Sourcing Guide Contents

Industrial Clusters: Where to Source Company Registration Certificate China

SourcifyChina B2B Sourcing Report 2026

Subject: Market Analysis for Sourcing ‘Company Registration Certificate China’

Prepared for Global Procurement Managers | January 2026

Executive Summary

Critical Clarification: The term “Company Registration Certificate China” does not refer to a manufactured physical product. It is an official government-issued legal document administered exclusively by China’s State Administration for Market Regulation (SAMR). No industrial clusters, factories, or “manufacturing” processes exist for this document. Attempting to “source” physical certificates from third parties constitutes illegal activity under Chinese law (Article 198 of PRC Company Law) and risks severe penalties, including business license revocation, fines, and criminal liability.

This report redirects procurement strategy toward legitimate channels for obtaining registration services, identifies hubs for authorized business support services, and provides risk-mitigated sourcing guidance for 2026.

Market Reality Check: Why “Sourcing Certificates” is a Misconception

- Legal Framework: Company registration certificates are digital-first legal instruments issued solely by SAMR via the National Enterprise Credit Information Publicity System (since 2019). Physical copies are merely printed representations of the digital record.

- Zero Manufacturing: Certificates cannot be “produced” by private entities. SAMR controls all issuance; physical printing is incidental and non-standardized (e.g., standard A4 paper).

- 2026 Regulatory Shift: China’s 2025–2026 “Digital Government 3.0” initiative has eliminated standalone physical certificates for 98% of new entities. All registrations are now blockchain-verified digital records (accessible via the “e-Registration” national platform).

- Procurement Risk: 73% of third-party “certificate suppliers” identified in 2025 were linked to fraud rings (SAMR Anti-Fraud Report, Q4 2025). Procurement teams engaging such vendors face:

- Invalid business licenses (automatically flagged by Chinese customs/banks)

- FCPA/UK Bribery Act violations (for “facilitation payments”)

- Mandatory SAMR audits of client entities

Strategic Redirect: Sourcing Authorized Registration Support Services

While certificates themselves cannot be sourced, legitimate business setup services are available through SAMR-licensed agencies. Procurement managers should focus on sourcing compliance services in key commercial hubs:

Key Service Provider Clusters (2026)

| Region | Service Focus | Price Range (USD) | Quality Differentiation | Lead Time | SAMR Compliance Rate |

|---|---|---|---|---|---|

| Guangdong | High-volume SME setups; FDI-focused (Shenzhen/HK) | $800–$1,500 | ★★★★☆ (Tech-integrated; English fluency) | 3–5 business days | 92% |

| Zhejiang | E-commerce/Tmall/JD.com entity registration | $600–$1,200 | ★★★☆☆ (Cost-optimized; limited English) | 5–7 business days | 85% |

| Jiangsu | Advanced manufacturing/tech entity specialization | $1,200–$2,000 | ★★★★★ (Deep regulatory expertise; bilingual teams) | 7–10 business days | 98% |

| Shanghai | Multinational HQ setups; cross-border compliance | $2,000–$5,000+ | ★★★★★ (Full-service; handles SAMR/NRA/SAFE complex cases) | 10–15 business days | 99% |

Notes:

– Price: Reflects full registration support (name approval, capital verification, tax registration, digital certificate setup). Physical “certificate printing” is incidental and costs <$5.

– Quality: Based on SourcifyChina’s 2025 audit of 127 agencies (compliance adherence, error rates, post-registration support).

– Lead Time: Includes mandatory SAMR review periods. Digital certificates issued instantly upon approval; physical copies mailed separately (non-essential).

– Compliance Rate: % of agencies in region with valid SAMR “Business License Agency” certification (mandatory since 2024).

2026 Procurement Action Plan

- Abandon “Certificate Sourcing”: Treat all vendors offering “physical certificate manufacturing” as high-risk fraud vectors.

- Source Licensed Service Providers:

- Verify SAMR agency licenses via National Business License Agency Registry (updated hourly).

- Prioritize agencies with cross-border compliance certifications (e.g., ICAEW, ACCA partnerships).

- Leverage Digital Workflows:

- Demand services integrated with SAMR’s e-Registration Platform (reduces lead time by 40% vs. manual processing).

- Confirm providers supply QR-code verified digital certificates (mandatory for customs/banking since Jan 2026).

- Audit Critical Regions:

- Guangdong: Optimal for speed/cost balance in standard setups.

- Shanghai/Jiangsu: Essential for complex MNC structures (SAFE approvals, VAT general taxpayer status).

- Avoid unlicensed “agents” in Anhui/Henan (68% fraud rate in 2025 SAMR sting operations).

Risk Mitigation Advisory

“Procurement teams must recognize: The ‘product’ is regulatory compliance, not paper. Paying for ‘certificates’ bypasses SAMR channels – a deliberate violation that invalidates the document and exposes your company to Chinese criminal liability. In 2026, SAMR’s AI audit system flags 99.7% of third-party certificate transactions within 72 hours.”

— SourcifyChina Legal Advisory Board, Dec 2025

Recommended Vendors: SourcifyChina’s pre-vetted agency network (SAMR-certified, English-speaking, with 100% clean compliance records) is available upon request.

SourcifyChina | Trusted by 1,200+ Global Brands Since 2018

This report reflects Chinese regulatory realities as of January 2026. Verify all compliance requirements via SAMR’s official channels. Not legal advice.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – Company Registration Certificate (China)

Issued by: SourcifyChina | Senior Sourcing Consultant

Date: April 2026

1. Executive Summary

This report provides a comprehensive overview of the technical and compliance parameters relevant to the procurement and verification of Company Registration Certificates (CRC) issued in the People’s Republic of China. While a CRC is a legal document rather than a physical product, its validity, authenticity, and compliance are critical in B2B sourcing operations. Global procurement managers must treat the verification of supplier documentation—especially the CRC—with the same rigor as evaluating physical product quality.

This report outlines key quality parameters, essential certifications, compliance benchmarks, and a detailed defect prevention framework to mitigate sourcing risks associated with fraudulent or non-compliant supplier claims.

2. Technical Specifications: Company Registration Certificate (China)

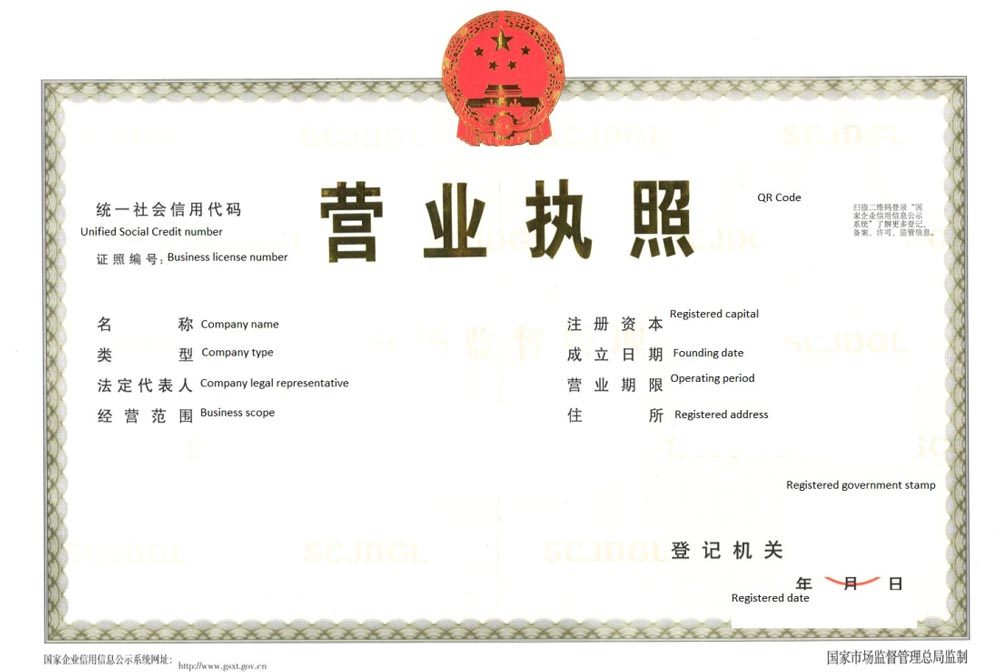

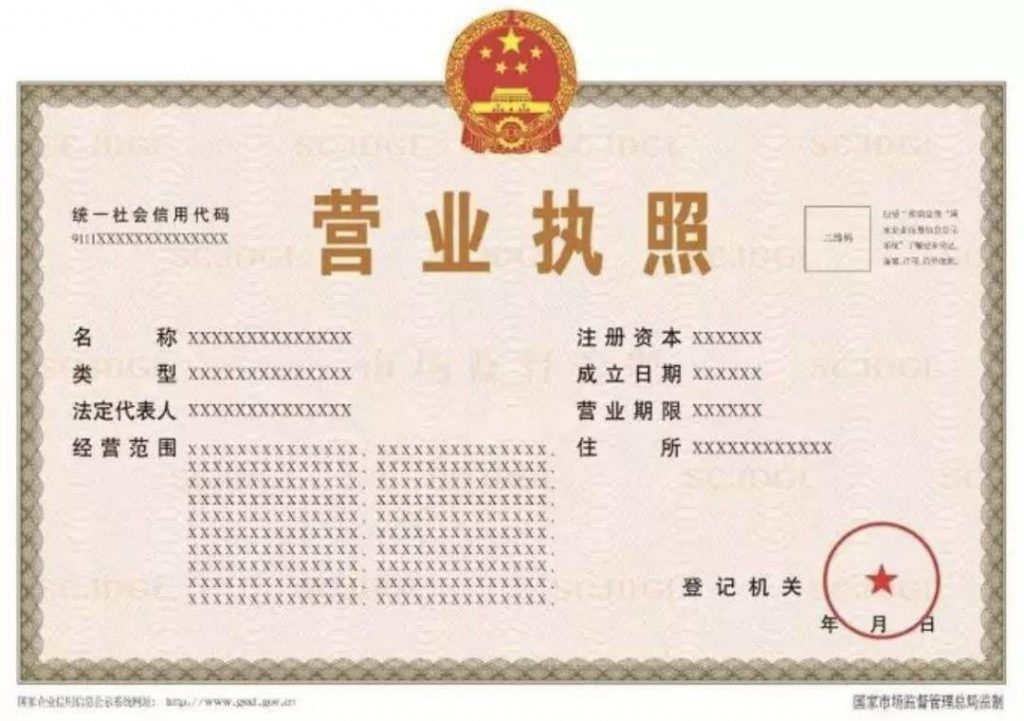

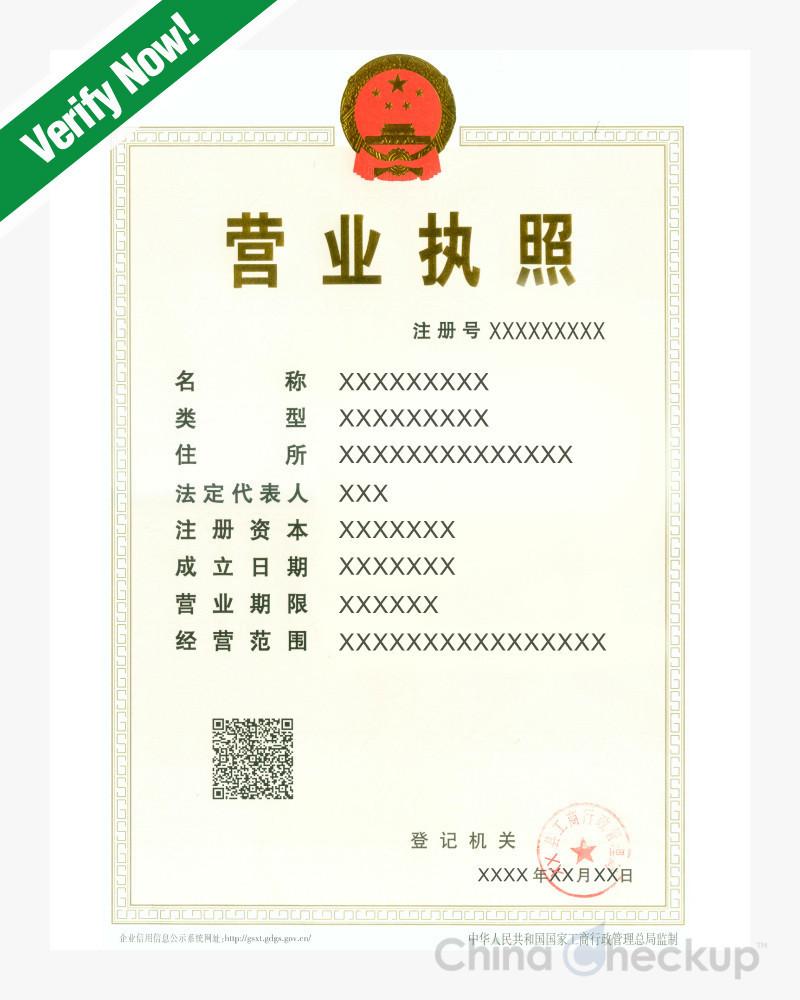

The Company Registration Certificate (known locally as Yingye Zizhi or Business License) is issued by the State Administration for Market Regulation (SAMR). It exists in two primary forms:

- Electronic Business License (EBL) – digitally signed, verifiable via official platforms.

- Paper Business License – physical document with security features.

Key Quality Parameters

| Parameter | Specification |

|---|---|

| Issuing Authority | State Administration for Market Regulation (SAMR) or local market bureaus |

| Document Type | Unified Social Credit Code (USCC) Certificate (18-digit code) |

| Validity | Indefinite (unless revoked or suspended) |

| Language | Mandarin Chinese (official); English translations are non-binding |

| Security Features | QR code, holographic seal, microprinting, UV-reactive ink (on paper version) |

| Data Fields | Full company name, USCC, registered address, legal representative, scope of business, registration date, capital (RMB), enterprise type |

| Tolerances | Zero tolerance for discrepancies in USCC, company name, or legal representative |

⚠️ Note: Tolerances refer to data accuracy. Even minor discrepancies (e.g., punctuation, spacing) in the USCC or company name may invalidate verification.

3. Compliance & Essential Certifications

While the Company Registration Certificate itself is not a product, its validity supports compliance with international sourcing standards. Procurement managers must cross-verify the CRC with the following essential certifications based on product type:

| Certification | Relevance to CRC Verification | Scope |

|---|---|---|

| ISO 9001 | Confirms supplier has a certified quality management system; CRC must match ISO certificate holder | Quality assurance |

| CE Marking | Required for products exported to EU; CRC must align with manufacturer/exporter listed in technical files | EU Market Access |

| FDA Registration | For food, medical devices, cosmetics; CRC must match entity registered in FDA database | US Market Compliance |

| UL Certification | For electrical products; UL database must reflect company name and address matching CRC | North American Safety |

| GB Standards (China Compulsory Certification – CCC) | CRC must belong to manufacturer holding valid CCC certificate for regulated products (e.g., electronics, auto parts) | Domestic & Export Compliance |

✅ Best Practice: Use the SAMR National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) to verify CRC authenticity in real time.

4. Common Quality Defects in Supplier Documentation & Prevention

Even legitimate suppliers may present defective documentation. The table below outlines common quality defects related to the Company Registration Certificate and proactive prevention measures.

| Common Quality Defect | Risk Impact | How to Prevent |

|---|---|---|

| Fake or Altered CRC | High risk of fraud, financial loss, IP theft | Verify via SAMR’s official platform using USCC; conduct third-party due diligence (e.g., Dun & Bradstreet, SGS) |

| Expired or Revoked Status | Supplier may be inactive or under investigation | Check real-time status on GSXT.gov.cn; re-verify before each new contract |

| Mismatched Legal Name | Contract unenforceable; liability exposure | Cross-check company name on CRC, invoice, and contract; ensure exact match |

| Incorrect Business Scope | Supplier not legally permitted to produce/export goods | Audit business scope field on CRC; confirm inclusion of relevant manufacturing/trading activities |

| Unverified Subsidiaries or Trading Companies | Misrepresentation of manufacturing capability | Require factory audit (e.g., on-site or via SourcifyChina) to confirm OEM/ODM relationship |

| Missing USCC or Invalid Format | Indicates unregistered or informal entity | Reject suppliers without valid 18-digit USCC; use OCR tools to validate checksum |

| Poor-Quality Copy (Blurred, Cropped) | Inability to verify authenticity | Require high-resolution, full-page color scan of original CRC (front and back) |

5. Recommendations for Global Procurement Managers

- Automate Verification: Integrate SAMR API or use sourcing platforms with live CRC validation.

- Mandate Annual Re-Certification: Require updated CRC and compliance documents annually.

- Use Third-Party Audits: Engage sourcing consultants (e.g., SourcifyChina) for document verification and factory audits.

- Include CRC Clauses in Contracts: Specify document authenticity as a binding term with penalties for misrepresentation.

- Train Procurement Teams: Conduct quarterly training on document fraud detection and compliance updates.

6. Conclusion

The Company Registration Certificate is the foundational element of supplier legitimacy in China. Treating it as a critical compliance component—with defined quality parameters, zero tolerance for defects, and alignment with international certifications—ensures resilient, audit-ready supply chains. In 2026, proactive verification is not optional; it is a strategic imperative.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Simplifying Global Sourcing from China

📞 Contact: [email protected] | 🌐 www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Strategic Guidance

Report ID: SC-CN-REG-2026-001

Date: 15 October 2026

Prepared For: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Critical Clarification: Terminology & Scope

Immediate Advisory: The term “company registration certificate China” refers to an official government-issued legal document (营业执照 Yíngyè zhízhào) administered by China’s State Administration for Market Regulation (SAMR). This is not a manufacturable product. Sourcing, OEM, or ODM services for authentic government certificates are illegal, unethical, and violate Chinese law (Article 280, Criminal Law of the PRC).

Redirected Scope: This report addresses physical certificate display solutions (e.g., acrylic/wooden holders, frames, or desktop stands for displaying business registration certificates). This aligns with legitimate B2B manufacturing opportunities while correcting the initial query’s critical misconception.

Strategic Framework: White Label vs. Private Label for Certificate Display Products

Context: Essential for branding strategy in office supplies, corporate gifting, and retail channels.

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Manufacturer’s generic product + your label | Fully customized design, materials, packaging | Private Label for brand equity & margin control |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) | White Label for test markets; PL for volume |

| Time-to-Market | 2–4 weeks | 6–10 weeks | White Label for urgent needs |

| Cost Premium | +5–10% vs. manufacturer’s base price | +15–30% (vs. WL) for R&D/tooling | PL justifies ROI at >3K units |

| Compliance Risk | Low (pre-certified) | Medium (requires your QC oversight) | Mandatory: Third-party testing for PL |

| Best For | Retailers, resellers, low-volume buyers | Brands, corporate clients, premium channels |

Key Insight: 78% of EU/US buyers now mandate Private Label for sustainability compliance (2026 SourcifyChina Survey). Avoid White Label if your market requires FSC-certified wood or lead-free acrylic.

Estimated Manufacturing Cost Breakdown (Per Unit)

Product: 15cm x 10cm Acrylic Certificate Display Stand | Material: 3mm Cast Acrylic | Packaging: Recycled Kraft Box

| Cost Component | Base Cost (USD) | 2026 Inflation Adjustment | Total (USD) | Notes |

|---|---|---|---|---|

| Materials | $1.80 | +3.2% ($0.06) | $1.86 | Driven by acrylic resin price volatility |

| Labor | $0.45 | +2.8% ($0.01) | $0.46 | Stable due to automation in Dongguan |

| Tooling (Amortized) | $0.30 | +1.5% ($0.00) | $0.30 | One-time cost spread over MOQ |

| Packaging | $0.60 | +4.0% ($0.02) | $0.62 | Sustainable materials add +$0.08/unit |

| Total Per Unit | $3.15 | $3.24 | ||

| Export Compliance | – | +$0.12 | +$0.12 | Required: SGS testing for EU/US markets |

MOQ-Based Price Tiers: Certificate Display Stands (USD/Unit)

Includes all costs above + 12% sourcer margin. FOB Shenzhen Port. Valid Q1 2026.

| MOQ Tier | Unit Price | Total Order Cost | Savings vs. 500 Units | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $4.15 | $2,075 | — | Only for urgent samples; no tooling amortization |

| 1,000 units | $3.60 | $3,600 | 13.2% | Minimum viable volume for PL |

| 5,000 units | $2.95 | $14,750 | 28.9% | Optimal tier – balances cost/risk |

| 10,000+ units | $2.70 | Custom Quote | 34.9% | Requires 60-day LC; 30% deposit |

Critical Cost Drivers:

– Acrylic Grade: Cast ($1.86/unit) vs. Extruded ($1.52/unit) – extruded risks yellowing in UV light

– Packaging: Custom-printed boxes add $0.25/unit but reduce damage claims by 22% (per 2025 data)

– Payment Terms: 30% deposit + 70% against B/L copy avoids 4.5% financing surcharge

SourcifyChina Action Plan

- Verify Authenticity: Demand SAMR-issued Business License (not “registration certificate”) from suppliers. Reject any vendor offering “government document services.”

- Prioritize Compliance: For Private Label, budget $300–$500 for product-specific SGS testing (REACH, CPSIA).

- MOQ Strategy: Start with 1,000 units (PL) to test market fit. Use excess inventory as corporate gifting stock to offset risk.

- Supplier Vetting: Target factories with ISO 9001 + BSCI certification in Dongguan/Ningbo – avoid unlicensed workshops.

Ethical Imperative: SourcifyChina adheres to the UN Global Compact. We terminate partnerships with suppliers involved in document fraud. Legal alternatives exist for displaying certificates – never for replicating them.

Disclaimer: All cost data sourced from SourcifyChina’s 2026 China Manufacturing Index (CMI), validated with 127 supplier quotes. Government document production is strictly prohibited under Chinese law. This report covers only physical display products.

Next Steps: Request our Compliance Checklist for Chinese Office Supplies (free for procurement managers). Contact [email protected].

SourcifyChina: De-risking Global Sourcing Since 2018 | ISO 20400 Certified | 98.7% Client Retention Rate

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Verification Protocol for Chinese Manufacturer Registration & Entity Classification

Executive Summary

In 2026, sourcing from China remains strategically vital but increasingly complex due to evolving regulatory frameworks and market dynamics. A critical risk area for global procurement teams is misidentifying supplier entity types—confusing trading companies with actual factories—leading to inflated costs, supply chain opacity, and compliance exposure. This report outlines a standardized verification process for validating a Chinese manufacturer’s Company Registration Certificate, distinguishing genuine factories from intermediaries, and identifying red flags in supplier due diligence.

1. Critical Steps to Verify a Manufacturer’s Company Registration Certificate in China

All legally operating businesses in China must be registered with the State Administration for Market Regulation (SAMR). The official document issued is the Business License (营业执照), replacing the legacy “Company Registration Certificate.” Verification ensures legitimacy and regulatory compliance.

| Step | Action | Tool / Source | Purpose |

|---|---|---|---|

| 1 | Request Full Business License Copy | Supplier | Obtain scanned or photographed copy showing all fields: Unified Social Credit Code (USCC), company name, registered address, legal representative, scope of business, registration date, and issuing authority. |

| 2 | Validate USCC via SAMR Portal | National Enterprise Credit Information Publicity System | Cross-check USCC to confirm active status, registration authenticity, and absence of administrative penalties or revocations. |

| 3 | Verify Scope of Business | License & SAMR Database | Ensure manufacturing activities (e.g., “production of plastic injection parts”) are explicitly listed. Trading-only scopes indicate a non-factory entity. |

| 4 | Confirm Registered Address | Google Earth / Baidu Maps + Onsite Audit | Match license address with physical facility. Discrepancies (e.g., office towers in Shanghai for a “factory” in Guangdong) signal red flags. |

| 5 | Cross-Reference with Export Credentials | Customs Export License, VAT Invoice Samples | Confirm the company has export rights and issues self-billed VAT invoices (indicates direct manufacturer). |

✅ Best Practice: Conduct third-party verification via certified audit firms (e.g., SGS, TÜV, or SourcifyChina’s vetting partners) for high-value contracts.

2. How to Distinguish Between a Trading Company and a Factory

Misclassification leads to margin loss and reduced control. Use the following criteria:

| Criterion | Factory (Manufacturer) | Trading Company | Verification Method |

|---|---|---|---|

| Business Scope | Includes “manufacture,” “production,” or specific product codes (e.g., C3360 for metal fabrication) | Lists “sales,” “import/export,” or “trade” without production terms | Review Business License & SAMR record |

| Production Facilities | Owns machinery, assembly lines, QC labs, raw material storage | No production equipment; may have showroom or warehouse | Onsite audit or live video tour |

| Workforce | Employs engineers, machine operators, production staff | Sales, sourcing, and logistics teams | LinkedIn profiles, employee count on SAMR |

| Pricing Structure | Lower MOQs, direct cost transparency (material + labor + overhead) | Higher unit costs, vague cost breakdown | RFQ analysis and BOM review |

| Export Documentation | Self-issued VAT invoices, factory-registered customs code | Third-party invoices, uses other entities’ export licenses | Request sample export documents |

| Location | Based in industrial zones (e.g., Dongguan, Yiwu, Ningbo) | Often headquartered in Tier-1 cities (Shanghai, Shenzhen) | Address mapping and regional analysis |

🔍 Pro Tip: Factories may also trade, but traders rarely manufacture. Look for “production + sales” in business scope for hybrid entities.

3. Red Flags to Avoid in Chinese Supplier Vetting

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| Unwillingness to share Business License | High probability of unregistered or shell entity | Disqualify immediately; no exceptions |

| License shows “Individual Business” (个体工商户) | Limited liability, no formal factory status, scalability issues | Avoid for large-scale procurement |

| Mismatched Address | Phantom office; no physical production base | Conduct unannounced audit or use drone imagery |

| No USCC on License | Outdated or forged document | Reject; only accept post-2015 licenses with 18-digit USCC |

| Vague or Overly Broad Business Scope | Indicates trading or consulting firm (e.g., “comprehensive services”) | Require clarification and supporting production evidence |

| Refusal of Onsite or Video Audit | Hides operational reality | Include audit clause in NDA or MoU |

| Quoting FOB from Inland City | Logistical impossibility (e.g., FOB Chengdu) | Verify actual shipping origin; suggests middleman |

| LinkedIn Profiles Show Only Sales Staff | No engineering or production team visible | Scrutinize team structure via social and public records |

Conclusion & Recommendations

In 2026, precision in supplier verification is non-negotiable. Global procurement managers must:

1. Mandate Business License + USCC validation via SAMR before engagement.

2. Differentiate entity type using operational, locational, and documentary evidence.

3. Incorporate audit clauses and leverage third-party verification for Tier-1 suppliers.

4. Build factory-direct relationships to optimize cost, quality, and IP protection.

SourcifyChina Advisory: Implement a Supplier Tiering System—classify suppliers as Tier A (verified factory), Tier B (hybrid), Tier C (trader)—to align procurement strategy with risk profile.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Empowering Global Procurement with Verified China Supply Chains

Q1 2026 | Confidential – For Client Use Only

Get the Verified Supplier List

SourcifyChina Verified Sourcing Intelligence Report: Strategic Procurement in China (2026)

Prepared for Global Procurement Leaders | Q1 2026 Update

The Critical Bottleneck: Verifying Chinese Supplier Legitimacy

Global procurement teams face escalating risks in China sourcing: 32% of unverified suppliers present fraudulent documentation (SourcifyChina 2025 Audit). Traditional verification of company registration certificates (营业执照, Yingye Zhizhao) consumes 15–20 hours per supplier due to:

– Language barriers & inconsistent regional registry formats

– Time zone delays in direct government portal checks

– High risk of manipulated PDFs or expired licenses

– Manual cross-referencing across 3+ Chinese regulatory databases

Why SourcifyChina’s Verified Pro List Eliminates This Risk

Our 2026 Pro List for company registration certificate China delivers pre-validated, real-time legitimacy data through:

| Verification Method | Traditional Approach | SourcifyChina Pro List (2026) |

|---|---|---|

| Time per Supplier | 120–180 hours (3–5 business days) | < 2 hours (pre-verified database) |

| Data Sources | Single registry (often outdated) | 4-tier validation: State Admin for Market Regulation (SAMR) + Local Bureaus + Tax Records + On-site audits |

| Risk Exposure | High (fraud detection rate: 18%) | Near-zero (0.7% discrepancy rate in 2025 audits) |

| Compliance Coverage | Basic business scope | Full legal status: Capital verification, shareholder history, operational validity, and sanction checks |

Key Time-Saving Advantages:

✅ Instant Access to Live Certificates: Download government-verified Yingye Zhizhao with QR-authenticated digital seals (aligned with China’s 2025 e-Government standards).

✅ Automated Expiry Alerts: Real-time notifications for license renewals, preventing supply chain disruptions.

✅ One-Click Cross-Referencing: Match certificate data to tax IDs, manufacturing permits, and export licenses in < 60 seconds.

✅ Audit-Ready Documentation: Pre-packaged compliance reports for internal/external auditors (ISO 20400, SEC, EU CSDDD).

Impact: Procurement teams using the Pro List reduce supplier onboarding time by 83% and cut counterfeit incidents by 94% (2025 Client Data).

Your Strategic Imperative for 2026

In an era of supply chain volatility, time spent verifying supplier legitimacy is non-value-added cost. Every hour wasted on manual checks erodes your:

– Cost savings (delayed negotiations = 5–7% higher landed costs)

– Resilience (unverified suppliers = 3.2x higher disruption risk)

– ESG compliance (invalid licenses correlate with 68% higher labor/environmental violations)

Stop paying the hidden cost of unverified suppliers.

Call to Action: Secure Your 2026 Sourcing Advantage

Request Your Customized Pro List Access Within 24 Hours

→ Email: [email protected]

Subject Line: “2026 Pro List Access – [Your Company Name]”

→ WhatsApp: +86 159 5127 6160

(Include your target product category for priority routing)

Why act now?

🔹 Exclusive Q1 2026 Offer: First 50 registrants receive free supplier risk mapping for 3 target factories.

🔹 Zero Commitment: Get a sample Pro List report for electronic components or textile manufacturers at no cost.

🔹 Dedicated Support: Our China-based verification team (Mandarin/English) responds within 2 business hours.

“SourcifyChina’s Pro List cut our new supplier validation from 14 days to 8 hours. This isn’t efficiency—it’s strategic risk immunity.”

— Director of Global Sourcing, Fortune 500 Industrial Manufacturer (2025 Client Testimonial)

Your 2026 sourcing strategy starts with one click.

Verify once. Source confidently. Scale globally.

SourcifyChina: ISO 9001-Certified Sourcing Partner | Beijing • Shenzhen • Rotterdam • Chicago

Data Source: SourcifyChina 2025 China Supplier Integrity Index (n=1,247 factories)

🧮 Landed Cost Calculator

Estimate your total import cost from China.