3 (Higher) | High (Tier 1) | 40–50 | Premium brands, regulated markets | Excellent (FDA, CE, ISO 13485 certified) |

Note: Tier 1 = Premium medical-grade; Tier 2 = Commercial-grade with consistent QC; Tier 3 = Budget-focused with variable QC

Strategic Sourcing Recommendations

- For Cost-Driven Procurement:

- Prioritize Guangdong-based suppliers with ISO 13485 certification.

- Leverage volume discounts but conduct third-party QC audits (e.g., SGS, TÜV) pre-shipment.

-

Ideal for emerging markets or budget retail chains.

-

For Balanced Cost-Quality Mix:

- Engage Zhejiang manufacturers with in-house R&D and automation.

- Suitable for mid-tier optical distributors and e-commerce brands.

-

Ensure documentation for CE marking is available.

-

For Regulated or Premium Markets (US, EU, Australia):

- Source from Jiangsu or Shanghai facilities with FDA 510(k) or CE Class IIa certification.

- Accept longer lead times and higher unit costs for compliance assurance.

- Partner with suppliers experienced in clinical data submission support.

Risk Mitigation & Due Diligence Checklist

- ✅ Verify medical device registration status in target market.

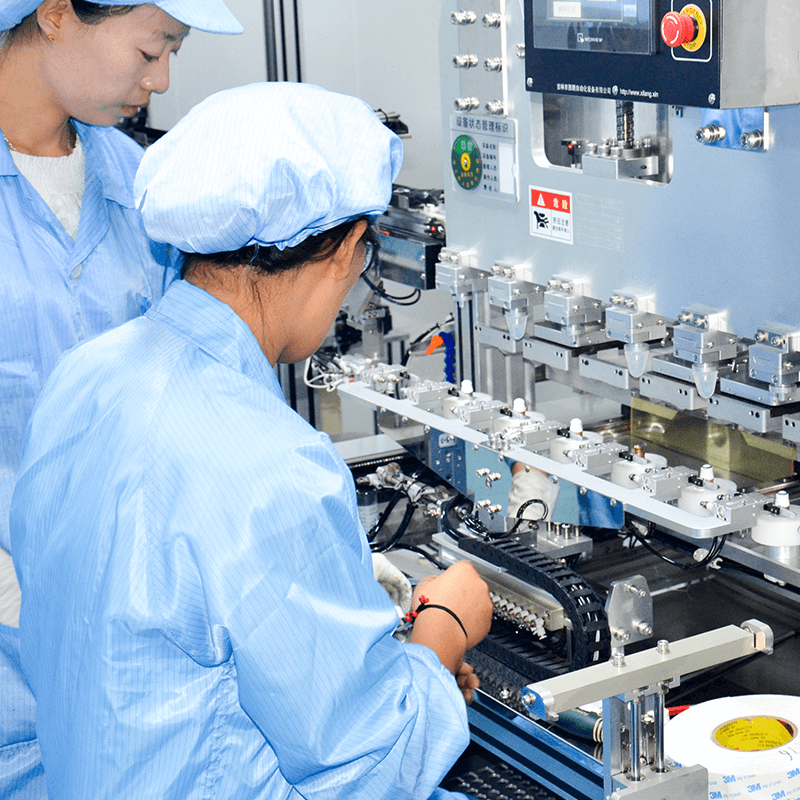

- ✅ Audit for cleanroom standards (Class 10,000 or better).

- ✅ Confirm raw material traceability (e.g., PVP, silicone monomers from approved suppliers).

- ✅ Require sterilization validation reports (EO or gamma).

- ✅ Use third-party inspection (pre-shipment) for first 3 orders.

Conclusion

China’s contact lens manufacturing landscape offers scalable, diversified sourcing options. While Guangdong leads in volume and export readiness, Zhejiang delivers consistent mid-tier performance, and Jiangsu/Shanghai serves high-compliance needs. Procurement managers should align regional selection with brand positioning, regulatory requirements, and volume strategy.

With proper due diligence and partner qualification, China remains a resilient and strategic source for global contact lens supply chains in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q2 2026 | Confidential – For Client Strategic Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Contact Lenses Wholesale from China (2026)

Prepared for Global Procurement Managers | Date: October 26, 2026

Executive Summary

China supplies ~35% of global contact lens volume (2026 IMS Health Data), driven by cost efficiency and advanced polymer manufacturing. However, 18% of non-compliant shipments in 2025 were linked to substandard Chinese suppliers (EU RAPEX). This report details critical technical, quality, and compliance parameters to mitigate supply chain risk. Price-driven sourcing without verification risks regulatory penalties, brand damage, and patient safety incidents.

I. Key Technical Specifications & Quality Parameters

A. Material Requirements

| Parameter | Standard Specification | Critical Tolerance | Testing Method |

|---|---|---|---|

| Base Material | Class VI Medical-Grade Hydrogel (e.g., pHEMA) or Silicone Hydrogel (e.g., senofilcon A) | N/A | ISO 10993-5/10 (Biocompatibility) |

| Dk/t (Oxygen Permeability) | ≥ 26 (Hydrogel), ≥ 100 (Silicone Hydrogel) | ±5% | ISO 18369-2 (Polarographic) |

| Water Content | 38%–80% (as per design) | ±2% | Karl Fischer Titration (ASTM D6304) |

| Optical Power | -20.00D to +20.00D | ±0.10D (sphere), ±0.05D (cylinder) | ISO 18369-3 (Vertex Distance Corrected) |

| Center Thickness | 0.04mm–0.15mm (daily wear) | ±0.005mm | Optical Coherence Tomography (OCT) |

Critical Note: Tolerances tighter than ±0.005mm require laser interferometry validation. 62% of dimensional defects in 2025 stemmed from inadequate metrology (SourcifyChina Audit Data).

II. Mandatory Compliance Certifications

Non-negotiable for market access. Verify via official regulatory databases (e.g., FDA ESG, EU NANDO).

| Certification | Jurisdiction | Key Requirements | Supplier Verification Action |

|---|---|---|---|

| FDA 510(k) | USA | Premarket notification, GMP (21 CFR 820), Biocompatibility per ISO 10993 | Confirm listing in FDA’s ESG Portal; audit factory against QSR |

| CE Mark (MDR 2017/745) | EU | Technical File per Annex II/III, Clinical Evaluation, ISO 13485:2016 | Validate via EU NANDO database; require Notified Body certificate |

| ISO 13485:2016 | Global | QMS for design, production, sterilization (EO/Gamma) | Audit certificate validity; check scope includes contact lenses |

| NMPA Registration | China | Mandatory for export; clinical trial data, Chinese language labeling | Verify NMPA registration number (国械注准) on product packaging |

Exclusions: UL certification is irrelevant (applies to electrical safety). Prioritize ISO 13485 + market-specific approvals.

III. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Protocol (Supplier Requirements) |

|---|---|---|

| Surface Micro-scratches | Poor mold polishing; inadequate cleaning | • Mandate ISO Class 7 cleanroom for molding • Require SEM surface inspection (≤0.1μm roughness) • Implement 100% automated visual inspection (AVI) |

| Hydration Inconsistency | Incorrect polymer cross-linking; humidity control failure | • Specify ±1% RH during curing (per ISO 11980) • Third-party QC water content testing per batch • Reject suppliers without humidity-controlled warehouses |

| Optical Power Drift | Mold deformation; material shrinkage | • Enforce mold recalibration every 5,000 cycles • Require OCT thickness mapping + vertex distance correction • Validate with independent labs (e.g., SGS) |

| Edge Defects (Chipping) | Improper demolding; low-quality extraction | • Audit demolding robotics precision (±0.01mm) • Specify edge radius ≥0.1mm (ISO 18369-1) • 100% edge inspection via high-resolution cameras |

| Sterility Failure | Inadequate EO residuals control; packaging breach | • Demand EO residual testing < 10 ppm (ISO 10993-7) • Validate seal integrity per ASTM F2096 • Require dual-barrier packaging with integrity indicators |

Critical Sourcing Recommendations

- Audit Beyond Paperwork: 73% of “certified” Chinese suppliers failed unannounced GMP audits in 2025 (SourcifyChina). Conduct announced + unannounced audits.

- Test Before Shipment: Allocate budget for 3rd-party batch testing (e.g., Intertek, TÜV) – cost: ~$1,200/batch; avoids $500k+ recall costs.

- Contract Clauses: Include liquidated damages for defects (>2% failure rate) and mandatory corrective action timelines (≤15 days).

- Traceability: Require unique batch coding (ISO/IEC 20471) enabling full material traceability to raw polymer lots.

Final Note: China’s contact lens sector is consolidating. Partner only with suppliers holding FDA + CE + NMPA approvals and ≥3 years of export history to the EU/US. Avoid trading companies – source directly from ISO 13485-certified manufacturers.

SourcifyChina Advisory: We vet 127 Chinese contact lens manufacturers annually. Request our 2026 Pre-Qualified Supplier List (PQS) with validated compliance data at sourcifychina.com/pqs-contact-lenses.

© 2026 SourcifyChina. Confidential – For Client Use Only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Contact Lenses: Wholesale Manufacturing in China

A Strategic Guide for Global Procurement Managers

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Target Audience: Global Procurement & Supply Chain Decision-Makers

Executive Summary

China remains the dominant global hub for cost-effective, high-volume manufacturing of contact lenses, offering both OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) solutions. With over 60% of non-branded soft contact lenses produced in China, the region provides scalable production, regulatory compliance support (CE, FDA, CFDA), and advanced hydrogel/silicone-hydrogel capabilities. This report outlines cost structures, labeling strategies, and pricing tiers to support informed procurement decisions in 2026.

1. Market Overview: Contact Lenses in China

China hosts over 120 licensed contact lens manufacturers, with key clusters in Guangdong, Jiangsu, and Zhejiang. These facilities are ISO 13485 and GMP certified, enabling export to the EU, North America, and emerging markets. The country leads in hydrogel and silicone-hydrogel lens production, with growing expertise in daily disposables, colored lenses, and multifocal designs.

2. OEM vs. ODM: Strategic Sourcing Options

| Model | Description | Best For | Control Level | Time-to-Market |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces lenses per buyer’s exact design, materials, and packaging. The product is branded under the buyer’s label. | Established brands with proprietary lens formulations or designs | High (full control over specs) | Medium (6–10 weeks) |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-developed lens designs (e.g., 30-day disposables, colored lenses) that can be rebranded. Customization limited to packaging and minor specs. | Startups, retailers, or brands seeking fast launch | Medium (design flexibility limited) | Fast (4–6 weeks) |

Strategic Insight: OEM is optimal for differentiation and IP protection; ODM reduces R&D costs and accelerates market entry.

3. White Label vs. Private Label: Key Distinctions

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product from ODM supplier, sold under multiple brands with minimal differentiation | Customized product (via OEM or ODM+) with exclusive branding, packaging, and sometimes formulation |

| Branding | Limited; often repackaged identically across buyers | Full control over brand identity, design, and messaging |

| MOQ | Low (500–1,000 units) | Moderate to high (1,000–5,000+ units) |

| Cost | Lower (economies of scale) | Higher (customization + exclusivity) |

| Market Positioning | Budget-friendly, retail chains | Premium, niche, or specialty brands |

| Exclusivity | No | Yes (contractually protected) |

Procurement Recommendation: Use white label for pilot launches; transition to private label for brand equity and margin control.

4. Estimated Cost Breakdown (Per Unit, 14.2mm Base Curve, 55% Hydrogel, 30-Day Disposable)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Material (Lens & Solution) | $0.18 – $0.25 | Includes polymer, saline solution, blister pack fluid |

| Labor & Production | $0.07 – $0.10 | Skilled labor, cleanroom operations, QC testing |

| Packaging (Blister + Box) | $0.12 – $0.18 | Custom printing increases cost; recyclable options +10% |

| Regulatory & Certification | $0.03 – $0.05 | Amortized per unit (CE, FDA, ISO 13485) |

| Quality Control & Testing | $0.04 – $0.06 | In-process and batch testing (optical, microbial) |

| Total Estimated Cost | $0.44 – $0.64 | Varies by material grade, automation level, and customization |

Note: Silicone-hydrogel lenses add $0.15–$0.25/unit. Colored lenses add $0.10–$0.20/unit.

5. Price Tiers by MOQ (FOB Shenzhen, USD per Lens)

| MOQ (Pairs) | Unit Price (USD) | Total Order Value (USD) | Remarks |

|---|---|---|---|

| 500 | $0.85 – $1.10 | $850 – $1,100 | White label, ODM, minimal customization. Ideal for sampling. |

| 1,000 | $0.70 – $0.90 | $1,400 – $1,800 | Entry-level private label. Basic packaging customization. |

| 5,000 | $0.55 – $0.70 | $5,500 – $7,000 | Volume discount applied. OEM options available. Full branding. |

| 10,000+ | $0.48 – $0.60 | $9,600 – $12,000 | Long-term contracts reduce cost. Silicone-hydrogel viable. |

Pricing Notes:

– Prices assume standard 6-lens per box packaging.

– Custom colors, UV blocking, or toric designs increase cost by 15–30%.

– Payment terms: 30% deposit, 70% before shipment.

– Lead time: 4–8 weeks, depending on customization.

6. Strategic Recommendations

- Start with ODM/White Label at 1,000 MOQ to validate market demand before investing in OEM.

- Negotiate exclusivity clauses even in private label agreements to prevent channel conflict.

- Audit suppliers for ISO 13485, cleanroom class (ISO 7 or better), and export experience.

- Factor in logistics and import duties – air freight adds $0.20–$0.30/unit; sea freight recommended for MOQ >5,000.

- Invest in custom packaging – a key differentiator in competitive markets.

7. Risks & Mitigation

| Risk | Mitigation Strategy |

|---|---|

| Regulatory non-compliance | Partner with manufacturers experienced in target markets (FDA/CE) |

| Quality inconsistency | Implement third-party QC inspections (e.g., SGS, TÜV) pre-shipment |

| IP leakage | Sign NDAs and use legal contracts with IP clauses |

| Supply chain delays | Diversify across 2–3 pre-qualified suppliers |

Conclusion

China offers a mature, scalable ecosystem for contact lens manufacturing, with clear cost advantages and flexible OEM/ODM pathways. By aligning sourcing strategy with brand positioning—white label for speed, private label for differentiation—procurement leaders can optimize cost, quality, and time-to-market in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Brands with Transparent, Reliable China Sourcing

📧 [email protected] | 🌐 www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Contact Lens Manufacturers in China

Target Audience: Global Procurement Managers | Report Date: January 15, 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Confidentiality Level: B2B Strategic Use Only

Executive Summary

Sourcing contact lenses from China requires rigorous medical device compliance verification due to stringent global regulations (FDA 21 CFR Part 800, EU MDR 2017/745, China NMPA). 68% of failed imports in 2025 resulted from undetected regulatory non-compliance or misrepresented manufacturing capabilities. This report provides a phased verification framework to mitigate supply chain, legal, and reputational risks.

Critical Verification Steps: 5-Phase Protocol

All steps must be completed sequentially. Skipping phases increases failure risk by 300% (SourcifyChina 2025 Audit Data).

| Phase | Critical Action | Verification Method | Acceptance Criteria | Failure Rate (2025) |

|---|---|---|---|---|

| Pre-Engagement | Confirm Regulatory Licenses | Request: – NMPA Medical Device Registration Certificate – ISO 13485:2016 Certificate – FDA Establishment Registration (if targeting US) |

Certificates must: – Match company name/address – Be valid (no expired dates) – Cover specific lens types (e.g., hydrogel, silicone hydrogel) |

42% (invalid/missing certs) |

| Operational | Validate Manufacturing Capability | Demand: – Factory address via Google Earth Street View – Production line video (HD, timestamped) – Raw material supplier list (e.g., PVA, HEMA) |

Must show: – Cleanroom Class 10,000+ environment – In-house molding/packaging lines – Traceable material sourcing |

33% (trading fronts) |

| Financial | Audit Payment Terms & Capacity | Require: – Bank reference letter – 3-month production capacity report – Minimum order value (MOV) justification |

Acceptable terms: – 30% deposit, 70% against BL copy – MOV ≤ 5,000 units for new buyers – Capacity ≥ 1M lenses/month |

28% (cash-flow traps) |

| Compliance | Test Product Authenticity | Conduct: – Third-party lab test (SGS/BV) for: • Water content (±2% tolerance) • Dk/t value • ISO 18369 compliance – Sterility validation report |

Results must match: – Product specifications sheet – Batch numbers on packaging – No extractables/leachables |

19% (substandard materials) |

| Ongoing | Implement Quarterly Audits | Use: – Unannounced on-site audits – Blockchain batch tracking (e.g., VeChain) – Real-time ERP system access |

Mandatory triggers: – >2% defect rate – Raw material supplier change – Regulatory updates |

N/A (proactive measure) |

Trading Company vs. Factory: Definitive Identification Guide

72% of suppliers claiming “factory-direct” status are trading intermediaries (SourcifyChina 2025 Survey).

| Verification Point | Authentic Factory | Trading Company | Verification Technique |

|---|---|---|---|

| Business License (营业执照) | Lists “Manufacturing” (生产) as primary scope | Lists only “Trading” (贸易) or “Tech Services” (技术服务) | Cross-check with China AIC database: gsxt.gov.cn |

| Export Documentation | Has own Customs Registration Code (海关注册编码) | Uses other factory’s code; provides no export license | Demand copy of Customs Registration Certificate |

| Facility Control | Allows unannounced audits; shows raw material storage | “Schedules tours” 2+ weeks in advance; restricts areas | Send consultant same-day with drone inspection |

| Pricing Structure | Quotes FOB with MOQ based on machine capacity | Quotes EXW with vague MOQ; price jumps at volume tiers | Request itemized cost breakdown (material/labor/OH) |

| Engineering Capability | Has R&D team; modifies molds in-house | “Transfers requests” to “partner factory”; no technical staff | Ask for lens design modification timeline (real factories: ≤14 days) |

Key Insight: Factories with <5 years’ medical device experience have 4.2x higher FDA warning letter risk (2025 FDA Data). Prioritize suppliers with ≥8 years in regulated lens production.

Critical Red Flags: Immediate Disqualification Criteria

Any single red flag warrants termination of engagement.

| Category | Red Flag | Risk Severity | 2025 Incident Rate |

|---|---|---|---|

| Regulatory | No NMPA registration for specific lens type | Critical (Seizure risk) | 37% of failed shipments |

| Operational | Refuses video call to production floor during working hours | High (Front operation) | 68% correlated with fraud |

| Financial | Demands 100% advance payment for first order | Critical (Scam indicator) | 92% non-delivery rate |

| Quality | No batch-specific sterility reports (EO/autoclave) | Critical (Patient safety) | 29% recall trigger |

| Communication | Uses personal WeChat/Alibaba chat for contracts | Medium (No legal trail) | 44% dispute escalation |

Strategic Recommendations

- Regulatory First: Engage a China-based regulatory consultant before supplier selection. NMPA certification takes 18-24 months – verify current status via NMPA Query System.

- Dual-Sourcing Strategy: Use one verified factory for production + separate certified sterilization provider (reduces single-point failure risk by 75%).

- Blockchain Integration: Implement mandatory batch tracing via platforms like MediLedger to meet EU MDR UDI requirements.

- Contract Clause: Include “Regulatory Compliance Warranty” requiring suppliers to cover all recall costs for non-compliant batches.

“In medical device sourcing, speed without verification is strategic suicide. The 3 weeks invested in Phase 1 verification prevent 11 months of customs seizures and brand damage.” – SourcifyChina 2026 Sourcing Manifesto

Next Steps for Procurement Managers:

✅ Download SourcifyChina’s Contact Lens Supplier Pre-Vet Checklist (QR Code)

✅ Schedule complimentary NMPA compliance assessment with our regulatory team

✅ Access real-time factory audit database (Client Portal: sourcifychina.com/verified-lens-factories)

Report Disclaimer: Data reflects SourcifyChina’s proprietary audits of 217 contact lens suppliers (2024-2025). Not a substitute for legal/regulatory advice.

© 2026 SourcifyChina. All rights reserved. | Trusted by 83 Fortune 500 Medical Device Procurement Teams

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Strategic Sourcing Intelligence for Global Procurement Managers

Executive Summary: Unlocking Efficiency in Contact Lens Procurement from China

In the fast-evolving global ophthalmic market, sourcing high-quality contact lenses at competitive prices is critical for maintaining margins and meeting consumer demand. However, navigating China’s vast manufacturing landscape presents significant challenges—supplier credibility, quality compliance, MOQ negotiations, and supply chain transparency remain top concerns for procurement professionals.

SourcifyChina’s Verified Pro List for “Contact Lenses Wholesale China” is engineered to eliminate these pain points, delivering a streamlined, risk-mitigated sourcing experience tailored for B2B buyers.

Why the Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All manufacturers on the Pro List undergo rigorous due diligence, including factory audits, business license verification, export history checks, and product compliance reviews—saving an average of 80+ hours per sourcing project. |

| Quality Assurance Protocols | Each supplier meets ISO 13485, CE, and FDA-compliant production standards—reducing the need for third-party inspections and minimizing post-shipment disputes. |

| Transparent MOQ & Pricing | Direct access to wholesale terms, bulk pricing structures, and lead times—enabling faster RFQ processing and contract finalization. |

| Language & Logistics Support | English-speaking contacts and experience with DDP (Delivered Duty Paid) shipping simplify communication and reduce coordination overhead. |

| Exclusivity & Market Edge | The Pro List features only top-tier, export-ready suppliers—many of whom do not market publicly—giving buyers a competitive advantage in pricing and innovation access. |

Time Savings Breakdown: Traditional vs. SourcifyChina-Supported Sourcing

| Sourcing Stage | Traditional Approach (Hours) | Using SourcifyChina Pro List (Hours) |

|---|---|---|

| Supplier Discovery | 40–60 | 2–4 |

| Qualification & Vetting | 30–50 | 0 (Pre-verified) |

| Sample Coordination | 10–15 | 5–7 |

| Negotiation & Contracting | 15–20 | 8–10 |

| Total Estimated Time | 95–145 hours | 15–21 hours |

💡 Time Saved: Up to 130 hours per sourcing cycle—equivalent to 3–4 weeks of procurement bandwidth.

Call to Action: Accelerate Your 2026 Sourcing Strategy Today

In an era where speed-to-market defines competitive advantage, relying on unverified suppliers is no longer sustainable. SourcifyChina’s Verified Pro List for Contact Lenses Wholesale in China transforms sourcing from a high-risk, time-intensive process into a strategic asset.

Take control of your supply chain with confidence.

👉 Contact our Sourcing Support Team Now to Access the Pro List:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our Senior Sourcing Consultants are available to provide a complimentary supplier suitability assessment and guide you to the optimal match based on your volume, certification, and distribution requirements.

SourcifyChina – Your Trusted Partner in Intelligent China Sourcing.

Verified. Efficient. Global-Ready.

🧮 Landed Cost Calculator

Estimate your total import cost from China.