The global conical metal components market is experiencing steady expansion, driven by rising demand across aerospace, automotive, construction, and industrial manufacturing sectors. According to a 2023 report by Mordor Intelligence, the global metal fabrication market — a key indicator for conical metal product demand — is projected to grow at a CAGR of 4.8% from 2023 to 2028. This growth is underpinned by advancements in precision engineering and an increased focus on lightweight, high-strength metal structures. Additionally, conical metal parts are gaining traction in specialized applications such as HVAC systems, military hardware, and renewable energy installations, where bespoke geometries and material integrity are critical. With manufacturing hubs in North America, Europe, and Asia-Pacific scaling production capabilities, the competitive landscape is evolving rapidly. Based on production capacity, technological expertise, and global reach, the following nine manufacturers have emerged as leaders in delivering high-quality conical metal solutions.

Top 9 Conical Metal Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Conicals – Elgen Manufacturing

Domain Est. 1999

Website: elgenmfg.com

Key Highlights: Conicals (54 items) · No Damper. 10″ CONICAL N/D Code – SF0807 · No Damper. 12″ CONICAL N/D Code – SF0813 · No Damper. 14″ CONICAL N/D Code – SF0817 · No Damper ……

#2 Cones, Conical Shapes & Tapers Spun

Domain Est. 2000

Website: fabricorproducts.com

Key Highlights: We are offering a few basic conical shapes you may be able to use. They are made from 18 gauge CRS for the heavy strength and weldability….

#3 Conical Cutting Tools

Domain Est. 2004

Website: conicalendmills.com

Key Highlights: Manufacturer of tapered, specialty and performance end mills in HSS & carbide. Same day shipping, custom tooling, reconditioning & expert support….

#4 Kennametal

Domain Est. 1995

Website: kennametal.com

Key Highlights: Kennametal is a leading provider of productivity solutions for metalworking, earth cutting, and wear components, coatings, and powders….

#5 Metso

Domain Est. 1996

Website: metso.com

Key Highlights: Metso is a frontrunner in sustainable technologies, end-to-end solutions and services for the aggregates, minerals processing and metals refining industries ……

#6 Custom Metal Spun Cones

Domain Est. 1997

Website: wenzelmetalspinning.com

Key Highlights: Wenzel Metal Spinning manufactures custom metal spun cones in a wide range of sizes, styles, and angles with options like flanges, bolt circles, and holes….

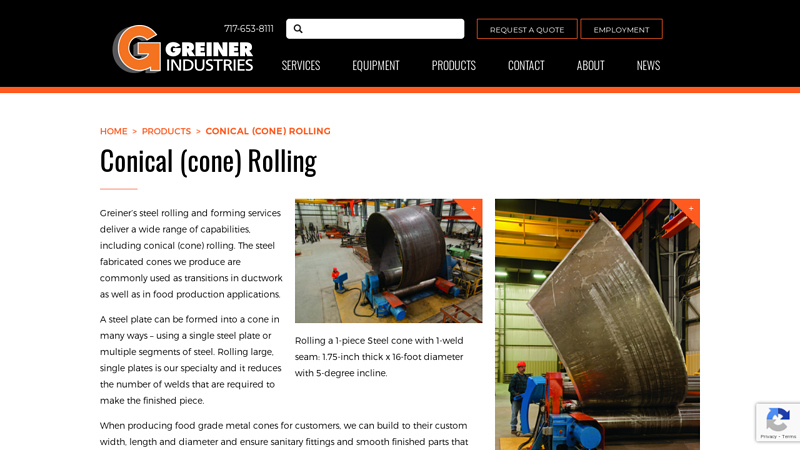

#7 Cones

Domain Est. 1998

Website: greinerindustries.com

Key Highlights: Conical shaped metal products are expertly crafted by Greiner. We can fabricate food grade metal cones, steel cones for ductwork and more….

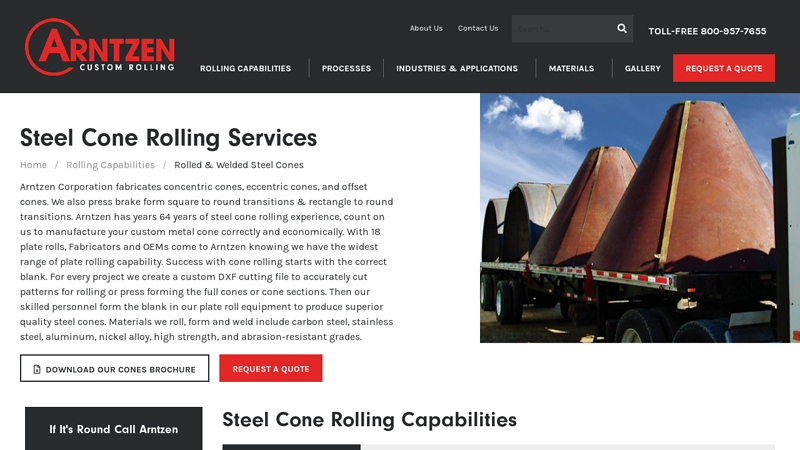

#8 Steel Cone Fabrication – Custom Metal Cone Rolling

Domain Est. 2000

Website: arntzenrolling.com

Key Highlights: Arntzen has over 60 years of steel cone rolling experience, so you can count on us to manufacture your custom metal cone correctly and economically….

#9 Guide: Conical & Dome

Domain Est. 2010

Website: krytonmetals.com

Key Highlights: Learn more about products that are made from conical and dome-shaped metal spinning, some of which we see and walk past every day!…

Expert Sourcing Insights for Conical Metal

H2: 2026 Market Trends for Conical Metal

The conical metal market is poised for significant transformation by 2026, driven by advancements in manufacturing technologies, rising demand across key industries, and a growing emphasis on sustainability. As global industrial sectors evolve, conical metal components—widely used in aerospace, automotive, energy, and construction applications—are benefiting from increasing demand for precision-engineered, lightweight, and durable metal solutions.

1. Rising Demand in Aerospace and Defense

The aerospace and defense sectors are expected to be primary growth drivers for conical metal products in 2026. The increasing production of commercial aircraft, drones, and next-generation defense systems is fueling demand for high-strength, heat-resistant conical components such as nozzles, fuselage sections, and turbine parts. Titanium and nickel-based superalloys in conical forms are particularly sought after due to their performance under extreme conditions. With major aerospace companies expanding their supply chains and investing in next-gen propulsion systems, the need for custom conical metal fabrications will continue to rise.

2. Expansion in Renewable Energy Applications

The global shift toward renewable energy is opening new avenues for conical metal use, especially in wind and solar power infrastructure. Conical transition pieces and support structures are essential in offshore wind turbines, where durability and corrosion resistance are critical. By 2026, increased investments in offshore wind farms—particularly in Europe, the U.S., and parts of Asia—are expected to boost demand for large-scale conical steel components. Innovative coatings and alloy compositions will further enhance longevity in harsh marine environments.

3. Advancements in Additive Manufacturing

Additive manufacturing (AM), or 3D metal printing, is revolutionizing the production of conical metal parts. By 2026, AM technologies will enable faster prototyping, reduced material waste, and the ability to create complex geometries that were previously unattainable with traditional methods. Industries such as medical devices and high-performance automotive engineering are leveraging AM to produce bespoke conical components with optimized weight and strength. As metal 3D printing becomes more cost-effective and scalable, it will significantly influence conical metal supply chains.

4. Sustainability and Circular Economy Pressures

Environmental regulations and corporate sustainability goals are reshaping the conical metal market. Manufacturers are increasingly adopting recycled metals and energy-efficient production processes to meet carbon reduction targets. In 2026, circular economy principles will gain traction, with companies prioritizing reusable, recyclable conical metal products. This shift is expected to drive innovation in alloy development and surface treatments that extend product life and facilitate end-of-life recovery.

5. Regional Market Dynamics

Asia-Pacific, led by China, India, and South Korea, will remain a dominant force in both production and consumption of conical metal products, supported by rapid industrialization and infrastructure development. Meanwhile, North America and Europe will focus on high-value, precision components driven by advanced manufacturing and defense modernization programs. Localization of supply chains—accelerated by geopolitical considerations and trade policies—will also influence where conical metal fabrication facilities are established.

6. Price Volatility and Raw Material Challenges

Fluctuations in the prices of key raw materials like steel, aluminum, and specialty alloys may impact profit margins through 2026. Supply chain disruptions, energy costs, and mining regulations could create volatility. As a result, manufacturers are likely to enter into long-term procurement agreements and explore alternative materials or hybrid composites to mitigate risk.

Conclusion

By 2026, the conical metal market will be shaped by technological innovation, sector-specific demand, and sustainability imperatives. Companies that invest in advanced manufacturing, diversify their material sourcing, and align with green industrial policies will be best positioned to capitalize on emerging opportunities. The integration of digital tools such as AI-driven design and predictive maintenance will further enhance competitiveness in this evolving landscape.

Common Pitfalls Sourcing Conical Metal Components (Quality, IP)

Sourcing conical metal components—such as conical springs, nozzles, or structural fittings—can present significant challenges, particularly concerning quality consistency and intellectual property (IP) protection. Failing to address these areas can result in product failure, legal disputes, and reputational damage. Below are key pitfalls to avoid:

Inadequate Quality Control and Material Verification

One of the most frequent issues is receiving conical metal parts that do not meet specified tolerances, strength requirements, or surface finish standards. Suppliers, especially those in low-cost regions, may use substandard alloys, deviate from heat treatment processes, or lack rigorous inspection protocols. Without third-party certifications (e.g., ISO, ASTM) or material test reports (MTRs), buyers risk integrating compromised components into critical systems.

Poor Dimensional Accuracy and Geometric Consistency

Conical geometries demand precise forming and machining. Small deviations in taper angle, wall thickness, or concentricity can lead to functional failure—for example, improper sealing in fluid systems or inconsistent load distribution in mechanical assemblies. Relying solely on supplier-provided drawings without independent first-article inspections (FAI) increases the risk of undetected dimensional drift across production batches.

Insufficient IP Protection and Reverse Engineering Risks

Sharing detailed design specifications (CAD files, GD&T annotations) with suppliers without proper legal safeguards exposes intellectual property. Unscrupulous vendors may replicate or resell designs, or use them to manufacture for competitors. A common pitfall is omitting robust non-disclosure agreements (NDAs) or failing to classify and control access to proprietary information.

Lack of Traceability and Documentation

Quality and IP issues are exacerbated when suppliers cannot provide full traceability—from raw material sourcing to production logs. In regulated industries (e.g., aerospace, medical), missing documentation can invalidate certifications and hinder compliance audits. Without batch-level tracking, isolating defective components during a recall becomes nearly impossible.

Overlooking Regulatory and Industry-Specific Standards

Conical metal parts used in high-risk applications must comply with industry regulations (e.g., AS9100 for aerospace, FDA 21 CFR for medical devices). Sourcing without verifying supplier compliance can lead to rejected shipments, compliance violations, or product liability exposure—especially if the component’s performance is tied to safety or environmental standards.

Dependence on Single or Unqualified Suppliers

Relying on one supplier without qualifying alternatives creates supply chain vulnerability. If the supplier fails a quality audit or breaches IP terms, redesigns and requalification can disrupt production. Conducting inadequate supplier audits—failing to assess their quality systems, tooling capabilities, or IP management practices—increases exposure to both quality lapses and legal risks.

Ineffective Communication and Specification Clarity

Ambiguous technical specifications, such as unclear surface finish requirements or undefined conical tolerances, lead to misinterpretation. Language barriers or time zone differences can compound misunderstandings. Without collaborative engineering reviews and clear acceptance criteria, the final product may not align with design intent—impacting both performance and IP integrity.

Mitigating these pitfalls requires a structured sourcing strategy: thorough supplier vetting, enforceable contracts with IP clauses, rigorous incoming inspection protocols, and ongoing quality monitoring. Proactive management of both technical and legal aspects ensures reliable, secure procurement of conical metal components.

Logistics & Compliance Guide for Conical Metal

This guide outlines the key logistics and compliance considerations for the safe, efficient, and legally compliant handling, transportation, and documentation of conical metal products. Adhering to these guidelines ensures product integrity, regulatory adherence, and supply chain reliability.

Product Specifications & Handling Requirements

Conical metal components—typically fabricated from steel, aluminum, or specialty alloys—require careful handling due to their shape, weight, and potential for surface damage. Ensure all handling procedures account for the unique geometry which may affect balance and stacking. Use padded slings, cradles, or custom fixtures during lifting to prevent deformation or scratching. Store horizontally on level, dry surfaces with adequate support at both ends and intermediate points to avoid sagging. Never stack conical metal pieces directly unless designed for nesting, and always use protective interlayers if stacking is permitted.

Packaging & Unitization Standards

Protect conical metal parts with industrial-grade packaging to prevent corrosion, dents, and contamination during transit. Use VCI (Vapor Corrosion Inhibitor) paper, desiccants, and sealed plastic wraps for indoor or international shipments. For external protection, secure items in wooden crates or steel-reinforced containers with internal bracing to immobilize the cone and prevent movement. Clearly label packages with orientation arrows, weight, and “Fragile” or “Protect from Moisture” indicators as needed. Unit load on pallets using steel or poly strapping, ensuring load stability under standard transport conditions.

Transportation & Carrier Compliance

Select carriers experienced in handling heavy metal fabrications and confirm their compliance with DOT (Department of Transportation), FMCSA (Federal Motor Carrier Safety Administration), and AAR (Association of American Railroads) regulations where applicable. For oversized loads, obtain necessary permits and follow route-specific restrictions. Secure all shipments using load securement methods compliant with FMCSA Part 393, ensuring conical items do not shift during transit. Maintain records of carrier certifications, insurance, and safety ratings as part of vendor compliance audits.

International Shipping & Export Controls

For cross-border shipments, verify conical metal composition against ITAR (International Traffic in Arms Regulations) or EAR (Export Administration Regulations). Most industrial conical metal parts fall under EAR99, but components used in defense, aerospace, or high-pressure systems may require export licenses. Prepare accurate commercial invoices, packing lists, and certificates of origin. Use HS codes appropriate to the metal type and manufacturing process (e.g., 7308.90 for structural steel cones). Comply with import regulations of destination countries, including CE marking in the EU or INMETRO in Brazil if applicable.

Regulatory & Environmental Compliance

Ensure manufacturing and finishing processes (e.g., welding, coating, galvanizing) comply with OSHA, EPA, and local environmental regulations. Manage hazardous waste, such as metal shavings or spent coolants, per RCRA guidelines. If shipping coated or treated conical parts, provide Safety Data Sheets (SDS) and comply with REACH (EU) or TSCA (US) chemical regulations. Monitor changes in environmental legislation affecting material sourcing or emissions during production.

Documentation & Traceability

Maintain full traceability of raw materials (mill test reports, heat numbers) and finished goods. Archive inspection records, non-destructive testing (NDT) results, and quality certifications (e.g., ISO 9001, ASME). All logistics documents—including bills of lading, customs forms, and delivery confirmations—must be retained for a minimum of five years. Implement a digital tracking system to monitor shipment status and ensure compliance with contractual delivery terms.

Incident Response & Non-Conformance Management

Establish procedures for reporting and addressing logistics-related damage, delays, or compliance deviations. Conduct root cause analysis for non-conforming shipments and implement corrective actions. Notify relevant authorities immediately in case of hazardous material spills or regulatory violations. Train logistics personnel annually on emergency response protocols and compliance updates to maintain operational resilience.

Conclusion for Sourcing Conical Metal Components

In conclusion, sourcing conical metal components requires a strategic approach that balances material quality, production capabilities, cost-efficiency, and supplier reliability. The selection of appropriate metals—such as stainless steel, aluminum, or specialty alloys—depends on the intended application, environmental conditions, and performance requirements. Establishing partnerships with reputable manufacturers who possess precision machining, forming, or fabrication expertise ensures dimensional accuracy and consistency in conical geometries.

Additionally, considerations such as MOQs (Minimum Order Quantities), lead times, certifications (e.g., ISO, AS9100), and logistics play a critical role in supply chain stability. Conducting thorough supplier evaluations, requesting prototypes, and implementing quality control checks are essential steps to mitigate risks and ensure long-term success.

Ultimately, a well-structured sourcing strategy for conical metal parts enhances product performance, reduces manufacturing delays, and supports cost-effective scaling, positioning the organization for greater operational efficiency and competitiveness in the market.