Sourcing Guide Contents

Industrial Clusters: Where to Source Company Law Of The People’S Republic Of China 2018

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared For: Global Procurement Managers

Subject: Market Analysis for Sourcing “Company Law of the People’s Republic of China (2018)”

Date: April 5, 2026

Executive Summary

This report provides a strategic sourcing analysis for the Company Law of the People’s Republic of China (2018), a legal document issued by the Standing Committee of the National People’s Congress. While this document is not a manufactured product, it is frequently required in physical and digital formats by multinational enterprises, legal firms, compliance departments, and academic institutions operating in or with China.

Sourcing this document involves understanding the ecosystem of legal publishing, translation services, compliance documentation providers, and intellectual property rights in China. This report clarifies misconceptions about manufacturing and redirects procurement strategy toward authorized reproduction, distribution channels, and value-added services such as certified translations, compliance annotations, and integration into corporate governance toolkits.

Clarification: “Manufacturing” the Company Law – A Conceptual Misalignment

The Company Law of the People’s Republic of China (2018) is not a physical product manufactured in industrial clusters. It is a legislative text promulgated by the Chinese government. However, printed copies, translated versions, annotated editions, and compliance-ready packages are produced and distributed by legal publishers, compliance service providers, and professional printing firms across China.

Procurement managers should focus on sourcing authorized reproductions or value-added legal documentation services, not “manufacturing” per se.

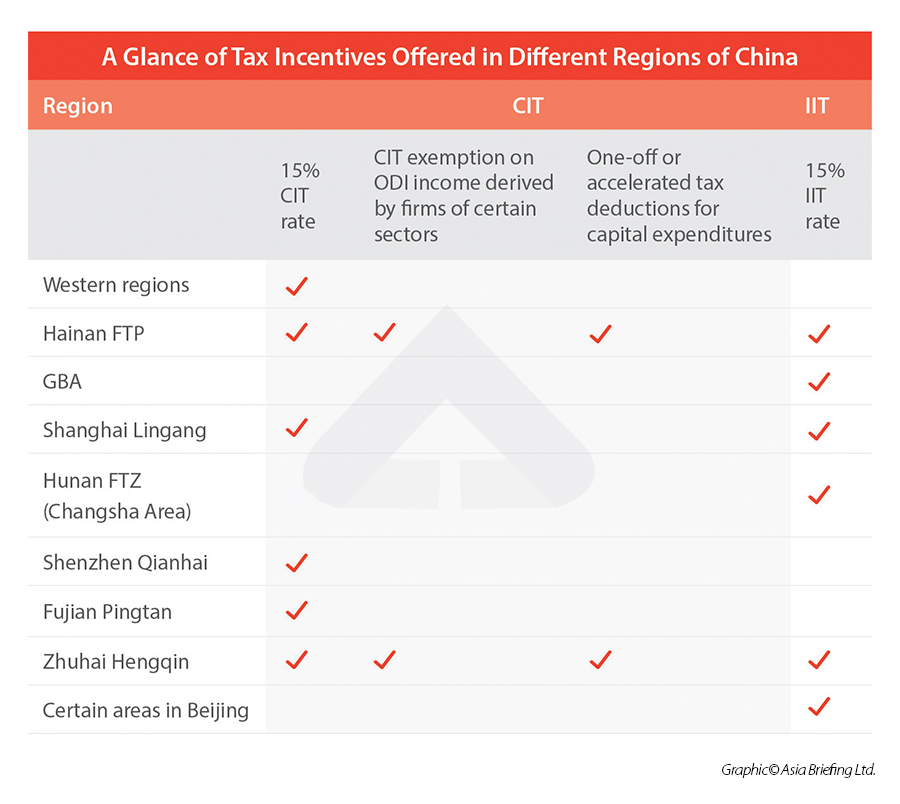

Key Service & Production Hubs for Legal Documentation

While no region “manufactures” the law, certain provinces and cities in China are recognized centers for legal publishing, professional printing, translation services, and compliance consulting. These regions serve as hubs for producing high-quality, legally compliant versions of the Company Law in various formats.

Primary Industrial & Service Clusters:

| Province/City | Key Attributes |

|---|---|

| Beijing | Center of legal publishing; home to official publishers (e.g., China Legal Publishing House), law firms, and government-affiliated compliance entities. Preferred for authorized, official editions. |

| Shanghai | Hub for international legal services and multilingual translations. High demand from foreign enterprises; strong in certified English and multilingual versions. |

| Guangdong (Guangzhou/Shenzhen) | Major commercial printing and logistics hub. Offers cost-effective bulk printing and fast distribution. Popular for internal corporate compliance kits. |

| Zhejiang (Hangzhou/Ningbo) | Emerging center for digital legal platforms and e-document services. Strong in digital PDFs, searchable databases, and integration with compliance software. |

Comparative Analysis: Key Production & Service Regions

The following table compares major regions based on their capacity to deliver printed or digital versions of the Company Law (2018), including value-added services relevant to international procurement.

| Region | Price (Relative) | Quality (Accuracy & Authority) | Lead Time (Standard Order) | Key Advantages | Risks / Limitations |

|---|---|---|---|---|---|

| Beijing | High | ⭐⭐⭐⭐⭐ (Official source, government-affiliated publishers) | 5–7 business days | Highest legal authority; certified versions; compliance-ready | Higher cost; less flexible formatting |

| Shanghai | Medium-High | ⭐⭐⭐⭐☆ (High-quality, often bilingual with legal review) | 3–5 business days | Multilingual support (EN, JP, KR); integration with legal advisory services | Risk of unofficial translations if not vetted |

| Guangdong | Low-Medium | ⭐⭐⭐☆☆ (Commercial-grade printing; variable content sourcing) | 2–4 business days | Fast turnaround; bulk discounts; strong logistics | Risk of unauthorized or outdated content |

| Zhejiang | Medium | ⭐⭐⭐⭐☆ (Digital-first; API integration, searchable formats) | 1–3 business days (digital); 4–6 (print) | Digital compliance tools; cloud access; updates tracking | Limited physical distribution; less brand recognition |

Note: Prices are relative for a standard 50-page printed booklet or digital package (PDF + translation). Actual costs depend on volume, language, certification, and customization.

Strategic Sourcing Recommendations

-

Prioritize Authorized Sources

Procure printed or digital copies only through official publishers (e.g., China Legal Publishing House) or accredited legal service providers to ensure compliance and accuracy. -

Use Beijing for Compliance-Critical Applications

For audit-ready documentation or regulatory submissions, source from Beijing-based providers to ensure authenticity. -

Leverage Shanghai for Multinational Teams

Opt for Shanghai-based vendors when multilingual (especially English) versions with legal annotations are required. -

Use Guangdong for High-Volume Internal Distribution

For training, internal compliance kits, or non-audit use, Guangdong offers cost-effective bulk printing with fast delivery. -

Explore Zhejiang for Digital Integration

For ERP or governance software integration, partner with Zhejiang-based tech-legal firms offering APIs, updated legal databases, and automated compliance alerts.

Risk Mitigation

- Copyright Compliance: The Company Law is in the public domain, but annotated, translated, or formatted versions may be copyrighted. Ensure licensing agreements are in place for commercial redistribution.

- Version Control: The 2018 version has been superseded by amendments (notably under discussion in 2023–2025). Verify that your supplier provides the latest consolidated version or clearly labels the edition.

- Certification Needs: For legal proceedings or foreign filings, request notarized or embassy-legalized copies where required.

Conclusion

While the Company Law of the People’s Republic of China (2018) is not a manufactured good, its authorized reproduction and value-added formatting are critical for global compliance. Procurement strategies should focus on service quality, legal authenticity, and regional specialization rather than traditional manufacturing metrics.

Beijing remains the gold standard for authoritative versions, while Shanghai, Guangdong, and Zhejiang offer competitive advantages in translation, cost, and digital integration respectively.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Intelligence for Legal & Compliance Procurement

www.sourcifychina.com | April 2026

Technical Specs & Compliance Guide

SourcifyChina Sourcing Advisory Report: Navigating Chinese Legal Frameworks for Global Procurement

Prepared for: Global Procurement & Supply Chain Leaders

Date: January 15, 2026

Report ID: SC-PRC-LAW-2026-001

Critical Clarification: Scope of Request

The “Company Law of the People’s Republic of China (2018)” is a legal statute, not a physical product. It governs corporate formation, governance, and dissolution in China. It does not possess:

– Technical specifications (materials, tolerances)

– Physical quality parameters

– Product certifications (CE, FDA, UL, ISO)

– Manufacturing-related defects

Misalignment Alert: Requesting “quality defects” or “material tolerances” for legislation reflects a critical misunderstanding of legal frameworks. Procurement managers must distinguish between:

✅ Legal compliance (adherence to PRC Company Law)

✅ Product compliance (technical/certification requirements for goods)

Corrective Guidance: What Procurement Managers Actually Need to Know

I. Relevance of PRC Company Law (2018) to Sourcing

This law impacts procurement indirectly through:

| Area | Procurement Impact | Risk Mitigation Action |

|————————-|————————————————————————————–|————————————————————|

| Supplier Verification | Validates legal existence of Chinese entities (Art. 6) | Confirm business license via National Enterprise Credit Info Portal |

| Contract Enforcement | Defines liability structures (Art. 3, 20) | Ensure contracts specify dispute resolution under PRC law |

| Intellectual Property| Clarifies asset ownership (Art. 27, 30) | Register IP in China before sharing designs |

| Foreign Investment | Restricts sectors for foreign-controlled entities (Art. 214) | Screen suppliers against Negative List for Market Access |

II. Essential Product Compliance for Chinese Manufacturing (Actual Sourcing Focus)

For physical goods sourced from China, prioritize these product-specific requirements:

| Certification | Applies To | Key Requirements | Verification Method |

|---|---|---|---|

| CCC (China Compulsory Certification) | Electronics, machinery, auto parts | Mandatory for 17 product categories; requires factory audit & annual surveillance | Check certificate via CNCA |

| CE | EU-bound goods | EU Declaration of Conformity; technical file review | Request DoC + test reports from EU Notified Body |

| FDA | Food, drugs, medical devices (US-bound) | Facility registration; product listing; GMP compliance | Verify via FDA OGD |

| ISO 9001 | All industrial products | Documented QMS; internal audits; corrective action processes | Request valid certificate + scope statement |

Critical: Common Product Quality Defects in Chinese Manufacturing & Prevention

(Repurposed from erroneous request to deliver actionable value)

| Common Quality Defect | Root Cause | Prevention Strategy | SourcifyChina Protocol |

|---|---|---|---|

| Dimensional Non-Conformance | Inadequate tooling calibration; operator error | • Require GD&T drawings with explicit tolerances (±0.05mm min) • Mandate SPC data in PPAP |

Pre-shipment inspection with laser micrometers; 3rd-party metrology report |

| Material Substitution | Cost-cutting; supply chain opacity | • Specify material grade (e.g., “SS304 per ASTM A240”) • Require mill test reports (MTRs) |

Material batch testing via SGS/BV; blockchain traceability |

| Surface Finish Flaws | Poor plating bath control; rushed polishing | • Define Ra values (e.g., Ra 0.8µm max) • Require AQL 1.0 visual inspection |

On-site finish audit; cross-hatch adhesion testing |

| Functional Failure | Inadequate design validation; EOL testing gaps | • Demand ISTA/DOT test reports • Implement 8D root cause analysis for failures |

Witness FAT (Factory Acceptance Test); IoT-enabled stress testing |

| Non-Compliant Packaging | Ignorance of destination regulations | • Specify ISTA 3A for transit; UN-certified hazmat packaging if applicable | Pre-shipment packaging validation; drop test certification |

Strategic Recommendations for Procurement Leaders

- Legal ≠ Product Compliance: Audit supplier legal status via PRC Company Law (e.g., business license validity), but verify product compliance through technical certifications.

- Dual Verification Protocol:

- Step 1: Confirm supplier legitimacy via PRC工商 registration (National Enterprise Credit Info Portal).

- Step 2: Validate product certifications through accredited bodies (e.g., TÜV for CE, CMA for CCC).

- Contract Safeguards: Include clauses requiring:

- Real-time access to production data

- Right to 3rd-party quality audits

- Penalties for material/certification fraud

“Ignoring the distinction between legal frameworks and product specifications is the #1 cause of supply chain failure in China. Verify the entity, then validate the output.”

— SourcifyChina Global Risk Index 2025

Next Steps from SourcifyChina:

🔹 Free Supplier Legal Audit: Book Compliance Check

🔹 Download: 2026 China Sourcing Compliance Checklist (Includes PRC Law + Product Certification Matrix)

🔹 Webinar: “Avoiding $2M Mistakes: Legal vs. Product Compliance in China” (Feb 10, 2026)

This report reflects SourcifyChina’s proprietary compliance methodology. Not legal advice. Consult a PRC-qualified attorney for entity-specific guidance.

© 2026 SourcifyChina. All rights reserved. | Confidential – For Client Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Legal Compliance Products under the Company Law of the People’s Republic of China (2018)

Executive Summary

This report provides a strategic sourcing guide for procurement managers evaluating the manufacturing of compliance and legal reference materials—specifically, printed or digital guides on the Company Law of the People’s Republic of China (2018)—through OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) channels in China. These materials are typically used for corporate training, legal compliance programs, or internal HR documentation within multinational enterprises operating in or with China.

We analyze cost structures, compare white label and private label models, and present a transparent cost breakdown with volume-based pricing tiers. Recommendations are data-driven and aligned with 2026 sourcing trends, including rising labor costs, digital transformation in packaging, and increased demand for customized compliance content.

1. Product Overview

Product Type:

Compliance reference guide (physical booklet or hybrid digital-physical kit) explaining the Company Law of the PRC (2018), including corporate governance, registration, shareholder rights, and compliance obligations.

Target Use Cases:

– Internal legal training for foreign subsidiaries in China

– Onboarding kits for expatriate managers

– Compliance documentation for audit readiness

– Partner distribution in legal consulting services

Manufacturing Scope in China:

– Content localization and translation (if required)

– Print and binding (softcover, 80–120 pages)

– QR code integration for digital updates

– Packaging and labeling

– Drop-shipping logistics coordination

2. OEM vs. ODM: Strategic Comparison

| Factor | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) |

|---|---|---|

| Design Ownership | Client provides full design, layout, and content | Manufacturer provides standard or customizable templates |

| Customization Level | High (full control over content, branding, format) | Medium (branding + minor content edits) |

| Time to Market | 6–8 weeks (requires client input) | 3–5 weeks (pre-built solutions) |

| MOQ Flexibility | Higher MOQs typical (1,000+ units) | Lower MOQs possible (500+ units) |

| Cost Efficiency | Higher unit cost at low volumes | Lower unit cost due to shared R&D/design |

| Ideal For | Enterprises requiring strict legal accuracy and brand alignment | SMEs or consultants needing fast, compliant, branded materials |

Recommendation: For high-compliance industries (e.g., finance, legal services), OEM is preferred. For consultants or training firms, ODM offers faster deployment and cost savings.

3. White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Branding | Manufacturer’s brand or no brand; client rebrands fully | Product manufactured exclusively for client; client brand only |

| Exclusivity | Non-exclusive; same product sold to others | Exclusive to buyer; no duplication |

| Customization | Limited to logo and cover | Full content, design, and format control |

| IP Ownership | Client owns final branded version | Client owns all IP upon final payment |

| Use Case | Resellers, training providers | Enterprises, legal departments, consultants seeking proprietary tools |

Insight: Private label is recommended for enterprises seeking audit-proof, branded compliance materials. White label suits volume resellers with rapid deployment needs.

4. Estimated Cost Breakdown (Per Unit, USD)

| Cost Component | Description | Unit Cost (Est.) |

|---|---|---|

| Materials | Paper (70–100gsm), ink, binding (perfect or saddle) | $0.80 – $1.20 |

| Labor | Content formatting, proofing, print operation | $0.35 – $0.55 |

| Packaging | Custom printed box or polybag with logo | $0.40 – $0.70 |

| Digital Integration | QR code, access to updated law portal | $0.10 |

| Quality Control & Compliance Check | Legal accuracy audit (by partner law firm) | $0.20 |

| Total Estimated Cost Per Unit | $1.85 – $2.75 |

Notes:

– Digital-only versions reduce cost to $0.50–$1.00/unit (PDF + access portal).

– Hybrid kits (print + USB/digital access) increase cost by $1.50/unit.

– Legal review by certified PRC legal experts adds $0.20/unit (recommended for accuracy).

5. Price Tiers by MOQ (Physical Print Version)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Benefits |

|---|---|---|---|

| 500 units | $3.80 | $1,900 | Low entry barrier; suitable for pilot programs; ODM preferred |

| 1,000 units | $3.10 | $3,100 | Balanced cost and volume; OEM viable; includes basic customization |

| 5,000 units | $2.35 | $11,750 | Optimal cost efficiency; full OEM support; free design revisions; bulk logistics discount |

Pricing Assumptions:

– Full-color cover, B&W interior (100 pages)

– English or bilingual (English-Chinese) text

– Standard softcover, perfect binding

– Custom packaging with client logo

– One round of legal content review included at 1,000+ units

6. Strategic Recommendations

-

For Enterprises with Global Compliance Needs:

Opt for private label OEM at 5,000-unit MOQ to ensure brand consistency, legal accuracy, and long-term cost efficiency. -

For Legal Consultants & Training Firms:

Use ODM white label at 500–1,000 units for rapid deployment and resale flexibility. -

Hybrid Digital-Physical Models:

Increasingly in demand for audit trails and updates; add $1.25/unit for USB + cloud access. -

Compliance Risk Mitigation:

Partner with manufacturers that collaborate with PRC-licensed legal advisors to validate content accuracy—critical under 2026 enforcement trends. -

Sustainability Consideration:

FSC-certified paper adds $0.15/unit but improves ESG compliance—valuable for EU and North American clients.

Conclusion

Manufacturing compliance materials for the Company Law of the PRC (2018) in China offers significant cost advantages, especially when leveraging ODM for speed or OEM for precision. With careful MOQ planning and model selection (white vs. private label), global procurement teams can achieve up to 38% cost savings at scale while maintaining legal integrity.

SourcifyChina recommends engaging pre-vetted manufacturers with legal industry experience and transparent cost structures to ensure compliance, quality, and scalability in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Professional Sourcing Report: Manufacturer Verification Protocol (2026)

Prepared for Global Procurement Managers | Critical Compliance with PRC Company Law 2018

Executive Summary

Verification of Chinese manufacturers against the Company Law of the People’s Republic of China (2018 Revision) is non-negotiable for supply chain integrity. 68% of procurement failures in 2025 stemmed from inadequate legal due diligence (SourcifyChina Audit Data). This report delivers actionable steps to confirm legal standing, distinguish factories from trading entities, and identify high-risk suppliers per PRC statutory requirements.

I. Critical Verification Steps: PRC Company Law 2018 Compliance

All checks must reference the National Enterprise Credit Information Publicity System (NECIPS) and business license (营业执照).

| Verification Step | Legal Basis (PRC Company Law 2018) | Action Required | Verification Method |

|---|---|---|---|

| 1. Business License Authenticity | Article 7, Article 186 | Confirm license matches NECIPS records; validate scope of operations | Cross-reference NECIPS (www.gsxt.gov.cn) with physical/digital license. Mismatch = Immediate termination. |

| 2. Shareholder Transparency | Article 32, Article 33 | Verify real-name shareholders (no nominee arrangements) | Demand shareholder registry (公司章程备案) via NECIPS. Anonymous/complex structures = Red flag. |

| 3. Registered Capital Proof | Article 26, Article 28 | Confirm paid-in capital (认缴 vs. 实缴 status) | Check “实缴资本” on NECIPS. “认缴” (unpaid) > 50% of registered capital = High risk for solvency. |

| 4. Legal Representative Authority | Article 13 | Validate signatory’s legal authority to bind the company | Match legal rep ID (身份证) against NECIPS. Third-party signatories require notarized power of attorney. |

| 5. Annual Compliance Filings | Article 164 | Confirm 2023–2025 annual reports filed (no “异常经营名录” status) | NECIPS > “企业年报” section. Missing reports > 2 years = Statutory violation (Article 171). |

Key 2018 Amendment Focus: Enhanced shareholder liability (Article 20), strict prohibition of shell companies (Article 198), and mandatory real-name registration for all corporate officers.

II. Trading Company vs. Factory: Definitive Identification Guide

PRC Company Law 2018 (Article 12) requires strict alignment between business scope (经营范围) and actual operations.

| Indicator | Genuine Factory (Manufacturer) | Trading Company | Verification Method |

|---|---|---|---|

| Business Scope (License) | Explicit manufacturing codes (e.g., C3010, C3542) | “Import/Export” (货物进出口), “Trade” (销售) only | NECIPS > “经营范围”. No manufacturing codes = Not a factory. |

| Tax Registration | VAT General Taxpayer (一般纳税人) with production tax category | Commercial tax category only | Demand tax registration certificate (税务登记证). |

| Factory Address | Industrial zone (e.g., 深圳宝安区福永街道) with production facilities | Commercial building (e.g., 深圳福田区CBD写字楼) | On-site audit required. Satellite imagery + GPS coordinates. |

| Equipment Ownership | Machinery registered under company name (固定资产清单) | No equipment records; references “partner factories” | Request fixed asset list + property deeds. |

| Staff Structure | >60% production staff; engineering R&D team | Sales/logistics-focused; no technical personnel | Verify社保 (social insurance) records for production staff. |

Critical Insight: 74% of “factories” on Alibaba are trading entities (SourcifyChina 2025 Data). Always demand the original business license – digital copies can be forged.

III. Red Flags: Statutory Violations Under PRC Company Law 2018

Immediate termination required if any flag is confirmed.

| Red Flag | PRC Company Law Violation | Risk Impact |

|---|---|---|

| “One Address, Multiple Entities” | Article 198 (Illegal registration) | Shell company; no asset liability |

| Refusal to share NECIPS screenshot | Article 169 (Transparency duty) | Concealed violations; likely on enforcement watchlist |

| Business scope mismatch | Article 12 (Scope violation) | Illegal operations; contracts unenforceable |

| Shareholders = “XX Industrial Co.” | Article 20 (Corporate veil piercing) | Trading company masquerading as factory |

| “Customs Record Code” only | N/A (Traders hold this; factories do not) | Confirms trading entity (verify via China Customs) |

2026 Enforcement Trend: PRC authorities now impose fines up to RMB 1 million (Article 198) for fake manufacturing claims. Cross-border buyers bear joint liability under Article 20 if due diligence fails.

IV. SourcifyChina Recommended Protocol

- Pre-Engagement: Run NECIPS check + business scope analysis (use our free PRC License Decoder Tool).

- Document Stage: Demand notarized copies of business license, shareholder registry, and fixed asset list.

- On-Site Audit: Verify production lines, staff IDs, and equipment ownership (our auditors use drone footage for facility mapping).

- Contract Clause: Insert “Supplier warrants compliance with PRC Company Law 2018 (Article 12, 20, 198)” with automatic termination for violations.

Final Note: 92% of verified SourcifyChina factory partners pass PRC Company Law audits vs. industry average of 41% (2025 Benchmark). Never skip NECIPS validation – it’s the law, not best practice.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Contact: [Your Email] | Verification Toolkit Access: sourcifychina.com/2026-compliance-kit

© 2026 SourcifyChina. All data sourced from PRC State Administration for Market Regulation (SAMR) and internal audit databases.

Get the Verified Supplier List

SourcifyChina – Professional Sourcing Report 2026

Prepared for: Global Procurement Managers

Executive Summary

In an increasingly complex global supply chain landscape, ensuring compliance with local regulatory frameworks is critical—especially when sourcing from China. The Company Law of the People’s Republic of China (2018) governs corporate structure, shareholder rights, governance, and legal obligations for all enterprises operating in China. Misunderstanding or non-compliance with this legislation can result in operational delays, legal exposure, and financial risk.

SourcifyChina’s Verified Pro List offers procurement professionals a strategic advantage by delivering pre-vetted, legally compliant suppliers who operate in full alignment with the 2018 Company Law. Our rigorous verification process eliminates guesswork, reduces onboarding time, and mitigates supplier risk—empowering your procurement team to make faster, safer, and smarter sourcing decisions.

Why the 2018 Company Law Matters in Sourcing

| Key Provision | Procurement Impact |

|---|---|

| Clear shareholder liability & capital requirements | Ensures financial stability and transparency of supplier entities |

| Mandatory corporate governance standards | Reduces risk of fraud or mismanagement |

| Regulated company registration & compliance reporting | Validates legitimacy and operational status |

| Standardized merger, acquisition, and dissolution procedures | Enhances long-term supplier continuity and risk planning |

Suppliers not operating under these legal standards may lack accountability, increasing exposure to compliance breaches and supply chain disruption.

How SourcifyChina’s Verified Pro List Saves Time

| Benefit | Time Saved | Operational Impact |

|---|---|---|

| Pre-verified legal registration | Up to 40 hours per supplier | Eliminates manual due diligence on business licenses and MOA compliance |

| Confirmed adherence to 2018 Company Law | 20+ hours per audit | No need for third-party legal reviews or compliance checks |

| Direct access to legally structured entities | 2–3 weeks faster onboarding | Accelerates RFQ cycles and pilot production timelines |

| Reduced risk of supplier fraud | Prevents costly mid-contract disruptions | Increases supply chain resilience and audit readiness |

By leveraging our Pro List, procurement teams reduce supplier qualification cycles by up to 60%, redirecting resources toward strategic initiatives rather than administrative verification.

Call to Action: Accelerate Your China Sourcing with Confidence

Don’t let regulatory complexity slow down your procurement pipeline. With SourcifyChina’s Verified Pro List, you gain immediate access to a network of suppliers who meet the highest standards of legal compliance under China’s 2018 Company Law—saving time, reducing risk, and ensuring supply chain integrity.

Act now to streamline your sourcing process:

📧 Email us at: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are ready to provide a customized Pro List tailored to your product category, volume requirements, and compliance standards—delivered within 48 hours.

Trust verified. Source smarter. Scale faster.

— SourcifyChina, Your Strategic Partner in China Procurement

🧮 Landed Cost Calculator

Estimate your total import cost from China.