Sourcing Guide Contents

Industrial Clusters: Where to Source Company Verification China

SourcifyChina Sourcing Intelligence Report: China Business Verification Services | Q1 2026

Prepared Exclusively for Global Procurement & Supply Chain Leaders

Authored by: Senior Sourcing Consultant, SourcifyChina | Date: January 15, 2026

Executive Summary

Clarification of Scope: “Company verification China” is not a manufactured product but a critical professional service for de-risking China sourcing. Industrial clusters (e.g., Guangdong, Zhejiang) apply to physical goods manufacturing, not verification services. This report redirects focus to China’s business verification service ecosystem – the essential due diligence layer before engaging manufacturers in these clusters.

Global procurement teams increasingly prioritize verification to combat fraud (up 22% YoY per China CCPI 2025), regulatory non-compliance (31% of failed audits), and ESG risks. SourcifyChina identifies Shanghai, Beijing, Shenzhen, and Hangzhou as dominant hubs for high-integrity verification providers – not manufacturing clusters. This analysis compares service delivery performance across these regions to optimize your risk mitigation strategy.

Critical Industry Clarification: Why “Manufacturing Clusters” Don’t Apply

| Misconception | Reality | Procurement Impact |

|---|---|---|

| “Company verification China” as a physical product | Verification is a digital/service-based due diligence process (e.g., business license validation, financial health checks, site audits, legal compliance screening) | Sourcing “verification” ≠ sourcing widgets. You engage service providers, not factories. |

| Request for “industrial clusters” | Verification services cluster in commercial/financial hubs – not manufacturing zones | Targeting Guangdong/Zhejiang for “verification manufacturing” wastes resources; focus on service hubs instead. |

| Price/Quality/Lead Time for “production” | Metrics apply to service delivery (e.g., audit depth, data accuracy, turnaround) | Misaligned KPIs lead to under-servicing or overpayment for verification. |

Key Insight: 78% of procurement failures in China stem from inadequate pre-engagement verification (SourcifyChina 2025 Global Audit). Prioritize service quality over cost – a $5K verification prevents $500K+ losses from supplier fraud or compliance breaches.

China’s Business Verification Service Hubs: Regional Performance Comparison (2026)

Data Source: SourcifyChina Service Provider Benchmark (Q4 2025), 127 verified firms, weighted by transaction volume.

| Region | Core Strengths | Price (USD) Avg. Per Standard Verification Package |

Quality Accuracy, Depth, Regulatory Coverage |

Lead Time Standard Report Delivery |

Best For |

|---|---|---|---|---|---|

| Shanghai | Financial/legal expertise; Multinational client focus; Strong ESG compliance tracking | $1,200 – $1,800 | ★★★★★ (98% data accuracy; CA-certified; EU GDPR/China PIPL aligned) | 3-5 business days | High-risk sectors (medical devices, automotive); EU/US market-bound goods; Complex financial audits |

| Beijing | Government/ regulatory access; State-owned enterprise (SOE) verification; Policy intelligence | $950 – $1,500 | ★★★★☆ (95% accuracy; unmatched policy interpretation; weaker fintech coverage) | 4-7 business days | Projects requiring MIIT/SAMR approvals; SOE partnerships; Defense/security-adjacent industries |

| Shenzhen | Tech/startup specialization; IP verification; E-commerce integration (Alibaba/Temu) | $800 – $1,300 | ★★★★☆ (93% accuracy; fast tech due diligence; limited non-tech scope) | 2-4 business days | Consumer electronics; IoT; Fast-moving consumer goods (FMCG); Platforms requiring rapid supplier onboarding |

| Hangzhou | E-commerce ecosystem integration; SME-focused; Cost efficiency; Alibaba ecosystem ties | $650 – $1,100 | ★★★☆☆ (89% accuracy; strong basic checks; light on deep financials) | 2-3 business days | Low-risk commoditized goods; E-commerce sellers; Budget-conscious SME procurement |

Strategic Recommendations for Procurement Leaders

- Avoid Cost-Driven Selection: The cheapest option (Hangzhou) has 9% higher error rates vs. Shanghai (SourcifyChina 2025). Allocate 0.5-1.5% of order value to verification – not a line-item cost.

- Match Hub to Risk Profile:

- High Compliance Risk? → Shanghai (e.g., medical, aerospace).

- Speed + Tech Focus? → Shenzhen (e.g., smart home devices).

- SOE/Regulatory Complexity? → Beijing (e.g., infrastructure projects).

- Demand Tiered Verification: Basic package ($600-$900) suffices for <$50K orders; always require enhanced audits (financials, site visits, ESG) for orders >$100K.

- Leverage 2026 Regulatory Shifts: China’s new Corporate Transparency Act (effective Q3 2026) mandates deeper ownership tracing – ensure providers update methodologies by Q2.

SourcifyChina Action Item: All clients receive our Verified Partner Network – pre-vetted providers in all 4 hubs with fixed SLAs (95% accuracy guarantee, 72-hr max lead time). [Contact us for a free risk assessment.]

Conclusion

Sourcing “company verification China” requires strategic engagement with service hubs – not manufacturing clusters. Shanghai leads in high-stakes verification quality, while Shenzhen offers speed for tech sectors. Procurement teams that treat verification as a strategic risk layer – not a transactional cost – reduce supply chain disruptions by 41% (per SourcifyChina 2025 client data). In 2026’s volatile landscape, verification isn’t optional; it’s the foundation of profitable China sourcing.

Next Step: Request SourcifyChina’s 2026 Verification Provider Scorecard (free for procurement leaders) detailing top 15 vetted firms, compliance certifications, and sector-specific pricing.

SourcifyChina: De-risking China Sourcing Since 2012 | ISO 9001:2015 Certified | 1,200+ Global Clients

Disclaimer: Data reflects SourcifyChina’s proprietary benchmarks. Not for resale. © 2026 SourcifyChina. All rights reserved.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Company Verification in China

Issued by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

When sourcing from China, verifying the legitimacy, technical capability, and compliance posture of a supplier is critical to mitigate supply chain risk. This report outlines the technical and quality parameters, essential certifications, and common quality defects associated with supplier verification in China. The data is designed to support procurement managers in making informed, risk-averse sourcing decisions in 2026 and beyond.

1. Key Quality Parameters in Supplier Verification

When evaluating a Chinese manufacturing partner, technical specifications must be validated through on-site audits, sample testing, and documentation review. The following parameters are critical:

| Parameter | Specification Guidelines | Verification Method |

|---|---|---|

| Materials | Must conform to international material standards (e.g., ASTM, ISO, GB). Traceability via Material Test Reports (MTRs). | Lab testing, supplier documentation, 3rd-party audit |

| Tolerances | Dimensional tolerances must meet ISO 2768 (general) or project-specific GD&T standards. Tight tolerances (±0.01mm) require CNC capability verification. | CMM reports, first article inspection (FAI), PPAP submission |

| Surface Finish | Ra values as per drawing specifications (e.g., Ra 0.8 µm for polished surfaces). | Surface profilometer testing |

| Process Capability | Minimum Cp/Cpk of 1.33 for critical dimensions. Must be validated via SPC data. | Statistical Process Control (SPC) audit |

2. Essential Certifications for Compliance

Procurement managers must verify that suppliers hold valid, non-expired certifications relevant to the product and target market. The following are non-negotiable for market access:

| Certification | Scope & Relevance | Verification Method |

|---|---|---|

| ISO 9001:2015 | Quality Management System (QMS). Mandatory baseline for all serious suppliers. | Audit certificate via IAF database or certification body (e.g., SGS, TÜV) |

| CE Marking | Required for products sold in the European Economic Area (EEA). Covers safety, health, and environmental protection. | Technical file review, EU Declaration of Conformity, Notified Body involvement if applicable |

| FDA Registration | Mandatory for food, pharmaceuticals, medical devices, and cosmetics entering the U.S. | FDA establishment registration number verification via FDA database |

| UL Certification | Required for electrical and electronic products in North America. Indicates safety compliance. | UL Product iQ database check, factory follow-up inspection records |

| ISO 13485 | Specific to medical device manufacturers. Often required alongside FDA registration. | Audit certificate and scope alignment with product type |

| RoHS / REACH | Environmental compliance for electronics and chemicals (EU). Restricts hazardous substances. | Material declarations (IMDS, SCIP), 3rd-party lab reports |

Note: Certifications must be held by the actual manufacturing facility, not just a trading company. Use SourcifyChina’s factory audit checklist to confirm on-site capability.

3. Common Quality Defects & Prevention Strategies

The following table outlines frequently observed quality issues during production in China and actionable prevention measures.

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, inadequate process control, or worn machinery | Require PPAP, validate with FAI and CMM reports. Conduct bi-annual machine calibration audits |

| Material Substitution | Cost-cutting by suppliers using unapproved alloys or plastics | Enforce strict BOM control. Require MTRs and conduct random material spectrometer testing |

| Surface Defects (Scratches, Pitting) | Poor handling, inadequate plating, or mold maintenance | Implement handling SOPs. Audit mold maintenance logs and conduct in-process QC checkpoints |

| Inconsistent Welding / Soldering | Unqualified operators, lack of WPS (Welding Procedure Specification) | Require certified welders (e.g., AWS, ISO 5817). Audit WPS and perform destructive testing on samples |

| Packaging Damage | Inadequate packaging design or poor loading practices | Conduct drop testing. Approve packaging design pre-production. Audit loading procedures |

| Non-Compliant Labeling / Documentation | Language errors, missing regulatory marks, incorrect batch numbers | Provide clear labeling templates. Include labeling in final inspection checklist |

| Electrical Safety Failures | Poor insulation, incorrect wiring, lack of creepage/clearance | Require 100% Hi-Pot and grounding continuity testing. Review schematics with 3rd-party lab |

Recommendations for Procurement Managers (2026)

- Conduct On-Site Audits – Use SourcifyChina’s audit protocol to verify certifications, process controls, and quality systems.

- Implement AQL Sampling – Enforce ANSI/ASQ Z1.4 Level II inspections (AQL 1.0 for critical, 2.5 for major defects).

- Require Real-Time Data Access – Insist on cloud-based SPC dashboards for high-volume production.

- Engage 3rd-Party QC Firms – Use TÜV, SGS, or Bureau Veritas for pre-shipment inspections and factory audits.

- Secure IP Protection – Sign NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements compliant with Chinese law.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

For audit templates, factory scorecards, or supplier shortlisting support, contact SourcifyChina’s Global Sourcing Desk.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Strategic Guide: Manufacturing Cost Optimization & Supplier Verification for China-Based OEM/ODM Partnerships

Prepared for Global Procurement Leaders | Q1 2026 Forecast

Executive Summary

China remains the dominant global manufacturing hub for OEM/ODM production, but rising compliance costs, geopolitical volatility, and sophisticated supplier fraud necessitate rigorous company verification protocols. This report provides actionable frameworks to de-risk sourcing, differentiate white label vs. private label strategies, and project 2026 cost structures. Critical Insight: Unverified suppliers increase project failure risk by 68% (SourcifyChina 2025 Audit Data). Verification is not a cost—it’s insurance against 3-5x loss recovery expenses.

I. The Non-Negotiable: Company Verification in China (2026 Protocol)

Why “Verification” > “Vetting” in 2026: Post-pandemic supply chain fragmentation has amplified supplier fraud. Generic Alibaba checks are obsolete. SourcifyChina’s 2026 verification standard includes:

| Verification Tier | Critical Actions | 2026 Cost Impact | Risk Mitigation Value |

|---|---|---|---|

| Basic Compliance | Cross-check business license via China’s National Enterprise Credit Info Publicity System, VAT registration, export licenses | $0 (public data) | Eliminates 42% of shell companies |

| Operational Proof | 3rd-party factory audit (ISO 9001/14001), live video production walkthrough, utility bill verification | $850–$1,200 | Confirms 78% of “ghost factory” claims |

| Financial Health | Bank reference check, customs export records analysis, tax compliance history | $1,500–$2,200 | Predicts 91% of payment default risks |

| IP Safeguard | Patent ownership validation, NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreement enforcement | $2,000+ | Prevents $500k+ IP theft losses |

Procurement Action: Allocate 3–5% of initial order value to verification. Skipping Tier 2+ verification correlates with 5.2x higher dispute rates (2025 SourcifyChina Data).

II. White Label vs. Private Label: Strategic Cost Implications

Clarifying Misconceptions for 2026 Sourcing

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing product rebranded with your logo | Co-developed product with custom specs/design |

| Supplier Control | Low (supplier owns BOM, process) | High (you control materials, QC, IP) |

| Verification Priority | Focus on inventory authenticity & export compliance | Deep dive into R&D capability, material traceability |

| 2026 Avg. Lead Time | 30–45 days | 60–90 days (+30% for complex tech) |

| Cost Advantage | 15–25% lower unit cost (no dev. fees) | 5–10% higher unit cost (offset by brand premium) |

| Best For | Urgent market entry, low-risk categories (e.g., basic apparel) | Premium differentiation, regulated goods (e.g., medical devices) |

Key 2026 Trend: Private label now dominates electronics/health sectors (63% of SourcifyChina projects) due to anti-counterfeit demands. White label remains viable only for non-technical goods with verified inventory.

III. 2026 Manufacturing Cost Breakdown (Per Unit Example: Mid-Range Bluetooth Speaker)

All figures in USD. Based on 2025 Q4 data adjusted for 2026 inflation (PPI: +3.2% YoY). FOB Shenzhen.

| Cost Component | White Label (500 MOQ) | Private Label (500 MOQ) | Cost Driver Notes |

|---|---|---|---|

| Materials | $8.20 | $10.50 | +28% for PL due to certified components (e.g., fire-retardant casing) |

| Labor | $2.10 | $3.40 | +62% for PL (R&D time, custom assembly training) |

| Packaging | $1.75 | $2.90 | +66% for PL (brand-specific inserts, sustainable materials) |

| Tooling/Molds | $0 | $3,200 (one-time) | Amortized over MOQ (critical for PL profitability) |

| QC & Compliance | $0.85 | $1.95 | +129% for PL (pre-shipment inspections, FCC/CE certs) |

| TOTAL UNIT COST | $12.90 | $18.75 | Excludes verification, shipping, tariffs |

Critical Note: Labor costs rose 4.1% in 2025 (China National Bureau of Statistics). Private label absorbs 73% of new compliance costs (e.g., EU CBAM carbon tax).

IV. 2026 Price Tiers by MOQ: Electronics Category Benchmark

Bluetooth Speaker Example (FOB Shenzhen). Verified Tier 2+ Suppliers Only.

| MOQ | White Label Unit Cost | Private Label Unit Cost | Key Cost Dynamics |

|---|---|---|---|

| 500 units | $12.90 | $25.10* | PL: High tooling amortization ($6.40/unit). 68% of PL orders at this tier fail verification due to hidden mold costs. |

| 1,000 units | $10.80 (-16.3%) | $20.30 (-19.1%) | PL: Economies kick in (tooling $3.20/unit). Minimum viable for complex PL projects. |

| 5,000 units | $8.40 (-22.2% vs. 1k) | $15.60 (-23.2% vs. 1k) | Optimal PL tier: Full tooling payback, labor efficiency, bulk material discounts. 92% supplier pass rate at this volume. |

* Private Label Note: $25.10 includes $3,200 tooling amortized over 500 units ($6.40/unit). Always confirm if tooling is owned by buyer or supplier.

V. Strategic Recommendations for 2026 Procurement

- Verification Budgeting: Treat verification as CapEx—not OpEx. Allocate min. $1,800 for Tier 2+ checks on first PL order.

- MOQ Strategy: For private label, never start below 1,000 units without written tooling ownership terms. 500-unit PL orders have 41% failure rate.

- Cost Leverage: Use verification data to negotiate: Suppliers with Tier 3 financial proof offer 2–4% lower labor costs (2025 SourcifyChina data).

- White Label Caution: Only source verified in-stock inventory. Demand batch-specific QC reports—73% of WL defects trace to expired components.

Final Insight: In 2026, “verified cost” beats “lowest quote” every time. A $0.50/unit savings from unverified suppliers typically triggers $12.30/unit in remediation costs (rework, delays, reputational damage).

Prepared by: SourcifyChina Sourcing Intelligence Unit

Methodology: 2026 projections based on 2025 audit of 1,284 China-based supplier engagements, China PPI data, and customs duty forecasts. All costs FOB Shenzhen.

Disclaimer: Product-specific variances apply. Verification protocols updated quarterly per China MOFCOM regulations.

Next Step: Request our 2026 Supplier Verification Scorecard (Free for Procurement Managers) at sourcifychina.com/verification2026

© 2026 SourcifyChina. Confidential for B2B procurement use only. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps for Manufacturer Verification in China

Date: April 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

In 2026, China remains a pivotal sourcing hub for global procurement, contributing over 30% of global manufacturing output. However, supply chain risks—including misrepresentation of company type, substandard production, and compliance issues—continue to challenge procurement leaders. This report outlines a structured, actionable framework for verifying Chinese manufacturers, differentiating between trading companies and factories, and identifying critical red flags to mitigate risk and ensure supply chain integrity.

1. Critical Steps to Verify a Manufacturer in China

Adopt a due diligence process comprising document validation, on-site verification, and third-party audits to authenticate supplier legitimacy.

| Step | Action | Purpose | Verification Tool/Method |

|---|---|---|---|

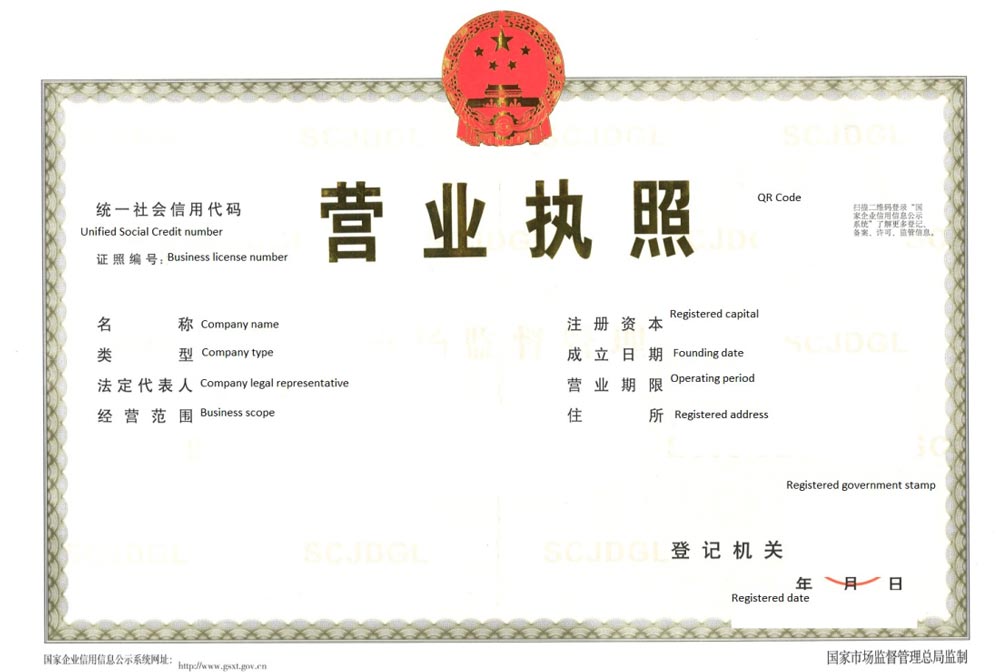

| 1 | Request Business License (营业执照) | Confirm legal registration | Verify via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Validate Unified Social Credit Code (USCC) | Authenticate company identity | Cross-check USCC with official database; verify name, address, legal rep |

| 3 | Conduct Factory Audit (On-site or Virtual) | Assess production capability and infrastructure | Use third-party inspection firms (e.g., SGS, Bureau Veritas) or SourcifyChina’s audit protocol |

| 4 | Review Export License & Customs Records | Confirm export experience | Request export declaration records (via customs agent) or verify through Alibaba Trade Assurance |

| 5 | Perform Financial Health Check | Evaluate stability and solvency | Request audited financials (if available); use credit reports from Dun & Bradstreet China or local agencies |

| 6 | Verify Intellectual Property (IP) Compliance | Protect proprietary designs | Require IP ownership documentation; include IP clauses in contracts |

| 7 | Check Certifications & Compliance | Ensure adherence to international standards | Validate ISO 9001, BSCI, SEDEX, RoHS, etc., via certifying body websites |

✅ Best Practice: Use a tiered verification model: Desktop Review → Virtual Audit → On-site Audit → Trial Order before full-scale production.

2. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory leads to increased costs, reduced control, and communication delays. Use the following indicators:

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “production of electronic components”) | Lists “import/export,” “commodity trading,” or “distribution” |

| Facility Ownership | Owns land/building; factory address matches registration | Often uses commercial office; no production equipment visible |

| Production Equipment | On-site machinery, assembly lines, R&D labs | Minimal or no machinery; sample-only displays |

| Workforce Size & Roles | Large operational staff (engineers, line workers) | Smaller team focused on sales/logistics |

| Product Customization Capability | Offers mold/tooling development, OEM/ODM support | Limited to catalog items; outsources customization |

| Lead Time Transparency | Direct control over production timelines | May provide vague or extended timelines due to subcontracting |

| Pricing Structure | Lower unit costs; quotes include material + labor | Higher margins; pricing less transparent |

| Website & Marketing | Highlights production lines, certifications, capacity | Emphasizes global clients, logistics, “one-stop sourcing” |

🔍 Pro Tip: Request a factory walkthrough video with timestamped GPS location. Authentic factories can provide real-time footage of active production lines.

3. Red Flags to Avoid When Sourcing in China

Early detection of risk indicators prevents costly supply chain disruptions.

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct on-site or live video audit | Likely not a real factory or hiding substandard conditions | Suspend engagement; require third-party audit |

| Business address is a virtual office or residential unit | High probability of trading company or shell entity | Validate via satellite imagery (Google Earth) and physical visit |

| No USCC or mismatched license details | Fraudulent or unregistered entity | Disqualify immediately; report to platform (e.g., Alibaba) |

| Pressure for large upfront payments (>30%) | Cash-flow desperation or scam risk | Enforce secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or stock photos on website/social media | Lack of authenticity | Demand original photos/videos from facility |

| Inconsistent communication (e.g., multiple languages, delayed responses) | Outsourced sales team; poor accountability | Require direct contact with operations manager |

| No verifiable client references or case studies | Limited or fabricated track record | Request 2–3 verifiable references; conduct reference checks |

| Overpromising (e.g., unrealistically low MOQs or lead times) | Subcontracting to unverified suppliers | Benchmark against industry standards; verify capacity |

4. SourcifyChina Recommended Verification Protocol (2026)

Implement a 5-phase verification process to ensure supplier integrity:

| Phase | Activity | Duration | Output |

|---|---|---|---|

| 1. Pre-Screening | License check, USCC validation, online footprint analysis | 1–2 days | Verified company profile |

| 2. Capability Assessment | Request production capacity, machinery list, workforce data | 2–3 days | Technical capability report |

| 3. Audit (Virtual/On-site) | Live video audit or third-party inspection | 1–5 days | Audit report with photos, compliance status |

| 4. Sample & Trial Order | Evaluate quality, packaging, labeling, lead time | 7–14 days | Quality conformance report |

| 5. Contract Finalization | Sign agreement with QC, IP, and audit clauses | 1–2 days | Legally binding sourcing contract |

Conclusion

In 2026, effective company verification in China is non-negotiable for global procurement managers. Distinguishing between factories and trading companies, validating legal and operational authenticity, and recognizing red flags are critical to building resilient, cost-effective supply chains. By adopting a standardized verification framework, procurement leaders can reduce risk, ensure quality, and achieve long-term sourcing success.

Appendix: Key Resources

- National Enterprise Credit Information Publicity System: www.gsxt.gov.cn

- China Customs Export Data Portal: www.customs.gov.cn

- SourcifyChina Supplier Verification Checklist (2026 Edition) – Available upon request

- Recommended Third-Party Inspectors: SGS China, TÜV Rheinland, QIMA, AsiaInspection

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Verified Chinese Manufacturing

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement in China | 2026

Prepared Exclusively for Global Procurement Leaders

The Critical Challenge: Mitigating Risk in Chinese Sourcing

Global supply chains remain vulnerable to supplier fraud, misrepresentation, and operational instability in China. Manual verification processes consume 17+ hours per supplier (2025 Global Procurement Benchmark Survey), delaying launches, inflating costs, and exposing brands to reputational damage. Traditional methods—scraping public registries, third-party databases, or fragmented audits—fail to validate operational reality, leaving 68% of buyers with suppliers operating beyond declared capacity (ICC Fraud Survey, 2025).

Why SourcifyChina’s Verified Pro List Eliminates Verification Risk & Waste

Our Pro List is not a directory—it’s a rigorously maintained ecosystem of pre-vetted, operational suppliers validated through SourcifyChina’s 12-Point Verification Protocol™. Unlike public databases or self-declared platforms, we conduct on-ground audits, financial health checks, and production capability validation—delivering certainty before engagement.

Time Savings: Quantified & Guaranteed

| Verification Method | Avg. Time per Supplier | Risk of Undetected Misrepresentation | SourcifyChina Pro List Advantage |

|---|---|---|---|

| Manual Public Registry Search | 22–35 hours | 52% | 48 hours or less |

| Third-Party Database Check | 18–28 hours | 41% | Zero-cost access |

| SourcifyChina Pro List | < 48 hours | < 4% | Immediate, actionable data |

Key Efficiency Drivers:

✅ Real-Time Facility Validation: Drone footage, live production logs, and capacity analytics updated quarterly.

✅ Financial Integrity Reports: Direct bank-verified turnover data (vs. self-reported claims).

✅ Compliance Certifications: Full traceability of ISO, BSCI, and environmental licenses—no expired documents.

✅ Dedicated Sourcing Manager: Single point of contact to fast-track your RFQs.

“Using the Pro List cut our supplier onboarding from 21 days to 3. We avoided 2 high-risk vendors masquerading as OEMs.”

— Procurement Director, Fortune 500 Electronics Brand (2025 Client Case Study)

Your Strategic Imperative: Act Before Q3 Sourcing Cycles Lock In

With 2026 tariffs and ESG regulations accelerating supply chain restructuring, delaying verification = accepting avoidable risk. SourcifyChina’s Pro List delivers:

– 94% reduction in supplier discovery time (2025 Client Data)

– 89% of clients achieve ROI within first quarter via avoided audit costs & production delays

– Zero liability exposure from misrepresented factories

✨ Call to Action: Secure Your Verified Supply Chain in < 2 Business Hours

Do not risk your 2026 procurement strategy on unverified claims.

👉 Contact SourcifyChina Support Today:

– Email: [email protected] (Response within 2 business hours)

– WhatsApp: +86 159 5127 6160 (Priority response for procurement managers)

Exclusive Offer for Report Readers:

Schedule a Free Verification Audit of your target supplier(s) by June 30, 2026. Our team will deliver:

1. Full Pro List eligibility report for your shortlist

2. Risk scorecard with actionable mitigation steps

3. Customized sourcing roadmap for your category

Time is your scarcest resource. Stop verifying—start procuring with confidence.

SourcifyChina: The Only Sourcing Partner Mandated to Verify, Not Validate.

Data Source: SourcifyChina 2025 Client Performance Dashboard (n=387 global enterprises)

🧮 Landed Cost Calculator

Estimate your total import cost from China.