The global construction machinery parts market is witnessing robust growth, driven by rising infrastructure development, urbanization, and increased investments in industrial and commercial construction. According to Grand View Research, the global construction equipment market was valued at USD 179.6 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. This growth trajectory underscores the escalating demand for high-quality, durable components that ensure optimal performance and longevity of heavy machinery. Parallel insights from Mordor Intelligence affirm this momentum, forecasting a CAGR of approximately 5.6% for the construction equipment market through 2029, with Asia-Pacific leading in both production and consumption due to rapid industrialization and government-backed infrastructure initiatives. As original equipment manufacturers (OEMs) and aftermarket suppliers compete to meet evolving technical standards and sustainability goals, identifying key players in the construction machinery parts sector becomes critical for procurement strategy and supply chain resilience. The following list highlights the top 10 manufacturers shaping this dynamic industry through innovation, scalability, and global reach.

Top 10 Construction Machinery Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 WPI

Domain Est. 1996

Website: wpi.com

Key Highlights: We focus on selling and servicing compression and onshore drilling support equipment from leading manufacturers in the industry….

#2 Shantui Construction Machinery Co., Ltd.

Domain Est. 2023 | Founded: 1952

Website: shantui-global.com

Key Highlights: Shantui was founded in 1952. We can provide you a full range of construction machinery product solutions, more than 10 types of machines and spare parts….

#3 Construction Equipment

Domain Est. 1990

Website: deere.com

Key Highlights: Explore John Deere’s full line of construction equipment: from small excavators to large ADTs, our machines work hard to help you succeed….

#4 CASE Construction Equipment

Domain Est. 1995

Website: casece.com

Key Highlights: Choose your country and language to explore CASE CE products, services, and support tailored to your region….

#5 Equipment World

Domain Est. 1996

Website: equipmentworld.com

Key Highlights: Equipment World covers construction news, equipment rollouts, and business solutions for construction industry professionals….

#6 New Holland Construction

Domain Est. 1997

Website: construction.newholland.com

Key Highlights: From loaders to mini excavators and forklifts, New Holland Construction equipment is built to help you get the job done….

#7 ACTParts

Domain Est. 1997

Website: actparts.com

Key Highlights: ACTParts is a worldwide supplier of heavy equipment parts offering a complete range of solutions to meet your needs at an affordable cost….

#8 Construction Machinery Company

Domain Est. 2004

Website: cmcky.com

Key Highlights: Extensive inventory of new and used equipment, as well as comprehensive sales, parts, service and construction equipment rentals departments in Kentucky….

#9

Domain Est. 2015

Website: hitachicm.com

Key Highlights: Hitachi Construction Machinery has been developing its engineering capabilities in line with social development and manufacturing and advancing construction ……

#10 Kobelco Construction Machinery Global Website

Domain Est. 2016

Website: kobelcocm-global.com

Key Highlights: Global Official Website of Kobelco Construction Machinery,a leading company of excavators and cranes. We globally present business through hydraulic ……

Expert Sourcing Insights for Construction Machinery Parts

H2: 2026 Market Trends for Construction Machinery Parts

The global construction machinery parts market is poised for significant transformation by 2026, driven by technological innovation, infrastructure demand, sustainability initiatives, and evolving supply chain dynamics. As economies recover and urbanization accelerates, the demand for reliable, efficient, and smart construction machinery components is expected to rise. Below are the key trends shaping the market:

-

Increased Demand from Infrastructure Development

Governments worldwide are investing heavily in infrastructure projects—from transportation networks to renewable energy installations—fueling demand for construction machinery and their replacement parts. Emerging markets in Asia-Pacific, Africa, and Latin America are particularly active, driving long-term growth in aftermarket parts such as engines, hydraulic systems, and undercarriage components. -

Rise of Smart and Connected Components

By 2026, the integration of IoT (Internet of Things) and telematics in construction machinery parts is expected to become standard. Sensors embedded in components like transmissions, pumps, and control systems enable predictive maintenance, real-time monitoring, and improved equipment uptime. Manufacturers are focusing on developing intelligent parts that communicate with fleet management platforms, reducing operational costs and downtime. -

Shift Toward Electrification and Alternative Powertrains

The push for carbon neutrality is accelerating the adoption of electric and hybrid construction equipment. This transition is reshaping the parts ecosystem, increasing demand for electric motors, battery systems, power inverters, and charging components. Traditional hydraulic and diesel-dependent parts may see reduced growth, while electrified alternatives gain market share, particularly in urban and emission-sensitive zones. -

Growth of the Aftermarket and Remanufactured Parts

Cost-efficiency and sustainability are driving the expansion of the aftermarket segment. By 2026, remanufactured and recycled parts are projected to capture a larger share of the market, especially in mature economies. These components offer up to 50% cost savings while maintaining OEM-level performance, appealing to contractors seeking to extend equipment life and reduce environmental impact. -

Supply Chain Resilience and Localization

Ongoing geopolitical tensions and post-pandemic disruptions have prompted OEMs and distributors to reevaluate supply chains. Regionalization of manufacturing and inventory hubs—particularly in North America, Europe, and Southeast Asia—is expected to rise. This trend enhances lead times and reduces dependency on single-source suppliers, improving availability of critical parts like filters, hoses, and electronic control units. -

Regulatory Influence and Emission Standards

Stricter emission regulations (e.g., EU Stage V, U.S. Tier 4 Final) will continue to influence design and compliance requirements for construction machinery parts. Components such as diesel particulate filters (DPFs), selective catalytic reduction (SCR) systems, and exhaust gas recirculation (EGR) valves will remain in demand, with upgrades required for older machines to meet evolving standards. -

Digital Platforms and E-Commerce Expansion

Online marketplaces for construction machinery parts are gaining traction, offering transparency, competitive pricing, and faster delivery. By 2026, digital procurement platforms powered by AI-driven inventory management and augmented reality (AR) for part identification are expected to streamline the buying process, especially for small and mid-sized contractors.

In summary, the 2026 construction machinery parts market will be defined by innovation, sustainability, and digital transformation. Companies that embrace smart technologies, support electrification, and strengthen supply chain agility will be best positioned to capitalize on emerging opportunities.

Common Pitfalls in Sourcing Construction Machinery Parts: Quality and Intellectual Property Risks

Sourcing construction machinery parts, especially from global suppliers or third-party manufacturers, presents significant challenges related to both product quality and intellectual property (IP) protection. Failing to address these pitfalls can lead to equipment failure, safety hazards, costly downtime, and legal exposure.

Quality-Related Pitfalls

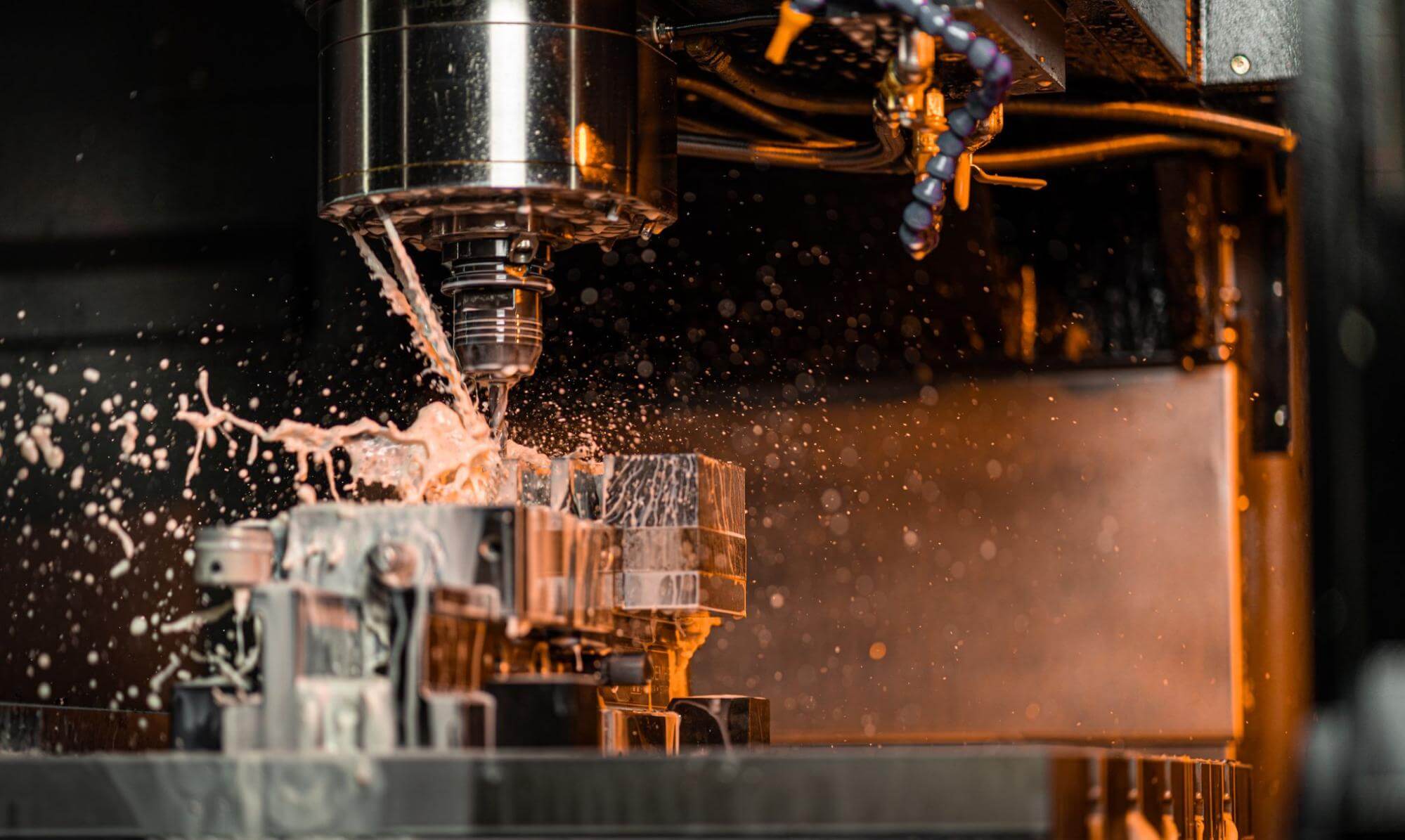

Inconsistent Material and Manufacturing Standards

Suppliers may use substandard materials or deviate from original equipment manufacturer (OEM) specifications to reduce costs. This includes inferior steel alloys, improper heat treatment, or inaccurate machining tolerances, leading to premature wear, breakdowns, or catastrophic failure under load.

Lack of Traceability and Certification

Many non-OEM parts lack proper documentation such as mill test reports, ISO certifications, or compliance with industry standards (e.g., ASME, ASTM, or DIN). Without traceability, verifying the part’s origin, material composition, or manufacturing process becomes impossible.

Poor Fit, Form, and Function

Even if a part appears identical, dimensional inaccuracies or design deviations can result in improper fitment, reduced performance, or damage to surrounding components. This is especially critical in high-stress applications like hydraulic systems or drivetrains.

Inadequate Testing and Quality Control

Reputable OEMs subject parts to rigorous performance and durability testing. Third-party suppliers may skip or shortcut these processes, resulting in parts that fail under real-world operating conditions.

Counterfeit or Refurbished Parts Represented as New

A growing issue in the aftermarket is the sale of counterfeit, recycled, or refurbished parts labeled as OEM-new. These parts may not meet safety or performance expectations and often lack warranties.

Intellectual Property-Related Pitfalls

Unauthorized Reproduction of OEM Designs

Many aftermarket parts are produced by copying patented or trademarked OEM designs without permission. Sourcing such parts exposes buyers to legal risks, including claims of contributory infringement, especially in jurisdictions with strong IP enforcement.

Trademark and Branding Infringement

Parts that carry OEM logos, part numbers, or branding without authorization violate trademark laws. Even if the part functions well, using or distributing such components can result in cease-and-desist orders, fines, or reputational damage.

Gray Market and Unauthorized Distribution Channels

Purchasing parts through unofficial distributors or brokers may lead to IP violations, especially if the supply chain lacks transparency. Gray market parts may be diverted, stolen, or produced without licensing, creating legal and warranty complications.

Limited Legal Recourse and Warranty Coverage

OEMs typically void warranties when non-genuine or infringing parts are used. Additionally, if IP infringement is alleged, suppliers of counterfeit or unauthorized parts often lack the financial or legal capacity to defend or indemnify the buyer.

Exposure to Customs Seizures and Import Restrictions

In countries with strict IP enforcement (e.g., the U.S. or EU), importing parts that infringe on patents or trademarks can result in shipment seizures, fines, and supply chain disruptions.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Source from authorized distributors or certified suppliers.

– Require material certifications, quality test reports, and compliance documentation.

– Conduct supplier audits and request samples for independent testing.

– Verify IP rights and avoid parts with OEM branding unless officially licensed.

– Include IP indemnification clauses in procurement contracts.

– Consult legal counsel when sourcing from high-risk regions.

Proactively addressing quality and IP concerns ensures reliable equipment performance, reduces legal exposure, and supports long-term operational efficiency.

Logistics & Compliance Guide for Construction Machinery Parts

Overview and Importance

Efficient logistics and strict compliance are critical in the construction machinery parts sector. These components are often heavy, high-value, and subject to international trade regulations. Ensuring timely delivery and adherence to legal standards prevents project delays, avoids penalties, and maintains supply chain integrity.

Classification and HS Codes

Accurately classifying construction machinery parts using Harmonized System (HS) codes is essential for customs clearance and tariff determination. Common HS codes include:

– 8431 (Parts for earth-moving equipment)

– 8413 (Pumps for hydraulic systems)

– 8501 (Electric motors and generators)

– 8708 (Parts for engines and transmissions)

Misclassification can lead to customs delays, fines, or shipment rejection.

Packaging and Handling Requirements

Construction machinery parts require robust packaging to prevent damage during transit. Best practices include:

– Use of wooden crates or reinforced pallets for heavy components

– Moisture barriers and anti-corrosion treatments (VCI paper)

– Secure strapping and corner protectors

– Clear labeling with part numbers, weight, and handling instructions (e.g., “Fragile,” “This Side Up”)

Transportation Modes and Selection

Selecting the appropriate transport mode depends on part size, weight, urgency, and destination:

– Road Freight: Ideal for regional deliveries; offers door-to-door service

– Rail: Cost-effective for bulk shipments over long distances within continents

– Sea Freight: Best for heavy or oversized parts shipped internationally; use FCL (Full Container Load) or break-bulk for large items

– Air Freight: Used for urgent, high-value, or lightweight replacement parts

Customs Documentation

Complete and accurate documentation ensures smooth cross-border movement. Required documents typically include:

– Commercial Invoice

– Packing List

– Bill of Lading (B/L) or Air Waybill (AWB)

– Certificate of Origin

– Import/Export Licenses (if applicable)

– End-User Declarations (for controlled goods)

Import/Export Regulations

Compliance with national and international trade laws is mandatory:

– Export Controls: Parts with dual-use potential (e.g., advanced hydraulics) may require licenses under regimes like the Wassenaar Arrangement

– Sanctions and Embargoes: Verify destinations against OFAC, EU, or UN sanction lists

– REACH and RoHS (EU): Ensure parts comply with chemical and hazardous substance regulations

– EPA and DOT (USA): Adhere to environmental and transportation safety standards

Duty and Tax Considerations

Understand applicable duties, VAT, and GST:

– Leverage Free Trade Agreements (e.g., USMCA, RCEP) to reduce or eliminate tariffs

– Use Authorized Economic Operator (AEO) status for faster customs processing

– Maintain records for duty drawback or bonded warehouse options

Inventory and Warehouse Management

Efficient warehousing supports just-in-time delivery and reduces downtime:

– Implement barcode or RFID tracking systems

– Store parts in climate-controlled environments to prevent rust

– Segregate hazardous materials (e.g., hydraulic fluids) per local regulations

– Conduct regular stock audits to ensure accuracy

Reverse Logistics and Returns

Establish clear procedures for returns, repairs, and replacements:

– Issue Return Material Authorization (RMA) numbers

– Use original packaging or equivalent protective materials

– Document reason for return for quality control and warranty claims

– Comply with local waste and recycling laws for scrap parts

Risk Management and Insurance

Mitigate risks through:

– Comprehensive cargo insurance covering theft, damage, and delay

– Contingency planning for supply chain disruptions (e.g., port strikes, weather)

– Supplier audits to ensure compliance and reliability

– Cybersecurity for digital logistics platforms

Sustainability and Environmental Compliance

Adopt eco-friendly logistics practices:

– Optimize routes to reduce fuel consumption and emissions

– Recycle packaging materials and promote reuse

– Comply with WEEE (Waste Electrical and Electronic Equipment) directives for electronic components

– Track carbon footprint using logistics software

Conclusion

A robust logistics and compliance framework ensures reliable delivery, regulatory adherence, and cost efficiency in the construction machinery parts supply chain. Regular training, technology adoption, and proactive monitoring are key to maintaining operational excellence and legal compliance globally.

In conclusion, sourcing construction machinery parts requires a strategic approach that balances cost, quality, reliability, and timely availability. Effective procurement involves identifying reputable suppliers, ensuring parts compatibility and authenticity, and considering factors such as lead times, warranties, and after-sales support. Leveraging both local and global supply chains, along with adopting digital procurement tools, can enhance efficiency and reduce downtime. Ultimately, a well-structured sourcing strategy not only supports the optimal performance and longevity of construction equipment but also contributes to project efficiency, cost savings, and overall operational success.