The global connector blade market is experiencing robust growth, driven by increasing demand across automotive, industrial machinery, and renewable energy sectors. According to Grand View Research, the global electrical connectors market—of which connector blades are a critical component—was valued at USD 86.3 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. This growth is fueled by rising electrification, the proliferation of electric vehicles (EVs), and advancements in automation technologies. Mordor Intelligence further underscores this trend, highlighting that the Asia Pacific region, in particular, is emerging as a key manufacturing and consumption hub, supported by strong industrial infrastructure and growing investments in clean energy. As demand for reliable, high-performance electrical connections intensifies, connector blade manufacturers are at the forefront of innovation and scalability. The following list highlights the top 10 companies leading this evolution through technological expertise, strategic global reach, and consistent product quality.

Top 10 Connector Blade Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 J.S.T. Mfg. Co., Ltd.

Domain Est. 1997

Website: jst-mfg.com

Key Highlights: YL connector (Meets glow wire testing standards) This is a 4.5 mm pitch, wire-to-wire connector that comes with glow-wire compliant housing material and allows ……

#2 Electrical Terminal and Wire Connector Manufacturer

Domain Est. 1997

Website: jeesoon.com.tw

Key Highlights: We offer an extensive selection, including non-insulated terminals, ring terminals, spade terminals, BLADE terminals, HOOK terminals, electrical ferrules, pin ……

#3 Scondar

Domain Est. 2008

Website: scondar.com

Key Highlights: Scondar: 20+ years leading China manufacturer of connectors & wire harnesses. Trust us for quality solutions tailored to your needs….

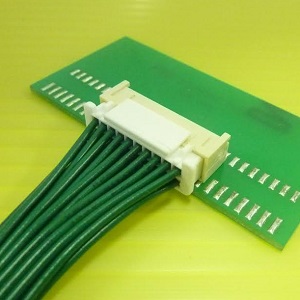

#4 Crimp Blade Terminals

Domain Est. 2014

Website: sgeterminals.com

Key Highlights: The crimp blade terminal is a single-wire electrical connector with flat conductive blades. Through innovation and in-house research, SGE specializes in ……

#5 What is a Power Blade Connector Comprehensive Overview

Domain Est. 2017

Website: medlonchina.com

Key Highlights: Medlon has established itself as a leading manufacturer of Power Blade Connectors, renowned for its innovative designs and commitment to ……

#6 Types of Electrical Connectors and Wire Connectors

Domain Est. 1992

Website: te.com

Key Highlights: From USB connectors and RJ45 connectors to TE’s DEUTSCH connectors and AMP connectors, we design and manufacture the electrical connectors and wire connectors ……

#7 Connectors

Domain Est. 1994

Website: molex.com

Key Highlights: Molex offers a wide variety of Board-to-Board Connectors for microminiature, high-speed, high-density, and high-power applications….

#8 Connectors

Domain Est. 1995

Website: aptiv.com

Key Highlights: We offer a large variety of connectors and housings, with options for device (wire-to-board) and in-line (wire-to-wire) connections….

#9 JST

Domain Est. 1996

Website: jst.co.uk

Key Highlights: JST is your ‘Full Service’ supplier for the design, manufacture and supply of electrical / electronic terminals, connectors and associated application tooling ……

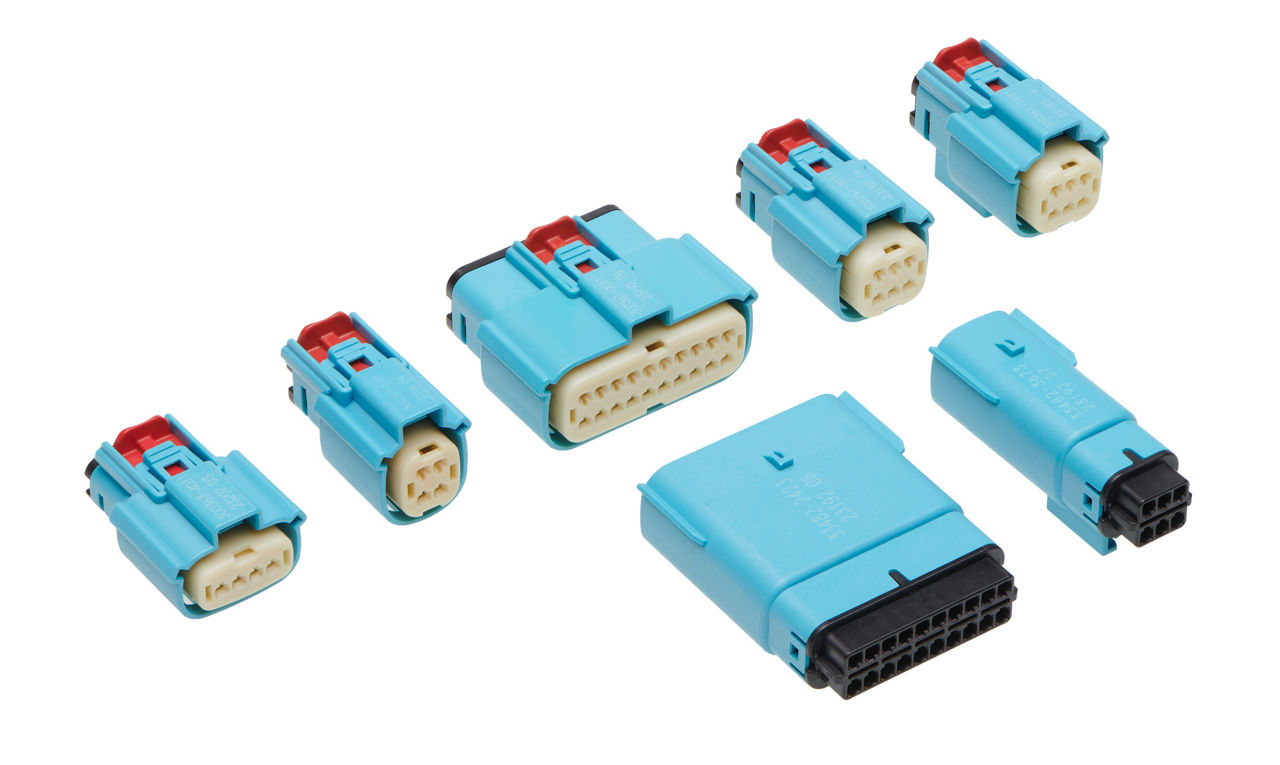

#10 New Product Release “Waterproof Blade & Receptacle Connectors”

Domain Est. 2009

Website: yokowoconnector.com

Key Highlights: New Product Release “Waterproof Blade & Receptacle Connectors”. □Catalog Line-up. Blade ▷ TBP-2827XS-5-30-0000. Receptacle ▷ TBR-6028XF-5-30-0000. Sep, 2021….

Expert Sourcing Insights for Connector Blade

H2: 2026 Market Trends for Connector Blades

The global market for connector blades is poised for significant evolution by 2026, driven by technological advancements, expanding applications across key industries, and shifting manufacturing dynamics. Connector blades—critical components in electrical and electronic systems that ensure reliable power and signal transmission—are witnessing increased demand due to their role in enabling connectivity in high-performance environments.

1. Growth in Electric Vehicles (EVs) and Charging Infrastructure

The rapid expansion of the electric vehicle market is a primary driver for connector blade demand. By 2026, EV production is expected to grow at a compound annual growth rate (CAGR) of over 20%, necessitating high-current, durable connector blades for battery packs, power distribution units, and onboard chargers. High-voltage systems (800V and above) in next-gen EVs require advanced blade connectors with improved thermal management and arc resistance, pushing innovation in materials such as copper alloys and silver-plated contacts.

2. Advancements in Renewable Energy Systems

Solar inverters, wind turbines, and energy storage systems increasingly rely on robust connector solutions. Connector blades are integral to power combiner boxes and grid-tie inverters. With global renewable energy capacity projected to rise by 50% by 2026, demand for high-reliability, corrosion-resistant blades—especially in harsh outdoor environments—is expected to surge.

3. Miniaturization and High-Density Applications

In consumer electronics and telecommunications, there is a growing trend toward smaller, more efficient devices. This drives demand for miniaturized connector blades capable of handling higher current densities without sacrificing performance. Innovations in stamped and formed blade contacts, along with tighter tolerances and improved insert molding techniques, support this trend.

4. Industrial Automation and Smart Manufacturing

The rise of Industry 4.0 and the Internet of Things (IoT) is increasing the need for reliable signal and power transmission in automated production lines. Connector blades used in programmable logic controllers (PLCs), sensors, and motor drives must offer high durability, vibration resistance, and long lifecycle performance. By 2026, smart factories are expected to adopt modular and plug-and-play systems, further boosting demand for standardized yet customizable blade connectors.

5. Supply Chain Resilience and Regional Manufacturing Shifts

Geopolitical factors and post-pandemic supply chain recalibrations are prompting a regional shift in manufacturing. North America and Europe are investing in local production of critical electronic components, including connector blades, to reduce dependency on Asian suppliers. This reshoring trend is expected to accelerate through 2026, with increased R&D investment in automation and precision manufacturing techniques.

6. Sustainability and Material Innovation

Environmental regulations such as RoHS and REACH are driving the adoption of lead-free, recyclable materials in connector blade production. Additionally, manufacturers are exploring alternatives to traditional copper, such as high-strength copper-nickel alloys and composite materials, to improve conductivity while reducing weight and environmental impact.

7. Competitive Landscape and Consolidation

The connector blade market is becoming increasingly competitive, with key players like TE Connectivity, Amphenol, Molex, and Smiths Interconnect investing in proprietary technologies and strategic acquisitions. Smaller niche manufacturers are focusing on specialized applications in aerospace, medical devices, and defense, where high-reliability standards command premium pricing.

Conclusion

By 2026, the connector blade market will be shaped by the convergence of electrification, digitalization, and sustainability. Growth will be strongest in high-tech mobility, renewable energy, and industrial automation sectors. Manufacturers that invest in material science, precision engineering, and supply chain agility will be best positioned to capitalize on emerging opportunities in this dynamic landscape.

Common Pitfalls Sourcing Connector Blades (Quality, IP)

Sourcing connector blades—critical components in electrical and electronic systems—can present significant challenges, particularly concerning quality assurance and intellectual property (IP) risks. Failing to address these pitfalls can lead to product failures, legal liabilities, and reputational damage.

Quality-Related Pitfalls

Inconsistent Material Specifications

One of the most frequent quality issues arises from suppliers using substandard materials, such as incorrect grades of copper alloy or inadequate plating thickness (e.g., insufficient tin or gold plating). This results in poor conductivity, increased resistance, and premature wear or corrosion, compromising long-term reliability.

Lack of Process Control and Testing

Many low-cost suppliers lack rigorous manufacturing process controls or fail to conduct essential quality tests (e.g., insertion/extraction force testing, contact resistance measurement, environmental stress screening). Without documented quality certifications (e.g., ISO 9001, IATF 16949), there is no assurance of consistent production standards.

Counterfeit or Non-Conforming Components

The connector market is vulnerable to counterfeit parts, especially when sourcing from unauthorized distributors or gray market channels. These components may visually resemble genuine parts but fail under operational conditions due to inferior construction or incorrect dimensions.

Insufficient Traceability

Poor lot traceability makes it difficult to identify and isolate defective batches during field failures or recalls. Suppliers who do not provide material certifications, batch records, or serial tracking increase supply chain risk.

Intellectual Property (IP)-Related Pitfalls

Unauthorized Manufacturing or Reverse Engineering

Some suppliers, particularly in regions with weak IP enforcement, may produce connector blades that mimic patented designs without licensing. Sourcing from such suppliers exposes the buyer to legal action for contributory infringement, even if unintentional.

Lack of IP Indemnification

Many supplier agreements—especially with offshore manufacturers—do not include IP indemnification clauses. This leaves the buyer liable for legal costs and damages if the sourced components infringe on third-party patents or trademarks.

Ambiguous Design Ownership

When custom connector blades are developed jointly or outsourced, unclear contracts may result in disputes over design ownership. Without explicit agreements, suppliers might claim rights to the design or sell similar products to competitors.

Use of Open-Source or Public Domain Misinterpretation

Some buyers assume that certain connector designs are freely usable because they are common or available online. However, many standardized or widely used designs are still protected by active patents. Failing to conduct proper freedom-to-operate (FTO) analysis can lead to unintentional infringement.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Conduct thorough supplier audits and request quality certifications.

– Require material and performance test reports for each batch.

– Source only through authorized distribution channels.

– Perform due diligence on IP status and obtain legal opinions when necessary.

– Include strong IP indemnification and ownership clauses in procurement contracts.

– Partner with suppliers who demonstrate compliance with industry standards (e.g., UL, IEC, IPC).

Proactive management of quality and IP risks ensures reliable performance and legal safety in connector blade sourcing.

Logistics & Compliance Guide for Connector Blade

This guide outlines the essential logistics procedures and compliance requirements for the safe and efficient handling, transportation, storage, and documentation of Connector Blade components. Adherence to these guidelines ensures regulatory compliance, product integrity, and supply chain reliability.

Product Overview

Connector Blades are precision-engineered electrical components designed for high-current applications in industrial, automotive, and energy systems. They are typically made from copper alloys with tin or silver plating and require careful handling to prevent damage to contact surfaces and mechanical integrity.

Packaging Requirements

All Connector Blades must be packaged to prevent physical damage, contamination, and corrosion during transit and storage:

– Use anti-static, sealed inner packaging for ESD-sensitive variants.

– Employ rigid outer packaging (e.g., corrugated cardboard or reusable containers) with sufficient cushioning.

– Label packages with handling symbols: “Fragile,” “This Side Up,” and “Protect from Moisture.”

– Include desiccants in packaging if shipping to high-humidity environments.

Storage Conditions

Store Connector Blades in a controlled environment to maintain performance and longevity:

– Temperature: 10°C to 30°C (50°F to 86°F)

– Relative Humidity: 30% to 60%, non-condensing

– Storage areas must be clean, dry, and free from corrosive gases or dust.

– Keep products in original packaging until ready for use.

– First-In, First-Out (FIFO) inventory rotation must be enforced.

Transportation Guidelines

Ensure compliance with domestic and international shipping standards:

– Use freight carriers experienced in handling electronic components.

– Secure loads to prevent shifting during transit.

– Avoid exposure to extreme temperatures, moisture, or vibration.

– For air freight, comply with IATA Dangerous Goods Regulations (not applicable unless batteries are integrated).

– For sea freight, follow IMDG Code guidelines where applicable.

Regulatory Compliance

Connector Blades must meet the following regulatory and industry standards:

– RoHS (Restriction of Hazardous Substances): Compliant with EU Directive 2011/65/EU and amendments.

– REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals): Ensure no substances of very high concern (SVHC) above threshold.

– Conflict Minerals: Adhere to U.S. SEC Rule 13p-1; source tantalum, tin, tungsten, and gold responsibly.

– WEEE (Waste Electrical and Electronic Equipment): Label products appropriately and support end-of-life recycling.

– UL/CSA/IEC Certification: Models intended for North America and global markets must carry applicable safety certifications.

Documentation and Labeling

Accurate documentation is critical for customs clearance and traceability:

– Include product name, part number, batch/lot number, and quantity on all packaging.

– Provide Safety Data Sheets (SDS) upon request.

– Ship with a commercial invoice, packing list, and certificate of compliance (CoC).

– Use standardized barcode or QR codes for inventory tracking.

– Export documentation must include HS Code: 8536.50 (Electrical connectors for circuits).

Import/Export Controls

Be aware of restrictions when shipping across borders:

– Verify no export licenses are required under EAR (Export Administration Regulations).

– Screen end-users against denied persons lists (e.g., BIS, EU sanctions).

– Maintain records of shipments for a minimum of five years.

Quality and Inspection

Perform incoming and outgoing quality checks:

– Visually inspect for damage, oxidation, or deformation upon receipt.

– Conduct periodic audits of packaging and storage conditions.

– Report non-conformances immediately through the quality management system (QMS).

Environmental and Sustainability Practices

Support sustainability goals through responsible logistics:

– Minimize packaging waste using recyclable or reusable materials.

– Optimize shipping routes to reduce carbon footprint.

– Partner with logistics providers with environmental certifications (e.g., ISO 14001).

Contact and Support

For compliance inquiries, logistics support, or documentation requests, contact:

Global Compliance & Logistics Team

Email: [email protected]

Phone: +1 (800) 555-0199

Hours: Mon–Fri, 8:00 AM – 5:00 PM EST

Conclusion for Sourcing Connector Blade:

After a comprehensive evaluation of potential suppliers, technical specifications, cost structures, quality standards, and lead times, it is concluded that sourcing the connector blade from [Selected Supplier Name] presents the most balanced and strategic solution. This supplier consistently meets the required mechanical and electrical performance criteria, including conductivity, durability, and resistance to environmental factors such as temperature and corrosion.

Additionally, [Selected Supplier Name] demonstrates strong manufacturing capabilities, adheres to international quality certifications (e.g., ISO 9001, IATF 16949), and offers competitive pricing with reliable delivery timelines. Their track record of on-time delivery and responsiveness to technical queries further strengthens their position as a preferred partner.

Alternative sourcing options were considered but were either less cost-effective, posed higher supply chain risks, or failed to meet key technical requirements. Therefore, proceeding with [Selected Supplier Name] ensures product reliability, supply continuity, and long-term cost efficiency.

It is recommended to formalize the partnership through a supplier agreement, including performance metrics, quality assurance protocols, and periodic reviews. Ongoing collaboration will support continuous improvement and scalability as demand evolves.

Final Recommendation: Approve sourcing of connector blades from [Selected Supplier Name] with immediate effect, pending contract finalization.