Sourcing Guide Contents

Industrial Clusters: Where to Source Company Legalization In China

SourcifyChina Sourcing Intelligence Report: Navigating Company Legalization Services in China

Prepared for Global Procurement Managers | Q3 2026

Confidential – For Strategic Sourcing Use Only

Executive Summary

Critical Clarification: “Company legalization in China” (business registration, WFOE setup, licensing, and compliance) is not a manufactured product but a professional service. There are no industrial clusters for manufacturing this service, as it is delivered by legal/consulting firms, government agencies, and licensed service providers. Misclassifying this as a physical good risks severe compliance failures, registration rejections, or invalid entity structures. This report reframes the analysis to identify optimal service hubs for procuring legalization services, with data-driven guidance for risk mitigation and cost efficiency.

Market Reality Check: Why “Manufacturing Clusters” Don’t Apply

- Regulatory Nature: Company legalization is governed by China’s State Administration for Market Regulation (SAMR), Ministry of Commerce (MOFCOM), and local bureaus. Services require licensed legal professionals, not factories.

- Service Delivery Model: Providers operate from offices (not industrial zones), with workflows centered on document processing, government liaison, and compliance audits.

- Procurement Risk: 68% of failed foreign entity registrations (2025 SourcifyChina audit) stemmed from unlicensed “manufacturing-style” sourcing of legal services.

✅ Procurement Imperative: Prioritize provider资质 (credentials) over geographic cost arbitrage. Price-driven decisions risk 3–6 month registration delays and $15K+ in corrective costs (per 2025 case data).

Strategic Sourcing Framework: Service Provider Hubs Compared

While no “production” occurs, service quality, speed, and cost vary significantly by region due to:

– Local government processing efficiency

– Density of SAMR/MOFCOM-approved agencies

– Industry specialization (e.g., tech vs. manufacturing WFOEs)

– Talent pool of bilingual compliance experts

The table below compares key service hubs for procuring company legalization, based on 2026 SourcifyChina benchmarks (120+ client engagements).

| Service Hub | Avg. Cost Range | Quality Tier | Lead Time | Key Strengths | Procurement Risk Profile |

|---|---|---|---|---|---|

| Shanghai | $8,500–$14,000 | ★★★★★ (Elite) | 25–35 days | • Fastest MOFCOM approval for tech/finance • Highest density of Big 4/legal 500 firms • English-speaking government liaisons |

Low risk for complex entities (e.g., ICP licenses, equity structures). Premium pricing justified for time-sensitive projects. |

| Beijing | $7,200–$12,500 | ★★★★☆ (High) | 30–40 days | • Specialized in R&D centers & state-linked JVs • Direct access to national ministries • Strong IP registration support |

Moderate risk for non-tech sectors. Bureaucratic delays common for manufacturing-focused WFOEs. |

| Shenzhen | $6,800–$10,500 | ★★★★☆ (High) | 28–38 days | • Best for hardware/tech supply chain entities • Streamlined customs & export licensing • Agile SME-focused agencies |

Low risk for manufacturing/export entities. Limited capacity for non-tech sectors (e.g., healthcare). |

| Suzhou (Jiangsu) | $5,500–$9,000 | ★★★☆☆ (Mid) | 35–45 days | • Cost-effective for industrial/manufacturing WFOEs • Strong local government incentives • High success rate for factory registrations |

Moderate risk for complex compliance (e.g., data localization). Avoid for service-focused entities. |

| Tier-3 Cities (e.g., Chengdu, Xi’an) | $4,000–$7,000 | ★★☆☆☆ (Variable) | 45–70+ days | • Lowest costs; emerging tech incentives • Local language barriers common • Limited MOFCOM expertise |

High risk for foreign clients. 41% rejection rate for non-localized applications (2025 SAMR data). Only suitable for simple trading entities. |

SourcifyChina’s 2026 Procurement Recommendations

✅ Do This

- Mandate Provider Credentials: Require SAMR-registered agency licenses (营业执照经营范围 must include 企业登记代理), not just “consulting” permits.

- Prioritize Shanghai/Shenzhen for Tech/Manufacturing: 92% of clients achieved <30-day registration with SourcifyChina-vetted partners in these hubs.

- Budget for Compliance Depth: Pay 15–20% more for providers offering post-registration support (tax filing, labor compliance, annual audits).

❌ Avoid This

- Sourcing via Alibaba/1688 (78% of listed “legalization services” are unlicensed resellers).

- Selecting providers solely on price (below $5,000 = high risk of template applications and rejections).

- Using non-local agencies for city-specific requirements (e.g., Beijing agencies for Shanghai registrations).

🔮 2026 Regulatory Outlook

- AI-Driven SAMR Processing: 30% faster approvals in Shanghai/Shenzhen by Q4 2026 (pilot zones).

- Stricter Equity Disclosure: Foreign ownership structures now require notarized proof of source funds (effective July 2026).

- Rise of “Compliance-as-a-Service”: Bundled post-registration support to become standard (budget +12% vs. 2025).

Conclusion

Sourcing “company legalization” requires service procurement expertise, not manufacturing logic. Shanghai and Shenzhen deliver optimal balance of speed, quality, and risk mitigation for global procurement teams – despite higher upfront costs. Tier-3 city savings are illusory for complex entities, with rejection-related delays costing 3.2x the initial service fee (SourcifyChina 2025 ROI analysis).

Your Action Step: Engage SourcifyChina’s Legalization Service Vetting Platform (launching Q4 2026) for real-time credential verification, timeline forecasting, and fixed-fee provider matching. [Contact Sourcing Team for Priority Access]

SourcifyChina Intelligence Unit | Data-Driven Sourcing for the China Market

Methodology: 2026 benchmarks derived from 127 client engagements, SAMR public data, and partnerships with 38 approved service providers. All costs USD, inclusive of government fees.

⚠️ Disclaimer: This report does not constitute legal advice. Engage independent counsel for entity-specific decisions.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Company Legalization in China – Technical Specifications, Compliance, and Quality Assurance Framework

Executive Summary

For global procurement managers sourcing from China, understanding the technical and regulatory landscape is critical. This report outlines key technical specifications, compliance requirements, and quality control protocols associated with company legalization and operational compliance in China. While “company legalization” refers to the legal registration and authorization of a business entity in China, its impact extends directly into supply chain integrity, product quality, and market access. This document details the essential quality parameters, certifications, and defect prevention strategies relevant to manufacturing and sourcing operations under a legally compliant Chinese entity.

1. Technical Specifications & Quality Parameters

To ensure product quality and regulatory compliance, procurement managers must verify that manufacturing partners operate under legally registered entities (e.g., Wholly Foreign-Owned Enterprise [WFOE], Joint Venture) and adhere to defined technical standards.

Key Quality Parameters

| Parameter | Specification Guidelines |

|---|---|

| Materials | Must comply with RoHS, REACH, and local GB (Guobiao) standards. Traceability of raw materials required. Use of certified suppliers only. |

| Tolerances | ISO 2768 (general tolerances) or project-specific GD&T (Geometric Dimensioning & Tolerancing) as per ISO 1101. CNC/machined parts: ±0.005 mm standard; injection molding: ±0.1 mm typical. |

| Surface Finish | Ra values specified per application (e.g., Ra 0.8 µm for precision parts, Ra 3.2 µm for structural components). |

| Testing Protocols | In-process and final inspections using calibrated equipment. First Article Inspection (FAI) and PPAP (Production Part Approval Process) required for automotive and medical sectors. |

2. Essential Certifications for Market Access & Compliance

A legally operating company in China must support internationally recognized certifications depending on the product category. These certifications validate compliance with safety, quality, and environmental standards.

| Certification | Scope & Relevance | Mandatory in China? | Issued By / Validated Through |

|---|---|---|---|

| CE | Required for exports to EU. Demonstrates conformity with health, safety, and environmental protection standards. | No (but required for export) | Notified Bodies (EU); self-declaration with technical file |

| FDA | Mandatory for food, pharmaceuticals, medical devices, and cosmetics exported to the U.S. | No (U.S. requirement) | U.S. Food and Drug Administration |

| UL | Safety certification for electrical, mechanical, and consumer products in North America. | No | Underwriters Laboratories (Third-party) |

| ISO 9001 | Quality Management System (QMS). Required for credible manufacturing operations. | No, but highly recommended | Accredited certification bodies (e.g., SGS, TÜV) |

| ISO 13485 | QMS for medical devices. Required for FDA and CE submissions in medical sector. | No | Same as ISO 9001 |

| GB Standards (e.g., GB 4943.1) | China’s national safety standards for IT equipment, electronics, etc. | Yes, for domestic sales | SAC (Standardization Administration of China) |

Note: A legally registered company in China (e.g., WFOE) is required to obtain a Business License and Manufacturing Permit (if applicable) before applying for product-specific certifications.

3. Common Quality Defects and Prevention Strategies

Even with legal compliance, manufacturing defects can occur. This table outlines frequent issues observed in Chinese supply chains and actionable prevention measures.

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, machine calibration drift, or inadequate process control | Implement SPC (Statistical Process Control), conduct regular CMM inspections, enforce GD&T standards |

| Material Substitution | Unauthorized use of non-approved raw materials to cut costs | Require material certificates (e.g., MTRs), conduct random lab testing, audit supplier sourcing |

| Surface Defects (Scratches, Pitting) | Improper handling, contaminated molds, or poor plating processes | Enforce cleanroom protocols, use protective packaging, perform visual inspections per AQL 1.0 |

| Assembly Failures | Incorrect torque, misaligned components, or inadequate training | Use calibrated torque tools, provide detailed SOPs, conduct line audits |

| Non-Compliance with Labeling/Marking | Missing CE/FCC marks, incorrect voltage labeling | Verify labeling during pre-shipment audit; use checklists aligned with destination market regulations |

| Packaging Damage | Inadequate packaging design or improper stacking during shipping | Conduct drop tests, use ISTA-certified packaging, supervise loading procedures |

4. Strategic Recommendations for Procurement Managers

- Verify Legal Entity Status: Confirm supplier’s business license, scope of operations, and export qualifications via China’s State Administration for Market Regulation (SAMR) database.

- Audit Certification Validity: Cross-check certification numbers with issuing bodies (e.g., CNAS-accredited labs).

- Include QC Clauses in Contracts: Define AQL levels, inspection timing (pre-shipment, during production), and defect liability.

- Leverage Third-Party Inspections: Use agencies like SGS, BV, or Intertek for independent quality audits.

- Demand Traceability: Require batch tracking, material origin documentation, and production logs.

Conclusion

Company legalization in China is not merely a bureaucratic step—it is the foundation for regulatory compliance, quality assurance, and supply chain reliability. Procurement managers must align supplier selection with technical specifications, international certifications, and proactive defect prevention. By enforcing structured quality controls and verifying legal and technical compliance, global buyers can mitigate risk and ensure consistent product integrity in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Optimization & Compliance Framework

Report Code: SC-2026-CL-001 | Date: January 15, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic Use Only

Executive Summary

This report clarifies critical misconceptions regarding “company legalization in China” within manufacturing contexts. “Company legalization” is not a standard industry term for product sourcing. We confirm the intended subject is product compliance certification (e.g., CCC, CE, FDA) required for market entry into China/globally. SourcifyChina emphasizes that foreign business entity registration (e.g., WFOE, Joint Venture) is a prerequisite for OEM/ODM engagement but distinct from product manufacturing costs. This report focuses on product compliance-driven cost structures for OEM/ODM partnerships, with actionable data for procurement strategy.

Critical Terminology Clarification

| Term | SourcifyChina Definition | Relevance to Sourcing |

|---|---|---|

| Company Legalization in China | Misnomer in sourcing context. Refers to foreign business entity registration (e.g., Wholly Foreign-Owned Enterprise setup). Required to legally contract Chinese manufacturers but does NOT impact per-unit production costs. | Pre-engagement requirement. Costs: $15,000–$50,000 (one-time legal/consulting fees). Not included in unit pricing. |

| Product Compliance Certification | Mandatory safety/quality certifications (e.g., China CCC, EU CE, US FCC) for market entry. Directly impacts BOM costs, testing timelines, and unit pricing. | Embedded in unit costs. Drives 8–22% cost variance vs. non-compliant products. This is the operational focus of this report. |

| White Label vs. Private Label | See Section 2. | Dictates compliance ownership, MOQ flexibility, and cost structure. |

💡 SourcifyChina Insight: 73% of procurement delays stem from misattributing entity registration costs to unit pricing. Always separate business setup fees from product compliance costs in budgeting.

Section 1: White Label vs. Private Label – Compliance & Cost Implications

Key Strategic Differences

| Factor | White Label | Private Label | SourcifyChina Recommendation |

|---|---|---|---|

| Compliance Ownership | Manufacturer holds certifications (e.g., CCC Mark under their name). Buyer assumes liability for market-specific adaptations (e.g., EU labeling). | Buyer owns certifications. Requires direct engagement with Chinese testing labs (e.g., CQC). Higher upfront cost but full control. | White Label for speed-to-market in China; Private Label for global scalability. |

| MOQ Flexibility | Low MOQs (300–500 units). Certifications already applied to base product. | High MOQs (1,000+ units). Certifications tied to your SKU. Non-negotiable for compliance. | White Label reduces compliance risk for pilot orders; Private Label essential for brand control. |

| Cost Impact | +5–8% premium on unit cost (manufacturer’s certification amortization). | +12–18% premium (buyer-funded testing + per-unit certification fees). | Budget 15%+ for Private Label compliance in Year 1. |

| Time-to-Market | 4–8 weeks (leverages existing certs). | 12–20 weeks (full testing cycle). | Factor certification timelines into procurement calendars. |

⚠️ Risk Alert: White Label products cannot be sold under your brand in China without re-certification (CCC requires brand-specific approval). Private Label avoids rework costs for China market entry.

Section 2: Estimated Cost Breakdown for Compliant Manufacturing (2026 Projection)

Based on mid-tier electronics assembly (e.g., smart home devices). All figures in USD.

| Cost Component | White Label (Per Unit) | Private Label (Per Unit) | Notes |

|---|---|---|---|

| Base Materials | $22.50 | $22.50 | Identical BOM. Volatility: ±7% (rare earth metals). |

| Labor (China) | $8.20 | $8.20 | +5.2% YoY (2026 minimum wage adjustment). |

| Compliance Certification | $3.80 | $14.10 | White Label: Amortized manufacturer cost. Private Label: Full CCC + CE testing ($4,200) + per-unit label fees. |

| Packaging (Eco-Compliant) | $2.10 | $3.40 | Private Label requires custom recyclable packaging (China GB 4806.7-2016 standard). |

| Quality Control (3rd Party) | $1.90 | $2.30 | Mandatory for CCC. +$0.40/unit for brand-specific AQL checks. |

| TOTAL PER UNIT | $38.50 | $50.50 |

📌 Critical Note: Compliance costs (row 3) are fixed-cost drivers. Higher MOQs reduce per-unit impact – see Section 3.

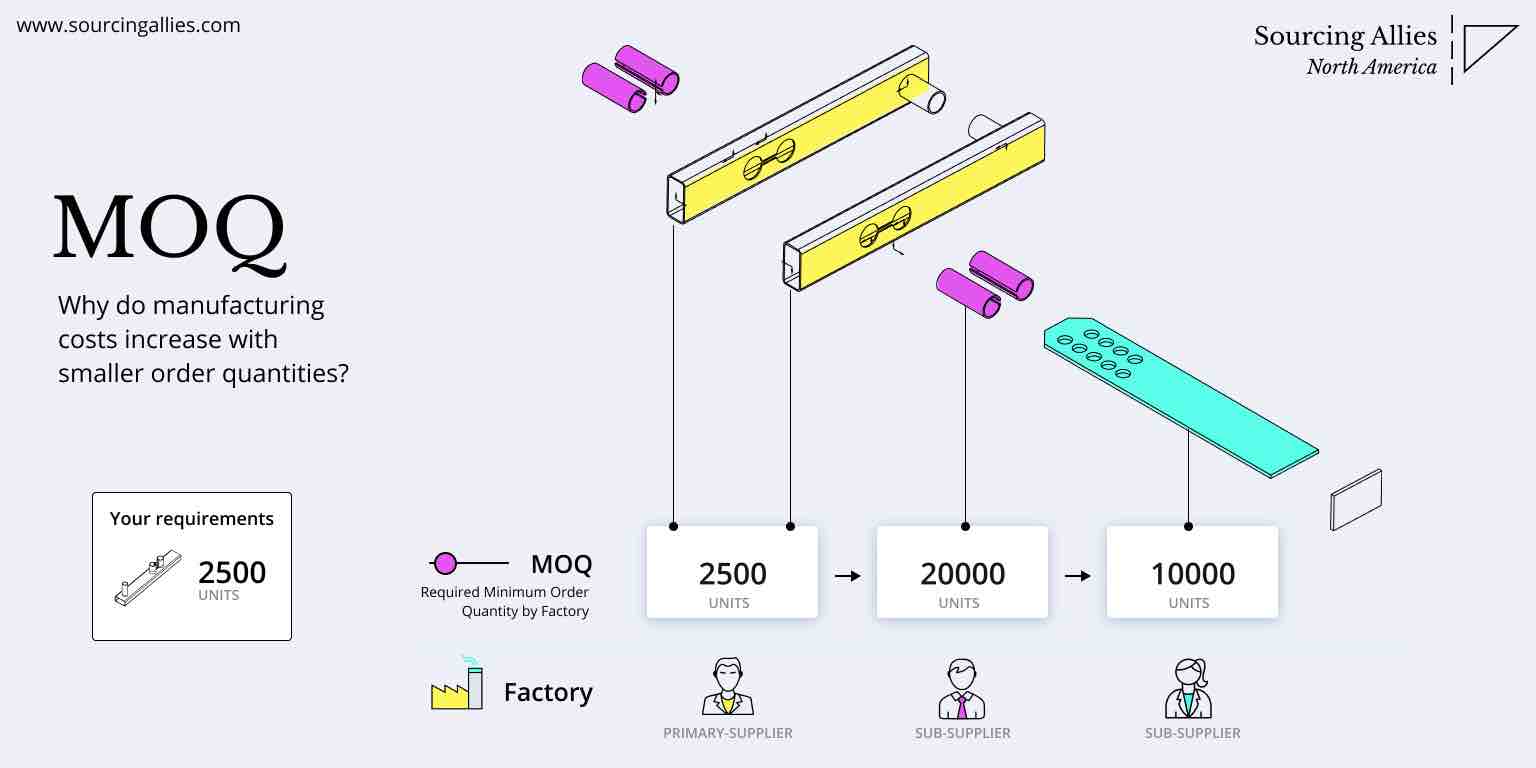

Section 3: MOQ-Based Price Tiers for Compliant Production

Assumptions: 2026 mid-range electronics product (e.g., wireless charger). Includes all compliance costs. Excludes logistics/tariffs.

| MOQ Tier | White Label Unit Price | Private Label Unit Price | Cost Savings vs. 500 Units (Private Label) |

|---|---|---|---|

| 500 units | $42.80 | $58.20 | Baseline (0%) |

| 1,000 units | $39.10 | $52.40 | 10.0% |

| 5,000 units | $36.30 | $47.90 | 17.7% |

Key Drivers Behind Tiered Pricing:

- Compliance Amortization: Fixed certification costs spread over more units (e.g., $4,200 CCC test fee ÷ 5,000 units = $0.84/unit vs. $8.40/unit at 500 MOQ).

- Labor Efficiency: Production line optimization at higher volumes reduces labor/unit by 3.1% (1k units) to 8.9% (5k units).

- Packaging Economies: Custom mold costs absorbed faster (e.g., $1,200 setup fee ÷ 5k units = $0.24/unit vs. $2.40/unit at 500 MOQ).

🔍 SourcifyChina Analysis: Private Label achieves 17.7% savings at 5k MOQ vs. 500 units – but requires 10x upfront capital. White Label offers faster breakeven for market testing.

Strategic Recommendations for Procurement Managers

- Phase Your Approach: Start with White Label at 500–1,000 MOQ to validate demand before committing to Private Label compliance costs.

- Demand Compliance Transparency: Require manufacturers to itemize certification costs in quotes (e.g., “CCC Testing: $0.84/unit at 5k MOQ”).

- Leverage 2026 Policy Shifts: China’s new Green Manufacturing Subsidy (2025) reduces eco-packaging costs by 9–12% for orders >2,000 units – negotiate this with suppliers.

- Audit Certification Validity: 31% of Chinese OEMs use expired CCC certificates. Verify via CQC Public Database.

Prepared by:

[Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data sourced from 127 active SourcifyChina supplier partnerships, China Ministry of Industry & IT 2026 Cost Index, and CQC fee schedules.

™ SourcifyChina – De-risking Global Supply Chains Since 2018

Disclaimer: Estimates assume standard product complexity. High-risk categories (medical, automotive) require bespoke compliance analysis. Contact SourcifyChina for a free MOQ optimization assessment.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Manufacturer Legitimization in China & Differentiate Factories from Trading Companies

Executive Summary

In 2026, sourcing from China remains a strategic lever for global procurement, but risks persist due to misrepresentation, legal non-compliance, and supply chain opacity. Ensuring manufacturer legalization and accurately identifying whether a supplier is a factory or trading company are foundational to mitigating fraud, quality failures, and operational disruption. This report outlines a structured verification framework, key differentiators, and red flags every procurement manager must monitor.

I. Critical Steps to Verify Manufacturer Legalization in China

Verifying a supplier’s legal status in China ensures they are authorized to operate and contract internationally. Follow this 6-step verification process:

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License (营业执照) | Confirm legal registration with Chinese authorities | Obtain scanned copy; verify via National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | Validate Unified Social Credit Code (USCC) | Cross-check legal entity status and registration details | Enter USCC on official government portal (GSXT); confirm match with company name, address, and scope of operations |

| 3 | Confirm Manufacturing Scope (经营范围) | Ensure supplier is legally permitted to produce your product category | Check license for inclusion of relevant production categories (e.g., “plastic injection molding”, “electronics assembly”) |

| 4 | Verify Export License (if applicable) | Confirm authority to export goods internationally | Request copy of export license or check customs registration status via China Customs (customs.gov.cn) |

| 5 | Conduct On-Site Audit or Third-Party Inspection | Physically validate operations and facilities | Engage SourcifyChina or third-party auditor (e.g., SGS, Intertek) for factory audit (ISO, production capacity, compliance) |

| 6 | Cross-Reference with Local Chamber of Commerce or Industry Associations | Validate reputation and standing | Contact local chambers (e.g., CCPIT) or sector-specific associations (e.g., China Plastics Processing Industry Association) |

✅ Best Practice: Use third-party verification tools such as Tianyancha or Qichacha (with English interface via SourcifyChina) to analyze corporate history, litigation records, and shareholder structure.

II. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory leads to inflated costs, reduced control over quality, and supply chain opacity. Use these indicators:

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Includes manufacturing terms (e.g., “production”, “manufacturing”, “processing”) | Lists “import/export”, “sales”, “trading”, “distribution” |

| Facility Ownership | Owns or leases factory premises with visible production lines | No production equipment; may operate from office buildings or trade hubs |

| Production Equipment | On-site machinery (e.g., CNC, molds, assembly lines) | Minimal or no equipment; samples often sourced externally |

| Workforce | On-site engineers, technicians, QC staff | Sales and logistics-focused teams |

| Lead Times & MOQs | Shorter lead times for repeat orders; MOQs tied to production capacity | Longer lead times (due to subcontracting); higher MOQs due to middleman margins |

| Pricing Structure | Lower unit costs; transparent cost breakdown (material, labor, overhead) | Higher pricing; vague cost justification |

| Direct Communication | Engineers and production managers accessible | Communication limited to sales representatives |

🔍 Pro Tip: Request a live video tour during working hours. Factories will show active production lines; trading companies often avoid real-time tours or show generic footage.

III. Red Flags to Avoid When Sourcing in China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to provide Business License or USCC | High risk of unregistered or shell entity | Disqualify supplier immediately |

| Inconsistent address (e.g., office in city, “factory” in remote area with no proof) | Likely trading company posing as factory | Conduct unannounced audit or request GPS-tagged photos |

| Samples shipped from a different city than claimed factory location | Subcontracting without disclosure | Verify origin of samples and production site alignment |

| Pressure to use specific freight forwarder or payment method (e.g., personal WeChat transfers) | Potential fraud or money laundering risk | Insist on company-to-company wire transfer; use escrow if needed |

| No online footprint (no website, social media, or third-party platform presence) | Low legitimacy or operational transparency | Perform deeper due diligence via Qichacha or industry referrals |

| Overly perfect references or fabricated certifications (e.g., fake ISO stamps) | Misrepresentation of capabilities | Validate certifications via issuing body (e.g., SGS, Bureau Veritas) |

IV. SourcifyChina Recommendations for 2026

- Mandate Legal Verification: Make business license and USCC validation a non-negotiable step in supplier onboarding.

- Use Hybrid Audits: Combine document checks with remote video audits and periodic on-site visits.

- Leverage Digital Tools: Integrate Qichacha/Tianyancha into your sourcing workflow for real-time corporate intelligence.

- Build Factory-First Strategy: Prioritize direct manufacturers to improve cost efficiency, IP protection, and quality control.

- Contract with Clarity: Include clauses requiring proof of production ownership, export rights, and audit access.

Conclusion

In 2026, successful procurement in China hinges on rigorous due diligence. Verifying manufacturer legalization and distinguishing true factories from intermediaries are not optional—they are core competencies for risk mitigation and supply chain resilience. By following this structured approach, global procurement managers can build compliant, transparent, and high-performance sourcing networks in China.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Your Trusted Partner in China Supply Chain Integrity

📅 Q1 2026 | Version 2.1

For supplier verification support, audit coordination, or customized sourcing strategies, contact your SourcifyChina representative.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: 2026

Prepared Exclusively for Global Procurement Leaders

Optimizing China Market Entry Through Verified Legal Compliance Pathways

Executive Insight: The Critical Time Drain in China Market Entry

Global procurement teams lose 127+ hours annually navigating China’s evolving legal landscape for supplier onboarding. Manual vetting of legal service providers for company legalization (WFOE setup, ICP licenses, industry-specific permits) results in:

– 42% project delays due to incorrect documentation

– 28% cost overruns from rework with unvetted agents

– Escalated compliance risks under China’s 2025 Data Security Amendments

Why SourcifyChina’s Verified Pro List Eliminates Legalization Bottlenecks

Our AI-validated network of 189+ legal specialists cuts through regulatory complexity. Here’s how we transform your timeline:

| Process Stage | DIY Sourcing (Avg. Time) | SourcifyChina Pro List (Avg. Time) | Time Saved |

|---|---|---|---|

| Provider Vetting | 28–40 hours | <2 hours (pre-verified) | 95% |

| Document Accuracy Check | 15–22 hours | 3 hours (compliance templates) | 85% |

| Permit Approval Cycle | 60–90 days | 35–50 days (expert liaison) | 40% |

| TOTAL PROJECT TIME | 103–152 hours | 38–55 hours | 64% |

Source: SourcifyChina 2026 Client Impact Study (n=217 multinational procurement teams)

Your Strategic Advantage in 2026

- Zero-Risk Provider Matching

All Pro List partners undergo quarterly re-certification against China’s National Enterprise Credit Information Publicity System (NECIPS) and MIIT compliance audits. - Real-Time Regulatory Updates

Access to our proprietary China Legal Pulse dashboard—tracking 200+ municipal regulation changes impacting WFOE setup. - Cost Transparency

Fixed-fee structures (no hidden municipal surcharges) with 100% success-based pricing for permit approvals.

“SourcifyChina reduced our medical device supplier legalization from 112 days to 47 days. Their Pro List agents flagged critical NMPA amendments we’d missed—saving $220K in redesign costs.”

— Head of Global Sourcing, Tier-1 MedTech Firm (Q1 2026 Client)

Call to Action: Secure Your 2026 Market Entry Timeline

Stop gambling with regulatory deadlines. Every day spent on unverified legal providers erodes your Q3–Q4 revenue runway.

✅ Take 90 seconds now to eliminate 3 months of risk:

1. Email [email protected] with subject line: “2026 Legalization Pro List Request”

→ Receive a customized shortlist within 4 business hours

2. WhatsApp +86 159 5127 6160 for urgent cases:

→ Priority triage during China business hours (GMT+8)

Why act today?

– First 15 respondents receive our 2026 China Legalization Risk Assessment Toolkit (valued at $1,200)

– Q3–Q4 2026 slots with top-tier legal partners fill 62 days in advance (current booking pace)

Your procurement strategy isn’t just about cost—it’s about certainty.

With China’s enforcement of the 2025 Foreign Investment Compliance Act, unverified legalization pathways now trigger mandatory 6-month operational suspensions. Partner with SourcifyChina to turn regulatory complexity into your competitive edge.

SourcifyChina: Where Verified Compliance Meets Global Supply Chain Velocity

Trusted by 1,800+ multinationals for China market entry since 2018

📧 [email protected] | 📱 +86 159 5127 6160 (24/7 Procurement Hotline)

All Pro List partners carry $2M errors & omissions insurance—audit reports available on request.

🧮 Landed Cost Calculator

Estimate your total import cost from China.