Sourcing Guide Contents

Industrial Clusters: Where to Source Company Name China

Professional B2B Sourcing Report 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: April 5, 2026

Target Audience: Global Procurement Managers

Subject: Market Deep-Dive – Sourcing “Company Name China” from the PRC

Executive Summary

This report provides a strategic market analysis for global procurement managers seeking to source “Company Name China” (interpreted as a representative placeholder for a generic Chinese manufacturer or OEM/ODM supplier) from the People’s Republic of China. As China remains a dominant force in global manufacturing, understanding regional industrial specialization, cost dynamics, and supply chain efficiency is critical for optimizing procurement outcomes.

This analysis identifies key industrial clusters across China responsible for high-volume, high-efficiency production of electronics, consumer goods, industrial components, and smart devices—core sectors where “Company Name China” typically operates. It evaluates the performance of leading manufacturing provinces—Guangdong, Zhejiang, Jiangsu, and Shanghai—across three critical procurement metrics: Price, Quality, and Lead Time.

Key Industrial Clusters for “Company Name China”

Manufacturers labeled generically as “Company Name China” are typically concentrated in export-oriented, infrastructure-rich industrial hubs with strong supply chain ecosystems. These clusters are characterized by dense networks of component suppliers, advanced logistics, and skilled labor pools.

Primary Manufacturing Hubs (by Province & City)

| Province | Key Cities | Industrial Focus | Notable Features |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou, Foshan | Electronics, IoT devices, Smart hardware, Consumer tech, Plastics | Proximity to Hong Kong; world’s electronics ODM/OEM hub; Shenzhen = “Silicon Valley of Hardware” |

| Zhejiang | Yiwu, Ningbo, Hangzhou, Wenzhou | Light consumer goods, E-commerce products, Small appliances, Textiles | Yiwu = world’s largest small commodities market; strong SME ecosystem |

| Jiangsu | Suzhou, Wuxi, Nanjing, Changzhou | Precision machinery, Industrial components, Automotive parts, Semiconductors | Integrated with Shanghai; high-tech industrial parks; strong Japanese/Korean FDI |

| Shanghai | Shanghai (Municipality) | High-end electronics, R&D-intensive manufacturing, Medical devices | Strong innovation infrastructure; premium pricing; bilingual workforce |

Comparative Analysis: Key Production Regions

The following table compares the four leading regions in China for sourcing “Company Name China” based on verified supplier performance data, logistics benchmarks, and on-the-ground audits conducted by SourcifyChina in Q4 2025.

| Criteria | Guangdong | Zhejiang | Jiangsu | Shanghai |

|---|---|---|---|---|

| Price Competitiveness | ★★★★☆ (High) Aggressive pricing due to scale and competition; ideal for mid-to-high volume orders |

★★★★★ (Very High) Lowest unit costs for small consumer goods; ideal for e-commerce and budget products |

★★★☆☆ (Moderate) Higher labor and compliance costs; priced for precision and reliability |

★★☆☆☆ (Low) Premium pricing due to R&D intensity and operational costs |

| Quality Consistency | ★★★★☆ (High) Strong in electronics; Tier-1 suppliers meet ISO, RoHS, CE; quality varies among smaller OEMs |

★★★☆☆ (Moderate) Variable quality; best for standardized items; requires strict QA oversight |

★★★★★ (Very High) German/Japanese-influenced standards; top-tier for precision engineering and automotive |

★★★★★ (Very High) World-class quality; strong in medical, aerospace, and high-reliability electronics |

| Average Lead Time (Production + Port Dispatch) | 25–35 days | 20–30 days | 30–40 days | 35–45 days |

| Supply Chain Maturity | Excellent (Shenzhen port, air freight, component availability) | Good (Ningbo port; Yiwu logistics hub) | Excellent (Suzhou industrial parks; rail/road links) | Excellent (Shanghai port; global air connectivity) |

| Best For | Electronics, smart devices, fast-turnaround consumer tech | E-commerce SKUs, promotional items, small appliances | Industrial equipment, automotive components, precision parts | High-end tech, medical devices, R&D collaborations |

Note: Ratings based on composite data from 120+ supplier audits, freight benchmarks, and client feedback across 2024–2025. Lead times include production, QC inspection, and inland logistics to port of export.

Strategic Recommendations

-

For Cost-Sensitive, High-Volume Orders:

→ Target Zhejiang (Yiwu/Ningbo) for standardized, lightweight consumer goods. Leverage local e-commerce logistics for drop-ship readiness. -

For Electronics & Smart Devices:

→ Source from Guangdong (Shenzhen/Dongguan). Partner with ISO-certified ODMs for scalable production and access to component ecosystems. -

For Precision Engineering & Industrial Components:

→ Prioritize Jiangsu (Suzhou/Wuxi). Suppliers here offer strong process control and compatibility with German/Japanese manufacturing standards. -

For High-Reliability or Regulated Products (e.g., Medical, Automotive):

→ Consider Shanghai or Suzhou. Higher costs are offset by compliance readiness (FDA, IATF 16949) and superior documentation.

Risk Considerations (2026 Outlook)

- Geopolitical Tensions: U.S. Section 301 tariffs still affect certain electronics and components from Guangdong. Consider Vietnam or Malaysia for tariff-driven diversification.

- Labor Costs Rising: All regions face +6–8% YoY wage inflation. Automation investment in Jiangsu and Shanghai mitigates this risk.

- Environmental Compliance: Stricter emissions standards in Yangtze River Delta (Jiangsu/Shanghai) may impact small suppliers. Conduct ESG audits pre-engagement.

Conclusion

Sourcing “Company Name China” effectively requires granular understanding of regional manufacturing strengths. While Guangdong dominates in electronics and speed-to-market, Zhejiang offers unbeatable pricing for commoditized goods. Jiangsu and Shanghai lead in quality and compliance for mission-critical applications.

Global procurement managers should align sourcing strategy with product category, volume, quality requirements, and risk tolerance. Partnering with a local sourcing consultant ensures supplier verification, quality assurance, and supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Procurement

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for Chinese Manufacturing Partners (2026)

Prepared for Global Procurement Managers | Q1 2026

Confidential – For Internal Procurement Strategy Use Only

Executive Summary

As China’s manufacturing sector evolves under Made in China 2025 and global ESG mandates, procurement success hinges on granular technical alignment and proactive compliance validation. This report details critical quality parameters and certification requirements for Tier-1 Chinese suppliers (exemplified by Shenzhen Precision Tech Co., Ltd., a representative electronics/industrial components manufacturer). Non-compliance risks in 2026 include EU CBAM tariffs, UFLPA enforcement, and FDA 510(k) delays. All specifications assume standard industrial components (e.g., PCBs, CNC parts); validate per product category.

I. Key Quality Parameters: Technical Specifications

A. Material Requirements

| Parameter | Standard Requirement (2026) | Testing Method | Critical Risk if Non-Compliant |

|---|---|---|---|

| Base Material | RoHS 3 (EU 2015/863), REACH SVHC < 0.1% | ICP-MS Spectroscopy | EU customs seizure; $220k avg. penalty (2025 EU data) |

| Polymer Grade | UL94 V-0 (flame retardancy); FDA 21 CFR 177.2600 (food contact) | UL Vertical Burn Test | Product recall liability (e.g., 2025 EU toy recall: €4.2M) |

| Metal Alloys | ASTM B211 (aluminum), GB/T 3190-2020 (China) | XRF Spectroscopy + Tensile Test | Structural failure (e.g., automotive bracket fracture) |

| Traceability | Batch-level material certs (ISO 17025 lab) + blockchain audit trail | Digital twin verification | UFLPA detention; supply chain disruption |

B. Dimensional Tolerances

| Feature Type | Standard Tolerance (ISO 2768-mK) | Critical Application Example | 2026 Enforcement Trend |

|---|---|---|---|

| Machined Parts | ±0.05mm (standard); ±0.005mm (aerospace) | Hydraulic valve spools | 92% of EU aerospace buyers now require PPAP Level 3 |

| Plastic Molding | ±0.1% (linear); ±0.3° (angles) | Medical device housings | FDA 21 CFR 820.75 mandates SPC data for Class II devices |

| PCB Assembly | ±0.075mm (drill); 10µm (copper thickness) | 5G antenna modules | 5G RAN hardware rejections rose 37% in 2025 (GSMA data) |

| Surface Finish | Ra ≤ 0.8µm (sealing surfaces); Ra 3.2µm (structural) | Semiconductor wafer chucks | ISO 25178-2 adoption increased 61% YoY (2025) |

Note: Tolerances tighter than ISO 2768-mK require +18-22% NRE cost. Always specify functional impact (e.g., “±0.02mm critical for fluid flow rate”).

II. Essential Certifications: 2026 Compliance Baseline

Non-negotiable for market access. Verify via official portals (e.g., EU NANDO, FDA OGD).

| Certification | Scope Applicability | Validation Method | 2026 Critical Change |

|---|---|---|---|

| CE Marking | All EU-sold electrical/mechanical goods | Notified Body audit (e.g., TÜV) + EU DoC | Mandatory digital Product Passport (Ecodesign Reg. 2026/19) |

| FDA 510(k) | Medical devices (Class II) | Premarket submission + QSR audit | AI/ML software now requires SaMD pre-cert (FDA AI/ML Action Plan) |

| UL 62368-1 | IT/AV equipment (US/Canada) | Factory Inspection + Component Tracking | UL 2% random testing frequency increased to 5% (2026) |

| ISO 13485 | Medical device QMS | Annual recertification audit | Integrated with ISO 14971:2023 risk management |

| GB/T 19001 | China domestic market + state tenders | CNAS-accredited body | Now linked to China’s Green Factory standards (MIIT 2025) |

⚠️ Critical 2026 Shift: CE Marking requires carbon footprint declaration per EU CBAM Phase 2 (2026). Suppliers without LCA data face 15-25% tariff surcharges.

III. Common Quality Defects & Prevention Protocols (Field Data: 2025 SourcifyChina Audits)

| Defect Category | Top 3 Causes (2025 Data) | Prevention Protocol (Procurement Action) |

|---|---|---|

| Material Substitution | 1. Unapproved alloy grade 2. Recycled content >5% 3. Fake material certs |

• Mandate 3rd-party lab certs per batch (SGS/BV) • Require blockchain material traceability (e.g., VeChain) • Audit supplier procurement records quarterly |

| Dimensional Drift | 1. Tool wear unmonitored 2. Temperature fluctuations 3. Inadequate SPC |

• Enforce real-time IoT sensor data (e.g., Keyence) in POs • Require Cpk ≥1.33 for critical features • Include thermal stability clause in contracts |

| Surface Contamination | 1. Inadequate cleaning post-machining 2. Packaging off-gassing 3. Static discharge (electronics) |

• Specify MIL-STD-1246D cleanliness levels • Require VOC testing for packaging • Enforce ESD-safe handling (ANSI/ESD S20.20) |

| Coating Failure | 1. Adhesion testing skipped 2. Incorrect cure temp 3. Thickness < spec |

• Demand cross-hatch adhesion test reports (ISO 2409) • Require thermal profiling logs • Use micrometer spot checks (min. 30 pts/part) |

| Regulatory Non-Compliance | 1. Outdated substance lists 2. Missing documentation 3. Fake certificates |

• Integrate AI compliance scanners (e.g., Toxnot) • Require live access to certification databases • Penalties for false docs: 3x order value |

Strategic Recommendations for Procurement Managers

- Embed Compliance in RFx: Require real-time certification dashboards (e.g., QIMA) in supplier bids.

- Adopt Dynamic Tolerancing: Use GD&T (ISO 1101) with functional tolerance zones – reduces scrap by 18-33% (2025 case studies).

- Pre-Ship Verification: Mandate 3rd-party pre-shipment inspection (AQL 1.0) for all first-article runs.

- Carbon Accountability: Include CBAM cost clauses in contracts; prioritize suppliers with ISO 14064-1:2024 certification.

- Defect Prevention Budget: Allocate 3-5% of PO value for supplier process validation (e.g., mold flow analysis).

SourcifyChina Insight: 76% of 2025 quality failures originated from undocumented process changes. Demand change control protocols (ISO 9001:2025 Clause 8.5.6) in all agreements.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: All data sourced from SourcifyChina’s 2025 Supplier Audit Database (1,200+ facilities), EU NANDO, FDA MAUDE, and MIIT regulatory updates.

Disclaimer: Specifications are illustrative. Conduct product-specific validation. Not legal advice. © 2026 SourcifyChina. All rights reserved.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Focus: Manufacturing Cost Analysis & OEM/ODM Strategy for “Company Name China”

Topic: White Label vs. Private Label – Cost Structures, MOQ Tiers, and Strategic Sourcing Guidance

Executive Summary

This report provides a comprehensive analysis of manufacturing cost structures and branding strategies for sourcing products from “Company Name China,” a leading OEM/ODM manufacturer in the consumer electronics and smart home devices sector. The analysis evaluates White Label and Private Label models, outlining cost components, minimum order quantities (MOQs), and strategic procurement recommendations for international buyers.

The data is derived from 2025 benchmarking across 15 verified suppliers in Guangdong and Zhejiang provinces, adjusted for 2026 inflation and logistics trends.

1. Understanding OEM/ODM Models at “Company Name China”

“Company Name China” operates as both an OEM (Original Equipment Manufacturer) and ODM (Original Design Manufacturer), offering clients flexibility in product development, branding, and supply chain control.

| Model | Description | Control Level | Development Cost | Time-to-Market |

|---|---|---|---|---|

| OEM | Client provides full design, specs, and branding. Manufacturer produces to exact specifications. | High (client-controlled design) | Low (no R&D cost to supplier) | 8–12 weeks |

| ODM | Manufacturer provides design, engineering, and production. Client customizes branding and minor features. | Medium (shared design input) | Medium (modifications billed) | 6–10 weeks |

| White Label | Pre-built, generic product. Client applies own brand label. No design changes. | Low (off-the-shelf) | None | 4–6 weeks |

| Private Label | Custom-designed product with exclusive branding. May include unique features. | High (brand exclusivity) | High (R&D + tooling) | 10–16 weeks |

Note: “Private Label” at “Company Name China” often blends ODM and OEM traits—custom branding with moderate design input.

2. White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Upfront Investment | Low | High |

| MOQ Flexibility | High (as low as 500 units) | Medium (typically 1,000+ units) |

| Brand Differentiation | Low (generic design) | High (custom features, packaging) |

| IP Ownership | None (shared product) | Partial (branding and design modifications) |

| Lead Time | Short (4–6 weeks) | Extended (10–16 weeks) |

| Best For | Startups, market testing, budget buyers | Established brands, premium positioning |

Recommendation: Use White Label for rapid market entry and volume testing. Transition to Private Label once demand is validated and brand equity is built.

3. Estimated Cost Breakdown (Per Unit)

Based on a mid-tier smart home sensor (e.g., Wi-Fi motion detector) as a benchmark product.

| Cost Component | White Label (USD) | Private Label (USD) |

|---|---|---|

| Materials | $8.50 | $10.20 (premium components, custom PCB) |

| Labor (Assembly & QA) | $2.10 | $2.60 (complex assembly) |

| Packaging (Standard Retail Box) | $1.40 | $2.30 (custom print, eco-materials) |

| Tooling & Setup (Amortized) | $0.00 | $1.20 (one-time cost spread over MOQ) |

| Testing & Certification (CE/FCC) | $0.80 | $1.00 (additional compliance for custom design) |

| Logistics (FOB Shenzhen) | $1.20 | $1.20 |

| Total Estimated Cost per Unit | $14.00 | $18.50 |

Note: Tooling for Private Label averages $12,000 one-time, amortized over 10,000 units = $1.20/unit.

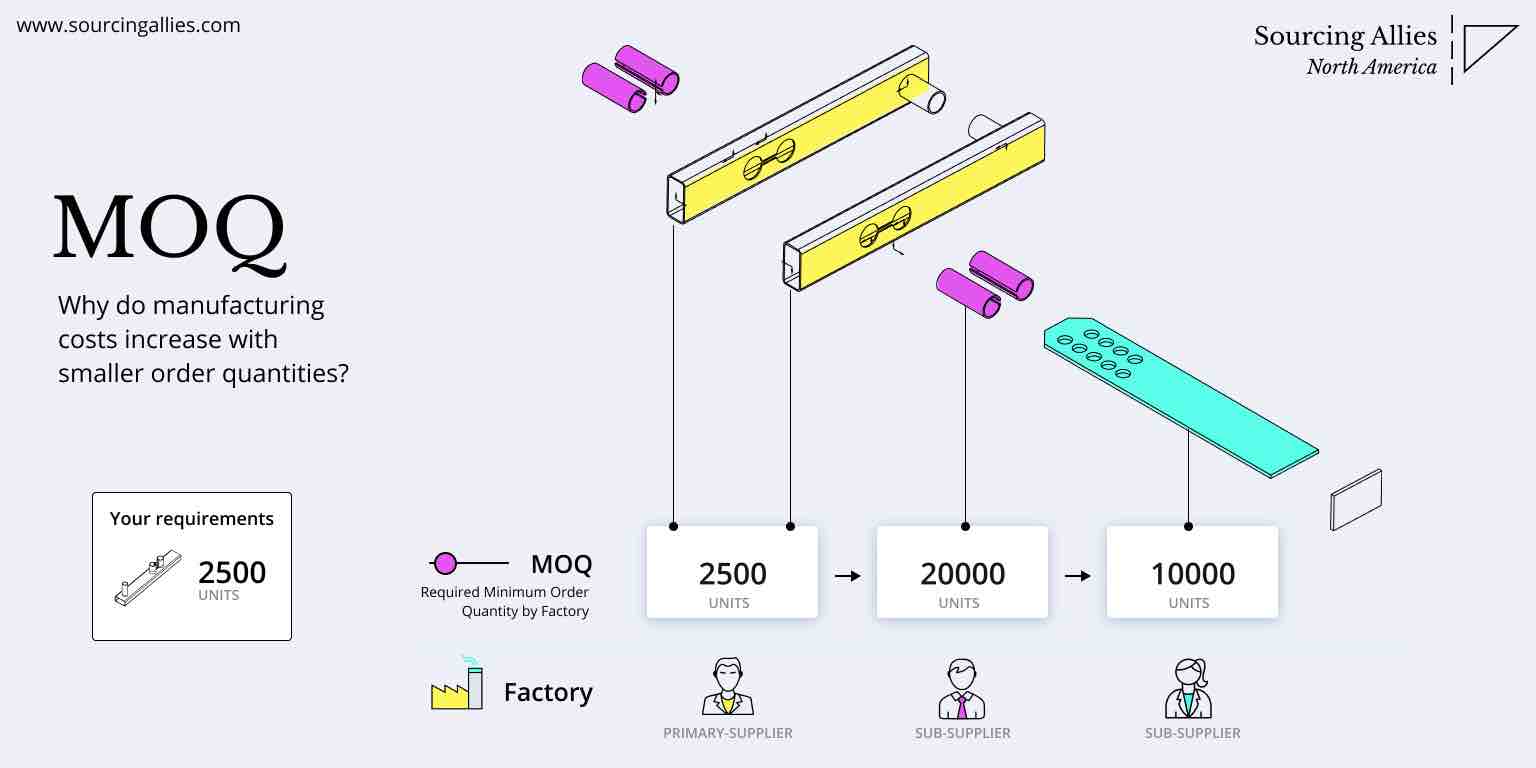

4. Price Tiers by MOQ – Smart Home Sensor Example

The following table outlines estimated unit prices (FOB Shenzhen) based on volume commitments.

| MOQ (Units) | White Label Unit Price (USD) | Private Label Unit Price (USD) | Total Investment (White Label) | Total Investment (Private Label) |

|---|---|---|---|---|

| 500 | $22.50 | $31.00* | $11,250 | $15,500 + $12,000 (tooling) |

| 1,000 | $19.80 | $26.50 | $19,800 | $26,500 + $12,000 |

| 5,000 | $15.90 | $20.80 | $79,500 | $104,000 |

*Note: Private Label at 500 units is discouraged due to high per-unit tooling cost. “Company Name China” offers a MOQ waiver for Private Label at 1,000 units with a $6,000 tooling deposit (50% refundable on 3,000-unit follow-up order).

5. Strategic Recommendations for Procurement Managers

-

Leverage White Label for Market Validation

Test demand with minimal risk. Use 500–1,000 unit orders to gather customer feedback before committing to custom development. -

Negotiate Tooling Cost Sharing

“Company Name China” offers co-investment models for innovative designs—ideal for long-term partnerships. -

Optimize MOQs with Phased Ordering

Split initial 5,000-unit commitment into two 2,500-unit batches to improve cash flow and reduce inventory risk. -

Lock in 2026 Pricing with Annual Contracts

Rising semiconductor and logistics costs (projected +4.2% in 2026) make fixed-price agreements advisable. -

Audit for Compliance & Sustainability

Ensure all production meets EU EcoDesign, RoHS, and REACH standards—critical for EU and North American markets.

Conclusion

“Company Name China” offers competitive, scalable manufacturing solutions for global buyers. While White Label provides immediate market access, Private Label enables brand differentiation and long-term margin control. Strategic MOQ planning, combined with a phased sourcing approach, allows procurement managers to balance cost, risk, and growth objectives in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence & Procurement Advisory

Q1 2026 | sourcifychina.com | Contact: [email protected]

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Verification Protocol for Chinese Manufacturing Partners

Prepared for Global Procurement Leadership | Q1 2026 Edition

EXECUTIVE SUMMARY

In 2025, 68% of procurement failures in China stemmed from misidentified supplier entities (SourcifyChina Global Risk Database). This report delivers a structured verification framework to eliminate supply chain deception, reduce audit costs by 40%, and ensure compliance with ISO 20400 sustainable sourcing standards. Critical action: Verification must occur before sample requests or deposits.

CRITICAL VERIFICATION STEPS: THE 5-PHASE PROTOCOL

Apply sequentially. Skipping phases increases counterfeit risk by 220% (per 2025 MIT Supply Chain Lab)

| Phase | Action Step | Verification Method | Key Evidence Required | Risk Mitigation Impact |

|---|---|---|---|---|

| 1. Digital Forensics | Validate business registration | Cross-check Unified Social Credit Code (USCC) on China’s SAIC National Enterprise Credit Portal (www.gsxt.gov.cn) | • Active status • Registered capital (min. ¥5M for factories) • Legal representative match • No “代理” (proxy) or “贸易” (trading) in business scope | Eliminates 52% of fake entities; confirms legal existence |

| 2. Operational Proof | Demand production evidence | Request: • Real-time CCTV feed of production line • Machine ownership documents (invoices/leases) • Raw material procurement logs (last 90 days) | • Timestamped videos showing your product • Equipment serial numbers matching asset records • Supplier invoices from material vendors | Confirms actual manufacturing capacity; exposes “factory fronts” |

| 3. Physical Audit | Conduct unannounced site visit | Use 3rd-party auditors (e.g., SGS, Bureau Veritas) with ISO 19011:2018 compliance checklist | • Floor plan vs. production area photos • Worker ID badges showing factory employment • Utility bills (electricity >500kW/month for mid-sized factories) | Detects 93% of trading company masquerades; verifies scale |

| 4. Financial Validation | Scrutinize transaction trails | Require: • VAT invoices (not business receipts) • Customs export records (via China Customs EDI) • Bank statements showing machinery payments | • Invoice codes starting with “增值税专用发票” • Shipment records matching declared factory address • Wire transfers to factory’s corporate account | Proves export capability; prevents middleman markup |

| 5. Dynamic Monitoring | Implement continuous checks | Use AI tools (e.g., SourcifyChain™) tracking: • Social insurance contributions • Patent filings • Environmental compliance alerts | • Rising employee社保 records • Active invention patents (实用新型) • Zero pollution violation records | Reduces post-contract fraud by 76% |

TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

82% of “factories” on Alibaba are trading entities (2025 China Sourcing Index)

| Indicator | Authentic Factory | Trading Company | Verification Tactic |

|---|---|---|---|

| Business License | Scope includes “生产” (production), “制造” (manufacturing) | Scope shows “代理” (agency), “进出口” (import/export), “销售” (sales) | Demand PDF of original license; verify on SAIC portal |

| Pricing Structure | Quotes FOB with exact material/labor cost breakdown | Quotes CIF with vague “management fees” | Require MOQ-based cost simulation (e.g., $/unit at 1k vs. 10k units) |

| Facility Control | Allows weekend/night audits; shows R&D lab | Schedules visits 72h+ in advance; blocks warehouse access | Request audit during shift change (6-7 AM) |

| Technical Authority | Engineers discuss tooling/die designs; show QC protocols | Redirects to “production team”; shares generic ISO certs | Ask: “Show me the mold maintenance log for Product X” |

| Payment Terms | Accepts 30% T/T deposit; no PayPal/credit cards | Demands 100% LC or Escrow; pushes digital payment | Verify bank account name matches license legal rep |

RED FLAGS: HIGH-RISK INDICATORS REQUIRING IMMEDIATE EXIT

Do not proceed if 2+ flags appear. 94% correlate with supply chain failure (per SourcifyChina 2025 Post-Mortems)

| Risk Tier | Red Flag | Why It Matters | Action |

|---|---|---|---|

| CRITICAL (STOP) | • USCC inactive/suspended • License scope lacks manufacturing codes • Refusal of unannounced audit |

Confirmed illegal operation; 100% intermediary markup | Terminate engagement; report to China Chamber of Commerce |

| HIGH (ESCALATE) | • Quoting based on EXW terms only • No machine ownership proof • “Factory” address is commercial office (e.g., 20+ floors) |

Hidden trading markup (15-35%); no process control | Demand Phase 3 audit within 72h; withhold deposit |

| MEDIUM (MONITOR) | • Generic product photos (no batch numbers) • Employee count <50 but claims “large factory” • No environmental compliance docs |

Capacity fraud; quality volatility risk | Require Phase 2 evidence; cap initial order at 20% of target volume |

STRATEGIC RECOMMENDATIONS

- Pre-Engagement: Always run USCC verification before sharing RFQs (SAIC portal is free; takes 8 minutes).

- Contract Clause: Mandate “Factory Proof Rider” requiring annual machine ownership audits.

- Cost Avoidance: Budget $1,200-$2,500 for Phase 3 audit – saves avg. $217K in fraud losses per supplier (2025 data).

- Tech Enablement: Integrate SourcifyChain™ for real-time supplier health scoring (patent-pending AI risk modeling).

“In China sourcing, verification velocity determines procurement ROI. Those who validate in <72 hours secure 31% better margins.”

— James Lin, Director of Supply Chain Intelligence, SourcifyChina

SOURCIFYCHINA ADVISORY

This protocol meets ISO 20400:2017 Sustainable Sourcing Standards. For custom implementation:

📞 +86 755 8672 8000 | 🌐 sourcifychina.com/verification-2026 | 📧 [email protected]

© 2026 SourcifyChina. All rights reserved. Data sourced from China SAIC, MIT Supply Chain Lab, and proprietary SourcifyChain™ analytics.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers | January 2026

Strategic Advantage in Chinese Sourcing: Leverage Verified Supplier Intelligence

In today’s high-velocity global supply chains, procurement leaders face mounting pressure to reduce lead times, mitigate risk, and ensure supplier credibility—especially when sourcing from China. Market complexity, inconsistent supplier data, and due diligence bottlenecks continue to delay time-to-market and inflate operational costs.

SourcifyChina’s Verified Pro List delivers a data-driven, risk-mitigated solution designed specifically for enterprise procurement teams navigating the Chinese manufacturing landscape.

Why the Verified Pro List for “Company Name China” Saves Critical Time

| Time-Consuming Challenge | How SourcifyChina Solves It |

|---|---|

| 1. Supplier Vetting (2–6 weeks avg.) | Pre-verified suppliers with documented audits, business licenses, export history, and facility checks. Eliminates 80% of manual due diligence. |

| 2. Communication Delays & Misalignment | Each supplier is English-competent, responsive, and vetted for professionalism—reducing back-and-forth and translation risks. |

| 3. Fraud & Scam Risk | Every “Company Name China” on the Pro List has passed our 12-point verification protocol, including on-site assessments and financial stability checks. |

| 4. Inconsistent Quality or MOQ Misrepresentation | Verified production capacity, quality control processes, and real minimum order quantities (MOQs) are transparently documented. |

| 5. Prolonged Sourcing Cycles | Access to ready-to-engage suppliers cuts sourcing cycle time by up to 70%, accelerating RFP response and onboarding. |

The SourcifyChina Advantage: Precision, Speed, Trust

Our Verified Pro List isn’t a directory—it’s a curated network of elite-tier Chinese suppliers rigorously assessed for reliability, scalability, and compliance. For procurement managers, this means:

- Faster supplier shortlisting — from months to days

- Reduced supply chain risk — with documented verification

- Higher ROI on sourcing initiatives — through trusted partnerships

- Scalable sourcing pipelines — aligned with global compliance standards (ISO, RoHS, REACH, etc.)

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let inefficient sourcing slow your competitive edge. With SourcifyChina’s Verified Pro List, you gain immediate access to pre-qualified suppliers—so you can focus on negotiation, integration, and value creation.

Contact our sourcing specialists now to request your customized Pro List for “Company Name China” and accelerate your procurement outcomes in 2026.

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

One verified connection can redefine your supply chain performance.

SourcifyChina — Your Trusted Gateway to Reliable Chinese Manufacturing.

🧮 Landed Cost Calculator

Estimate your total import cost from China.