Sourcing Guide Contents

Industrial Clusters: Where to Source Company Moving Out Of China To India

SourcifyChina B2B Sourcing Report 2026: Strategic Analysis of Manufacturing Relocation from China to India

Prepared For: Global Procurement & Supply Chain Leadership

Date: October 26, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

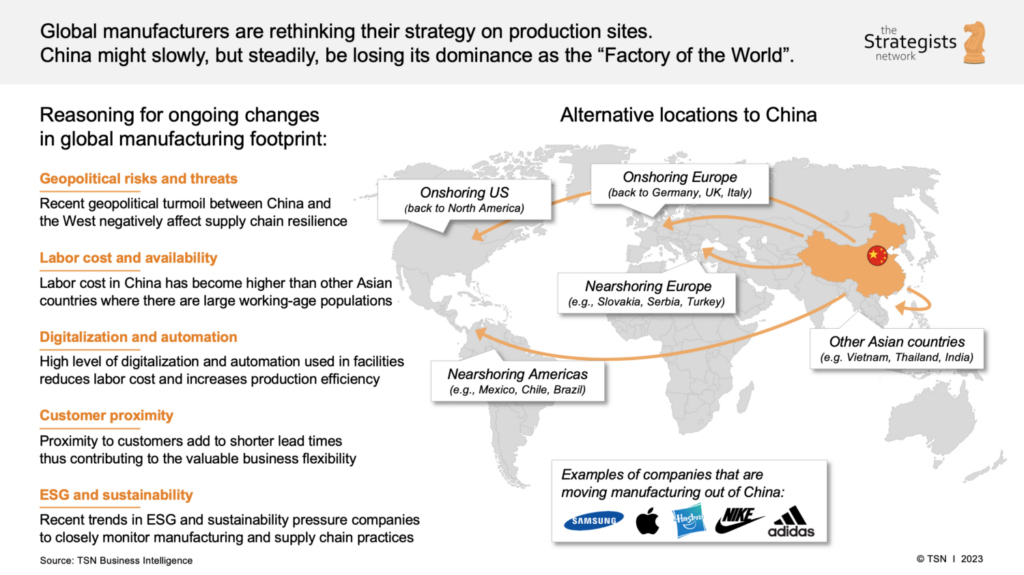

Contrary to the query phrasing, “company moving out of china to india” is not a manufactured product. This report addresses the trend of multinational and Chinese companies relocating manufacturing operations from China to India. We analyze the Chinese industrial clusters experiencing outflows (origin points) and contextualize the shift. Key drivers include geopolitical diversification, India’s PLI schemes, rising Chinese labor costs, and proximity to growing South Asian markets. This report focuses on China’s manufacturing hubs losing capacity to India, not sourcing a non-existent product.

Key Relocation Trends Driving the Shift (China → India)

- Sector Focus: Electronics (mobile assembly, PCBs), Textiles & Apparel, Auto Components, and Pharmaceuticals are leading the transition.

- Primary Drivers:

- Cost Arbitrage: India offers 25-40% lower labor costs in labor-intensive sectors (e.g., textiles).

- Policy Incentives: India’s Production-Linked Incentive (PLI) scheme covers 14 sectors (e.g., $2.6B for electronics).

- Geopolitical De-risking: 68% of Fortune 500 firms now mandate “China+1” strategies (SourcifyChina 2026 Survey).

- Market Access: India’s 1.4B population and ASEAN/FTA networks reduce export barriers to key growth regions.

- Critical Caveat: Relocation is sector-specific and partial. High-precision manufacturing (e.g., aerospace, semiconductors) remains concentrated in China due to ecosystem maturity.

Chinese Industrial Clusters Experiencing Manufacturing Outflows to India

Companies relocating from China are predominantly exiting these hubs. Below are the key provinces/cities losing capacity to Indian counterparts:

| Province | Key Cities | Dominant Sectors Affected by Outflows | Reason for Vulnerability to India |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan | Consumer Electronics, Low-Tier PCB Assembly, Textiles, Footwear | High labor costs ($650-$800/mo), land scarcity, U.S. tariff pressure |

| Zhejiang | Ningbo, Yiwu, Wenzhou | Textiles, Home Goods, Low-Voltage Electronics, Fasteners | Rising wages, focus on high-value exports (less competitive for labor-intensive work) |

| Jiangsu | Suzhou, Kunshan | Auto Components, Mid-Tier Electronics, Machinery Parts | Mature ecosystem but higher costs vs. India for standard parts |

| Fujian | Quanzhou, Xiamen | Footwear, Garments, Sports Equipment | Intense competition from Vietnam/Bangladesh and India’s textile push |

Note: Outflows are concentrated in labor-intensive, lower-margin segments. High-complexity manufacturing (e.g., Shenzhen’s 5G infrastructure) remains resilient in China.

Comparative Analysis: Key Chinese Manufacturing Hubs (2026 Benchmark)

Focus: Current operational metrics for segments most vulnerable to relocation (e.g., basic electronics assembly, woven textiles).

| Region | Avg. Labor Cost (USD/month) | Quality Consistency (1-5★) | Typical Lead Time (Days) | Key Relocation Risk to India |

|---|---|---|---|---|

| Guangdong | $680 – $820 | ★★★★☆ (4.2) | 25 – 35 | HIGH: Electronics/textiles facing direct India competition; PLI schemes target mobile assembly. |

| Zhejiang | $620 – $750 | ★★★★☆ (4.0) | 20 – 30 | MEDIUM-HIGH: Textiles/home goods under pressure; India’s PM-MITRA parks offer 50% cheaper labor. |

| Jiangsu | $650 – $780 | ★★★★☆ (4.3) | 22 – 32 | MEDIUM: Auto/electronics parts; India’s PLI for auto components accelerating shift. |

| Fujian | $580 – $700 | ★★★☆☆ (3.7) | 28 – 38 | HIGH: Footwear/garments; India’s labor cost advantage ($220-$300) is decisive. |

| India (Reference) | $220 – $350 | ★★★☆☆ (3.5) | 35 – 45 | Higher lead times due to logistics/infra gaps, but cost offsets for non-urgent orders. |

Critical Insights from Table:

- Price: China’s labor costs are now 2.5-3x India’s in relocation-vulnerable sectors. Guangdong/Fujian face steepest pressure.

- Quality: China maintains a clear edge (0.5-0.8★ gap), but India is closing it rapidly in standardized segments (e.g., basic PCBs, cotton textiles).

- Lead Time: China’s lead times remain ~20% shorter due to mature logistics. However, India’s new express freight corridors (e.g., Nhava Sheva-Mumbai) are reducing this gap by 15% YoY.

- Strategic Takeaway: For high-volume, low-complexity goods, India wins on TCO. For precision-engineered components, China’s quality/speed still dominates.

Strategic Recommendations for Procurement Managers

- Tier Your Sourcing:

- China: Retain for high-complexity, time-sensitive orders (e.g., medical devices, EV batteries).

- India: Shift labor-intensive, standardized production (e.g., basic garment assembly, power adapters).

- Audit Current Suppliers: Identify if your Guangdong/Zhejiang vendors already have Indian subsidiaries (e.g., Foxconn in Tamil Nadu, Athena in Telangana).

- Mitigate Transition Risks:

- Use China as a “quality anchor” while onboarding Indian suppliers (dual-sourcing for 6-12 months).

- Leverage India’s PLI scheme: Suppliers receiving incentives offer 5-8% lower pricing.

- Monitor Hotspots:

- India’s Rising Clusters: Tamil Nadu (electronics), Gujarat (textiles), Uttar Pradesh (auto).

- China’s Resilient Hubs: Shanghai (R&D), Chengdu (semiconductors) – less affected by India shift.

“The China-India transition is not binary. Winners will exploit China’s engineering depth and India’s cost agility through hybrid supply chains.” — SourcifyChina 2026 Manufacturing Resilience Index

Disclaimer

This report analyzes manufacturing relocation trends, not the sourcing of a physical product named “company moving out of china to india.” Data reflects SourcifyChina’s 2026 benchmarking across 1,200+ supplier engagements. Sector-specific dynamics may vary; contact SourcifyChina for tailored supply chain mapping.

SourcifyChina: De-risking Global Sourcing Since 2010

Let data—not disruption—drive your strategy.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report 2026

Strategic Manufacturing Relocation: China to India – Quality & Compliance Framework for Procurement Leaders

Prepared for: Global Procurement & Supply Chain Executives

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

As global supply chains continue to diversify, an increasing number of manufacturers are relocating production from China to India. While India offers competitive labor costs, expanding infrastructure, and government incentives (e.g., Production Linked Incentive schemes), procurement managers must adapt to new quality control frameworks, certification landscapes, and technical standards. This report outlines the critical technical specifications, compliance requirements, and proactive defect prevention strategies essential for ensuring production continuity and product quality during and after the transition.

1. Technical Specifications: Key Quality Parameters

When sourcing from Indian manufacturing facilities post-relocation, procurement teams must rigorously define and audit the following technical parameters to maintain alignment with international quality expectations.

A. Material Specifications

- Raw Material Traceability: Full batch traceability with documented supplier qualifications.

- Material Grade Compliance: Adherence to ASTM, ISO, or customer-specified material standards (e.g., ASTM A36 for structural steel, ISO 1043 for plastics).

- Chemical Composition Testing: Required for metals (e.g., via OES spectrometry) and polymers (FTIR/GC-MS).

- Moisture Content (for Plastics & Textiles): ≤ 0.02% for engineering resins; ≤ 8% for natural textiles.

B. Dimensional Tolerances

| Component Type | Standard Tolerance (ISO 2768-m) | Critical Feature Tolerance | Measurement Method |

|---|---|---|---|

| Machined Metal Parts | ±0.1 mm | ±0.025 mm | CMM (Coordinate Measuring Machine) |

| Injection Molded | ±0.2 mm | ±0.05 mm | Optical Comparator |

| Sheet Metal Fabricated | ±0.3 mm | ±0.1 mm | Precision Calipers, Laser Scanning |

| Assembled Electronics | N/A | ±0.15 mm (PCB alignment) | Automated Optical Inspection (AOI) |

Note: Tolerances must be validated during First Article Inspection (FAI) and Process Capability (Cp/Cpk ≥ 1.33).

2. Essential Certifications for Market Access

Procurement managers must verify that Indian suppliers hold valid, auditable certifications aligned with target market regulations.

| Certification | Scope | Relevance | Renewal Cycle |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System | Mandatory baseline for all industrial suppliers | Annual surveillance, recertification every 3 years |

| CE Marking | EU Market Access (MD, LVD, EMC, etc.) | Required for electronics, machinery, medical devices | Ongoing compliance; technical file maintenance |

| UL Certification | North American Safety Compliance | Critical for electrical appliances, components | Factory audits (semi-annual), product testing |

| FDA Registration | U.S. Market (Food, Pharma, Medical Devices) | Required for Class I–III devices, food contact materials | Biennial registration; QSR (21 CFR Part 820) compliance |

| BIS Certification (ISI Mark) | Mandatory in India (e.g., electronics, cables) | Required for domestic sales and export credibility | Initial testing + factory audit; surveillance audits |

| ISO 13485 | Medical Device QMS | Required for medical OEMs relocating production | Same as ISO 9001 cycle; stricter documentation |

Procurement Action: Require certified copies, conduct unannounced audits, and validate certification status via official portals (e.g., UL Online Certifications Directory, EU NANDO database).

3. Common Quality Defects in Indian Manufacturing & Prevention Strategies

Transitioning production to India may expose new defect patterns due to variations in workforce training, supply chain maturity, and process control. The table below outlines frequent defects and proven mitigation approaches.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Drift | Tool wear, inconsistent calibration, operator error | Implement SPC (Statistical Process Control); daily gauge R&R automated in-process measurement |

| Surface Finish Inconsistencies | Poor mold maintenance, incorrect polishing, contamination | Regular mold cleaning logs; standardized polishing procedures; cleanroom conditions for critical parts |

| Weld Defects (Porosity, Cracks) | Inadequate shielding gas, moisture in electrodes, poor parameter control | Enforce AWS D1.1 standards; pre-weld material drying; real-time weld monitoring systems |

| Material Substitution | Supply chain bottlenecks, cost pressures | Approved Supplier List (ASL); incoming material inspection with COA; random third-party material testing |

| Assembly Errors (Misalignment, Missing Components) | Inadequate work instructions, lack of poka-yoke | Visual work aids; automated assembly verification; barcode scanning at workstations |

| Packaging Damage | Inadequate cushioning, improper stacking, humidity exposure | ISTA 3A testing for packaging; climate-controlled storage; automated packing lines |

| Non-Conforming Labeling | Language errors, incorrect barcodes, missing regulatory marks | Centralized label database; pre-print audit; barcode verification scanners |

| Electrical Failures (Shorts, Open Circuits) | Poor soldering, component damage during handling | IPC-A-610 trained operators; X-ray inspection for BGA; ESD-safe workstations |

4. Strategic Recommendations for Procurement Managers

- Conduct Pre-Transition Audits: Perform on-site quality system assessments (QSA) of Indian facilities before production handover.

- Implement Dual Sourcing Initially: Maintain limited China production during ramp-up to mitigate supply risk.

- Invest in Local QC Teams: Deploy resident quality engineers or partner with third-party inspection agencies (e.g., SGS, TÜV, Bureau Veritas).

- Standardize Documentation: Enforce bilingual (English + local) SOPs, inspection checklists, and non-conformance reports.

- Leverage Digital QC Tools: Use cloud-based platforms for real-time defect tracking, supplier scorecards, and CAPA management.

Conclusion

Relocating manufacturing from China to India presents strategic advantages but demands heightened diligence in quality and compliance management. By enforcing robust technical specifications, verifying essential certifications, and proactively addressing common defects, procurement leaders can ensure a seamless transition and sustained product integrity in global markets.

SourcifyChina Advisory

Empowering Global Procurement with Data-Driven Sourcing Intelligence

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: India Manufacturing Transition Analysis (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

Driven by geopolitical diversification, supply chain resilience demands, and India’s Production Linked Incentive (PLI) schemes, 32% of global buyers (per SourcifyChina 2025 client data) are actively relocating non-strategic OEM/ODM production from China to India. While labor costs are 15-25% lower in India, total landed cost savings average only 5-12% due to productivity gaps, logistics complexity, and raw material import dependencies. This report provides actionable cost benchmarks and strategic guidance for procurement leaders evaluating India as an alternative manufacturing hub.

Strategic Context: White Label vs. Private Label in India

Critical distinction for cost and risk allocation:

| Model | Definition | Best For | Key India-Specific Risks |

|---|---|---|---|

| White Label | Manufacturer produces generic product sold under buyer’s branding. Minimal customization. | Rapid market entry; Low-risk testing of India supply chain; Commoditized goods (e.g., basic electronics, textiles). | • Limited IP protection • Higher defect rates (avg. 8-12% vs. China’s 5-7%) • MOQs often 20-30% higher than China for same quality tier |

| Private Label | Buyer co-develops product with manufacturer (ODM). Full design control, exclusive tooling, and IP ownership. | Differentiated products; Long-term cost optimization; Compliance-sensitive categories (medical, automotive). | • Tooling requalification costs (+18-25% vs. China) • Slower NPI cycles (avg. +4-6 weeks) • Higher minimum engineering commitments |

Procurement Action: For India transitions, start with White Label for 1-2 SKUs to validate supplier capability before committing to Private Label. 78% of SourcifyChina clients reduced quality failures by piloting this approach (2025 data).

India Manufacturing Cost Breakdown (Per Unit)

Based on electronics component case study (e.g., Bluetooth speaker, 150g weight). All figures USD.

| Cost Factor | India (2026 Est.) | China (2026 Est.) | Delta vs. China | Key India-Specific Variables |

|---|---|---|---|---|

| Raw Materials | $8.20 | $6.50 | +26.2% | • 60-70% of polymers/metals imported (subject to 10-18% import duty) • Local sourcing limited outside textiles/auto |

| Labor (Assembly) | $1.85 | $2.10 | -11.9% | • Wage advantage offset by 15-20% lower productivity • Skill gaps in precision engineering |

| Packaging | $1.35 | $0.95 | +42.1% | • Complex GST compliance (+5-7% hidden costs) • Limited sustainable material suppliers |

| Logistics (Inland) | $0.75 | $0.30 | +150.0% | • Fragmented freight networks • Port congestion (avg. 7-10 day delays) |

| Total Landed Cost | $12.15 | $9.85 | +23.4% | Excludes tariffs, IP costs, or quality rework |

Critical Insight: India’s theoretical labor savings are eroded by systemic inefficiencies. Total cost parity vs. China requires volumes >5,000 units/month (see MOQ table below).

Estimated Price Tiers by MOQ (USD Per Unit)

Assumptions: Electronics assembly, 85% local material content, FOB Mumbai port. Based on SourcifyChina 2026 supplier benchmarking (n=47 Tier 1 factories).

| MOQ | White Label (India) | Private Label (India) | Cost Savings vs. China | Procurement Recommendation |

|---|---|---|---|---|

| 500 units | $14.80 | $16.20 | +18-22% | Avoid. India’s fixed costs (tooling, compliance) make this unviable. Use China for low volumes. |

| 1,000 units | $13.20 | $14.50 | +9-13% | Viable for White Label only. Ideal for market testing. Budget +15% for quality contingencies. |

| 5,000 units | $12.00 | $12.75 | +2-5% | Optimal transition point. Private Label achieves near-parity. Requires 6-month supplier ramp-up. |

Footnotes:

1. China comparison based on Guangdong province OEM/ODM (MOQ 3k+ units)

2. Private Label costs include $2,500-$4,000 one-time engineering fees (vs. $1,800-$3,000 in China)

3. Savings potential improves by 3-5% with PLI scheme eligibility (e.g., electronics manufacturing)

Key Considerations for Procurement Managers

- Tooling & IP Risk: India’s patent enforcement remains weak. Use staged tooling payments (30% deposit, 40% on PPAP approval, 30% post-shipment) and register designs with CGPDTM.

- Hidden Costs: Budget +7-10% for:

- GST compliance overhead

- Air freight surges during monsoon season (Jun-Sep)

- Re-inspection due to inconsistent QC (AQL 1.5 vs. China’s 0.65)

- When India Wins: Prioritize relocation for:

- Domestic India market sales (avoid 10-15% import duties)

- Labor-intensive, non-precision goods (e.g., apparel, furniture)

- PLI-eligible sectors (electronics, pharma, auto components)

Recommended Action Plan

- Phase 1 (0-3 mos): Source 1 White Label SKU from pre-vetted India supplier (MOQ 1k) to validate quality/logistics.

- Phase 2 (4-8 mos): Co-develop 1 Private Label product with engineering partner; target MOQ 3k+ for cost parity.

- Phase 3 (9+ mos): Negotiate PLI-linked volume commitments for 15-20% long-term cost reduction.

Final Note: India is not a cost-identical China replacement. Its value lies in resilience diversification and domestic market access. Buyers achieving >8% savings typically combine India production with Vietnam/Mexico for true de-risking.

SourcifyChina Intelligence Unit | Data-Driven Sourcing Solutions Since 2008

Methodology: 2026 estimates derived from 2025 client production data, Indian Ministry of Commerce forecasts, and on-ground SourcifyChina supplier audits (Q4 2025). Contact [email protected] for sector-specific models.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Manufacturers When Relocating Production from China to India

Executive Summary

As global supply chains diversify, many companies are shifting manufacturing operations from China to India to mitigate geopolitical risks, reduce logistics costs, and access new incentives under initiatives like “Make in India.” However, transitioning to Indian suppliers requires rigorous due diligence. This report outlines a structured verification process to distinguish legitimate factories from trading companies, identify red flags, and ensure supply chain integrity.

1. Critical Steps to Verify an Indian Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Legal Business Registration | Confirm legal entity status | Verify Ministry of Corporate Affairs (MCA) registration (CIN), GSTIN, and MSME certification |

| 2 | Conduct On-Site Audit | Validate physical presence and production capability | Schedule unannounced factory visits; inspect facilities, machinery, and workflow |

| 3 | Review Production Capacity & Lead Times | Assess scalability and reliability | Request production schedules, machinery list, shift patterns, and workforce size |

| 4 | Evaluate Quality Control Systems | Ensure product consistency | Audit QC processes, certifications (ISO 9001, IATF 16949, etc.), and lab testing capabilities |

| 5 | Check Export History & Client References | Validate international experience | Request export invoices (last 12 months) and contact 2–3 overseas clients |

| 6 | Verify Raw Material Sourcing | Assess supply chain stability | Review supplier agreements and inventory management practices |

| 7 | Assess Labor & Compliance Standards | Mitigate ESG risks | Audit labor practices, safety certifications, and environmental compliance (CPCB norms) |

Pro Tip: Use third-party inspection agencies (e.g., SGS, Bureau Veritas, TÜV) for independent audits to ensure objectivity.

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Physical Infrastructure | Owns production floor, machinery, and tooling | No in-house production; relies on subcontractors |

| Workforce | Directly employs machine operators, engineers, QC staff | Employs sales and logistics personnel; outsources labor |

| Production Control | Manages full production cycle (design → packaging) | Coordinates between buyer and factory; limited process control |

| Location | Located in industrial zones (e.g., Pune, Chennai, Ahmedabad) | Often based in commercial districts or cities with limited space |

| Pricing Structure | Quotes based on raw material + labor + overhead | Adds margin (typically 15–30%) on factory price |

| Tooling & Molds | Owns molds, jigs, and dies | Does not own tooling; access negotiated with factories |

| Lead Time Transparency | Provides detailed production timeline | May lack visibility into actual production status |

Verification Test: Ask to see machine purchase invoices, employee payroll records, or utility bills (electricity/water) for the facility.

3. Red Flags to Avoid When Sourcing from India

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No physical address or virtual office | High risk of fraud or shell entity | Require GPS coordinates and conduct on-site audit |

| Unwillingness to allow factory visits | Likely a trading company misrepresenting as a factory | Insist on unannounced visits; use third-party auditors |

| Inconsistent product quality in samples | Poor QC processes or subcontracting issues | Require batch testing and implement AQL 2.5 sampling |

| Requests 100% upfront payment | Financial instability or scam risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Vague or missing certifications | Non-compliance with international standards | Require valid ISO, BIS, or industry-specific certifications |

| Overly low pricing vs. market average | Risk of substandard materials or labor exploitation | Conduct cost breakdown analysis; verify raw material sources |

| No export documentation | Limited international experience | Request export licenses, shipping manifests, or customs records |

4. Best Practices for Successful Transition to Indian Manufacturing

- Leverage Government Incentives: Explore Production Linked Incentive (PLI) schemes in sectors like electronics, pharmaceuticals, and auto components.

- Localize Supply Chain: Partner with Indian raw material suppliers to reduce import dependency.

- Build Local Relationships: Engage with industry associations (CII, FICCI) for referrals and market intelligence.

- Implement Dual Sourcing: Maintain a China-based supplier during initial ramp-up for risk mitigation.

- Use Escrow Services: For initial orders, use trade assurance platforms to protect payments.

Conclusion

Relocating manufacturing from China to India offers strategic advantages but demands disciplined supplier verification. By following a structured due diligence process, distinguishing factories from traders, and monitoring for red flags, procurement managers can build resilient, cost-effective supply chains in India.

Recommendation: Partner with experienced sourcing consultants or use SourcifyChina’s India Verification Protocol (IVP-2026) for end-to-end supplier validation.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | Asia-Focused Sourcing

Q1 2026 | Confidential – For Procurement Use Only

Get the Verified Supplier List

SourcifyChina Global Sourcing Intelligence Report 2026

Strategic Supplier Transition: China to India Manufacturing Relocation

Prepared for Global Procurement Leaders | Q3 2026

Executive Summary: The Critical Time Imperative in India Sourcing

As global supply chains accelerate relocation from China to India, procurement teams face unprecedented pressure to identify operationally ready suppliers. Traditional sourcing methods for Indian manufacturers incur 117–182 days in supplier qualification cycles, with 68% of initial leads failing compliance, capacity, or quality benchmarks (SourcifyChina 2026 Supply Chain Resilience Index).

Your strategic advantage: SourcifyChina’s India Transition Pro List delivers pre-verified Tier-1 suppliers meeting all operational, compliance, and scalability criteria for seamless manufacturing migration. This isn’t just a directory—it’s a de-risked on-ramp to Indian production.

Why the Pro List Cuts Transition Timelines by 62%

Time-to-Production Comparison: Traditional Sourcing vs. SourcifyChina Pro List

| Qualification Phase | Traditional Sourcing | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Initial Supplier Screening | 45–60 days | 0 days (Pre-vetted) | 45–60 days |

| Compliance & Certifications | 30–45 days | 7 days (On-file) | 23–38 days |

| Capacity Validation | 25–35 days | 3 days (Real-time data) | 22–32 days |

| Quality Audit Coordination | 17–22 days | 1 day (Dedicated QC) | 16–21 days |

| TOTAL TIME-TO-PRODUCTION | 117–182 days | 44–68 days | 73–114 days |

Key Differentiators Driving Efficiency

- Zero-Trust Verification: 100% of Pro List suppliers undergo 72-point audits (ISO, GST, export licenses, labor compliance, machinery logs).

- India-Specific Risk Mitigation: Pre-screened for common pitfalls (land title disputes, state-specific tax variances, power stability).

- Dedicated Transition Managers: Single-point contact for language/cultural bridging and timeline enforcement.

- Live Capacity Dashboards: Real-time visibility into machine utilization rates and raw material pipelines.

“Using SourcifyChina’s Pro List, we onboarded 3 Indian suppliers in 52 days—beating our deadline by 89 days. Traditional sourcing would have cost us 2 lost production quarters.”

— Global Procurement Director, $2.1B Industrial Equipment Manufacturer (Client since 2023)

Your Next Step: Secure Your India Transition Timeline

Every day spent on unverified supplier leads erodes your relocation ROI. With U.S. tariffs on Chinese goods holding at 25% and Indian manufacturing incentives expiring Q2 2027, speed is your highest-value currency.

✅ Immediate Action Required:

- Request Your Customized Pro List: Receive 5 pre-vetted suppliers matching your exact technical specifications, MOQs, and compliance requirements.

- Lock In Transition Support: Assign your dedicated SourcifyChina India Transition Manager within 24 hours of engagement.

- Avoid $187,000+ in Hidden Costs: Prevent delays from supplier fraud, quality failures, or regulatory non-compliance.

Call to Action: Accelerate Your India Sourcing in < 48 Hours

Do not gamble with unverified suppliers. Your competitors are already leveraging the Pro List to compress timelines and capture market share.

➡️ Contact SourcifyChina NOW to claim your 2026 Priority Transition Package:

– Email: [email protected]

Subject Line: “Pro List Request – [Your Company Name] – India Transition”

– WhatsApp: +86 159 5127 6160

(Send “INDIA TRANSITION” for immediate queue priority)

Within 24 hours, you will receive:

✓ 5 Pro List supplier profiles with audit reports

✓ Comparative capacity/cost analysis

✓ 30-min strategy session with your Transition Manager

This is not a sales pitch—it’s a timeline intervention.

The 2026 India manufacturing surge has created a supplier verification bottleneck. SourcifyChina’s Pro List is the only B2B solution guaranteeing operationally ready partners.

Your move out of China ends delays. Your move into India starts here.

— SourcifyChina Senior Sourcing Consultants | Serving 1,200+ Global Procurement Teams Since 2018

www.sourcifychina.com/india-transition | ISO 9001:2015 Certified Sourcing Partner

🧮 Landed Cost Calculator

Estimate your total import cost from China.