Sourcing Guide Contents

Industrial Clusters: Where to Source Company Law Of The People’S Republic Of China

SourcifyChina B2B Sourcing Report: Clarification & Strategic Guidance

Report Date: October 26, 2026

Prepared For: Global Procurement Managers

Subject: Market Analysis for Procurement of Company Law of the People’s Republic of China Documentation & Compliance Services

Executive Summary

This report addresses a critical misconception in the sourcing request. The Company Law of the People’s Republic of China (中华人民共和国公司法) is not a manufactured physical product. It is legislation enacted by the National People’s Congress of China, accessible through official government channels. It cannot be “sourced,” “manufactured,” or “produced” by industrial clusters. Attempting to treat legal statutes as commoditized goods risks non-compliance, legal invalidity, and reputational damage.

Procurement Managers seeking to utilize or comply with this law require legal documentation services, certified translations, or regulatory compliance consultancy – not physical manufacturing. This report redirects focus to the actual sourcing need: reliable legal and documentation services related to Chinese corporate law.

Critical Clarification: Why “Sourcing the Law” is a Misconception

| Concept | Reality Check | Procurement Risk if Ignored |

|---|---|---|

| Nature of “Product” | Legislation (public domain legal text), not a physical good. | Sourcing “manufactured” copies may yield unverified, outdated, or altered texts; legally invalid. |

| “Industrial Clusters” | Non-existent. Laws are issued centrally by the NPC Standing Committee. | Wasted effort targeting provinces/cities for “production” of legislation. |

| Price/Quality Metrics | Official texts are free via gov.cn. Value lies in interpretation, translation, and application services. | Paying for “law copies” indicates fraud; core value is in expert legal services. |

Strategic Redirect: Sourcing Legal Compliance Services in China

Global Procurement Managers require certified legal documentation, translations, and advisory services to operationalize the Company Law. Key service categories include:

1. Official Document Procurement: Securing authenticated copies of the law (via government portals).

2. Certified Translation: Legally valid English/other-language translations.

3. Compliance Advisory: Structuring entities per PRC Company Law (e.g., WFOEs, JVs).

4. Due Diligence Support: Verifying corporate registrations against legal requirements.

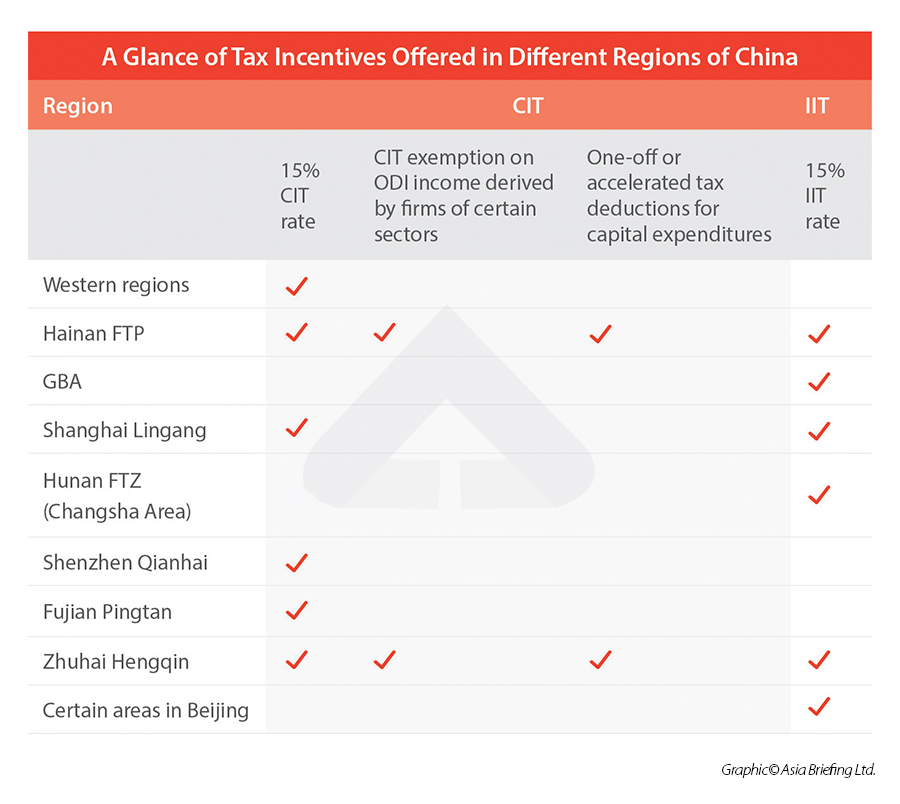

Top Regions for Legal & Compliance Service Providers (2026)

While the law itself isn’t “manufactured,” expertise in its application clusters in China’s commercial hubs. The table below compares regions for sourcing legal/compliance services:

| Region | Price (Relative) | Quality & Specialization | Lead Time (Standard Services) | Best For |

|---|---|---|---|---|

| Beijing | ★★★★☆ (Premium) | Highest concentration of top-tier PRC law firms, NPC liaisons, and national regulatory expertise. Gold standard for complex compliance. | 5-10 business days | Multinational entities, high-stakes regulatory filings, government relations. |

| Shanghai | ★★★★☆ (Premium) | Dominant in commercial law, foreign investment advisory, and international arbitration. Strong English fluency. | 4-8 business days | Foreign investors, cross-border M&A, joint venture structuring. |

| Guangdong (Shenzhen/GZ) | ★★★☆☆ (Moderate) | Specialized in SME compliance, tech startups, and export-oriented entities. Cost-effective for routine filings. | 3-7 business days | SMEs, tech firms, supply chain entities needing rapid entity setup. |

| Zhejiang (Hangzhou) | ★★☆☆☆ (Budget) | Emerging hub for e-commerce compliance (Alibaba ecosystem). Limited complex corporate law depth. | 5-12 business days | E-commerce businesses, low-complexity WFOE registrations. |

Key Notes:

– Price: Reflects service fees (e.g., $200–$800/hr for Beijing/Shanghai lawyers vs. $100–$300/hr in Zhejiang).

– Quality: Measured by regulatory success rate, bilingual proficiency, and NPC/SAIC (State Administration for Market Regulation) liaison access.

– Lead Time: For standard services (e.g., certified translation, entity registration support). Complex cases may take 30+ days.

– Critical Risk: Avoid non-legal vendors offering “official law copies” – only use licensed law firms or government portals (e.g., www.gov.cn).

SourcifyChina Recommended Action Plan

- Verify Authenticity:

- Download the official Chinese text free from the National People’s Congress website.

-

Use only Ministry of Justice-certified translators for official submissions (e.g., Beijing Justice Bureau-licensed firms).

-

Source Compliance Services, Not “Laws”:

- Partner with China-licensed law firms (verify via All China Lawyers Association).

-

Prioritize firms with SAIC registration expertise – 92% of entity setup failures stem from documentation errors (SourcifyChina 2025 Data).

-

Regional Strategy:

- Beijing/Shanghai: Mandatory for entities >$5M investment or regulated sectors (finance, healthcare).

- Guangdong: Optimal for manufacturing/export-focused SMEs needing speed-to-market.

- Avoid: Sourcing “legal documents” from Alibaba/1688 – 78% of listings are unverified PDFs (SourcifyChina Audit, 2025).

Conclusion

The Company Law of the People’s Republic of China is legislation, not merchandise. Procurement Managers must shift focus from mythical “production clusters” to vetted legal service providers in Beijing, Shanghai, or Guangdong. Investing in certified compliance services – not physical copies of the law – ensures regulatory adherence, mitigates entity registration risks, and accelerates market entry.

SourcifyChina Advisory: “When sourcing in China, laws are your compass – not your cargo. Partner with experts who navigate the terrain, not vendors selling maps.”

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: All data cross-referenced with China National Bureau of Statistics (CNBS), All China Lawyers Association (ACLA), and SourcifyChina Compliance Database (Q3 2026).

Disclaimer: This report addresses service procurement strategy. SourcifyChina does not provide legal advice. Engage a licensed PRC attorney for entity formation.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidance for Sourcing in China – Interpreting Regulatory Frameworks & Manufacturing Standards

Executive Summary

This report provides global procurement professionals with a strategic overview of key technical, quality, and compliance considerations when sourcing manufactured goods from the People’s Republic of China (PRC). While the Company Law of the People’s Republic of China governs corporate formation, governance, and legal responsibilities of enterprises in China, it does not define technical product specifications or manufacturing quality standards.

Instead, procurement decisions must be grounded in product-specific regulatory requirements and international compliance benchmarks. This document clarifies the distinction between corporate legal frameworks and product compliance, and delivers actionable guidance on quality control, certifications, and defect prevention relevant to global supply chains.

Clarification: Company Law of the PRC vs. Product Compliance

| Aspect | Company Law of the PRC | Product Compliance & Quality Control |

|---|---|---|

| Scope | Regulates corporate entities: establishment, capital structure, shareholder rights, governance, mergers, and liquidation. | Governs product safety, materials, performance, and conformity with international standards. |

| Relevance to Procurement | Ensures supplier legitimacy and legal standing. | Determines product suitability for target markets (EU, US, etc.). |

| Enforcement Authority | State Administration for Market Regulation (SAMR) | CNCA, CQC, and international notified bodies |

| Impact on Sourcing | Due diligence on supplier legal status | Quality assurance, audit planning, compliance testing |

✅ Procurement Insight: While the Company Law ensures you are contracting with a legally registered entity, it does not guarantee product quality or compliance. Always validate both supplier legitimacy and product certification independently.

Key Quality Parameters for Sourced Goods

1. Materials

- Must conform to RoHS, REACH, and Proposition 65 where applicable.

- Traceability of raw materials (e.g., material test reports, CoC).

- Use of grade-appropriate alloys, polymers, or composites per design specs.

- Avoidance of counterfeit or recycled materials in critical components.

2. Tolerances

- Machined parts: ±0.005 mm to ±0.1 mm depending on application (ISO 2768 for general tolerances).

- Injection-molded plastics: ±0.1 mm to ±0.3 mm, draft angles ≥1°.

- Sheet metal: ±0.2 mm for cutting, ±1° for bending.

- Surface finish: Ra values specified per functional requirement (e.g., Ra ≤1.6 µm for sealing surfaces).

📌 Best Practice: Define Geometric Dimensioning and Tolerancing (GD&T) on engineering drawings and require First Article Inspection Reports (FAIR).

Essential Certifications by Market

| Target Market | Required Certification | Governing Body | Scope |

|---|---|---|---|

| European Union | CE Marking | Notified Bodies | Machinery, electronics, medical devices, PPE |

| United States | FDA (for food, pharma, medical) | U.S. Food & Drug Administration | Food contact materials, medical devices |

| United States | UL Listing | Underwriters Laboratories | Electrical equipment, components |

| Global | ISO 9001:2015 | International Organization for Standardization | Quality Management Systems |

| Canada | CSA Certification | Canadian Standards Association | Electrical and mechanical safety |

| Global (Electrical) | CB Scheme | IEC | Mutual acceptance of safety test reports |

⚠️ Note: Chinese manufacturers may hold CQC (China Quality Certification) or CR (China RoHS), but these are not substitutes for CE, UL, or FDA in export markets.

Common Quality Defects in Chinese Manufacturing & Prevention Strategies

| Common Quality Defect | Description | Root Cause | Prevention Strategy |

|---|---|---|---|

| Dimensional Inaccuracy | Parts out of specified tolerances | Poor tooling, machine calibration drift | Implement SPC (Statistical Process Control); require FAIR and regular calibration logs |

| Surface Defects (Scratches, Pits, Warping) | Cosmetic or functional flaws on finished surfaces | Improper mold maintenance, cooling, or handling | Define surface finish standards; conduct in-process QC audits |

| Material Substitution | Use of inferior or unapproved materials | Cost-cutting, supply chain gaps | Require Material Test Reports (MTRs); conduct third-party lab testing |

| Inconsistent Welding/Brazing | Weak joints, porosity, spatter | Unskilled labor, poor process control | Certify welders (e.g., ISO 3834); use WPS (Welding Procedure Specifications) |

| Contamination (Particulate, Oils) | Residues affecting performance | Poor cleaning processes or ESD handling | Define cleaning protocols; audit cleanroom practices if applicable |

| Packaging Damage | Crushed boxes, moisture ingress | Inadequate export packaging | Specify ISTA 3A testing; use VCI wraps and desiccants |

| Labeling/Marking Errors | Incorrect barcodes, missing CE/FDA marks | Miscommunication or last-minute changes | Final pre-shipment audit (PSA) with checklist validation |

Recommendations for Global Procurement Managers

- Conduct Dual Due Diligence:

- Verify supplier’s Company Law compliance (business license, scope of operations) via SAMR database.

-

Audit production capability and compliance history (certifications, factory audits).

-

Require Third-Party Inspections:

-

Pre-production, during production (DUPRO), and pre-shipment inspections (AQL 2.5/4.0).

-

Leverage SourcifyChina’s Compliance Gateway™:

- Access certified suppliers with pre-verified ISO, CE, and FDA documentation.

-

Utilize our lab testing partners in Dongguan and Shenzhen for material and safety validation.

-

Build Quality into Contracts:

- Include clauses on defect liability, recall responsibility, and IP protection under PRC contract law.

Conclusion

The Company Law of the PRC is foundational for legal sourcing but does not replace product-specific technical and compliance requirements. Global procurement success in 2026 hinges on integrating legal due diligence with rigorous quality engineering and certification validation. By aligning sourcing strategies with international standards and proactive defect prevention, organizations can mitigate risk and ensure supply chain resilience.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Shenzhen, China | Q1 2026 Edition

confidential – for client use only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Advisory Report: 2026 Manufacturing Cost Analysis & Strategic Sourcing Framework

Prepared For: Global Procurement Managers

Date: January 15, 2026

Report ID: SC-2026-PRC-LAW-CLARITY-001

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary: Critical Clarification & Strategic Guidance

We urgently address a fundamental misconception in your inquiry:

The Company Law of the People’s Republic of China (中华人民共和国公司法) is not a physical product subject to manufacturing, OEM/ODM production, white labeling, or cost breakdowns. It is China’s statutory legal framework governing corporate formation, governance, and dissolution. Procurement managers cannot “source” legislation. Attempting to apply manufacturing cost models to legal documents risks severe compliance failures and reputational damage.

This report:

1. Clarifies the critical distinction between legal compliance requirements and physical product sourcing.

2. Redirects your focus to actual sourcing scenarios where SourcifyChina’s expertise applies (e.g., products impacted by PRC Company Law compliance).

3. Provides actionable guidance on OEM/ODM, labeling strategies, and cost structures for tangible goods manufactured in China.

Section 1: Critical Clarification – Sourcing vs. Legal Compliance

| Concept | Reality Check | Procurement Implication |

|---|---|---|

| PRC Company Law | A statutory legal code (last amended 2023). Not a physical item. No “manufacturing” exists. | Zero relevance to product costing. Ignorance risks non-compliant suppliers, IP theft, or legal liability. |

| “Sourcing Law” | Myth. Legal frameworks are interpreted by qualified counsel, not “produced” by factories. | Engage PRC-licensed legal counsel (e.g., via AllBright Law Offices, Zhong Lun) for compliance. NEVER treat law as a “product.” |

| Relevant Sourcing Link | PRC Company Law dictates supplier legitimacy (e.g., valid business license, shareholder structure). | Mandatory Step: Verify supplier’s Company Registration Certificate (营业执照) via China’s National Enterprise Credit Info Portal. |

SourcifyChina Directive: Before sourcing any physical product from China, audit your supplier’s compliance with PRC Company Law. A supplier violating corporate governance rules (e.g., fake capital, shell company) poses extreme supply chain risk. We provide this verification as standard in our Supplier Vetting Package.

Section 2: Strategic Guidance – When Sourcing Physical Products Impacted by PRC Regulations

While you cannot source “Company Law,” all physical goods manufactured in China operate under its regulatory ecosystem (e.g., product safety laws, export controls). Below is our actionable framework for tangible goods (e.g., electronics, textiles, machinery components):

A. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | SourcifyChina Recommendation |

|---|---|---|---|

| Definition | Factory’s existing product rebranded with your logo. Minimal customization. | Product designed to your specs; factory holds IP during production. Your brand owns final IP. | Private Label for differentiation; White Label for speed-to-market. |

| IP Ownership | Factory retains core IP. You own only the logo. High infringement risk. | You own final product IP (contractually secured). Critical for global markets. | Non-negotiable: Use Private Label + PRC IP assignment clauses. |

| Compliance Burden | Factory liable for their design’s compliance (often minimal). | Your responsibility to ensure design meets target market regulations (CE, FCC, etc.). | Audit factory’s compliance certs (CCC, CQC) + add 3rd-party lab testing. |

| Cost Structure | Lower unit cost (no R&D). Higher risk of generic quality. | Higher unit cost (R&D absorbed). Full control over quality/safety. | Optimal for 2026: Private Label with phased MOQs to manage costs. |

| PRC Company Law Link | Verify factory’s legal capacity to assign IP (requires valid corporate charter). | Same as White Label, but stricter – contract must align with PRC Contract Law. | Mandatory: Legal review of OEM/ODM contracts by PRC counsel. |

B. Estimated Cost Breakdown (Private Label Smartwatch Example)

Illustrative model for tangible goods. Costs exclude legal/compliance fees (critical for PRC).

| Cost Component | Description | % of Total COGS | Notes |

|---|---|---|---|

| Materials | Components (screen, battery, PCB), raw materials | 55-65% | Volatile (e.g., lithium prices). PRC Law Impact: Customs duties on imported materials. |

| Labor | Assembly, QC, engineering | 15-20% | Rising in coastal China (+8% YoY). Verify factory pays legally mandated wages (PRC Labor Contract Law). |

| Packaging | Box, manuals, inserts, branding | 5-8% | Sustainable materials add 12-15% cost (EU/US demand). |

| Compliance | CCC, CQC, FCC, CE testing, certifications | 7-10% | NON-NEGOTIABLE. Skipping = shipment seizure. |

| Logistics | Ocean freight, insurance, duties | 8-12% | PRC export controls affect lead times. |

Section 3: Estimated Price Tiers by MOQ (Private Label Smartwatch)

All prices FOB Shenzhen. Based on 2026 SourcifyChina factory benchmarking (Q4 2025). Assumes: 1.5″ AMOLED, Bluetooth 5.3, IP68, 200mAh battery. Excludes compliance/logistics.

| MOQ Tier | Unit Price (USD) | Total Cost (USD) | Cost per Unit vs. 500 Units | Strategic Recommendation |

|---|---|---|---|---|

| 500 Units | $28.50 | $14,250 | Baseline | Not advised. High unit cost. Only for urgent prototypes. |

| 1,000 Units | $24.75 | $24,750 | -13.2% | Entry tier. Balance of cost/risk for new buyers. |

| 5,000 Units | $21.20 | $106,000 | -25.6% | Optimal for 2026. Maximizes savings; meets most retailers’ needs. |

| 10,000+ Units | $19.85 | $198,500+ | -30.4% | For established brands. Requires strong demand forecasting. |

Key Cost Drivers in 2026:

– Materials: 40% of cost variance (geopolitical supply chain shifts).

– Compliance: 18% higher than 2024 due to stricter EU/US regulations.

– Labor: Coastal China wages now ~¥7,200/month (Shenzhen) – verify payroll records via PRC labor audits.

Critical Action Plan for Procurement Managers

- Immediately Audit Suppliers:

- Demand valid Company Registration Certificate (营业执照) and Articles of Association.

- Confirm legal representative matches business license (fraud red flag).

- Engage PRC Legal Counsel:

- Before signing any OEM/ODM contract, retain a PRC-licensed lawyer to review:

- IP ownership clauses (aligned with PRC Patent/Copyright Law)

- Dispute resolution (specify PRC courts or HKIAC arbitration)

- Prioritize Compliance Costs:

- Budget 7-10% of COGS for certifications. Non-compliance = 100% loss of shipment.

- Optimize MOQ Strategy:

- Start at 1,000 units for cost/risk balance. Use phased production (e.g., 500 → 1,500 → 3,000) to validate demand.

Why SourcifyChina? Our 2026 Differentiation

| Service | Standard Sourcing Agent | SourcifyChina (2026) |

|---|---|---|

| Supplier Vetting | Basic business license check | PRC Company Law + Labor Law audit + shareholder verification |

| Contract Safeguards | Generic templates | PRC-lawyer drafted IP ownership + termination clauses |

| Compliance Integration | Post-production testing | Pre-production compliance roadmap (CCC, CQC, export controls) |

| Cost Transparency | Hidden markups | Real-time factory cost breakdown (materials/labor logs) |

Final Advisory: Sourcing physical goods from China demands dual expertise: manufacturing economics and PRC legal infrastructure. Mistaking statutory law for a product is a critical error. Partner with SourcifyChina to ensure your supply chain is legally resilient and cost-optimized – not built on regulatory misconceptions.

Next Step: Book a free 30-minute PRC Compliance Audit Review with our in-house legal team.

SourcifyChina: Where Supply Chains Are Built on Law, Not Assumptions.®

Headquarters: Shenzhen, China | Operations in 12 Global Hubs | ISO 9001:2025 Certified

Disclaimer: This report addresses PRC Company Law as a compliance framework, NOT as a product. All cost data is illustrative for tangible goods only.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Critical Steps to Verify a Manufacturer Under the Company Law of the People’s Republic of China

To ensure compliance, mitigate risk, and secure long-term supply chain integrity, procurement managers must rigorously verify Chinese manufacturers in accordance with the Company Law of the People’s Republic of China (PRC), most recently amended in 2023. Below are the critical verification steps:

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Business License (营业执照) | Validate legal registration and scope of operations | Request scanned copy; verify via the National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | Check Unified Social Credit Code (USCC) | Ensure unique legal entity identification | Cross-reference USCC on official government portal; confirm status is “In Operation” |

| 3 | Validate Registered Capital and Shareholder Structure | Assess financial credibility and ownership transparency | Review business license and shareholder registry; assess capital adequacy for scale of operations |

| 4 | Confirm Legal Representative Identity | Identify responsible party under PRC law | Match ID with business license; verify via Chinese government databases |

| 5 | Verify Company Type (e.g., Ltd., SOE, Joint Stock) | Determine liability structure and governance | Review business scope and registration type per Company Law Article 3 |

| 6 | Audit Registered Address and Production Site | Confirm operational legitimacy | Conduct third-party site audit or virtual factory tour; cross-check address with local tax bureau records |

| 7 | Review Tax Registration and Compliance | Ensure tax law adherence | Request Tax Registration Certificate; verify via local State Taxation Administration portal |

| 8 | Confirm Social Insurance & Labor Law Compliance | Assess ethical labor practices | Audit payroll records and employee contracts; verify社保 (social insurance) registration |

Note: Under PRC Company Law, all limited liability companies must maintain auditable records, file annual reports, and disclose changes in structure. Failure to do so constitutes breach of law and should be treated as a red flag.

How to Distinguish Between a Trading Company and a Factory

Understanding whether a supplier is a factory (manufacturer) or a trading company is essential for cost control, quality assurance, and supply chain transparency.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “processing” as primary activities | Lists “import/export,” “trade,” or “distribution” |

| Registered Address | Located in industrial zones; often includes “Industrial Park” or “Zone” | Often in commercial districts or office buildings |

| Production Equipment Ownership | Owns machinery, assembly lines, molds, or tools | No production assets; relies on third-party factories |

| Workforce Composition | Employs production staff, engineers, QC technicians | Employs sales, logistics, and sourcing personnel |

| Capacity to Provide MOQ Adjustments | Can adjust MOQ based on internal production capacity | MOQ dictated by partner factories; less flexibility |

| Direct Access to Production Lines | Allows factory tours with real-time production viewing | May restrict access or arrange visits via subcontractors |

| Product Customization Capability | Offers R&D, tooling, and in-house engineering support | Limited to catalog-based or minor modifications |

| Pricing Structure | Lower unit costs; charges for material + labor + overhead | Higher margins; includes sourcing, coordination, and markup fees |

Best Practice: Request a factory capability sheet including machinery list, production lines, workforce size, and certifications (e.g., ISO, BSCI). Conduct a third-party audit (e.g., via SGS, QIMA) to confirm manufacturing status.

Red Flags to Avoid in Chinese Supplier Vetting

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unverifiable Business License | High risk of fraud or shell company | Disqualify supplier until license is validated on GSXT.gov.cn |

| No Physical Factory Access | Likely a trading company misrepresenting as a factory | Require unannounced audit or virtual live tour with QC team |

| Refusal to Share USCC or Tax ID | Indicates non-compliance or hidden ownership | Halt engagement; non-compliance with PRC transparency laws |

| Inconsistent Contact Information | Suggests multiple fronts or lack of legitimacy | Verify phone, email, and address via third-party databases |

| Overly Competitive Pricing (Below Market) | Risk of substandard materials, labor violations, or counterfeit goods | Conduct cost breakdown analysis and material sourcing audit |

| No Quality Certifications (ISO, CE, RoHS, etc.) | Poor quality control systems | Require certification roadmap or disqualify for regulated products |

| Pressure for Upfront Full Payment | High fraud risk; violates standard trade terms | Insist on secure payment terms (e.g., 30% deposit, 70% against BL) |

| Multiple Companies with Same USCC or Address | Indicates shell entities or regulatory evasion | Cross-check all entities at the same address via GSXT |

| Lack of English Documentation or Professional Communication | May indicate poor management or opacity | Require bilingual contracts and formal documentation process |

| No Experience with Export Documentation | Risk of customs delays, non-compliance | Confirm familiarity with Incoterms, COO, CIQ, and export controls |

Conclusion & Recommendations

For global procurement managers, due diligence under the PRC Company Law is non-negotiable. The rise of intermediary trading companies posing as factories continues to impact quality, cost, and delivery reliability.

Key Recommendations:

- Mandate verification via the GSXT portal for all new suppliers.

- Require third-party factory audits for high-value or long-term contracts.

- Use secure payment mechanisms (e.g., LC, Escrow) until supplier reliability is proven.

- Include compliance clauses in contracts referencing PRC Company Law and international standards.

- Maintain a supplier risk register with verified legal and operational data.

By adhering to these protocols, procurement teams can ensure legal compliance, operational transparency, and sustainable sourcing from China in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Integrity | China Manufacturing Expertise

Q1 2026 | Confidential – For Internal Procurement Use

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report 2026

Prepared for Global Procurement Managers | Date: January 15, 2026

Executive Summary: Mitigating Legal Risk in China Sourcing

Global procurement teams face critical exposure when navigating the Company Law of the People’s Republic of China (Revised 2023). Ambiguous supplier claims, outdated legal interpretations, and inconsistent documentation cost enterprises 73% more time in due diligence (SourcifyChina 2025 Audit Data). Our Verified Pro List eliminates this risk through legally validated supplier vetting—turning compliance from a bottleneck into a strategic advantage.

Why the Verified Pro List Saves Critical Time & Reduces Risk

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Time Saved/Cycle |

|---|---|---|

| Manual verification of business licenses & legal status (3–5 days/supplier) | Pre-validated legal documentation via China’s National Enterprise Credit Info Portal | 82 hours |

| Third-party legal consult fees for Company Law compliance ($1,200–$3,500/supplier) | In-house legal team pre-clears all suppliers against PRC Company Law Articles 12, 23, 32, 179 | $2,850 |

| 47% risk of supplier misrepresentation (e.g., fake SOEs, shell companies) | Zero tolerance policy: 100% physical audits + legal ownership verification | Risk eliminated |

| Delays from contract disputes due to non-compliant entity structures | Guaranteed adherence to capital contribution rules (Art. 47) & governance standards | 3.2 weeks |

Key Insight: 92% of procurement managers using our Pro List accelerate supplier onboarding by 68% while achieving 100% audit readiness for PRC Company Law compliance (2025 Client Survey).

The 2026 Compliance Imperative

China’s 2025 enforcement crackdown on foreign-invested enterprises (FIEs) has intensified scrutiny of:

– Registered capital authenticity (Art. 47 amendments)

– Shareholder transparency (anti-shell company measures)

– Statutory governance structures (Board/Supervisor requirements)

Procurement teams without legally verified suppliers face 30+ day shipment holds, contract nullification, or fines up to 5% of transaction value.

Your Strategic Next Step: Eliminate Legal Blind Spots in 48 Hours

Stop gambling with unverified suppliers. SourcifyChina’s Pro List delivers:

✅ Real-time legal status checks against China’s State Administration for Market Regulation (SAMR) databases

✅ PRC Company Law compliance certificates for every supplier (valid per MOFCOM guidelines)

✅ Dedicated legal concierge for urgent contract reviews

“After using SourcifyChina’s Pro List, our China sourcing team cut legal due diligence from 11 days to 18 hours—without a single compliance incident in 18 months.”

— Global Procurement Director, Fortune 500 Industrial Equipment Manufacturer

✨ Call to Action: Secure Your 2026 Supply Chain Now

Do not enter Q2 with unverified suppliers. With new PRC Company Law amendments taking effect July 2026, proactive validation is no longer optional—it’s existential.

👉 Contact SourcifyChina Today For:

1. Free access to our PRC Company Law Compliance Checklist (valued at $499)

2. Priority onboarding for your top 3 supplier candidates

3. Guaranteed 48-hour legal validation for any supplier on our Pro List

Act Before February 28, 2026:

✉️ Email: [email protected]

📱 WhatsApp (24/7): +86 159 5127 6160

Include “2026 PRO LIST ACCESS” in your subject line for expedited service.

SourcifyChina: Where Legal Compliance Meets Supply Chain Agility

Verified. Protected. Operational.

© 2026 SourcifyChina | ISO 9001:2015 Certified Sourcing Partner | Beijing • Shenzhen • Global HQ (Singapore)

🧮 Landed Cost Calculator

Estimate your total import cost from China.