The global biomass fuel market, driven by increasing demand for sustainable and renewable energy sources, is witnessing robust growth—with the compressed wood logs segment emerging as a key contributor. According to a 2023 report by Mordor Intelligence, the global wood pellets market (a category closely aligned with compressed wood logs) was valued at USD 8.9 billion in 2022 and is projected to grow at a CAGR of 7.3% through 2028. This expansion is fueled by stricter emissions regulations, rising energy costs, and government incentives for clean heating alternatives across Europe, North America, and parts of Asia-Pacific. Compressed wood logs, known for their high calorific value, low moisture content, and efficient combustion, are increasingly favored by both residential and industrial users seeking eco-friendly substitutes to fossil fuels.

As demand surges, a growing number of manufacturers are scaling production, adopting advanced densification technologies, and expanding distribution channels to capture market share. These companies are not only enhancing product consistency and energy efficiency but also prioritizing sustainable sourcing to meet certification standards like ENplus and DINplus. In this competitive landscape, identifying the leading compressed wood logs manufacturers becomes critical for distributors, energy providers, and environmentally conscious consumers alike. Based on production capacity, market reach, innovation, and sustainability practices, the following ten companies stand out as industry leaders shaping the future of biomass fuel.

Top 10 Compressed Wood Logs Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Wood Fire Logs

Domain Est. 1999

Website: homefirelogs.com

Key Highlights: Only firelogs from Home Fire Prest Logs produce heat for up to 12 hours. That is because of our patented technology compresses wood waste so densely….

#2 12” Compressed Log 6

Domain Est. 1995

Website: usstove.com

Key Highlights: In stock Rating 3.5 2 Made from compressed natural wood fibers, this log offers a longer burn time and consistent heat output, ensuring a cozy and warm ambiance in your home….

#3 Wood Fuel

Domain Est. 2000

Website: northidahoenergylogs.com

Key Highlights: Warmer, greener, cleaner and wiser wood fuel. North Idaho Energy Logs produce more heat from 100% natural recycled wood and cut emissions by more than 50%….

#4 Zip-O-Log Mills

Domain Est. 2000

Website: zipolog.com

Key Highlights: Our team promptly meets all customized timber construction needs. We provide top quality 100% Douglas Fir products for custom orders up to 52 feet in ……

#5 Wood Bricks & Coal

Domain Est. 2005

Website: btpellet.com

Key Highlights: Enviro-Bricks are manufactured from 100% kiln dried hardwood lumber sawdust and compressed with 24,000 lbs pressure making them twice as dense as cordwood….

#6 Compressed Wood Products

Domain Est. 2006

Website: allseasonsfirewood.net

Key Highlights: Manufactured wood products such as Natural Densified Fuelwood logs (firelogs as consumers refer to) and Woodstove pellets are part of the solid wood fuels ……

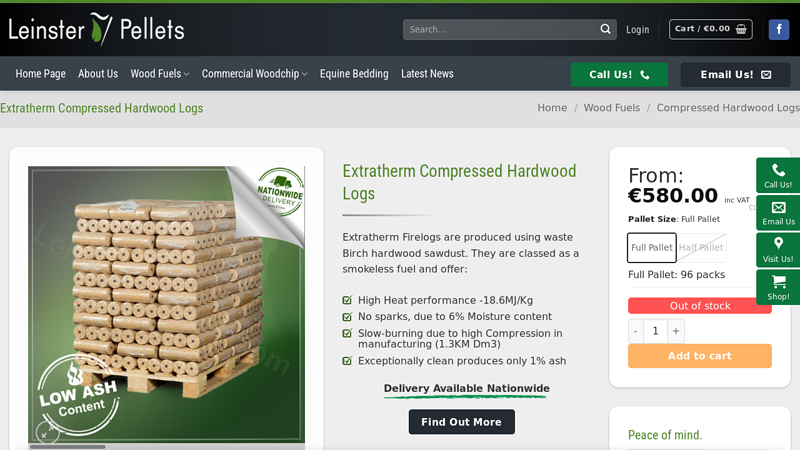

#7 Extratherm Compressed Hardwood Logs

Domain Est. 2007

Website: leinsterpellets.com

Key Highlights: Extratherm Firelogs are produced using waste Birch hardwood sawdust. They are classed as a smokeless fuel and offer: High Heat performance -18.6MJ/Kg ……

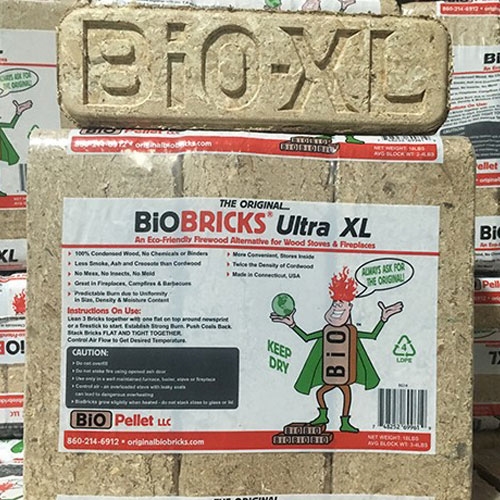

#8 Bio Blocks

Domain Est. 2009

#9 EnviroBrick

Domain Est. 2013

#10 Premium Certified Compressed Wood Heating Logs

Domain Est. 2024

Expert Sourcing Insights for Compressed Wood Logs

H2: 2026 Market Trends for Compressed Wood Logs

The global compressed wood logs market is poised for steady growth through 2026, driven by rising demand for renewable energy, environmental regulations, and increasing consumer awareness of sustainable heating alternatives. H2-level analysis reveals several key trends shaping the industry landscape.

-

Growing Demand for Renewable Energy Sources

As governments worldwide commit to net-zero emissions targets, biomass energy—including compressed wood logs—is gaining traction as a carbon-neutral heating solution. The European Union’s Renewable Energy Directive (RED III) and similar policies in North America and parts of Asia are incentivizing the use of solid biomass fuels, boosting market demand. -

Urban Adoption and Home Heating Shifts

Urban consumers are increasingly turning to wood logs for residential heating due to rising electricity and natural gas prices. Compressed wood logs offer high calorific value, low moisture content, and consistent burn quality—making them ideal for modern stoves and fireplaces. This shift is particularly evident in colder regions such as Scandinavia, the UK, and the northeastern United States. -

Sustainability and Circular Economy Focus

Compressed wood logs are predominantly made from sawdust, wood chips, and other forestry residues, aligning with circular economy principles. With stricter sustainability certifications (e.g., ENplus, DINplus) being adopted, producers are enhancing supply chain transparency and sourcing from responsibly managed forests—factors increasingly important to eco-conscious consumers. -

Technological Advancements in Production

Innovations in densification technology are improving efficiency and lowering production costs. Automated production lines, better binding agents (often natural lignin-based), and improved drying processes are enabling higher output and superior product consistency, supporting scalability. -

Regional Market Dynamics

- Europe: Remains the largest market, with strong regulatory support and widespread consumer adoption. Countries like Germany, France, and Poland are leading in both production and consumption.

- North America: Steady growth is expected due to increasing pellet stove installations and government incentives for biomass heating.

-

Asia-Pacific: Emerging markets such as South Korea and Japan are beginning to adopt compressed wood logs, especially for residential and small-scale industrial use, driven by air quality concerns and energy diversification efforts.

-

Price Volatility and Supply Chain Challenges

The market faces risks from fluctuating raw material prices and logistical disruptions. Climate change impacts on forestry and competition from the wood pellet industry may strain feedstock availability. However, vertical integration and strategic partnerships are helping key players secure supply. -

Competition with Wood Pellets

While compressed wood logs face competition from wood pellets—especially in automated heating systems—their ease of handling, lower equipment cost, and consumer familiarity with traditional log burning are maintaining their niche appeal. -

E-Commerce and Direct-to-Consumer Sales

Online retail platforms are expanding market access, allowing producers to reach urban consumers directly. Subscription models and bundled delivery services are enhancing customer convenience and brand loyalty.

In conclusion, the 2026 compressed wood logs market is characterized by strong fundamentals rooted in sustainability, energy security, and technological progress. While challenges remain, strategic investments in production, certification, and distribution are expected to drive continued expansion, positioning compressed wood logs as a vital component of the global bioenergy transition.

Common Pitfalls When Sourcing Compressed Wood Logs

Sourcing compressed wood logs can offer environmental and efficiency benefits, but several common pitfalls—particularly related to quality and intellectual property (IP)—can undermine value and lead to supply chain issues. Being aware of these risks is crucial for making informed procurement decisions.

Poor Quality Control and Inconsistent Composition

One of the most frequent challenges is receiving compressed wood logs with inconsistent quality. Variability in moisture content, density, and binder usage can significantly affect burn efficiency, heat output, and emissions. Logs made from contaminated feedstock (e.g., treated wood, plastics, or excessive bark) may release harmful pollutants when burned and can damage heating equipment. Suppliers lacking proper certification (such as ENplus or DINplus) may not adhere to standardized quality benchmarks, increasing the risk of subpar performance.

Lack of Transparency in Raw Material Sourcing

Many suppliers do not provide full traceability of the wood sources used in compression. This opacity raises concerns about sustainability and legality, especially if wood is sourced from deforested or protected areas. Without documentation such as FSC or PEFC certification, buyers risk supporting environmentally harmful practices or violating regulations, particularly in regions with strict sustainability requirements.

Misrepresentation of Performance Claims

Some suppliers exaggerate the calorific value, burn time, or ash residue levels of their compressed wood logs. These misleading claims can result in disappointed customers and operational inefficiencies. Third-party testing reports should be requested to verify performance metrics, as marketing materials alone are often unreliable.

Intellectual Property Infringement Risks

When sourcing compressed wood logs—especially from manufacturers offering proprietary technologies (e.g., unique compression methods, additive formulas, or branding)—there is a potential risk of inadvertently purchasing products that infringe on existing patents or trademarks. Using or reselling such products could expose the buyer to legal liability. Conducting due diligence on the supplier’s IP rights and ensuring they have freedom to operate is essential to avoid litigation.

Inadequate Packaging and Moisture Protection

Compressed wood logs are susceptible to moisture absorption, which degrades their structural integrity and combustion performance. Poor packaging—such as lack of sealed plastic wrapping or use of recycled, permeable materials—can lead to spoilage during transit or storage. Buyers should confirm packaging standards and storage recommendations with suppliers to maintain product quality.

Unreliable Supply Chain and Delivery Delays

Seasonal demand and reliance on specific biomass feedstock can lead to supply shortages or inconsistent delivery schedules. Suppliers without robust logistics planning may fail to meet contractual obligations, disrupting inventory and customer commitments. Establishing clear service level agreements (SLAs) and assessing supplier capacity beforehand can mitigate this risk.

By proactively addressing these pitfalls—through supplier audits, third-party certifications, performance testing, and IP vetting—organizations can ensure a reliable, high-quality, and legally compliant supply of compressed wood logs.

Logistics & Compliance Guide for Compressed Wood Logs

Compressed wood logs, also known as biomass logs or wood briquettes, are a popular renewable fuel source. Efficient logistics and strict compliance with regulations are essential for successful import, export, and domestic distribution. This guide outlines key considerations across the supply chain.

Product Classification and HS Code

Correct classification under the Harmonized System (HS) is the foundation for compliance. Compressed wood logs are typically classified as:

- HS Code 4401.39: Wood in chips or particles, briquettes, pellets, and similar solid fuels.

Note: Specific sub-codes may vary by country (e.g., 4401.39.0000 in the U.S.). Always verify with local customs authorities, as misclassification can lead to delays, fines, or seizure.

Phytosanitary and ISPM 15 Requirements

To prevent the spread of pests and diseases:

- ISPM 15 Compliance: If packaged in wood (e.g., pallets), all wood packaging material (WPM) must be heat-treated and marked with the official ISPM 15 stamp.

- Phytosanitary Certificate: Required for international shipments in many countries, especially from regions with known pest risks. Issued by the national plant protection organization (NPPO) of the exporting country.

Environmental and Emissions Regulations

Depending on the end market, logs may be subject to environmental standards:

- EU Ecodesign Directive (2015/1185): Applies to solid fuel heating appliances but indirectly affects fuel quality. High-quality, low-moisture logs are preferred.

- UK Ready to Burn Scheme: Logs sold for domestic use must have moisture content below 20%. While primarily for firewood, compressed logs should meet similar standards to be marketed as “Ready to Burn.”

- EPA Regulations (USA): No direct EPA regulation for compressed logs as fuel, but emissions from burning may be regulated at state level. Documentation on low ash and low emission performance can support market access.

Packaging and Labeling Requirements

Proper labeling ensures safety, traceability, and regulatory compliance:

- Mandatory Information:

- Net weight

- Moisture content (typically <10% for compressed logs)

- Calorific value (kWh/kg or BTU/lb)

- Manufacturer name and address

- Batch or lot number

- Country of origin

- Additional Labels:

- “Compressed Wood Logs – For Biomass Heating Use Only”

- Storage instructions (keep dry, ventilated area)

- Safety warnings (flammable, keep away from children)

Transportation and Handling

Logistics must preserve product integrity and ensure safety:

- Moisture Protection: Use waterproof tarpaulins or sealed containers during transit. Avoid direct ground contact; use pallets.

- Ventilation: Prevent condensation in shipping containers by ensuring adequate airflow, especially in maritime transport.

- Stacking and Weight Limits: Follow manufacturer stacking guidelines to avoid crushing lower layers. Confirm vehicle weight limits per axle to comply with road transport regulations.

- Hazard Classification: Not classified as hazardous goods under ADR/IMDG/IATA, but flammable solids regulations may apply if in large quantities or specific forms.

Import/Export Documentation

Complete and accurate documentation is critical:

- Commercial Invoice

- Packing List

- Bill of Lading or Air Waybill

- Certificate of Origin

- Phytosanitary Certificate (if required)

- Customs Declaration (using correct HS code)

- Test Reports (e.g., moisture, calorific value, ash content – upon buyer request)

Quality Assurance and Testing

Maintain consistent product quality through:

- Standardized Testing:

- Moisture content (EN 14774 or ASTM E871)

- Calorific value (EN 14918 or ASTM D5865)

- Ash content (EN 14775 or ASTM D3174)

- Density and mechanical durability

- Third-Party Certification: Consider ENplus® or DINplus certification for enhanced market credibility, especially in Europe.

Storage Best Practices

- Dry, Covered Area: Prevent moisture absorption, which reduces calorific value and increases emissions.

- Elevated Pallets: Keep logs off the ground.

- Adequate Ventilation: Minimize mold and off-gassing.

- Fire Safety: Store away from ignition sources, with appropriate fire extinguishers on-site.

Sustainability and Chain of Custody

Growing demand for sustainable biomass:

- Sustainable Sourcing: Ensure raw materials (e.g., sawdust, wood waste) come from certified or legal sources.

- FSC/PEFC Certification: Adds value in eco-conscious markets.

- Carbon Reporting: Provide carbon footprint data if required by customers or regulations (e.g., EU Renewable Energy Directive).

Conclusion

Successfully managing the logistics and compliance of compressed wood logs requires attention to detail across classification, documentation, phytosanitary standards, environmental regulations, and quality control. Proactive adherence to international and local requirements ensures smooth customs clearance, market access, and customer satisfaction. Always consult with regulatory experts and freight forwarders familiar with biomass products to mitigate risks.

In conclusion, sourcing compressed wood logs presents a sustainable, cost-effective, and efficient solution for renewable biomass fuel. Their high energy density, low moisture content, and consistent quality make them superior to traditional firewood in terms of burn efficiency and emissions. When sourcing, it is essential to prioritize suppliers that adhere to sustainable forestry practices, provide transparency in production, and comply with quality certifications such as ENplus or equivalent standards. Additionally, evaluating logistical factors—such as proximity to supply, transportation costs, and storage requirements—can significantly impact overall feasibility and environmental footprint. By carefully selecting reliable suppliers and considering environmental and economic factors, businesses and households can ensure a dependable, eco-friendly energy source that supports both operational needs and sustainability goals.