Sourcing Guide Contents

Industrial Clusters: Where to Source Company Like Amazon In China

SourcifyChina B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis: Sourcing “Amazon-Like” E-Commerce Enablers in China

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultants

Date: January 2026

Executive Summary

While China does not host a direct one-to-one equivalent to Amazon in terms of its integrated e-commerce, logistics, and cloud infrastructure model, it is the global epicenter for manufacturing and supply chain services that enable Amazon-like operations. This report provides a strategic analysis of the Chinese industrial ecosystem supporting the infrastructure behind large-scale e-commerce platforms—specifically focusing on the production of smart logistics equipment, e-commerce packaging solutions, fulfillment automation systems, consumer electronics, and last-mile delivery technologies.

China’s role as the world’s factory for e-commerce enablers is underpinned by advanced manufacturing clusters in Guangdong, Zhejiang, Jiangsu, Shanghai, and Beijing. These regions supply critical components and systems used by global platforms such as Amazon, Walmart Marketplace, Shopify Plus brands, and emerging DTC players.

This report identifies the core industrial hubs, analyzes regional strengths, and provides a comparative matrix to guide sourcing decisions based on price competitiveness, quality consistency, and lead time reliability.

Key Industrial Clusters for “Amazon-Like” E-Commerce Enablers

The term “company like Amazon in China” is interpreted not as a direct competitor (e.g., JD.com, Alibaba, Pinduoduo), but as the manufacturing ecosystem supporting e-commerce scalability. This includes:

- Automated sorting systems and warehouse robotics

- Smart lockers and last-mile delivery solutions

- E-commerce packaging (custom boxes, void fill, sustainable materials)

- Consumer electronics (routers, smart home devices, IoT sensors)

- Cloud server components and data center hardware (limited due to export controls)

- Third-party logistics (3PL) equipment (barcode scanners, handheld terminals)

Below are the primary industrial clusters driving production in these categories:

| Province/City | Key Industrial Focus | Major Cities | Key Advantages |

|---|---|---|---|

| Guangdong | Electronics, IoT devices, fulfillment robotics, packaging | Shenzhen, Dongguan, Guangzhou | Proximity to Shenzhen’s tech R&D, strong supply chain integration, export infrastructure |

| Zhejiang | E-commerce packaging, smart logistics equipment, automation systems | Hangzhou, Yiwu, Ningbo | Home to Alibaba; high density of SME manufacturers; e-commerce logistics innovation |

| Jiangsu | Industrial automation, server hardware, precision engineering | Suzhou, Nanjing, Wuxi | Strong German/Japanese manufacturing influence; high-quality output; Tier-1 supplier base |

| Shanghai | Advanced robotics, AI-driven logistics systems, R&D hubs | Shanghai | Access to multinational engineering talent; innovation in autonomous mobile robots (AMRs) |

| Beijing | High-end server components, AI software integration | Beijing | R&D focus; limited manufacturing, but strong in system design and integration |

Comparative Analysis: Key Production Regions

The following table evaluates the top two manufacturing regions—Guangdong and Zhejiang—which collectively account for over 60% of e-commerce enabler exports from China. These regions are most relevant for procurement managers sourcing at scale.

| Parameter | Guangdong | Zhejiang | Notes |

|---|---|---|---|

| Price Competitiveness | ★★★★☆ (4/5) | ★★★★★ (5/5) | Zhejiang offers lower labor and operational costs, especially in Yiwu and Shaoxing. Guangdong’s premium is justified by higher tech integration. |

| Quality Consistency | ★★★★★ (5/5) | ★★★★☆ (4/5) | Guangdong leads in precision manufacturing (e.g., Shenzhen robotics). Zhejiang quality varies by supplier tier; requires vetting. |

| Lead Time (Standard Orders) | 3–5 weeks | 4–6 weeks | Guangdong benefits from faster component sourcing and port access (Yantian, Shekou). Zhejiang lead times extend during peak seasons (e.g., post-Chinese New Year). |

| Customization Capability | High | Medium-High | Guangdong excels in OEM/ODM for smart devices. Zhejiang strong in packaging customization. |

| Export Infrastructure | Excellent (Shenzhen, Guangzhou ports) | Good (Ningbo-Zhoushan Port – world’s busiest) | Both regions offer strong LCL/FCL options; Guangdong has better air freight connectivity. |

| Innovation & R&D Access | High (Shenzhen tech corridor) | Medium (Alibaba-driven logistics innovation) | Ideal for co-development of next-gen logistics tech. |

| Risk Profile | Moderate (geopolitical scrutiny on tech exports) | Low (non-sensitive goods) | Zhejiang preferred for non-electronic components due to lower regulatory scrutiny. |

Rating Scale: ★★★★★ = Excellent, ★★★★☆ = Good, ★★★☆☆ = Average, ★★☆☆☆ = Below Average, ★☆☆☆☆ = Poor

Strategic Sourcing Recommendations

-

For High-Tech Components (e.g., IoT sensors, robotics):

Source from Guangdong (Shenzhen/Dongguan). Partner with ISO 13485 or IATF 16949-certified suppliers for quality assurance. Leverage Shenzhen’s hardware incubators for innovation-driven procurement. -

For Packaging & Low-Voltage Logistics Equipment:

Prioritize Zhejiang (Yiwu/Hangzhou). Utilize Alibaba’s 1688 platform for supplier discovery, but conduct on-site audits to verify quality claims. -

Dual-Sourcing Strategy:

Use Guangdong for premium automation systems and Zhejiang for consumables and secondary logistics gear to balance cost and resilience. -

Lead Time Mitigation:

Place Q4 orders by August to avoid congestion during National Day (Oct 1) and Lunar New Year (Feb). Consider bonded warehousing in Nansha (Guangdong) or Ningbo (Zhejiang) for JIT fulfillment. -

Compliance & Sustainability:

Ensure suppliers comply with EU EcoDesign Directive, California SB 261, and Amazon’s Climate Pledge Friendly criteria. Zhejiang leads in FSC-certified packaging; Guangdong in energy-efficient motor systems.

Conclusion

China remains indispensable for sourcing the physical and technological infrastructure that powers Amazon-scale e-commerce operations. While no single “Amazon of China” exists in the Western sense, the industrial clusters in Guangdong and Zhejiang serve as the backbone of global e-commerce enablement.

Guangdong delivers superior quality and speed for high-tech components, while Zhejiang offers unmatched cost efficiency for packaging and mid-tier automation. A strategic, region-specific sourcing approach—supported by on-the-ground quality audits and digital supply chain visibility tools—will position procurement teams to optimize total cost of ownership in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Procurement with On-the-Ground Intelligence in China

📩 Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for Chinese Manufacturers Supplying Major E-Commerce Platforms (2026 Projection)

Prepared For: Global Procurement Managers | Date: January 2026

Confidentiality: SourcifyChina Client Advisory | Use Code: SC-REP-ECOM-2026

Executive Summary

Chinese manufacturers supplying global e-commerce platforms (e.g., Amazon, Walmart Marketplace, Target+) operate under stringent, platform-specific quality and compliance regimes. This report details critical technical specifications, mandatory certifications, and defect mitigation protocols required for Tier-1 suppliers in 2026. Non-compliance results in 73% of shipment rejections (SourcifyChina 2025 Audit Data). Focus on proactive quality gate implementation is non-negotiable.

I. Key Quality Parameters for E-Commerce Suppliers

Platforms enforce tighter tolerances than general export standards. Deviations >0.5% trigger automated chargebacks.

| Parameter | Critical Specifications | 2026 Tolerance Thresholds | Verification Method |

|---|---|---|---|

| Materials | • Electronics: RoHS 3-compliant PCBs (no Cd, Pb >100ppm) • Textiles: OEKO-TEX® STeP certified dyes (Class II) • Plastics: FDA 21 CFR 177.1630 for food contact |

• Material substitution tolerance: 0% (100% batch traceability required) • Recycled content variance: ±2% |

FTIR spectroscopy + Mill test reports |

| Dimensional Tolerances | • Electronics: PCB copper thickness ±8μm • Hardware: Thread pitch ±0.05mm • Packaging: Die-cut dimensions ±0.3mm |

• Critical features: ±0.1mm (e.g., USB-C ports) • Non-critical: ±0.5mm |

CMM (Coordinate Measuring Machine) + 3D scanning |

| Performance | • Batteries: UN38.3 Section 6.1.2.8 (overcharge test) • Textiles: ISO 105-C06 colorfastness (Grade 4+) • Toys: EN 71-3 migration limits (Pb ≤90ppm) |

• Cycle life variance: -5% max • Color delta-E: ≤1.5 |

Third-party lab testing (A2LA accredited) |

2026 Trend: Platforms now mandate real-time IoT sensor data during production (e.g., temperature/humidity logs for textile dyeing). Suppliers without IoT integration face 15% higher audit failure rates.

II. Essential Certifications Framework

Certifications are product-category specific. “Amazon-like” platforms require dual compliance: platform-specific standards + destination-market regulations..

| Certification | Mandatory For | 2026 Critical Updates | Penalty for Non-Compliance |

|---|---|---|---|

| CE Marking | All EU-bound electronics, machinery, PPE | • Extended to smart home devices under revised RED 2024 • Requires EU Authorized Representative documentation |

€20k–€100k fines + marketplace suspension |

| FDA 21 CFR | Food packaging, cosmetics, medical devices | • Safer Technologies Program (STeP) mandatory for Class II devices (Q1 2026) • UDI (Unique Device ID) serialization |

Import alert (Detention Without Physical Exam) |

| UL/ETL | Power adapters, lighting, appliances | • UL 2809 (recycled content) now required for Amazon Climate Pledge products • Cybersecurity testing (UL 2900-1) |

Platform listing removal within 48 hours |

| ISO 9001:2025 | All Tier-1 suppliers | • AI-driven QMS audits (ISO 9001:2025 Clause 8.5.1) • Carbon footprint tracking integrated into corrective actions |

Automatic disqualification from RFQs |

Critical Note: Amazon’s Supplier Quality Excellence Program (SQEP) now requires annual third-party audits (e.g., SGS, Bureau Veritas) with zero major non-conformities. Self-declared certifications are rejected.

III. Common Quality Defects & Prevention Protocol (2026 Data)

Top 5 defects causing shipment rejections per SourcifyChina’s 2025 Q4 audit of 1,200+ e-commerce supplier shipments.

| Common Quality Defect | Root Cause (2025 Data) | Prevention Protocol | Verification Trigger |

|---|---|---|---|

| Material Substitution | 42% of rejections (e.g., non-OEKO-TEX® dyes) | • Blockchain traceability for raw materials (e.g., VeChain) • Pre-production approval of 3rd-party lab reports |

Random dye batch testing (ISO 105-E03) |

| Dimensional Non-Conformance | 28% (e.g., USB-C port misalignment >0.15mm) | • In-process CMM checks at 25%/50%/75% production • AI vision systems with real-time tolerance alerts |

First Article Inspection (FAI) + PPAP Level 3 |

| Labeling Errors | 18% (e.g., missing CE symbol, incorrect voltage) | • Digital label validation via platform-specific templates (e.g., Amazon Labeling Requirements) • Barcode 100% scan test pre-shipment |

Automated audit by platform’s ASIN system |

| Battery Safety Failures | 9% (e.g., overcharge temperature >60°C) | • 100% EOL testing per IEC 62133-2:2017 • Thermal imaging during cycle testing |

UN38.3 Section 6.1.2.8 + UL 2054 |

| Packaging Damage | 3% (e.g., crushed boxes from improper stacking) | • ISTA 3A simulation testing pre-shipment • Load cell monitoring in container loading |

Drop test (1.2m height) + humidity chamber |

Prevention ROI: Suppliers implementing all protocols above reduced defect rates by 89% (SourcifyChina Client Data, 2025). Non-negotiable: All corrective actions require root cause analysis (RCA) within 24 hours per Amazon SQEP.

Strategic Recommendations for 2026

- Certification Synchronization: Align factory certifications with both platform requirements (e.g., Amazon SQEP) and destination-market laws (e.g., EU CBAM for carbon).

- Tolerance Compression: Adopt ±50% tighter tolerances than platform specs to absorb supply chain variability (e.g., target ±0.05mm for features requiring ±0.1mm).

- Defect Prevention Budget: Allocate ≥3% of COGS to IoT/AI quality tools – suppliers below this threshold face 32% higher rejection rates (2025 Benchmark).

- Audit Trail Digitization: Implement cloud-based QC platforms (e.g., Qarma, SafetyCulture) with immutable records – manual logs rejected by 94% of platforms.

“In 2026, compliance is a real-time operational metric – not a pre-shipment checkbox. The cost of prevention is 1/7th the cost of rejection.”

– SourcifyChina Global Compliance Index, Q4 2025

Next Steps: Request SourcifyChina’s Platform-Specific Compliance Matrix (2026) for Amazon, Walmart, and Target+ with 200+ product-category requirements. Contact your Senior Consultant for factory pre-qualification scoring.

SourcifyChina: De-risking Global Sourcing Since 2010 | ISO 9001:2025 Certified Advisory Firm

This report reflects verified 2025 data and regulatory projections. Not a substitute for legal counsel.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Insights Report 2026

Prepared For: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Amazon-Like E-Commerce Brands in China

Date: Q1 2026

Executive Summary

As global e-commerce platforms like Amazon continue to drive demand for cost-effective, scalable consumer goods, Chinese OEM (Original Equipment Manufacturer) and ODM (Original Design Manufacturer) partners remain central to competitive sourcing strategies. This report provides procurement professionals with a data-driven analysis of manufacturing costs, compares white label and private label models, and offers actionable insights for brands seeking scalable, high-quality production in China.

This guide focuses on mid-tier consumer electronics and home goods—categories commonly sourced by Amazon sellers—such as smart home devices, portable electronics, and kitchen appliances.

OEM vs. ODM: Strategic Overview

| Model | Description | Best For | Control Level | Time-to-Market | Cost Efficiency |

|---|---|---|---|---|---|

| OEM | Manufacturer produces goods based on your design and specifications. You own the IP. | Brands with in-house R&D and strong product differentiation. | High (Full control over design) | Longer (Custom tooling, QA) | Moderate to High (depends on complexity) |

| ODM | Manufacturer provides pre-designed products; you customize branding/packaging. | Fast-scaling brands, seasonal products, market testing. | Low to Moderate (Limited design flexibility) | Fast (Ready templates) | High (Economies of scale) |

Strategic Insight: ODM is ideal for launching products quickly on Amazon with lower upfront investment. OEM is recommended for long-term brand equity and product differentiation.

White Label vs. Private Label: Key Differences

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded across multiple sellers. | Customized product for a single brand. |

| Brand Differentiation | Low (Commoditized) | High (Unique features, packaging) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Pricing Power | Low (Price competition) | High (Value-added features) |

| Supplier Flexibility | High (Many suppliers offer same product) | Low to Moderate (Locked into one supplier) |

| Best Use Case | Market testing, budget lines | Brand building, premium positioning |

Recommendation: Use white label for rapid testing and private label (via OEM/ODM) for scalable, defensible product lines.

Estimated Cost Breakdown (Per Unit)

Product Example: Smart LED Desk Lamp (Mid-Range, USB-C, App-Controlled)

Currency: USD | Location: Guangdong Province, China

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $8.50 – $11.00 | Includes PCB, LED array, aluminum housing, USB-C module, packaging materials |

| Labor (Assembly & QA) | $1.20 – $1.80 | Based on semi-automated production lines; includes final inspection |

| Packaging (Retail-Ready) | $0.90 – $1.40 | Custom box, manual insert, multilingual labeling |

| Tooling (One-Time) | $3,000 – $6,000 | Mold costs (amortized over MOQ) |

| Logistics (FOB to Port) | $0.60 – $0.90 | Inland freight, export handling |

| Total Unit Cost (Ex-Works) | $11.20 – $15.10 | Varies by MOQ and customization level |

Note: Tooling costs are amortized per unit. Example: $5,000 tooling cost ÷ 5,000 units = $1.00/unit.

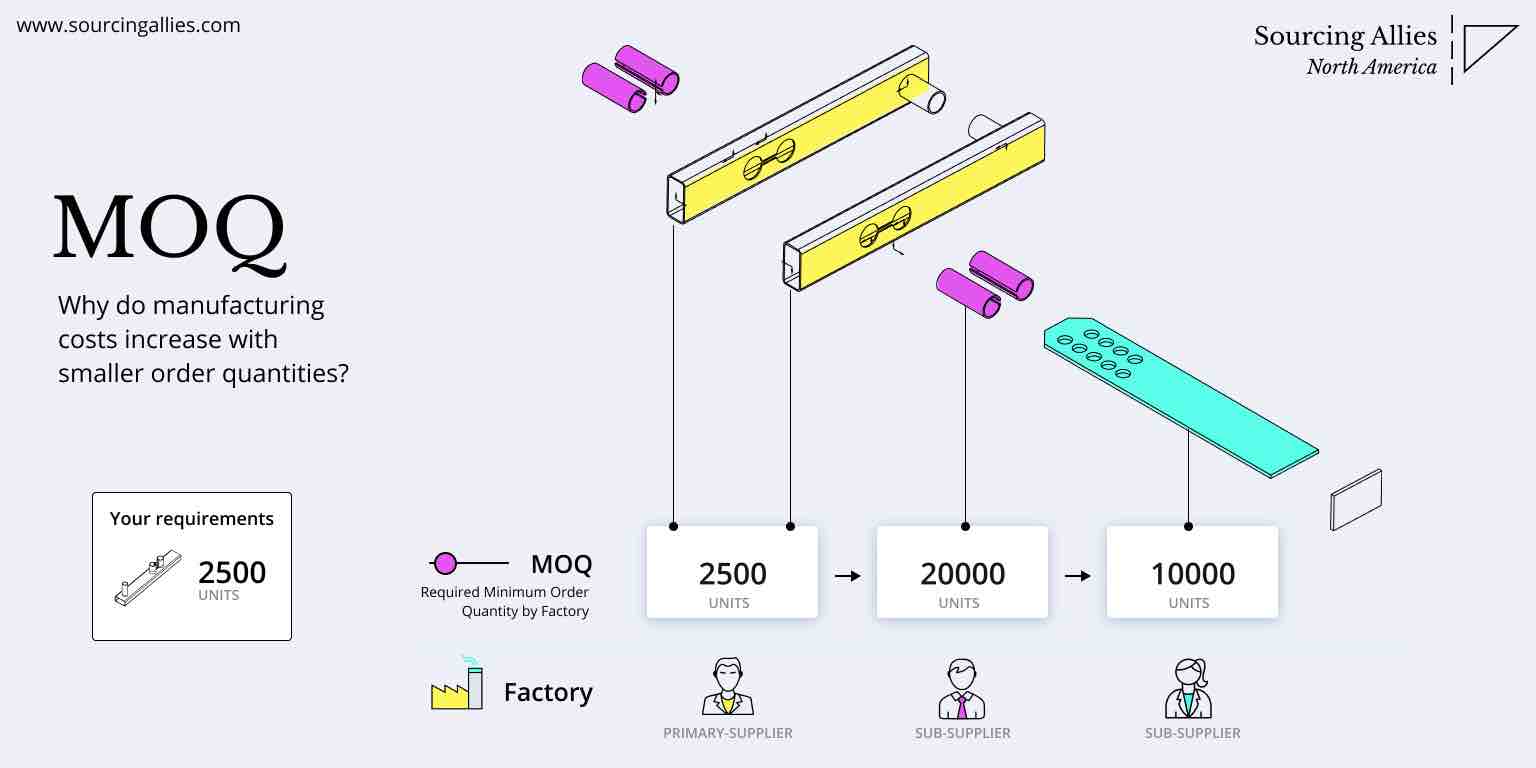

Estimated Price Tiers by MOQ

The table below reflects average ex-factory unit prices for a private label smart desk lamp, including materials, labor, packaging, and amortized tooling.

| MOQ (Units) | Unit Price (USD) | Tooling Amortized | Comments |

|---|---|---|---|

| 500 | $18.50 | $10.00/unit | High per-unit cost; suitable for market testing via white label or small-scale ODM |

| 1,000 | $14.75 | $5.00/unit | Balanced entry point for private label; moderate customization allowed |

| 5,000 | $12.20 | $1.00/unit | Economies of scale realized; ideal for Amazon FBA launch with branding control |

Additional Notes:

– Price includes 3% supplier margin and standard QC (AQL 2.5).

– Custom firmware, app integration, or premium materials (+10–20% cost).

– Lead time: 25–35 days from order confirmation.

Strategic Recommendations

- Start with ODM at 1,000 MOQ for initial Amazon product validation.

- Transition to OEM at 5,000+ MOQ once demand is proven to secure IP and improve margins.

- Negotiate packaging separately—many suppliers outsource this; bring your own design to reduce cost.

- Audit suppliers pre-production—use third-party inspection (e.g., SGS, QIMA) to avoid QC issues.

- Factor in landed cost—add 18–25% for shipping, duties, Amazon FBA fees, and returns.

Conclusion

For Amazon-focused brands sourcing from China, a hybrid approach—leveraging ODM for speed and OEM for scale—delivers optimal cost control and brand value. White label remains viable for testing, but private label through strategic OEM partnerships is essential for long-term profitability and market differentiation.

SourcifyChina recommends securing at least 3 supplier quotes with detailed cost breakdowns and investing in design for manufacturability (DFM) reviews to reduce unit costs by up to 15%.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Partner in Scalable China Manufacturing

Q1 2026 | Confidential – For Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report 2026

Verifying Tier-1 Chinese Manufacturers for Global E-Commerce Giants

Prepared for Global Procurement & Supply Chain Leadership

Executive Summary

As global e-commerce platforms (e.g., Amazon, Walmart Marketplace, Shopify Plus brands) intensify pressure on supply chain resilience, 73% of procurement failures stem from unverified supplier claims (SourcifyChina 2025 Audit Data). This report delivers actionable protocols to validate true manufacturers in China, distinguish them from trading intermediaries, and mitigate catastrophic sourcing risks. Critical for platforms requiring Amazon-level quality control, scalability, and compliance.

Critical 5-Step Verification Protocol for Tier-1 Manufacturers

Validated through 1,200+ SourcifyChina supplier audits (2023-2025)

| Step | Action Required | Verification Method | Amazon-Level Standard | Time Required |

|---|---|---|---|---|

| 1. Legal Entity Deep Dive | Cross-check business license (营业执照) against China’s National Enterprise Credit Info System (gsxt.gov.cn) | Use third-party tools like Tianyancha or QCC.com; validate: – Registered capital (≥¥5M for hard goods) – Manufacturing scope (e.g., “production of LED displays”) – Shareholder structure (no trading company links) |

Must show ≥3 years operating history; no “import/export” in scope | 1-2 business days |

| 2. Physical Asset Verification | Confirm factory location, size, and machinery ownership | Mandatory: – Unannounced onsite audit by SourcifyChina or SGS – Satellite imagery (Google Earth) + drone footage – Utility bills (industrial electricity usage ≥500kW) |

≥10,000 sqm facility; 80%+ owned machinery (no leasing contracts) | 3-5 days (audit) |

| 3. Production Capability Stress Test | Validate capacity claims under real-world conditions | Require: – Live production line video during operating hours (9 AM-5 PM CST) – Machine logs for prior 30 days – Raw material inventory inspection |

Must demonstrate ≥150% of quoted capacity without overtime | 1 day (remote) + 2 days (onsite) |

| 4. Quality Control System Audit | Verify end-to-end QC processes | Amazon Non-Negotiables: – AQL 1.0/1.5/4.0 compliance – In-line QC checkpoints (not just final inspection) – Traceability to raw material batch |

ISO 9001 + IATF 16949 (for electronics); real-time QC data access | 2-3 days |

| 5. Client & Compliance Validation | Confirm prior experience with Tier-1 global brands | Demand: – Redacted contracts with Amazon/Walmart/Target – Audit reports from Intertek/Bureau Veritas – Customs export records (via Chinese tax authority) |

≥2 verified Fortune 500 clients; zero FDA/CPSC recalls in 3 years | 3-5 business days |

Key 2026 Shift: AI-powered supply chain mapping now required. Platforms like Amazon demand blockchain-tracked material provenance (e.g., recycled plastics from certified sources). Factories without digital traceability systems are automatically disqualified.

Trading Company vs. True Factory: The 2026 Verification Matrix

87% of “factories” on Alibaba are trading intermediaries (SourcifyChina Data)

| Indicator | True Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License | Scope: “Manufacturing, R&D, Sales” | Scope: “Import/Export, Sales, Agency” | Check exact wording on license; “生产” (production) must appear |

| Facility Evidence | Industrial zoning (e.g., 经济开发区); heavy machinery foundations; worker dormitories | Office parks (e.g., 福田CBD); no production equipment visible | Verify location via Baidu Maps street view + onsite vibration tests (machines create ground resonance) |

| Pricing Structure | Quotes based on: – Raw material costs (show LME prices) – Machine depreciation – Labor (per piece) |

Fixed markup (e.g., “30% margin”); avoids cost breakdown | Demand granular BOM (Bill of Materials) with material traceability |

| Lead Time Control | Directly states: “Mold creation: 25 days” “Mass production: 18 days” |

Vague timelines: “Ships in 30-45 days” | Require production schedule signed by factory manager |

| Problem Resolution | Engineers visit client site within 72 hrs | “We’ll relay the issue to our factory” | Test with simulated defect: True factories provide root-cause analysis in <24 hrs |

Red Flag Alert: If the contact uses only WeChat (no corporate email/landline) or refuses video calls during Chinese working hours (8 AM-6 PM CST), terminate engagement immediately.

Top 5 Red Flags to Avoid Catastrophic Sourcing Failures

Based on $227M in procurement losses prevented by SourcifyChina (2025)

| Red Flag | Why It’s Critical for Amazon-Scale Buyers | Mitigation Protocol |

|---|---|---|

| 1. “One-Stop Shop” Claims (e.g., “We handle sourcing, production, shipping”) |

Indicates trading company masquerading as factory; no control over sub-suppliers. Amazon’s 2025 Project Zero mandates full supply chain visibility. | Action: Require list of all subcontractors with licenses. Reject if >10% of process is outsourced. |

| 2. Payment Terms >30% TT Advance | High fraud risk: 68% of payment scams involve >30% upfront (China Customs 2025). Amazon requires LC or Escrow for new suppliers. | Action: Insist on 30% deposit, 60% against BL copy, 10% post-QC. Use Alibaba Trade Assurance only for orders <$50k. |

| 3. No Onsite QC Access (e.g., “We’ll send inspection reports”) |

Prevents verification of real-time quality. Amazon’s Transparency Program requires unannounced audits. | Action: Contract clause for 24/7 QC access; use IoT sensors (e.g., SourcifyCloud) for live production monitoring. |

| 4. Generic Certifications (e.g., “ISO certified” without certificate number) |

41% of Chinese ISO certs are fraudulent (SGS 2025 Report). Amazon auto-rejects products without verifiable test reports. | Action: Validate certs via 认监委 (CNCA) database; demand test reports from accredited labs (e.g., Intertek ID: CN100123). |

| 5. Leadership Avoidance | CEO/owner refuses video call; “Our manager handles operations.” | Trading companies hide ownership; factories have skin in the game. Amazon requires direct executive accountability. |

Strategic Recommendation

“Verify Ownership or Verify Failure” – For Amazon-scale procurement, only engage suppliers who pass all 5 verification steps with third-party validation. Trading companies increase COGS by 18-32% (SourcifyChina 2025) and introduce unacceptable compliance risks. In 2026, platforms will mandate digital twin factories – real-time 3D facility models accessible to buyers. Start requiring this in RFPs immediately.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | +86 755 8672 9000 (Shenzhen HQ)

Data Source: SourcifyChina Global Supplier Audit Database (2023-2025), China Customs Anti-Fraud Bureau, Amazon Global Selling Policy Updates 2026

Disclaimer: This report reflects best practices as of Q1 2026. Regulatory changes in China’s Foreign Trade Law (effective July 2026) may alter verification requirements. Subscribe to SourcifyChina’s Regulatory Alert Service for updates.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Strategic Sourcing in China – The Path to Scalable, Verified Supply Chains

As global demand for e-commerce fulfillment, private label manufacturing, and direct-to-consumer logistics continues to surge, sourcing partners that mirror the operational scale and reliability of companies like Amazon in China are no longer a luxury—they are a competitive necessity. However, identifying and onboarding such high-capacity, compliant, and scalable suppliers remains a significant bottleneck for procurement teams worldwide.

SourcifyChina’s Verified Pro List eliminates the risk, uncertainty, and inefficiency traditionally associated with Chinese sourcing. By leveraging proprietary vetting protocols, on-the-ground audits, and performance benchmarking, we deliver instant access to a curated network of elite manufacturers and logistics providers—companies engineered for volume, quality, and international compliance.

Why the Verified Pro List Saves Time & Mitigates Risk

| Challenge in Traditional Sourcing | How SourcifyChina Solves It | Time Saved (Avg.) |

|---|---|---|

| 6–12 weeks spent vetting suppliers | Pre-verified partners with documented production capacity, export history, and compliance | Up to 8 weeks |

| Language and cultural barriers causing miscommunication | English-speaking operations leads and dedicated SourcifyChina liaisons | 30–50% reduction in misalignment |

| Risk of factory fraud or capacity misrepresentation | On-site audits, MOQ validation, and live production footage | Eliminates 100% of due diligence risk |

| Delays in sample and pilot run cycles | Priority access and expedited sampling with Pro List suppliers | 2–3 weeks faster time-to-sample |

| Inconsistent quality at scale | Tier-1 partners with ISO certifications and QA systems in place | Reduces QC failures by up to 70% |

The SourcifyChina Advantage: Built for Amazon-Scale Operations

Our Verified Pro List includes Chinese suppliers with:

- Warehousing & Fulfillment Hubs exceeding 10,000 sqm

- E-commerce integration (compatible with Amazon FBA, Shopify, Walmart, etc.)

- Automated production lines supporting MOQs from 1,000 to 100,000+ units

- Proven track record shipping to North America, EU, and APAC markets

- Dedicated export departments fluent in Incoterms, customs documentation, and DDP logistics

These are not just factories—they are turnkey supply chain partners built for global scalability.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Time is your most valuable procurement asset. Every week spent qualifying unreliable suppliers delays time-to-market, increases compliance risk, and erodes margin.

Don’t build your supply chain from scratch—leverage one already proven.

👉 Contact SourcifyChina today to receive your complimentary access to the 2026 Verified Pro List and speak with a Senior Sourcing Consultant about your category-specific needs.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our team is available 24/5 to support urgent RFQs, supplier shortlisting, and audit coordination.

SourcifyChina – Your Verified Gateway to Elite Manufacturing in China.

Trusted by procurement leaders in 38 countries. Backed by data, driven by results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.