The global computer power cable market is experiencing steady expansion, driven by rising demand for reliable power delivery solutions across consumer electronics, data centers, and enterprise computing environments. According to a report by Mordor Intelligence, the global power cable market was valued at USD 33.5 billion in 2023 and is projected to grow at a CAGR of over 5.2% from 2024 to 2029, fueled by advancements in energy-efficient technologies and increasing digital infrastructure investments. As critical components ensuring stable power transmission to desktops, servers, and IT peripherals, computer power cables are witnessing heightened demand for safer, higher-rated, and compliant designs—particularly those meeting IEC, UL, and RoHS standards. This growing market landscape has elevated the prominence of specialized manufacturers who combine scalability, quality assurance, and innovation. Below, we highlight the top 8 computer power cable manufacturers shaping the industry through technical excellence, global reach, and strong supply chain integration.

Top 8 Computer Power Cable Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 FSP TECHNOLOGY INC. |AC/DC Power Supply Manufacturer

Domain Est. 1998

Website: fsp-group.com

Key Highlights: FSP Group is a global leader in power supply manufacturing and solution supplier. By combining innovative technologies with professional R&D capabilities, ……

#2 Belden

Domain Est. 1997

Website: belden.com

Key Highlights: We design, manufacture and market networking, connectivity, cable products and solutions for industrial automation, smart buildings and broadcast markets….

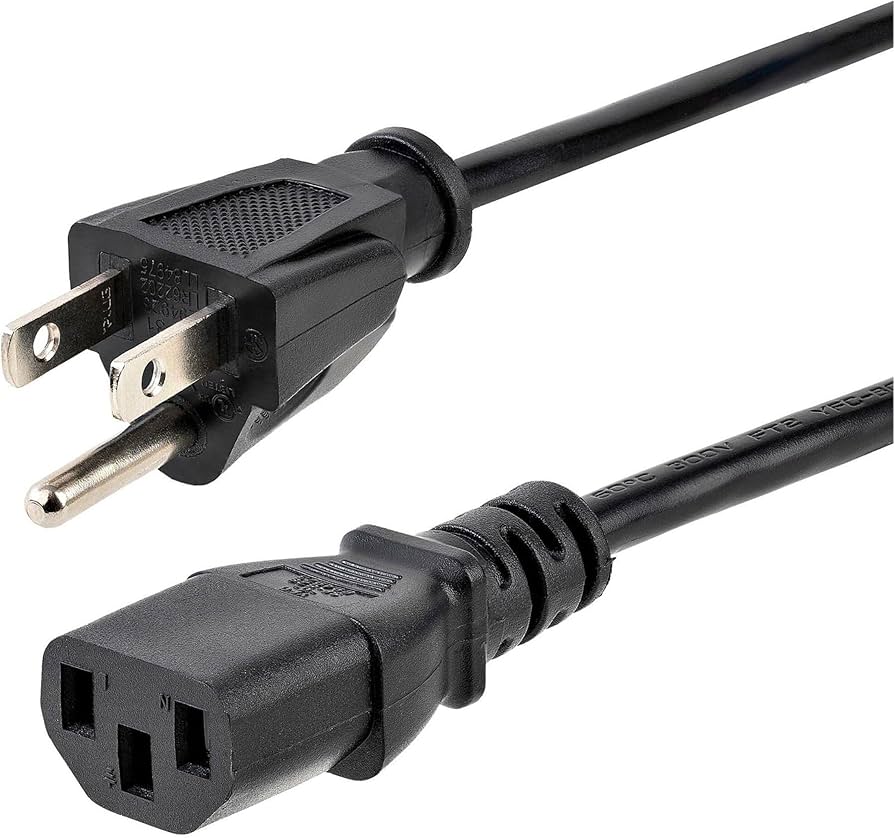

#3 Power Cord Manufacturer • Custom & Standard

Domain Est. 1997

Website: conwire.com

Key Highlights: Consolidated Electronic Wire & Cable is an industry-leading custom power cord manufacturer. We offer a comprehensive selection of high-quality power supply ……

#4 Power Cord Manufacturers

Domain Est. 2019

Website: powercordmanufacturers.com

Key Highlights: Quail Electronics is a worldwide power cord supplier, offering power cords and various other products….

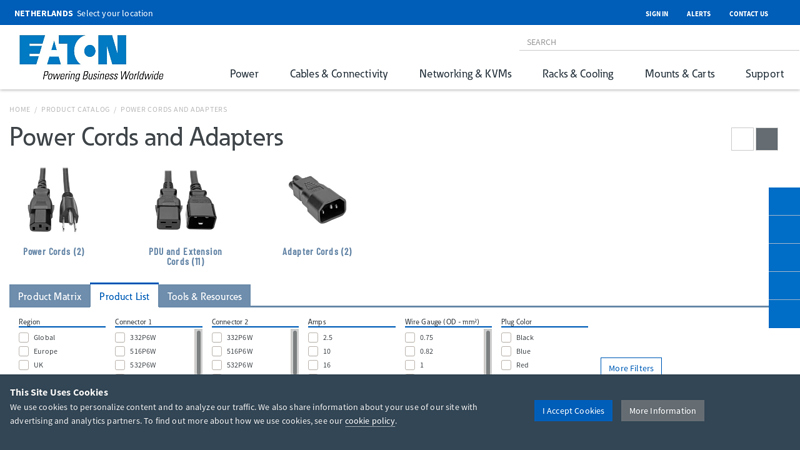

#5 Power Cords and Adapters

Domain Est. 1996

Website: tripplite.eaton.com

Key Highlights: We offer AC power cords, extension cords, splitters and adapters for computers, servers and PDUs. Our cords have innovative features like coiled cords and ……

#6 Computer Cables

Domain Est. 1996

#7 Wholesale Supplier for Power Cables, Adapters & More

Domain Est. 2001

Website: sfcable.com

Key Highlights: 1–3 day delivery · 60-day returnsWe offer a huge selection of high-quality cables, adapters, components & accessories at the lowest prices with fast shipping & lifetime technical …

#8 Computer Cable Store: Cables, Adapters, Fiber, Network Add

Domain Est. 2002

Expert Sourcing Insights for Computer Power Cable

H2: 2026 Market Trends for Computer Power Cables

The global computer power cable market is poised for notable transformation by 2026, driven by technological advancements, increased demand for energy-efficient devices, and the growing prevalence of remote work and digital infrastructure. Below are the key trends expected to shape the market:

-

Increased Demand for High-Efficiency and Energy-Saving Cables

As sustainability becomes a core focus for both consumers and enterprises, computer power cables with improved energy efficiency and reduced power loss are gaining traction. Manufacturers are investing in low-resistance conductors and eco-friendly insulation materials to meet global energy standards such as ENERGY STAR and EU Ecodesign Directive. -

Rise of USB-C and Universal Power Delivery (PD) Standards

The transition toward USB-C as a universal power and data transfer interface is accelerating. By 2026, USB-C power cables capable of delivering up to 240W (via USB PD 3.1) are expected to dominate the market, particularly for laptops, monitors, and docking stations. This shift reduces the need for multiple cable types and supports device interoperability. -

Growth in Remote Work and Home Office Setups

The lasting impact of remote work trends is driving demand for reliable, high-performance computer peripherals, including durable and long-lasting power cables. Consumers are investing in premium cables with enhanced shielding, braided exteriors, and tangle-free designs, contributing to market growth. -

Expansion of Data Centers and Cloud Infrastructure

With the surge in cloud computing and AI-driven applications, data centers are expanding rapidly. This growth fuels demand for high-capacity, reliable power distribution solutions, including industrial-grade computer power cables designed for server racks and power distribution units (PDUs). -

Adoption of Smart and Monitored Power Cables

Emerging innovations include intelligent power cables equipped with built-in sensors and monitoring capabilities. These cables can detect overheating, voltage fluctuations, and energy consumption in real time, enhancing safety and efficiency—particularly in enterprise environments. -

Regional Market Shifts and Manufacturing Relocations

Geopolitical factors and supply chain diversification efforts are prompting shifts in manufacturing hubs. While Asia-Pacific remains the largest producer, regions such as India, Vietnam, and Eastern Europe are emerging as alternative production centers, influencing cost structures and lead times. -

Focus on Durability, Safety, and Compliance

Regulatory bodies are tightening safety standards for electrical components. By 2026, compliance with certifications such as UL, CE, and RoHS will be mandatory, pushing manufacturers to adopt flame-retardant materials, improved grounding, and better strain relief in cable designs. -

Integration with Modular and Compact Computing Systems

The rise of compact PCs, all-in-one systems, and modular workstations requires customized power cable solutions that are shorter, more flexible, and optimized for space-constrained environments. This trend is encouraging innovation in form factors and connector designs.

Conclusion:

By 2026, the computer power cable market will be defined by innovation in connectivity standards, sustainability, and smart technology integration. Companies that prioritize energy efficiency, universal compatibility, and reliability will be best positioned to capture market share in an increasingly competitive and tech-driven landscape.

Common Pitfalls When Sourcing Computer Power Cables (Quality, IP)

Sourcing computer power cables may seem straightforward, but overlooking key factors can lead to safety hazards, equipment damage, and compliance issues. Below are common pitfalls related to quality and Ingress Protection (IP) ratings.

Poor Build Quality and Materials

Many low-cost power cables use substandard materials such as thin-gauge copper conductors,劣质绝缘层, or flimsy connectors. These can overheat under load, increasing fire risk, or fail prematurely due to wear and tear. Poor soldering or crimping at connection points may result in intermittent power delivery or complete failure.

Lack of Safety Certifications

A major pitfall is sourcing cables without proper safety certifications (e.g., UL, CE, RoHS, or ETL). Non-certified cables may not meet electrical safety standards, posing risks of electric shock, short circuits, or non-compliance with regional regulations, especially in commercial or industrial environments.

Misunderstanding or Ignoring IP Ratings

Ingress Protection (IP) ratings indicate a cable’s resistance to dust and moisture. A common mistake is assuming all power cables are suitable for harsh environments. For example, using a standard IP20-rated cable in a dusty or damp location (like a factory floor or outdoor enclosure) can lead to corrosion, short circuits, or equipment failure. Always match the IP rating to the operating environment.

Inadequate Cable Gauge for Power Requirements

Using undersized cables (e.g., 18 AWG instead of required 16 or 14 AWG) can result in excessive voltage drop and overheating, especially when powering high-draw devices. This not only reduces efficiency but also creates a fire hazard over time.

Counterfeit or Non-Compliant Products

Sourcing from unreliable suppliers increases the risk of receiving counterfeit cables that mimic reputable brands but fail to meet performance or safety standards. These often lack traceability and cannot be verified for compliance.

Overlooking Cable Length and Voltage Drop

Excessively long cables without proper gauge adjustments can suffer significant voltage drop, leading to unstable power delivery and potential damage to sensitive computer equipment. Always calculate expected voltage drop based on length and load.

Failing to Verify Connector Compatibility and Durability

Not all IEC or NEMA connectors are created equal. Poorly molded or non-latching connectors can disconnect accidentally, interrupting power. Ensure connectors match the device requirements and are rated for repeated plugging cycles.

Neglecting Environmental and Regulatory Compliance

Cables used in specific regions or industries must comply with environmental directives (e.g., REACH, RoHS) and industry standards. Ignoring these can lead to legal issues, especially in public infrastructure or medical applications.

Avoiding these pitfalls requires due diligence in selecting reputable suppliers, verifying certifications, and ensuring technical specifications align with the intended use and environment.

Logistics & Compliance Guide for Computer Power Cables

Product Classification and HS Code

Computer power cables are typically classified under the Harmonized System (HS) code 8544.42 or 8544.49, depending on specific characteristics such as voltage rating, shielding, and conductor material. Accurate classification is critical for customs clearance and determining import duties. Consult local customs authorities or a licensed customs broker to confirm the correct HS code based on cable specifications and destination country regulations.

Packaging and Labeling Requirements

Power cables must be securely packaged to prevent damage during transit. Use moisture-resistant, durable materials such as corrugated cardboard boxes with internal dividers or reels. Label each package with essential information including: product description, model number, voltage rating (e.g., 10A 250V), country of origin, manufacturer details, and compliance marks (e.g., CE, UL). Ensure labels are printed in the official language(s) of the destination country where required.

Transportation and Handling

Ship computer power cables via standard freight methods (air, sea, or ground) based on urgency and volume. Avoid extreme temperatures and humidity during storage and transit. Handle packages carefully to prevent kinking or crushing of cables. For international shipments, use freight forwarders experienced in electronics logistics and ensure proper documentation accompanies each consignment.

Regulatory Compliance

Compliance with regional and international safety standards is mandatory. Key certifications include:

– CE Marking (EU): Required for sale in the European Economic Area; indicates conformity with health, safety, and environmental standards.

– UL/ETL Listing (USA/Canada): Demonstrates compliance with North American safety standards (e.g., UL 62 for flexible cords).

– PSE Mark (Japan): Required for electrical products sold in Japan.

– CCC Mark (China): Mandatory for specified electrical products entering the Chinese market.

Ensure cables meet applicable standards such as IEC 60227 or IEC 60245 for insulation and performance.

Import Documentation

Prepare complete documentation for customs clearance, including: commercial invoice, packing list, bill of lading/air waybill, and certificates of compliance (e.g., Certificate of Conformity, RoHS Declaration). Some countries may require additional documentation such as import licenses or product registration. Verify import requirements with local authorities or customs agents.

Environmental and Safety Regulations

Comply with environmental directives such as:

– RoHS (EU and others): Restricts the use of hazardous substances (e.g., lead, cadmium) in electrical equipment.

– REACH (EU): Requires disclosure of substances of very high concern (SVHC).

– WEEE (EU): Mandates proper disposal and recycling of electronic waste; suppliers may need to register and contribute to take-back programs.

Ensure materials used in cables (PVC insulation, copper conductors, etc.) meet these standards.

Country-Specific Considerations

- United States: Comply with FCC regulations if cables could cause electromagnetic interference; ensure NRTL certification (e.g., UL, CSA).

- European Union: Apply CE marking and provide an EU Declaration of Conformity.

- Australia/New Zealand: Must meet AS/NZS 3191 and carry approval from the Electrical Regulatory Authorities Council (ERAC).

- United Kingdom: Post-Brexit, UKCA marking may be required; check current status for Northern Ireland (CE may still apply).

Record Keeping and Traceability

Maintain detailed records of product specifications, test reports, compliance certificates, and shipment documentation for a minimum of 5–10 years, depending on jurisdiction. Implement a traceability system (e.g., batch/lot numbering) to support recalls or audits if needed.

Risk Management and Contingency Planning

Conduct regular audits of suppliers and manufacturing processes to ensure ongoing compliance. Have contingency plans for supply chain disruptions, regulatory changes, or non-compliance findings. Work with legal or compliance experts to stay updated on evolving international trade and safety regulations.

In conclusion, sourcing computer power cables requires careful consideration of several key factors including compatibility, quality, safety certifications, supplier reliability, and cost-effectiveness. It is essential to ensure that the cables meet industry standards (such as UL, CE, or RoHS) and are compatible with the specific equipment they will be powering. Sourcing from reputable suppliers—whether OEMs, authorized distributors, or trusted manufacturers—helps guarantee product reliability and reduces the risk of electrical hazards. Additionally, evaluating long-term value over initial cost, considering factors like durability and warranty, contributes to a more efficient and secure IT infrastructure. Ultimately, a well-informed sourcing strategy ensures uninterrupted performance, enhances safety, and supports the overall reliability of computer systems.