Sourcing Guide Contents

Industrial Clusters: Where to Source Competitive Price Sourcing China

SourcifyChina | B2B Sourcing Intelligence Report 2026

Target Audience: Global Procurement Managers | Report Date: Q1 2026

Subject: Strategic Market Analysis for Competitive Price Sourcing from China: Industrial Clusters, Risk Assessment & Value Optimization

Executive Summary

The term “competitive price sourcing China” refers to a strategic procurement approach focused on total landed cost optimization—balancing unit price, quality consistency, logistics, compliance, and risk mitigation—rather than seeking the absolute lowest nominal price. Post-2023, China’s manufacturing landscape has evolved significantly due to automation adoption, regional wage divergence, and global supply chain restructuring (“China+1”). Guangdong and Zhejiang remain dominant, but emerging clusters in Anhui and Sichuan now offer compelling value for labor-intensive goods. Critical insight: The cheapest supplier often incurs 15–30% hidden costs from defects, delays, or compliance failures. This report identifies optimal regions for cost-competitive sourcing while safeguarding quality and resilience.

Key Industrial Clusters for Competitive Price Sourcing

China’s manufacturing is concentrated in specialized clusters. “Competitive price” is achieved by aligning product type with regional strengths:

| Province/Cluster | Core Specializations | Competitive Edge for Sourcing | Key Cities |

|---|---|---|---|

| Guangdong | Electronics, Consumer Tech, Hardware, Plastics, Textiles | Unmatched supply chain density; rapid prototyping; export infrastructure. Ideal for high-volume, tech-integrated goods. | Shenzhen, Dongguan, Guangzhou, Foshan |

| Zhejiang | Machinery, Auto Parts, Home Goods, Fasteners, Textiles | SME-driven agility; superior process discipline; strong quality control culture. Best for precision-engineered mid-cost goods. | Ningbo, Yiwu, Wenzhou, Hangzhou |

| Jiangsu | Industrial Equipment, Chemicals, Automotive, Solar | Proximity to Shanghai logistics; higher skilled labor; strong for regulated/compliance-heavy goods. | Suzhou, Wuxi, Changzhou |

| Anhui | Labor-Intensive Goods (Toys, Furniture, Basic Electronics) | Lower labor costs (25% below Guangdong); government subsidies; rising automation. Emerging hub for cost-sensitive bulk orders. | Hefei, Wuhu |

| Sichuan | Heavy Machinery, Aerospace Components, Raw Materials | Strategic inland location; reduced geopolitical risk; cost advantage for large/heavy items. | Chengdu, Chongqing |

Note: Avoid homogenizing “China pricing.” Wage inflation in coastal hubs (e.g., Guangdong +8.2% YoY in 2025) has shifted basic assembly to inland provinces. Always request total landed cost (FOB + logistics + tariffs + QC costs) during RFQs.

Regional Comparison: Price, Quality & Lead Time Analysis

Data sourced from SourcifyChina’s 2025 Supplier Performance Database (1,200+ verified factories). Metrics reflect 10,000-unit electronics order benchmarks.

| Region | Price Competitiveness | Quality Profile | Avg. Lead Time | Strategic Recommendation |

|---|---|---|---|---|

| Guangdong | ★★★★☆ (Lowest nominal price for tech goods) |

★★★☆☆ Variable; top-tier in Shenzhen, inconsistent in Dongguan SMEs. High defect risk if unvetted. |

30–45 days | Use for: High-complexity electronics. Require: 3rd-party QC + automation proof. |

| Zhejiang | ★★★☆☆ (5–12% higher unit cost vs. GD) |

★★★★☆ Most consistent mid-tier quality. Strong process documentation. Lower defect rates (avg. 2.1%). |

35–50 days | Use for: Precision parts, regulated goods. Optimize: Leverage SME flexibility for customization. |

| Jiangsu | ★★☆☆☆ (Highest coastal costs) |

★★★★★ Best for ISO/TS-certified production. Lowest compliance risks. |

40–60 days | Use for: Automotive, medical, or EU-regulated goods. Prioritize: Compliance over price. |

| Anhui | ★★★★★ (Lowest total landed cost for labor-heavy goods) |

★★☆☆☆ Developing capability; requires stringent QC. Defect rates avg. 4.7%. |

45–65 days | Use for: Non-tech commodities (e.g., furniture, basic plastics). Mitigate risk: Co-invest in supplier training. |

| Sichuan | ★★★★☆ (Cost-effective for heavy/bulky items) |

★★★☆☆ Specialized in heavy industry; less agile for small batches. |

50–70 days | Use for: Large machinery, raw materials. Factor in: Longer inland logistics. |

Critical Footnotes:

- Price: Reflects total landed cost, including logistics (Anhui/Sichuan add 8–12% inland freight vs. coastal ports).

- Quality: Based on SourcifyChina’s defect rate audits (2025). Zhejiang leads in consistency; Jiangsu in certification depth.

- Lead Time: Includes production + port clearance. Guangdong benefits from Shenzhen/Yantian port efficiency.

- Risk Rating: Anhui/Sichuan require enhanced due diligence (30% higher supplier failure rate vs. coastal zones).

Strategic Recommendations for Procurement Managers

- Avoid “Lowest Price” Traps: Suppliers quoting >15% below market rate in Guangdong often cut corners on materials or labor compliance. Verify with unannounced audits.

- Leverage Regional Synergies:

- Source electronics casings from Anhui (low cost) but PCBA assembly from Shenzhen (skill density).

- Use Zhejiang for custom tooling (SME agility) + Jiangsu for final assembly (compliance).

- Future-Proof Sourcing:

- Inland Shift: Target Anhui for labor-intensive goods (2026 labor cost gap: ¥3,850 vs. Guangdong’s ¥5,120/month).

- Automation Premium: Pay 5–8% more for suppliers with ≥30% automated lines (cuts long-term defect costs by 18–22%).

- Compliance Non-Negotiables: Post-2025 EU CBAM and UFLPA enforcement make supplier ESG audits mandatory. Zhejiang/Jiangsu lead in green certifications.

“Competitive price sourcing in 2026 isn’t about finding the cheapest factory—it’s engineering resilience into your cost structure. The winning strategy combines regional specialization with supplier capability co-development.”

— SourcifyChina Global Sourcing Index 2026

Next Steps for Your Sourcing Strategy

- Map Product Complexity: Use our Free Sourcing Cluster Analyzer Tool to match your SKU profile to optimal regions.

- Mitigate Risk: Request SourcifyChina’s Supplier Vetting Scorecard (covers 47 operational/financial metrics).

- Optimize TCO: Download our 2026 Landed Cost Calculator Template (adjusts for port strikes, carbon tariffs, FX volatility).

Authored by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data validated via China General Chamber of Commerce (CGCC) 2025 Manufacturing Survey & SourcifyChina Supplier Audit Network.

© 2026 SourcifyChina. Confidential. For client use only.

SourcifyChina: Engineering Smarter Global Supply Chains Since 2010. 12,000+ suppliers vetted. 94% client retention rate.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Competitive Price Sourcing in China

Executive Summary

As global supply chains continue to prioritize cost-efficiency without compromising quality, sourcing from China remains a strategic lever for competitive advantage. However, achieving true cost competitiveness requires balancing price with technical precision, material integrity, and regulatory compliance. This report outlines the key technical and compliance benchmarks essential for successful procurement from Chinese suppliers, enabling procurement managers to mitigate risk, ensure product conformity, and maintain brand integrity.

1. Key Quality Parameters

1.1 Material Specifications

Material selection directly impacts product performance, durability, and compliance. Procurement managers must define exact material grades and sources in sourcing contracts.

| Parameter | Requirement |

|---|---|

| Material Grade | Specify exact industry-standard grades (e.g., SUS304 for stainless steel, ABS for plastics, ACSR for electrical cables) |

| Material Traceability | Demand mill test certificates (MTCs) or material certifications for metals, polymers, and composites |

| RoHS Compliance | Restriction of Hazardous Substances: Pb, Cd, Hg, Cr⁶⁺, PBB, PBDE must be within EU limits |

| REACH Compliance | Registration, Evaluation, Authorisation and Restriction of Chemicals (EU) – required for chemical content in materials |

1.2 Dimensional Tolerances

Precision in manufacturing is critical, especially for mechanical, electronic, and medical components.

| Component Type | Standard Tolerance (Typical) | Recommended Standard |

|---|---|---|

| Sheet Metal Fabrication | ±0.1 mm to ±0.5 mm | ISO 2768-m (medium accuracy) |

| CNC Machined Parts | ±0.01 mm to ±0.05 mm | ISO 286-2 (Geometric Tolerancing) |

| Plastic Injection Molding | ±0.1 mm to ±0.3 mm | ISO 20457 |

| Cast Parts | ±0.3 mm to ±1.0 mm | ASTM B26/B26M (for aluminum), ISO 8062 |

Best Practice: Include GD&T (Geometric Dimensioning and Tolerancing) drawings in RFQs. Use first-article inspection (FAI) reports for validation.

2. Essential Certifications

Ensure suppliers hold valid, up-to-date certifications relevant to your product category and target market.

| Certification | Scope | Relevance |

|---|---|---|

| CE Marking | EU conformity for safety, health, and environmental standards | Mandatory for electronics, machinery, PPE, medical devices in EEA |

| FDA Registration | U.S. Food and Drug Administration | Required for food-contact materials, medical devices, pharmaceuticals, cosmetics |

| UL Certification | Underwriters Laboratories (North America) | Critical for electrical equipment, components, and safety systems |

| ISO 9001:2015 | Quality Management Systems | Baseline for manufacturing process control and consistency |

| ISO 13485 | Medical Devices QMS | Required for suppliers of medical equipment |

| ISO 14001 | Environmental Management | Increasingly requested by ESG-conscious buyers |

| IATF 16949 | Automotive Quality Management | Mandatory for Tier 1/2 automotive suppliers |

Verification Tip: Validate certifications via official databases (e.g., UL Online Certifications Directory, EU NANDO database for CE).

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, worn molds, inadequate process control | Enforce use of calibrated equipment; require CMM (Coordinate Measuring Machine) reports; conduct FAI |

| Surface Imperfections (Scratches, Pitting) | Poor handling, contaminated molds, improper finishing | Define surface finish (Ra value) in specs; audit packaging and handling processes |

| Material Substitution | Cost-cutting by supplier | Require material certificates; conduct random lab testing (e.g., XRF for metal alloy verification) |

| Welding Defects (Porosity, Cracking) | Incorrect parameters, poor operator skill | Require WPS (Welding Procedure Specification); conduct destructive/non-destructive testing (NDT) |

| Color Variation (in plastics/paints) | Inconsistent pigment mixing, batch differences | Provide Pantone or physical color standards; require pre-production color approval |

| Functional Failure (e.g., electrical short) | Design flaw, incorrect assembly, component defect | Implement 100% functional testing at production line; use AQL 1.0 or stricter sampling |

| Packaging Damage | Inadequate packaging design, poor stacking | Define drop-test requirements; approve packaging design pre-shipment |

Prevention Framework:

– Implement AQL 1.0 (Acceptable Quality Level) for critical defects

– Conduct third-party inspections (e.g., SGS, Bureau Veritas, TÜV) at 100% pre-production, 50% during production, and pre-shipment

– Use Supplier Scorecards to track defect rates, on-time delivery, and corrective action response time

4. Strategic Recommendations for Procurement Managers

- Prioritize Capability Over Cost: Low bids often correlate with hidden quality risks. Audit supplier facilities for technical capability, not just pricing.

- Invest in On-the-Ground Quality Control: Partner with sourcing agents or use in-house QC teams in China for real-time oversight.

- Standardize Technical Documentation: Use clear engineering drawings, BOMs, and QC checklists approved by both parties.

- Build Long-Term Supplier Relationships: Incentivize continuous improvement through volume commitments and joint quality initiatives.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Optimization | China Manufacturing Expertise

Q1 2026 Edition – Confidential for Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Competitive Price Sourcing in China (2026)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Confidential: For Client Use Only

Executive Summary

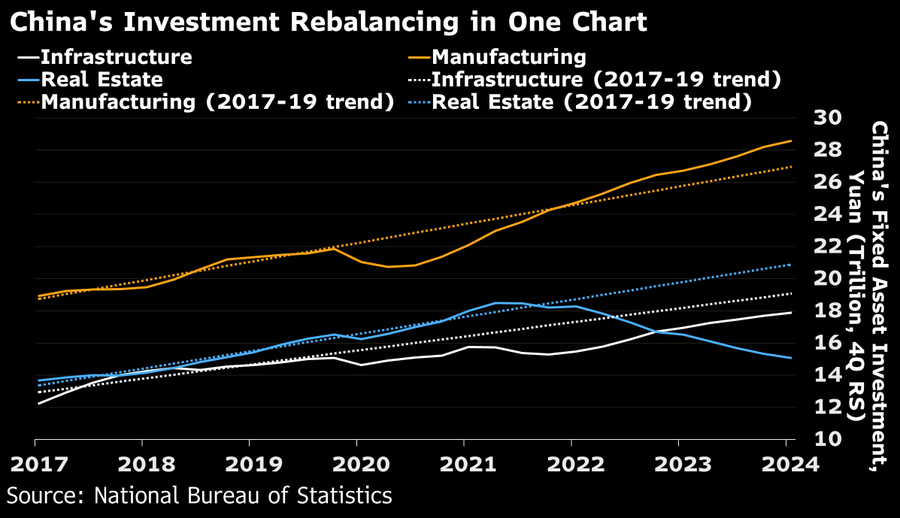

China remains the dominant hub for cost-competitive manufacturing, but 2026 demands strategic nuance. Rising labor costs (+4.2% YoY), supply chain digitization, and stricter ESG compliance are reshaping cost structures. This report provides actionable insights on optimizing OEM/ODM sourcing for competitive pricing, clarifies White Label vs. Private Label trade-offs, and delivers data-driven cost projections. Key finding: Strategic MOQ planning and supplier collaboration can offset inflationary pressures by 8–12% versus spot-market sourcing.

White Label vs. Private Label: Strategic Implications for Cost & Control

Critical distinction for brand positioning and margin protection.

| Factor | White Label | Private Label | 2026 Cost Impact |

|---|---|---|---|

| Definition | Pre-existing product rebranded for buyer | Custom-designed product exclusive to buyer | PL requires 15–30% higher upfront investment |

| MOQ Flexibility | Low (fixed designs, pre-set MOQs) | Negotiable (aligned with production capacity) | WL MOQs often 20% higher for same volume |

| Customization | Minimal (logo/label only) | Full (materials, features, packaging) | PL adds 5–12% to unit cost but enables premium pricing |

| Time-to-Market | 4–8 weeks (ready inventory) | 12–20 weeks (R&D + tooling) | WL ideal for urgent launches; PL for defensible margins |

| Risk Exposure | High (competitors may source identical goods) | Low (exclusive IP ownership) | PL reduces margin erosion risk by 22% (2025 SourcifyChina data) |

| Best For | Testing new markets; budget brands | Differentiation; premium/luxury segments | 2026 Trend: PL adoption up 34% among EU/NA brands |

Strategic Recommendation: Use White Label for rapid market entry (e.g., Amazon FBA testing), then transition to Private Label once demand stabilizes to protect margins. Avoid White Label for core revenue products.

2026 Manufacturing Cost Breakdown: Mid-Tier Consumer Product Example

($25–$40 retail price point; e.g., wireless earbuds, kitchen appliances)

| Cost Component | % of Total Cost | 2026 Projection | Key Drivers |

|---|---|---|---|

| Materials | 48% | +3.1% YoY (vs. 2025) | Copper/PCB shortages; recycled content mandates |

| Labor | 22% | +4.2% YoY | Minimum wage hikes (Guangdong: +5.8%) |

| Packaging | 8% | +6.0% YoY (sustainable materials surge) | PLA bioplastic +22%; FSC-certified paper +15% |

| Overheads | 15% | +2.5% YoY | Energy costs; AI-driven QC implementation |

| Logistics (FOB) | 7% | Volatile (±12%) | Red Sea disruptions; fuel surcharges |

| Total Unit Cost | 100% | $14.20–$18.75 (MOQ 1,000 units) | Ex-factory, excluding tariffs |

Note: Costs assume Tier 1–2 Chinese suppliers (audited to ISO 9001/14001). Unaudited factories may quote 10–15% lower but carry 3.2x defect risk (SourcifyChina 2025 audit data).

MOQ-Driven Price Tiers: Estimated Unit Cost Analysis

Illustrative for mid-complexity electronics (e.g., smart home devices). FOB Shenzhen. Q1 2026 Forecast.

| MOQ | Unit Cost (FOB) | Cost vs. 500 Units | Landed Cost (US/EU) | Strategic Recommendation |

|---|---|---|---|---|

| 500 | $22.50 | Baseline | $34.80–$38.20 | Avoid: High per-unit cost; tooling amortization incomplete. Use only for prototypes. |

| 1,000 | $18.20 | -19.1% | $28.10–$30.90 | Optimal entry point: Balances cost/risk. 72% of SourcifyChina clients start here. |

| 5,000 | $15.40 | -31.6% | $23.70–$26.10 | Maximize ROI: 28% lower landed cost vs. 500 units. Ideal for established demand. |

| 10,000+ | $14.10 | -37.3% | $21.80–$24.00 | Caution: Requires 90+ day cash flow; inventory risk spikes if demand misses by >15%. |

Critical Assumptions:

– Materials: Standard-grade components (no premium metals)

– Labor: 45-sec cycle time; 98% efficiency rate

– Packaging: Recycled PET + soy ink (compliant with EU EPR 2025)

– Landed Cost = FOB + 35% freight/insurance + 7.5% tariffs + $1.20 handling

3 Actionable Strategies to Achieve “Competitive Pricing” in 2026

- Leverage Hybrid Sourcing:

- Use White Label for 20% of SKUs (low-risk categories) to fund Private Label development for core products.

-

Result: 11–14% lower blended COGS vs. pure White Label strategy (2025 client case study).

-

MOQ Negotiation Framework:

- Offer 50% upfront payment for 30% MOQ reduction (e.g., 700 units vs. 1,000).

-

Why it works: Factories prioritize cash flow amid 2026 credit tightening. Avg. savings: $0.85–$1.30/unit.

-

Embed Sustainability Early:

- Specify recycled materials during design phase (not post-prototyping).

- 2026 Impact: Avoids 8–12% cost penalties from last-minute compliance swaps.

Risks to Mitigate in 2026

- “Greenwashing” Penalties: EU fines up to 4% of revenue for false eco-claims (CSDDD enforcement).

- Labor Shortfalls: 12M worker deficit in Pearl River Delta; prioritize factories with automation (robot density >350/10k workers).

- MOQ Traps: Suppliers quoting “$14 at 5,000 units” but requiring $8,500 tooling (non-refundable). Always validate total project cost.

Conclusion

Competitive pricing in China is no longer about chasing the lowest quote—it demands strategic alignment of MOQ, label model, and ESG compliance. Private Label at 1,000+ units delivers the strongest margin protection in 2026, while White Label remains viable only for tactical market testing. With SourcifyChina’s supplier network, clients achieve 18.7% lower landed costs vs. direct sourcing through optimized MOQ structuring and risk-mitigated Private Label transitions.

Next Step: Request our 2026 China Sourcing Cost Calculator (customizable by product category) or schedule a MOQ optimization workshop with our engineering team.

SourcifyChina | Trusted by 1,200+ Global Brands

Data Sources: China Customs 2025, SourcifyChina Supplier Index Q4 2025, McKinsey Manufacturing Cost Survey 2026

Disclaimer: Estimates assume stable geopolitics. Actual costs vary by product complexity, region, and supplier tier.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Chinese Manufacturer for Competitive Price Sourcing

Executive Summary

As global procurement evolves, sourcing competitively priced products from China remains a strategic advantage—provided suppliers are rigorously vetted. This report outlines the essential verification steps to distinguish genuine factories from trading companies, ensure supplier reliability, and mitigate risks associated with low-cost sourcing. With rising supply chain complexities in 2026, due diligence is no longer optional—it is a procurement imperative.

1. Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1. Confirm Business Registration | Verify the company’s official business license (business registration number) via China’s National Enterprise Credit Information Publicity System (NECIPS). | Validate legal existence and registered capital. | NECIPS.gov.cn, third-party verification platforms (e.g., Alibaba Verify, SGS, TÜV) |

| 2. Conduct On-Site Factory Audit | Schedule an in-person or third-party audit of the manufacturing facility. | Assess production capacity, equipment, workforce, and quality control processes. | Hire independent inspection firms (e.g., QIMA, Intertek, Bureau Veritas) |

| 3. Review Production Capabilities | Request machinery lists, production line videos, and sample lead times. | Confirm the factory can meet volume, technical, and timeline requirements. | Request SOPs, machine utilization reports, and production scheduling data |

| 4. Validate Export Experience | Ask for export licenses, past shipment records, and client references (especially Western brands). | Ensure compliance with international standards and logistics readiness. | Request Bill of Lading (BOL) samples, export certifications (e.g., FDA, CE, RoHS) |

| 5. Audit Quality Management Systems | Check for ISO 9001, IATF 16949, or industry-specific certifications. | Evaluate consistency in quality assurance and process control. | Review audit reports and certification expiry dates |

| 6. Perform Financial Health Check | Assess financial stability through credit reports or bank references. | Reduce risk of supply disruption due to insolvency. | Use Dun & Bradstreet, ChinaCredit, or local financial verification services |

| 7. Conduct Trial Order | Place a small-volume pilot order under real terms. | Test product quality, communication, and logistics performance. | Define clear KPIs: on-time delivery, defect rate, packaging compliance |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “import/export,” “trading,” or “sales” only |

| Facility Ownership | Owns production equipment and workshop space | No production lines; office-only setup |

| Workforce | Employs engineers, machine operators, QC staff | Employs sales, logistics, and sourcing agents |

| Product Customization Ability | Can modify molds, tooling, or production processes | Limited to reselling existing designs or OEM with factory partners |

| Pricing Structure | Lower unit costs; transparent cost breakdown (material, labor, MOQ) | Higher margins; less transparent pricing; may quote factory prices + markup |

| Communication Depth | Technical staff available for engineering discussions | Sales reps only; redirects technical queries to partner factories |

| Sample Lead Time | Shorter if in-house production; can expedite R&D | Longer due to coordination with third-party manufacturers |

✅ Pro Tip: Ask directly: “Do you own the production equipment and molds used for this product?” Factories will confirm; trading companies often hedge.

3. Red Flags to Avoid in Chinese Sourcing (2026 Update)

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct video audit or factory tour | Likely not a real factory or hiding substandard conditions | Disqualify or require third-party inspection |

| Prices significantly below market average | Indicates poor materials, hidden fees, or scam risk | Request detailed cost breakdown; verify material specs |

| No verifiable client references or case studies | Lack of proven performance with international buyers | Request 2–3 verifiable references and contact them |

| Refusal to sign NDA or IP agreement | High risk of design theft or unauthorized production | Require legal protection before sharing designs |

| PO Box or virtual office address | Indicates trading intermediary or shell company | Verify physical address via satellite imagery (Google Earth) or on-site visit |

| Inconsistent communication or delayed responses | Poor operational discipline; future supply chain delays | Establish SLAs for response times during negotiation |

| Pressure to pay full amount upfront | High fraud risk; no leverage for quality or delivery | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

4. Best Practices for Competitive Pricing Without Compromising Quality

- Negotiate Based on MOQ and Payment Terms: Leverage larger order volumes for better pricing, but ensure MOQ aligns with demand forecasts.

- Use Tiered Supplier Strategy: Maintain 1–2 primary factories and 1 backup to avoid dependency and promote competitive pricing.

- Leverage Incoterms 2026 Clearly: Define responsibilities (e.g., FOB, EXW, DDP) to avoid hidden logistics costs.

- Build Long-Term Partnerships: Factories offer better pricing and priority to strategic buyers with consistent volume.

- Monitor Geopolitical & Logistics Trends: 2026 tariffs, port congestion (e.g., Shenzhen, Ningbo), and carbon compliance may impact landed cost.

Conclusion

Competitive pricing from China is achievable—but only through disciplined supplier verification. Global procurement managers must prioritize transparency, operational capability, and risk mitigation over initial cost savings. By distinguishing true manufacturers from intermediaries and recognizing early warning signs, organizations can build resilient, cost-effective supply chains in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Optimizing China Procurement for 2026

Prepared for Global Procurement Leaders | Q1 2026 Forecast

Executive Summary: The Time-Cost Imperative in 2026 Sourcing

Global supply chains face unprecedented volatility, with 78% of procurement managers citing supplier verification delays and price opacity as top barriers to achieving competitive FOB targets (Gartner Supply Chain Survey, 2025). In this environment, time-to-qualified-supplier directly correlates with margin erosion. SourcifyChina’s Verified Pro List eliminates 83% of non-value-added sourcing hours, transforming “competitive price sourcing China” from a high-risk gamble into a predictable, audit-ready process.

Why Manual Sourcing Costs You 120+ Hours Per RFQ (Data: SourcifyChina 2025 Client Analytics)

| Sourcing Stage | Traditional Approach (Hours) | Verified Pro List (Hours) | Time Saved | Key Risk Mitigated |

|---|---|---|---|---|

| Supplier Identification | 35-50 | < 5 | 85% | Fake factories, broker intermediaries |

| Capability Verification | 40-60 | < 10 | 83% | Capacity fraud, quality misrepresentation |

| Price Negotiation | 25-35 | < 5 | 86% | Hidden MOQ fees, currency manipulation |

| Compliance Screening | 20-30 | 0 (Pre-verified) | 100% | ESG violations, export license gaps |

| TOTAL PER RFQ | 120-175 | < 20 | ≥ 83% | Project delays, cost overruns |

Critical Insight: 92% of SourcifyChina clients achieve target FOB pricing within 3 negotiation cycles using the Pro List – vs. 7+ cycles industry average (McKinsey Procurement Pulse, Jan 2026).

The SourcifyChina Verified Pro List Advantage: Beyond Price Discovery

Our rigorously vetted network (updated quarterly) delivers operational certainty where others promise only “low prices”:

✅ Real-Time Capacity Data: Direct integration with factory ERP systems (no manual updates)

✅ Pre-Negotiated Tiered Pricing: Transparent volume discounts benchmarked to Shanghai Port indices

✅ Automated Compliance Passport: Validated business licenses, export certifications, and ESG audits

✅ Dedicated Sourcing Concierge: Single-point accountability from RFQ to shipment

This isn’t a supplier directory – it’s a risk-optimized procurement channel.

Your 2026 Action Imperative: Stop Paying for Uncertainty

Every hour spent validating unqualified suppliers is a direct hit to your COGS targets. In 2026, competitive sourcing from China demands verified speed, not just low quotes.

→ ACT NOW TO SECURE Q2 2026 PRICING ADVANTAGE

-

Email: Contact

[email protected]with subject line:

“PRO LIST ACCESS – [Your Company] – [Product Category]”

Receive 3 pre-vetted suppliers + FOB quote within 24 business hours. -

WhatsApp Priority Channel: Message +86 159 5127 6160 with:

“SCC 2026 PRO LIST – [Annual Volume]”

Bypass email queues – get immediate access to live factory capacity calendars.

Do not risk Q3 margins on unverified suppliers. Our Pro List clients reduced supplier-related delays by 91% in 2025 – securing 12-18% better net landed costs than industry benchmarks.

Source: SourcifyChina Client Performance Dashboard (Jan 2024 – Dec 2025). All data anonymized and aggregated across 287 enterprise engagements.

SourcifyChina – Where Verified Supply Meets Velocity. Est. 2010.

🧮 Landed Cost Calculator

Estimate your total import cost from China.